In today’s fast-paced world, secure and swift digital payment methods are of paramount importance for both consumers and businesses. As the world moves more and more towards cashless transactions, Malaysia is not left behind, thanks in part to FPX – the Financial Process Exchange. Let’s delve deeper into uncovering this popular online payment method and understanding FPX’s contribution to the digital payment scene. Ready? Read on!

What is FPX?

FPX stands for Financial Process Exchange. It is a Malaysian-based online payment system that allows individuals and businesses to make real-time payments using their bank credentials. Rather than using credit cards or e-wallets, FPX users can pay directly from their bank accounts.

A bit of history

With the burgeoning growth of ecommerce and online businesses in Malaysia, there was a dire need for a payment system that could cater to the evolving demands of both businesses and consumers. FPX has been pivotal in this transformation.

Established under the aegis of Bank Negara Malaysia (BNM), which is the Central Bank of Malaysia, FPX operates as a part of the PayNet Group. This Group is a collaboration between BNM and 11 major Malaysian financial institutions. The system has seen significant traction, boasting nearly 90 million transactions in 2018 alone, reflecting its widespread acceptance and trust among Malaysians.

How does an FPX payment work?

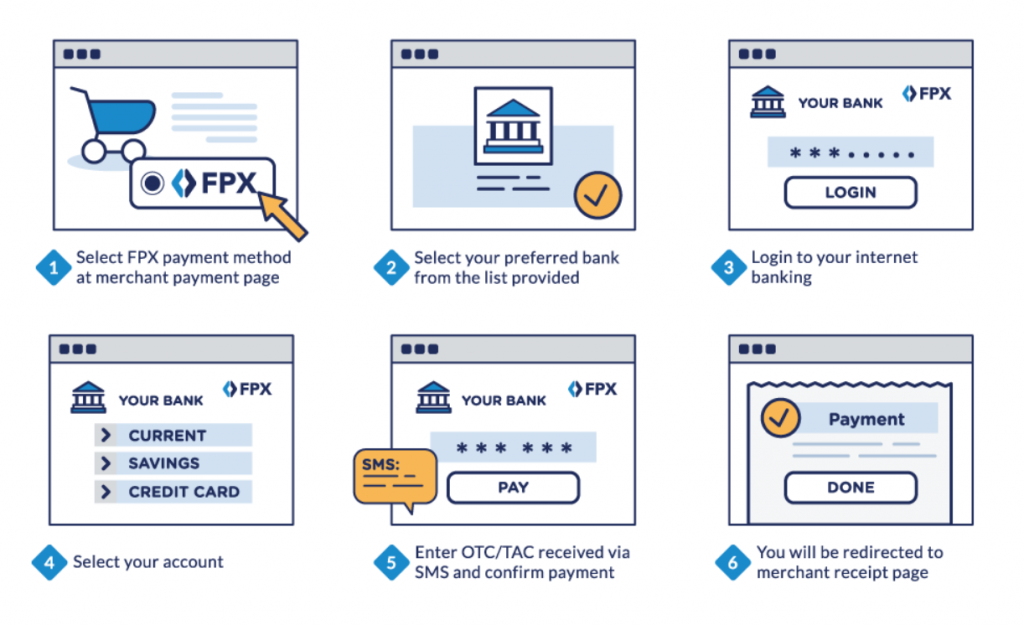

The payment flow with this service is straightforward:

1) At the checkout, a customer selects FPX as their payment method.

2) They choose their bank and are redirected to its online banking portal.

3) After entering their banking credentials, they complete a two-step authorization process.

4) Once authorized, they receive an immediate notification indicating the payment is complete.

5) Optionally, they may be redirected back to the merchant’s website for a payment confirmation.

Here’s how it usually works:

Source: PayNet

For Malaysians, this process is intuitive and familiar, making FPX a preferred choice for many.

Why choose FPX? The advantages

FPX offers numerous benefits:

- Real-time Payments: Transactions are processed immediately and directly debited from the user’s bank account.

- Convenience: Access to multiple banks is available under FPX, without the need for any separate registration.

- Reliability & Security: Payments are made securely through participating bank’s internet banking portals, ensuring financial details remain confidential.

- Cost-Efficient: Most merchants under FPX do not pass on any transaction fees to the user, making it cost-effective.

- Flexibility: Users can make payments from Current, Savings, or even Credit Card accounts.

Trying to find the perfect online payment system for your business? Dive into our article An Essential Guide to Payment Gateways: Choosing the Best Payment Gateway for Your Business.

Transaction limits with FPX

With FPX, transaction limits vary based on the type of user. For individual or retail users, the minimum transaction amount is RM1.00, while the maximum is capped at RM30,000.00 per transaction. On the other hand, corporate users have a minimum transaction limit of RM2.00 and can transact up to RM1,000,000 per transaction. It’s essential to remember that these limits are subject to your personal bank’s internet banking restrictions.

Availability of FPX

Several major banks in Asian-Pacific region support the FPX payment system, ensuring a seamless transaction experience for their customers. Among these are Citibank, HSBC, OCBC, Public Bank, Bank of China, Maybank and Alliance Bank. Their integration with FPX underscores their commitment to providing modern, secure, and efficient digital banking solutions to their clientele. You can find other participating banks here:

Source: PayNet

Safety first with FPX

In the age of digital scams and frauds, the security of online transactions is a major concern for users. FPX addresses these concerns head-on:

- Advanced Authentication: FPX employs top-notch authentication measures, ensuring that all transactions are safe.

- Encryption: Financial data is protected using advanced encryption standards. This ensures that personal banking details are never exposed or shared during transactions.

- Transaction IDs: Every transaction comes with a unique FPX Transaction ID, providing a reference point in case of discrepancies or disputes.

As you can see, FPX is a reliable internet based payment gateway, offering necessary level of security.

How FPX supports businesses

It’s not just individual consumers who benefit from FPX:

- B2C and B2B Models: FPX caters to both individual consumers and corporations, offering vital services. While individual payments fall under the Business to Consumer (B2C) model, corporate payments are categorized under the Business to Business (B2B) model.

- Merchant Assurance: With the instantaneous nature of FPX transactions, merchants can get real-time confirmations, streamlining their operations and reducing the risk of payment disputes.

Want to know more about popular payment methods in ecommerce? Check out our article Payment Methods in Ecommerce: A Full Guide to Various Ecommerce Payment Methods.

Accounting for multiple payment gateways

Do you have multiple payment gateways? Are you tired of juggling multiple sites and manually entering data into your books? There’s a solution that can do it accurately and automatically, while you focus on growing and expanding the business. Enter Synder Sync – an accounting automation software that primarily focuses on simplifying the way businesses and accountants handle, categorize, and manage transactions from different sales and payment platforms.

How can Synder help with managing multiple payment gateways?

- Automated data entry: Manually entering data from various payment gateways can be time-consuming and error-prone. Synder automates this process, ensuring all transactions are recorded in real-time without human intervention.

- Consolidation: If a business uses multiple payment platforms (e.g., Stripe, PayPal, Square), Synder consolidates all of these transactions into one centralized system – your accounting. This ensures that all financial data, regardless of its source, is readily accessible in one place.

- Reconciliation: One of the challenges of using multiple payment gateways is the reconciliation of accounts. Synder automatically matches transactions from your bank statement with sales records, making the reconciliation process more straightforward.

- Accurate record keeping: With Synder, transactions are categorized correctly, ensuring that financial statements and reports are accurate. This is particularly valuable during tax season or any financial auditing.

- Handling fees: Different payment gateways have different fee structures. Synder automatically records and categorizes these fees, so businesses can easily track and account for them.

- Multi-currency support: For businesses that operate internationally and deal with multiple currencies, Synder provides support to automatically convert and record transactions in the business’s primary currency. This feature is beneficial for keeping books consistent and straightforward.

- Integration with accounting software: Synder integrates seamlessly with popular accounting software like QuickBooks and Xero. This ensures that data flow between systems is smooth and that financial records are always up-to-date.

Discover the functionality of Synder by registering for our 15-day free trial. Alternatively, reserve a seat at our Weekly Product Demo to witness its features in action with an expert and have your queries addressed. Streamline your accounting and reclaim your time!

Common questions about FPX – selling & verifying

1. Do you need to register for FPX?

No. If you have an active internet banking account with any participating bank, you’re good to go!

2. What if there’s an error?

If money is deducted but the transaction fails, your bank will typically refund the amount. Always retain the FPX Transaction ID for reference.

3. How do you know if a merchant accepts FPX?

Look for the FPX logo or wordmark on their website or checkout page.

4. I completed an FPX transaction, but the merchant claims they haven’t received my payment. What should I do?

If the FPX transaction status indicates success, the merchant is obligated to either deliver the goods/services or update your payment promptly. In such cases, you should contact the merchant directly regarding the delivery of your purchased items. Ensure you provide essential details like the FPX online receipt, the email notification from FPX, the FPX Transaction ID, Merchant Order Number, payment amount, and the exact date and time of the payment.

5. How can I confirm that my FPX payment was successful?

You can verify the success of your FPX transaction in three ways:

- By checking the online receipt issued by FPX.

- Through an email notification from the FPX system (ensure you’ve provided your email address at the FPX bank selection page).

- By reviewing the online receipt from the merchant you made the payment to.

6. Can I cancel a successful FPX transaction?

No, you cannot cancel a successful FPX transaction through the system. However, you might be able to request the merchant for a cancellation, but it will be subject to the merchant’s individual policy.

7. What if there’s an error?

If money is deducted but the transaction fails, your bank will typically refund the amount. Always retain the FPX Transaction ID for reference.

8. Can I make FPX payments using my credit card?

Yes, you can make FPX payments using your credit card. While many people associate FPX with payments from savings accounts, a lesser-known feature of FPX is its ability to process payments using credit cards. When using certain providers, integrated with FPX, you don’t have to enter your card details like the card number, expiration date, or security code. Instead, you simply log in to your bank portal and select the credit card as your payment method.

Wrapping Up

FPX has undoubtably set a benchmark in the digital payment arena in Malaysia, as it’s a secure and reliable online payment gateway. Its blend of user-friendliness, security, and versatility makes it a favorite among Malaysians. As digital landscapes evolve, platforms like FPX are instrumental in steering the future of seamless, secure, and efficient digital transactions.

Experiencing QuickBooks issues? Discover how to void a check in QuickBooks Online.

.png)