PayPal, one of the pioneers in online payment services, has become an omnipresent platform used by millions of individuals and businesses worldwide. It changed the way online shopping works, becoming one of the world’s largest Internet payment companies. Particularly appealing to small businesses, especially those venturing into ecommerce or global trading, PayPal is often considered their ‘go-to’ solution.

However, like any service, it has its advantages and disadvantages. This comprehensive analysis will delve into the pros and cons of using PayPal as a safe payment system for small businesses.

Contents:

1. Overview of PayPal services for small businesses

2. Advantages and disadvantages of PayPal

3. How to optimize your PayPal workflow with Synder?

4. Bonus: Tips for using PayPal

6. Conclusion

Key takeaways

- PayPal is easy to get started and can be used by small businesses anywhere in the world as it integrates with various online trading platforms.

- Despite the benefits, businesses should be aware of PayPal transaction fees, account freezes, lack of customization options, high currency conversion fees, and the possibility of chargebacks.

- With the PayPal mobile app, business owners can process transactions on the go, such as sending invoices, tracking sales, and accessing customer information, all from their smartphones.

Overview of PayPal services for small businesses

To cater to the diverse needs of businesses, PayPal provides a broad spectrum of services.

These include online payment processing, invoicing tools, mobile payment solutions, and even business loans. PayPal’s primary offering is its online payment service, enabling businesses to receive payments over the Internet in a quick, convenient, and secure manner. But that’s not all. With invoicing tools, businesses can send professional, customizable invoices and set up recurring client billing. Moreover, mobile payment solutions facilitate transactions on the go, while PayPal’s business loans, like PayPal Working Capital, give businesses access to the funding they need to grow.

PayPal’s services cover various sectors, including retail, services, digital goods, and beyond. Its versatility makes it suitable for many types of businesses and contributes significantly to its popularity among small business owners.

Now let’s look through the pros and cons of PayPal every business owner should be aware of.

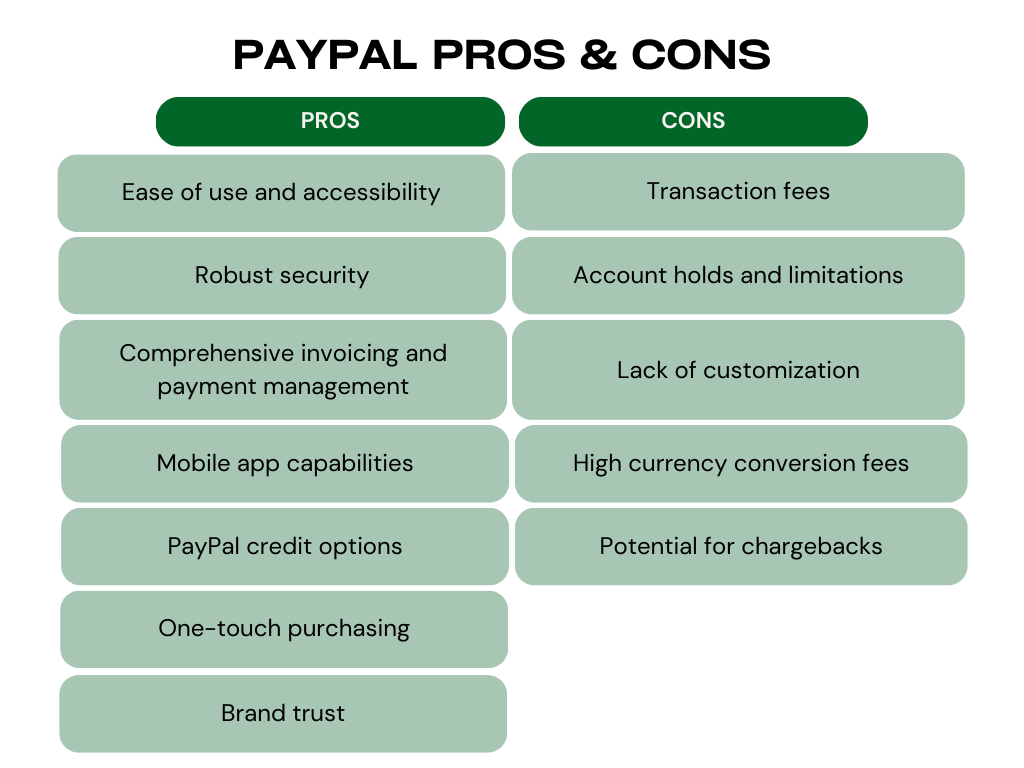

Advantages and disadvantages of PayPal

Pros of using PayPal for small businesses

1. Ease of use and accessibility

PayPal is designed to be user-friendly and straightforward. A business owner needs just an email address, a bank account, and a few details about their business to set up a PayPal account. Its compatibility with most ecommerce platforms enables seamless integration, allowing businesses to accept payments almost instantly.

Moreover, with PayPal’s global presence in over 200 countries and 426 million users, businesses can significantly expand their potential customer base. This extensive reach offers a truly global platform for small businesses seeking to tap into international markets.

2. Robust security

Security is a top priority for PayPal. The platform employs advanced encryption and fraud detection systems to protect users’ data and transactions. For small businesses, this level of security brings much-needed peace of mind and mitigates the need for complex, in-house cybersecurity measures.

In addition, PayPal offers a Seller Protection program. This program protects sellers against unauthorized transactions and chargebacks that result from items not being received by the customer, providing an extra layer of security for businesses.

3. Comprehensive invoicing and payment management

PayPal offers a complete invoicing system that allows businesses to manage billing and payments effectively. Businesses can create and send professional invoices, track their status, and even set up recurring payments for regular clients.

Also, with automatic payment reminders, chasing late payments is a thing of the past. This not only saves time but also reduces the administrative burden. The platform also offers tracking features that provide a real-time overview of transactions, assisting businesses in managing their cash flow more efficiently.

4. Mobile app capabilities

In the modern, fast-paced business environment, having mobile accessibility is a must. The PayPal mobile app, available for both iOS and Android devices, enables business owners to manage transactions in their account anytime, anywhere.

Businesses can send invoices, track sales, manage payments, and access customer information right at their fingertips. The ability to issue refunds, transfer funds, and withdraw funds via the app provides an all-in-one solution for managing their PayPal business account on the go.

5. PayPal credit options

For many small businesses, access to funding can be a significant hurdle. To address this, PayPal offers credit services like PayPal Working Capital. These loans are based on a business’s PayPal sales history, and the application process is quick and straightforward.

Credit services have no lengthy forms, long waiting periods, or hidden charges. Repayments are automatically deducted as a percentage of daily sales, providing a flexible repayment solution that matches the ebb and flow of a small business’s sales. Plus, it’s easy, because all necessary information can be found in your account.

6. One-touch purchasing

PayPal’s One Touch feature is a significant advantage for businesses aiming to offer a smooth shopping experience. This feature allows customers to stay logged in and complete purchases without entering their password, resulting in a fast and seamless checkout experience.

Businesses can significantly reduce cart abandonment rates by minimizing the steps customers need to take to finalize a purchase, leading to improved sales.

7. Brand trust

PayPal’s reputation as a trusted and secure payment provider is well-established. By offering PayPal as a payment option, small businesses can align themselves with a recognized brand, fostering trust and credibility with customers. This can be especially beneficial for businesses new to ecommerce.

Cons of PayPal for small businesses

Now, let’s dive into the disadvantages of PayPal that business owners might face.

1. Transaction fees

One of the most significant drawbacks of using PayPal for small businesses is its transaction fees. For online transactions, PayPal charges a fee of 2.9% plus a fixed fee based on the currency received. While these fees may seem relatively low, they can add up over time and eat into a small business’s profit margins, especially for businesses with high sales volumes or low-priced products.

2. Account holds and limitations

PayPal has a reputation for freezing or limiting accounts without much warning. These holds can last from a few days to several months, during which businesses can’t withdraw their funds. This can be particularly troublesome for small businesses that rely on cash flow to cover their expenses and operations. Although these measures are designed to protect against fraud, they can be disruptive to businesses that fall victim to them.

3. Lack of customization

PayPal’s one-size-fits-all approach might not meet every business’s unique needs. While PayPal’s ease of use and simplicity are part of its appeal, it also means the platform lacks flexibility and customization options compared to other payment processors. If a small business requires more specific features, such as tailored payment plans or unique checkout interfaces, PayPal might not be the best choice.

4. High currency conversion fees

For international business transactions, PayPal’s high currency conversion fees can be a significant disadvantage. While PayPal’s global reach facilitates international business, the platform charges a 3% to 4% fee above the exchange rate for converting currencies. These charges can significantly impact businesses that frequently deal in multiple currencies, adding to their operating costs.

5. Potential for chargebacks

PayPal’s buyer protection policies can sometimes work against businesses. Customers dissatisfied with their purchase or claiming they never received their order can file for a chargeback. While these policies are designed to protect consumers, they can also leave sellers vulnerable to fraudulent chargeback claims. The time and effort spent dealing with chargebacks can be a significant drain on a small business’s resources.

How to optimize your PayPal workflow with Synder?

As a merchant using PayPal, managing financial transactions can be challenging. However, integrating your PayPal account with accounting software like Synder can greatly simplify the whole process.

Synder processes 2.5 million synchronizations per month from different platforms. Why should you trust it with your PayPal accounting?

By getting accurate information about sales, commissions, and expenses from PayPal integration, Synder prepares you for error-free reconciliation. You’ll also be able to connect additional sales channels and receive reports on your overall business performance across all platforms.

Synder provides a comprehensive solution for all your PayPal accounting needs and is a reliable partner when dealing with both low and high volumes of transactions.

Join our Weekly Public Demo to learn how Synder can improve your accounting workflow. Or take the first step toward managing your finances and sign up for a free trial today.

Bonus: Tips for using PayPal

PayPal tip #1. Understand PayPal’s fee structure

Business owners should get to know PayPal’s fee structure, including charges for online transactions, invoicing, currency conversion, etc. Fees can accumulate quickly, especially for businesses with high sales volumes, so it’s important to factor these costs into pricing and budget strategies.

PayPal tip #2. Ensure strong account security

PayPal has robust security measures, but businesses should still ensure they follow best practices to protect their accounts. This includes using strong, unique passwords, enabling two-factor authentication, and regularly reviewing account activities for any signs of suspicious behavior.

PayPal tip #3. Take advantage of seller protection

PayPal’s Seller Protection program can help protect businesses from chargebacks, reversals, and claims. To maximize these protections, businesses should provide detailed product descriptions in its account, communicate promptly and professionally with customers, and keep comprehensive records of all transactions.

PayPal tip #4. Leverage PayPal’s business tools

PayPal provides a range of tools to help businesses manage transactions and track performance. These include comprehensive invoicing, payment management systems, and integration with other business software. By leveraging these tools, businesses can streamline their operations and gain valuable insights into their sales and customer behavior.

PayPal tip #5. Optimize the checkout process

Implementing PayPal’s One Touch feature can help streamline the checkout process and reduce cart abandonment rates. It’s also beneficial to make PayPal’s logo clearly visible at checkout, as the familiar logo can instill trust and encourage customers to complete their purchases. It doesn’t hurt to add the PayPal logo to your home page to show customers that this option is available.

PayPal tip #6. Stay updated with policy changes

PayPal periodically updates its user agreement and policies. Business owners need to stay informed about these changes as they may impact fees, dispute resolutions, account limitations, and more.

PayPal tip #7. Explore international markets

With PayPal’s global reach, businesses can easily expand to international markets. However, they should also be aware of additional fees for international transactions and currency conversions.

PayPal tip #8. Understand dispute resolution process

Businesses should understand PayPal’s dispute resolution process, which provides a platform for resolving issues with customers. In the event of a dispute, responding promptly and providing all requested information can help expedite resolution.

Alternatives to PayPal

While PayPal is one of the most popular online payment platforms, it isn’t the only option. Here are some alternatives that small businesses might consider:

Stripe

Stripe is a payment platform designed for businesses of all sizes. It offers a variety of features, including support for subscriptions and recurring billing, the ability to customize its checkout experience, and support for many different payment methods, such as credit card or bank apps. It also offers a robust API for those who want to integrate payment processing into their own app.

Square

Square is known for its point-of-sale (POS) system, but it also offers a variety of other services, including online payment processing, invoicing, and even business financing. Its card readers and POS system make it a great choice for businesses with a physical presence.

Venmo for business

Venmo, a mobile payment service owned by PayPal, has gained popularity for personal transactions and is increasingly being used for business transactions. It’s easy to use and has a social aspect that some customers enjoy.

Authorize.net

Authorize.net is a payment gateway that allows you to accept online payments through credit cards and electronic checks. It offers a variety of pricing plans to meet the needs of different businesses.

Conclusion

PayPal offers a myriad of benefits for small businesses. Its ease of use is due to its flexibility (you can even use it from your phone through the app), robust security measures, comprehensive invoicing and payment management features. However, its disadvantages can present significant challenges that can affect your workflow.

Determining whether PayPal is the right choice for a small business largely depends on the specific needs, operating model, and circumstances of that business. Hence, small businesses must evaluate their unique needs and conduct a careful cost-benefit analysis when choosing a payment system.

Read about Xero accounting alternatives and Business savings account.

PayPal FAQs

Why use PayPal for small business?

It’s simple. PayPal can be used for e-business, whether you want to receive or send money. Just add it as a payment method on your website and make the process automatic. It is also possible to use it through the application or connect it to your bank account.

Is PayPal free for small businesses?

You can create an account on the service or in the app for free. PayPal merchant account fees are only charged when transactions begin to take place there. This means that your payment begins only when sales begin.

I just opened up a PayPal credit account, when is my payment due?

PayPal will automatically send you monthly reminders about payment due dates. The first payment is due approximately 35 days after you open a PayPal credit account for your small business.

How will PayPal protect sellers’ money?

If you receive an unauthorized payment or a buyer claims they never received their item, PayPal Seller Protection can help you recover the full amount of the eligible payment that is the subject of a claim, chargeback, or cancellation and waive the chargeback fee if applicable.

Share your opinion

Have additional pros and cons of PayPal that you’d like to share or think we missed something important? We’d love to hear from you! Share your thoughts and experiences in the comments section below and help fellow business owners make informed decisions. Your feedback is invaluable!

%20(1).png)

I didn’t know that there were so many ways to pay for items and business thanks for the update.

I liked paypal for many years. A few months ago ,i noticed payts automatically going thru every month for something i never ordered. When i advised, they tried to sell me more. So I’m closing my paypal to prevent future fraudulent charges.

Hi Ann, we’re sorry to hear about your experience with unauthorized charges through PayPal and the disappointing response when you sought assistance. It’s understandable why you’d choose to close your account to prevent future issues. Protecting yourself from fraudulent transactions is crucial.