Invoicing is one of the most important aspects of accounting that helps ensure your business is financially stable and you are getting paid for the goods and services you provide. The approach to invoice recording and management can affect a business’s ability to maintain a positive cash flow, so it’s the area that needs special attention.

In this guide, we’ll look at the basics of invoicing and how it works within the accounting system.

What is invoicing in accounting

Invoicing in accounting refers to the process of creating and issuing a document that requests payment for goods or services that have been provided to a customer. An invoice typically includes information about the type and quantity of goods or services provided, the unit price, any applicable taxes or discounts, and the total amount due. Invoicing in accounting is critical for recognizing revenue, which is deeply influenced by the accounting methods a business uses.

Invoicing is an essential part of the accounting process because it allows businesses to track sales, revenue, and cash flow. Invoices also provide a record of the transaction that both the seller and buyer can refer to in case of any disputes or questions.

In accounting, invoices are a source document that records a sale transaction. The invoice proves that the business has provided goods or services to the customer and is entitled to payment. This is where the MS Excel invoice template to create professional-looking and detailed invoices comes in handy.

Issued but unpaid invoices are typically recorded in the accounting system as accounts receivable, which is a fundamental aspect of the accounting basics for small businesses, and represents the amount owed to the business by the customer for goods or services provided. Accounts receivable is listed as a current asset on the balance sheet.

Upon receiving the payment, the accounts receivable is reduced, and the cash account is increased by this payment amount. However, if the invoice remains unpaid, the accounts receivable remains on the balance sheet as an asset until the payment is received.

Businesses should carefully monitor unpaid invoices, as they can impact their cash flow and overall financial health. At this point, an efficient invoicing system helps ensure that a business receives payments on the invoices promptly and that accounts receivable do not become a burden on the business’s finances.

Why is invoicing important for a business?

Invoicing is an essential business process that helps manage finances, communicate with customers, and maintain accurate records. By implementing a proper invoicing system, businesses can improve their cash flow, reduce the risk of disputes, and operate more efficiently. Invoicing is important for a business for many reasons, including:

- Revenue recognition and forecasting. Invoicing plays a critical role in recognizing revenue for businesses, as it represents sales of goods or services, allowing them to recognize revenue and, based on it, make revenue projections for the future.

- Cash flow management. Invoicing impacts a business’s cash flow, as the timing of invoicing and the receipt of payments can affect the amount of cash available at any given time, reflecting the principles of double entry accounting by affecting both the accounts receivable and cash flow statements.

- Financial reporting. Invoicing data is a part of financial reports, such as balance sheets, income statements, and cash flow statements. Accurate invoicing data is critical for decision-making.

- Tax compliance. Invoicing is important for tax compliance purposes, as it helps businesses track their sales and calculate the amount of tax owed to the government. Accurate invoicing data is necessary for filing tax returns and avoiding penalties.

- Legal protection. Invoices can serve as legal protection for businesses in case of disputes or non-payment.

- Professionalism. Invoicing creates a professional image for businesses, demonstrating that they are organized and efficient.

- Customer communication. Invoicing helps businesses communicate with their customers about the transaction, including the amount owed, payment terms, and applicable discounts or taxes.

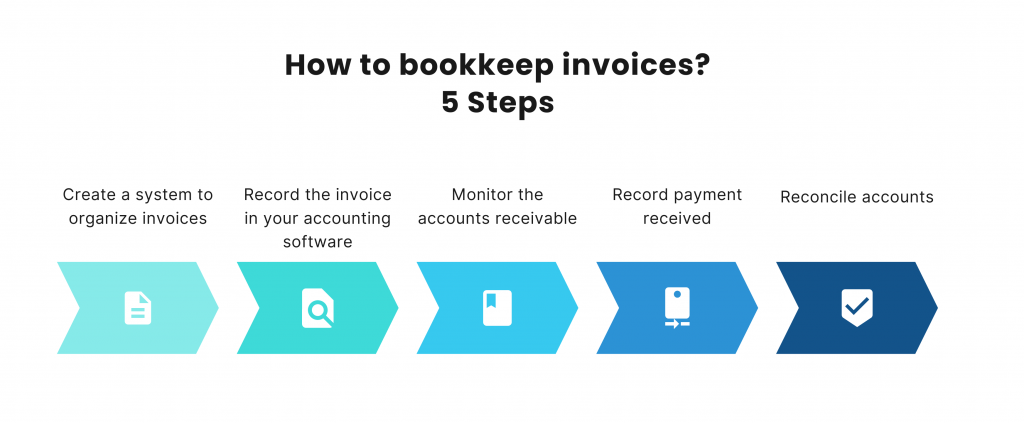

How to bookkeep invoices?

With the above said in mind, a wise approach to invoice bookkeeping can determine the success of business invoicing. So, we’ll look at some steps that might be needed to bookkeep invoices.

Please, bear in mind that it’s a general overview of invoice bookkeeping, and whenever you need it, it’s highly recommended to turn to a bookkeeper or an accounting specialist for professional help.

- Create a system to organize invoices. You can use a filing system or accounting software to organize your invoices. Ensure that each invoice has a unique identification number for easier tracking.

- Record the invoice in your accounting software. In the accounting software, create a record in the accounts receivable account to track the invoice until it is paid. This record will reflect the amount owed to your business by the customer.

- Monitor the accounts receivable. Regularly monitor your accounts receivable to ensure you receive payments on the invoices on time. You can set up reminders to follow up on unpaid invoices.

- Record payment received. Once payment is received, record it in your accounting software under the cash account. You can mark the invoice as paid and reduce the accounts receivable on the amount owed.

- Reconcile accounts. At the end of each accounting period, reconcile the accounts receivable to ensure the records are accurate and up-to-date.

The benefits of invoicing automation

As you can see, invoicing, as a part of business management, can demand a lot of your focus, time, and effort because the cost of errors is high (you literally lose cash), and you’ll need even more time and effort to beat the hassle they create. At this point – unless you issue just a couple of invoices a month – invoicing can be where automation does wonders for your business, ensuring the speed and accuracy of invoice bookkeeping no manual process can ever reach.

Here are some benefits of invoice automation for businesses:

- Time-saving. Invoice automation can save businesses significant time by eliminating manual data entry and reducing the time spent processing invoices, allowing them to focus on other important tasks and improve productivity.

- Reduced errors. Manual data entry can lead to errors in invoicing, resulting in delayed payments, disputes, and other issues. Invoice automation can help reduce errors by automating the data entry process, ensuring accurate and consistent data.

- Faster payment processing. Invoice automation can help speed up payment processing by reducing the time it takes to process and approve invoices, reducing the risk of late payments.

- Improved visibility. Invoice automation can provide businesses with better insights into their invoicing process, including real-time tracking of invoice status, payment history, and outstanding invoices.

- Cost-saving. Invoice automation can help businesses save costs associated with manual invoicing processes, such as paper-based invoicing, manual data entry, and printing and mailing costs.

- Enhanced customer experience. Faster and more accurate invoicing can improve the customer experience by reducing delays and errors and providing a more professional and efficient service.

Invoicing efficiency best practices

While automation can be a great tool in your invoice management kit, you might want to consider applying some best practices to make invoicing more efficient.

Offer early payment discounts. Offering early payment discounts can incentivize customers to pay their invoices earlier, improving cash flow for the business. For example, a business might offer a 2% discount for invoices paid within 10 days of receipt.

Automate payment reminders. Automating payment reminders can help businesses reduce the time and effort of following up on late payments. Automated reminders can be sent to customers via email, text messages, or other communication channels.

Implement invoice factoring. Invoice factoring involves selling outstanding invoices to a third-party company for immediate cash. Implement invoice factoring, as It can help businesses improve their cash flow and reduce the risk of going out of cash due to late payments.

Include detailed descriptions. Including detailed descriptions of the goods or services provided in the invoice can help avoid confusion or disputes with customers.

Offer multiple payment options. Offering multiple payment options, such as credit cards, PayPal, or bank transfers, can make it easier for customers to pay their invoices, improving the likelihood of timely payments.

By implementing these advanced tips, businesses can streamline their invoicing process, improve cash flow, reduce errors and disputes, and enhance the overall customer experience.

What’s invoicing in accounting: bottom line

Invoicing is an essential part of accounting as it affects several key financial areas, such as revenue recognition, accounts receivable, cash flow management, financial reporting, and tax compliance. Accurate and efficient invoicing processes are essential for maintaining reliable financial records and making informed business decisions. Invoice automation and following invoicing best practices can help businesses make the most of cash flow management and keep their accounting records accurate and up-to-date.

%20(1).png)