Product cost and period cost are accounting concepts used to categorize and allocate expenses in a business. These terms play a part in determining the cost of goods sold (COGS) and overall profitability.

Today, we’re breaking down these two concepts to understand their general aspects, relationship with financial statements, and overall impact on business decision-making.

Key takeaways

- Product costs, like the materials and labor that go into making things, are recorded as assets until the items are sold, then they show up as the cost of goods sold (COGS) on the income statement.

- Period costs, such as rent and salaries, are regular expenses that don’t depend on how much you produce, showing up in the operating expenses section of the income statement as they happen.

- Knowing the difference between product and period costs helps businesses set the right prices for their products and manage day-to-day expenses more effectively.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

Understanding product cost: a general overview

Shall we start right away? Let’s look at the anatomy and key aspects of a product cost.

Product cost definition

Product costs are the expenses directly tied to the creation of goods or services within a business. These costs represent the financial resources invested in the production process.

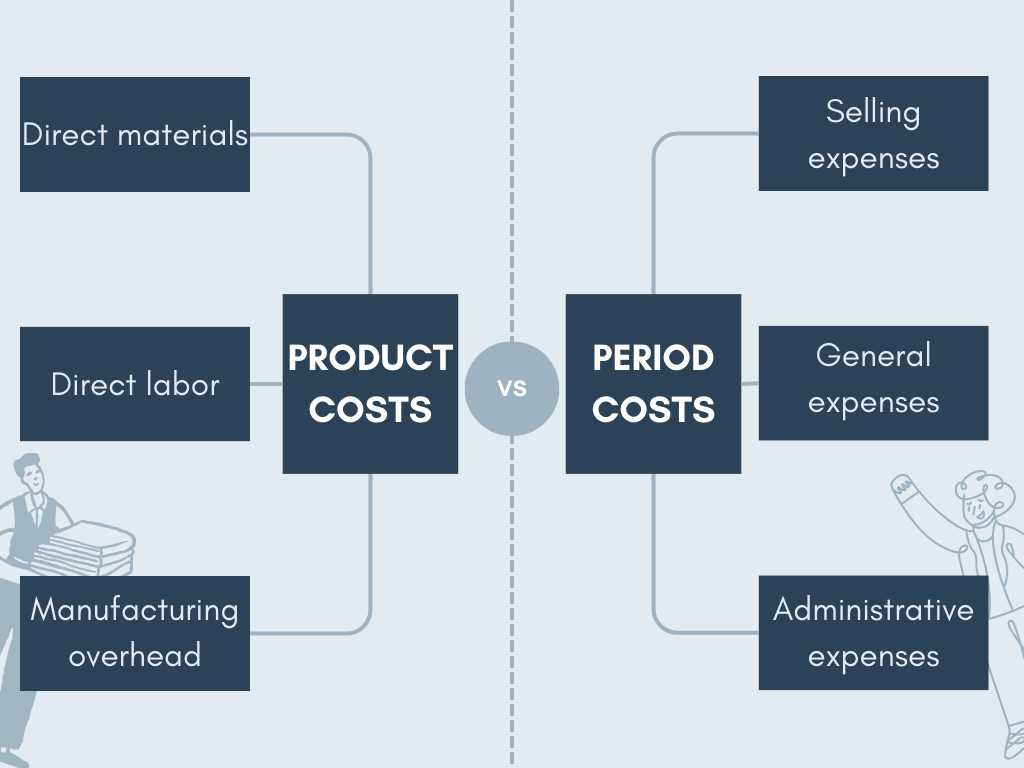

The components of product costs encompass three main categories: direct materials, direct labor, and manufacturing overhead.

- Direct materials are the raw materials that directly contribute to the final product.

- Direct labor are the wages paid to workers directly involved in the production process.

- Manufacturing overhead are indirect costs such as utilities, rent, and maintenance that support production but aren’t directly tied to specific units.

The timing of product costs

Product costs are incurred during the production phase. This means they accumulate as the business transforms raw materials into finished products. This timing is crucial for accurately determining the total cost of producing each unit.

Product costs capitalization

One unique aspect of product costs is their treatment as assets until the product is sold. Instead of being immediately expensed, product costs are capitalized, meaning they are recorded on the balance sheet as an asset. It’s only when the product is sold that these costs are transferred to the Cost of Goods Sold (COGS) category on the income statement. This approach aligns with the principle of matching expenses with revenue, providing a more accurate representation of the true cost of goods sold.

A quick look at period costs

People often confuse product and period costs due to the complexity of accounting terminology and the different ways these costs are treated in financial reporting. But as mentioned above, they are different concepts. So, now we’re looking at period costs.

Period cost definition

Period costs are the expenses in a business that aren’t directly linked to making specific products or services. Instead, they’re more about keeping the business running smoothly and supporting its overall operation.

The components of period costs fall under three main categories known as Selling, General, and Administrative expenses (SG&A):

- Selling expenses are costs associated with the marketing and selling of products or services, like advertising and sales commissions.

- General expenses are indirect costs necessary for day-to-day operations, such as rent, utilities, and office supplies.

- Administrative expenses are costs related to management and administration, including executive salaries and office staff wages.

The timing of period costs

Unlike product costs, period costs don’t depend on the production volume. They occur consistently over a specific time period, like a month or a year, and are incurred regardless of how much or how little the business produces during that time.

Period costs recognition

Period costs are expensed in the period they happen. This means that these costs directly impact the income statement for the specific time frame. Unlike product costs, which are initially treated as assets, period costs are deducted from revenue in the period they are accrued, providing a clear snapshot of the business’s financial performance during that time.

Understanding period costs helps assess the day-to-day financial health of a business. And while product costs focus on the creation of goods or services, period costs represent the broader expenses necessary to sustain the business’s overall operations and facilitate growth.

Period cost vs product: calculation of product and period costs

Calculating product costs and period costs involves different methods and considerations. Here’s a breakdown of each:

Calculating product costs

Product costs are tied to the production of goods or services. As mentioned above, the main components of product costs are direct materials, direct labor, and manufacturing overhead. Considering all these, the formula for calculating total product cost is:

Total Product Cost = Direct Materials + Direct Labor + Manufacturing Overhead

Calculating period costs

Period costs are not tied to the production of specific goods or services and are incurred over a specific time period. The main components of period costs, as you remember, are selling, general, and administrative expenses. This way, the formula for calculating total period cost looks like the following:

Total Period Cost = Selling Expenses + General Expenses + Administrative Expenses

Key considerations

- For product costs, the calculation is specific to the units produced. The total product cost is allocated to each unit, influencing inventory valuation.

- For period costs, the calculation is not tied to the number of units produced. These costs are expensed in the period they are incurred, directly impacting the income statement for that period.

- In both cases, accurate record-keeping and allocation methods are crucial for financial reporting and decision-making.

Cost of product vs period cost: reflecting costs in financial statements

Product and period costs take part in the financial story, influencing the bottom line and revealing the business’s financial health. When you look at a business’s income statement or a balance sheet, product and period costs show up there, influencing different parts of these financial statements.

Let’s look at it in more detail.

Product costs influence the Cost of Goods Sold (COGS) on the Income statement

When we talk about product costs, we’re diving into the nitty-gritty of how much it takes to make the things a business sells. This cost is like a backstage pass to the world of production. So, in the financial statements, it’s a key player in the Cost of Goods Sold (COGS) section on the income statement.

What is COGS?

In a nutshell, COGS is the bill for creating or buying the stuff a business sells. The product cost directly influences this bill. Imagine your favorite bakery – the cost of flour, sugar, and the baker’s time to make those croissants you’re so fond of. All these costs add up and get a front-row seat on the COGS stage.

Period costs affect Operating Expenses, impacting overall profitability on the Income statement.

Now, let’s shift our attention to period costs. These are more like ongoing business expenses, not tied to a particular product but necessary for keeping the lights on. Where do they hang out on the financial statements? Look no further than the operating expenses section.

What are Operating Expenses?

Operating expenses are the funds a business pays regularly to stay in business – rent, salaries, and advertising costs, to name a few. They play a significant role in shaping the overall profitability of a business because they directly impact how much money it gets to keep after covering all these ongoing expenses.

Product costs contribute to the valuation of Ending inventory on the balance sheet

The balance sheet is another critical financial statement product costs relate to. It’s a snapshot of a business’s financial health at a specific moment. And product costs play a significant role, especially in valuing the goods a company hasn’t sold yet.

In other words, Ending inventory.

Ending inventory is like a treasure trove of products waiting to leave the shelves and go to customers. The product costs, including direct materials, labor, and overhead, are like the guardians of this treasure. They determine the value assigned to these unsold goods on the balance sheet.

Why does it matter?

If a business doesn’t value its ending inventory properly, the balance sheet won’t show an accurate picture of its assets. The product costs ensure that the value assigned to these goods accurately reflects the resources invested in creating them. It’s like saying, “Hey, this is how much we’ve spent to make these things, and this is their value sitting in our storage.”

Period costs don’t impact inventory valuation

Let’s shift our attention to period costs in this financial play.

Unlike product costs, period costs don’t linger in the inventory valuation storyline. They make a swift exit from the balance sheet drama. Period costs immediately expense themselves, appearing on the income statement for the specific period they occurred.

So, as they don’t influence inventory valuation, period costs don’t create confusion about the value of unsold goods.

Product costs vs period costs: the role in decision-making

If a company’s management understands both product and period costs, they can use it in improving decision-making. It works in many ways. Product costs help businesses figure out how much it truly costs to make each item they sell, helping set prices for profit. Period costs guide decisions on running the whole business efficiently, like deciding on staffing or advertising, ensuring everything works well financially. It’s like finding the right balance to make good products and keep the entire business in good shape.

Product cost: assessing the true cost of production and setting product prices

We mentioed already that the product cost metric can help a business build their pricing structure. At this point, it’s pretty much critical to know what makes product costs and use this knowledge wisely. Let’s look at it in an example.

Understanding true costs

Imagine you’re running a bakery (we love bakeries, noticed?), and you want to figure out how much it really costs to make each cake. Product costs come to the rescue. They include everything from the flour and eggs to the baker’s wages and the electricity to run the oven. By adding up all these costs, you get a clear picture of the true cost of producing each cake.

What this knowledge can give you?

Setting product prices

Now, imagine you’ve figured out that each cake costs $10 to make. To make a profit and keep your bakery thriving, you’ll likely set a price for your cakes that’s higher than $10. Product costs help you set these prices, ensuring you cover all the expenses and have some left for profit. So, product costs become your pricing compass, guiding you to set prices that keep your bakery in business.

Period cost: understanding business operations and efficiency

Period costs are of no less help, as they allow you to understand how well you’re running your business.

Efficiency of running the business

Period costs are like the backstage crew ensuring the business show runs smoothly. Remenber, they include things like rent, salaries, and advertising costs? These costs don’t attach themselves to a specific cake or product. But they’re ongoing expenses necessary for the daily operation of the entire bakery.

How does knowing period costs help you make right decisions?

Decision-making power of period costs

Let’s say you’re considering hiring more staff to handle the increasing number of orders. The salaries of these new hires would be a period cost. By looking at period costs, you can evaluate the impact of such decisions on the bakery’s overall financial health.

Finding the balance between product and period costs

Balancing product and period costs is important for your business performance efficiency. Product costs help you fine-tune the price of each item you sell, ensuring profitability. Period costs guide decisions about how to efficiently rule your small business realm to stay afloat, impacting staffing, advertising, and day-to-day operations.

Bottom line

Grasping the difference between product and period costs serves as a financial compass for businesses. It’s like having a roadmap that guides accurate financial reporting, ensuring that the numbers on the balance sheet and income statement tell a clear and truthful story about the business’s health. Moreover, this understanding empowers businesses to manage costs effectively, making informed decisions about product pricing, production efficiency, and overall operational strategies. Just as a captain navigates a ship through stormy seas, businesses, armed with the knowledge of product and period costs, can navigate the complex waters of financial management, steering towards success and sustainability.

Want to learn more? Discover the key to effective financial management with our straightforward guide on variance reporting.

Continue reading: What is product cost?

Share your thoughts

What helps you handle business expences? Please share your thoughts in the coments section below!

.png)