When you sell goods or services online, you might want to offer customers a safe and secure way to pay you the money. Both sellers and buyers will often go for PayPal, an online payment system that enables users to send and receive money, shop online, and make payments without sharing their financial information with the recipient.

Verification ensures that your business or personal account has access to all PayPal functions and your data is secure. So, for marketplace sellers and business owners, it’s a must. Let’s take a closer look at PayPal verification to make the selling chain between you and your customers more stable.

Struggling with PayPal? Learn how top business minds streamline their PayPal processes.

Contents:

1. What is PayPal Business and Personal account verification?

2. How to verify your Business and Personal PayPal account and add your credit or debit card

- PayPal Business account verification: Link and confirm your bank account

- How to get a PayPal Personal account verified?

3. How to manage your accounting records for PayPal?

4. FAQs

Key takeaways

- Verifying your PayPal Business account ensures your safety, helps customers trust you more, and gives you access to more features.

- To verify a Business account, you must link and confirm a bank account or debit card by adding their details to your PayPal and completing the confirmation process.

- Verifying your personal PayPal account is also useful because it increases security and removes transaction restrictions. The process is simple: link your bank account or card and verify through the website or app.

- You can link your bank account to PayPal in several ways: through the website, the mobile app, or the business app. To verify it, you can choose between instant confirmation or making a deposit.

What is PayPal Business and Personal account verification?

Verification is a very important process, as with it you can handle larger amounts of money, which is helpful as your business grows. It also makes your business appear more trustworthy to customers and helps prevent scams and fraudulent activities. Plus, you get full access to all of PayPal’s features, making it easier to manage your money.

On the other hand, an unverified account limits how much money you can send and receive, which might hold back your business activities. You also might have delays in accessing your money, and your business could seem less reliable to others. PayPal might check your transactions more closely, which could lead to frequent freezes.

Through verification the platform validates and confirms that a user is an authorized account holder. This guarantees that only trustworthy individuals can open and operate with PayPal. It also gives you peace of mind that your business information is safe and that transactions can be completed securely whenever necessary.

Once you create PayPal for Business, you’ll be asked to set it up by providing:

- Your account type;

- Business email address and information;

- Personal information;

- Financial information;

When you enter your bank account type and details, you’ll begin the verification process.

How to verify your Business and Personal PayPal account and add your credit or debit card

When you first register, the platform only asks you to enter the necessary information. However, as you continue to use PayPal services, they’ll ask you for additional data. To become verified, you need to go through the process of adding and authenticating your bank account or, if you choose, adding and authenticating your credit or debit card through your settings.

Note: When you enter your bank account name, it has to fully match your business name on your business registration.

PayPal for Business verification: Link and confirm your bank account

There are three main ways to link the bank account to the PayPal for Business.

1. On the web:

- Enter login and password to open your account;

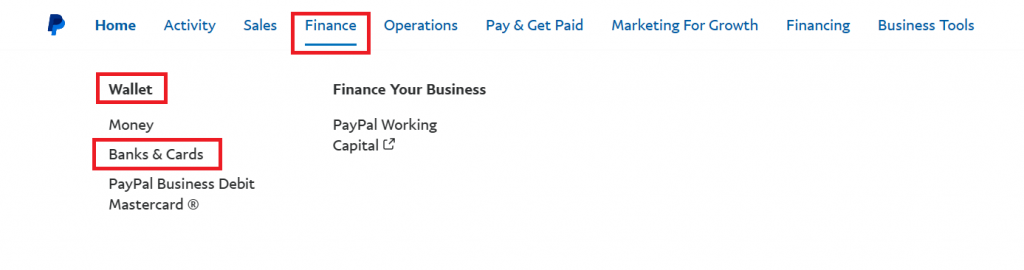

- Click to “Finance”;

- Go to “Wallet”;

- Select “Banks & Cards”;

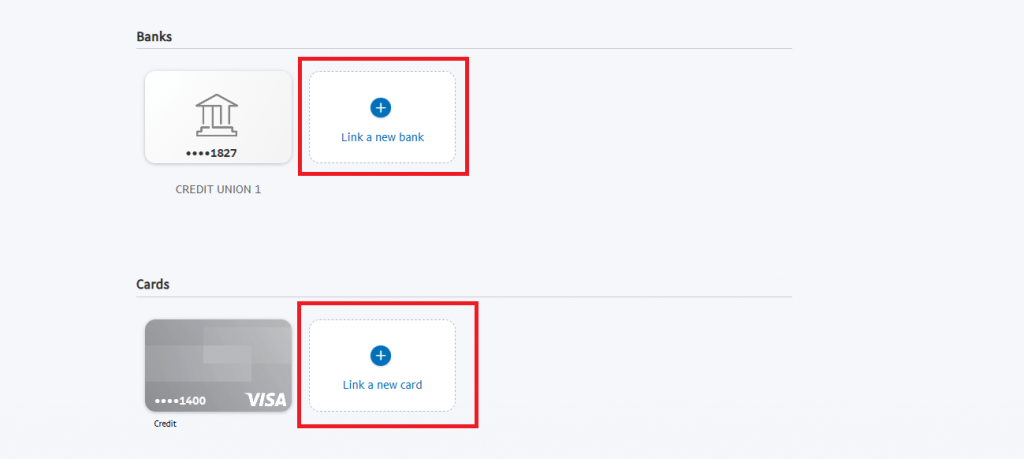

- Link a new bank.

2. On the app:

- Go to “Wallet”;

- Click “Banks and cards” ;

- Choose “Banks”.

3. On the business app:

- Click “More”;

- Go to “Settings”;

- Choose “Cards and Banks”;

- Click “Connect a Card or Bank Account”;

- Select “Bank account”.

For confirmation, you have two options:

Option 1: Confirm instantly

You’re required to input your online banking user ID and password. The platform will verify this information with your bank. Once the confirmation is received, your bank account will be immediately verified.

Option 2: Deposit

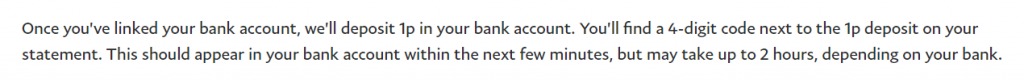

This option means requesting PayPal to transfer up to 2 deposit amounts into your bank account.

As soon as you get this 4-digit code, all you need to do is:

- Click the “Pay & Get Paid”;

- Go to “Wallet”;

- Select “Banks and Cards”;

- Choose the bank you want to confirm;

- Click “Confirm”;

- Enter the 4-digit code;

How to get a PayPal Personal account verified?

1. On the web:

- Go to “Wallet”;

- Link your bank;

2. On the app:

- Go to “Wallet”;

- Click “Banks and cards”;

- Choose “Banks” to link yours;

3. On the business app:

- Click “More” ;

- Choose “Settings”;

- Select “Cards and Banks” ;

- Link a Card or Bank Account;

PayPal will send two small deposits to your account. Simply enter these amounts on their website. Then, validate your information by answering a quick confirmation phone call from their third-party authentication service, and you’re good to go.

Drowning in PayPal issues? Grab a life belt of tried-and-true methods from top business minds from our next article!

How to manage your accounting records for PayPal?

Running an online business is time-consuming. You’ve got to plan for growth, stay ahead of competition , and boost sales. And a lot of small businesses tend to face another challenge – accounting.

Managing PayPal transactions in your accounting can be tricky without messing it up. Inputting every transaction manually means you have to be very careful with sales, fees, refunds, reconciliation, and transfers. It gets even harder if you’re dealing with a lot of activity. So wouldn’t it be great to have an online software that links your platform to your accounting platform?

Imagine having all your transactions and expenses neatly organized without any effort on your part. Just a quick setup, and automation does the rest. You can also create reports on your top-selling products or those needing attention. With everything running smoothly, you’ll have more time to focus on what’s important and drive your business to success.

So what is this lifesaver for small businesses? Let’s look in more detail:

How can Synder help with accounting for PayPal?

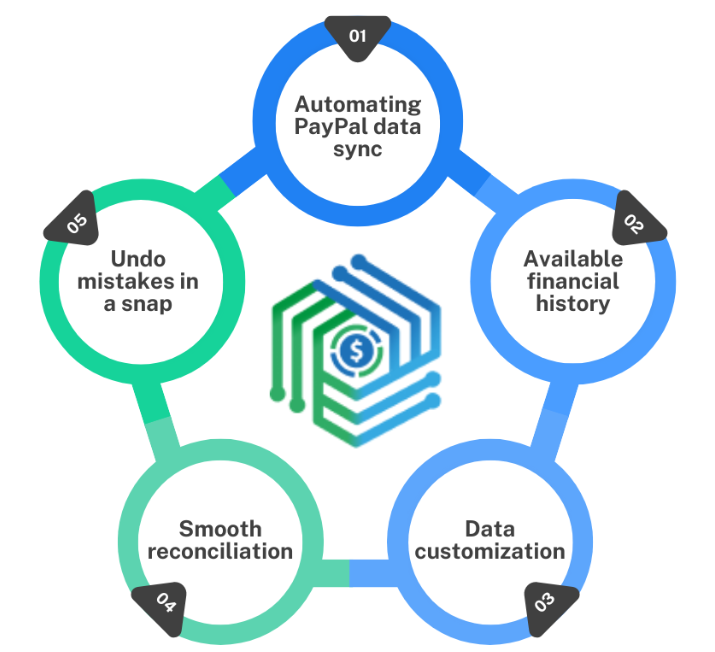

Switching to automated small business accounting solutions can greatly improve the efficiency and accuracy of managing your PayPal transactions. Synder stands out as an ideal tool for this purpose. Here’s why:

1. Automating PayPal data synchronization

Synder automatically collects all your transactions and keeps them safe in one spot. It covers everything—payments, fees, expenses, refunds, deposits—making your bookkeeping easier and ensuring your financial info is always accurate and up-to-date.

2. Unlimited historical data import

Synder’s historical data import feature, allows you to check your financial data even from the past three years. It’s perfect for tax time or when you’re planning your business future, giving you a complete view of your finances over time.

3. Data customization

If you need to customize your data, Synder’s Smart Rules can help. Simply set up your custom algorithm, and they automatically adjust taxes, categorize transactions into the right categories for accurate reporting, and more. This ensures your financial data is accurate and meaningful, such as having a system that puts every dollar where it belongs. Simply set up your custom algorithm, and you’re all set.

Here’s how the Smart Rules feature works:

4. Smooth reconciliation

Worried about your transaction details matching your bank statements? Synder facilitates reconciliation, making sure everything fits together perfectly. You don’t have to act like an editor, carefully checking every line for errors. This means you can focus more on growing your business rather than focusing on the nitty-gritty numbers.

5. Undo mistakes in a snap

Sometimes mistakes do happen. If the synced data doesn’t meet your expectations, simply use the Rollback feature. It allows you to easily reverse transactions, keeping your financial records clean and accurate without any hassle.

Take advantage of Synder’s free trial to see how it can improve your business accounting, and join our informative Weekly Public Demo for additional insights and advice.

Conclusion

While PayPal has a lot of advantages and is easy to use for businesses, it’s important to remember that only verified sellers are trustworthy and have customers’ loyalty.

Verification is beneficial for individuals and online sellers, it’s critical to protect themselves against credit card fraud.

Share your thoughts

We’ve talked a lot about PayPal verification and how it can improve the platform functionality. Tell us, have you verified your PayPal ? If so, how has it changed the way you process transactions or do business? Share your thoughts with us!

FAQs

Why is PayPal for Business verification necessary?

- Security: It confirms your ownership, reducing fraud risks.

- Trust: A verified status makes your PayPal more reliable, especially for business transactions.

- Increased functionality: Verifying removes limitations on fund transactions, offering more flexibility.

What are the requirements for a PayPal Business account?

To create a Business account, you’ll need to provide your full legal name, email address, a password, your tax ID or social security number (SSN), a brief business description, and your business bank account details.

What is the difference between PayPal and PayPal for Business?

PayPal for Business provides all the functionalities of a Personal one and offers additional features for small to medium-sized business owners. For instance, with a PayPal for Business, you can send and receive PayPal invoices and establish subscription services.

Is there a fee for a PayPal Business account?

No, signing up is free. PayPal merchant fees are only applicable to transactions, so you’ll only incur charges when you begin selling.

It’s good to verify accounts

This article provides valuable information on PayPal account verification, explaining its importance and the steps to verify both Personal and Business accounts. It highlights the benefits of verification in terms of trust and transaction security.

Thank you so much! I am glad you found a lot of valuable information in this article. We always strive to make comprehensive and helpful pieces.

Thank you for sharing your experiences that give others practical, honest, and inspirational advice!

I am very glad you found the advice in our article practical and beneficial. We always strive to create helpful pieces.

Hi, I wish for to subscribe for this blog to obtain latest updates, thus where can i do it please assist.

Hi Sherri, thank you for your interest in our blog! We are currently preparing a subscription option for our readers, so stay tuned!

I am asked to pay something PayPal. I am.about to but sceptical since I have been scammed before. What details of a recipient will I have for incase the person dissappear with my money? Are their PayPal account linked ro any credible personal information?

Hi! The safest approach would be to contact the PayPal support team, they will be able to assist you with your questions and help you navigate your situation. Best of luck!

Pretty! This was a really wonderful article.

Many thanks for supplying this information.

Superb, what a webpage it is! This webpage gives useful facts to us, keep it up.