Running a business is hard enough without adding the complexity of filing taxes each year. A small business owner usually has a lot to deal with. From managing customers to marketing and budgets – the list is almost infinite. Taxes add a big chunk to this plate. Tax filing deadlines and taxes themselves become a really big deal for ecommerce business owners, adding even more stress to their busy lives.

According to experts, the key to success lies in maintaining a continuous collaboration with your tax professional throughout the entire year rather than solely during tax return preparation. Undertaking financial decisions without seeking advice from an accountant or financial adviser can expose you to risks and potentially lead to higher costs in the long term.

Navigating a tax season for your business doesn’t have to be a headache. This guide combines insights on how taxes impact your business, including some basic tax due preparation aspects and tax tips for small business. Get ready for the tax season with ease by incorporating these valuable insights.

Contents:

1. What is a small business tax?

2. How do taxes impact your business?

3. How much do small businesses pay in taxes?

- How to file income tax?

- How to file self-employment tax?

- How to file employment tax?

- How to file excise tax?

- How to file estimated tax?

4. Tax preparation tips: How to prepare in 14 steps

- Master essential financial terms

- Stick to proactive tax planning

- Collect your business accounting records

- Calculate your quarterly taxes to prevent any surprises for your business

- Stay Informed about tax law changes

- Know your earnings: the net and gross income difference

- Ensure accurate business classification

- Keep business and personal expenses separate

- Carefully categorize your expenses

- Ensure you have correct payroll records

- Accurately track inventory

- Gather all the needed documents

- Choose a tax preparer for your small ecommerce business

- Donate to charity: Learn not only to take but also to give

5. Recap of key tips for small business success: How to prepare for tax filing season

6. FAQs

What is a small business tax?

A small business tax refers to the various taxes imposed on businesses that operate on a smaller scale, typically with fewer employees and lower annual revenue compared to larger enterprises. These taxes are essential for funding government services and programs.

Small businesses can be charged different taxes like income tax, payroll tax, sales tax, and other fees, depending on their location and business structure.

Understanding and complying with these tax obligations is crucial for small business owners to avoid legal issues and ensure the financial sustainability of their enterprises.

Tax planning and seeking professional advice can help businesses optimize their tax positions and minimize the impact on their bottom line.

How do taxes impact your business?

Every U.S. small business owner is obligated to fulfill tax obligations, with the amount varying based on the state and business structure. Taxes stand out as the biggest costs for small businesses, constituting one of the most substantial lumps in the budget. For the tax year 2023, the top tax rate remains 37% for individual single taxpayers.

Apart from being a major business expense, taxes are also among the most critical bills to address. It’s crucial to stay informed about tax rates, as they directly impact your business’s financial health and compliance with legal obligations. Small business owners who neglect to file their taxes promptly, provide inaccurate information, or abandon the process altogether may face fines or, in extreme cases, criminal prosecution.

The reassuring news is that small business taxes aren’t as intricate as one might assume. Understanding the basics and staying informed can simplify the process significantly. Moreover, with assistance from tax professionals, using online tools, small business owners can further ease the burden and effectively manage their tax responsibilities and ensure compliance without unnecessary complications.

How much do small businesses pay in taxes?

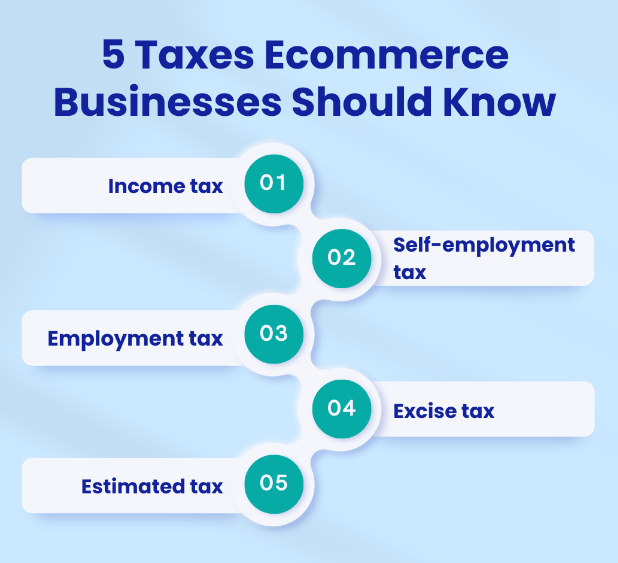

It’s worth noticing that your small business taxes may differ and highly depend on the form of business you operate. But generally, we speak about 5 types of taxes that apply to ecommerce businesses, such as

- income tax;

- self-employment tax;

- employment tax;

- excise tax;

- estimated tax.

How to file income tax?

The income tax is the tax you pay on the net income that your ecommerce business received during the year (total income minus expenses). In most cases, the income tax is a federal tax. However, in some states, the small business income tax can be the local state tax and can be paid instead of the federal tax. So if you’re unsure about how you need to file your income tax and how it works for your state in general, don’t hesitate to inquire with your state authorities or professional tax preparers to clarify the matter.

How to file self-employment tax?

Usually, when we speak about tax prep for self-employment taxes, we mean the taxes that sole proprietors, partners in a partnership, and LLC owners pay for Social Security and Medicare. The self-employment tax is determined based on the net income of the business.

Understanding how to file self-employment tax is essential for ensuring compliance and fulfilling your obligations to the social security system and any property-related taxes. This contribution plays a vital role in supporting various benefits, including

- retirement benefits,

- disability benefits,

- survivor benefits,

- and hospital insurance benefits.

Additionally, if you’re eligible for certain tax credits, you might even be entitled to a tax refund.

How to file employment tax?

If you have employees working for your small business, then you’re obliged to pay the employment taxes. Such taxes include:

- the Social Security and Medicare taxes;

- the federal income tax withholdings;

- the federal unemployment tax.

Please bear in mind that it’s your responsibility as a business owner to withhold these taxes from the employees’ paychecks. The Social Security and Medicare taxes are paid by both employees and employers. And the federal unemployment taxes are a business owner’s burden.

How to file excise tax?

If your business comprises manufacturing or selling certain types of products, using various equipment, facilities, and goods (fuel, for example), or receiving payment for certain services, it’s your responsibility to pay the excise taxes. There are also excise taxes on activities, such as wagering or highway usage by trucks.

How to file estimated tax?

The estimated tax is the tax that you need to pay quarterly throughout the year as a business owner. The thing is, you don’t get paychecks as your employees do, and still, you need to withhold income tax and self-employment tax from the money you get out of your business.

Usually, the estimated tax form for ecommerce business owners combines business and personal income and taxes. It’s critical to pay this tax on time, as failing to do so may result in penalties from the IRS (and that’s definitely not something you’re up to).

Tax tips for small businesses: How to prepare in 14 steps

But before filing or paying your small business taxes, there’s a lot to do. Depending on how thoroughly you prepare your ecommerce business for the tax due dates, the process can be quite placid or turn your life into total chaos.

Here are some small business tax preparation tips that you can take to make all the tax calculations, filing, and payments loads easier for you and a tax preparer who may be helping you.

1. Master essential financial terms

Mastering essential financial terms is crucial for small business owners navigating the complexities of tax management. The accounting sphere often feels like a different language, with its unique set of specialized terminology. Take the time to familiarize yourself with key terminology that sheds light on your business’s financial standing.

For instance, understanding terms such as

- revenue (the money earned through product sales);

- cost of goods sold (the expense of producing products sold);

- gross profit (the surplus after subtracting COGS from total revenue);

- and net sales (the total profit after deducting all expenses) are essential.

Additionally, be aware of other critical things, like operating expenses (the ongoing costs to run your business) and depreciation (the decrease in the value of assets over time).

This knowledge empowers you to make informed financial decisions and enhance the overall financial health of your small business. As practice shows, small business owners frequently overlook the difference between their net and gross income. Being well-versed in financial terms is key to optimizing profitability and fostering the growth of your company.

2. Stick to proactive tax planning

Preparing for tax season, particularly with attention to post-tax deductions, well in advance can significantly ease stress for business owners. Instead of falling into chaos often associated with tax time, taking proactive steps to organize your finances beforehand ensures that you not only meet but potentially beat the deadlines.

The optimal time to initiate tax considerations is around mid-November, allowing you to assess your tax situation realistically before the year concludes. This strategic approach enables plenty of time for planning and avoids the last-minute rush that could result in inaccuracies or oversights. If you regularly review financial records and tax documents throughout the year, it can also help identify potential issues early on, allowing for timely corrections and a smoother tax preparation process.

Keep in mind that even the most skilled CPA may face limitations once the year has closed. For a comprehensive guide on proactive tax planning, consider exploring reputable sources like the IRS’s Tax Center, which offers valuable insights and resources for business owners. Taking these steps not only ensures a smoother tax season but also positions you for financial success in the long run.

3. Collect your business accounting records

Keeping accurate records throughout the tax year is essential for effective tax planning and preparation. However, many ecommerce business owners don’t collect financial information regularly and often end up madly bringing their business transaction data into books at the beginning of the tax season.

Automation software can be of great help when working with money. The software gives you the opportunity to connect your sales channel or payment platform with your books and banking records, eliminating manual data entry from the process.

How can Synder help with record keeping?

Calculating sales tax for ecommerce businesses can be complex due to multiple sales channels and payment platforms involved. Synder simplifies this process by calculating taxes based on the sales total and tax amount, using transaction data from various payment processors like Stripe, Square, PayPal, IntegraPay, and others. It then matches the calculated tax rate to the tax codes in your QuickBooks or Xero accounts.

Check this guide on how to set up sales tax in QuickBooks or Xero with Synder.

4. Calculate your quarterly taxes to prevent any surprises for your business

To avoid unpleasant surprises, consider estimating and paying your taxes quarterly instead of making one large yearly payment.

Note: Most small businesses are required by the IRS to make quarterly payments if they anticipate owing more than $1,000.

Keeping track of your taxes throughout the year can help you

- Fulfill requirements and stay prepared for tax bills.

- Prevent unexpected financial surprises.

- Adjust payments based on varying income.

- Avoid a large payment during a slower business season.

- Stick to the proactive approach that can lower financial stress during tax season.

- Provide more predictable cash flow management for your business.

5. Stay informed about tax law changes

Tax laws are always changing, and staying updated is crucial. To avoid compliance issues and take advantage of new benefits, consider simple steps like subscribing to tax newsletters, attending webinars, or checking the IRS website regularly.

Make adapting to changes a breeze with login to pre-accounting solutions. It offers real-time updates, ensuring your financial records and deductions align with the latest laws. Essentially, pre-accounting solutions make it easy to adjust your strategies and stay compliant without the hassle of manually tracking changes.

6. Know your earnings: The net and gross income difference

Understanding the distinction between net and gross income is crucial for business success, as it helps you identify eligible tax deduction opportunities, ultimately reducing your overall tax liability. If it costs more to make your product than what you charge for it, you’ll end up losing money, regardless of how many units you sell. Many small business owners overlook the difference between their net and gross income.

For example, if your product costs $300 to produce and you sell it for $350, your gross income is $50. However, after deducting your expenses, your net income may be reduced to $20. It’s vital to be aware of both your gross and net profits to enhance profitability and foster business growth.

Another example: Imagine you provide a service for $200, but it costs you $150 to deliver, so your gross income is $50. Understanding the net income after deducting expenses is crucial for making strategic investment decisions, as you can ensure a more robust financial position for your small business.

7. Ensure accurate classification of your business

Incorrectly classifying your business may lead to tax overpayments. The following categorization of businesses has distinct implications for your taxes:

- C Corporation;

- S Corporation;

- Limited Liability Partnership (LLP);

- Limited Liability Company (LLC);

- Single Member LLC;

- Sole Proprietor.

Small businesses should seek advice from both an attorney and an accountant to accurately determine the most suitable classification for their operations. This proactive step ensures compliance and can potentially result in significant tax savings. Choosing the right business class is crucial for optimizing your tax strategy and ensuring you take advantage of available deductions and benefits.

8. Keep business and personal expenses separate

To avoid complications with the IRS, it’s crucial to distinguish between your business and personal expenses. Even if you accurately report business expenses, intertwining personal and business expenses may trigger scrutiny from the IRS, leading them to examine your personal accounts.

To prevent this, establish dedicated bank accounts and credit cards exclusively for your business transactions. By funneling only business-related expenses through these separate accounts, you maintain a clear and organized financial record, reducing the risk of potential audits or misunderstandings with tax authorities.

Utilizing dedicated credit cards is not only a focused and streamlined view into your overall tax management but also compliance and accountability in your business dealings.

9. Carefully categorize your expenses

Properly collecting and categorizing your business expenses is critical for your small business tax preparation, as it can significantly reduce your tax load with applied tax deduction.

Simply put, small business tax deductions are the expenses that can be extracted from your taxable income if they comply with the IRS criteria for deductible expenses. We usually speak of ordinary and necessary expenses in this context, which means these are the expenses that are usual, helpful, and appropriate for your trade or business.

The list of deductible expenses is quite broad and, depending on the type of your business, may include the following:

- Business travel;

- Business meals;

- Business insurance;

- Use of your car for business purposes;

- Home office expenses;

- Education costs;

- Independent contractor fees;

- Bank or payment processor fees, and many more.

Small business owners often overlook the importance of tracking tax deductions. By understanding and maximizing these deductions, you can optimize your tax strategy and reduce your overall tax liability.

Learn how Synder helps record Canadian taxes correctly with the help of automatic categorization.

10. Ensure you have correct payroll records

Beyond merely distributing paychecks, being an employer involves a multifaceted role, encompassing the management of taxes, Social Security contributions, and various deductions for each employee. The accuracy of your payroll records is paramount, ensuring the correct filing of employment taxes in preparation for the upcoming tax season.

Effective payroll management initiates with the proper classification of workers as either an employee or an independent contractor, ensuring the correct filing of employment taxes in preparation for the upcoming tax season. Thoroughly collecting accurate information from all employees, calculating their gross pay, accounting for necessary deductions, and ensuring timely payment of corresponding taxes are integral components. Additionally, staying informed about changes in labor laws is essential for compliance and optimizing your investment in the workforce.

Accurate payroll management not only aids in tax savings by sidestepping late payment penalties but also maximizes eligible tax deductions, offering financial flexibility for small business owners in need of loans.

Conversely, erroneous payroll practices can lead to tax fines and, ultimately, dissatisfied employees. For small business owners, meticulous payroll management translates to cost savings and the seamless operation of their business.

11. Accurately track inventory

Accurate inventory tracking plays a pivotal role in effective financial management for small businesses.

By thoroughly monitoring your inventory, you not only enhance operational efficiency but also gain valuable insights into the cost of goods sold (COGS) – a crucial component in calculating taxable income and potential deductions.

Implementing a reliable inventory tracking system allows you to account for every product or service sold. In turn, this contributes to precise calculations of profits and losses. As a result, accurate calculations can impact your eligibility for various tax deductions.

Small businesses, whether operating as a sole proprietorship or another legal structure, should prioritize individual inventory tracking methods. Such methods should be adapted to unique business needs and product offerings. Moreover, small businesses need to account for mileage, if applicable.

This level of accuracy not only ensures compliance with tax regulations but also empowers small business owners to make informed decisions about purchasing, pricing, and overall financial strategy.

A well-maintained inventory system provides a clear snapshot of your business’s financial health, aiding in efficient tax filing and strategic planning for sustained growth.

Synder’s data-syncing app seamlessly records product names and quantities sold to your books. However, note that inventory tracking operates one way only, moving from your payment platform to your books.

Explore our guide on how to account for inventory tracking and COGS with Synder.

12. Gather all the needed documents

Like many ecommerce business owners, you can decide to entrust preparing and filing your tax return form to a tax preparer or a certified accountant.

A good rule of thumb here is to plan ahead and get all the necessary documentation prepared before scheduling an appointment. Moreover, such a tactic will help you build better relations with your tax specialist, leading to significant time and cost savings.

Though the list of required documents may vary depending on the type of your business, the minimal set of documents can be as follows:

- Last year’s tax return;

- Financial statement;

- Capital-asset activity;

- Vehicle use/Home office expenses.

13. Choose a tax preparer for your small ecommerce business

While you might have a good grasp of taxes, hiring a professional ensures compliance and optimization in navigating intricate tax codes, providing peace of mind. A qualified tax professional must be registered with the IRS and possess a current preparer tax identification number (PTIN).

Professionals in this field fall into distinct categories based on their education, certifications, and continuing education requirements:

- Attorneys: Law degree, bar exam, state licensing.

- CPAs: CPA exam, state licensing, specializing in tax.

- Enrolled Agents (EAs): IRS exam, federal tax competence.

- Annual Filing Season Program Participants: IRS-recognized, tax-year-specific education.

- PTIN Holders: Active PTIN, no professional credentials, no IRS representation authority.

Check whether your tax professional falls into one of these categories. This ensures that your tax advisor possesses the necessary qualifications to handle your business’s unique financial needs and navigate the ever-changing landscape of tax regulations.

Take a look at our CPA directory and find an accounting professional for your business with ease.

14. Donate to charity: Learn not only to take but also to give

The next strategy that also serves as a valuable tax tip is supporting charitable causes. How can this be beneficial to you?

A. Tax deductions for your business

Small businesses can enhance their financial standing while supporting community causes by making charitable contributions – a strategy that also reduces tax liability.

By making donations to registered charities, you can usually deduct the contributed amount from your taxable income. This not only assists a worthy cause but also results in a reduction in your tax liability, creating a mutually advantageous situation. Looks like a win-win, doesn’t it?

Note: It’s essential to be aware of the limits on donations for the tax year. Individuals can write off up to 100% of their taxable income, while corporations are eligible for a write-off of up to 25% of their taxable income.

B. Boosting business and brand appeal

Moreover, beyond being a tax-saving tactic, engaging in philanthropy is a powerful means of connecting with your target customers. As is well-known, consumers are more likely to patronize businesses with strong brand values.

Thus, donating causes not only benefits to your community but also enhances your business’s appeal to customers who value socially responsible practices. Consider this dual approach for both financial and brand-building benefits.

Recap of key tips for small business success: How to prepare for tax filing season

Ideally, an ecommerce business owner needs to keep small business taxes in mind all year round. A wise and structured approach may help prepare business taxes much easier and make tax season less stressful for you.

Usually, it comes down to:

- keeping accurate accounting records throughout the year;

- making appropriate estimated tax payments;

- filing correct returns and making payments by the end of business tax season.

You don’t necessarily need to go through it alone – ecommerce business tax preparation is the time when you definitely need the help of an accountant or a tax advisor. However, a little advance preparation won’t hurt.

Hope this article covers a variety of essential topics to help you navigate the complexities of small business taxes and has given you a clearer idea of the steps you need to take before completing and submitting your tax returns!

FAQs

1. How do small business taxes impact my business?

Taxes are a significant cost for small businesses, constituting one of the most substantial expenses. The average small-business tax rate on income is around 19.8%. Failing to fulfill tax obligations can result in fines or even criminal prosecution. Understanding the basics and staying informed can simplify the tax process, with assistance from tax professionals further easing the burden.

2. How do I file income tax for my ecommerce business?

Income tax is paid on the net income, i.e., total income minus expenses. It’s recommended to consult with state authorities or professional tax preparers for state-specific details. Seeking assistance ensures accurate filing and compliance with federal and state regulations.

3. How can I set up sales tax in Intuit’s QuickBooks?

Using Synder can simplify the process of setting up sales tax in QuickBooks. Especially when you are using transaction data from various payment processors. This ensures accurate sales tax tracking, a critical aspect for ecommerce businesses, which makes it easier to adhere to sales tax regulations.

4. What’s the key tax tip for small businesses during tax season?

The key to success is to collaborate year-round with your tax professional. Regular discussions ensure a more informed and strategic approach to small business tax management.

This proactive approach helps:

- optimize tax strategies;

- identify risks;

- eliminate last-minute stress during tax season.

%20(1).png)

nice article.

I appreciated you pointing out that a business owner has an estimated tax that needs to be paid quarterly throughout the year. My friend is having a hard time with their tax preparation. I should advise him to hire a firm that has assisted clients with all types of accounting and tax matters.

Your information about choosing a tax preparer will show my sister how to find one for her business. She’s starting an online boutique, and she’ll need to hire someone to keep track of her finances and taxes to avoid any IRS issues. I’ll email your tips about checking a tax preparer’s PTIN and skillset before choosing one.

We’re very glad we could be of help. Best of luck to your sister in her new venture!

Thanks for the reminder that the document collection should also be done early on when planning to get tax preparation services. I’m interested in looking for a good accountant soon because I’m thinking about finding a good way to make it easier to find a good way to more easily start a new business soon. Planning ahead for the tax requirements that I will have to deal with will be very important for that.

Hi Alice, when looking for a good accountant you can consider Synder Accountants Directory.

It’s so excellently done, and you have some exceptionally good ideas. This post is excellent! Thanks for sharing.

Thank you so much for your kind words!

Thanks for suggesting investing in tax preparation to avoid finance-related problems later on. I have a friend who wants to start a business where he can sell smartwatch accessories to athletes. I should talk to him about finding a tax preparation expert when we meet again.

This article is a goldmine of essential information for business owners preparing for the upcoming tax season in 2023. Your comprehensive guide to tax preparation highlights key areas that require attention, such as organizing financial records, understanding deductions, and staying updated on tax laws. The emphasis on planning ahead and seeking professional advice is crucial for a smooth tax season. Thank you for sharing these valuable tips and helping businesses prepare effectively. It’s a resource I’ll definitely revisit as tax season approaches.

We’re thrilled to hear you found the article to be a valuable resource for the tax season! It’s our goal to provide thorough and helpful guidance to support business owners. Thank you for your feedback!

I blog frequently and I seriously want to thank you for the detailed information. This article has piqued my interest. I’m going to take note of your site and keep checking for new information once per week.

Thank you so much for your kind words! We’re delighted to know you’ve found the content engaging and helpful. Keep an eye out for our latest posts, and feel free to share your thoughts and ideas with us anytime.

Thanks for the article! This guide is unlike any others I have read.

Tax return preparation involves the process of calculating, filing, and submitting income tax returns to the relevant tax authorities. It requires careful review of financial records, income sources, deductions, and credits to ensure compliance with tax laws and regulations. Professional tax preparers or software programs are often used to facilitate the accurate and timely filing of tax returns, which is essential to avoid penalties and maximize tax savings.