When it comes to managing payments for your ecommerce business, Stripe has established itself as a popular and widely-used payment gateway provider. However, as the business landscape evolves, it is essential for entrepreneurs to explore various options and find the right Stripe alternative that aligns with their specific needs.

In this article, we will overview some Stripe alternatives, highlighting the key considerations and providing insights to help ecommerce business owners make an informed decision.

Brief Stripe overview

Let’s start with a short overview of Stripe as a payment provider. Stripe is a technology company founded in 2010 that simplifies online payment processing for businesses. It offers a developer-friendly platform with robust APIs, allowing businesses to integrate payment processing into their websites or applications easily.

Stripe brings several benefits to businesses.

- Its versatility allows businesses to offer a seamless checkout experience across different devices and channels. Whether it’s a website or a mobile app, Stripe enables businesses to accept payments with ease.

- Stripe provides tools for subscription management, allowing businesses to handle recurring payments efficiently. This is especially beneficial for businesses that offer subscription-based services or products.

- Stripe prioritizes security and reliability. It invests heavily in advanced security measures to protect customer data and ensure secure payment processing. Businesses can trust Stripe to handle sensitive financial information securely.

- Stripe’s documentation and support make it easy for developers to implement and customize payment processing according to their specific needs. The platform’s developer-friendly infrastructure ensures a smooth integration process.

- Stripe is compliant with industry standards and regulations, providing businesses with peace of mind when it comes to handling financial transactions. This compliance helps businesses meet regulatory requirements without additional complexities.

All these benefits have long made Stripe a popular choice for businesses seeking a comprehensive and streamlined payment solution.

How does Stripe help deal with business payments?

Stripe supports a wide range of payment methods, enabling businesses to offer diverse options for their customers. Some of the payment methods supported by Stripe include:

Debit and credit cards

Stripe allows for accepting major card networks like Visa, Mastercard, American Express, Discover, Diners Club, and JCB, thus helping businesses accommodate customers who prefer card payments, regardless of their preferred card network and offer a seamless and secure payment experience. Stripe’s advanced fraud prevention measures further ensure secure transactions for businesses and customers alike. Overall, Stripe’s acceptance of major card networks empowers businesses to thrive in the competitive landscape of modern commerce.

Digital wallets

Stripe integrates with widely used digital wallet services like Apple Pay and Google Pay, enabling customers to make purchases conveniently and securely through mobile devices and online platforms. Apple Pay allows seamless transactions for millions of iPhone, iPad, and Mac users, eliminating the need for manual payment entry. Google Pay offers a swift and secure checkout process for Android users, leveraging Google’s user-friendly interface. Both digital wallets prioritize security through tokenization technology, protecting sensitive payment information and reducing the risk of fraud. By embracing these digital wallets, businesses can adapt to evolving customer preferences and stay ahead in the rapidly advancing world of mobile commerce.

Bank transfers

Stripe enables businesses to accept payments directly from customers’ bank accounts through ACH transfers in the United States and SEPA transfers in Europe. This feature is ideal for recurring payments and large transactions, simplifying operations and ensuring a seamless experience for both businesses and customers.

Local payment methods

By offering support for various local payment methods, Stripe empowers businesses to adapt their payment strategies to different markets and cater to the payment preferences of their customers in specific countries or regions. This localized approach enhances the user experience, fosters trust, and ultimately helps businesses capture more sales opportunities in diverse markets.

Cryptocurrencies

Stripe supports cryptocurrency payments, allowing businesses to accept digital currencies from customers. By integrating cryptocurrency payments through Stripe, businesses can attract tech-savvy customers and tap into a growing market. Stripe primarily focuses on Bitcoin, securely converting the cryptocurrency into traditional fiat currencies. This feature aligns with Stripe’s emphasis on security and keeps businesses at the forefront of the digital revolution.

Understanding the need for Stripe alternatives

However, with all the benefits it provides, Stripe possesses a range of limitations that might discourage businesses from using it, at least as their primary payment provider, making them seek alternatives to Stripe. While some of these limitations can be pretty much addressable, others might be a stop light. Let’s look at those limitations in more detail.

Geographic limitations

When it comes to international expansion, businesses need to consider whether Stripe has a presence in the countries they plan to operate in. While Stripe has steadily expanded its reach, there may still be regions where their services are not yet available or have limited functionality. For example, some emerging markets or developing countries may have specific regulatory requirements or payment infrastructures that are not fully compatible with Stripe’s capabilities. In such cases, businesses should assess whether Stripe’s limitations align with their expansion plans and evaluate whether alternative payment processors or platforms can better cater to their needs in those regions.

Industry-specific limitations

Certain industry verticals might also have unique requirements or face regulatory challenges that impact their ability to use Stripe’s services effectively. Stripe has implemented industry-specific restrictions and guidelines to comply with legal frameworks and mitigate risks associated with particular sectors. However, there may be instances where businesses operating in highly regulated industries, such as gambling, adult content, or pharmaceuticals, find that Stripe’s policies or features do not align with their specific compliance requirements. In such situations, businesses must carefully review the available options and seek out specialized payment solutions tailored to their industry’s unique demands.

Account holds and suspensions

Stripe has a strict compliance and risk management system in place to protect against fraudulent activities. In some cases, this can lead to account holds or suspensions, especially if there is a sudden increase in sales volume or unusual activity. This can be disruptive to businesses, as it may result in funds being temporarily unavailable.

Limited dispute resolution

Stripe provides some tools for handling disputes and chargebacks, but its dispute resolution process is not as robust as some other payment processors. Resolving disputes may involve manual intervention and communication with the customer, which can be time-consuming and potentially lead to financial losses.

Stripe payout schedule

Stripe has a default payout schedule where funds are transferred to your bank account on a rolling basis, typically every two business days. However, depending on your location, industry, and business history, Stripe may impose longer payout schedules, such as weekly or monthly payouts. This can affect cash flow and liquidity for some businesses.

Pricing and fee structure

While Stripe offers transparent pricing, many users find Stripe’s fee structure to be less competitive compared to other payment processors, especially for high-volume businesses. The transaction fees can add up, especially when combined with additional fees for certain features or services.

Technical integration

Stripe, being super developer-friendly, on the other hand, can be pretty much complicated to integrate into your website or application. Stripe integration requires some technical expertise to set it up correctly. While it provides comprehensive documentation and client libraries for various programming languages, the integration process may still require development resources and knowledge of APIs and web development.

PCI Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is essential for securely processing credit card transactions. Stripe helps simplify PCI compliance by handling sensitive card data on their servers. However, if you choose to store card details on your own servers for various reasons, you’ll need to ensure your infrastructure and processes meet the necessary PCI requirements.

Customization and branding

Stripe’s checkout experience is customizable to a certain extent, but it may not offer the same level of branding and customization as building a fully custom payment flow. If you have specific design requirements or a desire for complete control over the customer experience, you may need to invest more effort in customizing the checkout process.

Tax compliance

Depending on your business and the jurisdictions you operate in, handling taxes can be complex. Stripe provides some tools and integrations to help with tax calculations and compliance, but you’ll need to understand and configure them correctly to ensure accurate tax calculations and proper compliance with local tax regulations.

Synder – an intelligent accounting software for online businesses – might help overcome several Stripe limitations, allowing you to keep this payment processor in your business tool set, at some point. With Synder, you can consolidate payments from various platforms, automatically sync transactions into accounting software, match payments for accurate reporting, handle currency conversions, ensure tax compliance, customize transaction mapping, and gain insights through comprehensive reporting.

It’s worth noting, however, that while Synder enhances Stripe integration, it doesn’t address all Stripe limitations, such as business restrictions, regional availability, or account holds.

Should you believe Synder might be a solution for you to implement Stripe into your business, feel free to book office hours with our team to have your questions answered, or sign up for a free trial to explore Synder yourself and decide whether it fits the bill for you.

With the above said in mind, ecommerce businesses should consider conducting thorough research and due diligence when choosing Stripe or any other payment service provider. They should examine the geographical and industry limitations of Stripe’s services to ensure they align with their expansion plans and regulatory obligations. It’s also necessary to ensure a business has enough expertise and resources to implement and set up Stripe correctly. So basically, there’re many scenarios where a business might want to consider an alternative payment provider. We gathered some options they might want to consider, so let’s go look at those.

Let’s explore some alternatives to Stripe

If you look at the market of online payment processors, you might see that there are plenty of solutions that can be alternatives to Stripe. They might have their advantages, putting them in front of Stripe for you, depending on your situation and needs. There can also be flaws to consider and understand whether you can overcome them somehow before making your final decision.

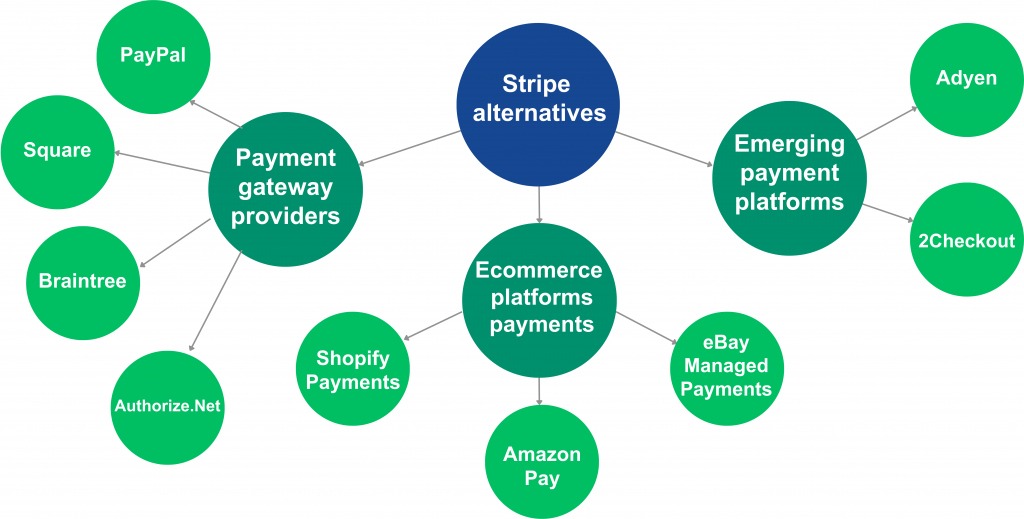

At large, the whole lot of the available options fall into several categories that we’re going to explore.

Payment gateway providers

Payment gateways are technology platforms that enable online businesses to accept and process payments securely from their customers. They act as a bridge between the merchant’s website or application and the financial institutions involved in the transaction, such as banks and credit card networks. Payment gateways facilitate the transfer of payment information between the customer, the merchant, and the acquiring bank.

Payment gateway providers we’ll look at include PayPal, Braintree, Authorize.Net, and Square.

Payment options by ecommerce platforms and marketplaces

In addition to utilizing payment gateway providers, ecommerce platforms and marketplaces often offer their own payment options to facilitate transactions for their users. These built-in payment solutions provide convenience and streamline the buying and selling process. Here are some popular payment options offered by ecommerce platforms and marketplaces.

Within this category, we’ll examine Shopify Payments, Amazon Pay, and eBay Managed Payments.

Emerging payment platforms

In the rapidly evolving landscape of payment platforms, several emerging alternatives to established services like Stripe have gained prominence. These platforms offer innovative features and solutions to meet the diverse needs of businesses operating in today’s global and subscription-based markets. They provide businesses with the flexibility, scalability, and specialized capabilities required to streamline their payment processes and drive growth.

Of this group, we’ll look at Adyen and 2Checkout.

Now, let’s look at these Stripe alternatives in more detail.

Alternative #1 – PayPal

PayPal, a widely recognized and trusted brand in the payments industry, is a popular Stripe alternative for many ecommerce businesses. With a user-friendly interface and an extensive set of features, PayPal offers a seamless payment experience for both merchants and customers. Their pricing starts with transparent transaction fees, making it easier for businesses to calculate their costs. PayPal also provides a range of integration options, allowing businesses to connect their ecommerce platforms effortlessly.

Alternative #2 – Braintree

Braintree, owned by PayPal, is another Stripe alternative that offers a comprehensive set of features and developer-friendly tools. Its pricing starts with competitive transaction fees, making it an attractive option for small to medium-sized businesses. Braintree’s customizable checkout experience and support for recurring payments make it an excellent choice for subscription-based businesses. Furthermore, Braintree’s strong emphasis on security and fraud prevention measures ensures that businesses can confidently process payments.

Alternative #3 – Authorize.Net

Authorize.Net is a long-standing payment gateway provider that offers a reliable and secure alternative to Stripe. With a robust set of features, Authorize.Net enables businesses to accept credit cards and e-checks seamlessly. Their pricing starts with competitive transaction fees, and they provide various integration options and developer tools to facilitate smooth payment management. Additionally, Authorize.Net prioritizes data security and offers comprehensive fraud detection and prevention measures.

Alternative #4 – Square

Square has gained popularity as a versatile Stripe alternative, especially for businesses that require both online and in-person payment capabilities. Their intuitive software and user-friendly interface make it easy for businesses to start accepting payments quickly. Square’s pricing starts with transparent transaction fees, which is beneficial for budget-conscious entrepreneurs. Moreover, Square offers a range of additional features such as inventory management, sales analytics, and even payroll integration.

Alternative #5 – Shopify Payments

Shopify, a leading ecommerce platform, offers its own integrated payment solution called Shopify Payments. This feature allows merchants to accept payments directly on their online stores without the need for third-party payment gateways. Shopify Payments supports various payment methods, including major credit cards, digital wallets, and alternative payment options. With competitive transaction fees and a seamless setup process, Shopify Payments simplifies payment processing for businesses operating on the platform.

Alternative #6 – Amazon Pay

As one of the largest online marketplaces globally, Amazon provides its own payment solution called Amazon Pay. This payment option allows customers to use their existing Amazon accounts to make purchases on external websites. By leveraging Amazon’s trusted and secure infrastructure, businesses can enhance the checkout experience for their customers. Amazon Pay supports multiple currencies and offers fraud protection measures, giving both buyers and sellers peace of mind during transactions.

Alternative #7 – eBay Managed Payments

eBay, a prominent online marketplace, offers eBay Managed Payments as a comprehensive payment solution for sellers on their platform. This feature enables sellers to process payments directly through eBay, simplifying order management and reducing the complexity of managing multiple payment providers. eBay Managed Payments supports various payment methods, including credit cards, debit cards, and digital wallets, offering flexibility to buyers. Additionally, eBay provides seller protection and handles customer disputes, further enhancing the overall payment experience.

Alternative #8 – Adyen

Adyen is a global payment platform that supports multi-currency payments and offers a wide range of local payment methods. This makes it an ideal Stripe alternative for businesses operating in international markets or targeting a diverse customer base. Adyen’s pricing structure is tailored to individual business needs, and they provide comprehensive reporting and analytics to help businesses gain insights into their payment performance.

Alternative #9 – 2Checkout

2Checkout is a Stripe alternative that focuses on subscription management and recurring billing capabilities. It offers flexible pricing models and supports a wide range of payment methods. With its user-friendly interface and robust features, 2Checkout simplifies the process of managing recurring payments for SaaS businesses and subscription-based models. Their extensive documentation and developer resources ensure a smooth integration process.

How to choose a Stripe alternative to fit your business needs?

When choosing a Stripe alternative as an ecommerce business owner, it’s crucial to prioritize your specific requirements. You might want to assess factors like payment types, customization, pricing, integrations, security, provider reputation, and more. Consider your unique needs to make an informed decision that sets the foundation for success. Let’s break it down.

Cost and pricing models

Understanding the transaction fees, processing fees, and any additional costs associated with each alternative is essential for accurate cost calculations. Compare the pricing structures across different alternatives to determine which option offers the best cost-effectiveness for your business size and model. Look for alternatives that offer transparent pricing and align with your budgetary constraints.

Integration and developer-friendly features

Consider the ease of integration with your existing systems, such as your ecommerce platform or accounting software. Look for alternatives that provide robust APIs, SDKs, and customization options to ensure a seamless payment management experience. This is particularly crucial for businesses that rely on specific programming languages or frameworks.

International payments and currency support

If your business operates in international markets or targets a global customer base, it’s important to choose an alternative that supports multi-currency payments and provides localization options. Evaluate the availability of local payment methods to cater to your customers’ preferences and reduce friction in the checkout process. Additionally, consider cross-border transaction fees and exchange rates to optimize your international payment operations.

Security and fraud prevention

Safeguarding your customers’ payment information and ensuring compliance with data security standards are critical. Prioritize alternatives that adhere to PCI-DSS compliance and offer robust security measures to protect against fraud. Look for features such as tokenization and encryption of payment data, as well as effective fraud detection and prevention tools. Additionally, consider the alternative’s chargeback management and dispute resolution processes to ensure efficient resolution of any payment-related issues.

Want to learn more? Read our Stripve vs Sqaure vs PayPal article or Stripe and Quickbooks payments comparison.

Looking for a Stripe alternative: final words

Now, making the long story short, Stripe is a great payment provider – it’s reliable, secure, and a pretty widespread option. It supports multiple payment methods and can seamlessly integrate with the most popular accounting and some other business software. However, businesses might need an alternative to Stripe in various scenarios. At this point, selecting the right Stripe alternative should be approached wisely with the business’s needs considered. Businesses might want to evaluate various factors, such as cost, integration capabilities, international payment support, and security measures, to choose an alternative that aligns with their goals.

.png)