Accounting stands as the backbone of every business and financial activity, serving as the language of commerce that enables organizations to convey their financial health, performance, and prospects. From small startups to multinational corporations, accurate accounting is indispensable for informed decision-making, attracting investors, securing loans, and adhering to legal and regulatory standards. In essence, accounting provides the essential data necessary for steering the ship of business through both calm waters and turbulent storms.

The article explores the world of double entry accounting, its foundational principles and significance in both business and personal finance, demonstrating dual effects of financial transactions, the role of debits and credits, as well as the advantages and criticisms of double entry accounting.

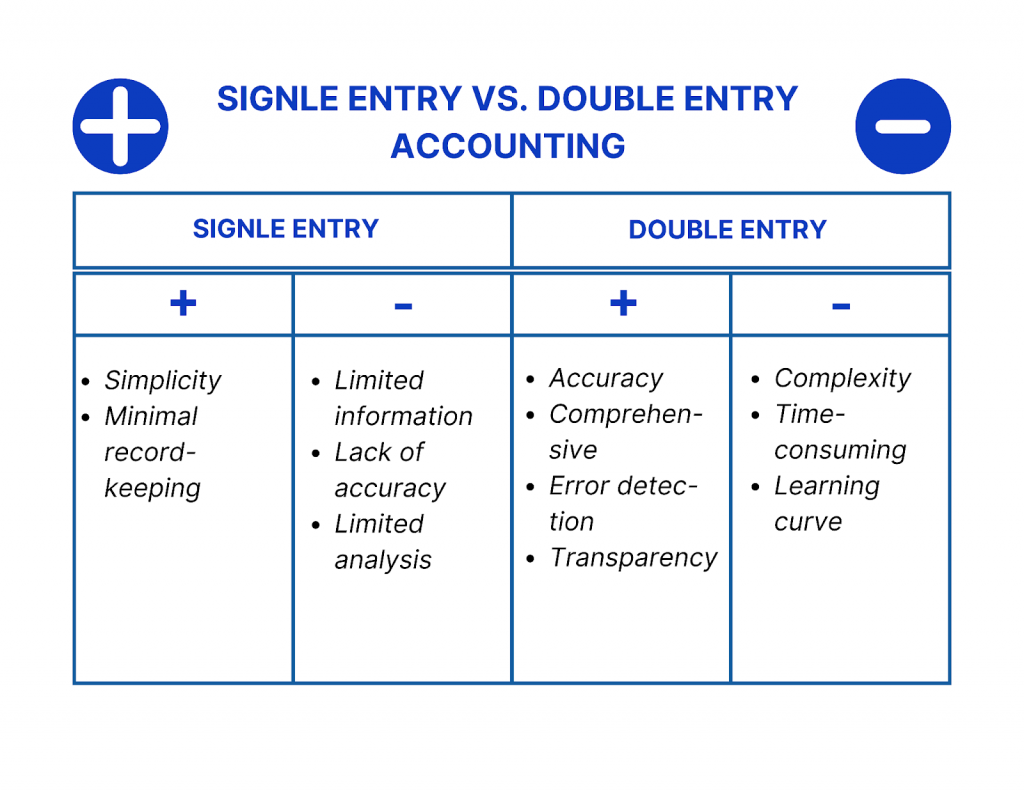

Single entry vs. double entry

Single entry accounting and double entry accounting are two distinct methods of recording financial transactions, each with its own characteristics, advantages, and limitations.

Single entry accounting

Single entry accounting is a basic and less structured method of recording financial transactions. In this system, only one entry is made for each transaction, typically in a simple journal or record-keeping book. This method is commonly used by small businesses or individuals with relatively straightforward financial activities. Here are some key features:

Advantages:

- Simplicity: Single entry accounting is easier to understand and implement, making it suitable for small businesses with minimal financial complexity.

- Minimal record-keeping: Since only one entry is made for each transaction, the record-keeping process is less time-consuming.

Limitations:

- Limited information: Single entry accounting provides only partial information about a company’s financial position, making it difficult to generate comprehensive financial statements.

- Lack of accuracy: The absence of a systematic cross-checking mechanism can lead to errors, omissions, and inaccurate financial records.

- Limited analysis: Single entry accounting lacks the depth required for detailed financial analysis and reporting.

Double entry accounting

Double entry accounting is a structured and comprehensive method of recording financial transactions. It involves making two entries for each transaction, balancing debits and credits. This system is widely used by businesses and organizations of varying sizes due to its accuracy and ability to generate meaningful financial reports. Here are some key features:

Advantages:

- Accuracy: The dual-entry system inherently verifies the accuracy of transactions by ensuring debits equal credits.

- Comprehensive: Double entry accounting provides a complete picture of financial activities, enabling the preparation of accurate financial statements.

- Error detection: The balance between debits and credits serves as a built-in mechanism to identify errors and discrepancies.

- Transparency: Double entry accounting enhances transparency by showcasing the flow of resources in and out of the business.

Limitations:

- Complexity: Double entry accounting requires a solid understanding of its principles and can be more intricate to implement than single entry methods.

- Time-consuming: The need to record two entries for each transaction makes the process more time-consuming than single entry methods.

- Learning curve: Learning the principles of double entry accounting can be challenging for individuals without a financial background.

In short, while single entry accounting offers simplicity, double entry accounting provides accuracy, transparency, and comprehensive financial insights. The choice between the two methods depends on the complexity of financial activities, reporting requirements, and the organization’s goals for financial management.

Whichever model you opt for, make sure you streamline your workflow and maximize efficiency of your accounting processes. Synder Sync is the right solution for you to automate syncing sales data from the ecommerce platforms and payment processors you’re using to the books, eliminating manual data entry and significantly reducing the risk of errors.

Start enjoying our accounting routine by signing up for a 15-day free trial or spare a spot at our weekly public demo for Synder specialists to walk you through the workflow.

The concept of double entry accounting

At the heart of accounting lies the concept of double entry accounting, or, as some call it – double entry bookkeeping, a system that has revolutionized the way financial transactions are recorded, analyzed, and reported. Developed during the Renaissance period and refined over centuries, double entry accounting transforms transactions into systematic records by capturing not just their value, but also their economic impact. Unlike single entry systems, which merely record changes in a single account, double entry is bookkeeping where every financial transaction is recorded in at least two accounts recognizing every transaction from two sides: a giver and a receiver. This duality forms the cornerstone of financial transparency and accuracy.

Definition and historical development of double entry accounting

Originating during the Renaissance period in Italy, this method had a transformative shift from rudimentary single entry systems to a more systematic approach, paving the way for transparent and accountable financial management.

Core principle: Every transaction has dual effects

At the heart of double entry accounting lies the pivotal concept that every financial transaction has two distinct and inseparable effects. For every action, there is a reaction, and this duality ensures that the equation of assets equals liabilities plus equity remains consistently balanced. Whether a business receives payment for goods sold, incurs an expense, or acquires an asset, both the giving and receiving sides of the transaction are meticulously recorded, capturing the financial ecosystem’s intricate interplay.

Explanation of debits and credits as fundamental components

Debits and credits are fundamental concepts in accounting and finance used to record and track the financial transactions of a business or individual. They are part of the double-entry bookkeeping system, which ensures that every transaction has equal and opposite effects on different accounts. This system forms the basis for accurate financial recording and reporting.

Here’s an explanation of debits and credits and how they work:

Double entry bookkeeping system: This system is based on the principle that every financial transaction has at least two effects – one that increases an account and another that decreases another account. These effects are recorded using debits and credits to maintain the balance of the accounting equation: Assets = Liabilities + Equity.

Debits: A debit is an entry made on the left side of an account. It represents an increase in assets and expenses and a decrease in liabilities and equity. In simpler terms, debits are used to record inflows or additions to an account. For example, when a company receives cash, the cash account is debited to reflect the increase in cash.

Credits: A credit is an entry made on the right side of an account. It represents an increase in liabilities and equity and a decrease in assets and expenses. In other words, credits are used to record outflows or reductions from an account. For instance, when a company borrows money, the liability account is credited to show the increase in liabilities.

To illustrate how debits and credits work, consider a few common transactions:

- Cash sale: If a business makes a cash sale of $500, the cash account will be debited by $500 (increase in assets), and the revenue account will be credited by $500 (increase in revenue).

- Purchase on credit: If a business purchases supplies on credit for $200, the supplies account will be debited by $200 (increase in assets), and the accounts payable account will be credited by $200 (increase in liabilities).

- Loan repayment: If a business repays a loan with a payment of $1,000, the liability account (loan payable) will be debited by $1,000 (decrease in liabilities), and the cash account will be credited by $1,000 (decrease in assets).

- Expense payment: If a business pays $50 for office supplies, the expense account will be debited by $50 (increase in expenses), and the cash account will be credited by $50 (decrease in assets).

In each transaction, the total debits must equal the total credits to maintain the accounting equation’s balance. This concept is essential for ensuring accurate financial records, identifying errors, and generating accurate financial statements like the balance sheet, income statement, and cash flow statement.

Remember that debits and credits can have different effects depending on the type of account (asset, liability, equity, revenue, expense), so understanding the classification of accounts is crucial for accurate financial recording.

Role of accounts and ledgers in organizing financial data

Accounts and ledgers provide the organizational framework for the multitude of financial transactions a business engages in, much like the process of invoicing, which is crucial for understanding what is invoicing in accounting. An account represents a specific financial element, such as cash, inventory, or accounts payable. Ledgers group related accounts together, creating a systematic structure that enables businesses to track and manage their financial activities. This hierarchical arrangement not only simplifies data retrieval but also facilitates the preparation of financial statements and the identification of errors or discrepancies.

In mastering these fundamental elements of double entry accounting, businesses and individuals gain a profound understanding of their financial health and enable accurate reporting that is essential for prudent decision-making, regulatory compliance, and sustainable growth.

Purpose and benefits of double entry accounting

The central purpose of double entry accounting is to provide a complete, accurate, and organized view of an entity’s financial activities. By meticulously recording each transaction’s debit and credit aspects, this method ensures that the equation “Assets = Liabilities + Equity” remains consistently balanced. Beyond balance, double entry accounting offers an array of benefits that elevate financial record-keeping to a strategic asset. The inherent checks and balances built into the system enhance error detection, minimizing the risk of accidental or intentional misreporting. This transparency not only instills trust among stakeholders but also empowers businesses to make well-informed decisions based on a holistic understanding of their financial position. Moreover, the comprehensive financial reports derived from double entry accounting facilitate regulatory compliance, strategic planning, and effective communication with investors, creditors, and other stakeholders. In essence, double entry accounting transforms the complex tapestry of financial transactions into a clear and comprehensible narrative, providing a reliable foundation for the intricate world of business and finance.

Principles of double entry accounting

A. The accounting equation: Assets = Liabilities + Equity

At the core of double entry accounting lies the foundational principle encapsulated by the accounting equation: Assets = Liabilities + Equity. This equation succinctly represents the fundamental balance between what a company owns (assets), what it owes (liabilities), and the residual interest of the owners (equity). The accounting equation provides the compass by which financial transactions are recorded, ensuring that any change on one side is matched by a corresponding change on the other.

B. Impact of transactions on the accounting equation

Every transaction triggers a symphony of effects on the accounting equation. When a company sells a product, for instance, it simultaneously increases both assets (cash or accounts receivable) and equity (revenue). Likewise, when it purchases inventory, both assets (inventory) and liabilities (accounts payable) are affected. This delicate interplay ensures that the equation’s equilibrium remains unbroken, reflecting the essence of double entry accounting’s accuracy and reliability.

C. Categories of accounts: Assets, liabilities, equity, income, expenses

Double entry accounting categorizes transactions into five key account types, each representing a distinct aspect of an organization’s financial landscape:

- Assets: Tangible and intangible resources owned by the company.

- Liabilities: Obligations owed to external parties, such as loans and accounts payable.

- Equity: Owner’s residual interest in the company after deducting liabilities from assets.

- Income: Revenue generated from business operations.

- Expenses: Costs incurred to facilitate business operations. These categories provide a structured framework for classifying transactions and maintaining a clear overview of the company’s financial activities.

Learn how to effectively categorize expenses and income.

D. Applying debit and credit to different types of accounts

The symmetrical nature of double entry accounting requires consistent application of debits and credits across different account types. Debits increase asset accounts and decrease liability and equity accounts. Credits, on the other hand, increase liability and equity accounts and decrease asset accounts. Understanding how debits and credits impact various accounts is essential for accurate recording. For instance, a debit to a cash account signifies an increase in available funds, while a credit to an accounts payable account represents an increase in obligations to creditors.

By grasping these principles, individuals can navigate the intricate tapestry of financial transactions, ensuring accuracy, transparency, and the ability to derive valuable insights from their financial records.

Recording transactions

A. Step-by-step process of recording transactions

The process of recording transactions in double entry accounting follows a systematic sequence that ensures comprehensive and accurate financial records:

1. Identify the transaction: Recognize the event that triggers a financial impact.

2. Analyze the impact: Determine how the transaction affects different accounts.

3. Determine debits and credits: Apply the appropriate debits and credits to maintain the accounting equation.

4. Record in the journal: Chronicle the transaction in chronological order in the journal, detailing accounts involved, amounts, and debits/credits.

5. Post to the ledger: Transfer journal entries to respective accounts in the ledger.

6. Prepare trial balance: Summarize ledger balances to ensure debits equal credits.

7. Create financial statements: Generate reports like the balance sheet and income statement from the trial balance.

Importance of accuracy and consistency in recording

The accuracy and consistency of recording transactions form the bedrock of reliable financial data. Errors or inconsistencies can ripple through subsequent calculations, leading to skewed financial statements and misguided decisions. Misreporting financial data can also lead to legal and regulatory issues. Maintaining precise records ensures that a company’s financial health is accurately portrayed, strengthening trust with stakeholders, investors, and regulatory bodies. Additionally, consistent recording facilitates easy audits, enables trend analysis, and supports proactive financial management. As the lifeblood of informed decision-making, accurately recorded transactions are a critical component in the foundation of successful business operations.

T-Accounts: Visualizing transactions

Explanation of T-Accounts as a visual aid for recording transactions

T-Accounts, named for their shape resembling the letter “T,” are a powerful visual tool used in double entry accounting to depict the flow of transactions. Each T-Account represents a specific account, with the left side (debit side) showing increases, and the right side (credit side) showing decreases. T-Accounts provide an intuitive way to grasp the impact of transactions on individual accounts and understand the corresponding debits and credits.

How T-Accounts help in identifying imbalances and errors

T-Accounts play a vital role in error detection and maintaining the equilibrium in double entry accounting. If a transaction is recorded inaccurately, it disrupts the balance between the debit and credit sides of a T-Account. By comparing the two sides of the T-Account for any account, discrepancies become immediately apparent. This visual tool simplifies the process of identifying errors, such as missing entries or incorrect debits/credits. The ability to quickly pinpoint imbalances aids in maintaining the integrity of financial records and ensures accurate financial reporting.

All in all, T-Accounts provide a bridge between the abstract concept of double entry accounting and its practical application. They empower individuals to visualize the financial impact of transactions, contributing to a deeper understanding of how different accounts interact and reinforcing the importance of maintaining accurate and balanced records.

Balancing and the trial balance

Purpose of balancing accounts

Balancing accounts is a critical step in double entry accounting that ensures the accuracy and integrity of financial records. Balancing involves comparing the total debits and total credits in an account to determine if they are equal. When debits and credits balance, it signifies that transactions have been accurately recorded and the accounting equation remains in equilibrium. Balancing also aids in detecting errors and preventing inconsistencies that could distort financial reporting.

Role of the trial balance in verifying the accuracy of recorded transactions

The trial balance serves as a snapshot of a company’s financial position at a specific point in time. It compiles all the balances from the various accounts and lists them in a systematic manner. The primary purpose of the trial balance is to verify the accuracy of recorded transactions by confirming that total debits equal total credits. If the trial balance balances, it indicates that the accounting records are mathematically accurate, increasing confidence in the financial data.

Identifying errors through trial balance discrepancies

Discrepancies in the trial balance, where total debits do not equal total credits, highlight potential errors in the accounting records. Such discrepancies can arise due to various reasons, including:

- Incorrect posting of transactions to ledger accounts

- Omission of transactions

- Mistakes in the recording of debits and credits

- Transposition errors (digits swapped)

- Errors in account classification

When discrepancies occur, accountants must meticulously review each entry to pinpoint and rectify errors. This process not only enhances the accuracy of financial statements but also fosters a culture of precision in financial record-keeping.

In summary, balancing accounts and utilizing the trial balance are integral steps in the double entry accounting process. They provide mechanisms for error detection, ensure accuracy, and contribute to the overall reliability of financial information used for decision-making and reporting.

Financial statements and double entry accounting

Preparation of financial statements from the trial balance

The trial balance, a concise summary of all account balances, serves as the foundation for crafting comprehensive financial statements. Financial statements provide a holistic view of a company’s financial performance, position, and cash flows. From the trial balance, three primary financial statements are derived:

- Income (P&L) statement: Displays the company’s revenues, expenses, and net income over a specific period.

- Balance sheet: Presents the company’s assets, liabilities, and equity as of a particular date, reflecting its financial position.

- Cash flow statement: Chronicles the company’s cash inflows and outflows, offering insights into liquidity and operational efficiency.

Link between double entry accounting and accurate financial reporting

Double entry accounting is the bedrock on which accurate financial reporting stands. It ensures that every transaction’s impact is recorded in a balanced manner, maintaining the equilibrium of the accounting equation. This systematic approach minimizes the likelihood of errors and omissions while enhancing transparency and reliability. Accurate financial reporting is vital for stakeholders, including investors, creditors, and regulators, as it enables them to make informed decisions based on trustworthy data.

Balance sheet and income statement as reflections of double entry system

The balance sheet and income statement, two cornerstone financial statements, directly mirror the principles of double entry accounting.

Balance sheet

As a mirror of an organization’s financial position at a given moment, the balance sheet demonstrates the equation “Assets = Liabilities + Equity.” Assets (on the left side) are financed through a combination of liabilities and equity (on the right side), showcasing the dual effect of transactions.

Income statement

The income statement portrays the impact of various transactions on the company’s revenue and expenses. Revenues (credits) increase equity, while expenses (debits) decrease equity. The net result is the company’s net income or net loss, a testament to the double entry accounting’s impact on financial performance.

On the whole, financial statements transform the intricate web of debits and credits into insightful narratives that guide strategic decisions, investment choices, and a comprehensive understanding of a company’s financial well-being. Double entry accounting is the driving force behind these statements, ensuring their accuracy, transparency, and credibility.

Double entry accounting in modern software

Evolution of accounting software and its impact on double entry Accounting

The landscape of accounting has undergone a transformation with the advent of sophisticated accounting software. These digital tools have revolutionized the way businesses manage their financial records, bringing automation and efficiency to the core principles of double entry accounting. From simple spreadsheet-based applications to advanced cloud-based platforms, accounting software has evolved to cater to diverse needs and complexities.

How accounting software automates and streamlines the double entry process

Accounting software serves as a powerful ally in the world of double entry accounting by automating tasks that were once manual and time-consuming. These tools:

- Automatically generate double entry journal entries based on input data.

- Update ledger accounts in real time, reducing the chance of errors.

- Generate trial balances and financial statements with a click.

- Offer interactive dashboards for visualizing financial data and trends.

- Facilitate seamless collaboration among accounting teams, auditors, and stakeholders.

Advantages and considerations of using software for double entry

Advantages:

- Accuracy: Automation reduces human errors in data entry and calculations.

- Efficiency: Streamlining processes saves time and allows for quicker decision-making.

- Accessibility: Cloud-based solutions enable remote access to financial data.

- Reporting: Software generates accurate financial statements with ease.

- Scalability: Growing businesses can handle increased transactions without difficulty.

Considerations:

- Cost: Software solutions might come with subscription fees and implementation costs.

- Training: Users need to be trained to maximize the software’s potential.

- Data Security: Protecting sensitive financial data is crucial.

- Integration: Compatibility with other software systems is essential for data flow.

- Customization: Some software might need to be tailored to match specific business needs.

In the digital age, accounting software has become an indispensable tool that enhances the efficacy of double entry accounting. While its benefits are undeniable, choosing the right software solution requires careful evaluation of the business’s size, complexity, budget, and growth trajectory. When harnessed effectively, accounting software becomes an enabler of accurate financial reporting and strategic decision-making.

Case studies: Learning from historical accounting errors

Enron scandal: Use of complex accounting techniques to hide debt resulting in bankruptcy, job losses, and loss of investor trust

The Enron scandal was a high-profile corporate fraud and accounting scandal that shook the business world in the early 2000s. Enron Corporation, once considered one of the most innovative companies in the United States, used complex accounting practices to manipulate financial statements and hide massive debts, thereby inflating its reported profits.

The scandal came to light in 2001 when Enron filed for bankruptcy, revealing that the company’s financial health was far worse than it had been portraying. The fallout from the scandal was severe, resulting in the dissolution of the company, massive financial losses for investors, and the loss of thousands of jobs. The scandal also led to a loss of trust in corporate governance, auditors, and financial reporting practices.

The Enron scandal exposed flaws in accounting regulations and oversight, leading to reforms like the Sarbanes-Oxley Act, which aimed to enhance transparency, corporate governance, and accountability. The scandal serves as a stark reminder of the importance of ethical behavior, accurate financial reporting, and the need for effective regulation to prevent similar incidents in the future.

WorldCom collapse: Inflated earnings through improper accounting leading to WorldCom’s downfall, financial losses and shattered investor confidence

The WorldCom collapse was a significant corporate scandal that unfolded in the early 2000s, involving one of the largest telecommunications companies in the United States. The scandal revolved around fraudulent accounting practices that artificially inflated the company’s financial performance and misled investors and regulators.

WorldCom, under the leadership of CEO Bernard Ebbers, engaged in accounting manipulations that shifted operating expenses from the company’s income statement to its balance sheet, making it appear more profitable than it actually was. This was achieved by classifying routine costs as capital expenditures, which allowed the expenses to be spread out over several years rather than being recognized immediately. This deceptive practice led to an overstatement of assets and profits.

The fraud was exposed in 2002 when an internal auditor at WorldCom discovered irregularities in the company’s financial statements. The subsequent investigation revealed that the company had inflated its profits by nearly $4 billion.

The fallout from the scandal was severe. WorldCom filed for bankruptcy in 2002, which at the time was the largest bankruptcy in U.S. history. Shareholders suffered massive losses, and thousands of employees lost their jobs. The scandal further eroded trust in corporate governance, auditing practices, and the accuracy of financial reporting.

The WorldCom collapse led to increased scrutiny of accounting practices, the strengthening of regulatory oversight, and the implementation of reforms to prevent such fraud in the future. It serves as a cautionary tale about the consequences of corporate greed, inadequate oversight, and the critical importance of maintaining ethical and transparent financial practices.

Lehman Brothers bankruptcy: Accounting maneuvers masking Lehman’s financial woes, contributing to financial crisis and economic turmoil

The Lehman Brothers bankruptcy was a watershed moment in the 2008 global financial crisis, marking one of the largest and most significant corporate collapses in history. Lehman Brothers, a prominent investment bank, faced insurmountable financial challenges primarily due to its extensive exposure to risky mortgage-backed securities.

The bankruptcy had far-reaching consequences that reverberated throughout the financial system and the global economy. Key factors contributing to the Lehman Brothers bankruptcy included:

- Subprime mortgage exposure: Lehman Brothers held a substantial amount of securities tied to subprime mortgages, which were at the epicenter of the housing market crash in the United States. As the value of these securities plummeted, Lehman’s financial health deteriorated rapidly.

- Liquidity crunch: As investor confidence waned and credit markets froze, Lehman Brothers faced a severe liquidity crisis. The bank struggled to secure short-term funding, exacerbating its financial woes.

- Inadequate capital reserves: Lehman Brothers had a significant imbalance between its assets and liabilities, leaving it with insufficient capital reserves to absorb losses from its mortgage-related holdings.

- Market panic: The bankruptcy of Lehman Brothers triggered a panic in financial markets and a crisis of confidence in the banking sector. This cascaded into a broader financial crisis, causing stock markets to plummet and credit markets to freeze.

The aftermath of the Lehman Brothers bankruptcy included severe economic downturns, widespread job losses, and government interventions to stabilize the financial system. The crisis exposed vulnerabilities in the global financial system and prompted regulatory reforms aimed at preventing similar events in the future.

The Lehman Brothers bankruptcy serves as a stark reminder of the interconnectedness of financial institutions, the risks of excessive leverage, and the need for robust risk management practices. It underscored the importance of transparency, accountability, and effective regulatory oversight in maintaining the stability of the financial sector.

Lessons learned for maintaining the integrity of double entry accounting

The failures of these cases emphasize the importance of maintaining the integrity of double entry accounting:

- Transparency and accountability: Openness in financial reporting builds trust among stakeholders and prevents unethical practices.

- Auditing and oversight: Independent audits and strong oversight mechanisms are essential to identify errors and manipulation.

- Ethical practices: Upholding ethical standards is paramount to prevent misleading financial statements.

- Accuracy and consistency: Ensuring accurate recording and consistent application of double entry accounting principles are fundamental.

- Continuous education: Regular training keeps accounting professionals updated on best practices and regulations.

By studying these historical cases, businesses and accounting professionals can internalize the critical role of transparency, ethics, and accuracy in financial reporting. Applying the lessons learned safeguards against accounting errors that could lead to devastating consequences.

Conclusion

Double entry accounting stands as a cornerstone of financial management, underpinning the accurate recording and reporting of transactions. Its core principles—recording dual effects, using debits and credits, and maintaining the accounting equation—ensure the integrity and reliability of financial data.

Double entry accounting’s enduring significance can’t be overstated. It provides a framework for businesses and individuals alike to maintain transparent, accountable, and comprehensive financial records. The method’s ability to detect errors and its role in building trust among stakeholders make it an indispensable tool in the realm of finance.

Overall, double entry accounting serves as a reliable compass guiding us through the complexities of financial transactions, underpinning the accounting basics for small business and ensuring transparency and accuracy in the financial world

.png)