Understanding cash flows is paramount for businesses, investors, and stakeholders alike. The debate between the direct vs indirect cash flow methods often surfaces, with each presenting its own merits and nuances.

This article delves into the key distinctions between these two predominant cash flow methods, shedding light on their individual characteristics and their implications for a comprehensive cash flow analysis. As you navigate your business finances, let’s demystify the difference between these methods and equip you with the knowledge to analyze cash flows more effectively.

Learn how automated accounting provides businesses with accurate cash flow reporting and other bookkeeping records, without the need for manual data entry.

In this article, you’ll find the answers to the following questions:

3. What is indirect cash flow?

4. Relevance of indirect and direct methods to different business stakeholders

5. How to keep track of your cash flow

6. Tips for effective cash flow reporting and analysis

7. FAQs

What is cash flow?

Cash flow, in the context of business finance, refers to the net amount of cash and cash-equivalents that move into and out of a company. It represents the operating activities and financial health of a company, indicating the firm’s capability to uphold its operations, settle debts, reinvest in its business, and provide returns to shareholders. Essentially, cash flow gives a snapshot of a company’s liquidity and its efficiency at generating and using cash.

In simple terms, cash flow is like the heartbeat of your business. It shows how much money is coming in and going out. Think of it as your business’s wallet: if more money is coming in than going out, your wallet is getting thicker; if not, it’s getting thinner. A healthy cash flow means your business can pay its bills, invest in new opportunities, and even reward you, the owner. It’s a quick way to see if your business is doing well with its money.

There are two major ways in which cash flow can be calculated: direct and indirect methods. We’ll now review them both in detail.

What is direct cash flow?

The direct method of cash flow, often referred to as the “receipts and payments method,” provides a detailed record of actual cash inflows and outflows from operations. This method gives you a clear picture of your business’s daily cash activities, showing exactly where your money is coming from and where it’s being spent.

Direct method cash flow components

When trying to calculate your cash flow using the direct method, you should take into consideration different aspects of your business activities.

Operating activities

Cash receipts from customers (money in): These are the actual payments received from customers for goods or services. It encompasses all cash sales and collections from credit customers.

Cash payments to suppliers and employees (money out): This covers payments for raw materials, inventory, and services as well as wages, salaries, and other operating expenses. Payments for other operating expenses can include rent, utilities, taxes, and administrative costs. Payments made for interest on loans and taxes to governmental entities are also counted in these cash outflows.

Investing activities

Cash inflows: Funds you get from selling things like buildings, equipment, or shares in other companies. Also includes money back from loans you’ve given out.

Cash outflows: What you spend on buying new equipment, investments, or lending money to others.

Financing activities

Cash inflows: Funds raised from selling company shares or taking on new loans.

Cash outflows: Paying back loans, dividends to shareholders, or buying back your own company’s shares.

Pros and cons of the direct method

When it comes to tracking your business’s money movements, you might choose the direct method. But like all tools, it has its strengths and drawbacks.

The direct method of cash flow offers clear visibility into actual cash transactions, presenting a detailed view of a company’s cash sources and expenditures. This method is especially beneficial for internal management as it provides a comprehensive insight into operational cash flows without the need for additional adjustments or interpretations.

However, the direct method of cash flow, while detailed, can be cumbersome and time-consuming due to its need for meticulous cash transaction records. Despite its precision, it’s less popular than the indirect method, making company comparisons trickier. Additionally, its emphasis on actual cash can sometimes miss out on important non-cash operational details crucial for a thorough financial analysis.

Hence, while the direct method offers a lucid view of cash transactions, it might not always be the most efficient or comprehensive method for all businesses or stakeholders.

What is indirect cash flow?

The indirect method for calculating cash flow, predominantly used by businesses, determines the cash flows from operating activities by starting with net income and then making adjustments for non-cash transactions and changes in working capital. It contrasts with the direct method, which lists out actual cash receipts and payments.

Components of the indirect cash flow method

Net income is the starting point for the indirect method because it represents the company’s profit as calculated under accrual accounting. However, not all components of net income affect cash, so adjustments are made to reconcile the net income to actual cash flows from operating activities.

Adjustments for non-cash items

Since depreciation and amortization are expenses that reduce net income but don’t involve any actual cash outflow, they’re added back to the net income. These adjustments represent the allocation of the cost of tangible and intangible assets over their useful lives, respectively, rather than a cash expense.

Working capital encompasses current assets and liabilities that impact operations. Changes in items like accounts receivable, inventory, accounts payable, etc., need adjustment. For instance, if accounts receivable increase during a period, it means sales were made on credit, and cash wasn’t collected yet. This increase would be subtracted from net income. Conversely, if accounts payable increased, it indicates that expenses were incurred without cash payment. This increase would be added to net income.

Expenses like stock-based compensation, where employees or directors are compensated with shares or options instead of cash, are added back to net income. Similarly, provisions for doubtful debts or losses on impairments are other examples that reduce net income but don’t involve a cash outflow, so they are added back.

Pros and cons of the indirect method

The indirect method of cash flow is favored by most businesses, offering ease in company comparisons. Its preparation is straightforward, starting with the net income and adjusting for non-cash activities. Notably, it underscores the variances between net income and net cash from operations, enriching financial analysis.

The indirect method of cash flow, while popular, can be less intuitive for those not well-versed in financial statements, as it doesn’t show clear cash transactions. Its starting point, the net income, might lead to an excessive focus on profits over actual cash movements. Additionally, it offers less detailed insights into specific cash operations compared to the direct method.

So while the indirect method offers efficiency and comparability, it may not provide as granular an understanding of a company’s cash activities as the direct method. However, its widespread adoption signifies its value in financial reporting and analysis.

Relevance of indirect and direct methods to different business stakeholders

The choice of method often rests on the intended audience and the specific insights a business wishes to convey. Understanding the preferences and needs of different stakeholders can guide this choice, ensuring the cash flow statement serves its intended purpose effectively.

Investors

Investors often seek clarity on a company’s ability to generate cash, which underpins dividend payments and capital appreciation. Both methods can offer insights, but the indirect method, due to its widespread use, might be more familiar to most investors.

Management

For internal decision-making, management might prefer the direct method as it provides detailed insights into cash transaction patterns. However, for overall financial reporting and performance review, they might lean towards the indirect method for its summarization of cash flows.

Lenders

Lenders are primarily concerned with a company’s ability to generate enough cash to service its debts. While they can derive this information from both methods, the direct method can provide a more granular view of cash inflows and outflows, aiding in a deeper analysis of cash flow solvency.

How to keep track of your cash flow

The manual calculation, while an option, is riddled with high error probability, but above all, is cumbersome and time-consuming. Using software to help you manage your incoming and outgoing cash flow offers an accurate and efficient approach to financial reporting.

Synder automates the synchronization of transactions from various platforms (like ecommerce and payment processors) directly into accounting software, ensuring that all revenue and expenses are accurately recorded. Using the direct cash flow method, Synder provides businesses with an up-to-date, accurate, and granular view of their cash flow, making it easier to monitor financial health, spot trends, and make informed financial decisions.

Utilizing accounting software such as Synder takes away the stress of maintaining accurate records, invoicing, receipts for expenses, and other incoming and outgoing payments in your business and manages it all for you!

Try Synder for free or book a seat at our Weekly Public Demo to learn more about Synder’s functionalities.

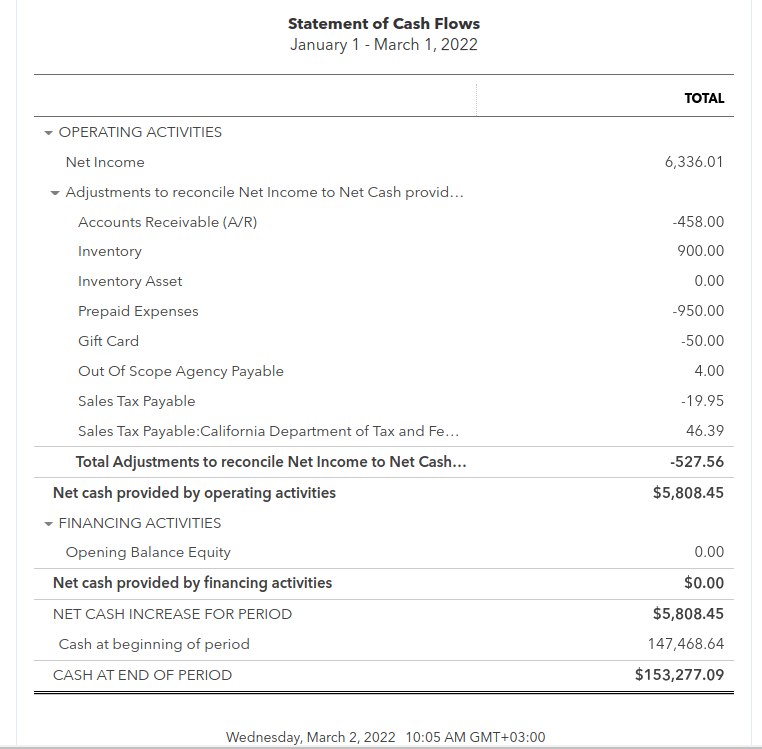

Here’s what the cash flow statement produced by Synder looks like:

Tips for effective cash flow reporting and analysis

Last but not least, let’s look into essential tips to enhance your cash flow analysis and reporting, ensuring a comprehensive grasp of your company’s financial pulse:

- Maintain consistency: Once you’ve picked either the direct or indirect method for a particular purpose, stick with it. Maintaining consistency in the chosen method for cash flow reporting is crucial for accurate period-to-period comparisons. If you need to switch, clearly explain the reasons and provide figures using both methods for clarity. Standardize any adjustments to ensure comparability.

- Know your business: Understand the specific cash flow patterns of your industry. For instance, manufacturing might have large outflows for inventory, while service businesses may not. Recognize your business’s cash flow rhythm, whether seasonal or steady, and always factor in external influences like market changes or economic shifts.

- Use both methods for a full picture: Even if you primarily use one method, occasionally analyzing cash flow with the other can offer additional insights. This dual perspective can help reconcile performance with cash position and is invaluable in forecasting scenarios for future projections.

A thorough cash flow analysis goes beyond just numbers; it demands a deep understanding of the business environment, consistent application of chosen methods, and the ability to draw insights from both direct and indirect cash flow perspectives.

FAQs

What’s the difference between direct and indirect cash flow accounting?

The direct method of cash flow shows the actual cash transactions, like money received from customers and paid to suppliers. The indirect method starts with your net profit and adjusts for things that don’t involve actual cash, like depreciation. In simple terms, direct cash flow is like tracking every dollar in and out, while indirect focuses more on the difference between your profits and actual cash movements.

When to use the direct method?

Consider using it if you want to give stakeholders a clear view of all cash transactions. It’s also particularly beneficial for business management to gain insights into cash collection and spending, aiding in formulating payment policies. Small or new businesses, which predominantly deal with cash transactions, might find the direct method more straightforward. Additionally, if your industry’s standard or key stakeholders prefer the direct method, it’d be wise to adopt it to meet their expectations.

When to use the indirect cash flow method?

Opting for the indirect method might be the right choice if you’re seeking streamlined and efficient cash flow reporting, as it builds upon the net income and adjusts for non-cash items. It’s particularly suitable for larger corporations with intricate operations, as it offers a summarized perspective that might be easier to manage.

Given its popularity, this method also allows for easier comparisons with other companies’ cash flow statements, favored by external stakeholders. Additionally, if you aim to emphasize how well your business is converting its profits into actual cash, the indirect method provides that clarity by highlighting differences between net income and cash flow from operations.

How does cash flow reporting and analysis impact financial planning?

Cash flow reporting and analysis directly influence financial planning by highlighting how much money is coming in and going out of your business. This helps ensure you have enough cash for daily operations, making informed investment decisions, managing debts, and setting realistic financial goals. In simple terms, understanding your cash flow is crucial to making smart financial decisions that bring about business stability.

Direct vs indirect cash flow: Conclusion

The choice between direct and indirect cash flow methods can significantly influence how a company’s monetary activities are presented and understood. While both methods arrive at the same net cash flow, their individual pathways offer distinct insights.

The decision between them should hinge on a company’s specific needs, its stakeholders’ preferences, and its operational intricacies. Regardless of the choice made, consistency in application and a deep understanding of the underlying principles are paramount to ensure accurate, insightful, and actionable cash flow analysis.

Learn more by reading our guide on How to prepare Cash Flow Statement.

%20(1).png)