In an era where digital transactions are becoming increasingly commonplace, the safety and security of these processes are paramount. PayPal, a trailblazer in the world of online financial transactions, has become a preferred choice for many due to its ease of use and global accessibility. But with the digital sphere often being a double-edged sword, concerns around data security are inevitable. Is PayPal safe? Can users confidently use it without the fear of falling prey to cybercrime?

This article aims to dissect the intricacies of PayPal’s security mechanisms, scams associated with the platform, and measures users can take to ensure their transactions remain secure. Join us as we delve into the world of PayPal to assess its credibility and security.

Are you a merchant working with PayPal payments? Discover how financial management software made especially for ecommerce and SaaS can help you streamline your bookkeeping, book a seat at a Weekly Public Demo .

Contents:

2. Understanding PayPal’s security measures

- PayPal’s secure encryption technology

- Two-factor authentication for additional security

- PayPal’s data protection policies

3. How PayPal ensures the safety of transactions

4. Discussing user experiences: Is PayPal truly safe?

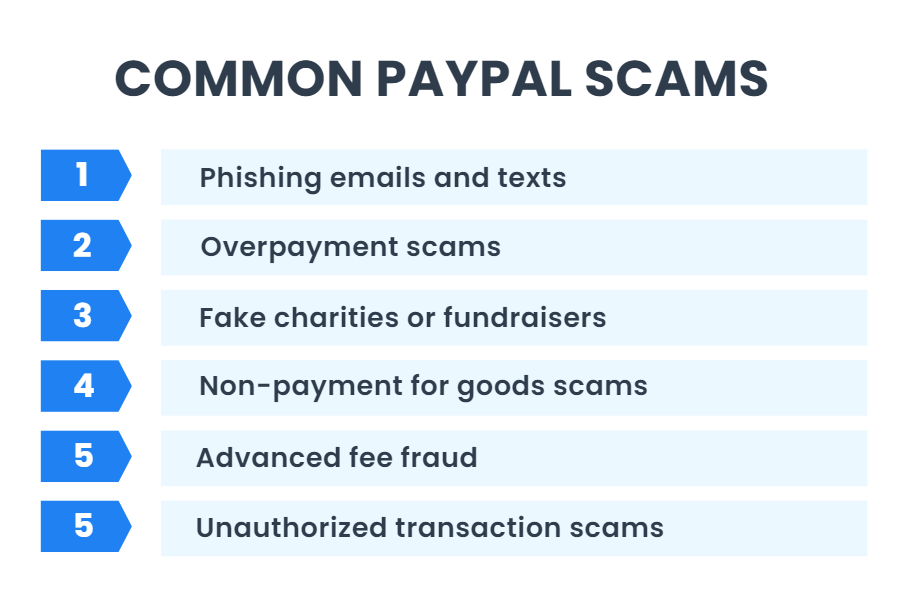

5. Explanation of common PayPal scams

- Phishing emails and texts

- Overpayment scams

- Fake charities or fundraisers

- Non-payment for goods scams

- Advanced fee fraud

- Unauthorized transaction scams

6. How to recognize and avoid scams

7. Safe practices for using PayPal

8. How businesses can ensure that their PayPal account is safe and secure?

9. How Synder secures online transactional data

- SOC2 compliance

- Vanta Trust Report

- Data encryption

- Secure Sockets Layer (SSL)

- Two-factor authentication (2FA)

- Secure servers

- Privacy policies

- Regular audits and updates

10. Closing thoughts: Is PayPal safe?

The basics of PayPal

PayPal is a leading player in the digital payments revolution. The company offers a variety of services, including online money transfers, ecommerce payment processing, and even a credit line. PayPal operates on a global scale, available in over 200 markets, allowing customers to send, receive, and hold funds in 25 currencies worldwide. Its convenience and accessibility have made it an integral part of ecommerce.

Understanding PayPal’s security measures

While the benefits of PayPal are many, its popularity has also led to an important question: Is PayPal safe? Many consumers and businesses alike question the safety of digital transactions, particularly when personal and financial information is at stake. This concern is quite legitimate in today’s digital world, where cybercrime and data breaches are a reality. As such, it’s crucial to delve into PayPal’s security measures to ascertain whether or not users can trust this platform with their money and sensitive data.

PayPal’s secure encryption technology

At the heart of PayPal’s security measures is its robust encryption technology. Whenever you use PayPal, whether, on your desktop, tablet, or smartphone, your financial information is automatically encrypted using the highest level SSL (Secure Sockets Layer) standards. This technology transforms sensitive information into an unreadable format, ensuring your financial details are safely transmitted over the internet. This complex encryption system plays a significant role in making PayPal a secure platform for online transactions.

Two-factor authentication for additional security

PayPal also offers an added layer of protection through two-factor authentication, known as PayPal Security Key. With this feature, whenever you log into your account, PayPal sends a unique one-time PIN to your phone. This means even if someone knows your password, they still cannot access your account without this code. This process further elevates the security measures implemented by PayPal and contributes to making your transactions and account more secure.

Read more about PayPal pros and cons.

PayPal’s data protection policies

Besides its top-notch encryption and two-factor authentication, PayPal takes data protection seriously. Its privacy policy is designed to protect personal and financial data in accordance with international standards and local laws. PayPal limits the sharing of your information with third parties and assures users that their data is not sold to marketers.

It also employs firewalls and implements regular security updates to stay one step ahead of potential cyber threats. These comprehensive data protection policies help to ensure a secure environment, further enhancing PayPal’s credibility as a safe online payment system.

How PayPal ensures the safety of transactions

PayPal’s commitment to safety extends beyond secure login mechanisms to the transactions themselves. One key feature is its Buyer Protection policy. If an item you’ve purchased online doesn’t arrive or doesn’t match the seller’s description, PayPal will reimburse you for the full amount of the item plus shipping costs.

Furthermore, sellers never see your sensitive financial information. When you make a payment through PayPal, the receiver doesn’t see any of your card or bank details, only the payment and your email address, thus limiting the potential misuse of your information.

PayPal also provides security for sellers through its Seller Protection policy. This helps safeguard sellers against claims, chargebacks, or reversals that are a result of unauthorized purchases or items not received.

Discussing user experiences: Is PayPal truly safe?

Given these security measures, the user experience with PayPal tends to be positive, with millions trusting the platform for their transactions. However, like any online platform, it is not completely immune to challenges. Users have reported instances of phishing scams, account hacks, and disputes over transactions.

However, it’s important to note that PayPal takes each of these incidents seriously and has measures in place to resolve them. Its robust customer support system, along with its policies of Buyer and Seller Protection, provides a safety net for users.

Therefore, while occasional security concerns arise, they are typically exceptions rather than the rule. Most users find PayPal to be a secure, convenient, and reliable platform for online transactions. As with any financial service, being aware of potential threats and taking appropriate precautions is key to ensuring your safety.

Explanation of common PayPal scams

To understand exactly how users can be targeted by scammers, let us look at some more detailed examples of common scams involving PayPal.

1. Phishing emails and texts

This is perhaps the most common type of scam where fraudsters send an email or text message impersonating PayPal. The message may allege there’s a problem with your account that requires immediate attention. It will likely include a link that leads to a fake PayPal login page designed to capture your username and password. Always double-check the sender’s email address and never click on suspicious links.

2. Overpayment scams

In these scams, a buyer will “accidentally” send too much money for an item and ask the seller to refund the excess. After the seller sends the refund, the initial payment is charged back, and the seller loses both the item they were selling and the money they refunded.

3. Fake charities or fundraisers

Scammers may set up false charities or fundraising campaigns, requesting donations via PayPal. Always verify the authenticity of a charity or fundraiser before donating money.

4. Non-payment for goods scams

Sometimes, a scammer will pledge to purchase an item but ask the seller to send it before they have made payment. The payment never arrives, and the seller is left without their item and payment.

5. Advanced fee fraud

This scam involves someone asking you to make an upfront payment for a service or item, but the service isn’t provided, or the item never arrives. These can often involve high-value transactions such as property rentals or car purchases.

In these scams, a user’s account is accessed by scammers who make unauthorized transactions. This often results from the user’s login credentials being stolen through phishing or other means.

Each of these scams uses deception and manipulation to exploit PayPal users. Recognizing these common scams can help you protect yourself from becoming a victim.

How to recognize and avoid scams

PayPal is proactive in combating scams. It uses sophisticated fraud models and algorithms to detect suspicious activity and prevent fraud. The PayPal Resolution Center also addresses issues of unauthorized activity and disputes between buyers and sellers. PayPal’s Buyer and Seller Protection policies also provide a layer of defense against scams.

The company is also transparent about potential scams, providing detailed information on its website to help users understand and identify fraudulent activity.

Awareness and vigilance are key to avoiding scams. Be skeptical of any unexpected emails or messages that seem to be from PayPal, especially those asking for personal information. Always check the sender’s email address—PayPal official emails will always come from an address that ends in “@paypal.com”.

Never click on suspicious links and avoid entering personal information in pop-up screens. If you suspect a scam, report it to PayPal immediately.

Lastly, always review transactions before sending money and make sure you’re sending the correct amount to the verified account of the intended recipient. These steps can help ensure your PayPal experience remains secure.

Safe practices for using PayPal

Even as PayPal equips its platform with extensive security measures, the actions of users are paramount in maintaining the security of their accounts. Here are some guidelines that you can follow to enhance the safety of your PayPal usage.

Tip 1. Use a strong and unique password

It’s essential to ensure that your PayPal password is robust, complex, and not used elsewhere. It should be difficult to guess and not associated with your personal information like birth dates, names, or common words. Regularly updating your password can also prevent unauthorized access.

Tip 2. Enable two-factor authentication

This security feature provides an additional layer of protection by requiring not just your password, but also a unique code that’s sent to your mobile device, to access your account. This means that even if someone manages to get your password, they wouldn’t be able to access your account without the code.

Tip 3. Regularly monitor transactions

Make it a habit to frequently review your transactions on PayPal. The faster you identify and report any suspicious activity, the quicker actions can be taken to prevent potential loss. PayPal’s Resolution Center is designed to help handle disputes and unauthorized transaction claims.

Tip 4. Be wary of suspicious emails

Be cautious of unexpected emails that appear to be from PayPal, especially those asking for personal information or urging you to click on a link. These are often phishing attempts aiming to steal your information. Always log into your account by directly entering PayPal’s official website address into your browser or by using the official PayPal app to verify your account status.

Tip 5. Don’t share personal information

Sharing your PayPal login credentials, password, or other sensitive details with anyone can put your account at risk. Even in scenarios where someone is helping you troubleshoot a problem or process a transaction, there is never a legitimate need for them to know your password or security codes. Also, be cautious while using public networks, as they can often be less secure, increasing the risk of your personal information being intercepted.

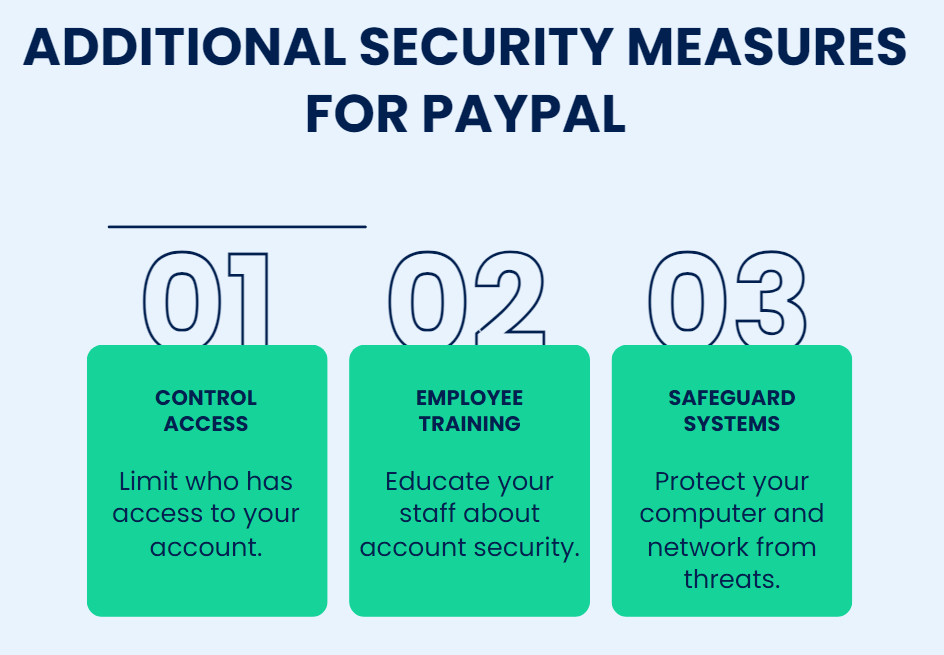

How businesses can ensure that their PayPal account is safe and secure?

Businesses using PayPal, like individuals, need to adopt various security measures to ensure their PayPal accounts remain secure. Apart from the above-mentioned practices here are some additional ones that companies can follow.

1) Limit access

Keep the number of employees who have access to your PayPal business account as low as possible. The fewer people who have access to the account, the lower the chances of unauthorized transactions or breaches.

2) Educate employees

Ensure that any employees with access to the account are educated about security best practices and potential scams. They should know never to share account details, be cautious of phishing attempts, and to regularly update their passwords.

3) Protect your computer and network

Make sure your business computers and networks are protected by up-to-date antivirus and firewall. This is your first line of defense against malware and hacker attacks aiming to gain unauthorized access to your sensitive data.

How Synder secures online transactional data

Synder is a popular financial management solution that helps streamline and automate accounting processes. As a financial platform, Synder implements a wide variety of measures to secure its users’ data.

SOC2 compliance

Synder is SOC 2 Type 2 certified. The SOC 2 Type 2 Report is an independent audit that delineates the methods utilized by a cloud-based service provider to manage sensitive customer information and evaluates the effectiveness and safety of its security measures. This report provides assurance that the service provider’s commitments and system requirements have been fulfilled based on the Trust Criteria of Security, Availability, Processing Integrity, Confidentiality, and Privacy.

Given that all SOC 2 assessments span over multiple months to ensure persistent control and compliance with the Trust Service Criteria, this kind of report validates the service provider’s capability to safeguard data over a prolonged duration.

Synder makes its SOC 2 Type 2 report accessible to its customers upon request, which can be made by reaching out to [email protected].

Get a full understanding of all the security measures Synder takes.

Vanta Trust Report

To view the real-time status of Synder’s security checks and controls, consider reviewing Synder’s Vanta Trust Report. This report can also provide you with the necessary security documentation if needed.

Data encryption

Synder uses strong encryption for data at rest and in transit. This means that your sensitive information is converted into code to prevent unauthorized access.

Secure Sockets Layer (SSL)

This technology establishes an encrypted link between a server and a client—typically a web server (website) and a browser, or a mail server and a mail client. Synder employs SSL to ensure that all data passed between the web server and browsers remains private and integral.

Two-factor authentication (2FA)

Synder gives an additional layer of security by implementing 2FA. It requires users to provide two types of identification before accessing their account, a password and a verification code sent to a mobile device.

Secure servers

Synder’s servers are securely housed and maintained. They are regularly updated and patched to ensure the highest security level and to protect against known vulnerabilities.

Privacy policies

Synder has stringent privacy policies in place, which govern how they handle and secure your personal and transactional data. They commit to not sharing your information with unauthorized third parties.

Regular audits and updates

Synder conducts regular security audits to check for potential vulnerabilities and keeps its systems updated with the latest security measures.

Closing thoughts: Is PayPal safe?

PayPal provides a solid foundation of security measures, including secure encryption technology, two-factor authentication, and robust data protection policies. It also implements specific controls to protect against common scams. But, the responsibility doesn’t end with PayPal; users also play a crucial role in maintaining the security of their accounts. This involves using strong, unique passwords, enabling two-factor authentication, monitoring transactions, avoiding suspicious emails, and never sharing personal information.

For businesses, these practices also include limiting access to the account, using a secure network, educating employees about security best practices, and ensuring their computers and networks are well protected.

Security in the online world is a joint effort. By combining the robust security measures offered by PayPal with proactive security practices, users can safely enjoy the convenience of online transactions. While the digital landscape continues to evolve, staying informed and maintaining good cybersecurity habits remain the best defense against potential threats.

Learn about Xero alternatives and What time of day does irs deposit refunds.

Share your experience

Have you ever encountered a PayPal scam? We’d love to hear about your experience—feel free to share it in the comments section below!

.png)