Knowing your net cash flow can make a difference between success and failure when handling your business finances. It’s a measure of your business’s financial health and can alert you to potential problems with your cash flow. But how do you find your net cash flow?

In this article, we’ll cover the term net cash flow and how to leverage this concept in your business. Armed with this knowledge, you’ll fully understand your business’s cash flow position and take the necessary steps to secure a healthy cash flow.

Contents:

2. Cash flow from various business activities

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

4. The difference between net cash and cash flow (net)

5. How to calculate net cash flow

- Calculating operating cash flow

- Calculating cash flow from financial activities

- Calculating cash flow from investments

6. How to find the necessary net cash figures from various business activities?

- The purpose of a cash flow statement

- The role of accounting software (like Synder, QBO, or FreshBooks) in generating a company’s financial statements

What is cash flow?

To understand net cash flow, we need to start with breaking down several terms. So we’ll look at cash flow first.

By definition, cash flow is the movement of money into or out of a business, project, or financial product. It’s a crucial metric for assessing the financial health of an entity. When more money comes into the business than goes out, it’s generally a sign of financial health. More money going out than in indicates challenges or short-term issues in a company’s finances.

Understanding positive cash flow and negative cash flow

Positive and negative cash flows represent opposing financial scenarios for a business, each carrying distinct implications for its financial health.

- Positive cash flow occurs when a company generates more cash than it spends during a specific period. This surplus of cash is often a positive indicator, signaling that the business is efficiently managing its operations and can cover expenses, invest in growth opportunities, or even return value to shareholders. Positive cash flow provides a financial cushion, enhancing the company’s ability to weather economic downturns and seize strategic opportunities.

- On the other hand, negative cash flow arises when a company’s cash outflows exceed its cash inflows. While negative cash flow isn’t inherently disastrous—especially for businesses in growth phases—it can raise concerns. It may suggest that the company is investing heavily, financing expansion or significant projects, or facing operational challenges. Continuous negative cash flow without a clear strategy for improvement can be a red flag, as it might indicate a reliance on external financing or a need for operational adjustments to ensure long-term sustainability.

Understanding the nuances between positive and negative cash flow is crucial for investors, creditors, and management, as it provides insights into financial resilience and strategic business direction.

Cash flow from various business activities

Imagine a company as a dynamic entity, constantly engaging in financial activities, and cash flow is the lifeblood that keeps it functioning. In our financial anatomy, cash flow manifests through three main channels: operating activities, investing activities, and financing activities.

Cash flow from operating activities

First, consider the bloodstream of a business—its operating activities. These activities encompass the day-to-day transactions that keep the heart pumping. Revenue from sales, payments to suppliers, salaries to employees—these are the essential beats that sustain the business’s life. Positive operating cash flow indicates that the heart is effectively pumping, with more money flowing in from operations than is being spent.

Cash flow from investing activities

Next, we move to the business’s investments, ventures, and undertakings that shape its future. It’s a kind of circulatory system, distributing resources to where they can grow and prosper. Whether acquiring new equipment, investing in research and development, or making strategic acquisitions, these are the capillaries through which a business breathes life into its potential. Cash flow from investing activities illustrates the health of this circulatory system, showcasing how well a company is nourishing its future growth.

Cash flow from financing activities

Last (but not least), we explore the financing activities and the capital that keeps the business standing tall. It’s the backbone of the financial structure, involving transactions with shareholders and lenders. Dividends, loans, and equity issuances are the backbone’s vertebrae, supporting the business’s upright stance. Cash flow from financing activities reveals the stability of this backbone, indicating whether a company is standing on solid financial ground or relying heavily on external support.

What is net cash flow?

Now, let’s look at what net cash flow is.

In the simplest terms, it’s the amount of cash you have left after subtracting total cash outflows from total cash inflows. The result helps determine whether a business has a positive or negative balance, giving insight into how well you manage your cash and whether you can cover your financial obligations, thus, keeping your business on track without additional funding.

Analyzing your net cash flow will enable you to identify potential financial issues and help you make informed decisions about where your business should move. Knowing what constitutes a positive or negative net cash flow will also give you more insight into business performance and how effective your current strategies are.

To get a more accurate picture of your net cash flow, you might want to consider several factors, including accounting methods, inventory management, capital expenditures, taxes, dividends, and other investments. All of these components can significantly affect your net cash flow.

The difference between net cash and cash flow (net)

Often, people confuse net cash flow and net cash, using the terms interchangeably. While nothing is critical about it, they’re still different terms describing different aspects of a company’s finances.

What does net cash stand for?

Net cash typically refers to the net amount of cash and cash equivalents a company has on hand at a specific point in time. It’s a snapshot of the company’s liquidity at a given moment, often reported on the balance sheet.

The formula for net cash is straightforward:

Net Cash = Cash and Cash Equivalents – Total Debt.

What does net cash flow stand for?

On the other hand, net cash flow is a measure of the total cash generated or consumed by a business during a specific period. It represents the net result of cash inflows and outflows over a set timeframe, encompassing operating, investing, and financing activities.

As you can see, they’re pretty similar. However, while net cash is a balance sheet item representing the current cash position, net cash flow is a dynamic measure indicating the change in cash over a period of time. So, while related, they represent different aspects of a company’s financial status.

How to calculate net cash flow

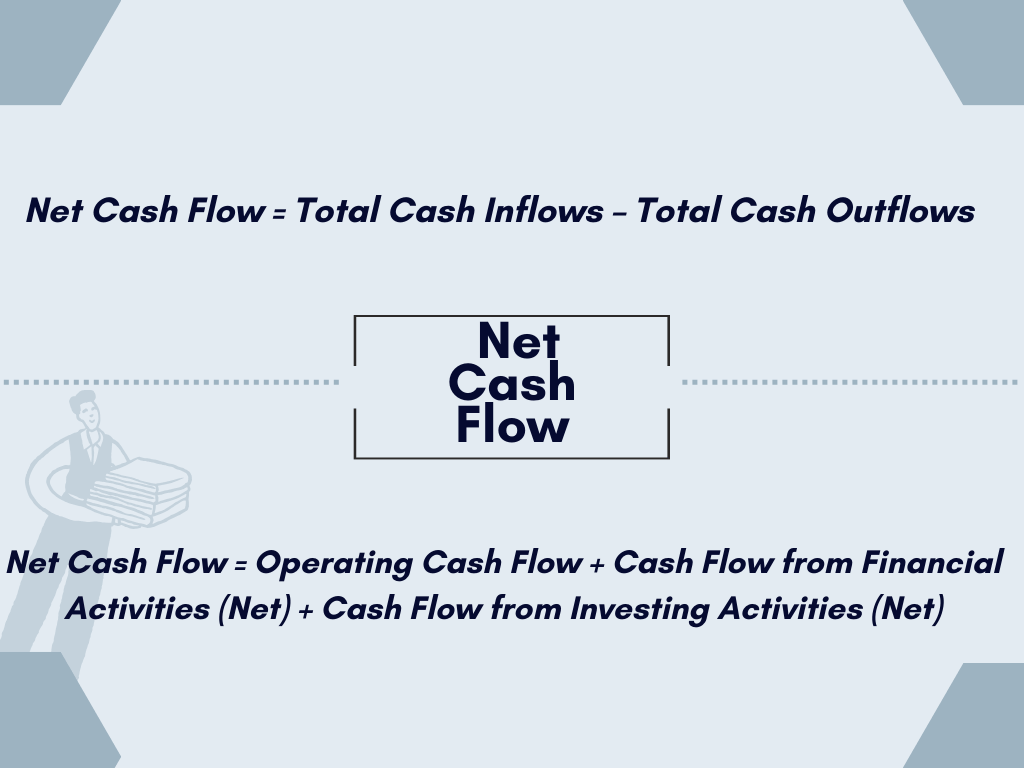

The calculation of net cash flow – being the difference between all the cash coming in and out of your business – at its most basic representation, looks like the following:

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

However, to better understand how to find your net cash flow, you need to know the components that make those cash totals. So let’s break them down and see how many calculations you might need to make to get the final result.

As previously mentioned, all your company’s earnings and expenses come from three types of activities, such as operating, financial, and investing. Altogether, they form those cash flow totals you need to calculate net cash flow. This way, you have an extended net cash flow formula to comprise all these components.

Net Cash Flow = Operating Cash Flow + Cash Flow from Financial Activities (Net) + Cash Flow from Investing Activities (Net)

You might want to look at each component in more detail to get a clear picture of where those figures come from.

Calculating operating cash flow

Speaking of operating cash flow, we usually mean a company’s earnings and expenses from its normal operation (such as sales, cost of goods, etc.). So, to calculate net operating cash flow, you might want to add your net income and non-cash expenses, then subtract the change in working capital.

Operating Cash Flow = Net Income + Non-Cash Expenses – Change in Working Capital

Calculating cash flow from financial activities

Cash flow from financing activities usually implies the flows of cash used to fund the company. Financing activities might include transactions involving debt, equity, and dividends. Calculating cash flow from financing activities usually takes three steps. These include adding all cash inflows from issuing equity or debt, adding all cash outflows from stock repurchases, dividend payments, and repayment of the debt, and finally, subtracting the latter from the first.

Cash Flow from Financial Activities = Cash Inflows From Issuing Equity or Debt – (Dividends Paid + Repurchase of Debt and Equity)

Calculating cash flow from investments

Ultimately, you find your cash flow from investing, which is cash generated or spent from various investment-related activities, like capital expenditures, mergers and acquisitions, investments in securities, and so on. A formula for calculating cash flow from investing activities might look like this:

Cash Flow from Investing Activities = Purchase/Sale of Property and Equipment + Purchase/Sale of Other Businesses + Purchase/Sale of Marketable Securities

So now, as you have all the necessary figures involved, you can calculate your net cash flow.

How to find the necessary net cash figures from various business activities?

Having all the necessary formulas ready for calculating net cash flow, you might still need to know where to go to search for the components – some of them might not be that obvious, especially if you’re not a finance specialist. Usually (and it makes sense), a business owner would delegate all about financial analysis to an accountant. However, they might want to know where the figures come from to have more control over their finances, particularly cash.

So, here’s where financial statements come to light as the source of truth. The three most important, like basic for any business, are an income statement (or profit and loss), a cash flow statement, and a balance sheet. And here, we’ll focus on the cash flow statement.

The purpose of a cash flow statement

As it derives from the name, the purpose of a cash flow statement is to display all the cash inflows and outflows involved in your business activities. A typical cash flow statement comprises three sections – cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. So the vast majority of the components required to calculate net cash flow will be displayed in the cash flow statement – you need to look through the corresponding section.

However, the best approach to analyzing the net cash flow might be to look at the cash flow statement in connection with the balance sheet and income statement. This way, the picture of a business’s financial health will be more comprehensive.

Explore How to prepare a Cash Flow statement easily here.

The role of accounting software (like Synder, QBO, or FreshBooks) in generating a company’s financial statements

Accounting software may help generate a company’s financial statements efficiently and accurately. Platforms like Synder, QuickBooks Online (QBO), FreshBooks, and others can streamline various accounting processes, providing businesses with the tools to manage their financial data effectively.

Let’s look at how accounting software works in the context of financial statement generation in the example of Synder:

- Automated data entry and synchronization

Synder automatically integrates with payment systems such as Stripe, Paypal, and Square and ecommerce platforms like Shopify and Amazon (and many more). It ensures the synchronization of ongoing and historical transactions with accounting solutions like QuickBooks and Xero.

- Detailed transaction recording

The platform captures granular transaction data, including sales, expenses, fees, taxes, and tips. This detalization provides a comprehensive view of financial activities, which is essential for accurate reporting.

- Smart rules for categorization

Synder utilizes Smart Rules to automatically categorize transaction data based on various parameters such as fees, taxes, discounts, inventory, and customer location. Automated categorization reduces the risk of manual errors and ensures accurate financial reporting.

- Invoicing and payments

Synder’s invoicing feature allows businesses to generate and send one-click invoices. Integrated payment links enable businesses to receive online credit card payments seamlessly, contributing to accurate tracking of cash inflows.

- Bank reconciliation and undo functionality

The platform simplifies bank reconciliation by automatically recording transactions for an entire fiscal period. In case of errors or duplicates, Synder allows for bulk undoing of transactions without affecting the integrity of the books.

- Multi-channel sales tracking

For those businesses operating across multiple sales channels, Synder centralizes transaction data from various platforms into a single accounting system. This consolidation ensures a unified and accurate representation of financial data.

- Clean bookkeeping practices

Synder includes features like intelligent duplicate detection and rollback functionality. Clean bookkeeping practices eliminate discrepancies, ensuring financial data used for reporting is accurate and reliable.

- Comprehensive reporting

Automated categorization, detailed transaction records, and Smart Rules support intelligent reporting capabilities. Accurate categorization helps generate error-free financial statements, including cash flow and P&L statements and balance sheets.

- Financial statement preparation

Accounting software simplifies generating financial statements, including the income statement, balance sheet, and statement of cash flows. Businesses can generate accurate financial reports with just a few clicks, saving time and reducing the likelihood of errors associated with manual calculations. It’s particularly beneficial for meeting reporting requirements and providing insights for stakeholders.

As you can see, accounting software simplifies and automates various accounting tasks, contributing to the efficient and accurate generation of financial statements. It, in turn, empowers businesses with the financial insights needed for strategic planning, compliance, and overall financial management.

If you believe you might want to try Synder, don’t hesitate to book a seat at a free demo or go for a free trial to explore Synder’s capabilities and find out whether it can fit the bill for you.

Understanding cash flows: a final word

As a business owner, you need to know your net cash flow and how to find and calculate it, even if you have an accountant or a CPA firm responsible for your finances. It gives you more control and confidence in your business’s well-being and ensures you can see any possible issues coming in and timely react. Today, most accounting software available for small businesses can generate accurate financial statements, including the cash flow statement, making it easier for you to keep track of your cash.

Find out what is the difference between direct and indirect cash flows reading our article.

%20(1).png)

Thanks for the article! Was helpful to learn about net cash flow.

Hey, David, thanks for stopping by!