In the thrilling world of entrepreneurship and business growth, there lies a critical cornerstone that aids in the transformation of ambitious start-ups into burgeoning businesses: equity financing. It possesses the power to ignite startups, stimulate growth, and ensure financial stability. Its significance goes beyond mere numbers; it often marks the difference between dreams that fizzle out and those that become resounding successes. In the realm of finance, the ability to secure capital is not only about survival; it’s also about capacity, potential, and the ability to scale up operations to make an impact.

Understanding the intricacies of equity financing is crucial for anyone interested in the business world, be they entrepreneurs, investors, or those simply curious about how businesses fund their operations and growth. In this article, we delve deep into the concept of equity financing, offering a comprehensive exploration of its benefits, drawbacks, types, process, and its pivotal role in managing business finances.

Note that each business situation is unique, and the considerations related to equity financing should be made in consultation with financial and legal advisors. Regardless of whether a company chooses to pursue equity financing, understanding the concept will undeniably enhance any entrepreneur’s business profundity.

Contents:

1. Understanding equity financing

2. Types of equity financing: Equity financing examples

- Common stocks

- Preferred stocks

- Venture capital

- Angel investors

- Crowdfunding

- Initial Public Offering (IPO)

3. Two options: Stay private or go public

4. Advantages of equity financing

5. Disadvantages of equity financing

7. Equity financing trends and future

Understanding equity financing

In its simplest terms, equity financing involves raising capital by selling shares or stakes in a company. When a business engages in equity financing, it essentially sells a piece of its future profits in return for immediate funding. This stands in contrast to debt financing, which involves borrowing funds that need to be repaid over time, typically with interest. Unlike a loan, equity financing doesn’t create a debt or an obligation to repay the investor. Instead, it provides investors with an ownership stake in the company.

The choice between equity and debt financing often depends on a variety of factors. These include the financial health of the company, market conditions, the nature of the industry in which the company operates, and the company’s long-term strategic goals. For some businesses, the benefits of equity financing make it an attractive option, especially for those with high growth potential.

Debt and equity: The difference between equity and debt financing

Equity financing and debt financing are two main ways businesses raise capital, but they function differently and have different implications for a company and its owners. Here’s a breakdown of the key differences between equity and debt financing.

Ownership

In equity financing, companies raise money by selling a share of their business or equity to investors. This means the investors become partial owners of the company and have a claim on future profits. In contrast, debt financing involves borrowing money from a lender (like a bank or a bondholder), which has to be paid back over time with interest. The lender doesn’t gain any ownership in the company.

Repayment

In debt financing, the company is obligated to repay the principal amount borrowed along with interest, regardless of its profitability. This means it’s a fixed cost that the company must budget for. In equity financing, there’s no obligation to repay the money invested. However, as investors own a share of the company, they may receive dividends or a share of the profits.

Decision making

Equity investors often get voting rights in the company, meaning they can have a say in the company’s strategic decisions. With debt financing, lenders don’t have any voting rights or control over the company’s decisions, as long as the company continues to meet its repayment obligations.

Risk

With equity financing, the risk is shared. If the business fails, the investors share the loss. With debt financing, the company has the risk. It has to repay the loan irrespective of whether it’s successful or not, and failure to do so can lead to bankruptcy.

Tax implications

In many jurisdictions, the interest paid on debt can be deducted before calculating corporate taxes, which is a potential advantage of debt financing. On the other hand, dividend payments to equity investors are usually not tax-deductible.

Impact on balance sheet

Debt increases the liabilities on a company’s balance sheet, which can make the company seem riskier to investors or other lenders. Equity doesn’t increase liabilities, but it does dilute the ownership of the existing owners.

Each of these forms of financing has its advantages and disadvantages, and the choice between the two often depends on a company’s specific circumstances, such as its stage of development, financial health, growth prospects, and the state of the financial markets.

Types of equity financing: Equity financing examples

Equity financing can come in various forms, each with its unique characteristics and suitability for different kinds of businesses.

Common stocks

When investors buy common stocks, they’re essentially buying a piece of ownership in the company. They also get voting rights, which can be used to influence company decisions, and may receive dividends, a portion of the company’s profits distributed to shareholders.

Example: Consider a retail investor who has some savings they want to invest. They believe in the long-term growth potential of a particular tech giant and decide to buy common stocks of the company through a stock exchange. By buying the stocks, they become a part-owner in the company. They have the right to vote on key company decisions and might receive dividends. However, their investment is also subject to market risk, meaning the stock’s value can go up or down based on the company’s performance and market conditions.

Preferred stocks

Similar to common stocks, preferred stocks give ownership stakes. However, preferred stockholders have a higher claim on dividends and assets, especially in the event of liquidation. Preferred stock often doesn’t come with voting rights.

Example: Imagine a well-established manufacturing company looking to fund its expansion. Instead of borrowing, the company decides to issue preferred stocks. Investors who purchase these stocks receive a fixed dividend every year, which is paid out before any dividends for common stockholders. While they don’t have voting rights like common stockholders, they have a higher claim on the company’s assets in the event of bankruptcy. An investor who prefers steady income and less risk might purchase these preferred stocks.

Venture capital

Venture capitalists are professional investors or firms that invest in early-stage companies (startups) with high growth potential. They provide large sums of money in exchange for equity in the company, and they often seek to exit their investment in a few years through a sale or an IPO.

Example: A biotech company with a promising drug discovery requires capital for further research and development. A venture capital firm sees the potential in the company and invests a significant amount of money in exchange for equity in the company. This venture capital funding is an instance of equity financing.

Angel investors

Angel investors are wealthy individuals who provide capital for startups, usually in exchange for convertible debt or ownership equity. They may offer mentorship and connections in addition to funding.

Example: Let’s take the example of an entrepreneur with a groundbreaking idea for a new kind of renewable energy technology. However, they lack the capital to build prototypes and hire a team. They pitch their business plan to an angel investor, a retired energy industry executive with wealth to invest. The angel investor is convinced of the technology’s potential and decides to invest $200,000 in exchange for a 15% stake in the company. The angel investor also offers valuable mentorship and industry connections.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, usually via online platforms. It’s made it possible for a more diverse range of businesses to attract funding.

Example: A small business creating sustainable clothing lines wants to expand its operations. Instead of taking out a loan, the business opts to launch a campaign on an equity crowdfunding platform, where hundreds of individuals invest small amounts of money in exchange for a stake in the company. This is another form of equity financing.

Initial Public Offering (IPO)

An IPO is the first sale of stock by a company to the public. This usually occurs when a company has a proven track record and wants to raise significant capital. Going public is a complex and expensive process but can bring substantial benefits. Let’s go into more detail.

Example: A well-established tech company decides to go public to raise capital for its expansion plans. It offers its shares to the public for the first time in an IPO, which allows anyone to buy a stake in the company. The funds raised through this process constitute equity financing.

Two options: Stay private or go public

You’ll have to choose either the Private Placement of stock with investors or the Public Stock Offering (IPO) for the first equity financing. Let’s take a closer look at both.

Private Placement

Private Placement or Regulation D offering in equity financing is a sale of stock shares or bonds to sophisticated investors: banks, pension funds, insurance companies, wealthy investors, etc. or institutions.

Also, such processes don’t have to be registered with the SEC. The only condition is to meet a certain private placement with the requirements stipulated in an SEC Rule.

The participants can only be so-called accredited investors, individuals allowed to trade securities, who don’t have to register this with any financial authorities. This also means that after buying shares, the investors can do their due diligence and have much more bargaining power than the average investor. They have all the financial information they need at hand. In fact, accredited investors don’t need the SEC protection that is offered to less sophisticated investors.

Here we’ll stop for a moment to make things clear about this form of financing. The company is NOT required to provide a potential investor with a prospectus. Instead, the Private Placement is sold using the Private Placement Memorandum (PPM). The PPM consists of the information primarily about the terms of the offering and the investment risks. Such a document can’t be broadly marketed to the general public.

The Private Placement process is definitely faster due to the absence of any complex requirements. On the other hand, be prepared that your investors may be picky. They’ll try to find as many pitfalls as possible because they want to be sure they aren’t running a risk of losing money.

IPO (Initial Public Offering)

When choosing this option, you’ll be dealing with public investors. The IPO is offering shares of a private company previously unlisted to the public, for the first time.

Once a company gains a unicorn status or it has a strong foundation for further development and meets the SEC requirements, it can qualify for an IPO.

The whole process is really complicated, but in general, it has main 5 steps:

- Selecting the investment bank (the underwriter) that’ll help with the underwriting process. Basically, this bank buys the shares from the issuing company and resells them to the public.

- Choosing an underwriting agreement and documentary preparation. Depending on the preferred results of equity financing, the issuing company can choose one of the several options: whether it’ll gain a certain amount of money or not after reselling shares to the public, multiple managers or just one, etc. After that, the underwriter has to draft the specific documents: engagement letter, letter of intent, registration statement, red herring document. As soon as the company files all the necessary documents, a “quiet period” begins lasting through the 40 days after the stock starts trading.

- Book building process. Book building process involves finding the appropriate price for the shares that will be offered to the public market.

- Stabilizing bid. The underwriters purchase the stocks at the offering price to the public or below to create a preferable market.

- The market competition itself. It starts with the end of the SEC “quiet period”.

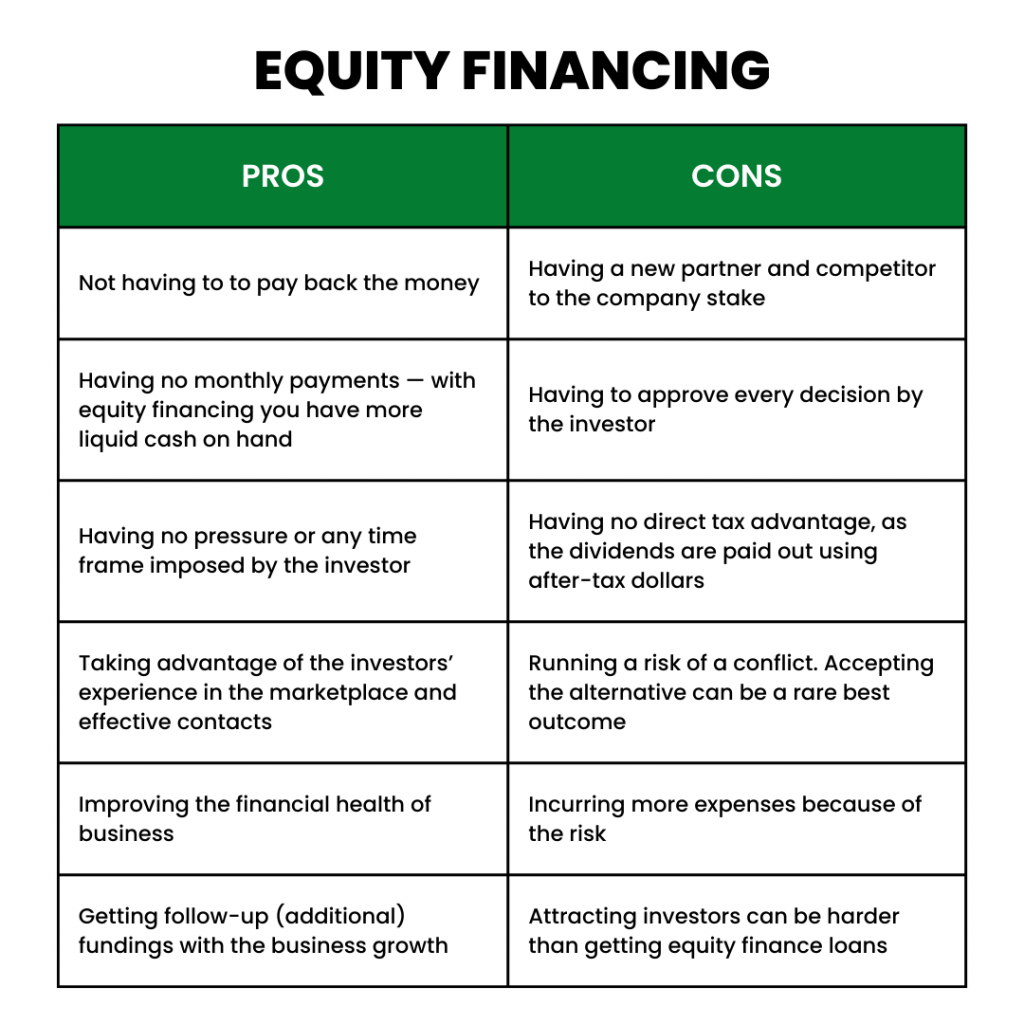

Advantages of equity financing

Equity financing offers several notable advantages that make it a preferred choice for many businesses.

No repayment obligation

Unlike loans, equity financing doesn’t need to be repaid. This means businesses can use the capital raised to grow without the burden of regular repayments or the stress of accumulating interest.

Access to additional resources and networks

Equity investors often provide more than just funding. They can bring industry experience, strategic advice, and valuable business connections to the table. This can be especially beneficial for early-stage companies that can benefit from the guidance and expertise of seasoned investors.

Risk-sharing

With equity financing, the business risk is shared. If the business doesn’t perform well or fails, the investors bear the loss, unlike in debt financing where the business would still need to repay the loan.

Positive impact on the company’s balance sheet

As equity financing doesn’t increase the company’s liabilities, it can make the company’s financial position look more attractive. This can be beneficial for future borrowing and business credibility.

Disadvantages of equity financing

Despite its advantages, equity financing also carries potential drawbacks.

Loss of control and ownership

Equity financing involves giving up a part of your company’s ownership. This could mean less control over your business as investors get voting rights and may influence business decisions.

Dividend payments

Businesses might be required to pay dividends to equity investors out of their profits. This can reduce the amount of profit that could be reinvested back into the business.

Potential conflicts with investors

Having investors can lead to potential conflicts, especially if they have different visions for the business. Balancing the interests of all stakeholders can become a challenging task.

Complex and time-consuming process

Equity financing often requires considerable preparation, including business valuations, due diligence, and legal processes. It can be more complex and time-consuming compared to other financing options.

Equity financing process

The equity financing process involves several steps. While these can vary somewhat depending on the type of equity financing and the specific circumstances of the business, most equity financing rounds will generally follow this sequence.

Step #1. Decision making

Determining the right time to seek equity financing involves a careful assessment of the company’s needs, goals, and financial situation. Factors such as the readiness of the business to take on investors, its current valuation, and the state of the financial markets can all play a role.

Step #2. Preparation

Businesses need to prepare before seeking equity financing. This includes creating comprehensive business plans, compiling financial projections, crafting a compelling investor pitch, and possibly also getting a business valuation. Being well-prepared can increase the chances of attracting investors and getting favorable terms.

Step #3. Finding investors

The next step is to identify potential investors. These could be venture capitalists, angel investors, or even friends and family. Businesses can also reach out to investors through networking events, investor meetups, or online platforms.

Step #4. Negotiation

Once potential investors have expressed interest, the company must decide on the amount of equity to offer and negotiate other terms with investors. It’s important to find a balance between raising enough capital and retaining control over the business.

Step #5. Legal process

After agreeing on the terms, businesses need to navigate the legal process, which can include drafting and signing investment agreements, updating company records, and possibly also meeting regulatory requirements, especially for larger investments or IPOs.

Equity financing trends and future

As we look towards the future, it’s clear that equity financing is set to continue playing a crucial role in funding businesses. The rise of technology has already begun to reshape the landscape of equity financing. For instance, crowdfunding and online investment platforms have democratized access to capital, allowing a more diverse range of businesses to attract funding.

Furthermore, changes in regulations have opened up new possibilities for equity financing. For example, equity crowdfunding, which was once limited to accredited investors, is now accessible to a wider pool of investors. This trend is likely to continue as technology further disrupts the financial sector and democratizes access to funding.

Despite these changes, the core principles of equity financing remain the same. It will continue to be a vital tool for companies seeking to fund their growth without increasing their debt load.

Conclusion

In conclusion, equity financing is more than just a fundraising tool. It’s a strategic decision that can shape the trajectory of a company. It offers the potential to access capital, share risk, and leverage the expertise and networks of investors. However, it also comes with its challenges.

As businesses navigate their growth journeys, understanding equity financing and its implications can open up new avenues of opportunity and possibility. A well-informed, strategic approach to equity financing can empower businesses to fuel their growth, achieve their goals, and make their mark on the world.

It’s important to note that each business situation is unique, and the considerations related to equity financing should be made in consultation with financial and legal advisors. Regardless of whether a company chooses to pursue equity financing, understanding the concept will undeniably enhance any entrepreneur’s business profundity.

%20(1).png)

By making strategic upgrades, you can enhance the property’s market value and attract higher-quality tenants, thereby increasing rental income and potential appreciation.

There are various types of financing tactics in the business world. This article provides a comprehensive guide on equity financing. Thanks for sharing!

Thank you! We are very glad you enjoyed the article.