COGS or cost of goods sold is a crucial financial metric that applies to all businesses selling physical goods. It’s not only an accounting valuation on your income statement, but a barometer of your business management health. It can influence your costs and expenses and even financial planning or investment opportunities as COGS for many businesses is one of the highest expenses they incur. Online retail is a good example of such businesses.

In this article, we’ll review why COGS is an important metric in business and accounting. We’ll show you how to calculate COGS and tell you about the intricacies of the COGS formula using a healthy dose of illustrative examples.

Contents:

1. Cost of goods sold as a key performance indicator

5. Cost of Goods Sold formula and calculation

6. Inventory costing methods and cost of goods sold calculation

- FIFO

- LIFO

- Average Cost Method or Weighted Average Cost (WAC)

- Inventory method and cost of goods sold: bottom line

7. E-commerce solutions for managing cost of goods sold

Cost of goods sold as a key performance indicator

KPI (key performance indicator) is an abbreviation known to any savvy business owner who wants to keep their finger on the pulse of their company. KPIs allow you to track your company’s progress and failures and invest more time and effort where it’s required.

According to Luis Mocsa, a certified public accountant, owner of several small businesses, and a consultant with American Management Services, KPIs are both strong and versatile indexes of the business performance. A KPI is a guide that helps achieve business success by evaluating employee productivity and measuring your finances to the status of a job in progress. Key performance indicators change depending on the goals of your business, projects, and timelines, which means that business KPIs shift over time. Being versatile, KPIs fall into various categories. One of the financial KPIs, namely cost of goods sold or COGS, offers you the opportunity to explore your business in depth.

Want to find out how COGS influences your business strategies and what are the benefits and limitations of COGS calculations? Read this expert article.

COGS – basic definition

COGS is an essential metric for any business that reflects the direct costs of producing the goods sold by the business. According to the cost of goods sold definition, this metric includes the cost of the materials and labor directly used to create the product and excludes indirect expenses like distribution and sales force costs. Cost of goods sold is sometimes called “cost of sales.”

COGS is also an accounting term under U.S. Generally Accepted Accounting Principles (GAAP) that requires businesses to apply certain inventory costing principles. GAAP provides guidelines about which costs are to be included or excluded in the process of COGS calculation.

Why is COGS important?

The importance of COGS is explained by its direct connection to the gross profit of the company, which is calculated by subtracting COGS from a company’s revenue. Gross profit is a key indicator of a company’s profitability, which measures how effectively a company uses its resources while producing goods or services. Here’s the formula:

| Gross profit = Revenue − Cost of Goods Sold |

COGS is also a key component in determining a company’s gross margin, which is calculated by subtracting COGS from a company’s net sales. Gross margin is the amount of money a company keeps after incurring the direct costs needed for creating the goods it sells and the services it provides. The formula for gross margin calculation is:

| Gross Margin = Net Sales − Cost of Goods Sold |

All in all, COGS is an essential component of determining two critical business metrics: a company’s gross profit and gross margin.

COGS and income statement

COGS is included in business expenses on the income statement which is one of the 3 key financial statements that businesses produce. Increasing COGS means decreasing net income, which is beneficial for income tax purposes but means less profit for the shareholders. Based on that, businesses try to keep their COGS low and their net income high.

Read about basic accounting for small businesses.

How does COGS work?

As we’ve seen, COGS are costs or expenses that are closely tied to your revenue, margins, and net income. That’s why having an accurate valuation of your COGS metric will help you get a clearer picture of your business health. So let’s look at the parts that need to be accounted for in the COGS calculation.

What does COGS consist of?

In the process of product or service creation, all companies incur certain costs like material, labor, building rentals, and utilities, which make up some part of the final price of a product. It should be mentioned once again that the cost of goods sold includes only the direct costs paid by a business to produce the goods or services that were sold during the period while excluding indirect costs like overhead, sales, and marketing. Manufacturing overhead is part of COGS, though.

It’s necessary to stress that the cost of goods sold doesn’t include the expenses sustained to make the products that haven’t yet been sold during the specified period. Thus, only the cost of the products sold successfully is taken into account.

A simple example of COGS components

If you buy a pair of shoes for $100, part of this price is contributed by COGS. In the case of shoes, COGS will include the cost of material, labor to make the shoes, sewing equipment, and electricity to run them. The costs of transportation, accounting services, advertising, and selling of the shoes aren’t part of COGS.

GAAP for COGS

Now, if we turn to GAAP, defining COGS components may not be that easy. GAAP guidelines help to account for operating expenses. Under GAAP, all operating expenses must be registered on the company’s books. However, there are no direct and specific instructions on how to categorize some expenses. That means that two companies may account for the same expense differently and both of them might still be in compliance with GAAP. Let’s look closer at the way it works.

Business expenses and some examples of COGS components

COGS/COS and SG&A represent different categories of expenses.

- COGS or COS (cost of services, a term that works for service companies) stands for all the costs directly associated with producing a product or delivering a service.

- SG&A is a part of operating expenses and stands for selling, general, and administrative expenses.

It’s up to the accounting department of a company to decide what should be included in COGS or COS and what shouldn’t. This seems easy in theory, but in practice, the situation is a bit more complicated.

It has to be mentioned that service companies can’t list COGS on the income statement. They have COS instead, but it doesn’t count as a COGS deduction.

In some situations the decision is obvious: for example, the cost of the fabric/material for the shoes (mentioned in the example before), the wages of the people making them are directly related to the final product for sale, so they go into the cost of goods sold. There’s no doubt here as COGS by definition includes direct labor costs and any direct material costs associated with the production process. On the contrary, the salary of the human resources manager and the cost of supplies used by the sales department go into SG&A, not in COGS or COS.

But this is where black-and-white definitions end and we enter the gray area. Where do we put the salary of the managers of the shoe factory or the quality supervisors? GAAP doesn’t say “yes” to one and “no” to the other. So companies combine GAAP guidelines with logical approaches and apply them according to their particular situations. The key moment here is to apply these guidelines sensibly and consistently.

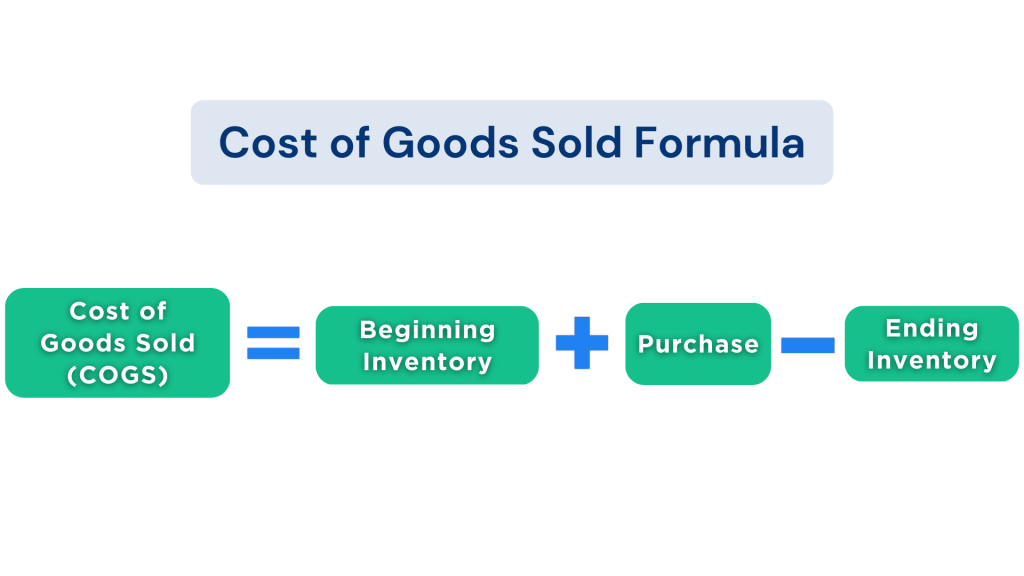

Cost of Goods Sold formula and calculation

Now let’s turn to the formula for COGS calculation. In order to establish your COGS, you need to know the value of your beginning inventory, your ending inventory, and the purchases’ value. The formula seems rather straightforward:

| Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Sold |

It’s necessary to clarify what we call inventory as there are different inventory costing methods that we will look into later in the article.

Beginning and ending inventory

The term inventory refers to the goods and materials that a business holds for the ultimate goal of resale, production, or utilization. Inventory is one of the most important assets and consists of three components:

- raw materials;

- production in progress;

- final goods for sale.

Inventory is reflected on the company’s balance sheet under the category of current assets account. The balance sheet gives information about the state of a business at the end of an accounting period, and the inventory value recorded there is the closing or ending inventory cost.

If we look at the beginning or opening inventory, it’s basically the inventory that wasn’t sold during the previous year. Everything that’s manufactured and purchased during the year by a manufacturing or retail company is added to the beginning inventory.

Now let’s put the knowledge of the beginning and ending inventory into practice. The products that weren’t sold by the end of the year (closing or ending inventory) are subtracted from the amount we get after adding up beginning inventory and purchases. The result is the COGS of the year.

Find out what a good inventory turnover ratio is.

Inventory costing methods and cost of goods sold calculation

The cost of goods sold calculation depends on the inventory costing method practiced by the accounting department of a company. Here, we’ll share the three most popular inventory costing methods.

1. FIFO

The FIFO (first in, first out) method assumes that the earliest manufactured or purchased goods are sold first. In other words, your older units are sold before your new units. So if we have in mind growing prices, the company that adopted the FIFO method sells the cheapest products first. The cheapest inventory items sold lead to a lower cost of goods sold and a higher net income over a period of time. There are some advantages of FIFO that should be mentioned here:

- FIFO is the most universal and widely used method of inventory evaluation;

- FIFO reduces the impact of inflation;

- FIFO minimizes obsolete inventory;

- FIFO gives a more accurate picture of inventory costs.

It’s worth mentioning that certain industries like those selling perishable items, for example, are automatically put into the first in, first out inventory model of selling items. This makes sense since the goods they sell have a short shelf life, so to benefit the business, they need to sell first the items that came in first (i.e. FIFO).

2. LIFO

On the contrary, LIFO (last in, first out) indicates that your new units are sold before your old units. That usually means selling the latest and the most expensive goods from the inventory first. That leads to a net income decrease and consequently a higher COGS. Here are some peculiarities of the method:

- LIFO is used only in the United States under GAAP.

- Using LIFO is tax advantageous during a period of rising prices.

- Companies practicing LIFO normally have large inventories (e.g. retail or car dealerships).

- LIFO lowers net income during a period of rising prices, which isn’t beneficial when reporting the financial results.

3. Average Cost Method or Weighted Average Cost (WAC)

Average cost method, as prompted by the name, represents the golden medium. The value of the goods in stock is calculated with the help of the average price over a period of time, regardless of the purchase date. This method helps to level out COGS and net income fluctuation when prices of goods change significantly.

Inventory method and cost of goods sold: bottom line

Summing up, all the mentioned inventory costing methods bring the same results with zero inflation. With high inflation, inventory costing method choice can significantly change the numbers.

The choice of method might be influenced by several factors such as the industry you operate in, taxes purposes, the current state of the market, and the accepted accounting standards specific to your geographic area.

E-commerce solutions for managing cost of goods sold

The changeable world of e-commerce requires a solid combination of global business management knowledge and business software programs. This combination allows you to analyze your business data with the help of a reliable software solution tracking your business metrics, business management CRM platforms following your client data, and accounting software simplifying your accounting procedures.

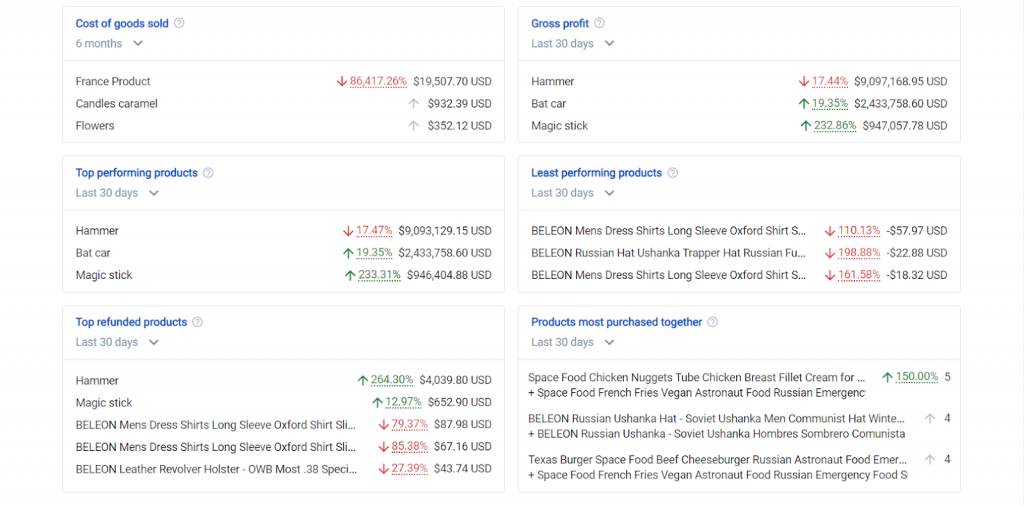

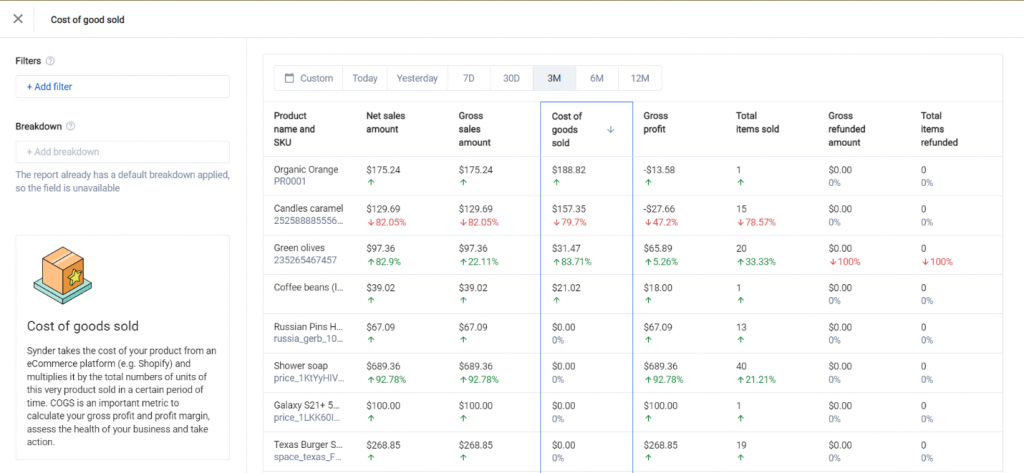

We see the world of new professional services automation unfolding now, so it’s time to jump on the bandwagon and take your business to the next level. Synder Business Insights is e-commerce business intelligence software that can help your business grow strategically. It’s a tool that contains your business data and gives you access to reports with explanations of how the insights from these reports might scale your business. Reliable information takes the guessing game out of everyday decision-making and boosts your business growth. If you want to get an understanding of how the features can apply to your business, book an office hour.

When it comes to the Cost of Goods Sold calculation, Synder Business Insights is the simplest solution as it boasts the following features:

- Hourly multichannel data imports;

- Sales analytics;

- Product and COGS analytics;

- Customer cohort reports;

- Cross platform e-commerce KPIs.

Synder Business Insights helps to accumulate, analyze and visualize your business data. This is how it looks with the tracking COGS example:

If you want a more thorough description of how Synder Insights works, check out Synder’s step-by-step video tutorial by clicking on this link.

Cost of goods sold: closing thoughts

Calculating and analyzing COGS might be tricky sometimes. But since it represents such a fundamental element of many businesses, it needs to be addressed with the attention it requires.

Regardless of the inventory costing method, it has to be consistent and precise, which demands a lot of effort, but with the right accounting and inventory software, it’s a matter of one click to produce a full COGS report providing you with insights that can help you with financial modeling and future strategies.

Check out our article Is the Cost Of Goods Sold an Expense? Moreover, keep reading our Use Cases about Accrual Accounting with Synder!

%20(1).png)