Few things are as important to a company’s success as its products. Regardless of industry, having a product that helps address customers’ pain points is often the key to growing a business. However, a high-quality solution is only half of the success equation — pricing also plays a significant role in the growth of a product-driven organization.

While outward pricing results from the market and what consumers are willing to pay, the production price of an item is something a business has control over. One way a company can manage the production cost of their goods is to use marginal cost. So let’s dive in and see how calculating and utilizing marginal cost can save money and maximize product profitability.

Contents:

1. Understanding marginal cost

3. How to calculate marginal cost?

- Marginal cost formula explained

- Change in total cost

- Change in quantity

- Steps for calculating marginal cost

4. Calculating marginal cost: Example

6. Creating accounting efficiencies with Synder

7. Why is it important to know your marginal cost? Practical applications in business

- Pricing decisions

- Production volume decisions

- Evaluating profitability of additional production

- Strategic planning

8. Limitations and challenges in calculating marginal cost

- Separating fixed and variable costs

- Changes in cost over time

- Ignoring external costs

- Overemphasis on short-term costs

Understanding marginal cost

Marginal cost plays a critical role in taking economic and business decisions. It provides insights into how much it costs to produce one additional unit of a product. Understanding how you can calculate marginal cost and its implications can be a game changer in financial modeling, determining product prices, volume of production, and assessing the profitability of additional production.

What is marginal cost?

Marginal cost is the additional cost to produce one more extra unit of a product. For instance, if your organization is currently making 100 units of your most valuable product per run, then the cost to create the 101 would be the marginal cost of that particular item.

When considering the marginal cost of producing one additional unit, you’ll need to consider specific cost factors, like labor and materials. However, you won’t need to account for fixed costs unless the additional unit requires increasing certain fixed expenses like overhead or administrative support.

Ultimately, by determining your marginal cost for each product, your organization can achieve economies of scale, optimize overall production, and much more:

- Set production activity levels;

- Optimize production lines;

- Set product pricing;

- Compare other methods of production;

- Create a hierarchy of products to manufacture throughout the year.

Looking to improve your inventory management? Read our solutions review: Small Business Inventory Management.

Key terms and concepts

Before diving into the calculation, it’s important to understand key concepts including fixed costs, variable costs, total cost, marginal cost, and units of production.

Fixed costs

Fixed costs are expenses that don’t change with the level of production or sales. These costs must be paid regardless of how much a company is producing or selling. They’re often considered sunk costs because they’re incurred no matter what. Examples of fixed costs include rent, salaries, insurance premiums, and depreciation. In the short run, these costs are usually constant, but in the long run, they could change.

Variable costs

Variable costs, as the name implies, vary with the level of output or production. These costs increase or decrease based on the volume of goods or services produced. Examples include direct labor costs, raw material costs, utilities (like electricity used in manufacturing), and sales commissions. The more units a business produces, the higher the total variable costs will be.

Total cost

Total cost is the sum of fixed costs and variable costs. It represents all costs a business incurs during production. Total cost provides a comprehensive view of the financial burden of production. It’s crucial in assessing profitability, as it enables the calculation of profit margin when revenue is known.

Marginal costs

Marginal costs refer to the increase or decrease in the total cost of production when the quantity produced changes by one unit. It’s a fundamental concept in the field of economics and finance that helps businesses optimize their production costs. Understanding the marginal cost allows a company to pinpoint the level of production where it can achieve economies of scale.

Units of production

Units of production refer to the total quantity of goods or services produced over a specific period of time. It’s a crucial factor in understanding various economic metrics such as unit costs, productivity, and efficiency.

Bottom line

Understanding all of the above terms is important when calculating and interpreting the marginal cost. They provide the necessary context and input variables for the marginal cost formula and contribute to a more thorough understanding of cost structure and its influence on financial decision-making.

Find out how to calculate Cost of Goods Sold: Formula and useful example to help you calculate COGS.

How to calculate marginal cost?

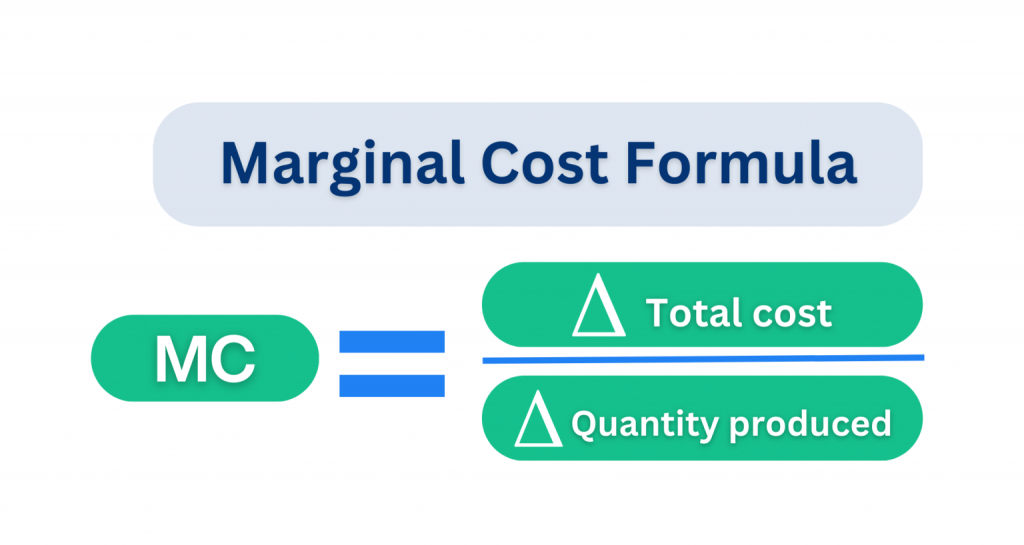

Business owners might worry that calculating marginal cost requires extensive financial knowledge but the cost formula is relatively straightforward:

Marginal Cost = Change in Total Cost / Change in Quantity (ΔTC / ΔQ)

Marginal cost formula explained

This formula states that the marginal cost is the ratio of the change in total cost to the change in the quantity of output. By utilizing the “change in total cost” and “change in quantity” of a product batch, it’s possible to determine the overall marginal cost. Here’s a closer look at both components of the equation.

Change in total cost

When considering an increase in production levels for a specific item, it’s essential to account for any additional costs. For example, your costs will naturally go up if you need more raw materials or additional staff to produce an item.

To determine the number for “change in total cost” you’ll want to subtract the cost of running your normal batch of a product from the cost of running a new, higher quantity batch.

Change in quantity

If you’re planning on increasing the number of products you make in each batch, you’ll need to consider how the change in quantity will affect the cost.

For the “change in quantity”, subtract the number of units you typically produce in a batch from the total units you plan to make in a new batch.

Steps for calculating marginal cost

Taking all this information together, here’s an easy 4-step process for calculating marginal costs.

Step 1. Gather the necessary information

You need data on your total costs and the number of units produced.

Step 2. Calculate the change in total cost

This is the difference in total cost when the units of production are increased by one unit.

Step 3. Calculate the change in quantity

This is usually one unit if we’re considering the cost of producing one additional unit.

Step 4. Apply the Marginal Cost Formula

Use the formula (ΔTC / ΔQ) to find the marginal cost.

Calculating marginal cost: Example

The easiest way to understand marginal cost is to illustrate it with an example. Let’s look at how companies can use marginal costs in a manufacturing environment.

Suppose your company produces windows at a manufacturing plant. Typically, a single batch will produce 100 windows for $3,000. As your sales representatives continue to expand your business’s territory, demand for windows increases. To meet the growing demand, you now start producing 200 windows for $5,000.

The formula for uncovering the marginal cost in this scenario would be as follows:

Marginal Cost = ($5,000 – $3,000) / (200-100) = $20

In this example, the marginal cost to produce one extra window would be $20.

Interpreting the results of marginal cost calculation: Which is better — a high or low marginal cost?

When marginal cost is low, it indicates that the cost to produce one additional unit is relatively small. This could be due to efficiencies in production, economies of scale, or simply a low-cost production method. Businesses might want to decrease their marginal cost and make it lower as it may allow for increased production without significantly increasing costs, potentially leading to higher profitability.

On the other hand, a high marginal cost suggests that producing an additional unit is quite costly. This could be due to inefficient production methods, lack of economies of scale, or high-cost inputs. High marginal costs might indicate that increasing production could decrease returns, as the cost of producing each additional unit may exceed the revenue it generates.

Creating accounting efficiencies with Synder

Synder is a financial management software that can indeed assist businesses in understanding their financial data better, which can support the calculation of marginal costs.

Accurate financial data: Synder provides accurate and real-time financial data by seamlessly integrating with your e-commerce, point of sale, and payment platforms. It helps keep track of every sale, fee, or refund, which can provide the data needed to calculate variable costs.

Inventory tracking: By integrating with e-commerce platforms, Synder can help track the cost of goods sold (COGS). This is an important part of calculating variable costs, which are needed to determine marginal cost.

Expense tracking: Synder allows for detailed categorization and tracking of business expenses. This can help businesses separate their costs into fixed and variable costs more accurately.

Reporting: The software offers comprehensive financial reporting, which can provide a snapshot of your business’s overall financial health. This includes detailed insights into income, expenses, and profitability, which are essential for calculating and understanding marginal costs.

Automated bookkeeping: Manual entry errors can lead to inaccurate cost calculations. Synder automates your bookkeeping, reducing the risk of errors and ensuring your financial data is accurate and up-to-date.

To fully understand the broad functionality of Synder software, book a seat at our Weekly Public Demo and learn how financial automation can help you not only save time but also make informed business decisions.

Why is it important to know your marginal cost? Practical applications in business

There are a number of insights that can come from calculating marginal costs of a product. Understanding and using marginal cost can lead to precise financial modeling and more informed and strategic business decisions that drive efficiency, profitability, and growth. Let us look closer at those business markers.

Pricing decisions

Marginal cost can greatly influence pricing strategies. If the marginal cost of producing an additional unit is known, a business can ensure that the selling price is set above this cost to guarantee profitability for each additional unit sold. It can also provide insights for volume discounts. If the marginal cost tends to decrease, lower prices for larger quantities can be offered without compromising on profit margins.

Production volume decisions

Businesses can use marginal cost to decide on the optimal level of production. If the marginal cost is less than the market price, a business could increase production to maximize profits. Conversely, if the marginal cost is higher than the market price, it may be more beneficial to reduce the quantity of production.

Evaluating profitability of additional production

Marginal cost can also be used to assess the profitability of increasing production. If a business is considering an increase in production, comparing the additional revenue (marginal revenue) with the additional cost (marginal cost) can help determine whether this decision will be profitable.

Strategic planning

Marginal cost analysis can also inform strategic planning. By understanding how costs behave as production levels change, businesses can strategically plan their growth and manage their resources effectively.

Limitations and challenges in calculating marginal cost

While the calculation and application of marginal cost can offer significant financial insights for businesses, there are also some limitations and challenges associated with it. Here are a few notable ones.

Separating fixed and variable costs

In reality, it can be challenging to neatly separate costs into fixed and variable categories. Some costs may have both fixed and variable components, making it difficult to accurately calculate marginal cost. For instance, a worker may be on a fixed salary but may also receive overtime pay for additional work, thereby making labor costs partially variable.

Changes in cost over time

The marginal cost of production can change over time due to factors like changes in the price of raw materials, shifts in labor costs, technological advancements, and more. This means that businesses must continually update their marginal cost calculations to ensure they’re working with the most accurate and up-to-date information.

Ignoring external costs

The traditional calculation of marginal cost often ignores external costs, also known as externalities. These are costs (or benefits) that affect a party who didn’t choose to incur that cost (or benefit). For example, a factory’s pollution that affects the local community is an external cost not typically included in the factory’s marginal cost calculation.

Overemphasis on short-term costs

Marginal cost analysis tends to focus on short-term costs, often overlooking longer-term factors like the potential for future cost reductions due to process improvements, technological advancements, or strategic financial investments. This might lead to decisions that are profitable in the short term but can prove to be otherwise in the long run.

These limitations don’t necessarily undermine the utility of marginal cost calculations, but they do highlight the need for careful consideration and context when interpreting and applying these financial calculations in decision-making processes.

Closing thoughts

With business landscape in constant change, knowledge of key financial principles like marginal cost is a powerful tool. It can help businesses in financial modeling and equip them with the foresight to make strategic decisions that not only enhance profitability but also ensure long-term success and growth.

Technological tools like Synder can play a crucial role in offering accurate, real-time financial data that serves as the backbone for such calculations. The insights derived from it provide the necessary input for businesses to compute and interpret marginal cost effectively.

%20(1).png)

![All You Want to Know About Donation Receipts [Synder Guide]](https://synder.com/blog/wp-content/uploads/sites/5/2022/12/all-you-want-to-know-about-donation-receipts-1.jpg)