This blog is a part of a series dedicated to the most popular ecommerce marketplaces’ payment solutions. Click here if you want to check out more.

As a wise business owner, you can’t overestimate the power of selling on Etsy, especially if selling in particular niches. The platform can connect you with an extensive pool of customers, allow for setting up and promoting your store, providing all the necessary tools, including those for accepting payments. So, it’s highly likely Etsy is a part of your business. Meanwhile, you might as likely have PayPal for receiving payments with your other sales channel and might want to offer this option to your Etsy customers.

Can you do it, and how does the Etsy PayPal combination work in this scenario? Let’s figure it out!

Record your PayPal transactions with the details provided by Etsy in accounting and get a full picture of your sales, product and customer trends, and business performance.

Contents:

1. How do you get paid on Etsy: introducing Etsy Payments (former Direct Checkout)

4. PayPal alternatives for Etsy

5. How to easily account for Etsy and PayPal transactions (Synder example)

Key takeaways

- Etsy Payments, mandatory since 2017, centralizes payment processes for eligible sellers, handling tasks like payment acceptance, processing, and fund transfers directly to sellers’ bank accounts.

- Etsy Payments offers buyers various payment methods, including credit/debit cards, Etsy Gift Cards, Apple Pay, Google Pay, PayPal, and Klarna financing, enabling sellers to cater to diverse customer preferences.

- Integrating accounting software facilitates efficient tracking and management of Etsy and PayPal transactions, providing accurate financial reports and aiding in better financial decision-making for online businesses.

How do you get paid on Etsy: introducing Etsy Payments (former Direct Checkout)

We start by mentioning that Etsy provides its native payment processing service called Etsy Payments. It became a primary and obligatory payment processing option for all Etsy sellers in eligible countries starting May 17, 2017. However, it hasn’t been something new but rather a rebranding of Etsy’s Direct Checkout. The difference is Direct Checkout was an option sellers might or might not have chosen to go with, and Etsy Payments is, again, obligatory (to the extent that you can’t set up your Etsy story if you’re not eligible for Etsy Payments).

Sellers enroll in the program and, as a result, let Etsy tackle all the procedures related to accepting, and processing payments, transferring money between bank accounts, dealing with payment providers, handling disputes and chargebacks, etc.

In other words, this system serves as a unified gateway through which merchants receive money directly to their business bank account, regardless of the payment method the buyers used.

Related:

- Exploring Etsy Payments: A Comprehensive Guide to Seamlessly Transacting on Etsy

- How to Start Selling on Etsy: Tips to Sell on Etsy Successfully

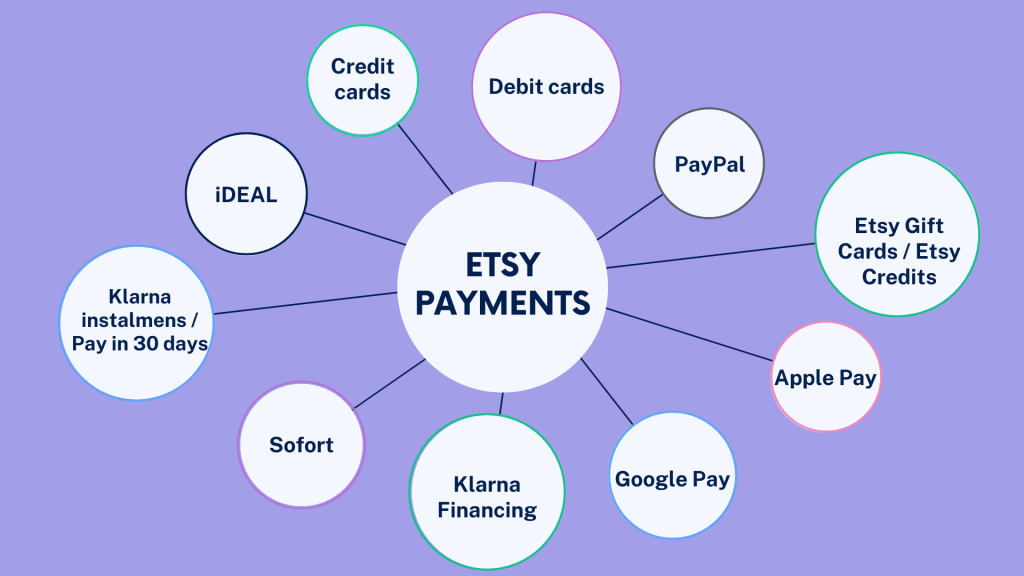

Payment methods Etsy Payments offer

And it’s worth saying that there’s a plethora of methods you can provide your customers within Etsy Payments. Just look at those.

- Credit cards;

- Debit/bank cards;

- Etsy Gift Cards and Etsy Credits;

- Apple Pay;

- Google Pay;

- PayPal;

- Klarna Financing (United States);

- Klarna installment payments (Australia, Canada, Spain, United Kingdom, US);

- Klarna Pay in 30 days (Germany, Netherlands, Sweden, Austria, Switzerland, Denmark, Finland, and Norway );

- iDEAL (the Netherlands);

- Sofort (Austria and Germany).

As you can see, some of the payment methods might differ from country to country, but in general, the list is quite extensive, and we’ll look at some of them in more detail a bit further on.

How does it work?

Whichever way a customer pays for your goods on Etsy, the money will go to your Etsy Payment account. From there, you can manage deposits to your bank account or, in certain countries, Payoneer account, enable or disable available payment methods, etc.

Let’s take a quick look at how it all works within Etsy Payments.

As mentioned, Etsy is the default payment processing option. That’s to say that when you’re creating your store, setting up Etsy Payments is a part of the process.

Setting up deposits

You provide your bank account details and set up bank deposit schedule to let the service know how often you want your funds transfered to the bank from your Etsy Payments account. Typically, you can choose from daily, weekly, biweekly, or monthly deposits. The specific timing and frequency of deposits may differ based on your location and other factors.

Setting up payment methods

During the setup of Etsy Payments, you have all available payment methods included within Etsy Payments enabled by default. However, Etsy usually allows sellers to customize their accepted payment methods, switching this or that option on or off if desired.

To do so, you might want to go to the Finance section of your Shop Manager and select Payment Settings. There, you can find a list of all available payment methods and deactivate or reactivate them according to your preferences. You can do it pretty simply using the toggle switch.

This way, you can customize the checkout experience for your customers and tailor your payment methods to suit your business’s needs.

Getting paid via PayPal

As you may have noticed, PayPal is one of the payment methods available within Etsy Payments. There’s no mistake – PayPal is integrated into this payment processing system as one of the options. And that’s the primary way of using it on Etsy. Sometimes – in a few rare cases – you can use standalone PayPal as the payment option alongside Etsy Payments. Let’s look at the difference.

What is integrated PayPal?

In countries where PayPal is available, sellers can receive funds from PayPal purchases directly into their Etsy payment account. There’s no need to manage a separate PayPal business account. And even if you don’t have a PayPal account, you can allow your customers to pay for your goods via PayPal. If you have a PayPal account, you can link it to your Etsy Payments, but that won’t change the fact of processing your transactions through Etsy.

The standard Etsy Payments fee applies to orders that go through integrated PayPal, with no additional PayPal fee.

What is standalone PayPal?

As mentioned, on some rare occasions, Etsy might allow sellers to use a standalone PayPal account to process customer payments via PayPal. Etsy does it at its discretion for some markets where there’s no requirement to use Etsy Payments. That’s to say that this option isn’t guaranteed. Still, we’ll look at it real quick.

As mentioned, on some rare occasions, Etsy might allow sellers to use a standalone PayPal account to process customer payments via PayPal. Etsy does it at its discretion for some markets where there’s no requirement to use Etsy Payments and, sometimes, for sellers from countries eligible for Etsy Payments, but temporarily. That’s to say that this option isn’t 100% guaranteed. Still, we’ll look at it.

For sellers accepting standalone PayPal, the difference is you receive funds from PayPal purchases directly into your PayPal account. You also have to pay PayPal fees for processing these transactions.

It’s also worth mentioning that Etsy takes responsibility for resolving disputes and chargebacks for sellers. It’s a convenient way, as a business owner doesn’t have to spend time gathering and providing the correct sales data to the banks. However, this protection doesn’t cover your transactions processed with standalone PayPal.

Processing fees and taxes

Each time a buyer uses Etsy Payments, a seller has to pay a fee for processing this payment. Therefore, if the credit card (or any other method, including PayPal) processing happens through Etsy Payments, the seller pays a payment processing fee being the percentage of the total amount of the item sold (including shipping and applicable taxes) plus a flat rate fee. The percentage and the flat rate may vary based on the location of a seller’s bank account.

The percentage part varies from 3 to 6.5% of the total sale amount, and the flat rate is different for different countries and is calculated in the native currency.

- For US sellers, Etsy Payments processing fee is 3% + 0.25 USD;

- For Canada, it makes 3% + 0.25 CAD for domestic orders and orders from the US and 4% + 0.25 CAD for international orders;

- For the UK, you have the fee equal to 4% + 0.20 GBP.

Other fees you deal with as a seller

So, you get the idea – sellers from different countries pay different fees for payment processing. But those are just part of the fees you pay when selling on Etsy, and we’ll touch upon some other fees real quick.

Deposit fees

Usually, you don’t have to pay anything for depositing money into your bank account. However, in some cases, if the amount you’re depositing falls below certain thresholds, especially in specific markets, a deposit fee may apply. This fee is deducted from your Available Funds and is reflected in your payment account when your scheduled deposit is made.

Listing fees

You’re listing a product when you add it to your shop, regardless of any sales made. The standard flat charge is $0.20 USD per listing. Etsy also gives you several options: automatic renewal once an item is sold, multi-quantity listing, or even private listing so that you can tailor them to your needs. Each of those additional listings is covered by the same standard fee of $0.20 USD per listing, so for multiple items sold, the respective amount of fees is being debited.

Transaction fees

Etsy transaction fee is based on the order amount of the items sold. It’s 6.5% of the total order amount which is calculated based on all costs of the item (including shipping and gift wrapping, if applicable) and shown in the currency that the listing was made in.

Related:

Etsy Seller Fees: The Ultimate Etsy Fees Guide. What Percentage Does Etsy Take in 2024

How is tax paid with a seller account?

As an Etsy seller, you might want to ensure calculating, filing, and paying your taxes.

Etsy may calculate, collect, and remit sales tax on your behalf based on applicable tax laws. It determines the sales tax rate based on the shipping address and sends the collected taxes to the respective state authorities.

However, this may only apply to specific states. In other cases, you are responsible for figuring out applicable sales tax rates and setting them up in your account. The setup requires several steps:

- In Shop Manager, you go to Finances and select Payment Settings.

- There, you locate and click on the Sales Tax tab.

- You might want to select the US state (or Canadian province) for which you’re setting up sales tax rates and enter the zip code or postal code (for Canadian provinces) that corresponds to the location where your business is based.

- Next, you input the tax rate to charge for the selected location in decimal format.

- The last thing you do is save your changes to apply the sales tax rate for the selected location.

If you reside outside the US, ensure that taxes are displayed appropriately according to guidelines set by the government. Classify your products accurately on Etsy or other sites to place the appropriate taxes on specific product groups. You might want to consult an accountant to learn the rules applicable in your country of residence.

Related:

Etsy Taxes: A Quick Etsy Tax Guide for Sellers

PayPal alternatives for Etsy

As previously mentioned, Etsy offers a variety of payment options to make it easier for its merchants to get paid online. As has been already said, PayPal is the most popular payment option on Etsy, but there are alternatives, and we promised to get beck to them.

So, let’s take a look at what they are.

Credit and debit cards

With Etsy Payments, sellers can accept payments from a wide range of major credit card issuers, including well-known cards such as Visa, Mastercard/Eurocard, Discover, American Express, and Carte Bleue (which is particularly popular in France).

A customer, therefore, can pay using any of these major credit cards. During checkout, they enter their card details, and Etsy securely processes the payment using its payment processing system.

Etsy Payments ensures a smooth and secure transaction process for a seller and buyer.

Etsy Gift Cards and Etsy Credits

Etsy Gift Cards and Credits are payment methods available for buyers to purchase on Etsy. Let’s look at what they are and how to get paid via these solutions.

Etsy Gift Cards

Etsy Gift Cards are typical gift cards you can meet with other services. They are prepaid cards purchased from a service provider (Etsy, in this scenario) that one can use to buy goods from Etsy sellers. Sellers can accept payments via Etsy Gift Cards by simply enabling them as a payment option in their shop settings. Upon getting a payment with an Etsy Gift Card during checkout, Etsy Payments processes it as any other payment transaction, and the funds get into the seller’s Etsy Payments account.

Etsy Credits

Etsy Credits are virtual currency Etsy issues to award customers as returns, refunds, or promotions. If a seller enables Credits as a payment method, people can use them to buy things from them. Etsy Payments processes the Credits transaction by deducting the equivalent amount of credits from the buyer’s Etsy account balance and placing the corresponding amount into the seller’s Etsy Payments account the same way as any other transaction.

Apple Pay

Etsy sellers can include Apple Pay as a payment option for buyers, offering a convenient and secure way to purchase. It allows the latter to swiftly finalize their transactions using their Apple devices, like iPhones or iPads, without the hassle of manually entering credit card details. This process makes a seamless payment experience and maintains security through tokenization, which replaces sensitive card information with a unique identifier for each transaction.

For sellers, integrating Apple Pay into Etsy Payments can improve the payment receiving process and increase the likability of purchase, as customers can conveniently complete transactions right from their mobile device and with minimal effort from their side.

Google Pay

Sellers can enable Google Pay as a payment method within Etsy Payments to expand their buying audience to Android device users, offering them a convenient and efficient way to make purchases using their mobile phones or devices or Google Chrome browser.

Google Pay eliminates the need for manual credit card entry, thus enhancing the overall shopping experience for customers.

For sellers, integrating Google Pay into their Etsy shop allows for secure processing of transactions through Etsy Payments, ensuring prompt receipt of funds. Offering Google Pay as a payment option can help sellers increase sales and conversion rates due to a smoother and more enjoyable shopping experience for buyers.

Buy now, pay later: Klarna

Another payment option that’s available to Etsy sellers and is definitely worth mentioning is Etsy’s partnership with Klarna.

It’s a payment provider that, in selected countries, offers specific buy-now-pay-later payment schedules:

- Klarna Financing (US);

- Klarna installment payments (Australia, Canada, Spain, United Kingdom, US);

- Klarna Pay in 30 days (Germany, Netherlands, Sweden, Austria, Switzerland, Denmark, Finland, and Norway).

Under Etsy Payments, there’s no necessity for merchants to have a Klarna account to use this solution.

Buyers can pay for certain items in a few installments after the purchase. Here are the options available in the US:

- 4 interest-free installments for orders totaling between $50 and $250 after discounts, and before shipping and tax. With this option, buyers can pay the first installment when checking out on Etsy, and afterward, 1 installment every 2 weeks, until the whole amount due is paid. There’s no interest fee on this payment schedule, as long as all payments are made on time.

- Klarna financing is a monthly schedule with interest for orders totaling between $250.01 and $10,000 after discounts and before shipping and tax. Klarna will determine payment schedule options and an interest rate based on the order total and a credit check assessed by the provider.

What’s good for merchants is that this solution gives more chances to catch clients while they’re hot and close the deal. Customers can purchase goods when they have fallen in love with them, even if they don’t have the whole budget right away.

How to easily account for Etsy and PayPal transactions (Synder example)

As you can see, Etsy Payments simplifies accepting payments by various methods, including PayPal, as you can manage them under the same roof through a single dashboard. This way, it’s easier to account for sales transactions, having a single source to record them from.

However, as an ecommerce business, you may sell on other marketplaces or have a standalone web store. PayPal can be a payment option for these sales channels, but it will be a separate account where you manage your sales data. In terms of accounting, it bears a huge risk of duplicates and inaccuracies in records.

Synder is accounting automation software for online businesses that integrates all your sales sources with accounting, saving you from dealing with multiple integration apps and the havoc they may cause to your books (accountants here can relate, I think). It supports 30+ systems, including Etsy, PayPal Stripe, Amazon, eBay, Shopify, and many more.

Want to easily integrate Etsy and PayPal with accounting and automate a good chunk of accounting tasks and reconciliation? Get hands-on experience of using Synder during a 15-day free trial and book a seat at our Weekly Public Demo for a guided tour by our support team.

But that’s not the biggest virtue of such solutions. They come with some brain, let’s say, allowing for more amazing and helpful automated workflows. Let’s break them down real quick on the example of Synder.

- Synder simplifies tracking withheld taxes from your sales channels, ensuring their accurate recording in the books. This feature helps manage tax liabilities and facilitates reconciliation by recording expenses correctly.

- By connecting PayPal and other sales channels to Synder, users can seamlessly sync all transaction data to their accounting, like QuickBooks, Xero, or Sage Intacct, ensuring comprehensive sales tracking across various platforms, including Etsy, for accurate financial analysis and reporting.

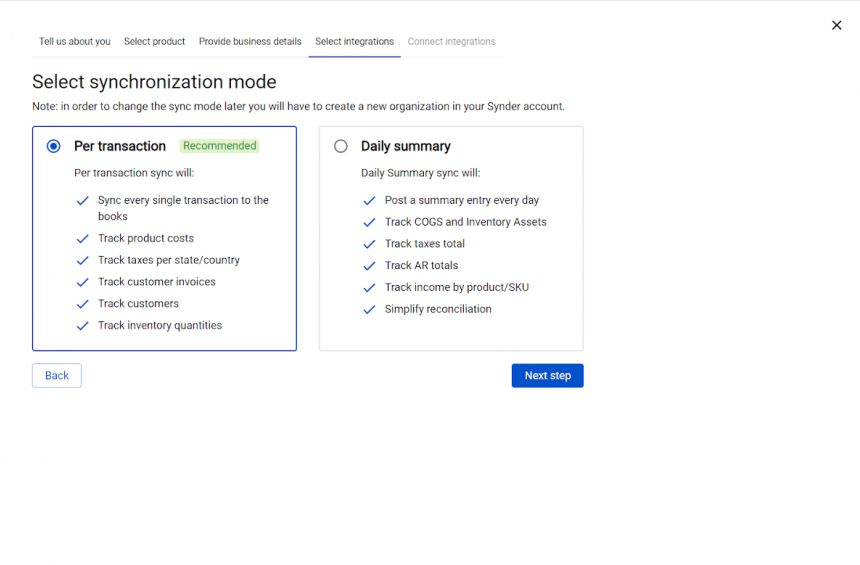

- Synder offers per-transaction and daily summary sync options, catering to different business needs. Per-transaction syncing provides detailed records, while daily summary sync is suitable for managing a large volume of transactions by batching them and synching in daily amounts, leaving unnecessary details aside.

- With SOC 2 Type 2 Certification, Synder ensures robust data security and compliance, safeguarding sensitive financial information during transfer between platforms like Etsy and QuickBooks.

- Synder captures granularly detailed accounting data not for the sake of capturing. It enables users to generate comprehensive profit and loss (P&L) and balance sheet reports for their business. For example, it might include income and expense details from Etsy, Etsy Payments, and other connected payment gateways, facilitating accurate financial analysis.

- You have real-time recording of ongoing transactions in the books, ensuring an up-to-date overview of financial performance.

- Synder simplifies reconciliation by reviewing all transactions from connected platforms, minimizing discrepancies, and aiming for a zero balance difference during the reconciliation process.

- Synder allows you to create custom rules for automating tasks like categorizing products and tracking income or expenses, reducing your manual efforts and improving your accounting processes.

- You can track inventory levels accurately, ensuring optimal stock levels and minimizing the risk of overstocking or running out of inventory.

- For multi-currency transactions, Synder synchronizes them with precise exchange rates, ensuring accurate recording of payments in their original currency and conversion into the preferred home currency in the books.

Setting up you ecommerce accounting integration

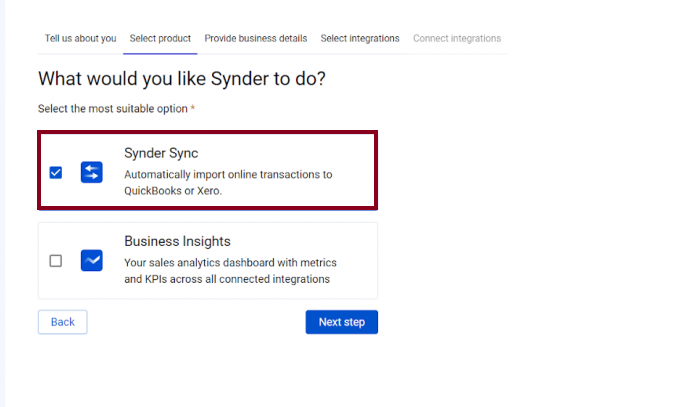

I want to show you how you can build your Etsy and PayPal integration with QuickBooks to demonstrate how Synder handles setting it up. But again, it works for any other configuration you might have for your business.

Signing up

It all starts with creating your account in Synder. You can do this right from Synder’s website homepage (or any integration page) by clicking the Sign up free button.

Why free? You have a 15-day free trial, allowing you to experience the functionality in full swing and decide what you might want to have and what might be unnecessary. Overall, this period is quite enough to understand whether the solution addresses your needs and does it the way you like it.

At this point, you can choose which product to go with for your integration, namely Synder Sync or Synder Insights, or you can choose both.

- Synder Sync is a connector that allows you to sync transactions from Etsy to QuickBooks.;

- Synder Insights is an analytics tool that allows you to monitor important metrics for your ecommerce business.

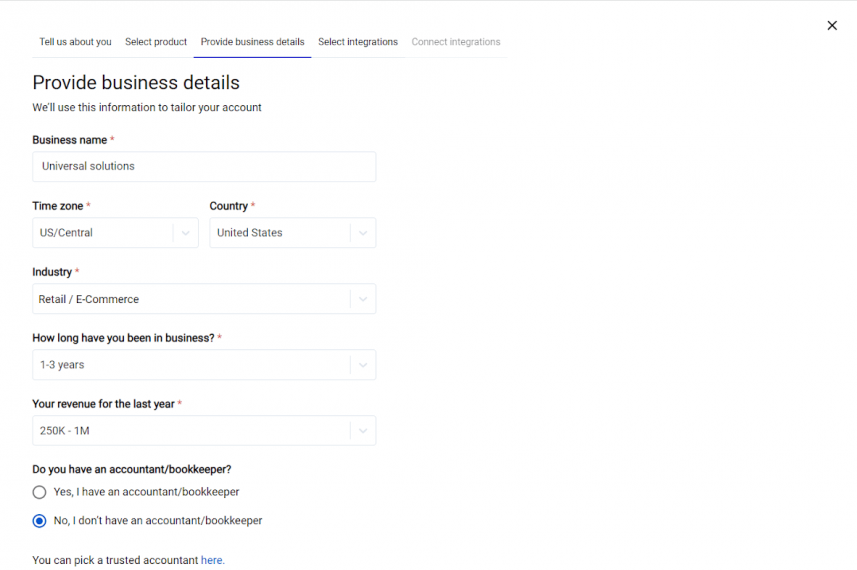

Creating your organization (account)

At the following step, you’ll provide your business data, such as name, your country, industry, etc. to create your business account (or how ir called in Synder – organization). The process is pretty simple – you need to fill in the corresponding fields and you;re good to go.

Selecting the platforms to integrate

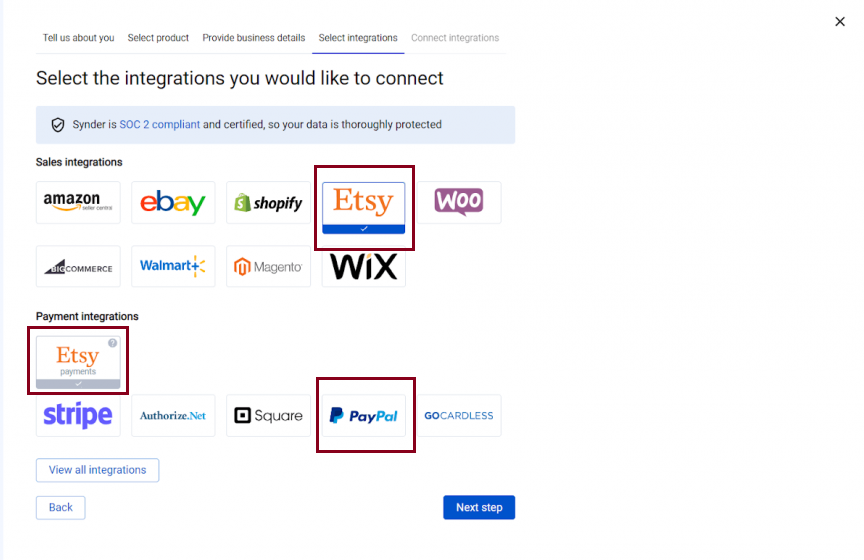

Now, you get to the point where you can connect all your sales channels, like your marketplaces (Etsy, in this example), your PayPal, or any other platforms your business deals with. It’s woth noting that you always can return to this step in your account setting and add additional platforms or remove those you stopped using for some reason.

Tick everything you want to add, and move on.

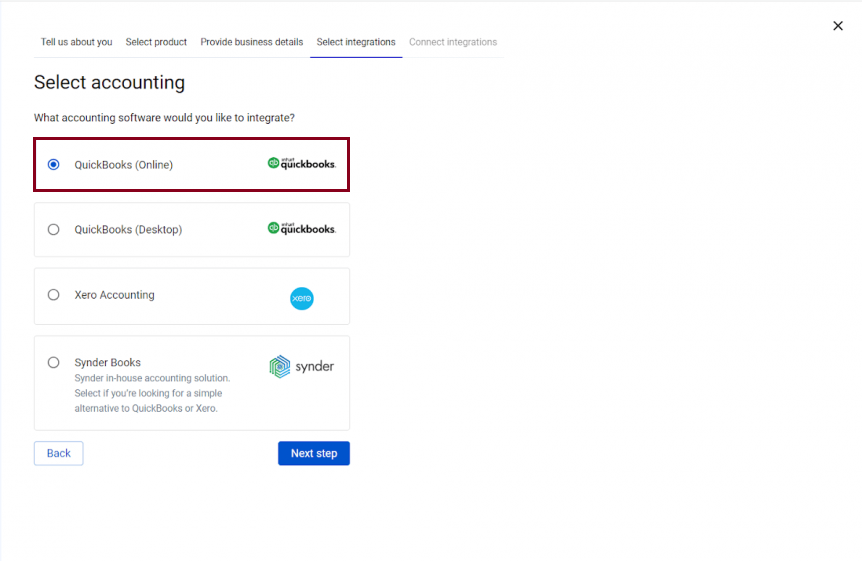

Connecting your accounting and choosing sync mode

It’s a pre-final step, at which you need to choose your accounting system from the list of available options and decide on how you want your transactions to get to your books – detailed or batched in daily summaries.

You can select any of the available third-party accounting systems or go with Synder’s native solution called Synder Books.

As mentioned, another choice you make here is whether you want transactions synchronized one by one with all the tiny details or as a single daily total of transactions. You might want to be careful with the decision, as it’s something you can’t change.

At the final step, you need to permit Synder to connect all the chosen platforms. It will allow you to do it one by one, and when done with that, it’ll finalize the setup for you. And so, you can start bringing transactions from all your sales channels to the books, accurately categorize them, and have ready for analysis, reconciliation, and taxation matters.

It’s worth noting that you’re never alone in this journey, as Synder’s support team always covers your back, so you can turn to them should any issue occur or a question pop up. They’re available 24/7.

Bottom line

The variety of payment options adds more flexibility and bigger revenue potential for an e-commerce business.

Modern marketplaces, such as Etsy, offer a variety of solutions for merchants to accept payments online. They partner with the most popular payment providers, for example, PayPal and Klarna, debit and credit card issuers, such as Visa, MasterCard, and American Express, and produce in-home solutions like branded Gift and Credit Cards.

To make payment processing simpler and more secure, Etsy offers a unified payment gateway for all merchants called Etsy Payments. It helps merchants get paid without having to deal with any of the separate payment processing platforms directly.

Marketplaces’ payment policies keep evolving during this time. Having trustworthy software like Synder for all your merchant payment data and accounting in one place is the key to the financial success of your online business.

Share your thoughts

Feel free to share your thoughts in the comments! We’d love a good discussion.

.png)