Cost of goods sold (COGS) is a crucial part of any business both in terms of finance and marketing. If you wonder how to calculate the cost of goods sold, search no more. In this article, we will show you how COGS is calculated, and how the value of COGS metric is determined by a specific set of elements.

To aid the understanding of COGS in your businesses, we will provide a helpful example when showing the COGS formula.

Last but not least, we will share our eComm Marketing Agency knowledge by reviewing the benefits as well as limitations of COGS metrics to give a full picture of the use of COGS in your business.

Contents:

2. Why is COGS important for your business?

3. How to calculate cost of goods sold?

4. COGS formula with an example

5. What insights can be drawn from the COGS metric?

6. What are the limitations of the COGS calculation method?

What is COGS?

COGS, or Cost of Goods Sold, is a key financial metric that is essential for any business, especially when it comes to marketing. COGS represents the direct cost associated with the production or acquisition of a product. It is important to understand COGS as it helps determine the profitability of a product and assists in developing effective marketing strategies.

Why is COGS important for your business?

COGS, is a major financial metric for any business, and it plays an essential role in marketing. COGS represents the direct costs associated with producing or acquiring a product, and it’s critical to understand this metric as it helps determine the profitability of a product.

Profitability

When calculating COGS, businesses take into account the cost of raw materials, labor, manufacturing overheads, and shipping. By understanding COGS, businesses can calculate the gross profit margin by subtracting the COGS from the sale price of the product. This metric is important for marketing as it provides insight into the financial performance of a product and its potential for profitability.

Optimal price point

Knowing the COGS is momentous for pricing a product optimally. By understanding the costs associated with a product, businesses can determine the optimal price point that will ensure that the profit margin is maintained while also being competitive in the market. Setting the right price point can have a significant impact on a business’s revenue and profitability.

Budgeting

COGS is also important for budgeting marketing activities. By calculating the profit margin, businesses can determine how much they can afford to spend on marketing activities to drive sales and boost revenue. Understanding the COGS can help businesses make strategic decisions about which products to promote or invest in, depending on the profit margins they offer.

Importance of calculating COGS

COGS is a metric that is essential for any business, and it’s especially important in marketing. By understanding COGS, businesses can set the right price point, allocate marketing budgets, and make strategic decisions about which products to promote or invest in.

How to calculate cost of goods sold?

Calculating the Cost of Goods Sold (COGS) is a critical aspect of a business’s financial management, which helps to determine the profitability of a product.

What items need to be included in the formula to determine COGS

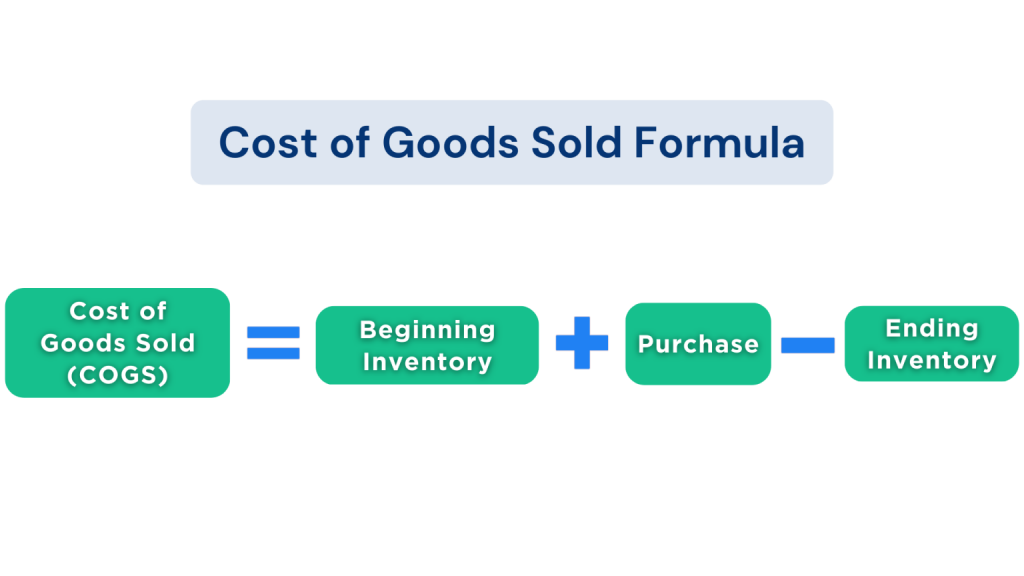

The formula for calculating COGS is relatively straightforward and involves the following steps:

- Determine the cost of all the materials and supplies needed to produce a product.

- Add the cost of labor, including any wages or salaries paid to employees who contributed to the production process.

- Include any overhead costs associated with production, such as rent, utilities, insurance, and depreciation.

- Add the cost of shipping and handling for the product.

COGS formula with an example

Here is an example to illustrate the calculation of COGS.

Suppose a company manufactures and sells T-shirts. The company incurs the following costs in producing and delivering the T-shirts:

- Cost of raw materials, such as fabric and thread: $5,000

- Cost of labor: $2,000

- Overhead costs: $1,000

- Shipping and handling: $500

Using the formula above, we can calculate the COGS as follows:

COGS = Cost of raw materials + Cost of labor + Overhead costs + Shipping and handling

COGS = $5,000 + $2,000 + $1,000 + $500

COGS = $8,500

So, the Cost of Goods Sold for the T-shirts produced by this company is $8,500.

The formula for COGS calculation method: Overview

By calculating the COGS, businesses can determine the profit margin and set the appropriate price for their products. Understanding the COGS is crucial for effective financial management and making strategic marketing decisions.

What insights can be drawn from the COGS metric?

The Cost of Goods Sold is a critical financial metric for any business, and it can provide valuable insights into a company’s financial performance. Here are some insights that can be drawn from the COGS metric:

- Profitability: COGS is a measure of the direct costs associated with producing or acquiring a product, and it’s a pivotal component in calculating a company’s gross profit margin. By subtracting the COGS from the revenue generated from the sale of a product, a business can determine the profit margin. This metric provides insight into the profitability of the product, and whether it’s generating enough revenue to cover the cost of production.

- Efficiency: COGS can also provide insight into the efficiency of a company’s production processes. If the COGS is high, it can indicate that the company is inefficient in producing or acquiring a product, and there may be opportunities to optimize the production process to reduce costs and increase profitability.

- Pricing: COGS is important in determining the optimal price point for a product. By understanding the direct costs associated with a product, a business can set the right price that will ensure that the profit margin is maintained while also being competitive in the market.

- Product mix: COGS can help businesses make strategic decisions about which products to promote or invest in. By analyzing the profit margins of different products, businesses can identify the products that offer the most significant revenue potential and allocate resources accordingly.

The COGS metric provides valuable insights into a company’s financial performance, and it’s a crucial component in financial management and marketing strategy. By understanding the COGS, businesses can determine the profitability of their products, optimize production processes, set the right price point, and make strategic decisions about product mix.

What are the limitations of the COGS calculation method?

While the cost of goods sold (COGS) calculation is a useful metric for businesses, it has some limitations that should be taken into account. Here are some limitations of the COGS calculation method:

- Limited scope: The COGS calculation only takes into account the direct costs associated with producing or acquiring a product. It doesn’t consider other indirect costs such as marketing, administrative expenses, and research and development costs. As a result, businesses may underestimate the actual cost of a product and the true profit margin.

- Complex production processes: In some industries, the production process can be complex, with several stages involving different raw materials, labor, and overhead costs. It can be challenging to determine the cost of each stage accurately, and it can result in an inaccurate COGS calculation.

- Inventory accounting methods: The COGS calculation can vary depending on the inventory accounting method used. For example, if a business uses the first-in, first-out (FIFO) method, the COGS will be different from the last-in, first-out (LIFO) method. This can result in different profit margins and financial performance metrics.

- Timing of expenses: The COGS calculation is based on the expenses incurred during a particular period. However, there may be a time lag between the actual expenses and when they are recorded, which can result in an inaccurate COGS calculation.

While the COGS calculation is an essential financial metric for businesses, it has some limitations. To obtain a more accurate picture of a company’s financial performance, businesses should consider other financial metrics in addition to COGS and take into account the limitations of the COGS calculation.

How to calculate COGS: Closing thoughts

COGS formula is a vital part of a proper business management strategy. It carries a strong informative value for the goods your company sells. While COGS metric can direct your production process, purchases strategy, and other major expenses, it has its limitations. Bear them in mind when drawing conclusions and putting them into practice.

We hope that by providing you with the COGS formula and useful example you will be able to calculate the value of COGS and use this information to grow your business further.

Want to learn more? Explore Is The COGS is an Expense.

.png)