As businesses strive to maximize their revenue, they need to have a clear understanding of their customers’ spending patterns. One of the most important metrics that companies use to measure their revenue is ARPU. It’s a critical indicator that reflects the amount of revenue a company generates per its active users.

In this article, we will delve deeper into what ARPU is, how it’s calculated, and why it’s such an important metric for businesses of all sizes. We’ll also explore how companies can use ARPU to improve their revenue and customer retention strategies.

Here’s what you’ll learn about ARPU:

1. What is average revenue per user?

What is ARPU (average revenue per user)?

If you run an online business, you’ve probably already heard of ARPU, or average revenue per user. It’s a key metric for advertisers and other partners who hope to make money from an online business. But what is it about and how can you improve your business’s revenue per user?

Let’s take a look at the definition.

Average revenue per unit (ARPU) is an indicator of the profitability of a product based on the amount of money that is generated from each of its users or subscribers.

— Investopedia

So, basically, ARPU is a key metric for understanding the health of a company’s subscription model. It measures the earnings generated per user or unit. In other words, it shows how valuable each user is to the company based on the average revenue they bring.

A company with high ARPU generally has a more lucrative subscription model compared to a company with low ARPU.

ARPU allows to calculate the average revenue generated by customers and compare it to costs to see if the company’s making money and whether the business financial situation is under control or not.

🧮 How to calculate ARPU?

ARPU is calculated by dividing a company’s monthly or annual revenue by its monthly or annual ARPU count. This is a key indicator of how well a business is doing with regards to its customer base.

Here’s the formula you need:

ARPU = Total revenue (MRR) / Total number of customers over a specific period of time (month/year)

Understanding and predicting your customers’ willingness to pay is an important part of managing your business. Calculating ARPU gives you a sense of how much revenue a specific user group will generate for your business. It can be helpful in planning future product and service offerings, and it’s also a good gauge of how well your marketing and customer service strategies are working.

In other words, it answers the question “How much does each of my users spend in my store on an average day?

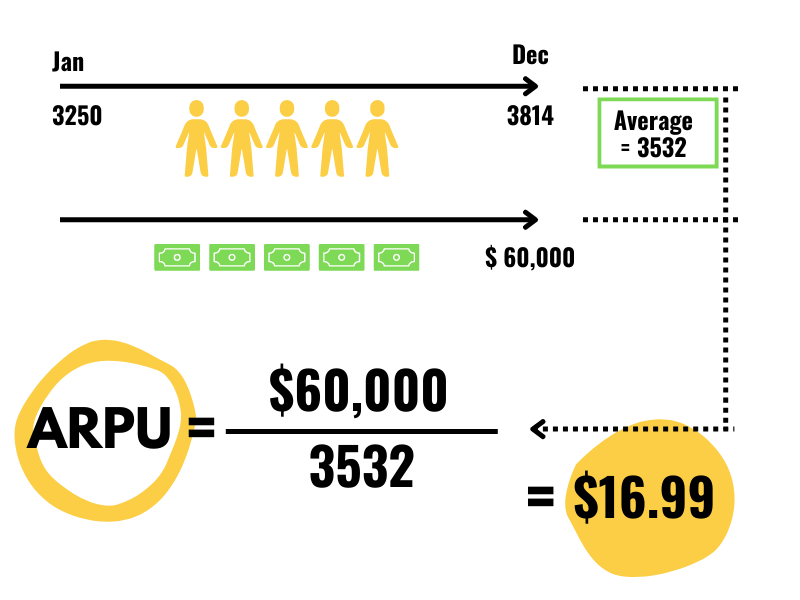

Example: how to make ARPU

Let’s imagine that Joanna has an amazing online business and her yearly revenue is around $60,000. Since the beginning of the year she’s been implementing a new marketing strategy for her Shopify store. Now Joanna wants to see the actual numbers and according to the formula her result is the following:

The main point of ARPU is that you need to make decisions based on the final number you see. Only with calculations can you create new strategies for your business. Understanding how to calculate ARPU also helps you see from which store you gain the higher revenue, so that you can either focus your growth on this store or try to improve the situation with the other ones.

⚖️ Pros and cons of ARPU

| ARPU pros | ARPU cons |

|---|---|

| It’s an actual number, not a rate | 📌 It’s a macro-level measure |

| It helps to control the weakest and the strongest points of the business | To be useful, it needs to be provided with enough information |

| It can be the base for accelerating your MRR growth | It can be not as useful as churn and customer growth |

📌 You have to look in-depth at the numbers you see in the ARPU formula. For example, your MRR is $100 and 10 total paying users. That means that your ARPU = $10. But don’t be fooled by this number! Only two or three customers may be providing you with 90% of the revenue, since the prices on the products are different and not all the customers buy the same thing.

📊 Why is ARPU important?

ARPU provides insights into the company’s revenue generation and customer behavior. By analyzing ARPU, businesses can determine the profitability of different customer segments, identify opportunities for upselling and cross-selling, and make informed decisions about pricing strategies. Here are some some points at which businesses can leverage ARPU:

1. Track the health of your business

Be sure that your business strategies are working as they should with constant checking of their performance. From budgeting to planning for the future, it can be difficult to know where your company’s headed. However, a sound health strategy can help your business grow and reach its full potential. And ARPU is a key point here.

2. Analyze the products per segment

ARPU allows you to keep track of the business per different segments such as users, products, sales channels, or even geographical regions. With one formula you can not only check which product is the most sellable, or which store brings you the most revenue, but also trace your customer flow in general.

3. Forecast

With ARPU you can set predictions of your business performance and make goals for your MRR and customers’ LTV. Customers who have a clear understanding of what they want and need from you will be more likely to buy from you again in the future. But in order to make sure that you understand your customers correctly, you should also rely on ARPU to forecast your business performance.

What makes ARPU important for SaaS business?

ARPU is particularly crucial for SaaS business. Usually, SaaS companies operate on a subscription-based model where customers pay recurring fees for access to software and related services (so each user can secure recurring revenue for a company for the whole time of using the software). At this point, ARPU can reveal insights into customer behavior, such as which pricing plans and features are most popular and which ones are not performing well. This information can help optimize pricing strategies and develop targeted marketing campaigns to encourage customers to upgrade to higher-tier plans or purchase additional services.

Besides, ARPU helps SaaS companies understand the lifetime value of their customers or the total revenue that a customer might generate over their entire relationship with the company. By calculating the lifetime value of their customers, SaaS businesses can make informed decisions about customer acquisition costs and retention strategies. For example, they can determine how much money they are willing to spend on acquiring a new customer based on the expected revenue that the customer will generate over time.

📈 How to increase ARPU

For businesses, it means keeping customers coming back for more. Here are a few ways of increasing ARPU so your customers stay loyal and bring in more revenue per user.

1. Choose the right pricing for your product

Pricing your product the right way will not only increase your ARPU, but it will also make your life easier in the long run.

Pricing your product doesn’t just involve slapping a price tag on something and expecting customers to pay. It’s a key part of your entire business model, so it’s important to understand your goals and motivations before choosing a price. Pricing your product isn’t just about making money; it’s about creating a balance that incentivizes both you and your customers.

2. Focus on product quality

The best way to attract new customers and increase your ARPU is to offer them a quality experience from the moment they enter your store to the moment they leave. It’s not enough to just launch new products or services and hope that they’ll take off. It’s essential to focus on product quality and be sure that your end product delivers what your customer’s hoping for. This will not only keep them coming back but also build your brand as a trustworthy and reliable brand.

So, how can you make sure your customers have the best product experience? You can’t treat every customer like a random sampling experiment. But, you can focus on a few key areas of your product experience to improve the overall customer experience and increase your business ARPU.

3. Reduce customer churn

Reducing customer churn is about changing your customer retention rate and increasing ARPU. You have to change your entire business model and reduce the number of barriers your customers face. Instead of focusing on growth, you’ll need to make sure your customers are happy and don’t leave you.

For better ARPU and business growth, you have to constantly keep your customers informed, address their concerns, and make sure they have everything they need. If you have a high churn rate, it’s going to be extremely difficult to grow your business. You’ll constantly have to dedicate time and resources towards retaining customers instead of growing your customer base.

ARPU: bottom line

Companies these days have to have a keen sense of customer analytics in order to remain competitive. In a world where so many businesses are going online for marketing and sales, learning how to optimize your content, design, and marketing is essential.

But with great power comes great responsibility, right? So the higher your ARPU and the higher the number of customers is, the more complicated the accounting will be for your business.

There is no easy-to-use formula such as it was with ARPU, but there’s an easy-to-use accounting software solution that helps to automate all the accounting processes.

Synder will back you up on your journey to success and will deal with such tasks as reporting, categorization, recording, etc. automatically. Try it yourself and see the results or schedule a personal Demo session and discuss your case with our experts who will help you and tell you more about Synder workflow.

.png)