The hero of our new story is Maxime – the owner of QANTU – a company that transforms cocoa beans into pure bliss and sells chocolate.

In this user case, we’ll give an overview of what Maxime’s problem with tax (Canada and US) was, how Synder tackled it, and how Maxime evaluates the time he’s spent with Synder.

Quick preview: you’ll find out how to record the Canadian taxes into QuickBooks with the right rate with the help of Synder Sync automated categorization feature. Interested? Let’s get into detail!

Failing to file Canadian taxes correctly: Tax preparation is difficult due to issues with recording Canada taxes

Initially, Maxime wanted to import historical data for a year. Since among his online customers he had lots of Canadians and Americans, there were two conditions: 1 – separate taxes needed to be applied to his Quebec and Ontario transactions, and 2 – no taxes had to be applied to his US transactions.

We all know there might be some issues with QuickBooks when trying to record your Canadian taxes – occasionally you might find yourself living in Nova Scotia instead of Ontario at the end of the month. And believe me, in this case you won’t be the only one questioning this situation – the Ministry of Financial Tax will probably want to have a talk with you as well at the end of a tax year due to some tax-filing issues.

The problem is that QuickBooks has a list of rates per Canadian provinces, but when you transfer the transactions right into QuickBooks, the software will record the tax to the first province in the list with the same % of tax (for example, if you have two provinces with the same tax rate, QuickBooks will record both transactions to the Canadian province that stands first on its alphabetical list with this particular rate). This issue is quite common and makes it extremely difficult to record Canada’s taxes correctly, and, consequently, makes filing taxes more stressfull each year.

Maxime was well aware of these Canadian tax issues and didn’t want to leave his Canada tax problem up to fate. After all, if you can’t properly record your taxes, come the end of the tax year, you won’t be able to file Canadian taxes for your online business correctly and incorrect tax filing may result in serious penalties. So when he needed to separate records for two particular provinces, he decided to receive some help – find a reliable solution – and turned to Synder. Spoiler: Maxine controls his Canada taxes like an expert now and tax preparation and filing each year is easy!

Want to ease tax filing? Nail recording Canadian taxes with Synder’s Smart Rules feature

Q: How did you find out about Synder?

“I found Synder looking for QuickBooks PlugIns that would manage Stripe transactions. We use Stripe to process our online store payments. It looked like the best option for businesses operating online, I tried it and I liked the simplicity of the tool.”

With great management also came other benefits, and in particular, a useful automated categorization feature – Smart Rules. So how does it help to record the taxes correctly?

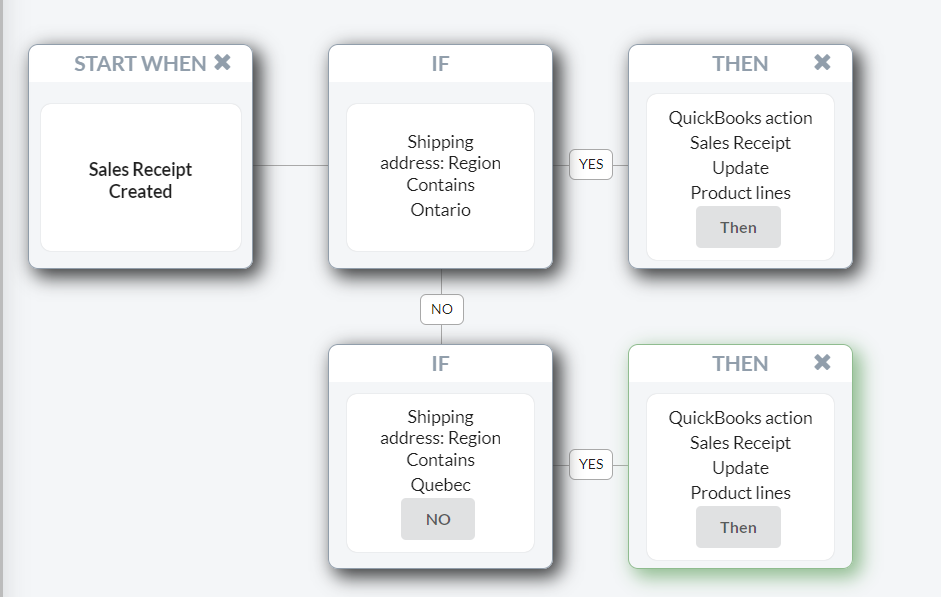

Smart Rules works as an easy-to-build flow that can be tailored to the needs of a particular user. The best part is that the user can put their own triggers and actions that’ll be activated automatically – no preparation or special skills needed. For example, you can create the following flow:

IF the receipt includes Ontario in the shipping line, THEN in QuickBooks the tax will be applied to Ontario.

This is the exact pattern that Maxime so desperately needed! All he had to do was to create a single rule with two conditions – one for Ontario and one for Quebec. Canadian tax problem solved!

This is the example of how the form might look in Synder in case you face the same problem as Maxime did:

📌 Note: The rule with multiple conditions can be applied to only one type of transaction – you can’t use one rule for both your Invoice and Sales Receipt. If you have both of them, you’ll have to form two rules.

Q: Apart from helping you to file taxes correctly, how is Synder helping you now?

“I use Synder to bring into QuickBooks all the online store sales and apply categorization rules to automatically select the right Canadian tax. With Synder, we manage 4 types of taxes and charge no taxes for international sales made by people from foreign countries online. It also considers the fee paid for Stripe processing, so each payment goes into the right accounts in Quickbooks.”

Want to solve your problems with international sales and incorrect tax filing just like Maxime did? Try Synder Sync for your online business and create your own categorization flows. No more worries about errors and discrepancies! Ensure that come the end of tax year, you’re ready to file taxes!

To learn more about how Synder works, book a call with our specialists who are always ready to answer your questions and find solutions to your problems! Receive the information and help you need to ease tax filing!

Are you ready to take your business to the next level just like Maxime did? Join us and see everything yourself – register for our webinar.

.png)