Today, businesses face a myriad of choices when it comes to payment processing solutions. While Stripe has established itself as a leader in the industry, providing seamless and efficient payment processing services, there are situations where businesses may find it beneficial to consider alternatives. Whether it’s due to specific business needs, industry requirements, or a desire for a more tailored solution, exploring the landscape of Stripe’s alternatives might become imperative. Knowing the offerings and capabilities of these alternatives can help businesses gain a comprehensive understanding of the available options and make an informed decision that aligns perfectly with their unique requirements.

This article aims to provide a thorough and insightful guide to Stripe’s competitors, equipping businesses with the knowledge needed to navigate the payment processing landscape confidently.

What is Stripe?

Stripe is a renowned payment processor that offers businesses a seamless and efficient way to accept online payments. With its robust set of tools and APIs, Stripe enables businesses to process payments efficiently and securely, manage subscriptions, and handle complex billing scenarios. Stripe’s developer-friendly approach and extensive documentation make it a popular choice for startups and enterprises alike. Additionally, Stripe’s emphasis on reliability and security has gained it a strong reputation in the industry.

What payment methods does Stripe support?

Stripe supports a wide range of payment methods, catering to the diverse needs of businesses and their customers. It enables businesses to accept major credit and debit cards, including Visa, Mastercard, American Express, Discover, business loans and more.

Stripe also supports popular digital wallets such as Apple Pay, Google Pay, and Microsoft Pay, making it convenient for customers to complete transactions using their preferred method. Additionally,

Stripe provides support for local payment methods, such as Alipay and iDEAL, allowing businesses to cater to international customers and expand their global reach. The flexibility and versatility of Stripe’s payment method support contribute to its popularity among businesses seeking a comprehensive payment processing solution.

Stripe limitations: why might businesses consider competitors?

While Stripe excels in many areas, it’s important to recognize that it may not always be the perfect solution for every business. Several factors can influence businesses to explore alternative payment processing solutions. Understanding these limitations and considering alternative options allows businesses to make an informed decision that best suits their unique requirements and objectives. Let’s look at some key considerations that might prompt businesses to look beyond Stripe and explore the offerings of its competitors.

- Pricing structure and fees

Stripe employs a straightforward pricing model, but its transaction fees may not be the most cost-effective option for businesses processing high volumes of transactions or large-ticket sales.

Learn more about Stripe fees!

- Global reach and currency support

Stripe’s global reach and currency support have significantly improved over the years, but businesses with a strong international presence may require more extensive global payment capabilities offered by competitors.

- Customer service and support

Stripe provides support through various channels, including email and chat, but some businesses may prefer more personalized support options, such as phone support, which competitors may offer.

- Industry-specific considerations

Certain industries or business models may have specific payment processing requirements that Stripe does not fully cater to. Exploring alternatives can help businesses find solutions tailored to their unique needs.

- Alternatives to Stripe’s additional services

Stripe offers ancillary services like financing and point-of-sale solutions. However, businesses may find competitors offering more suitable options that align better with their specific requirements.

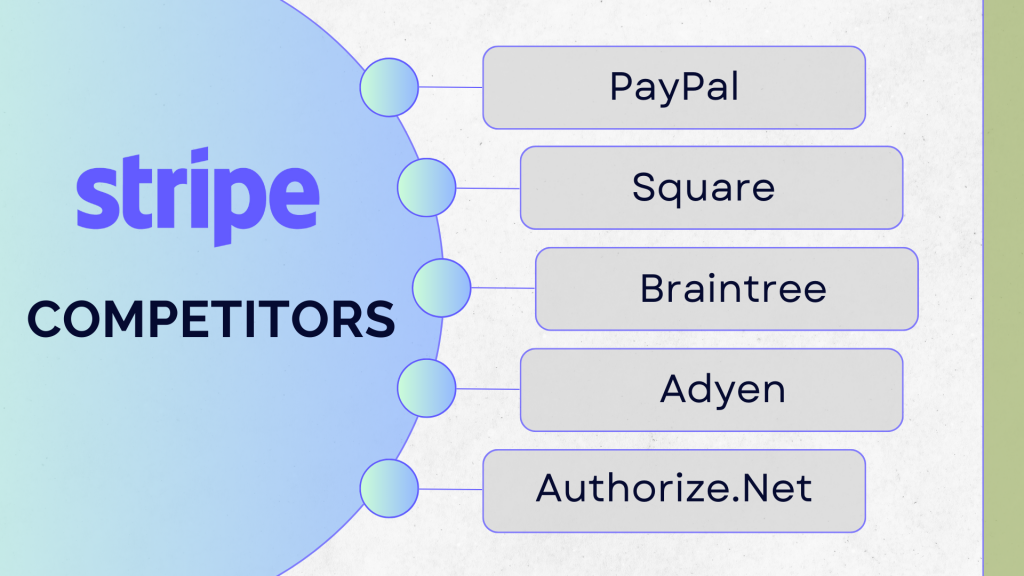

Five Stripe competitors a business might want to look at

With all the above in mind, let’s explore payment processing solutions that compete with Stripe in the US and Global market.

Competitor #1 – PayPal

PayPal has established itself as a globally recognized payment processor, with a rich history spanning over two decades. It offers a comprehensive suite of solutions, including payment gateways, express checkout, and invoicing services. As one of the pioneers in the industry, PayPal has built a solid reputation and a strong presence in the online payment ecosystem.

Key features and services offered by PayPal

PayPal provides businesses with a user-friendly interface that simplifies the payment process for both buyers and sellers. One of its standout features is its robust buyer and seller protection, which instills confidence in customers and helps mitigate risks for businesses. PayPal’s extensive network of active users also contributes to its appeal, as it offers a vast potential customer base for businesses to tap into.

In terms of integration options, PayPal offers seamless integration with various e-commerce platforms, making it a popular choice among online businesses. Its APIs and developer tools allow for smooth integration, enabling businesses to incorporate PayPal’s payment functionality into their websites or applications with ease.

Comparison of PayPal’s strengths and weaknesses against Stripe

PayPal’s strengths lie in its extensive user base, brand recognition, and global reach. Its long-standing presence in the market has garnered trust and familiarity among consumers, making it a preferred payment method for many. PayPal’s international support and ability to process transactions in multiple currencies make it well-suited for businesses with global operations or those targeting diverse markets.

However, when compared to Stripe, PayPal may not offer the same level of flexibility and customization options. Stripe’s developer-centric approach and extensive documentation provide more room for customization and integration with complex systems. Additionally, Stripe’s emphasis on developer tools and APIs appeals to businesses seeking a more tailored payment processing solution.

Target audience and industries suited for PayPal

PayPal caters to businesses of all sizes, ranging from startups to established enterprises. It is particularly well-suited for businesses starting out in the e-commerce, retail, and service industries. PayPal’s user-friendly interface and wide acceptance make it a convenient option for businesses seeking a straightforward payment processing solution that can cater to a broad customer base.

As you can see, PayPal’s extensive industry experience, user-friendly interface, and widespread recognition position it as a strong competitor to Stripe. While it may have some limitations in terms of flexibility and customization compared to Stripe, PayPal’s global reach, buyer and seller protection, and ease of integration make it an attractive choice for businesses looking for a reliable and trusted payment processing solution.

Competitor #2 – Square

Square is a comprehensive payment processing platform that has gained significant popularity among small and medium-sized businesses. With its diverse range of solutions for in-person, online, and mobile payments, Square offers a versatile platform that caters to businesses across various industries.

Explanation of Square’s core offerings and its unique selling points

Square sets itself apart with its intuitive and user-friendly point-of-sale (POS) systems. These systems integrate seamlessly with Square’s payment processing capabilities, allowing businesses to accept payments easily and efficiently. Moreover, Square provides a wide array of payment options, including credit cards, debit cards, and mobile wallet payments.

One of Square’s unique selling points is its integrated hardware solutions, such as the Square Reader, which enables businesses to transform their smartphones or tablets into fully-functional POS systems. This hardware integration simplifies the payment process and provides a seamless customer experience.

Square also offers additional services that further enhance its value proposition. For instance, its inventory management feature assists businesses in tracking and managing their product inventory. The invoicing service streamlines the process of creating and sending professional invoices to clients, facilitating efficient payment collection.

Differentiation between Stripe and Square in terms of features and target markets

While both Stripe and Square provide online payment solutions, they differ in their primary focus and target markets. Stripe emphasizes its developer-friendly APIs and documentation, making it an attractive choice for businesses that require a high level of customization and integration flexibility. On the other hand, Square’s emphasis is on providing integrated hardware and software solutions, making it particularly appealing to brick-and-mortar businesses, retailers, and local service providers. Square’s POS systems and hardware solutions cater to businesses that require physical payment processing capabilities alongside their online operations.

Overview of Square’s additional services, such as Square Capital and Square Point of Sale

Square Capital is an additional service offered by Square that provides business financing options. Through Square Capital, businesses can access funding to support their growth and expansion initiatives. This service simplifies the financing process and offers flexibility to businesses looking for capital to invest in their operations or seize growth opportunities.

Square Point of Sale (POS) is another notable service provided by Square. It offers a comprehensive ecosystem for managing sales and inventory. Businesses can utilize Square POS to process transactions, track sales data, manage customer information, and monitor inventory levels. This integrated approach streamlines operations, reduces manual effort, and provides businesses with valuable insights into their performance.

By offering a combination of user-friendly payment processing solutions, integrated hardware options, and additional services like Square Capital and Square Point of Sale, Square presents itself as a strong contender in the payment processing landscape. Its tailored focus on in-person transactions and integrated business management solutions makes it an appealing choice for businesses seeking a holistic payment processing solution.

Check out our complex comparison of Stripa, Square and Paypal.

Competitor #3 – Braintree

Braintree, a subsidiary of PayPal, is a robust payment gateway that has gained recognition for its emphasis on simplicity and scalability. As a leading payment solution, Braintree offers flexible integration options suitable for businesses of all sizes, making it an attractive choice for companies seeking a reliable and customizable payment processing solution.

Overview of Braintree’s integration capabilities and developer-friendly tools

Braintree provides businesses with a range of advanced tools and resources to seamlessly integrate payment processing into their applications. With a comprehensive set of APIs, SDKs, and extensive documentation, Braintree enables developers to implement and customize the payment gateway effectively. This developer-friendly approach streamlines the integration process and empowers businesses to tailor their payment experience to their specific needs.

Braintree’s competitive advantages and target audience

Braintree offers several competitive advantages that make it an appealing alternative to Stripe. Firstly, Braintree boasts robust fraud detection capabilities, employing sophisticated algorithms to identify and prevent fraudulent transactions effectively. This feature ensures enhanced security for businesses and their customers, safeguarding against potential financial losses.

Additionally, Braintree provides comprehensive support for recurring billing, making it a suitable choice for businesses that rely on subscription-based or recurring revenue models.

Braintree’s user-friendly interface simplifies the payment experience for customers, contributing to higher conversion rates and customer satisfaction. Overall, Braintree caters to businesses seeking a high level of customization, control, and security in their payment processing operations.

Comparison of Braintree’s fees, security, and international support with Stripe

In terms of pricing, Braintree offers competitive rates, particularly for businesses processing large transaction volumes. By optimizing their fee structure, Braintree presents a cost-effective option for companies dealing with significant payment volumes, potentially resulting in substantial savings.

Braintree prioritizes security and implements stringent measures to protect businesses and their customers from fraudulent activities. Its advanced fraud detection system and adherence to industry-leading security standards ensure a secure payment environment.

Braintree provides extensive international support, allowing businesses to accept payments in multiple currencies and expanding their global reach. This comprehensive international coverage makes Braintree well-suited for businesses with a global presence or those targeting specific international markets.

In other words, Braintree, as a subsidiary of PayPal, offers businesses a reliable, scalable, and customizable payment gateway solution. Its array of integration capabilities, competitive pricing, robust security measures, and extensive international support make it a compelling alternative to Stripe for businesses looking for a versatile and tailored payment processing solution.

Competitor #4 – Adyen

Adyen stands out as a leading global payment processing platform renowned for its comprehensive suite of payment solutions. With its extensive experience and robust infrastructure, Adyen offers businesses a reliable and advanced platform to facilitate payment processing.

Overview of Adyen’s all-in-one platform and payment methods

Adyen’s all-in-one platform is designed to cater to the diverse needs of businesses operating in a global marketplace. It supports a wide array of payment methods, including major credit cards such as Visa, Mastercard, American Express, and Discover. Additionally, Adyen enables businesses to accept payments through popular digital wallets like Apple Pay, Google Pay, and Samsung Pay. The platform also offers localized payment options, allowing businesses to provide a tailored payment experience to customers across different regions. By supporting a comprehensive range of payment methods, Adyen empowers businesses to reach a broader customer base and facilitate transactions smoothly.

Adyen’s strengths in terms of scalability and global reach

One of Adyen’s notable strengths lies in its scalability, making it an ideal choice for businesses with growing transaction volumes. Adyen’s infrastructure can handle high volumes of transactions without compromising performance or security. Moreover, Adyen’s global reach is a significant advantage for businesses expanding into new markets. The platform supports numerous currencies and has extensive expertise in local payment methods, ensuring that businesses can provide localized payment experiences to customers worldwide. This global reach and localization capability enable businesses to seamlessly navigate the complexities of international transactions and cater to the unique preferences of customers in various regions.

Comparison of Adyen’s features, fees, and reporting capabilities with Stripe

Adyen offers an impressive range of features that enhance the payment processing experience for businesses. Intelligent routing, a notable feature, optimizes transaction routing to maximize successful payment rates and minimize costs.

Adyen’s robust fraud prevention mechanisms, powered by advanced machine learning algorithms, provide businesses with effective protection against fraudulent activities.

Adyen offers comprehensive subscription management tools, enabling businesses to handle recurring billing and subscription-based services effortlessly.

In terms of pricing, Adyen tailors its fee structure to enterprise-level businesses, considering factors such as transaction volumes and specific requirements. While the pricing may be higher compared to some other providers, it reflects the enterprise-grade services and extensive capabilities Adyen offers.

Adyen’s reporting capabilities provide businesses with valuable insights into their payment activities. Through detailed reporting and analytics, businesses can gain a comprehensive understanding of transaction data, identify trends, and make informed decisions to optimize their payment processes.

Considering Adyen’s feature-rich platform, scalability, global reach, and robust reporting capabilities, businesses seeking a sophisticated payment processing solution for international operations and enterprise-level needs may find Adyen to be an excellent alternative to Stripe.

Competitor #5 – Authorize.Net

As one of the pioneers in the payment processing industry, Authorize.Net has established itself as a long-standing and trusted payment gateway. It offers businesses a reliable and secure platform to accept online payments, making it a popular choice for a wide range of businesses.

Overview of Authorize.Net’s features, including fraud protection and recurring billing

Authorize.Net provides businesses with a comprehensive suite of features to enhance their payment processing capabilities. One notable feature is its advanced fraud detection tools, which help businesses mitigate the risks associated with fraudulent transactions. By analyzing multiple data points and employing machine learning algorithms, Authorize.Net can identify potential fraudulent activities and safeguard businesses against financial losses.

Another valuable feature offered by Authorize.Net is its recurring billing options. This allows businesses to set up automated recurring payments, making it convenient for customers to pay for subscription-based services or regular invoices. The flexibility and automation provided by Authorize.Net’s recurring billing feature help businesses streamline their payment processes and improve customer satisfaction.

In addition, Authorize.Net offers seamless integration with popular e-commerce platforms, enabling businesses to integrate their online stores with ease. This integration simplifies the payment process for customers, providing a smooth and cohesive experience.

Comparison of Authorize.Net’s ease of integration and pricing structure with Stripe

When comparing Authorize.Net with Stripe, one aspect to consider is the ease of integration. Authorize.Net offers straightforward integration options, allowing businesses to seamlessly incorporate its payment gateway into their existing infrastructure. Its developer-friendly tools and comprehensive documentation make the integration process efficient and hassle-free.

In terms of pricing, Authorize.Net provides flexible plans to accommodate businesses of various sizes and transaction volumes. Its pricing structure includes competitive transaction fees and the option for customized pricing based on individual business requirements. This flexibility allows businesses to choose a pricing plan that aligns with their specific needs, potentially resulting in cost savings compared to Stripe’s pricing model.

Target markets and use cases for Authorize.Net

Authorize.Net caters to a diverse range of businesses across various industries. It is particularly well-suited for retail businesses, e-commerce platforms, and service-based businesses that require a reliable and secure payment gateway. Whether it’s a brick-and-mortar store seeking to expand into online sales or a subscription-based service provider, Authorize.Net offers the necessary tools and features to facilitate seamless online payments.

Moreover, Authorize.Net’s extensive industry experience and track record make it a popular choice for businesses in regulated sectors such as healthcare and financial services. Its compliance with industry standards and robust security measures ensure that sensitive customer data is handled securely, helping businesses maintain regulatory compliance and build trust with their customers.

With all this in mind, it’s safe to say that Authorize.Net stands as a formidable competitor to Stripe, providing businesses with a reliable, secure, and feature-rich payment gateway. Its advanced fraud protection tools, recurring billing options, and seamless integration capabilities make it an attractive choice for businesses across industries. With a focus on ease of integration and flexible pricing plans, Authorize.Net offers businesses the necessary tools to enhance their payment processing efficiency and cater to their specific needs.

Do you need to choose? Leveraging multi-channel payments

While businesses typically rely on a single payment processor to handle their transactions, there are situations where leveraging the power of multiple payment processing options can be beneficial. As businesses grow and expand their operations, they may encounter specific needs and challenges that can be effectively addressed by incorporating multiple payment processors into their system.

Diversifying payment options

One of the primary reasons businesses consider using multiple payment processors is to diversify their payment options. By offering customers a variety of payment methods, businesses can cater to different preferences and increase their chances of completing successful transactions. For example, some customers may prefer to pay with credit cards, while others may prefer digital wallets or localized payment methods. By incorporating multiple processors, businesses can accommodate these preferences and provide a seamless payment experience to a broader customer base.

Improving financial management

Another advantage of leveraging multiple payment processing solutions is improved financial management. By integrating various payment processors into a single system with accounting capabilities, businesses can streamline their financial processes. This integration allows for automatic synchronization of transactions, simplifies reconciliation, and provides a centralized view of all financial data. With consolidated financial management, businesses gain valuable insights into their performance, cash flow, and revenue streams, enabling better decision-making and strategic planning.

Scaling for growth

Scalability is another significant benefit of using multiple payment processors. As businesses grow, they may need to expand their operations across different sales channels or geographical regions. Each channel or region may have specific payment preferences or requirements. By leveraging multiple payment processors, businesses can easily adapt and cater to these diverse needs. This flexibility enables businesses to scale their operations efficiently and capture opportunities in new markets, ultimately driving growth and revenue.

Managing multi-channel payments in a single system with Synder

In this context, Synder emerges as a valuable solution for managing multi-channel payments. Synder is a robust accounting automation platform that seamlessly integrates with various payment processors, including Stripe and other leading providers. By consolidating transactions from different payment processors into a single system, Synder simplifies financial management and provides a unified view of all transactions. With Synder’s intuitive interface and comprehensive reporting capabilities, businesses can gain real-time insights into their financial performance, track revenue streams, and reconcile transactions effortlessly.

On top of that, Synder’s synchronization with accounting software such as QuickBooks or Xero streamlines the accounting process, eliminating manual data entry and reducing errors. This automation not only saves time but also improves accuracy and ensures financial records are up to date.

If you want to learn more about Synder’s capabilities to help your particular business, please feel free to book office hours with the team to have all your questions answered. You might also want to explore Synder yourself, just sign up for a free trial and have instant access to Synder’s features and services.

Bottom line

While Stripe remains a popular choice for many businesses, exploring its competitors might help identify the best payment processing solution that aligns with specific business needs and priorities: be it cost-effectiveness, global reach, industry-specific solutions, or personalized support. PayPal, Square, Braintree, Adyen, and Authorize.Net each offer unique features, strengths, and industry focus. By carefully evaluating these options, businesses can enhance their payment processing capabilities and provide a seamless experience to their customers.

%20(1).png)