In the digital era, secure and efficient payment processing is crucial for businesses operating online. One prominent player in the realm of online payment systems is Stripe. With its robust features and widespread adoption, the platform has revolutionized the way businesses handle transactions.

In this article, we will provide a guide to Stripe payments, exploring its features, setup process, key functionalities, and more.

Understanding a Stripe payment

Stripe is a revolutionary online payment platform that has gained immense popularity since its establishment in 2010. It stands out from traditional payment processors due to its user-friendly interface, seamless integration options, and advanced security measures.

With its intuitive design and navigation, the platform ensures a smooth payment process for businesses and customers alike. It offers a wide range of integration choices for various platforms, allowing businesses to easily incorporate this platform into their existing systems.

What truly sets this platform apart is its developer-friendly infrastructure, providing powerful APIs and tools that enable businesses to customize payment experiences according to their unique requirements. Its emphasis on security is remarkable, employing encryption, tokenization, and proactive fraud prevention measures to safeguard sensitive customer data. Its commitment to combining user-friendliness, integration flexibility, customization options, and robust security has made Stripe the preferred choice for businesses seeking an advanced and reliable solution.

Speaking of a Stripe payment

A Stripe payment is a secure and streamlined transaction processed through the platform. It enables businesses to accept and process payments from customers worldwide. It collects and encrypts payment information, verifies payment method authenticity, and conducts fraud checks for secure transactions.

Once authorized, this platform facilitates the transfer of funds from the customer’s account to the business’s account. Businesses can monitor and manage payments in real-time through the user-friendly dashboard, which provides detailed transaction records and insights. In essence, a Stripe payment offers a reliable and efficient way to accept payments while ensuring the privacy and security of customer data.

Setting up Stripe

To embark on your journey, the first step is to sign up for a Stripe account. This can be done by visiting the website and providing the necessary information, such as your email address, business details, and contact information. The software offers a straightforward registration process designed to minimize friction and get you up and running quickly.

Easy integration with various platforms

One of the notable advantages is its seamless integration capabilities. Whether you have an ecommerce website, a mobile app, or any other digital platform, Stripe provides easy integration options to suit your specific needs. For popular ecommerce platforms like Shopify, WooCommerce, or Magento, this platform offers pre-built integrations that simplify the setup process. Similarly, if you have a custom-built solution, it provides robust APIs and comprehensive documentation to facilitate smooth integration.

Verifying identity and compliance

Once your account is set up, the next step is to verify your identity and comply with any necessary requirements. This verification process helps ensure the security and legitimacy of transactions processed through the platform. Depending on your location and business type, Stripe may require additional information or documentation to meet regulatory and compliance standards. These measures are in place to protect both businesses and customers and maintain the integrity of the ecosystem.

Enhanced security and fraud prevention

The platform takes security seriously and employs advanced measures to protect against fraud and unauthorized access. As part of the setup process, businesses can configure security settings and customize fraud prevention rules to match their risk tolerance. Stripe’s comprehensive security features, such as encryption, tokenization, and real-time fraud monitoring, help safeguard sensitive customer data and minimize the risk of fraudulent transactions.

Ensuring a smooth onboarding experience

Throughout the setup process, the platform offers resources and support to ensure a smooth onboarding experience for businesses. Their documentation and guides provide step-by-step instructions for integrating Stripe into various platforms, resolving common issues, and optimizing payment processes.

Ready to accept payments with Stripe

Once you’ve completed the setup process, verified your identity, and configured the necessary settings, your account is ready to accept payments. With a user-friendly interface, robust integration options, and emphasis on security, businesses can confidently offer their customers a seamless and secure experience. Stripe’s continuous innovation and commitment to providing businesses with powerful solutions have made it a trusted and widely adopted platform.

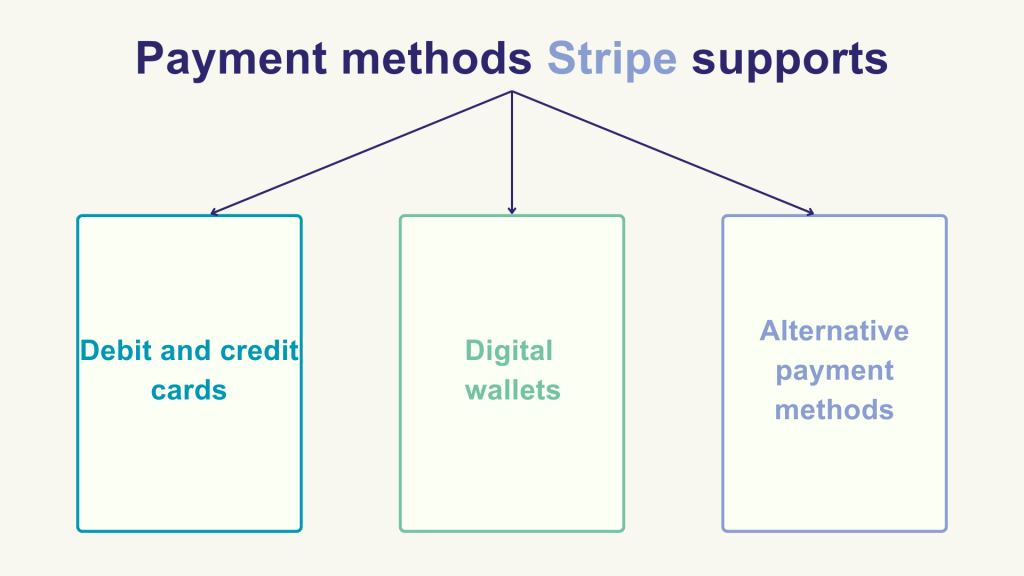

Payment methods Stripe supports

The software supports a wide range of payment methods, including credit/debit cards, digital wallets, and alternative methods. Security is a top priority, with robust fraud prevention measures and advanced encryption technologies to protect sensitive customer data. Additionally, Stripe offers features like recurring billing and subscription management, making it ideal for businesses with subscription-based models. It also supports international payments and provides currency conversion capabilities.

Processing payments with Stripe

Integrating Stripe into a website or application is a streamlined and user-friendly process. With a step-by-step guide, businesses can effortlessly set up this platform to start accepting payments from their customers. Here’s a closer look at the integration process and the benefits it offers:

Simple integration steps

Integrating Stripe involves a few simple steps that can be completed without extensive technical knowledge. Businesses can sign up for a Stripe account and access the necessary API keys and credentials. With these credentials, developers or website administrators can integrate payment functionality into their platform.

Seamless payment processing

The platform takes care of the complexities of payment processing behind the scenes, ensuring a smooth experience for both businesses and customers. When a customer initiates a payment, it handles authentication, authorization, and settlement processes efficiently. This means that businesses don’t have to worry about handling sensitive customer information or managing the intricacies of transactions.

Robust security measures

One of the key advantages is its focus on security. Stripe implements industry-standard security practices, including data encryption, to safeguard customer information during payment processing. By relying on Stripe’s secure infrastructure, businesses can enhance their payment security and protect sensitive data from potential threats.

Transparent fee structure

Stripe fee structure is pretty transparent, allowing businesses to understand the costs associated with using the platform. Businesses can easily access information about transaction fees, currency conversion fees, and any additional charges directly from the dashboard. This transparency enables businesses to make informed decisions about their payment processing and optimize their cost management strategies.

Access to additional features

The platform offers a range of additional features and tools that businesses can leverage. These include features such as subscription management, invoicing, and advanced reporting and analytics. By integrating Stripe into their platform, businesses gain access to these value-added features, enhancing their payment capabilities and overall business operations.

Developer-friendly environment

The integration process is designed to be developer-friendly, providing comprehensive documentation, robust APIs, and SDKs. This environment enables developers to easily integrate the platform into different platforms, customize payment flows, and leverage Stripe’s extensive functionalities. With a wealth of developer resources and a supportive community, businesses can tap into Stripe’s vast potential for customization and optimization.

Stripe Dashboard and reporting

The dashboard serves as a control center for businesses, offering a user-friendly interface to manage transactions, monitor sales, and gain insights. Within the dashboard, businesses can access detailed transaction data, generate financial reports, and analyze key metrics. This data empowers businesses to make informed decisions.

Integrations and customization

The software provides a powerful API and developer tools, allowing businesses to integrate Stripe into their existing systems and customize payment flows to match their branding. With a wide range of third-party integrations and plugins available, businesses can enhance their experiences with additional functionalities like invoicing, customer relationship management, and more. Customizing payment forms and checkout experiences further enables businesses to create a seamless and cohesive brand experience for their customers.

Managing customers and subscriptions

The platform simplifies customer management by allowing businesses to create and manage customer profiles. This feature enables businesses to securely store customer information for future transactions, streamline the checkout process, and provide personalized experiences. For businesses with subscription-based models, it offers robust tools to manage subscriptions, modify billing cycles, handle upgrades or downgrades, and handle customer inquiries related to billing.

International expansion with Stripe

The global reach extends to numerous countries, making it an ideal solution for businesses looking to expand internationally. Stripe supports multiple currencies, enabling businesses to accept payments in different monetary units. It also provides localized support and compliance resources, helping businesses navigate regional regulations and address specific payment preferences in different markets.

Stripe support and resources

Should businesses encounter any issues or have questions, the platform offers comprehensive customer support channels, including email and live chat. Additionally, it provides extensive documentation, guides, and troubleshooting resources to assist businesses in resolving common issues and making the most of Stripe’s features. The vibrant community forums and developer community engagement foster knowledge sharing and collaboration.

Conclusion

Stripe has emerged as a leading online payment platform, offering businesses a secure, flexible, and customizable solution to process payments. With its extensive feature set, user-friendly interface, and global reach, the platform empowers businesses to create seamless payment experiences and expand their operations internationally. As the digital landscape continues to evolve, this payment platform remains at the forefront, enabling businesses to thrive in the world of online commerce. Embrace Stripe as your payment partner and unlock the potential for growth in the digital economy.

What to know learn more about Stripe? Check out our Stripe and PayPal comparison article and our guide How does Stripe works!

.png)