A balance sheet is one of the most helpful tools for a business owner because it shows the real health of a company. It is one of the three financial statements that, all together, can give you a picture of the overall financial situation of your business and can help evaluate it. The other two financial statements are the cash flow statement and the profit & loss statement, which sometimes can be called the income statement.

It can’t be overstressed that maintaining regularity in producing and analyzing balance sheets is crucial for businesses, as 29% of all businesses fail due to running out of cash – an issue that can be tackled early by comparing current assets and liabilities. We hope that you will be able to utilize the unique power of balance sheets in order to ensure your business’ growth and success!

So let’s take a closer look at what a balance sheet is, and what useful insights you can learn from it as a business owner.

Tired of dealing with your business’s finances manually? Automate financial reporting using Synder and get yourself prepared for a smooth tax season!

Contents:

1. How the balance sheet in accounting is formed: Definition and examples

2. What are assets in a balance sheet?

3. What are liabilities in a balance sheet?

4. What is shareholders’ equity?

5. How can a balance sheet help you as a business owner?

How the balance sheet in accounting is formed: Definition and examples

The balance sheet provides an overview of the financial health of a business at a specific short period of time. So that’s why it is important to constantly compare the new one with the previous reports to see the whole picture.

Who can prepare a simple balance sheet:

- Company bookkeeper

- External accountant

- Owner

Just don’t forget to automate the process!

The balance sheet is formed by using a double-entry system of bookkeeping, with all transactions being recorded in at least two different accounts. What this means is that each transaction has both: a corresponding positive and a negative entry. Every entry has its corresponding credit and debit.

In keeping the records all the recorded transactions should be in balance according to the following formula:

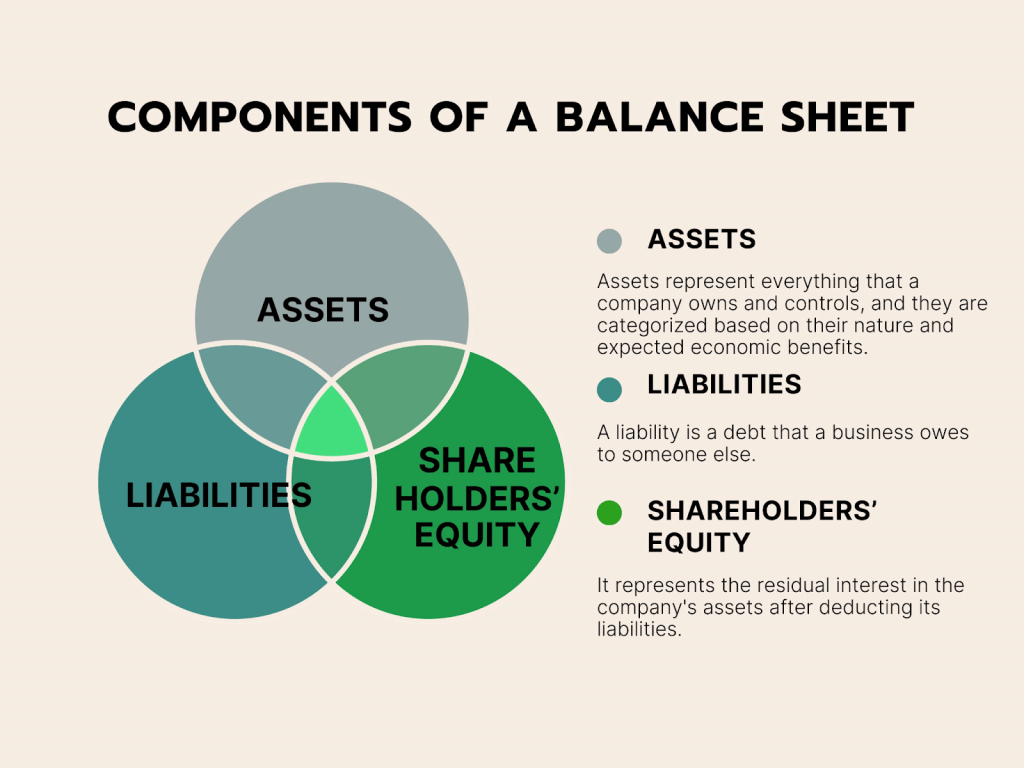

In such a balance sheet assets stand for all things the company owns and has to pay for, liabilities represent the borrowed money and shareholder’s equity is the money taken from investors.

If something in the equation does not end up matching or balancing, this tells you that you have probably made a mistake recording one or several transactions or entries.

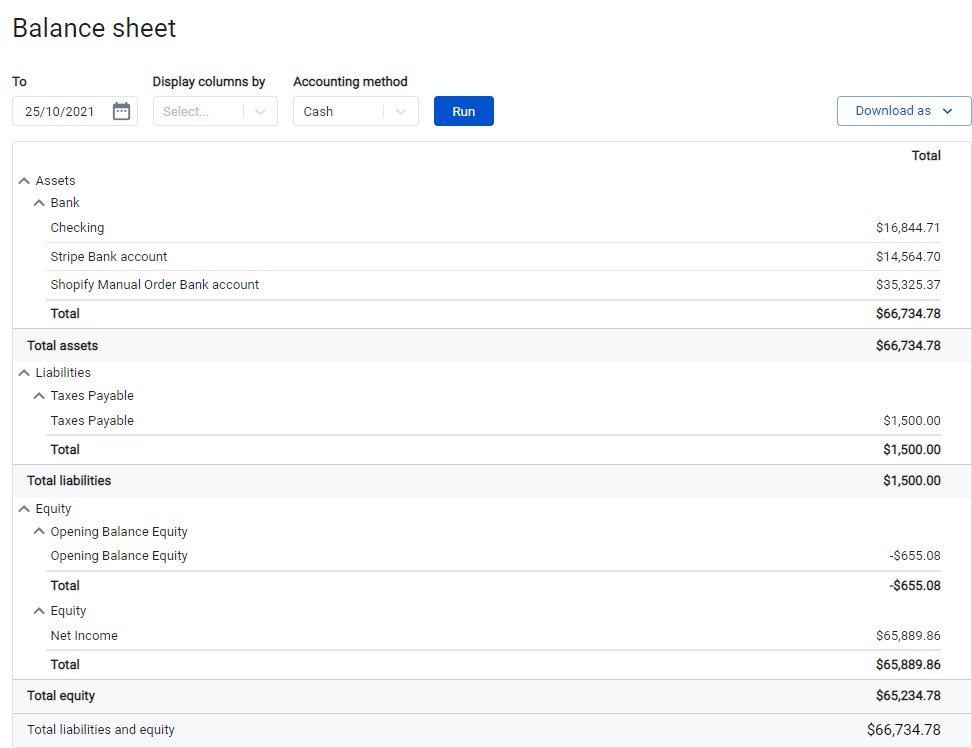

📌 A sample balance sheet

Here’s what a balance sheet example from Synder:

Let’s look deeper into each of the components.

What are assets in a balance sheet?

Assets are one of the key components of a company’s balance sheet, which is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. Assets represent everything that a company owns and controls, and they are categorized based on their nature and expected economic benefits. Assets are typically listed on the balance sheet in order of their liquidity, with the most liquid assets appearing first. There are two main categories of assets on a balance sheet:

Current assets

Current assets are assets that are expected to be converted into cash or used up within one year from the balance sheet date or the company’s operating cycle, whichever is longer. Examples of current assets include:

a. Cash and cash equivalents: This includes physical cash, bank account balances, and highly liquid investments with maturities of three months or less.

b. Accounts receivable: Amounts owed to the company by customers for goods sold or services rendered on credit.

c. Inventory: Goods held by the company for resale or for use in the production process, including raw materials, work-in-progress, and finished goods.

d. Prepaid expenses: Costs that have been paid in advance but have not yet been consumed or used.

e. Short-term investments: Investments in securities like stocks or bonds that the company intends to sell or convert into cash within a year.

f. Other current assets: This category may include various other assets that are expected to be realized as cash or used up within a year, such as advances to suppliers or tax refunds receivable.

Non-current assets (or fixed assets)

Non-current assets, also known as fixed assets or long-term assets, are assets that are expected to provide economic benefits for more than one year. Examples of non-current assets include:

a. Property, plant, and equipment (PP&E): Physical assets such as buildings, machinery, land, and vehicles that are used in the company’s operations.

b. Intangible assets: Non-physical assets with no physical substance, such as patents, trademarks, copyrights, and goodwill.

c. Long-term investments: Investments in securities or other entities that the company does not intend to sell in the short term.

d. Other non-current assets: This category may include assets like deferred tax assets, long-term prepaid expenses, or long-term deposits.

Total assets

Total assets represent the sum of all the resources and properties owned by a company at a specific point in time, as reported on its balance sheet. It encompasses everything that the company owns, including both current and non-current assets.

On a company’s balance sheet, the total assets figure is typically found at the bottom of the assets section, and it represents the total value of the company’s resources available for use in its operations. The formula for calculating total assets is as follows:

Overall, assets represent the resources a company has at its disposal to generate revenue and fulfill its obligations. The total assets of a company must always equal the sum of its liabilities and equity according to the fundamental accounting equation: Assets = Liabilities + Equity. This balance ensures that the company’s financial position is accurately reflected on the balance sheet. Assets are a critical component in evaluating a company’s financial health and performance, and they play a key role in various financial ratios and analyses.

What are liabilities in a balance sheet?

A liability is a debt that a business owes to someone else. In a typical balance sheet, the main distinction between liabilities and assets is that assets have a ‘dollar amount’ and liabilities have an ‘amount.’ They are categorized based on their maturity or when they are expected to be settled. Liabilities are typically listed on the balance sheet in order of their due date, with the most immediate liabilities appearing first. There are two main categories of liabilities on a balance sheet:

Current liabilities

Current liabilities are obligations that are expected to be settled within one year from the balance sheet date or the company’s operating cycle, whichever is longer. Examples of current liabilities include:

a. Accounts payable: Amounts owed by the company to suppliers and vendors for goods and services received but not yet paid for.

b. Short-term loans and borrowings: Debt that is due for repayment within one year.

c. Accrued liabilities: Liabilities that have been incurred but have not yet been paid or recorded, such as accrued wages, taxes payable, and interest payable.

d. Deferred revenue: Payments received in advance for goods or services that have not yet been delivered or earned.

e. Current portion of long-term debt: The portion of long-term debt that is due for repayment within the next year.

f. Other current liabilities: This category may include various other short-term obligations, such as customer deposits or short-term lease liabilities.

Non-current liabilities

Non-current liabilities, aka long-term liabilities, are those obligations which are due after 1 year. Examples of non-current liabilities include:

a. Long-term debt: Debt with maturities extending beyond one year, such as bonds or mortgages.

b. Deferred tax liabilities: Taxes that the company will owe in the future due to differences between accounting and tax rules.

c. Pension obligations: Liabilities related to the company’s pension plans and employee retirement benefits.

d. Other non-current liabilities: This category may include items like long-term lease liabilities or long-term warranty obligations.

Total liabilities

Total liabilities, often referred to as “Total liabilities and equity” or “Total liabilities and shareholders’ equity,” is a key section of a company’s balance sheet. It represents the sum of all the company’s obligations or debts to external parties and its shareholders’ equity, which is the residual interest in the company’s assets after deducting its liabilities.

The total liabilities figure includes both current liabilities (obligations expected to be settled within one year or the company’s operating cycle) and non-current liabilities (obligations due beyond one year), necessitating regular balance sheet reconciliation. These liabilities can encompass various items, such as accounts payable, short-term loans, long-term debt, accrued expenses, deferred tax liabilities, pension obligations, and more.

The formula for calculating total liabilities is:

Total liabilities represent the external claims on a company’s assets, including obligations to creditors and lenders. It also indicates the extent to which the company has utilized debt financing as a source of capital.

Investors, creditors, and financial analysts often examine the total liabilities figure when assessing a company’s financial health, liquidity, and solvency. Comparing total liabilities to assets and equity can help in evaluating the company’s leverage and its ability to meet its financial obligations. A lower ratio of total liabilities to total assets or equity generally suggests lower financial risk and greater financial stability.

📌 Keep in mind that some liabilities are considered off the balance sheet so you could not find them in the reports. Off-balance sheet items are typically those not owned by or are a direct obligation of the company.

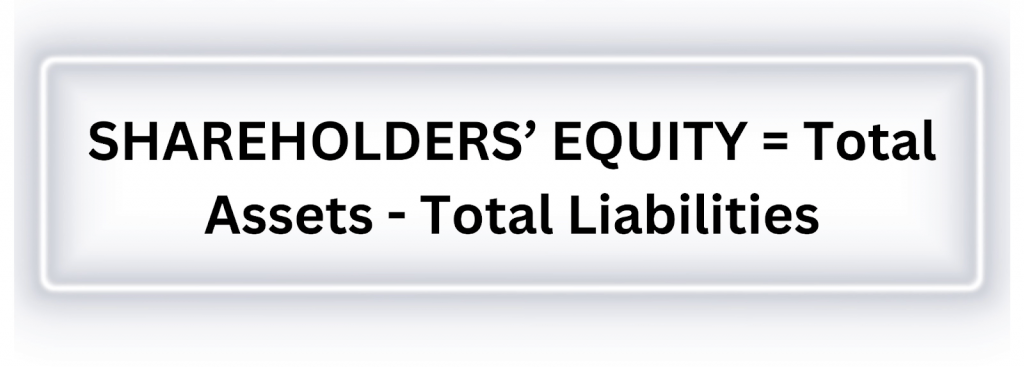

Shareholders’ equity, often referred to as “owner’s equity” or “stockholders’ equity,” is a key component of a company’s balance sheet. It represents the residual interest in the company’s assets after deducting its liabilities. In other words, it is the net value of the company’s assets that belongs to the shareholders (owners) of the company.

Calculate shareholders’ equity using the following formula:

Shareholders’ equity is what remains after all the company’s debts and obligations (liabilities) have been subtracted from its total assets. It represents the ownership interest in the company and reflects the cumulative contributions by the company’s shareholders and retained earnings (profits that have been reinvested in the business rather than distributed as dividends).

There are three main components of shareholders’ equity:

a. Common stock: This represents the amount of capital that shareholders have invested in the company by purchasing common stock. Common stockholders have ownership rights in the company and may receive dividends and participate in corporate voting.

b. Retained earnings: Retained earnings are the cumulative profits or losses that the company has generated over time but has not distributed to shareholders as dividends. Retained earnings are a critical component of shareholders’ equity as they represent the portion of earnings that has been reinvested in the business to support its growth and operations.

c. Additional paid-in capital: This component includes any capital contributed by shareholders in excess of the par or stated value of the common stock. It can arise from the issuance of additional shares at prices above their nominal value.

Shareholders’ equity is an important indicator of a company’s financial health and net worth, distinct from temporary accounts that are cleared at the end of each accounting period. A higher shareholders’ equity generally suggests that the company has a strong financial base and is less reliant on debt financing. Conversely, a lower shareholders’ equity relative to liabilities may indicate higher financial risk.

Investors, creditors, and financial analysts often analyze shareholders’ equity to assess a company’s financial stability, ability to generate future profits, and overall value to shareholders. It’s an essential element in evaluating a company’s financial statements and its long-term prospects.

📌 If shareholders’ equity is positive, that means the company has enough assets to cover its liabilities, but if it’s negative, then the company’s liabilities exceed its assets.

Learn more about equity financing.

How can a balance sheet help you as a business owner?

⭐️ Balance sheets shed light on the risks which you may face and show the positive outcomes

One of the most significant benefits of keeping a succinct balance sheet in accounting comes from their content, which is mainly having both assets and liabilities in one place. Both current and long-term assets speak about a business’ ability to produce cash and keep its operations running. Debts, both short and long-term, help prioritize the obligations a business has. Ideally, a thing to strive for would be having more assets than liabilities, which would signal a positive net worth.

When you compare current assets and current liabilities in your balance sheet, you can see whether the business is able to cover its immediate obligations. If current liabilities exceed the cash you have available, it shows that your business may need to seek outside working capital.

You can also see from a balance sheet when the levels of debt become unsustainable. That happens when there is too much debt on your balance compared to the existing current assets and may lead to having to either default on debt payments or declare bankruptcy.

A rule of thumb, which is good to keep in mind, is that if the ratio of assets to liabilities is less than 1 to 1, the company is in danger of bankruptcy, so for you, as a business owner, it’ll mean that some strategic improvements are necessary in order to stabilize the company’s financial health.

⭐️ Balance sheets build up your trustworthiness in the eyes of investors and lenders

A great thing about the balance sheet is that it allows people outside of your company to very quickly understand your financial condition, without you having to persuade anyone. The numbers will speak for themselves.

Most lenders in fact require a balance sheet to determine a business’s financial health and its creditworthiness. Potential investors may also use it to understand where their funding will end up and when they can expect to be repaid (for this, it’s important to be able to show your ability to pay your business obligations on time and in full measure).

When you update a balance sheet (important to notice here that it needs to be done on a regular basis and a balance sheet in accounting always needs to be titled with a date, as it shows the health of a business for a particular period in time), it shows your ongoing ability to take payments and repay debts. It also shows lenders that you have a track record of successfully managing assets and liabilities. When you apply for loans, you can use a simple balance sheet to show lenders that you are very likely to repay your debts on time.

In fact, a carefully maintained balance sheet can be described as a single most potent tool that can be used in order to demonstrate that a business can be trusted.

⭐️ Balance sheets provide businesses with unique ratios that demonstrate their financial health at any given time

There are certain techniques that can be used to analyze a balance sheet in greater detail. The main one is the financial ratio analysis, which is described in detail here. The ratio analysis in short is a quantitative method of gaining insight into liquidity, profitability, and operational efficiency by comparing its main financial statements such as the income statement and balance sheet.

Among some other ratios that can be used are the debt-to-equity ratio, which can provide a good sense of the company’s financial condition. More information on this ratio can be obtained here. Normally, these ratios need more than just the balance sheet, income statements often being necessary as well.

Things like activity ratios mainly focus on current accounts in order to show how well the company manages its operating cycle (this report would include receivables, inventory, and payables).

In general, these and other accepted ratios can provide even more insight into the company’s operational efficiency than a balance sheet alone, but even just having a well-maintained balance sheet as well as a practice of regularly analyzing it can be a great way for business owners of any types of businesses to stay on top of their operations.

How to assess your company’s financial standing and health with a balance sheet: Rounding up

In conclusion, the balance sheet is a vital financial statement that serves as a powerful tool for assessing a company’s financial standing and overall health. It provides a clear snapshot of the company’s assets, liabilities, and equity at a specific point in time, ensuring that the fundamental accounting equation (Assets = Liabilities + Shareholders’ Equity) remains balanced.

Analyzing a balance sheet can reveal critical insights into a company’s liquidity, solvency, and capital structure, including how to calculate net income from a balance sheet. Investors, creditors, and stakeholders rely on this document to gauge the financial stability and viability of a business. Current assets and liabilities offer a glimpse into short-term financial obligations and the company’s ability to meet them, while non-current assets and liabilities shed light on longer-term commitments and investments.

Furthermore, equity represents the residual value owned by shareholders, serving as a measure of the company’s net worth. Understanding how a company finances its operations, whether through equity or debt, is crucial for assessing risk and return potential.

Incorporating ratios and metrics derived from the balance sheet, such as the current ratio, debt-to-equity ratio, and working capital, can provide deeper insights into a company’s financial performance and its ability to weather economic challenges.

Ultimately, a well-analyzed balance sheet is a key tool for making informed investment decisions, assessing creditworthiness, and ensuring the long-term financial health of a company. Regularly reviewing and interpreting this financial statement is essential for businesses of all sizes to stay on top of their financial standing and make strategic decisions that lead to sustained success.

However, in spite of these important insights, we shouldn’t forget that the balance sheet is just one part of a full-fledged financial audit. Besides reviewing the current state of affairs, you should also evaluate the past: in order to know what factors affect your balance sheet the most, you need to dig deeper.

And last but not least – automating routine financial tasks is fundamental for business scaling. Synder collects your sales data from ecommerce and payment channels for actionable reports that give you insights into your company’s financial health. Test Synder’s powerful functionality during a 15-day free trial or hop on our Weekly Public Demo to get all your questions answered by the company’s specialists.

%20(1).png)