Small business owners often have to wear many hats, diving into different aspects of their company. It makes sense to delegate certain tasks, accounting and bookkeeping being one of them. However, delegating doesn’t mean staying out of the loop completely, especially when it comes to the lifeblood of the business – finances.

While some people run at the sight of numbers, spreadsheets, and financial jargon, the truth is, as a small business owner, you simply can’t outrun them. Understanding bookkeeping and accounting basics for small businesses is a must. But don’t despair, the basic accounting and bookkeeping are easier than they seem.

In this article, we’ll break down basic accounting concepts (in a simple and easy-to-understand way), the steps you need to take to set up your small business accounting, and the best ways to manage your finances.

Ready to take the hassle out of your business accounting? Synder is here to streamline your financial processes, from effortless online transaction management to insightful financial reporting. Don’t let accounting tasks slow down your business!

TL;DR

What every small business owner should know about bookkeeping and accounting:

- What’s the difference between bookkeeping (tracking daily transactions) and accounting (financial analysis for decision-making).

- How to choose the right bookkeeping/accounting methods and what software to use for automation and efficiency.

- How to review financial statements (balance sheet, income statement, cash flow statement) for business insights and profitability.

- How to stay informed on tax obligations and procedures, and work closely with accounting professionals.

Contents:

1. The basic: Accounting vs bookkeeping

2. What small businesses should know about basic bookkeeping

3. Financial statements or how you summarize account information

4. When and how are transactions recorded?

- When do you record transactions: Accounting methods

- How do you record transactions: Bookkeeping methods

5. Recording a financial transaction in a general ledger

6. Basic steps in accounting for small businesses

7. Do you need an accountant for your small business?

The basic: Accounting vs bookkeeping

We’ll start our journey of small business accounting basics by clearing 2 key terms: accounting and bookkeeping. To do that, we’ll use a simple example of running a lemonade stand. Bookkeeping and accounting are both crucial to understanding how well your stand is doing but they focus on different aspects of its financial story.

What is bookkeeping?

Bookkeeping, in our example, is keeping a detailed diary of everything that happens at your lemonade stand. Every time someone buys a lemonade, you write down how much money you made. And every time you buy more lemons or sugar, you note how much you spent.

Bookkeeping is about recording these daily transactions accurately and systematically. It’s the groundwork for understanding your lemonade stand’s financial activities, ensuring every penny earned and spent is tracked.

What is accounting?

Accounting, on the other hand, is taking that diary at the end of the month and analyzing how your lemonade stand is doing. You look at the entries to figure out if you’re making money or losing it, which items cost you the most, and how you can sell more lemonade or spend less on supplies.

Accounting takes the information from your bookkeeping records and turns it into insights and strategies. It involves preparing financial statements, making budgets, and providing advice to help the lemonade stand grow and become more profitable.

The key takeaway for a small business

Bookkeeping is the day-to-day recording of financial transactions, laying the foundation. Accounting builds on this foundation by analyzing these records, helping you make informed decisions. So, one can’t exist without the other and you need both to run your business.

What small businesses should know about basic bookkeeping

Now, we’ll slowly dip our toes in the bookkeeping jargon. But don’t worry, while the names might seem intimidating at times, most of them are just fancy words for straightforward ideas.

In this section, we’ll take a top-down approach, starting from big structures and getting more granular as we explore these financial terms.

General Ledger (GL)

General ledger is our top-level book. You can have a physical book for it, though usually it’ll be an online book (like accounting software for example). It provides a complete record of financial transactions over the life of the company.

But if we were to input every single transaction as they come in, the general ledger would turn into a mess of data. So, to avoid that, all those transactions are organized in their allotted accounts.

Accounts

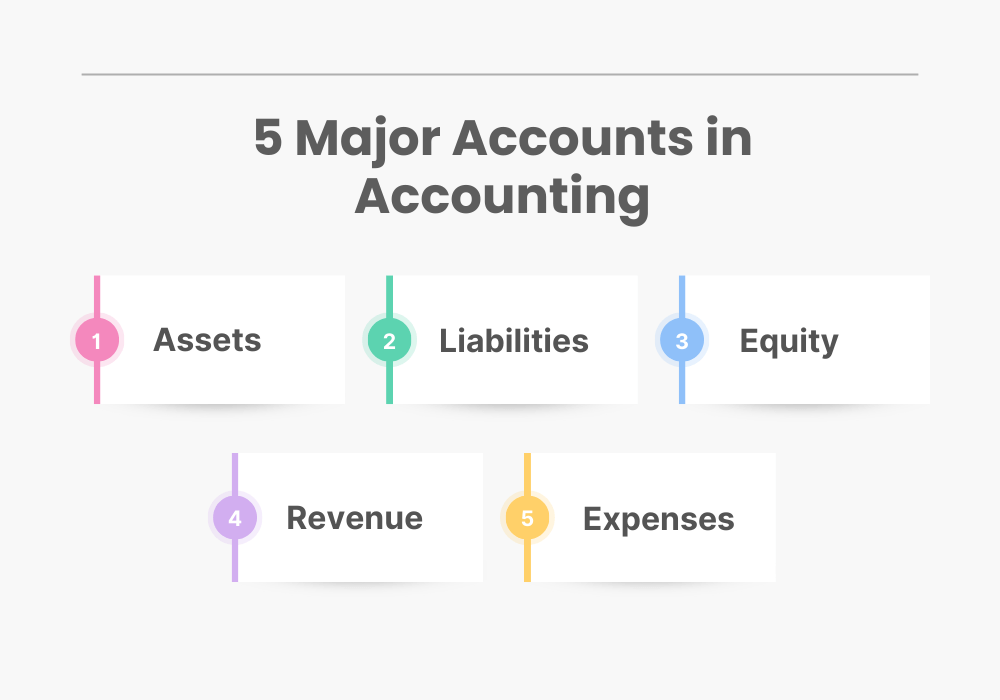

Thankfully, there’s a list of only 5 account types that any transaction can be allocated to. So if you need to record a transaction in your general ledger, it must fit into one of those types:

- Assets: Anything of value your business owns, like cash, inventory, equipment, and real estate. Assets can be used to generate revenue.

- Liabilities: Debts or obligations your business owes, such as loans, accounts payable, and mortgages. Liabilities are what your business needs to pay back.

- Equity: The owner’s stake in the business. It’s what remains after you subtract liabilities from assets and represents the owner’s claim to the business assets.

- Revenue: The total amount of money your business earns from its normal business activities, usually from the sale of goods and services to customers.

- Expenses: The costs incurred by your business to generate revenue. This includes rent, utilities, salaries, and the cost of goods sold.

But even though there are 5 basic account types, they’re then further subdivided into more specific account categories, like accounts payable, for example. This can create a whole list of subaccounts that your business has. And that takes us neatly, to a chart of accounts.

Chart of Accounts (COA)

If you imagine your general ledger being, literally, a book, your various accounts can be seen as chapters, then a chart of accounts would be a table of contents listing all the accounts you have.

COA organizes financial information into a clear, accessible format that mirrors the major financial categories, as outlined in the accounts section: assets, liabilities, equity, revenue, and expenses.

Each of these categories is then broken down into more specific accounts, reflecting the diverse nature of your business transactions. For instance, under assets, you might find subaccounts for cash, inventory, accounts receivable, equipment, and more.

How the chart of accounts is different for every small business

The COA’s strength lies in its ability to be tailored to the needs of the business. While the basic structure remains consistent, the level of detail and the specific accounts included can vary widely.

A small retail business, for example, might have a detailed set of inventory accounts to track different product lines, whereas a service-based business might have a more elaborate set of expense accounts to capture various service delivery costs.

In other words, every chart of accounts is a unique representation of a specific business. It’ll also be evolving as your business grows and changes.

Want to learn from experts? Read a guide on how to set up and use Chart of Accounts in QuickBooks for efficient financial management.

Key takeaways for a small business

This is how the basic bookkeeping for small businesses is done: there’s a general ledger that holds all transactions categorized by the types of accounts they belong to and further divided into subcategories which create a chart of accounts – an account map for a particular small business.

Financial statements or how you summarize account information

All these accounts can (and should) be periodically summarized in the form of financial statements to give you a good understanding of your business health. Here are the 3 key financial statements:

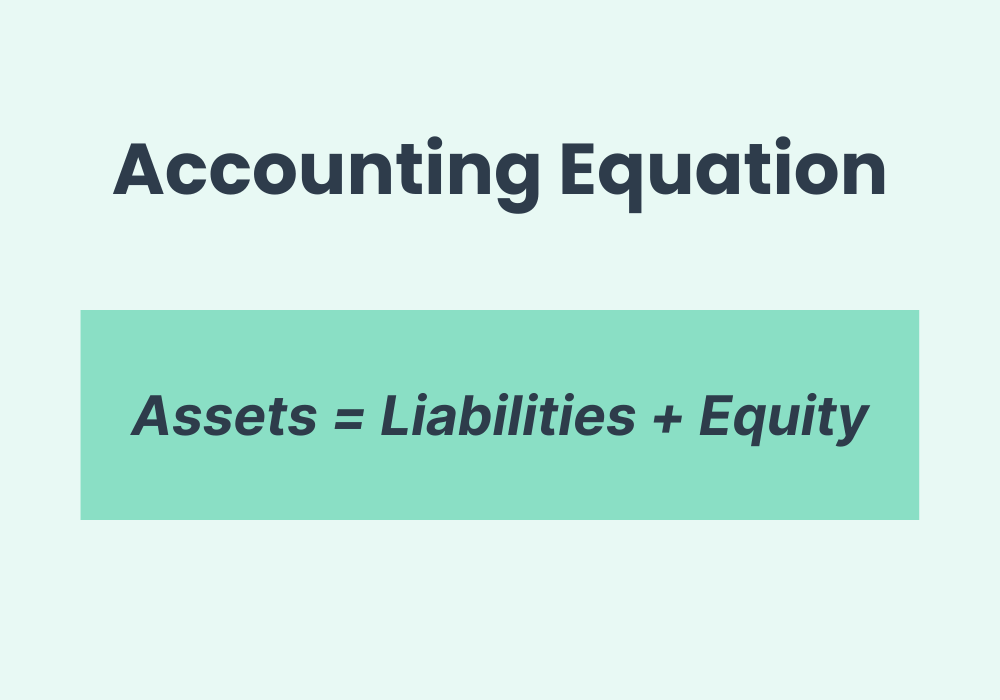

- Balance sheet: Summarizes what the company owns (assets), owes (liabilities), and the ownership stake (equity) at a specific point in time.

The balance sheet is essentially a detailed and structured representation of the accounting equation:

Assets = Liabilities + Equity

- Income statement: Shows the company’s financial performance, including revenues, expenses, and profit or loss over a period.

- Cash flow statement: Details the inflows and outflows of cash from operating, investing, and financing activities over a period.

And this is how accounting is done: you compile and summarize the transaction records to understand how your business is actually doing.

When and how are transactions recorded?

While it might seem obvious that a small business simply records transaction details when the transaction takes place, the bookkeeping and accounting world has a more nuanced take on it. Let’s take a look at accounting and bookkeeping methods.

When do you record transactions: Accounting methods

There are two primary accounting methods: accrual basis and cash basis. These methods determine when transactions are recorded:

- Cash basis accounting: Records income when cash is received and expenses when cash is paid.

For example, if you complete a service in March but don’t get paid until April, you record the revenue in April, i.e. when you receive the money.

This method is simple but may not accurately reflect the business’s financial status at a given time.

- Accrual basis accounting: Records income when earned and expenses when incurred, regardless of when cash is received or paid.

Using the same example, if you complete a service in March but don’t get paid until April, you still record the revenue in March because that’s when the service was completed and the income was technically earned (i.e. you’re owed to be paid).

This method provides a more accurate financial picture but is more complex to manage.

Some small businesses start with cash-based accounting and, as they grow, they move into accrual accounting. However, many small businesses jump straight into accrual accounting simply because it gives them a more accurate view of their finances.

N.B. Country-specific laws and regulations usually determine the conditions under which the business must record transactions using the accrual method of accounting.

How do you record transactions: Bookkeeping methods

Here, we also have two options as there are two primary bookkeeping methods: single-entry and double-entry. These methods determine how transactions are recorded and tracked:

- Single-entry bookkeeping: It’s a simple and intuitive method. Transactions are recorded once, either as an income or an expense, similar to how one would maintain a personal checkbook.

This method typically tracks cash disbursements and receipts, making it straightforward and suitable for small, cash-based businesses or sole proprietorships. However, it may not provide a complete picture of a business’s financial health because it doesn’t track assets, liabilities, or equity in detail.

- Double-entry bookkeeping: It requires that every financial transaction be recorded in at least two accounts: one debit and one credit (we’ll talk about them in more detail in a moment).

This method ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced, offering a more accurate representation of a business’s financial position.

While more complex to manage due to the need for detailed tracking and balancing, double-entry bookkeeping gives comprehensive insights into the financial activities of a business.

Recording a financial transaction in a general ledger

We continue our top-down journey through accounting and bookkeeping basics. Now that we have the large-scale picture, let’s look at a smaller level of transactions and exactly how they’re recorded in your general ledger.

Journal entry

A journal entry is the basic recording unit in double-entry bookkeeping, used to document a financial transaction. Every transaction in a business involves the transfer of value from one account to another, and this transfer is recorded as a journal entry.

Debit and credit

As you can imagine, this transfer of value affects the account it leaves and the account it gets into. That’s what we call debits and credits.

Debit and credit are the two sides of any financial transaction, recorded in journal entries. Their roles in a transaction depend on the types of accounts involved:

- Debit (Dr): This represents an increase in assets or expenses and a decrease in liabilities, equity, or income. In plain terms, adding to what you own or what costs you incur, and decreasing what you owe or what you’ve earned.

- Credit (Cr): This represents an increase in liabilities, equity, or income and a decrease in assets or expenses. In other words, adding to what you owe, what you’ve earned, or your investment in the business, and decreasing what you own or what costs you incur.

Does it make sense? Of course, it doesn’t! Even if you read it a few times, it still seems arbitrary. There’s a logic behind it though, and it has to do with balancing the left and right sides of the accounting equation. However, as a small business owner, what matters is the following:

- Debits and credits don’t automatically mean a decrease or an increase. It all depends on which account it affects.

- Every action has an equal and opposite reaction – it applies to physics as much as to the debits and credits concept.

- Debits and credits are a way that helps you balance your books in the double-entry method. They’re means to an end – accurate accounting.

Small business accounting: Summary

I hope that we’re now armed with a good understanding of bookkeeping and accounting basics that will let any small business step into financial waters. With this knowledge under our belt, we’re ready to see what bookkeeping and accounting look like in practice.

Basic steps in accounting for small businesses

Every small business will usually go through a series of steps that ensure that they set up their bookkeeping and accounting practices the right way. Without further ado, let’s dive straight into it.

1. Open a business bank account

You start by opening your business checking account. Depending on your business structure, a separate business bank account can be either legally required or not obligatory. However, it’s strongly recommended to have a separate business account.

This way, your personal and business records won’t mix up, and it’ll be much easier for you to prepare for the tax season, secure a loan or a credit line, and talk to investors.

To open a business account, you need a business name and a registration with your state or province. However, it’s better to check with the bank to find out what other documents they might require. Also, conditions and fees for managing business accounts can vary from bank to bank, so it’s wise to compare the offerings from several banks to see what will suit your business needs best.

2. Choose your bookkeeping and accounting methods

Choosing bookkeeping and accounting methods (as we very well know now) is a crucial step that will affect all aspects of recording and analyzing your finances.

Deciding to go with single-entry bookkeeping, will make your books much simpler however, it won’t give you a detailed picture of your business. Double-entry, on the other hand, while more complex, is more fine-tuned to show you exactly what happens with your finances.

The same goes for accrual vs. cash-based accounting. The nuanced approach of accrual accounting gives you a better understanding of your business’s financial standing.

While in most cases the choice might be your preference, however, there are situations where you’re legally obliged to switch to a particular method.

3. Pick the right accounting software

If you’re worried about the complexities involved in the above methods, you can be reassured that nowadays, bookkeeping and accounting software let you automate most of the recording.

Whether it’s recording transactions, syncing them with payment processors, analyzing the data, handling payroll, and many, many more – there’s software for all your business needs.

So take a good look at your accounting processes in order to decide what you need to automate. Your technology stack will be a representation of your unique business needs, much like your chart of accounts.

4. Set up your financial recording basics

In this step, we’re talking about the general ledger and your chart of accounts. As we know, each account you create will fall into one of 5 categories of accounts, namely, assets, liabilities, equity, revenue, and expenses.

You can create your chart of accounts in the accounting software you use. While you can do this task yourself, a trusted bookkeeper or an accountant can really add value to this process. Whether 7 or 70 accounts better capture your business’ finances, is a question best answered by an expert who is familiar with your industry and your business.

5. Record transactions in your books

No matter how money moves between you and your clients, each transaction needs to be recorded. And if you’re dealing with online transactions, payment processors, or subscriptions, you need the right software that can fully automate the process, without you manually inputting those transactions.

Software like Synder offers a robust solution for businesses that handle a high volume of online transactions, integrating seamlessly with 25+ ecommerce and payment platforms. The software automates the recording of sales, expenses, and even inventory changes directly from your online transactions, reducing the need for manual data entry and minimizing errors.

Apart from automatically capturing online transactions, accurately categorizing them, and facilitating reconciliation, Synder offers comprehensive reporting on sales, products, and customers, providing a deep analysis of your business for informed strategic decision-making.

Join our free trial to see how Synder can revolutionize your online transaction management. Also, don’t miss out on our Weekly Public Demo to see Synder in action and get your questions answered by our experts.

6. Track your small business profit and expenses

Your accounts exist not only for record-keeping but also for assessing and informing your business decisions. One of the key elements in any business is profitability.

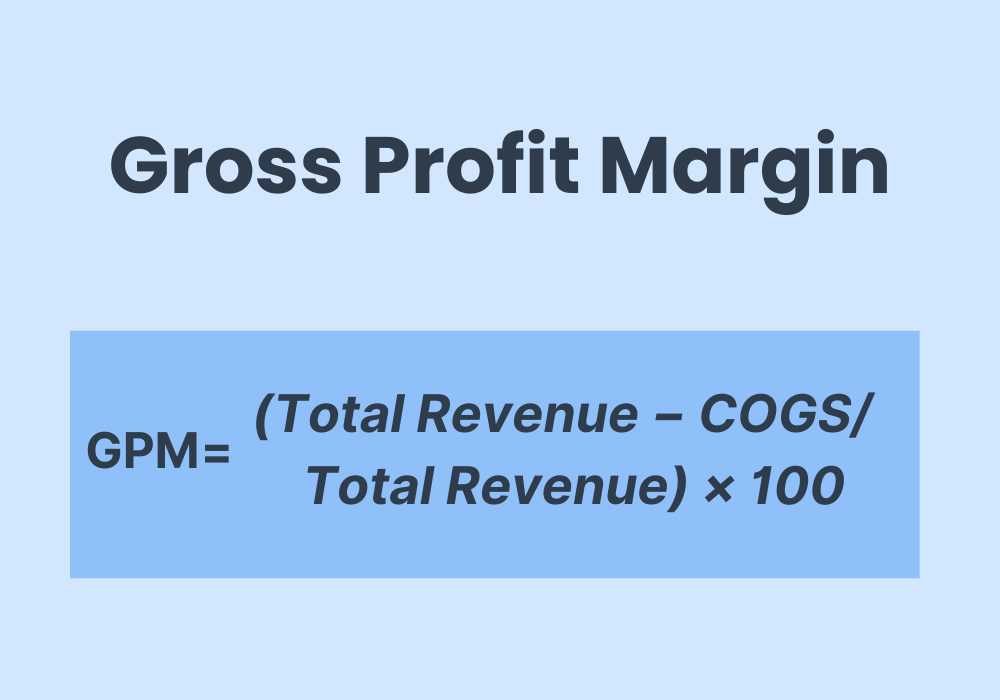

Small businesses use the gross profit margin to measure their profitability. Gross profit margin, in simple terms, is a measure that shows what percentage of your sales is profit after subtracting the costs of producing your products or services (COGS). It’s like looking at how much of the money you make from selling something actually stays with you as profit after paying for what it costs to make or buy that item.

Here’s the formula:

Gross Profit Margin = ( Total Revenue − COGS / Total Revenue ) × 100

Profitability and gross profit margins in practice

Here’s a simple way to think about it: If you sell a product for $100, and it costs you $60 to make or buy it, your gross profit is $40. The gross profit margin would then be the gross profit ($40) divided by the sales price ($100), which gives you 0.4. To express this as a percentage, you multiply by 100, so the gross profit margin is 40%. This means for every dollar you earn from selling that product, you keep 40 cents as profit before considering other expenses like rent, utilities, and salaries.

After determining the target goal of the gross profit margin, you can see how much markup should be applied to get the revenue you want. Jeff Wiener, an entrepreneur, shared his 19 easy ways to increase profit margins for your small business, where you can find some interesting ideas on how to make your business more profitable.

7. Get to know small business tax obligations and procedures

For a business owner, it’s crucial to understand your business tax obligations. Here, a lot depends on your industry, business structure, and activities, but, in general, business taxes fall into three types: federal, state, and local.

It’s true that the tax system is complex and accountants’ help in this matter can’t be overstated but it’s an investment that pays off. Let’s go through the basic federal taxes for small businesses:

- Income tax. This tax is levied on the net income (profits) of the business. For sole proprietorships, partnerships, and S corporations, the income is passed through to the owners’ personal tax returns. C corporations are taxed separately on their income.

- Self-employment tax. Comprising Social Security and Medicare taxes, this 15.3% tax applies to the earnings of individuals who work for themselves. It’s similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

- Employment tax. If you have employees, you’re responsible for withholding Social Security and Medicare taxes, federal income tax withholdings, and paying your share of Social Security and Medicare taxes. Additionally, you’re required to file and pay the Federal Unemployment Tax Act (FUTA) taxes, which provide funds for paying unemployment compensation to laid-off workers.

- Excise tax. Levied on specific goods, services, and activities. The applicability of excise taxes can depend on the business’s specific activities and products.

- Estimated tax. For income not subject to withholding (like earnings from self-employment, interest, dividends, rent, or gains from the sale of assets), you may need to make estimated tax payments quarterly. This is common for business owners who don’t have taxes withheld from their income.

8. Balance and close your books: Accounts reconciliation

Balancing the books refers to the process of ensuring that all financial transactions are accurately recorded and that total debits equal total credits in the double-entry bookkeeping system.

This process involves reviewing and reconciling all accounts to verify accuracy, making any necessary adjusting entries, and preparing an adjusted trial balance. The goal is to confirm that the sum of all debit balances equals the sum of all credit balances, which confirms the accounting equation, we learned about in the beginning:

Assets = Liabilities + Equity.

Balancing and closing books mark the end of the accounting period and the beginning of a new one and involve several steps.

Preparing an unadjusted trial balance

This step involves listing all the accounts in the general ledger along with their balances (whether debit or credit). The total debits should equal the total credits. If they don’t, it indicates errors that must be identified and corrected. Software like Synder will pre-match all the balances for you.

Adjusting entries

Adjusting entries is necessary to account for income and expenses that haven’t been recorded yet but belong to the current accounting period. This can include accrued revenues (income earned but not yet received), accrued expenses (costs incurred but not yet paid), deferred revenue (money received but not yet earned), and pre-paid expenses (payments made in advance for goods or services to be received in future periods).

Running an adjusted trial balance

After correcting the errors and putting in adjusting entries, you can run a final adjusted trial balance. This adjusted trial balance serves as the basis for preparing the financial statements.

Closing the books

The process of closing the books involves transferring the balances of temporary accounts (like revenues, expenses, and dividends or withdrawals) to permanent accounts (like retained earnings). This is done to zero out the balances in temporary accounts so you can start fresh in the new accounting period.

9. Prepare financial statements

After you’re done with balancing your books, you can proceed with generating financial statements to look at the performance of your business during a given period. Usually, with a click of a button, the software will generate these basic financial statements.

Balance sheet

A balance sheet is a financial statement that provides a snapshot of a small business’s financial position at a specific point in time. It lists the company’s assets (what it owns), liabilities (what it owes), and equity (the owner’s share), enabling an assessment of the company’s net worth and financial health.

Profit and loss (income) statement

A profit and loss (P&L) statement, or income statement, details a company’s revenues and expenses over a particular period, such as a quarter or a year. It shows how the revenues are converted into net income or net loss, providing insight into the company’s operational efficiency and profitability.

Cash flow statement

A cash flow statement summarizes the cash inflows and outflows from a company’s operational activities, financing activities, and investment activities over a specific period. It tracks the actual cash generated and used by the company, offering insight into its liquidity and ability to finance operations, pay debts, and make investments without external financing.

Do you need an accountant for your small business?

If you’re still wondering if you need to hire an accountant. Let’s consider a few things. When you’re just starting out, it might seem easier and more affordable to handle your money matters by yourself, especially with all the accounting software available that makes bookkeeping less of a headache.

However, as your business starts to grow, things get a bit more complicated. This is where an accountant and a bookkeeper can really make a difference.

Accountants as business advisors

Accountants can be secret weapons for your business as they can offer you insightful advice on how to make your business stronger and more profitable. Accountants can also give you a heads-up on financial risks and opportunities you might not see on your own.

So, while you might not need an accountant right away when you’re starting, as your business gets bigger and more complex, having an accountant can save you a lot of time and stress, and even money in the long run.

Accounting basics for small businesses: Closing thoughts

Accounting basics are essential tools for small business owners. And it’s more than record-keeping and tax compliance. Grasping key financial concepts equips you to make smarter decisions, from pricing your products to investing in growth.

So keep this mantra in mind: knowledge is power. By mastering the basics of accounting, you’re not just managing numbers; you’re crafting a strategy for success.

Here’s to making every number count and transforming financial foresight into business growth!

Disclaimer:

This article is for informational purposes only and is not intended as professional financial or accounting advice. Readers should consult a qualified expert for specific guidance.

Share your experience

Got accounting tips or stories from your small business journey? Share your insights with our community and inspire fellow entrepreneurs!

.png)

Great post thanks for the great information and well delivered. This is exactly what I was looking for.

Recently, my sister’s husband said he’s interested in opening a small business next March. I liked what you said about tracking a business’s profits and expenses to measure our products’ success. I’ll happily share this with my sister so her husband knows how to improve his business finances in the future.

We are very glad you found this information helpful. Best of luck!

I found it interesting when you said that business transaction tracking could help with proper management. A couple of nights ago, my brother informed me he and his business associate were looking for a trustworthy tax service to assist with his tax planning for their future business plans. He asked if I had ideas on the best option for their clothing project development. I appreciate this instructive accounting guide article for the best planning approach. I’ll tell him it will be much better if he consults a trusted accounting service as they can provide more details about their services.

Hi Steve, I’m glad you found the information about business transaction tracking helpful! It’s definitely a crucial aspect of effective management, especially when it comes to tax planning for a business. Professional tax services can offer tailored advice, ensure compliance, and often find ways to optimize tax strategies that align with business goals. They have the expertise to handle complex financial details, which can be incredibly beneficial for a growing business. Best of luck to your brother and his business associate with their clothing project!

Excellent article! Was good to learn these accounting basics.

Thank you so much, David!