As a business owner, you might know that managing a business often requires additional financing. Whether launching a new project or expanding an existing one, proper financing might become a great helping hand, and debt financing is a significant player in this game.

So, I suggest looking at debt financing in more detail, examining its role, advantages, and considerations for businesses seeking essential funds.

Key takeaways

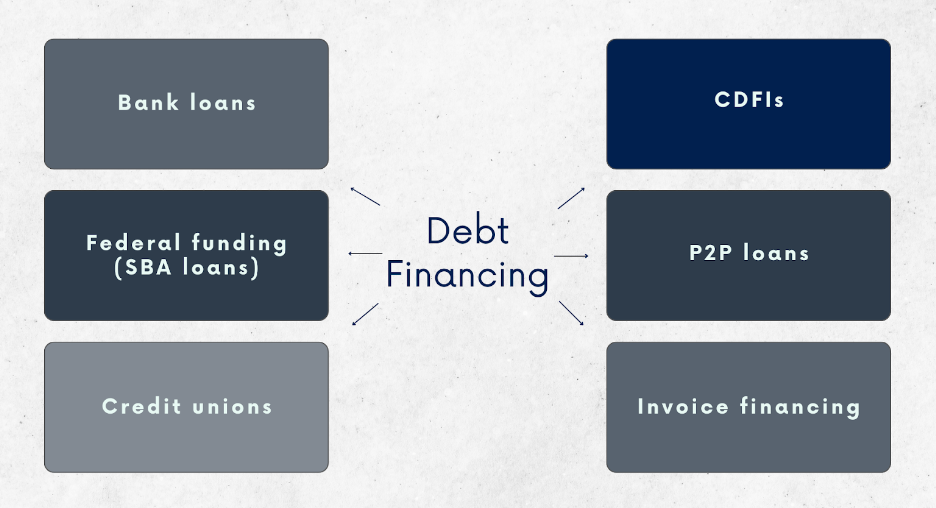

- Debt financing involves businesses borrowing funds, commonly through bank loans, SBA loans, credit unions, etc. These forms differ in structure and sources, providing businesses with various avenues to obtain capital for different needs.

- Debt financing offers businesses the advantage of maintaining ownership and predictable repayment. However, it comes with the drawback of total cost exceeding the initial amount and the obligation to repay regardless of the financial state.

- Accounting for debt financing involves recording the funds received, recognizing interest expenses over time, and tracking principal repayments.

Contents:

1. Understanding business funding, and why you might need it

- Financing option #1 – Bank loan

- Financing option #2 – SBA loans

- Financing option #3 – Credit unions

- Financing option #4 – Community Development Finance Institutions (CDFIs)

- Financing option #5 – Peer-to-peer loans

- Financing option #6 – Lines of credit

- Financing option #7 – Invoice financing (via specialized companies like Stenn, Fundbox, etc.)

- No equity share as an advantage

3. How exactly does debt financing work?

4. Types of debt financing based on terms and repayment structure

- Long-term vs. short-term debt financing

- Secured vs. unsecured debt financing

- The variety of repayment structures

5. The pros and cons of debt financing

6. A look at debt financing accounting

- Scenario #1 – Bank loan for a manufacturing company

- Scenario #2 – Corporate bonds issuance by a telecommunications company

8. Bottom line

Understanding business funding, and why you might need it

Let’s start with understanding business financing, and why you might want to leverage it.

Business funding is the financial support businesses can use to sustain and grow their operations. It involves obtaining money to cover various needs, such as starting a new business, expanding existing operations, managing day-to-day expenses, or addressing financial challenges. Besides, businesses might leverage funding to invest in new technologies, hire skilled personnel, launch marketing campaigns, or enter new markets.

There are different forms of business funding, including equity financing, where businesses sell ownership stakes to investors; debt financing, which involves borrowing money and repaying it with interest; and alternative options like venture capital, angel investors, bank loans, crowdfunding, grants, and self-funding (bootstrapping).

The choice of the means of funding usually depends on factors like the business’s size, industry, and the specific purpose for which one might need funds. Each form of funding has its advantages and considerations, and businesses often use a combination of these sources to meet their financial requirements.

Businesses pursuing financing should focus on accurate accounting as it builds trust with lenders and investors, providing a clear picture of the company’s financial health and aiding in meeting repayment commitments.

Book your seat at a free Synder Weekly Demo to learn how it can help turn your accounting into a single source of truth about your business’s financial performance. You can also go with a 15-day free trial to see whether Synder can address your business needs for accurate accounting across multiple sales channels.

What’s debt financing?

Back to debt financing, it’s one of the forms of financing a business. So, let’s look at it in more detail.

Debt financing is a way for businesses to raise money by borrowing funds, typically from banks or other financial institutions. These institutions issue the funds upon agreement that a business repays the borrowed amount over a specified period and an additional amount known as interest. This interest is essentially the cost of using the borrowed money.

What makes debt financing different from other business funding types is that the business retains ownership and control. Instead, it commits to repaying the borrowed money according to the agreed-upon terms.

The most common forms of debt financing include bank loans, federal funding (SBA loans), credit unions and Community Development Finance Institutions (CDFIs), peer-to-peer loans, lines of credit, and more. Let’s break them down a bit.

Financing option #1 – Bank loan

Bank loans are traditional financing arrangements where businesses borrow a lump sum from a bank and agree to pay it back over time with interest. Banks typically offer short-term and long-term loans, catering to different business needs. The approval process usually involves examining the borrower’s creditworthiness and financial health.

Financing option #2 – SBA loans

Small Business Administration (SBA) loans are government-backed financing solutions that aim at supporting small businesses. These loans offer favorable terms and lower interest rates, making them an attractive option for entrepreneurs who may face challenges obtaining traditional bank loans. Here, the SBA is a guarantor, encouraging lenders to extend loans to small businesses with less stringent requirements.

Financing option #3 – Credit unions

Credit unions are financial cooperatives owned and operated by their members. They often provide business loans at competitive rates. These institutions focus on community-centric finance, offering a more personalized approach than larger banks. While credit unions may have membership requirements, their commitment to supporting local businesses can make them a valuable resource.

Financing option #4 – Community Development Finance Institutions (CDFIs)

CDFIs are organizations that aim to provide financial services to underserved communities. These institutions offer loans to businesses that may face difficulty securing funding through traditional channels. CDFIs play a crucial role in fostering economic development in areas with limited access to financial resources.

Financing option #5 – Peer-to-peer loans

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders. These platforms facilitate loans without the involvement of traditional financial institutions. Businesses can access funding from a network of individual investors willing to lend money based on predetermined terms. P2P lending offers an alternative to conventional financing, leveraging technology to streamline the lending process.

Financing option #6 – Lines of credit

Lines of credit give businesses access to a predetermined amount of funds, allowing them to borrow as needed. Interest is only charged on the amount borrowed, providing flexibility for managing cash flow fluctuations. Lines of credit are suitable for short-term financing needs, such as covering operational expenses or seizing business opportunities when they arise.

Financing option #7 – Invoice financing (via specialized companies like Stenn, Fundbox, etc.)

Invoice financing allows businesses to borrow against the value of their outstanding invoices, providing immediate access to cash instead of waiting for customer payments. Businesses sell their invoices to financial institutions or specialized companies (such as Fundbox, Stenn, Behalf, and more), receiving an upfront advance, typically around 80-90% of the invoice value. When the invoice payment is due, the financing provider collects the full amount from the customer, and the business repays the borrowed funds. Invoice financing is beneficial for addressing cash flow gaps, optimizing working capital, and sustaining operations. It can suit businesses with extended payment terms or fluctuating cash flow patterns.

It’s important to note that all the above isn’t an extensive list of available options. But they’re the most common and frequently used.

Unlike equity financing—another popular business financing tool—debt financing doesn’t require sharing equity, which many consider a great benefit. Equity financing can be helpful for businesses, but it has its risks. When a business sells part of its ownership to investors, the original owners lose some control. This way, they have less say in decision-making and a smaller profit share.

Unlike debt financing, where payments are fixed, equity financing involves sharing profits with investors, which can reduce the earnings for the original owners as the business grows. Debt financing usually offers a transparent and predictable repayment structure, typically with fixed interest rates and a predetermined timeline. This predictability allows businesses to plan and budget more effectively.

At this point, debt financing might be a better choice for a business that aims at maintaining autonomy, controlling costs, and having a straightforward repayment plan.

How exactly does debt financing work?

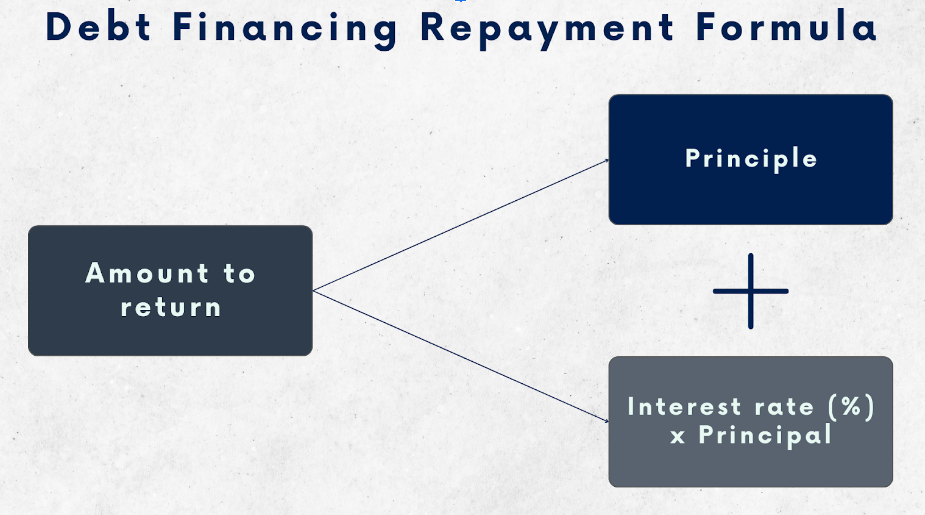

As mentioned, repaying the money acquired under a debt financing agreement involves returning not only the borrowed amount, known as principle. You also pay the interest (the cost of using money). Besides, any debt financing agreement features strict rules (covenants), including provisions in case a business fails to repay the debt (default).

Principal and interest rate

As you’ll have to promise to repay those two things by the agreed date in the future, you might want to have a better grip on each of them.

First comes the principal. It’s the amount of money you’ll get from a lender and repay as agreed. That’s pretty simple so far.

The interest or interest rate (or else nominal rate) is a bit more complicated. It’s an additional charge that the borrower has to pay the lenders for using their assets.

Financial institutions usually don’t lend money for the sake of lending. Business financing is one of the means of earning money for them. They could have invested those in some other venture and gained some profit. Instead, they give funds to your business and lose access to them for the loan period. At this point, the interest is the compensation you pay the lenders for using their money during this period.

After calculating the real interest rate for the period of your loan, they’ll give you a specific percentage of the total amount of the lent money. So you have to repay the principal and this percentage. The amount will vary depending on whether the lender considers you a high or low-risk borrower.

Considering all the above, the formula for your final repayment will look as follows:

Amount to return = Principal + (Interest rate (%) x Principal)

It’s worth noting that, in most cases, the debt interest is tax-deductible.

Covenants and default

In a loan agreement between a lender and a borrower, covenants are the agreed-upon rules that outline the borrower’s responsibilities. Covenants can be negative (restrictive) and positive (affirmative).

Negative covenants

These impose restrictions on the borrower, for example, not taking on additional debt until they fully repay the current loan (and some more). These limitations are in place to protect the interests of the lender.

Positive covenants

These are specific requirements that the borrower must fulfill, like meeting financial obligations, paying taxes, and providing financial statements to the lender. Positive covenants ensure that the borrower is managing its financial responsibilities appropriately.

Default

If the borrower violates these rules, it’s considered a technical default—failure to repay the debt. Lenders typically assess the risk of default beforehand. Some lenders may even request a personal guarantee, adding an extra layer of security to ensure the debt gets repaid. Borrowers must know and adhere to these covenants to maintain good standing with their lenders.

Types of debt financing based on terms and repayment structure

As you can see, debt financing is a loan by nature. However, it may come in various options based on timeframes, purposes, and ways to pay back, offering borrowers a good deal of flexibility. Let’s explore the main types of debt financing, considering the duration and methods of repayment.

Long-term vs. short-term debt financing

Regarding loan duration, you can choose between a long-term and a short-term debt.

Long-term debt

Businesses usually select long-term loans for large investment projects like equipment or buildings. Such loans come with a longer time to pay back. It helps spread the financial load over a more extended period, matching the benefits of these investments.

Short-term debt

As a rule, short-term loans help cover immediate needs like inventory or meeting payroll. While they need quicker repayment, they’re handy for addressing short-term financial challenges and running daily operations.

Secured vs. unsecured debt financing

Depending on the involvement of collateral, you might go with secured or unsecured debt.

Secured debt

In these loans, you provide the lender with collateral, either valuable assets or a personal guarantee. If you can’t repay, the lender keeps the collateral. The advantage here is a higher chance of loan approval due to reduced risk for the lender.

Unsecured debt

Unsecured loans need no collateral, which makes them riskier for lenders. At this point, they usually come with higher interest rates and fees, and people with a poor credit history might find getting an unsecured loan challenging. However, they’re a practical option for those without significant assets.

The variety of repayment structures

Financial institutions may offer businesses various repayment strategies, so you might want to know what they’re about.

Installment loans

As it goes from the name, you repay these loans in installments. They’re the most standard type of loans, with clear repayment terms and fixed monthly payments until the end date. Structured repayment helps businesses manage their cash flow effectively, making installment loans great for growing companies.

Moreover, these loans often have lower interest rates, making them a cost-effective solution for financing long-term projects.

Revolving loans

Revolving loans are a dynamic financing tool, providing ongoing access to a line of credit until you hit a set limit. As you reach the limit, the borrowed amount must be repaid, allowing for further borrowings. Lenders typically check a borrower’s financial statements beforehand to gauge the company’s ability to pay back.

A strong credit history is vital for obtaining and keeping access to a revolving loan. Falling short of lender expectations may lead to a reduction in the maximum loan amount.

Cash flow loans

Cash flow loans offer unsecured funds for working capital needs, such as paying for inventory or payroll, making it most suitable for addressing daily business operations. A business usually repays such loans from their incoming cash flow.

Given its unconventional nature, a cash flow loan undergoes detailed credit analysis. If a lender considers a higher risk of default, interest rates will also be higher. Sometimes, lenders may ask for a blanket lien, establishing a legal interest in the borrower’s assets as collateral.

As you can see, there are many nuances a business might want to know and consider when choosing debt financing as a means of business funding. Knowing those might help decide on the right debt instrument wiser and hence, be a strategic move toward sustained financial health.

The pros and cons of debt financing

While debt financing can be a strategic move for businesses, they might want to weigh the pros and cons before committing to such financial arrangements.

Let’s start with the pros

- Tax deductibility

One significant advantage is that debt payments are often tax-deductible. It means the interest paid on loans can be subtracted from the business’s taxable income, providing potential tax savings.

- Rapid business growth

Debt financing can fuel rapid business growth by providing immediate access to capital. This infusion of funds allows businesses to seize growth opportunities, invest in expansion, or address critical operational needs.

- Sole ownership

Opting for debt financing means you retain full ownership of your business. Unlike equity financing, where you exchange ownership for funds, debt financing allows you to maintain control.

- Building a business credit history

Successfully managing debt obligations contributes to building a positive business credit history. It can be beneficial for securing favorable loan terms in the future.

- No claim to future profits

Unlike equity financing, where investors claim a share of future profits, lenders in debt financing have no such claim. Once you repay the debt, you retain all profits.

- Predictable debt obligations

Debt payments follow a predictable schedule, making it easier for businesses to plan and budget for their financial commitments.

Shall we proceed with the cons?

- Total cost exceeds initial amount

While debt financing provides immediate funds, the total cost paid back, including interest, often exceeds the initial borrowed amount. This cost is what one should carefully consider when evaluating financing options.

- Repayment, regardless of the financial state

Regardless of the business’s financial state, they must repay the debt. This obligation persists even during challenging times, so a company planning on debt financing might want to assess its repayment capacity.

- Risky for small businesses

Debt financing can be risky for small businesses, particularly those with inconsistent cash flow. Meeting regular debt payments may become challenging during lean periods, potentially leading to financial strain.

- Collateral requirement

Most debt financing options require collateral, which poses a risk of asset seizure in case of default. Businesses might want to factor in the impact on their operations if collateral is at stake.

- Negative covenants

Lenders often impose negative covenants, restricting businesses from pursuing certain activities or alternative financing options. These limitations can constrain business flexibility.

A look at debt financing accounting

When a company acquires funds through debt financing, it should reflect it in accounting. The process involves several steps to record and manage the financial transactions. Here’s a simplified breakdown of it.

Step #1 – Initial recording

The first step is to record the initial receipt of funds. It involves recognizing the increase in cash or a similar asset account on the balance sheet, representing the amount borrowed. A corresponding liability account, often named “Notes Payable” or “Bonds Payable,” is created on the balance sheet to represent the obligation to repay the borrowed amount.

Step #2 – Interest expense recognition

As time passes, the business incurs interest expenses on the outstanding debt. The interest is an additional cost for using the borrowed funds. Usually, they record interest expense on the income statement, and the interest payable is adjusted on the balance sheet to reflect the accrued but unpaid interest.

Step #3 – Principal repayments

When it’s time to repay the principal amount, you reduce a portion of the liability (Notes Payable) on the balance sheet. You also record the repayment as a decrease in cash or the asset used to repay the debt.

Step #4 – Amortization of fees and costs

Sometimes, fees or costs can be associated with obtaining the debt (such as loan origination fees, for instance). You might want to amortize those over the life of the debt. The amortization expense is recorded on the income statement, spreading the cost over the debt’s duration.

Step #5 – Periodic reporting

Financial statements, including the balance sheet, income statement, and cash flow statement, are prepared periodically to reflect the ongoing impact of debt financing on the company’s financial position and performance.

Proper accounting for debt financing is business-critical, as it ensures accurate financial reporting and compliance with accounting standards and grants transparency to stakeholders. The steps above, as mentioned, are a simplified picture of this complex process. Usually, businesses engage with professional accountants or financial experts to account for debt financing correctly.

Debt financing examples

Before we’re done, let’s look at how all the above works in a couple of examples. We’ll look at two scenarios: a small manufacturing business that needs funding expansion and a telecommunications business seeking financial help for R&D.

Scenario #1 – Bank loan for a manufacturing company

So, here’s a small manufacturing company wanting to expand its operations by investing in new machinery. To fund this expansion, the company approaches a bank for a loan.

Debt financing process

The bank evaluates the company’s creditworthiness, financial health, and the purpose of the loan. If approved, the bank provides a lump sum amount as a loan. The company records this increase in cash on its balance sheet. It also creates a liability account (e.g., “Bank Loan”) representing the obligation to repay the borrowed amount.

Repayment

Over the agreed-upon term, the company makes periodic payments, including principal and interest. These payments are recorded in the company’s financial statements until they fully repay the loan.

Scenario #2 – Corporate bonds issuance by a telecommunications company

Another scenario is a large telecommunications company that needs significant capital to invest in the new technology development. Instead of taking out a traditional bank loan, the company issues corporate bonds to raise funds from the public.

Debt financing process

The company issues bonds with a predetermined face value, interest rate, and maturity date. Investors purchase these bonds, providing the company with the necessary funds. The company records the cash received and creates a liability account (e.g., “Corporate Bonds Payable”) to represent the debt.

Interest payments and principal repayment

The company makes periodic interest payments to bondholders based on the agreed-upon interest rate. When the bonds mature, the company repays the principal amount to the bondholders. The company records these transactions in the financial statements.

Bottom line

Long story short, debt financing opens many opportunities for growth and development. It offers various advantages, such as immediate access to capital, sole ownership retention, and potential tax benefits. However, businesses must tread carefully, considering potential pitfalls like the total cost exceeding the initial amount and risks for those with inconsistent cash flow.

Accurate accounting and effective financial management are instrumental in successfully obtaining and handling debt financing. Those build trust with lenders, providing a clear financial picture for investors.

This way, leveraging the opportunities that debt financing offers and prudent financial practices, businesses can pave the way for sustainable growth and resilience.

Lean more about business financing:

- Introduction To Business Financing

- How to Prepare Your Business for Financing

- Equity Financing

- Debt Financing

- Grants

- Crowdfunding

Share your thoughts

Have you ever thought about funding your business, or maybe you’ve tried debt financing? Share your experience in the comments section below. We love great stories!

.png)

This blog post on debt financing provides a comprehensive overview of this important topic. It covers various aspects of debt financing, including its definition, types, benefits, and potential risks. The information provided is well-organized and easy to understand, making it a valuable resource for business owners and individuals seeking financing options. Thank you to the author for sharing this insightful article and shedding light on the intricacies of debt financing!

Thanks for stopping by, Dawn! Glad you find the article usefull and appreciate your comment.