As a business owner, you might want to gain better insight into your company’s financial performance. A cash flow statement is the right tool that can help you better understand your business’s financial health. Knowing how to create a cash flow statement can help you scale your business and make informed decisions about your company’s future strategies.

Let’s look at the cash flow basics and what it takes to prepare a cash flow statement.

Manage your cash flow using Synder, a top-notch accounting software which automates syncing sales data from ecommerce and payment platforms like incoming cash, fees, refunds, taxes, etc. into your books. Try Synder out for free or visit our Weekly Public Demo to get actionable insights into how it works.

Contents:

2. Understanding cash flow statement components

3. How to prepare a cash flow statement

4. Direct method of preparing a statement of cash flow

- Steps you need to take to prepare a statement of cash flows using the direct method

- Basic formula for calculating cash flows from operating activities using the direct method

5. Indirect method for creating a statement of cash flow

- Steps for making a statement of cash flows with the indirect method

- Basic formula for calculating cash flow from operating activities using the indirect method

7. Uses of cash

8. A сash flow statement summary

9. Analyzing your cash flow statement

What is cash flow?

First things first: we start with the explanation of cash flows. The term “cash flow” refers to the movement of money into and out of a business or individual’s financial accounts over a specific period of time. It’s a crucial aspect of financial management and provides insights into how money is managed within an organization or personal finances. Cash flow can be positive, negative, or neutral, depending on whether more money is coming in than going out, vice versa, or if the inflows and outflows are equal.

There are two primary components of cash flow:

- Cash inflows: These are the sources of money coming into a business or individual’s accounts. Common examples of cash inflows for a business include revenue from sales, loans, investments, and any other funds received. For an individual, cash inflows might include a salary, rental income, dividends, or gifts.

- Cash outflows: These represent the expenditures and expenses that result in money leaving the accounts. For a business, cash outflows include expenses such as rent, payroll, utilities, loan repayments, and other operational costs. For an individual, cash outflows encompass expenses like rent or mortgage payments, groceries, utility bills, loan payments, and discretionary spending.

Managing cash flow is crucial because it helps organizations and individuals ensure they have enough liquidity (cash or cash equivalents) to cover their obligations, whether those are regular expenses, debt payments, or unexpected financial emergencies. A positive cash flow indicates that there is more money coming in than going out, which can be used for reinvestment, savings, or paying down debt. Conversely, a negative cash flow suggests that more money is going out than coming in, which may require taking on debt or using savings to cover expenses.

Cash flow analysis is a fundamental tool in financial planning, budgeting, and decision-making, as it helps individuals and businesses maintain financial stability and make informed choices about their financial future.

Learn more about cash flow basics: direct vs. indirect cash flow, reimbursements vs. disbursements.

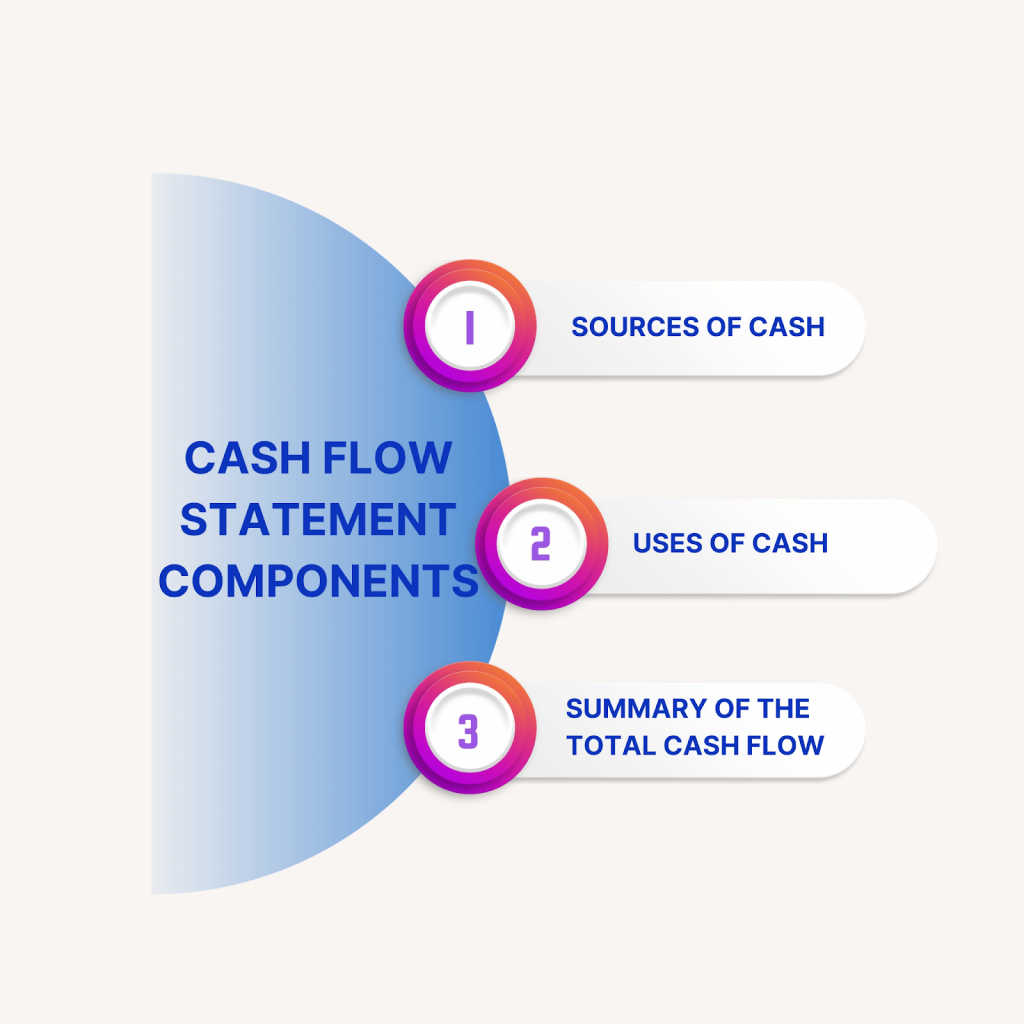

Understanding cash flow statement components

The cash flow statement is an essential financial document for businesses. It provides a comprehensive view of all cash inflows and outflows throughout a specified time period. As such, it’s critical for business owners to maintain an accurate and up-to-date version of the cash flow statement in order to make informed decisions about their finances. The statement is divided into three main sections: sources of cash, uses of cash, and a summary of the total cash flow.

The sources of cash section outlines where the company’s money is coming from, such as loans, investments, and revenue. The uses of cash section details how the funds are being used, such as salaries, bills, taxes, and other payments. Finally, the cash flow statement summary provides an overview of the net amount of funds that are being generated or spent by the business during the given time frame. Based on this information, you can perform a cash flow analysis to better understand the profitability of each investment and operation.

Having access to this information can help business owners assess their overall financial health and keep track of their expenses. Furthermore, it can be used to identify any potential issues related to cash flow and make necessary adjustments in order to ensure that the company remains profitable. With its comprehensive view of both income and expenses, the cash flow statement is a vital tool for businesses of all sizes.

How to prepare a cash flow statement

A cash flow statement is an important financial document which reports the movement of cash into and out of a business. It is usually prepared using either a direct or an indirect method. The direct method is simpler and easier to read, as it directly shows the sources of cash receipts and payments made by the company. However, the indirect method is a more traditional approach that uses accrual accounting to measure and report revenues and expenses throughout the year. The indirect method also takes into account non-cash transactions such as depreciation, amortization, and deferred taxes.

No matter which method is used to create a cash flow statement, it’s essential for businesses to understand the impact of their transactions on their overall financial health. By using a cash flow statement, companies are able to determine their liquidity levels and identify potential cash shortages or surpluses. This information can be used to create more accurate forecasts of future cash flows, allowing companies to plan ahead and make informed decisions about their finances. Additionally, a cash flow statement can help assess the efficiency of the company’s operations, enabling better financial performance over time. Ultimately, the accurate creation and analysis of a cash flow statement can have great benefits for any business.

Direct method of preparing a statement of cash flow

The direct method for calculating the cash flow of an account is a straightforward procedure. This method requires simply adding up the cash inflows and outflows for each month and then calculating the difference between them. It provides a better understanding of how much money is coming in and going out of the business, which can be beneficial in making important financial decisions.

Steps you need to take to prepare a statement of cash flows using the direct method

1. List cash receipts from customers: Make a list of all the cash receipts from customers during the accounting period. These include cash sales, collections from accounts receivable, and any other sources of cash from customers.

2. Report cash payments to suppliers and vendors: Document all cash payments made to suppliers and vendors for goods and services. This includes cash payments for inventory, operating expenses, and other purchases.

3. List cash payments for operating expenses: Make a list of all cash payments for operating expenses, such as rent, utilities, salaries, and any other day-to-day expenses.

4. Document cash interest and dividends received: Record any cash interest and dividends received during the period. These are considered cash inflows from investing activities.

5. Record cash payments for interest and income taxes: Document cash payments for interest expenses and income taxes. These are considered cash outflows from operating activities.

6. Add other cash receipts and payments: Include any other significant cash receipts and payments not covered in the above categories, such as the sale of assets, loans received or repaid, or other investing and financing activities.

7. Calculate cash flow from operating activities: Subtract the total cash payments (steps 2, 3, and 5) from the total cash receipts (steps 1 and 4) to calculate the cash flow from operating activities. This represents the net cash generated or used by the company’s core operational activities.

You might also be interested in the article “What is Operating Cash Flow: An Introduction to the OCF Basics”.

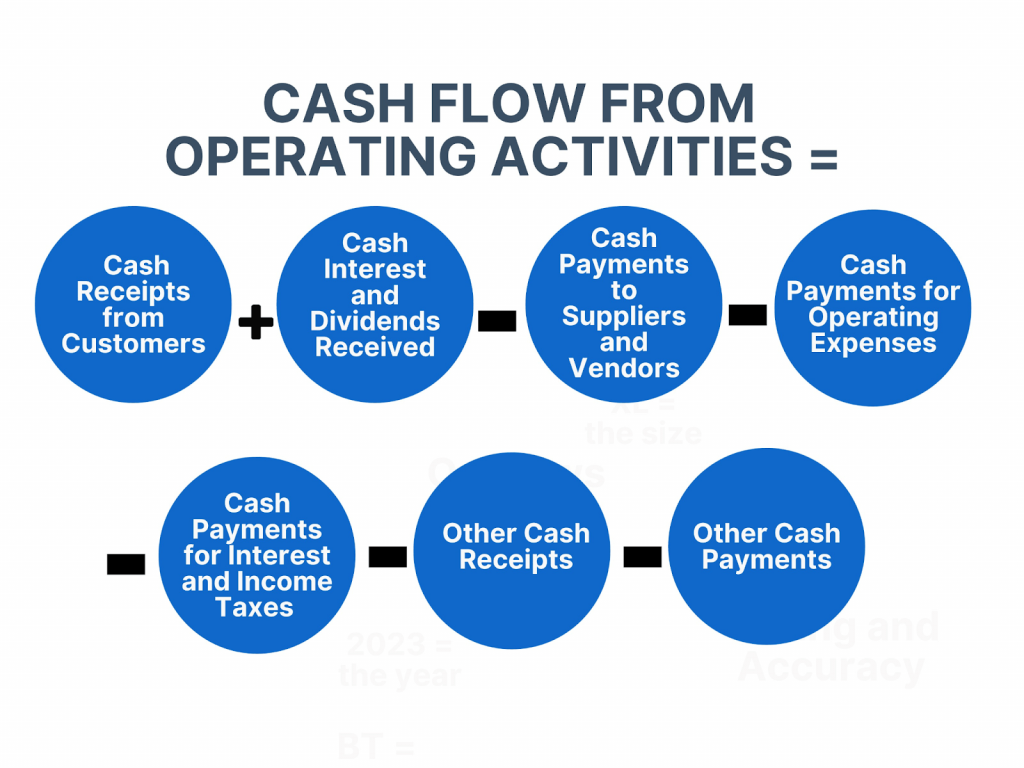

Basic formula for calculating cash flows from operating activities using the direct method

The result of this calculation provides a detailed breakdown of cash inflows and outflows directly related to the company’s operating activities, offering a clearer picture of how cash is generated and used in day-to-day operations.

Once you have determined the cash flow from operating activities, you can proceed to calculate the cash flow from investing activities and cash flow from financing activities to complete the cash flow statement. The sum of these three sections should equal the net increase or decrease in cash and cash equivalents for the period.

The direct method is relatively easy to use and understand, but it does not provide a complete picture of all cash transactions. Therefore, it should be used in tandem with other methods to gain a thorough understanding of an organization’s overall financial health. For example, preparing an accurate cash flow statement is essential for a company’s long-term success as it provides insight into its ability to meet its current obligations and maintain liquidity.

Overall, the direct method for calculating the cash flow of an account is an effective tool for getting an overview of a company’s financial performance quickly and efficiently. It can be used alongside more comprehensive analysis to make informed decisions about financial matters that can ultimately benefit the organization in the long run. By tracking and monitoring their cash flow statement on a regular basis, businesses are able to remain solvent and keep their operations running smoothly.

Indirect method for creating a statement of cash flow

The indirect method is the preferred method when preparing a cash flow statement as it takes into account all accrual amounts for the month. This process involves adding up all the inflows and outflows of cash for the month, which are then compared to the net income figure reported on the income statement. The net income figure is then adjusted to reflect the actual change in cash, which is then reported on the cash flow statement.

Steps for making a statement of cash flows with the indirect method

1. Start with net income: Begin with the net income figure from your income statement (also known as the profit and loss statement). This represents the profit or loss earned during the accounting period.

2. Add back non-cash expenses: Include any non-cash expenses that were deducted in calculating net income. Common non-cash expenses include depreciation and amortization. These expenses reduce net income but do not involve actual cash outflows.

3. Adjust for changes in current assets and liabilities: Analyze changes in current assets (like accounts receivable and inventory) and current liabilities (such as accounts payable and accrued expenses) between the beginning and end of the accounting period. Adjust for changes that have affected cash flow as follows:

- Increase in current assets: Subtract the increase in assets (e.g., accounts receivable) because this represents cash that has not been received yet.

- Decrease in current assets: Add the decrease in assets because this represents cash that has been received.

- Increase in current liabilities: Add the increase in liabilities (e.g., accounts payable) because this represents cash that has not been paid yet.

- Decrease in current liabilities: Subtract the decrease in liabilities because this represents cash that has been paid.

4. Adjust for non-operating and investing activities: Separate out non-operating activities and investing activities that do not fall under the core operating cash flows. These might include buying or selling assets, investments, or loans. Add or subtract the cash flows associated with these activities as necessary.

5. Calculate cash flow from operating activities: Sum up all the adjustments made to the net income to arrive at the cash flow from operating activities. This represents the cash generated or used by the company’s core operational activities.

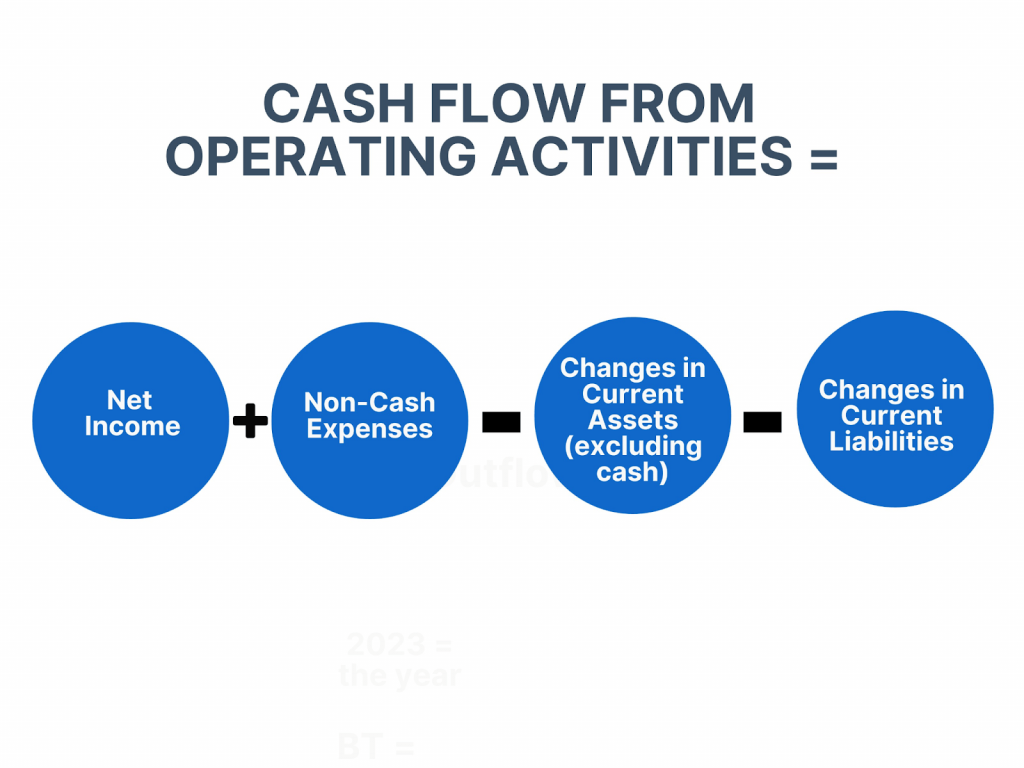

Basic formula for calculating cash flow from operating activities using the indirect method

Cash Flow from Operating Activities = Net Income + Non-Cash Expenses – Changes in Current Assets (excluding cash) + Changes in Current Liabilities

The result of this calculation represents the net cash flow generated or used by the company’s day-to-day operational activities. It provides insights into how the company’s core business operations impact its cash position.

The indirect method is a great way to obtain an accurate picture of a company’s cash flow. This method allows users to see how much money has flowed in and out of a business in a given month, and this can be used to determine whether or not there are any deficiencies in cash coming into the business. Additionally, it allows users to track their accounts receivables and payables, allowing them to make informed decisions on how they should manage their cash flow.

Furthermore, using the indirect method can help businesses better forecast their future cash flows. By understanding how much cash has been received in each month, businesses can better plan for future expenses and investment opportunities to ensure that they remain financially solvent. Additionally, this method can provide insight into seasonal trends for businesses as well as identify any potential issues with cash flows.

Sources of cash

Sources of cash are the places where your business is generating cash. The primary sources of cash on your cash flow statement are the change in cash, operating cash flow, and excess cash flow. The change in cash is the total of all cash that is held in your business’s accounts, such as checking or savings accounts. Operating cash flow is the difference between your company’s cash inflows and outflows. Excess cash flow is the amount of cash that you have left over from your operating cash flow.

Uses of cash

Uses of cash are the places where your business is spending cash. The main uses of cash on your cash flow statement are the change in cash, investing cash flow, and financing cash flow. The change in cash is the total amount of cash that is being deposited into your business’s accounts. Investing cash flow is the amount of cash that you are spending to purchase fixed assets like machinery or real estate. Financing cash flow is the amount of cash that you are spending on short-term liabilities like credit card payments or loans.

A сash flow statement summary

A cash flow statement summary is a summary of the sources and uses of cash. The cash flow statement summary can be written as a single sentence or a paragraph. Financial experts recommend that you write your cash flow statement summary in a way that is easy to understand. You do not need to use complicated financial terms when writing your cash flow statement summary.

Analyzing your cash flow statement

After you have completed your cash flow statement, you can use it to gain a better understanding of your business’s financial health. Your cash flow statement will help you determine whether your company is generating enough cash to cover its expenses.

You can use your cash flow statement to determine if your company is generating enough cash to sustain its operations for the next few months.

You can also use your cash flow statement to determine whether your company is generating enough cash, but you can’t use it to determine if your company is generating too much cash.

Finally, you can use your cash flow statement to compare your cash inflows and outflows from one month to the next to determine whether your company is generating more or less cash than it did during the previous month.

Conclusion: Best practices for cash flow statements

Cash flow statement is an important financial document that can help a business better understand and manage their revenues and expenses and make better decisions.

A cash flow statement should be prepared using generally accepted accounting principles (GAAP). This ensures accuracy and credibility of the document. At this point, it’s important to use the right accounting terms when creating your cash flow statement.

It’s important to create a cash flow statement regularly so that you can have a clear understanding of where your business stands financially. A cash flow statement can also help you in assessing how much capital you need and how you can use it efficiently. Furthermore, it’ll also help you in predicting future expenses and making decisions accordingly.

Finally, make sure that all the financial transactions are correctly recorded and classified. This will allow for more accurate analysis of financial data related to the cash flow statement. Keeping accurate records is essential for creating an effective cash flow statement that can provide deep insights into the financial position of your business.

.png)

Well explained.

Thanks very much.

Thank you, David! We’re glad you found our article helpful.