Crowdfunding has long historical roots but is relatively young and innovative in comparison with traditional business funding options. Not so long ago, when someone wanted to raise capital for a venture idea, they had quite a few methods with which to achieve this. But with the development of technology and the Internet, crowdfunding has connected millions of young entrepreneurs with financial sponsors worldwide and gained immense popularity due to its simplicity and accessibility.

This article is for those who don’t know how to run a successful crowdfunding campaign but would like to learn the basics. You’ll learn how crowdfunding works and find simple but effective crowdfunding tips for beginners.

Contents:

2. How does crowdfunding work?

3. Types of crowdfunding for business

5. How to run a successful crowdfunding campaign

6. 5 Crowdfunding Tips for Beginners

7. Crowdfunding vs. small business loans

What is crowdfunding?

First, define the term. You have a business idea or a business need, and you need a certain amount of money to fund it. You reach out to a crowd of individuals who can collectively provide you with the necessary amount to fund your venture. That’s it.

So, crowdfunding is raising small amounts of money from many different sponsors so that you can get the total amount of money you need.

A crowdfunding investment is a type of alternative finance crowdsourcing. You don’t have to go to a bank or any other financial institution for your business funding. If you want to support your business idea through crowdfunding financially, you need to pitch it to the crowd.

Unlike some other types of investment, you don’t pitch to (or ever meet) these people in person. Usually, the whole process runs online through specialized crowdfunding sites. Interested people contribute small individual investments to help a company, a product, or a project they like to get started.

Crowdfunding is particularly good for startups and innovative product ideas. Actually, 40% of all crowdfunding investments are focused on business and entrepreneurship. The global crowdfunding market is around $30 billion, with North America being the leading region in the industry.

How does crowdfunding work?

Now that we know what crowdfunding is, let’s try to learn how crowdfunding works.

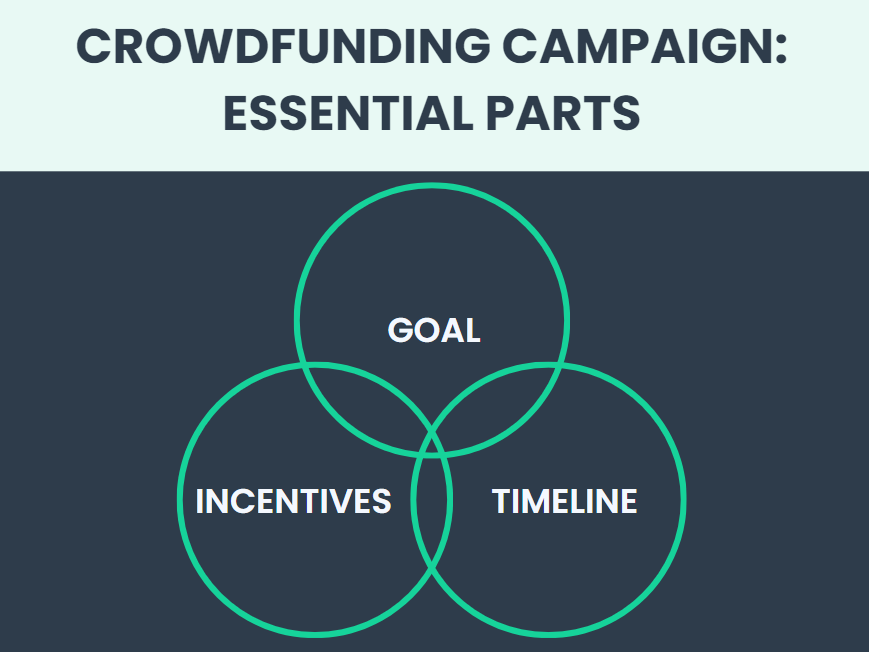

Three common parts of a crowdfunding campaign

Usually, crowdfunding for business campaigns consists of these major parts:

- Goal. How much money do you need and what is the money for?

- Incentives. What will those who invest get for their donation?

- Timeline. What is the deadline for getting the decided amount?

One of the most significant specifics of crowdfunding is that businesses can only get investments if the project reaches the amount of money set as the campaign’s goal. These regulations are supposed to protect unsophisticated or non-wealthy investors from a high risk of losing their savings. It’s also required that you unveil certain financial information in order to raise funds. To fulfill these specific financial reporting obligations, you can use accounting software such as Synder to prepare all the necessary information and statements required by law.

Three aspects to consider to succeed in your crowdfunding project:

- A campaign initiator, who introduces the idea.

- Individuals or groups interested enough in the idea to invest (also called “backers”).

- The crowdfunding platform, where you can reach out to the sponsors and get the money from them.

Each person on the crowdfunding platform selects the projects in which they believe. They sometimes play a donor role and may contribute without expecting any monetary payoff in the future, or in some cases, they become shareholders.

When the individual sponsors start making their contributions, often, it has a snowball effect, triggering the crowdfunding investment process. Sponsors who are genuinely interested in the successful completion of the project may distribute information about the project further, serving as free promoters to the idea they help crowdfund. This influences the ultimate value of the offerings and outcomes of the campaign.

It’s not uncommon that free advertising and a ready-made audience come as a pretty good bonus for the campaign, thereby reducing marketing costs for the product launch. This makes crowdfunding one of the best small business funding options for entrepreneurs with limited start-up capital.

Types of crowdfunding for business

As previously mentioned, your crowdfunding project should present a specific incentive to make people want to invest in your idea. Basically, the return on crowdfunding investment can be either financial, or some sort of non-monetary reward

Based on what backers get in return, there are several principal types of crowdfunding for business.

1. Equity-based crowdfunding

Equity crowdfunding is the type of business venture crowdfunding that implies the collective effort of individuals to support ventures initiated by other people or organizations through finance procurement in the form of equity.

The business owner must produce and market the product announced in the crowdfunding campaign and offer securities for a return on investment.

2. Reward-based crowdfunding

This type is also called non-equity crowdfunding. People donate to achieve a particular reward connected to the project they support.

For example, backers want to use some innovation that wasn’t present on the market before. Or they may expect to get the product they fund earlier than anyone else.

3. Donation-based crowdfunding

Donation-based crowdfunding can work best for non-profit initiatives to collect financial help. It works pretty straightforwardly, allowing investors to support the ideas that resonate with them. Usually, investors, or donors, don’t get any incentive for their participation. Check out unique fundraising ideas to help you extend your programs to more communities, serve a larger number of individuals, and address a broader range of social issues.

4. Debt-based crowdfunding

Debt-based crowdfunding is a mix of crowdfunding and business loans. It allows raising funds to support a project through small loans that can be of high, low, or no interest. It can be an option for a business that, for some reason, can’t reach a full-fledged business loan but can already ensure stable cash flow to repay the lenders.

Best crowdfunding sites

There are hundreds of online platforms to do crowdfunding in the US. The key global companies providing crowdfunding help are Kickstarter, Indiegogo, GoFundMe, Fundable, Patreon, Fundrazr, Campfire, AngelList, GoGetFunding, DonorsChoose, Crowdfunder UK, Crowdfunder, Milaap, RocketHub, Companisto, Crowdo, and many others.

How do crowdfunding sites work?

As you can see, many sites and platforms enable you to start a crowdfunding campaign. The principles of how they work might be slightly different, which makes crowdfunding accessible to more people and businesses who can’t reach for loans.

The most common ways it works includes a call for funds from companies, usually startups or early stage, that want to release a product or start a service and individuals that require financial help. This help might be welcome to cover expensive medication or other urgent needs.

The most popular crowdfunding platforms

Let’s explore some best crowdfunding sites to fund your next big business idea.

Kickstarter crowdfunding

Kickstarter is the most popular option to do crowdfunding for startups. It has the highest number of completed business-oriented projects. Having an average of 135 backers for each campaign, Kickstarter becomes the platform with the audience most open to new innovative commercial ideas.

Indiegogo crowdfunding

Indiegogo is a more flexible crowdfunding platform, compared to Kickstarter. Interestingly, Indiegogo initially focused purely on funding independent films, but later, it began accepting projects from any other category. Luckily for many small business owners, it holds the highest project average crowdfunding amount raised at $172,473.

GoFundMe crowdfunding

GoFundMe is one of the largest crowdfunding sites, as it’s number one for individual projects. It has 0% fees and a payment processing fee of 2.9% and is the cheapest in that regard. No wonder it’s so popular among people seeking to raise money for personal projects.

Patreon crowdfunding

Patreon is one of the most popular crowdfunding platforms for creative people, such as artists, writers, musicians, photographers, etc. It allows them to reach out for funding to keep their creative work and have a steady source of income.

Note that many of the sites charge investors a fee ranging from 5% to 12%. So look out for the platform fees information before choosing the right one for your project.

How to run a successful crowdfunding campaign

Running a successful crowdfunding campaign isn’t an easy task. Nearly three-quarters of all business ideas fail to raise the set amount of money from backers. Most of those that do, however, end up exceeding the desired goal significantly. On average, successful crowdfunding campaigns raise $20,000-40,000 of investment.

Starting on the right foot is the key to a campaign’s success. This is why every good crowdfunding project begins with good preparation. You need to think out every detail of your pitch and marketing beforehand and come to the people prepared, with a well-thought-out offer.

Bear in mind that many backers will like your product or service idea, but they may hold off from investing until they can see how your project develops. Remember about the snowball effect? Herd behavior is typical of crowdfunding.

It’s essential to keep your backers regularly updated on the progress of your campaign and engaged with your content. Give them something to come back to. It can make a huge difference and define the success of the whole venture.

What do you need to provide for a crowdfunding project?

- a good idea pitch;

- engaging and personal content;

- plenty of video and image material.

If you want to hook people, you’ll need to present them with details. It’s always a good idea to be very specific about what you’re raising the funding for and where the money will go.

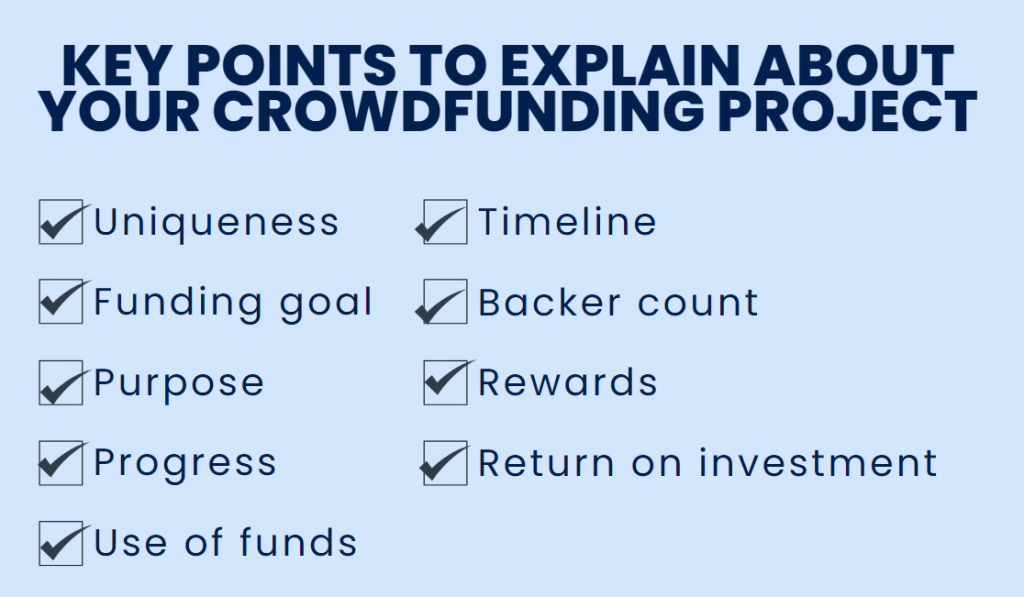

What to clearly explain about your crowdfunding project?:

- What is unique about your business idea?

- How much money do you want to raise?

- Why do you want to raise precisely this amount?

- How much have you raised so far?

- What will you use this money for?

- How long is the project open for investment?

- How many people have already invested?

- What will sponsors receive in return on investment?

- If they receive shares in the company, then how many?

- If they receive another type of reward, what will it be?

- How and when will sponsors receive their return on investment or reward?

5 Crowdfunding Tips for Beginners

If you want to know how to do crowdfunding well, you can always hire a crowdfunding consultant. There are many professionals offering crowdfunding help for beginners. But if you want to know how to run a successful crowdfunding campaign on your own, check out the following tips.

- Prepare a polished business presentation. Present your company and a product or service in the most polished way. Try to identify what makes it special and innovative — it will be your unique value proposition (UVP). Describe your company’s history and back this up with some facts to explain why people should put trust in you, and your idea.

- Use PR and marketing promotion techniques. Just posting your project on the crowdfunding site isn’t enough. You need to go loud where you possibly can. Share links and promote your campaign through social media, send email newsletters, contact bloggers who might be interested in providing more coverage of your project.

- Ask for crowdfunding investments early on. Start the buzz as early as you can. Reach out to possible sponsors, who may be among your friends and family, even before you set up a page on a crowdfunding platform. Search for potential contacts for promotion beforehand too. The earlier you begin advertising your project, the more likely you’ll reach your fundraising goal. Statistically, 42% of funds are raised in the first and last three days of the campaign.

- Offer incentives and keep people engaged. Offering incentives is a great way to build an emotional connection with the backers and make them remember your campaign. Just make sure that you choose incentives that your sponsors will be interested in.

- Update supporters on the progress of the campaign. People have short memory spans, especially on the Internet. The more regularly you update supporters, the better. Keep your campaign page active. Others will see how far you’ve come with your fundraising campaign. They’ll be more likely to remember you and share the information about your project with their network.

Hopefully, these crowdfunding tips will help you succeed with your project. Save this list to your reading list if you liked it, and share it with your fellow entrepreneurs if you found this article helpful.

Crowdfunding vs. small business loans

Before the concept of crowdfunding evolved, small businesses could raise funds by applying for a business loan. Loans are still a viable option that helps companies get a cash influx. This way, businesses have more choice of the funding sources. However, these options don’t work interchangeably and suit everyone. Let’s take a quick look at what makes the difference.

What’s a business loan?

A business loan stands for funds borrowed from a bank or another lender to cover the needs and expenses of a company, including payroll costs, purchasing supplies, inventory, investing in business growth, etc. The essence of a business loan is that you need to repay it with the added interest that can be higher or lower, depending on the lender.

Business loans usually have strict repayment terms that state the schedule and amount of payments. Often, you might need to start paying off the loan right away (like in a month from borrowing).

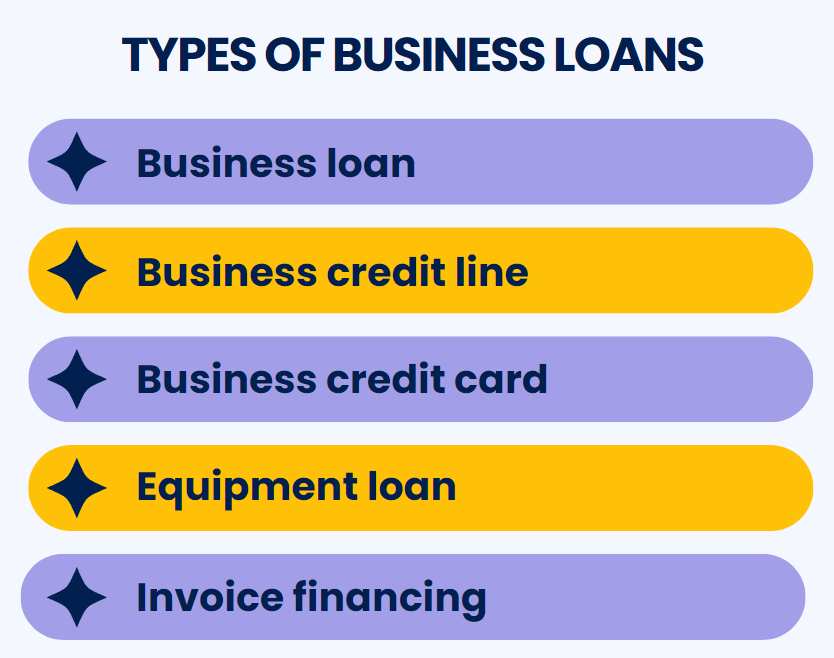

Types of business loans

Lenders can offer business loans in various forms, so businesses can select the most suitable one. Let’s look at the most frequently offered types of business loans:

Business loan

A loan is a certain sum you receive from a bank to finance certain business investments, long or short-term. Usually, it features a set interest rate and a payment term.

Business credit line

A business credit line is a type of borrowing where you pay interest only on the money you spend. Such flexibility allows you to significantly cut the paybacks if you don’t need to spend the whole credit amount at once and be confident to have a source of additional cash once you need it.

Business credit card

Business credit card is an access to a business credit line that’s available to you as long as you make the minimum monthly payments and don’t exceed the credit limit. A business credit card is a popular option for ongoing expenses.

Equipment loan

Equipment loan is, usually, a long-term business loan specifically designed to invest in big purchases, like machinery, for example. Usually, the bought equipment serves as collateral.

Invoice financing

Invoice financing is a type of advancing money for the amount of your due invoices. Usually, you repay it as soon as you get paid. Additionally, you might need to pay a fee.

Why might businesses prefer crowdfunding over small business loans?

Though loans are among the most popular funding options for small businesses, they possess a set of features that make people look more into crowdfunding. They include:

- Extensive application requirements;

- Long approval;

- Risk of losing assets;

- Lack of flexibility in repayments;

- High fines for exceeding the repayment deadlines, etc.

Final thoughts on how crowdfunding works

Crowdfunding is genuinely one of the most popular small business funding options for individual entrepreneurs, go-getters, and innovative thinkers. It creates alternative investment opportunities for many people who can’t or don’t want to raise money for a business venture via traditional financial institutions.

Anyone can pitch to anyone online on crowdfunding sites that serve as the intermediary between the innovators and crowds of private investors.

Indeed, these platforms are saturated with excellent business ideas. Who will get the money? One of the best crowdfunding tips to attract the desired investment is to bring a clear and unique solution to the market.

Share your opinion

Share your thoughts and experiences with crowdfunding in the comments below! Have you ever backed a project that exceeded expectations or encountered a crowdfunding campaign that faced unexpected challenges? Maybe you’ve run a crowdfunding campaign yourself and have lessons learned to share. Your experiences can offer inspiration, tips, and guidance to others navigating the exciting world of crowdfunding. So, don’t hesitate to join the conversation and contribute to the collective wisdom of our community!

.png)

This was very informative, Thank you.

That was a really well written article. Would have liked more info from the contribution side. In other words, how does a person donating funds obtain share in a tangible manner (ie hard copies, electronically v. account established with a financial broker).