Selling, General and Administrative Expenses (SG&A) is a crucial element of any business’s finance. It refers to the costs associated with sales, marketing, and general administration, represents a significant portion of companys’ overall operating expenses and can impact their financial profitability.

If a business owner overlooks this, the company could encounter setbacks and financial difficulties. On the contrary, tracking the right combination of financial KPIs may prove effective for making data-driven decisions and as a result building a successful and modern business.

In this article, we’ll look into SG&A and learn why this KPI is vital in terms of a company’s financial fund profitability and the calculation of its break-even point.

Contents:

2. Components of SG&A expenses

- Selling expenses

- General expenses

- Administrative expenses

- Why is it important for any business income statement?

3. Preparing for the calculation SG&A expense

4. Calculating and reporting SG&A expenses

5. How can Synder simplify SG&A calculation?

6. SG&A vs Operating expenses (OPEX)

7. SG&A vs COGS (Cost of Goods Sold)

Key takeaways

- SG&A (Selling, General, and Administrative) expenses are critical components of a company’s finances and include costs associated with sales, marketing and general management.

- SG&A expenses are divided into three categories: selling expenses, general expenses, and administrative expenses.

- SG&A expenses are distinct from COGS (Cost of Goods Sold), as they aren’t directly tied to the production of goods or services.

- Using accounting software can make managing expenses easier and provide valuable information about a business’s finances.

What is SG&A?

SG&A expenses are made of all the costs of running a business that aren’t related to production of goods and services.

Basically, Selling, General, and Administrative Expenses (SG&A) are the costs that businesses have outside of making their products. These include things like sales, marketing, and running the office. Unlike the cost of goods sold (COGS), which is directly tied to production, SG&A costs are separate.

Components of SG&A expenses

As we’ve already mentioned, SG&A expenses are split into three categories: selling, general, and administrative costs. Let’s take a closer look at them.

Selling expenses

Here most typical types of selling expenses include:

- Marketing expenses: Marketing expenses cover the work of analyst professionals on creating marketing strategies and techniques as well as market research for particular products or services.

- Advertising expenses: These expenses come in lots of forms of goods or services promotion starting with good-old TV/Radio ads, billboards all the way to online – social network campaigns and investment in collaborations with influencers.

- Sales expenses: These are made up of salaries and wages of salespeople together with commissions, payroll tax, and benefits.

- Travel expenses: They cover the costs for trips of the staff to various events like trade shows, meetings with clients. These may include transport expenses, accommodation fees, cost of meals, calls, tools for managing hotel bookings and whatever costs are reasonably needed by a person on a business trip.

Selling expenses can be also divided into direct and indirect:

- Direct selling expenses occur only when the product is sold. Packing and shipping costs as well as commissions of salespeople can be a good example of direct selling expenses. Direct selling expenses are often variable, unlike other SG&A expenses.

- Indirect selling expenses happen while manufacturing or after finishing the product, before or after making sales.For instance, marketing, advertising and promotion expenses, including social media costs are indirect selling expenses. Base salaries of salespeople and travel expenses refer to this category as well, even if they don’t generate finance growth.

General expenses

General expenses are incurred by a company regardless of the industry or products/services it creates. These are expenses that keep any business functioning on a daily basis.

General expenses include the following:

- Rent. Any place for an office or headquarters of a company brings its costs. This also includes any other items not related to making the product, for example equipment costs that aren’t involved in manufacturing, like coffee machines, vending machines or professional cleaning equipment.

- Utilities. These costs cover electricity, water, sewer, or garbage expenses that aren’t part of the manufacturing process.

- Office equipment. This category comprises the cost of equipment like computers, internet connection equipment, printers, telephones or their rent.

- Supplies. This is all that’s necessary for administrative personnel to perform their functions, like stationery, desk accessories, filing and organization items.

- Insurance. Any insurance costs that are necessary for operating a business, for example, insurance of equipment such as air conditioning, coffee machines, etc.

Administrative expenses

Administrative expenses can be called the cost of personnel, including internal or external staff, if a company outsources any services. It has to be mentioned here, that these people’s work shouldn’t be directly related to making products or providing services by a company. Administrative costs include:

- Accounting payroll;

- Information technology payroll;

- Human resources payroll;

- Legal council;

- Consulting fees;

- Certifications.

Note: G&A, or general and administrative expenses, are called a company’s overhead. They occur in the daily functioning of a business and aren’t directly tied to any specific function or department in a company. General and administrative expenses are usually fixed regardless of the amount of production or sales over a period of time and normally reported together in the financial fund statements.

Why is it important for any business income statement?

You need to be very careful about managing SG&A. While reducing SG&A costs can provide a quick boost to profits, it’s important to avoid making cuts that could have a negative impact on long-term profitability. For example, reducing marketing and advertising costs might provide a short-term increase in profit, but it could also harm sales in the long term.

To control SG&A expenses properly, businesses should keep a close watch on costs like rent, utilities, salaries, and advertising. This means understanding these expenses and finding ways to save money where possible.

Preparing for the calculation SG&A expense

Calculating SG&A is quite simple since it’s the sum of all non-product expenses, but there are some things related to finance to consider along the way:

- Check if expenses are directly related to making the product. If not, include them in SG&A.

- Don’t count “below the line” costs like interest and taxes in SG&A, as they’re deducted from operating income.

- Decide on your reporting period—monthly, quarterly, or yearly. Expenses are typically closed at year-end.

- Choose your accounting method. Cash basis only counts paid expenses, while accrual basis counts expenses incurred but not yet paid.

Calculating and reporting SG&A expenses

- Start with net revenue at the top.

- Deduct Cost of Goods Sold (COGS) to get the gross margin.

- List SG&A and other expenses below the gross margin.

- Subtract these expenses from the gross margin to get operating profit.

Note that certain expenses like interest and taxes are reported separately below operating income.

Companies may also present SG&A in one total line or split selling costs from general and administrative costs.

Here how it works:

SG&A is reported in the section of expenses on a company’s income statement.

Net/total revenue is always found at the top of the income statement, then COGS is deducted to get the gross margin or gross profit.

Then there comes the section of operating expenses with SG&A, R&D and any other expenses that are listed below the gross margin.

Operating/net profit is the result of deduction of these expenses from the gross margin/profit. Some expenses, such as interest expense or tax expense are reported below operating income.

Note: G&A expenses, when measured as a percentage of revenue, tend to be higher for healthcare and telecommunications companies compared to real estate and energy companies.

How can Synder simplify SG&A calculation?

The most important thing in SG&A calculation is to define which costs are to be added into the category, but this procedure is way simpler when using accounting software which automatically categorizes expenses based on the initial setup.

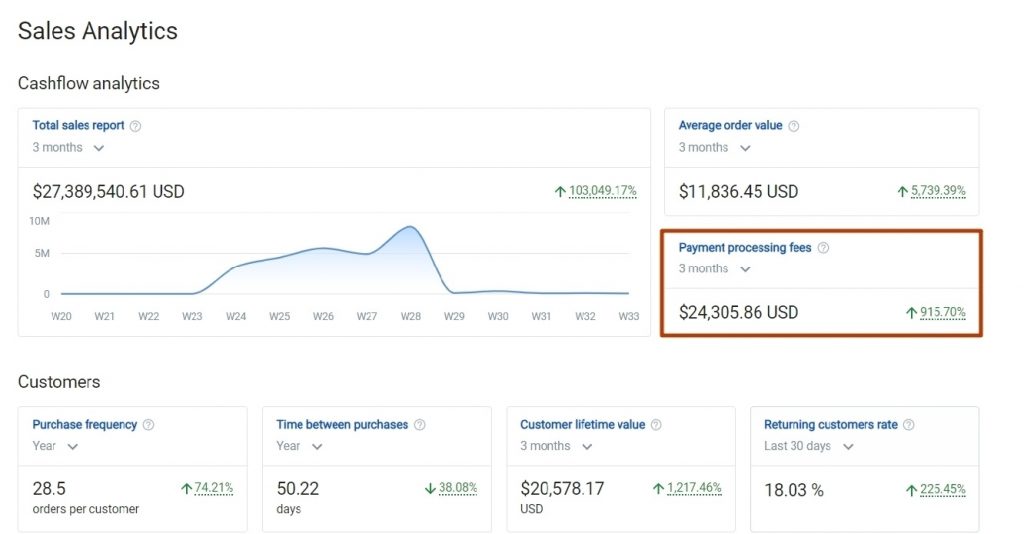

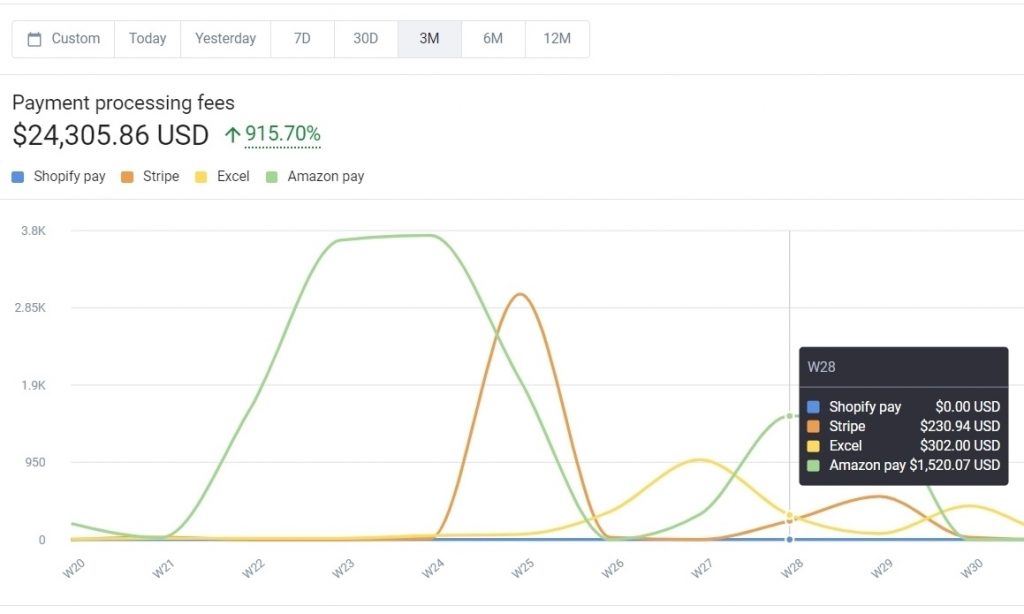

This is where Synder will come to help you, because it’s able to not only categorize and sum up all the expenses your business incurs in different accounts, but also give you quality ыcategorization and accurate numbers on your goods sold, how your metrics, in our case expenses, increase or decrease and help you with business finance management in general.

The following pictures reflect how payment processing fees are changing over time.

To test the functionality, sign up for a 15-day free trial or join Synder’s informative Weekly Public Demo to make sure Synder is your right choice.

SG&A vs Operating expenses (OPEX)

When it comes to the difference between SG and operating expenses (OPEX) often there’s none, especially in the way many companies report them on the income statement. What’s different is the degree of granularity when reporting operating expenses. This degree depends on the size of the company.

Larger companies often separate the components of SG&A and find it useful for tracking purposes. In bigger companies, SG&A costs are split up on the income statement. But smaller ones might just group them together, as all these expenses are vital for running the business and not linked to making products or services.

There are also a few specific categories that are part of operating expenses but are excluded from SG&A:

- R&D, or research and development costs

- Depreciation costs

Both categories are separately reported in the same section under Operating Expenses of the income statement as SG&A.

SG&A vs COGS (Cost of Goods Sold)

COGS or COS (cost of services, the term that works for service companies) represents all the costs directly associated with producing goods or delivering a service, while SG&A covers all the expenses that aren’t directly attributed to the manufacturing process or creating a service.

It has to be said that there are no direct regulations from GAAP. It’s the accounting department of a company that decides what should go into COGS and what should go into SG&A.

For example, the cost of the materials for making the goods, and the wages of the people making them are directly related to the final product for sale, so they go into COGS. On the contrary, the salary of the team manager and the cost of supplies used by the sales department go into SG&A.

SG&A ratio formula

SG&A ratio may help with management of non-product related costs over a period of time and clearly see the tendency, because just growing SG&A might be a very positive thing, while growing SG&A ratio is a signal to look into the expenses.

The SG&A ratio is the relationship between SG&A and revenue or the expense expressed as a percentage of total sales. The SG&A ratio formula is:

This indicator shows what percentage of a dollar earned is spent on SG&A expenses.

Imagine a company with $3 million in SG&A and $15 million in total revenue. We’d get the SG&A ratio of 20%, which means that every dollar of revenue gives $0.20 on SG&A expenses.

3,000/15,000=0.2 or 20%

Tracking SG&A ratio over time allows you to predict future expenses and take some steps in case of their fast increase.

Conclusion

Tracking SG&A and generally knowing the numbers is a must for an aspiring businessman, but it’s even more important to make use of these numbers by taking necessary steps based on data-driven decisions, which demands analytical skills and experience.

At the same time, the process of gathering business information and turning it into visually perceptible sources for such analysis is streamlined by a good business accounting software. A good management talent can work wonders.

FAQs

What is the difference between SG&A and OPEX?

SG&A is subtracted from gross profit to determine a company’s operating income. Operating expenses, often referred to as OPEX, include all costs incurred in the day-to-day operations of a company, including selling and administrative expenses, but excluding cost of goods sold (COGS).

What is a good SG&A ratio?

In simple terms, it’s better to keep SG&A expenses low compared to sales. But the acceptable level varies widely by industry. For example, manufacturers usually aim for SG&A to be between 10% to 25% of sales. However, in healthcare, it’s common for SG&A costs to go up to 50% of sales.

Does SG&A include salary?

It varies depending on what the cost is for. Salaries for tasks directly involved in making products, like those for manufacturing line supervisors, are part of the cost of goods sold (COGS). But salaries for roles like accounting staff are put under SG&A expenses.

What is included in SG&A?

SG&A expenses basically cover all the costs of running a business, except for those directly tied to making the product or service (COGS). This includes things like salaries, rent, utilities, advertising, marketing, technology, and supplies not used in manufacturing.

.png)