Want to dive into ecommerce, where every click can lead to a sale, and every sale must be counted? Welcome to our ecommerce accounting guide, your all-in-one portal to mastering the numbers behind the screen.

Let’s take a closer look at the peculiarities of ecommerce accounting and share some of the accounting best practices to consider in the changing landscape of the ecommerce business.

Key takeaways

- Due to digital operations, ecommerce accounting requires handling diverse online payment methods, complex inventory management, and specific tax compliance needs.

- Utilizing cloud-based solutions, staying compliant with tax regulations, keeping finances organized, and regularly reviewing key financial metrics can drive operational excellence.

- The balance sheet, income statement, and cash flow statements are key to assessing an ecommerce business’s financial health and operational efficiency.

- Vital financial indicators such as gross margin, net profit, customer acquisition costs, and others offer insights into business health and guide strategic decisions.

Contents:

1. What is ecommerce accounting?

2. The difference between traditional business and ecommerce accounting

3. Components of ecommerce accounting

4. What accounting software is best for ecommerce?

5. Ecommerce accounting entries

6. Ecommerce accounting: Where to begin?

7. The checkbox of regular ecommerce accounting tasks

8. Best practices for ecommerce accounting

9. Ecommerce accounting methods explained

- Cash accounting

- Accrual accounting

- Hybrid method (Modified cash accounting)

- How do you choose an accounting method?

10. The most important financial statements for ecommerce sellers

11. Bonus section: Essential financial metrics to be aware of

What is ecommerce accounting?

Ecommerce accounting refers to the process of managing and recording financial transactions for businesses that sell goods or services online. It encompasses a wide range of financial activities, including:

- Tracking sales;

- Expenses;

- Taxes;

- Profits generated from online sales channels.

Given the ecommerce nature, which often involves multiple online platforms, currencies, payment gateways, and international sales, ecommerce accounting can be more complex than traditional retail accounting.

The difference between traditional business and ecommerce accounting

The differences between business accounting and ecommerce accounting primarily stem from the unique challenges and operational characteristics of ecommerce.

#1. Sales channels and payment methods

Ecommerce accounting must handle a variety of online payment methods and sales channels, including online marketplaces, social media platforms, and cryptocurrency transactions in some cases.

Traditional business accounting, on the other hand, often deals with a more straightforward set of sales channels and payment methods, such as in-person sales, checks, or bank transfers.

#2. Inventory management

Ecommerce businesses may face more complex inventory management challenges, especially if they sell on multiple platforms or deal in dropship products.

Traditional businesses might deal with more stable inventory levels and fewer platforms.

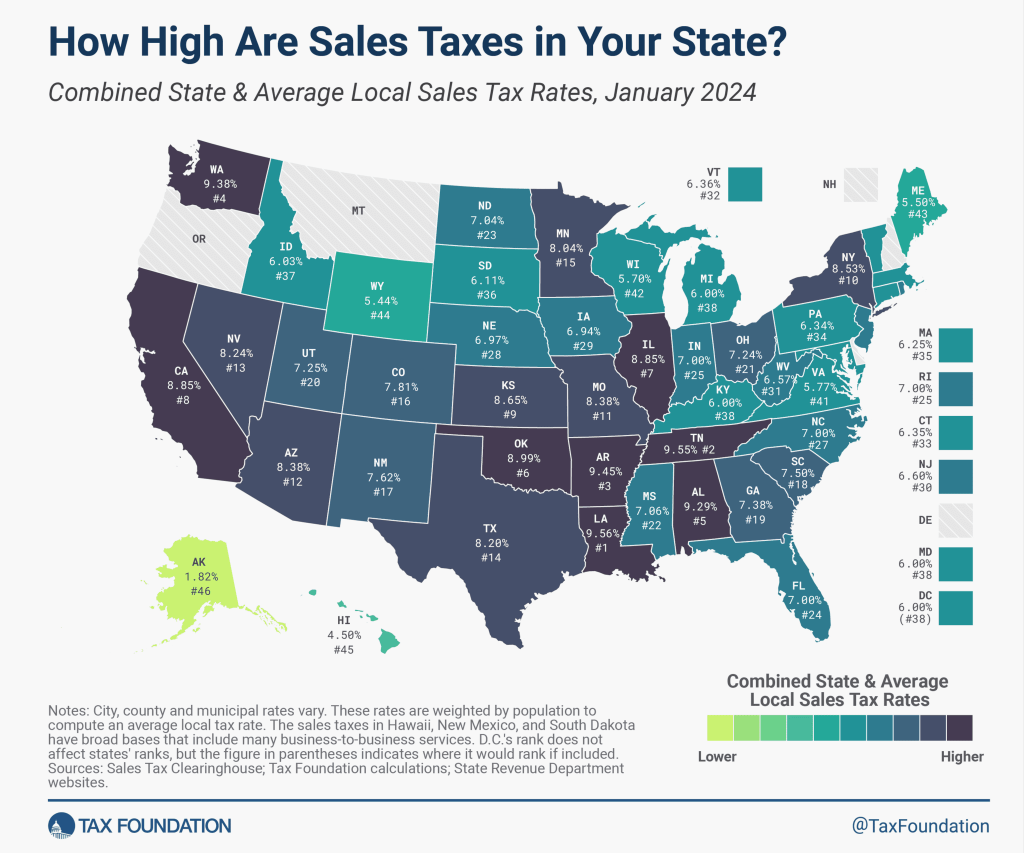

#3. Sales tax and VAT compliance

Ecommerce businesses often have to deal with more complicated sales tax and VAT compliance issues due to selling to customers in multiple jurisdictions or countries.

Traditional businesses, especially those operating in a single location, face simpler tax compliance requirements.

#4. International operations

Ecommerce naturally lends itself to international sales more than many traditional businesses. This introduces complexities in currency exchange, international shipping regulations, and cross-border tax laws.

#5. Digital advertising expenses

Ecommerce businesses typically spend a significant portion of their budget on digital advertising across various platforms.

Traditional businesses may spend more on physical advertising or may have different types of marketing expenses.

#6. Use of technology

Ecommerce accounting often relies more heavily on integration with online sales platforms, payment processors, and analytics tools.

While modern traditional businesses also use technology, ecommerce operations require more specific tools that can handle online transactions and integrate with ecommerce ecosystems.

Summary

Let’s look at the table, which highlights the key differences in accounting practices that ecommerce businesses face compared to more traditional business models.

| Aspect | Ecommerce accounting | Business accounting |

| Sales channels | Multiple, dynamic online channels | Fewer, more stable channels |

| Payment methods | Diverse, including digital wallets, online payment gateways | Checks, bank transfers, in-person payments |

| Inventory management | Complex due to multiple platforms, dropshipping | Stable levels, simpler logistics |

| Tax compliance | Complex, multiple jurisdictions and international sales | Generally simpler, localized |

| International operations | Common, with additional regulatory and currency challenges | Limited by physical presence |

| Advertising expenses | Primarily digital, across multiple platforms | Varied, with a possible focus on physical spaces |

| Technology use | Extensive, requires integration with ecommerce platforms | Moderate, with some digital tools |

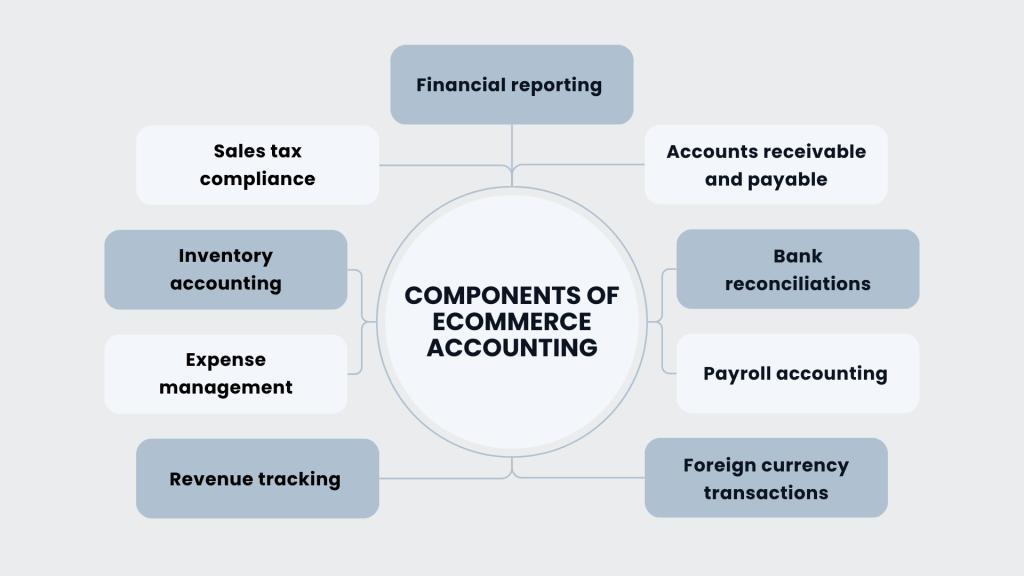

Components of ecommerce accounting

Ecommerce accounting involves several components that are crucial for accurately capturing the financial activities of an online business. Here are the main ones:

1. Revenue tracking

Central to ecommerce accounting, this involves accurately recording all sales transactions.

Ecommerce businesses often operate across multiple channels, making integrating sales data from websites, marketplaces, and social media platforms crucial.

Effective revenue tracking helps in assessing the performance of different sales channels and making informed marketing and inventory decisions.

2. Expense management

This encompasses all costs associated with running an ecommerce operation, including but not limited to:

- Web hosting;

- Payment processing fees;

- Advertising;

- Shipping;

- Handling expenses.

Proper management and categorization of these expenses are vital for calculating profitability, budgeting, and tax preparation. Tools that automate expense tracking and categorization can significantly improve efficiency and accuracy.

→ Learn how automated software can help you with expense categorization in QuickBooks Online.

3. Inventory accounting

For businesses selling physical goods, inventory accounting is essential for tracking:

- Cost of goods sold (COGS);

- Stock levels;

- The value of inventory on hand.

Methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out) are used to manage inventory costs and valuation. Accurate inventory accounting affects both profitability analysis and tax calculations.

4. Sales tax compliance

Navigating the complexities of sales tax in various jurisdictions is a significant challenge for ecommerce businesses. This involves:

- Understanding nexus laws;

- Accurately calculating and collecting the correct amount of sales tax;

- Timely remitting it to the appropriate tax authorities.

→ Learn how to manage sales tax when selling on Amazon with ease.

5. Financial reporting

Creating financial statements (income statement, balance sheet, and cash flow statement) provides insights into the business’s financial health.

These reports are essential for internal decision-making, attracting investors, and complying with regulatory requirements. Financial reporting requires accurate data from all areas of the business.

6. Accounts receivable and payable

Efficient management of receivables and payables ensures healthy cash flow. This includes:

- Promptly invoicing customers;

- Managing credit terms;

- Ensuring bills and supplier invoices are paid on time.

7. Bank reconciliations

Regular reconciliation of bank accounts ensures that the business’s financial records match bank statements.

This process helps identify discrepancies, prevent fraud, and maintain accurate cash flow tracking.

→ Automated reconciliation features in accounting software can save time and reduce errors.

8. Payroll accounting

Managing payroll involves:

- Calculating wages;

- Calculating taxes and other deductions;

- Ensuring compliance with employment laws.

For ecommerce businesses, this may also include managing diverse workforces, such as remote employees or contractors.

9. Foreign currency transactions

Ecommerce businesses selling internationally must manage transactions in multiple currencies, which involves tracking exchange rates and accounting for currency gains or losses.

This component is crucial for accurate financial reporting and minimizing the impact of currency fluctuations on profitability.

What accounting software is best for ecommerce?

Right now, you might find yourself wrestling with how to manage everything simultaneously, wishing for a simpler way to handle the complexities of your ecommerce finances.

Lucky you are, because Synder is a perfect match!

Synder is your ultimate ally in streamlining the financial operations of your online business. Designed to minimize manual data entry and maximize accounting efficiency, Synder transforms how you manage your business finances.

Imagine having the power to monitor your cash flow in real time, manage inventory with precision, breeze through tax season preparations, generate insightful financial reports, and reconcile your accounts with unparalleled ease—all within a single platform.

But Synder offers more than just functionality. It brings peace of mind, allowing you to focus more on growing your business and less on the nitty-gritty of accounting.

Why juggle the complexities when Synder can harmonize your accounting processes? Embrace the change and let Synder transform your ecommerce accounting experience into one of simplicity, accuracy, and peace of mind!

Ecommerce accounting entries

Ecommerce accounting entries form the backbone of your financial record-keeping. These entries document every transaction that occurs within your ecommerce business, from sales and purchases to expenses and income.

Key ecommerce accounting entries include:

1. Sales transactions

Every sale made through your ecommerce platform needs to be recorded, detailing the revenue earned and the cost of goods sold (COGS).

2. Purchase orders

Entries for purchases capture the cost of inventory bought from suppliers, including any associated expenses such as shipping or handling fees, which directly impact your COGS and overall profitability.

3. Expenses

All operational costs, from web hosting fees and digital marketing expenses to payment processing charges and employee salaries, must be meticulously recorded.

4. Customer returns and refunds

These entries account for the return of goods by customers and the subsequent refunds issued. Tracking these transactions is vital for inventory management and understanding the return rate, which can influence business strategies.

5. Tax payments

Recording entries for sales tax, VAT, or any other applicable taxes collected and paid is critical for compliance with tax regulations.

6. Bank transactions

This includes all transfers, deposits, and withdrawals related to the business’s bank accounts. Regular reconciliation of these entries with bank statements is essential for accurate cash flow management.

Ecommerce accounting: Where to begin?

Starting with ecommerce accounting requires a structured approach to ensure your financial operations are set up correctly and can scale with your business. Here are essential accounting tasks to begin with, focusing on establishing a strong foundation for your ecommerce venture:

Step #1. Set up a business bank account

Open a dedicated business bank account to keep personal and business finances separate. This simplifies accounting, tax preparation, and financial management.

Step #2. Choose and set up accounting software

Select accounting software that suits your ecommerce business needs. Look for software that can integrate with your ecommerce platform, payment processors, and inventory management systems. This will automate much of your financial tracking and reporting.

Book a seat at the Weekly Public Demo with a Synder specialist to discuss your particular case and find out how to streamline your accounting.

Step #3. Establish your chart of accounts

Create a chart of accounts—a listing of all the individual accounts that make up the financial records of the business.

This should include categories for assets, liabilities, equity, income, and expenses tailored to the specific needs of your ecommerce business.

Step #4. Understand ecommerce tax obligations

Keep up to date with the tax obligations specific to ecommerce businesses, including income tax, sales tax, and any other relevant taxes.

Understand the sales tax requirements in the jurisdictions you operate in and set up your ecommerce platform to collect the correct amount of sales tax from customers.

Consider consulting with a tax professional or accountant specializing in ecommerce to ensure compliance and optimize your tax situation.

→ Learn how Synder simplifies tracking taxes and sales by countries and states.

Step #5. Implement an inventory management system

An inventory management system is a must-have if your business involves selling physical goods.

This system should track product quantities, sales, returns, and reorder levels and, ideally, integrate with your accounting software for real-time financial insights.

Step #6. Organize your receipts and invoices

Develop a system for organizing and storing all business-related receipts and invoices.

This could involve digital storage solutions that integrate with your accounting software, ensuring that all financial documents are easily accessible and properly categorized.

Step #7. Schedule regular financial reviews

Establish a routine for reviewing your financial statements, including profit and loss statements, balance sheets, and cash flow statements. As said above, regular reviews help you stay informed about your business’s financial health and make data-driven decisions.

The checkbox of regular ecommerce accounting tasks

It’s nice to know where to start. But you know what can be even better? Having a plan of what to do next!

Below is a checklist of regular ecommerce accounting tasks that can help ensure smooth financial operations and compliance for your online business. This list covers various recurring tasks that should be managed on different schedules (daily, weekly, monthly, quarterly, and annually).

Daily tasks

✔️ Record transactions

Daily recording of sales, expenses, refunds, and any other financial transactions. This task involves categorizing each transaction in your accounting software, ensuring that income and expenditures are tracked in real time.

✔️ Monitor cash flow

Monitoring cash flow involves reviewing the amounts of cash that come in and go out of the business daily. This task is key to ensuring that the business has enough cash on hand to cover short-term obligations, such as paying suppliers or purchasing inventory. It can involve checking bank balances and reviewing upcoming expenses.

Weekly tasks

✔️ Review inventory levels

Regular checks help prevent overstocking or stockouts. This task includes assessing which products are selling quickly and which aren’t, allowing for timely reorder decisions or promotions to clear slow-moving stock.

✔️ Process payroll (if needed)

For businesses with employees or contractors, processing payroll involves calculating wages, deductions, and taxes and then making payments. This task must be done accurately and on time to comply with labor laws and maintain staff morale.

✔️ Reconcile transactions

Reconciliation involves matching transactions recorded in your accounting system against bank statements to ensure accuracy. This helps identify discrepancies early, preventing financial errors and potential fraud.

✔️ Review and pay bills

Managing accounts payable involves reviewing all vendor invoices and bills, ensuring they’re accurate, and that you pay them before their due dates.

Monthly tasks

✔️ Close monthly books

This includes finalizing all financial activities for the month ensuring all transactions are recorded accurately. The process provides a snapshot of the business’s financial status at month-end.

✔️ Review profit and loss statement

Analyzing the profit and loss statement helps understand the business’s financial performance over the month, showing revenue, costs, and expenses. The review is critical for identifying trends, managing budgets, and strategizing for growth.

✔️ Reconcile bank accounts

Monthly bank reconciliation ensures all cash transactions are accurately recorded in the accounting system. This is a more thorough check than the weekly transaction reconciliation.

✔️ Manage accounts receivable and payable

This involves following up on outstanding customer invoices to ensure timely payments. Managing accounts payable includes scheduling payments for upcoming bills helping manage cash flow effectively.

✔️ Calculate and record depreciation

For businesses with physical assets, calculating monthly depreciation is necessary for accurate financial reporting. This task involves spreading the cost of an asset over its useful life, affecting profit and loss statements.

Quarterly tasks

✔️ Prepare/Review financial statements

Quarterly financial statements, including the balance sheet, income statement, and cash flow statement, offer a comprehensive view of the business’s financial health.

✔️ Submit sales tax

Calculating, reporting, and submitting ecommerce sales tax involves understanding the different rates and rules across jurisdictions where the business operates.

✔️ Review budget vs. actuals

Comparing actual financial performance against budgeted figures helps identify variances and adjust strategies or budgets accordingly.

✔️ Evaluate marketing spend and ROI

This helps in understanding the effectiveness of marketing strategies. This evaluation guides future marketing budget allocations and strategy adjustments.

Annual tasks

✔️ Close year-end books

Finalizing the year’s financial records prepares the business for tax filing and provides a clear picture of the year’s financial performance.

✔️ Prepare tax documents

Gathering and preparing all necessary documents for tax purposes, such as receipts, invoices, and financial statements, is essential for accurate tax filing.

→ Get aware of tax tips for businesses that’ll help you with tax season preparation.

✔️ File business taxes

Completing and submitting annual tax returns by the deadline is a must for legal compliance and avoiding penalties.

✔️ Review annual performance

An annual review of the business’s financial performance compared to previous years helps in assessing growth, profitability, and areas needing improvement.

✔️ Update business and accounting plans

Based on the annual review, updating business strategies and accounting practices ensures that the business remains aligned with its goals and adapts to any financial changes or challenges.

✔️ Conduct inventory audit

A thorough count and inventory valuation at year-end are important for accurate financial reporting and planning for the new year.

Best practices for ecommerce accounting

Ecommerce accounting involves unique challenges due to the online nature of transactions, multiple sales channels, and often a global customer base. Adhering to best practices can help streamline financial processes. But what are the options?

Tip #1. Utilize cloud accounting solutions

Cloud-based accounting software offers accessibility, scalability, and security. It allows you to access your financial data from anywhere, share information easily with your team or accountant, and benefit from automatic updates and backups.

Tip #2. Stay compliant with sales tax regulations

Understand and comply with sales tax laws in all jurisdictions where you sell. This may involve collecting, reporting, and remitting sales tax in multiple states or countries. Consider using automated sales tax software to simplify compliance and reduce the risk of errors.

Tip #3. Regularly reconcile your accounts

Perform regular reconciliations of your bank accounts, payment gateways, and merchant accounts against your accounting records. This practice helps catch discrepancies early, prevents fraud, and ensures the accuracy of your financial data.

Tip #4. Keep business and personal finances separate

Open a separate bank account for your business and avoid using business funds for personal expenses. Keeping finances separate simplifies accounting, tax preparation, and legal compliance.

Tip #5. Understand your cost of goods sold (COGS)

Accurately calculate and monitor your COGS. This includes all direct costs associated with producing or purchasing the goods you sell, such as material costs, direct labor, and shipping costs. It’s essential for pricing strategies, profitability analysis, and financial reporting.

Tip #6. Plan for taxes year-round

Rather than treating taxes as an annual event, engage in tax planning throughout the year. This includes setting aside money for tax liabilities, making estimated tax payments if required, and taking advantage of tax deductions and credits applicable to your business.

Tip #7. Monitor key performance indicators (KPIs)

Regularly track financial KPIs, such as gross profit margin, net profit margin, inventory turnover, and average order value. Monitoring these metrics helps you understand your business’s financial health and guides strategic decision-making.

Tip #8. Seek professional advice

Consult with an accountant or financial advisor who has experience with ecommerce businesses. They can provide valuable insights on tax strategy, financial planning, and compliance matters specific to the ecommerce sector.

→ Consider choosing an accountant firm approved by Synder. You don’t have to spend your time searching for the best match – we’ve done it for you!

Ecommerce accounting methods explained

Ecommerce businesses can choose from several accounting methods to manage their finances. The choice of method can significantly affect financial reporting and tax obligations.

Below, we detail three primary accounting methods:

- Cash accounting;

- Accrual accounting;

- Hybrid method (modified cash accounting).

Cash accounting

Cash accounting is a straightforward method where transactions are recorded only when cash is exchanged. Revenue is recognized when payment is received, and expenses are recorded when they’re paid.

This method offers simplicity and a clear view of cash flow, making it easy to see how much cash is on hand at any given time.

Advantages:

- Simplicity and ease of implementation;

- Clear visibility of cash flow;

- Suitable for businesses with straightforward transactions and without inventory.

Disadvantages:

- Doesn’t accurately reflect the financial health of a business over time, as it can distort the timing of revenue and expense recognition;

- Not suitable for businesses with inventory or those that extend credit to customers.

Accrual accounting

Accrual accounting is more complex but provides a more accurate picture of a company’s financial health.

Transactions are recorded when they’re earned or incurred, regardless of when cash is exchanged. This means revenue is recognized when a sale is made (not when payment is received), and expenses are recorded when they’re incurred (not when they’re paid).

Advantages:

- Provides a more accurate picture of financial health and profitability;

- Recognizes accounts receivable and payable, offering a comprehensive view of finances;

Disadvantages:

- More complex to implement and manage;

- May require more diligent cash flow management since it doesn’t directly track cash inflow and outflow.

Hybrid method (Modified cash accounting)

The hybrid method combines elements of both cash and accrual accounting. It allows businesses to track cash flow (like cash accounting) while also accounting for accounts receivable, payable, and inventory (like accrual accounting).

This method is often customized to fit specific business needs, offering flexibility in recording and reporting transactions.

Advantages:

- Offers flexibility, allowing businesses to enjoy the benefits of both cash and accrual accounting;

- Suitable for businesses that need to account for inventory but prefer simplicity in other areas.

Disadvantages:

- May be confusing due to the mix of accounting practices;

- Not always accepted by all tax authorities or for all financial reporting requirements.

How do you choose an accounting method?

In short, the choice of accounting method should be based on your ecommerce business’s specific needs, complexity, and goals.

- Smaller ecommerce businesses with simple operations may prefer cash accounting for its simplicity. Larger businesses or those with inventory, on the other hand, might benefit from the accrual method or the hybrid method to capture financial activities accurately.

- If you carry inventory, accrual accounting provides a better representation of cost of goods sold and inventory levels, which is crucial for ecommerce.

- Depending on your jurisdiction and business structure, legal requirements may dictate which accounting method you must use. For example, GAAP requires accrual accounting for larger businesses.

- If managing cash flow is a primary concern, cash accounting (or the hybrid method) gives a more direct understanding of cash on hand.

- Accrual accounting may be preferred or required if you plan to apply for business loans or attract investors, as it provides a more accurate picture of long-term financial health.

Consulting with an accounting professional can provide valuable insights and help you make the best decision for your situation.

The most important financial statements for ecommerce sellers

Ecommerce sellers must regularly review and analyze these financial statements. But what’s so important about them?

- These statements collectively provide a comprehensive overview of the business’s financial status and are used for internal management and decision-making.

- They are critical for communicating with potential investors or lenders, showcasing the business’s financial health and prospects.

- Ensuring accurate and timely financial reporting is essential for compliance with tax laws and regulations.

Let’s dive into more detail about each financial statement.

Balance sheet

The balance sheet provides a snapshot of an ecommerce business’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity, offering insights into the business’s net worth and financial health.

- Assets: Include current assets like cash, inventory, and accounts receivable, as well as long-term assets like property and equipment.

- Liabilities: Comprise both current liabilities, such as accounts payable and short-term loans, and long-term liabilities like long-term debt.

- Equity: Represents the owner’s or shareholders’ equity in the business.

Understanding the balance sheet helps ecommerce sellers manage their resources efficiently, ensure liquidity, and plan for future growth or debt repayment.

Income statement (P&L statement)

The income statement, or profit and loss statement, shows the company’s revenues, expenses, and profits over a specific period (e.g., monthly, quarterly, annually). It provides a clear view of the business’s operational efficiency and profitability by detailing how revenue is transformed into net income.

- Revenue: Includes all income from sales, minus returns or discounts.

- Cost of goods sold (COGS): Represents the direct costs associated with the production or purchase of the goods sold.

- Operating expenses: Encompasses selling, general, and administrative expenses, including marketing, rent, salaries, and other overhead costs.

- Net income: The bottom line, calculated as Revenue – COGS – Operating Expenses – Taxes.

Ecommerce sellers can use the income statement to assess profitability trends, control costs, and optimize pricing strategies.

Cash flow statement

The cash flow statement provides a detailed account of the cash inflows and outflows from operating, investing, and financing activities over a period. It’s crucial for understanding the liquidity and cash management of the business.

- Operating activities: Reflects cash generated or used in the business’s core operations, adjusting net income for non-cash items and changes in working capital.

- Investing activities: Involves cash used for or generated from the purchase or sale of assets, like equipment or investment securities.

- Financing activities: Includes cash inflows from loans or equity investments and outflows for loan repayments, dividends, or buybacks.

For ecommerce sellers, the cash flow statement is essential for ensuring that the business maintains adequate cash reserves to fund operations, grow, and meet obligations.

Bonus section: Essential financial metrics to be aware of

Now that you’ve got the big picture, we’ll delve deeper into the specific metrics to monitor when entering an ecommerce business. Closely monitoring specific financial metrics is fundamental for understanding performance and driving growth.

Here are the essential financial metrics that ecommerce accounting should be aware of:

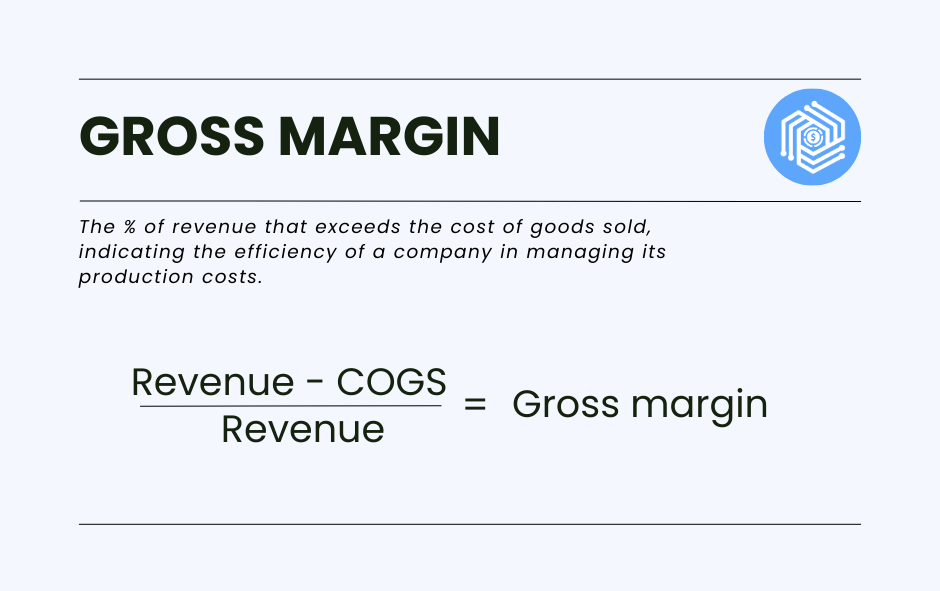

1. Gross margin

Understanding gross margin helps ecommerce businesses evaluate their pricing strategies, cost efficiency, and profitability of specific products or categories.

Gross margin represents the difference between revenue and the cost of goods sold (COGS) divided by revenue. It’s expressed as a percentage and indicates how much profit a company makes on each dollar of sales before other expenses are deducted.

⭐️ To accurately calculate gross margin, ensure that all direct costs associated with the production or acquisition of goods sold are included in COGS.

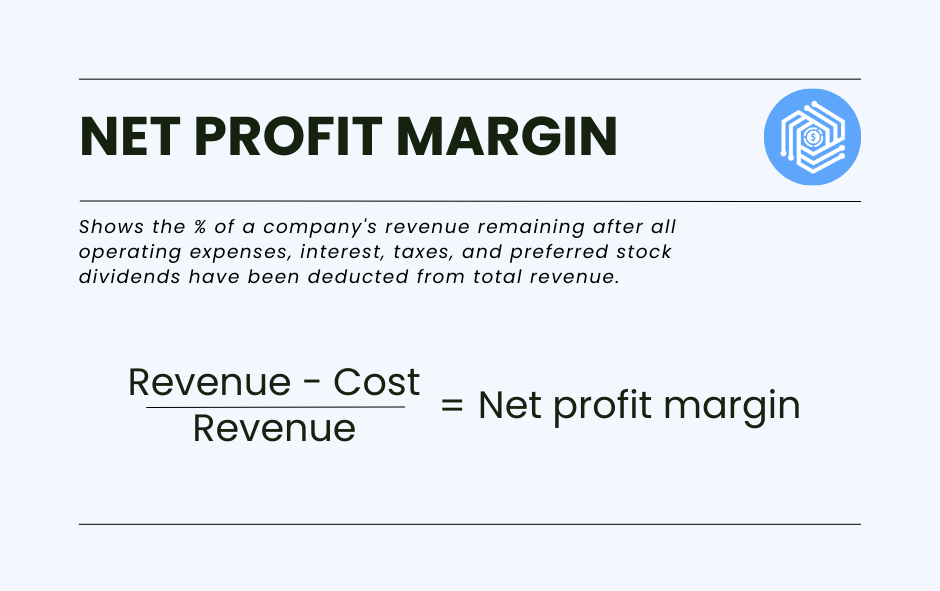

2. Net profit margin

This metric provides a comprehensive view of a business’s overall profitability and efficiency in managing its expenses.

Net profit margin measures the amount of net income generated as a percentage of revenue. It takes into account not just COGS, but all expenses, including operating expenses, interest, taxes, and other costs.

⭐️ Regularly review all operating expenses and look for areas to optimize spending without sacrificing quality or growth potential.

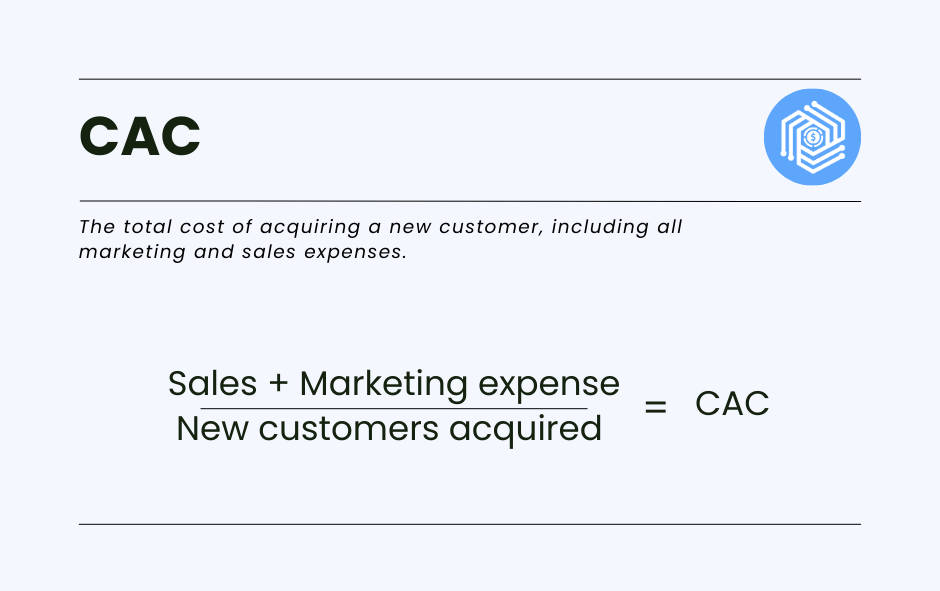

3. Customer acquisition cost (CAC)

For ecommerce businesses, understanding CAC is essential for evaluating the effectiveness of marketing strategies and determining the sustainability of growth.

CAC is the total cost of acquiring a new customer, including all marketing and sales expenses. It’s calculated by dividing the total acquisition costs by the number of new customers acquired over a specific period.

⭐ ️ Include all marketing and sales-related expenses in the calculation, and segment CAC by marketing channel to identify the most efficient acquisition sources.

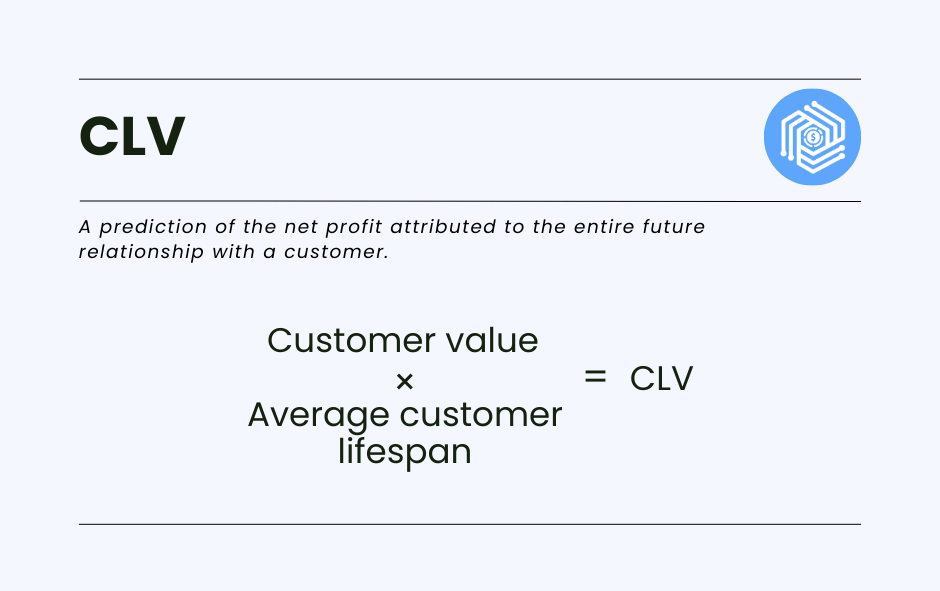

4. Customer lifetime value (CLV)

CLV helps businesses understand the long-term value of customers and guides decisions on customer retention and marketing spend.

CLV is the total amount of money a customer is expected to spend on your business during their lifetime. It’s calculated by multiplying the average purchase value by the average number of purchases over a customer’s lifetime.

⭐️ Use detailed customer data to segment CLV by different customer groups, helping tailor marketing and retention strategies effectively.

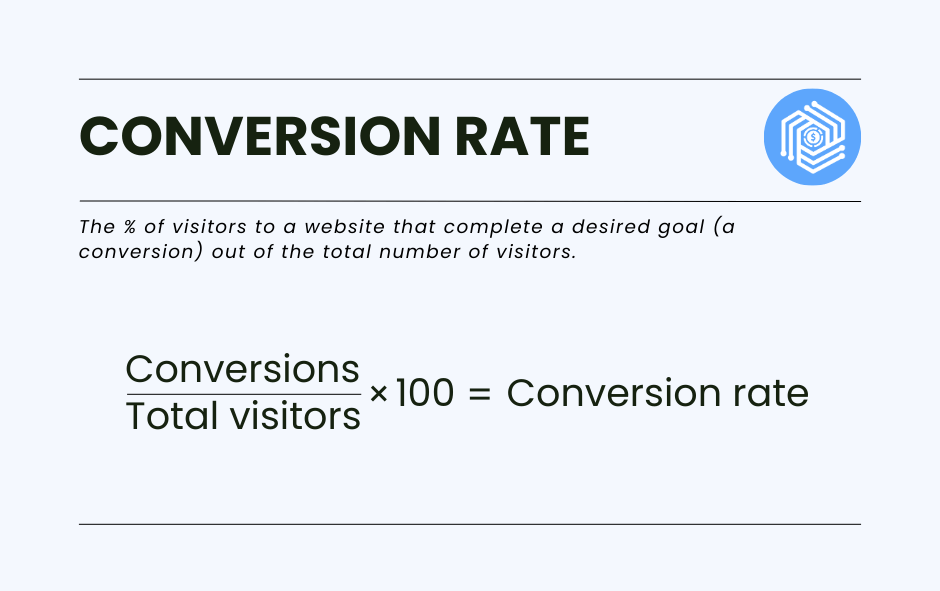

5. Conversion rate

Monitoring the conversion rate helps ecommerce businesses gauge the effectiveness of their website and marketing efforts in generating sales.

The conversion rate is the percentage of visitors to your ecommerce site who make a purchase. It’s calculated by dividing the number of conversions by the total number of visitors and multiplying by 100.

⭐️ Conduct A/B testing on different website elements to identify changes that positively affect the conversion rate.

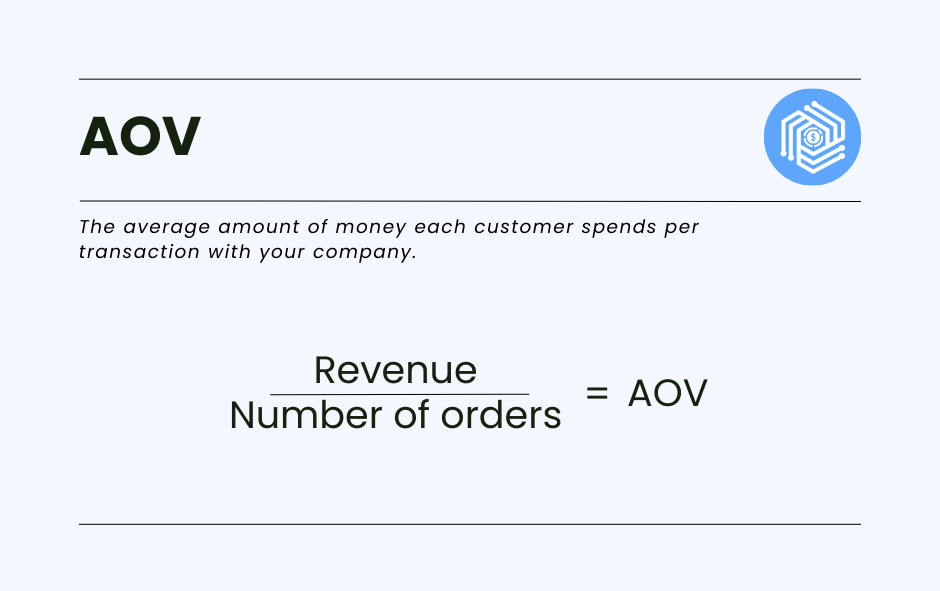

6. Average order value (AOV)

AOV is a key metric for understanding purchasing behavior and identifying strategies to increase revenue, such as upselling or cross-selling.

AOV tracks the average dollar amount spent each time a customer places an order on a website. It’s calculated by dividing total revenue by the number of orders.

⭐️ Monitor AOV alongside promotional campaigns or changes to product offerings to measure their impact.

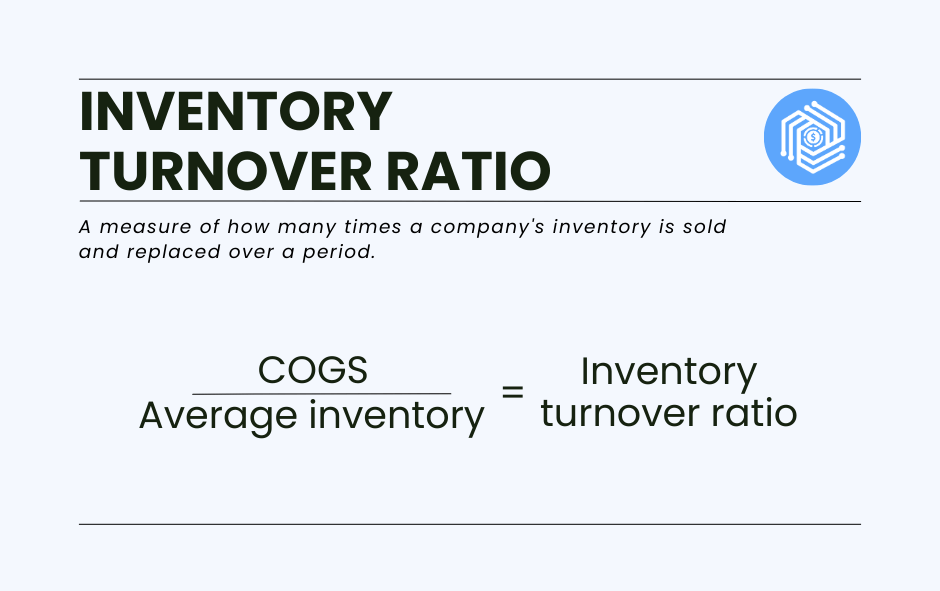

7. Inventory turnover ratio

High inventory turnover indicates efficient inventory management and sales performance, while low turnover may suggest overstocking or weak sales.

Inventory turnover ratio measures how often a business sells and replaces its inventory over a certain period. It’s calculated by dividing COGS by average inventory during the period.

⭐️ Regularly review inventory levels in relation to sales trends to adjust purchasing and pricing strategies accordingly.

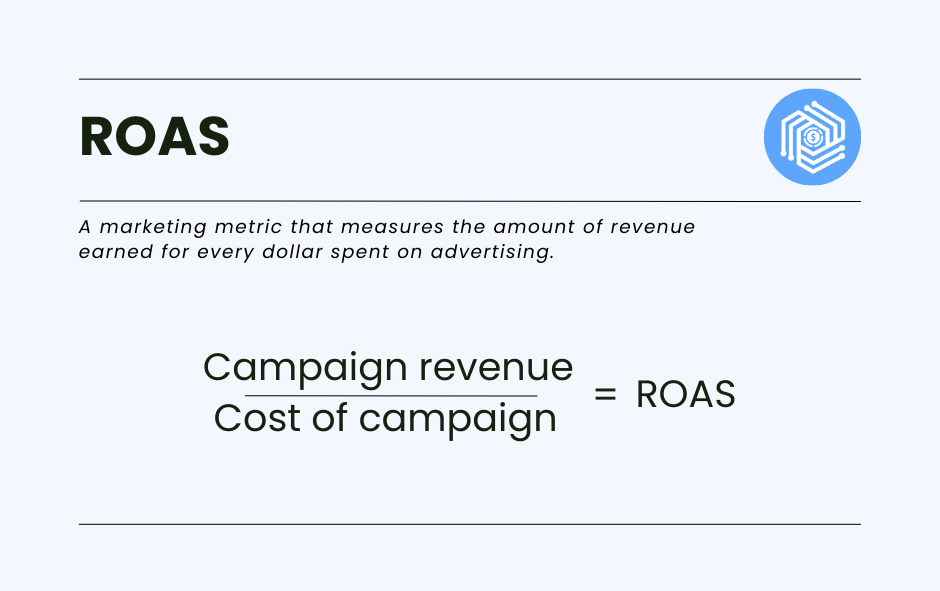

8. Return on advertising spend (ROAS)

ROAS helps ecommerce businesses evaluate which advertising strategies are most profitable and make informed decisions on marketing investments.

ROAS measures the effectiveness of advertising campaigns by comparing the revenue generated from advertising to the cost of the advertising. It’s calculated by dividing the revenue attributed to advertising by the cost of the advertising.

⭐️ Segment ROAS by campaign or channel to identify which marketing efforts are yielding the best returns.

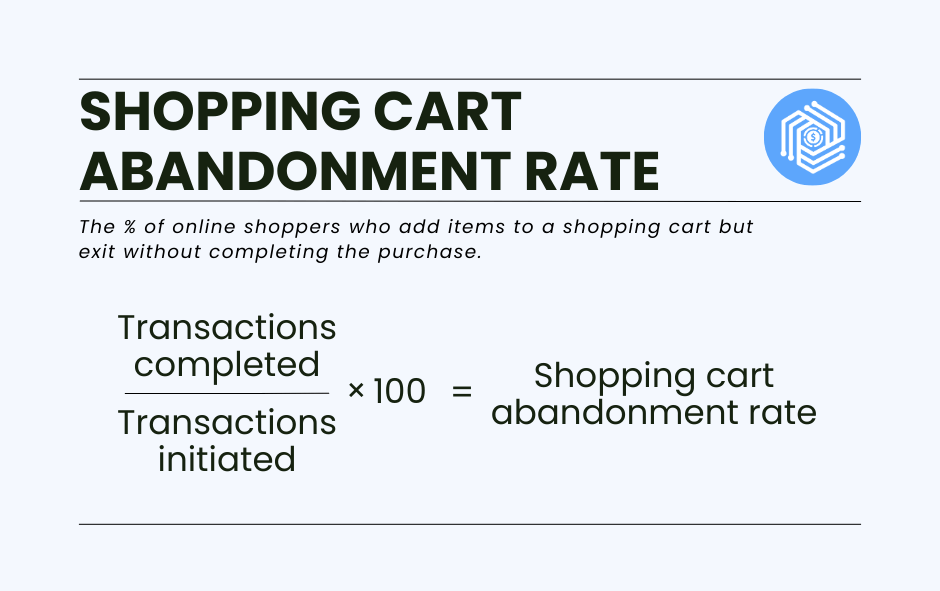

9. Shopping cart abandonment rate

A high abandonment rate may indicate issues with the checkout process, pricing, shipping costs, or website usability.

This metric measures the percentage of online shoppers who add items to their cart but don’t complete the purchase. It’s calculated by dividing the number of completed purchases by the number of shopping carts created.

⭐️ Use exit-intent surveys or analytics to understand why customers are abandoning carts and test different interventions to address these issues.

Bottom line

Our journey through the fundamentals of ecommerce accounting covers much more than mere numbers and spreadsheets. This guide has provided you with the knowledge and tools necessary to guide your online ventures toward success. Knowing key financial statements and best practices, you’re now prepared to confront the challenges of the digital marketplace with confidence.

In the world of online retail, having a strong grasp of accounting principles isn’t just beneficial—it’s crucial for sustainability and growth.

May your journey in ecommerce be both prosperous and rewarding!

Share your experience

Whether you’ve faced challenges, discovered effective strategies, or have insights to offer from your journey, we invite you to share your experience. Leave a comment below with your stories, tips, or lessons learned. Let’s foster a community of knowledge-sharing and support.

%20(1).png)