Known for its unique handmade products for sale, Etsy can impress not only the buyers but the sellers as well. While buyers check the product lists, sellers explore the depths of marketplace settings and features to get the most from selling on Etsy. And what can be more stressful than the work with finances?

Only work with finances when you need to manage everything yourself manually. Luckily, Etsy has hacked the system and created the solution—Etsy Payments—that has everything a seller might need at the very beginning of their journey on the platform.

So what’s so special about Etsy payments with Etsy Payments? Let’s find out.

Key takeaways:

- Etsy Payments integrates multiple payment options such as credit and debit cards, PayPal, Klarna, and more, providing an all-in-one solution for easier management.

- All sellers are required to enroll in Etsy Payments unless it’s unavailable in their country.

- Sellers using Etsy Payments must be aware of the fees involved, including payment processing, currency conversion, and potential deposit fees.

- While Etsy Payments centralizes and simplifies transaction management, sellers might still need additional tools for complete financial tracking and accounting.

Contents:

1. What is Etsy Payments, and how does it work?

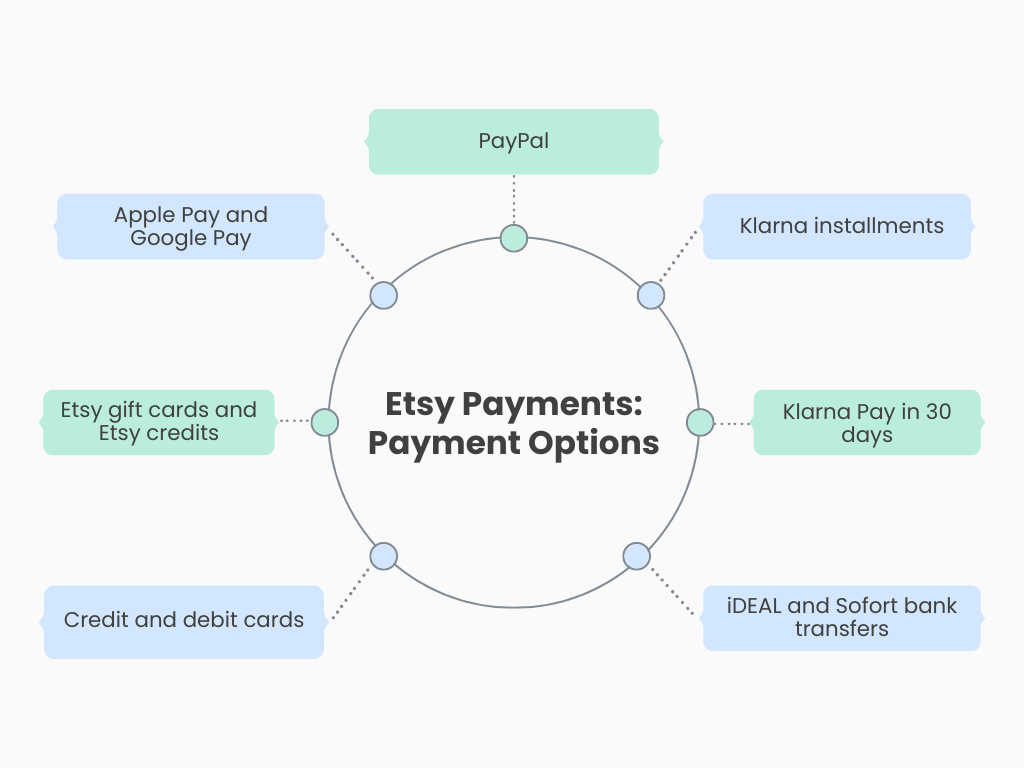

2. What are the Etsy payment options?

- Credit and debit cards

- Etsy gift cards and Etsy credits

- Apple Pay and Google Pay

- PayPal

- Klarna installments

- Klarna Pay in 30 days

- iDEAL and Sofort bank transfers

3. What are the requirements for Etsy Payments?

5. Ecommerce accounting: Managing finances on Etsy

6. What are the benefits of Etsy Payments from an Etsy sellers perspective?

What is Etsy Payments, and how does it work?

The answer is pretty simple:

Etsy Payments is the primary way for sellers to accept payments through Etsy. There is a list of payment methods—we’ll look through them in the following sections—supported under Etsy Payments. A so-called all-in-one solution if you’d like.

- For Etsy shoppers, there are still options to choose from.

- For Etsy sellers, there is no need to struggle with all the payment platform management since Etsy keeps the records from all options in one system – Etsy Payments.

However, a very obvious question may arise: “Can I sell on Etsy without Etsy Payments?”

No. Enrolling in Etsy Payments is a mandatory step when opening an Etsy Shop. Of course, there are exceptions for the countries where Etsy Payments isn’t available*, but overall, without Etsy Payments, you, as a seller, won’t be able to sell on the platform.

* – If you live in a country where Etsy Payments isn’t available (Argentina, Chile, China, India, Japan, Peru, Thailand, and Ukraine), you’re required to sign up for Etsy Payoneer.

So, as you can see, Etsy Payments gives sellers opportunities and limits them at the same time. Sounds controversial, right?

Now, let’s get into more details of what Etsy Payments offers to the sellers and find out whether it’s worth it.

→ Learn how to start an Etsy business from scratch.

Etsy Payments: What are the Etsy payment options?

When the Etsy shop is enrolled in Etsy Payments, the marketplace allows sellers to accept payment by:

- Authorized credit and debit card transactions;

- Etsy Gift cards and Etsy credits;

- Apple and Google Pay;

- PayPal (where available);

- Klarna installments (Australia, Spain, U.K., U.S.);

- Klarna Pay in 30 days (Germany, Netherlands, Sweden, Austria, Switzerland, Denmark, Finland, Norway);

- iDEAL bank transfers (Netherlands);

- Sofort bank transfers (Austria and Germany).

Once the transaction is completed, the funds are reflected as a balance in a seller payment account on Etsy, which then can be deposited into a seller’s bank account.

The list of Etsy payment options already looks impressive, but let’s break it down and check each of the payment methods in more detail.

#1. Credit and debit cards

This one is a fundamental option of any online marketplace.

Etsy accepts most major credit issuers, among which are:

- Visa;

- Mastercard/Eurocard;

- Diners Club;

- Discover;

- American Express;

- JCB.

Transactions are processed on Etsy’s platform, utilizing encryption and security protocols to protect card information.

#2. Etsy gift cards and Etsy credits

Etsy also allows sellers to accept Etsy gift cards or Etsy balance credits as a form of payment. This option will work only for shoppers with an Etsy account.

Note for buyers: The option to pay with balance credits will be automatically selected. If you don’t want to use it, deselect it before purchasing.

#3. Apple Pay and Google Pay

These are some more familiar payment options.

Apple Pay is available as a payment option for iOS users, and Google Pay – for Android users. These payment methods work regardless of the device used.

#4. PayPal payment

Now things are getting more complicated yet interesting.

First of all, it’s important to understand that Etsy supports two versions of PayPal:

- As an integrated platform;

- As a standalone solution.

The whole workflow will differ depending on the option you choose to provide your buyers with. I suggest we go into more detail for each case.

a. Integrated PayPal

When choosing an integrated PayPal option, you’ll receive the money from PayPal payments directly into your Etsy payment account. There is no need to manage a separate PayPal account.

Moreover, there will be no additional PayPal fee, only the standard Payment Processing fee set by Etsy Payments.

→ Learn how to easily record PayPal fees into the accounting software.

b. Standalone PayPal

“Standalone PayPal exists for sellers in countries that are not yet eligible for Etsy Payments and/or, in Etsy’s discretion, in some markets where it’s not an Etsy requirement to use Etsy Payments.” – Etsy Payment Policy

In this case, you’ll receive sales funds from PayPal purchases directly into your PayPal account. You’ll also be charged additional PayPal fees for payment processing.

This option is not available if:

- You don’t have an active Etsy shop account;

- Etsy Payments is available in your country.

Note: Such orders won’t be covered by Etsy’s Purchase Protection program for sellers.

→ Read more about accepting payments on Etsy with PayPal and its alternatives.

#5. Klarna installments

Available in: Australia, Spain, the United Kingdom, and the United States.

As for the U.S., with Klarna installments, buyers can split the cost of their purchases into 4 smaller, manageable payments completed over time. The first payment is made after the Etsy order confirmation. The rest are automatically paid every 2 weeks.

For Etsy sellers, Klarna doesn’t charge fees; only Etsy’s standard payment processing fee applies. In your shop account, you can view the order in the same way you would with any other payment method.

Note: The terms and conditions may vary per country, so it’s better to check Klarna’s policy for your particular region before implementing this Etsy payment option.

#6. Klarna Pay in 30 days

Available in: Germany, the Netherlands, Sweden, Austria, Switzerland, Denmark, Finland, and Norway.

This payment option allows buyers to order and receive goods without immediately paying for them. The invoice issued by Klarna gives buyers up to 30 days to pay.

If you, as an Etsy seller, complete the order within 21 days of checkout, Klarna sends the payment instructions to the shopper 5 days after the completion date.

#7. iDEAL and Sofort bank transfers

Available in: iDEAL bank transfers in the Netherlands, Sofort bank transfers in Germany and Austria.

If you’re selling on Etsy within the mentioned countries, you can offer these payment options to provide shoppers with more options. There is nothing extra here; these are just bank transfers.

What are the requirements for Etsy Payments?

So far, the options for sellers sound good, but to try them out, you first need to enroll. And to enroll in Etsy Payments, you must meet specific requirements that ensure your account is set up correctly and complies with Etsy’s policies.

You must have:

- A residential address and a valid bank account in an eligible country;

- A valid credit, debit, or reloadable prepaid card (unless you’re in Austria, Germany, or the Netherlands).

If everything is alright with these two requirements, you can proceed to the next step: creating the account. You’ll need to:

- Choose the Individual or Business account (for legal and tax purposes);

- Verify your identity;

- Verify your bank account.

After that, you’ll have access to Etsy Payments account.

Note: For Payoneer users, you’ll verify your bank account while setting up Payoneer.

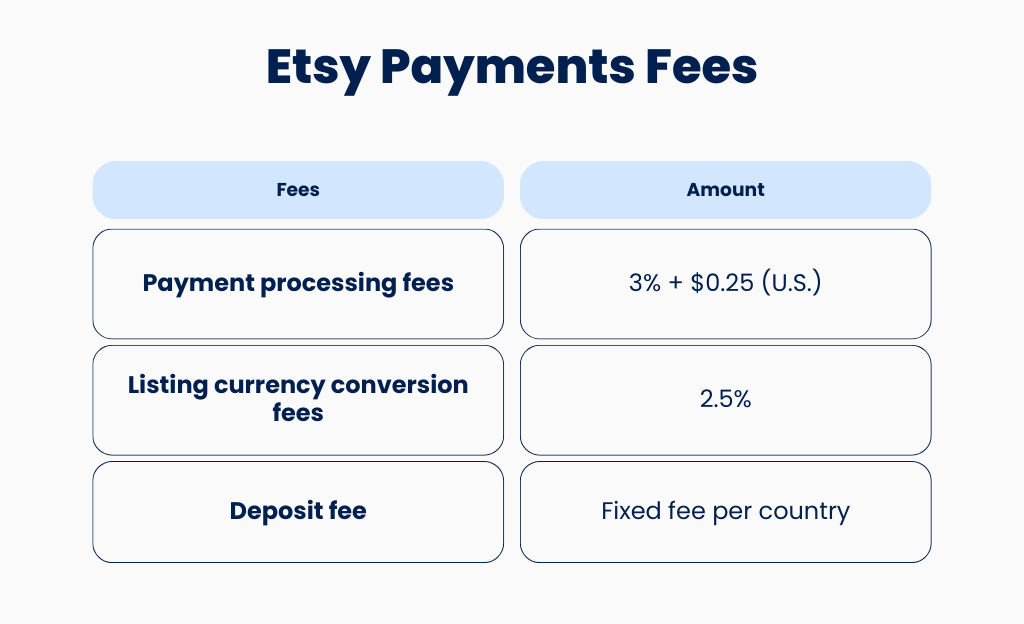

Etsy Payments fees

Well, where without them?

Etsy Payments involves several types of fees that sellers need to be aware of when using the platform. We’ll cover the following types of fees sellers may be required to pay:

- Payment processing fees;

- Currency conversion fees;

- Deposit fee.

→ These fees are connected to Etsy Payments only and are required to be paid in addition to the other fees. To check the full list of Etsy fees, check our Etsy seller fees guide.

Etsy Payments fees #1. Payment processing fees

Payment processing fees on Etsy are applied to every transaction made through Etsy Payments. These fees are a combination of a percentage of the total transaction amount and a fixed fee per order.

The rate for the payment processing fee is subtracted from the total payment when the transaction is finalized. This fee is then reflected in your Etsy payment account, allowing you to see exactly what has been deducted.

The amount is based on your bank account location. For example, in the U.S., the payment processing fee will be 3% + $0.25, and in the U.K. – 4% + £0.20.

Note: If your Etsy sale includes additional charges, such as shipping or taxes, these are included in the calculation of the payment processing fee.

Etsy Payments fees #2. Listing currency conversion fees

Currency conversion fees on Etsy are applicable when a seller lists and sells items in a currency different from their payment account’s currency. In such cases, Etsy will convert the transaction proceeds to the seller’s account currency.

Etsy applies an additional fee of 2.5% for this currency conversion service. This fee is calculated on the total transaction amount, ensuring that all aspects of the sale are converted at the same rate.

Etsy Payments fees #3. Deposit fee

For some countries (Indonesia, Israel, Malaysia, Mexico, Morocco, Philippines, South Africa, Türkiye, and Vietnam), an additional fixed fee is charged if the deposit is below the fee threshold.

Ecommerce accounting: Managing finances on Etsy

Even though managing finances in one place within an Etsy account sounds tempting, it’s not always feasible as it doesn’t cover the whole ecommerce accounting cycle. You can track the cash flow, but what do you do when it comes to reconciling Etsy transactions? Or when you need a detailed report?

Some processes still can’t be covered within Etsy as it simply doesn’t offer the necessary functionality. However, we have a solution!

By integrating Synder Sync into your Etsy business management process, you’ll be able to automate not only the process of recording transactions but also inventory tracking, Etsy fees management, and more! Best of all, Synder also records the Marketplace Facilitator Tax, so it’ll be reflected in the final income reports and you can take this load off your shoulders.

All you need to do is:

- Create a free Synder account;

- Connect your Etsy store and additional platforms (if necessary) to Synder;

- Connect your accounting system (QuickBooks Online or Desktop, Xero, or Sage Intacct);

- Enjoy the flow!

→ Learn about the benefits of integrating Etsy with QuickBooks Online via Synder.

Synder supports 30+ integrations, so even if your business has multiple channels, it’s not a problem. Let’s get real here and use an example of one of our users, TJAYZ, a successful online business selling rings, leather vests, SASS holsters, cowboy boots, and other authentic products from Mexico.

Tony and Kissandra have stores on five platforms, including Etsy, Amazon, Shopify, and more. Finding the best accounting solution was challenging because not every software can support all marketplaces—but Synder can!

By implementing Synder Sync in their day-to-day accounting, not only did they connect all the online channels in use but also saved 40 hours monthly on accounting tasks. Now, they easily track details such as fees, shipping costs, tax amounts, refunds, and more without the need to manually check all the records.

→ Want to learn the whole story? Learn how Synder saves 40+ h/mo on accounting for TJAYZ and helps them connect customers to culture.

Create your own success story by signing up for a 15-day free trial with no credit card required. To learn more about Synder’s features, visit a Weekly Public Demo session.

What are the benefits of Etsy Payments from an Etsy sellers perspective?

Now, to the pleasant part—the benefits of Etsy Payments. Since this system is what Etsy sellers are going to use constantly.

#1. Consolidated payments

The most obvious benefit of Etsy Payments is that it streamlines the payment process by consolidating multiple payment methods into one platform.

We’ve already covered all the main options provided by Etsy. Still, it’s worth mentioning that this consolidation is highly convenient for Etsy sellers as it simplifies the management of incoming funds and minimizes the hassle of having to set up and manage multiple payment gateways. As we already said, all-in-one.

#2. Access to international markets

Another one is that sellers can sell to buyers around the world. Effortlessly.

Etsy automatically handles the complexities of currency conversion and complies with international payment regulations, making global sales as straightforward as domestic ones. This is particularly beneficial for sellers looking to expand their customer base beyond their home country, as it removes the barrier of dealing with foreign banks or currency issues.

→ Learn the 6 proven strategies of how to increase Etsy sales.

#3. Quick access to funds

This one might sound a bit vague, but the system does facilitate a faster payment process, ensuring that sellers receive their funds shortly after a sale is finalized. Typically, once an Etsy payment is processed, funds are deposited directly into the seller’s bank account within a few business days.

#4. Dispute management

If you’ve already had experience in ecommerce, you know that handling disputes and chargebacks can be one of the more challenging aspects. Etsy Payments offers a structured process for managing these issues, providing support to sellers when a buyer files a dispute or initiates a chargeback.

→ Check Etsy alternatives to compare the platform with other marketplaces.

Conclusion

So, what’s the verdict?

For sellers, Etsy Payments provides centralized financial management. The platform simplifies financial management, allowing sellers to dedicate more of their time and energy to what they do best: crafting unique, eye-catching products and engaging with their customers.

But it doesn’t stop there. Etsy Payments safeguards transactions with robust protective measures that ensure both buyer and seller peace of mind. This level of security fosters a safe and trustworthy environment for all transactions.

In essence, Etsy Payments equips you to confidently enter the marketplace arena, empowering you with the most necessary tools for your first steps.

→ You might also want to read our article about how to promote your Etsy store.

Share your thoughts

How has Etsy Payments influenced your shop’s operations? Are there other tools or services that have significantly impacted your online business? Share your experiences, tips, or any standout software solutions that have helped streamline your Etsy selling process.

.png)

I have been trying to change my credit card for some time. The one on file was closed as it was hacked . Etsy will not except my new card. Their customer service is the worst I have ever encountered. Others have had similar dealings.

Thank you

Hi Marjorie, we are sorry to hear about the trouble you’re experiencing with updating your credit card on Etsy, especially following such a frustrating situation with your old card being compromised. It’s unfortunate when customer service doesn’t meet expectations, making already stressful situations even more challenging. Here are a few suggestions you might consider:

1. Check the steps on adding new card to Etsy: To add a new credit card to your Etsy account, first, sign into Etsy.com and navigate to your Shop Manager. From there, head to “Finances” and click on “Payment settings,” then go to the “Billing” section. Here, you can add a new card by choosing “Add new card” under the “Your cards” section. Simply enter your new card details and click “Save” to update your payment information.

2. Contact Etsy through other channels: Sometimes reaching out through different platforms like Etsy’s social media accounts or using their community forums can prompt a response.

We hope your issue will get resolved soon. Best of luck!

Thanks for the article!

You’re most welcome!