Online payment platforms like PayPal have revolutionized the way we conduct transactions. However, with the convenience and popularity of PayPal, there’s been a surge in PayPal scams that target unsuspecting sellers. And while you might already use the software that ensures the security of all your accounting data, you might want to walk the extra mile and explore tricks PayPal scammers can use against you to avoid getting scammed on PayPal as a seller.

TL;DR

- Common PayPal scams for sellers: overpayment, invoice, phishing, and unauthorized transaction scams.

- Key red flags: unusual buyer behavior, off-platform transaction requests, and poor communication.

- Safety tips: use strong passwords, enable two-factor authentication, and monitor account activity.

- Steps if scammed: 1. report to PayPal, 2. provide evidence, and possibly receive a refund after investigation.

Contents:

1. Understanding PayPal scams: Can you get scammed on PayPal receiving money?

2. Payment and invoice PayPal scams

- False claims of non-delivery

- Misrepresentation of items

- Exploiting PayPal’s buyer protection policies

5. Unauthorized transactions scam

6. Detecting scammers: What can you do to avoid a scammer taking your money?

- Red flag #1 – Unusual buyer behavior

- Red flag #2 – Requests for off-platform transactions

- Red flag #3 – Poor communication and unrelated inquiries

- Red flag #4 – Emotional manipulation and urgency

- Red flag #5 – It feels too good to be true

- Red flag #6 – Your gut feeling tells you that something is wrong

- Key takeaways

7. How to avoid PayPal scams and protect your business

8. PayPal’s safety measures and protections

9. I think it might be a scam: Responding to suspicious transactions

10. What to do if you get scammed on PayPal?

11. Getting your money back: PayPal refund for scams

12. Bottom line: Making transactions safe for you as a PayPal seller

13. FAQ Section

Understanding PayPal scams: Can you get scammed on PayPal receiving money?

A scam is a common word for fraudulent schemes or deceptive practices one can use to exploit individuals or organizations for personal gain. It involves the intention to deceive others by presenting false information, promises, or opportunities, usually to obtain money, personal information, or other valuable assets.

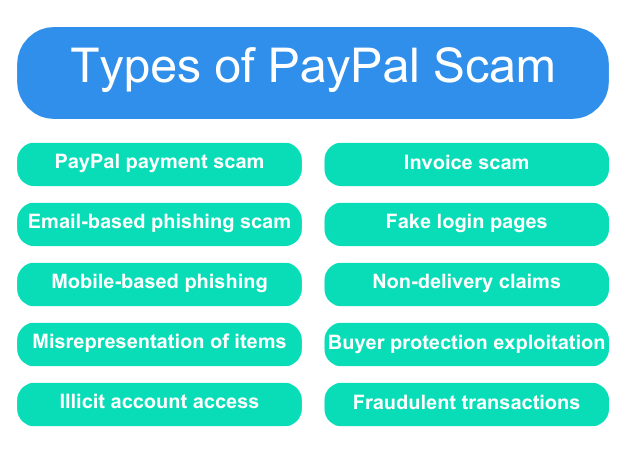

Speaking of PayPal scams, we mean various fraudulent actions people can stumble upon using PayPal when paying for their purchases online or receiving payments as a seller or service provider (both sellers and buyers can fall victim to PayPal scams).

PayPal scams that sellers might face encompass a range of deceptive practices employed by scammers to defraud sellers. These scams exploit vulnerabilities within the PayPal system or target PayPal sellers directly. Understanding the common types of scams is crucial in identifying potential threats. And now, we’ll walk you through the most common scams, so you can spot them in time and not fall prey to those fraudulent tactics.

Payment and invoice PayPal scams

PayPal payment scams and invoice scams are prevalent fraudulent activities that specifically target sellers. These scams exploit the trust and convenience associated with PayPal’s payment platform to deceive sellers and obtain goods or services without paying for them.

PayPal overpayment scams

In a PayPal overpayment scam, fraudsters initiate a transaction with a seller and send a payment via PayPal. However, the payment is either unauthorized or made using fraudulent funds. The scammer may use various tactics to deceive the seller, such as claiming they mistakenly overpaid and requesting a refund of the excess amount. In some cases, scammers may manipulate the PayPal system to make it appear as if the payment was successful when it was actually not.

Invoice scams

Invoice scams, on the other hand, involve the manipulation of invoices. In other words, such scams fake invoices to deceive sellers. Scammers often pose as legitimate buyers or businesses and send invoices for goods or services they claim to have received.

These invoices may appear genuine, complete with logos, contact information, and professional formatting, tricking sellers into believing they’re dealing with legitimate customers. However, the scammers have no intention of paying for the goods or services and are merely attempting to obtain them fraudulently.

PayPal phishing scams

Phishing scams are a prevalent and dangerous tactic used by fraudsters to deceive sellers and gain unauthorized access to their personal and financial information. These scams typically involve the scammer posing as a representative from PayPal or another trusted entity, such as a financial institution or well-known online marketplace, and may result in identity theft (which makes these frauds so dangerous).

Fake email phishing scams

Scammers often initiate phishing scams through fraudulent emails sent to sellers’ inboxes. These emails are designed to appear genuine and mimic official communication from PayPal, complete with logos, formatting, and language that closely resemble legitimate messages. The fake email typically includes urgent or alarming messages, such as a security breach, suspicious activity on the account, or the need to update account information. They create a sense of urgency and fear to prompt sellers to take immediate action.

Within the email, fraudsters include links that direct unsuspecting sellers to fake websites, carefully crafted to resemble the official PayPal website. These spoofed websites may have a URL that appears legitimate or be hosted on a domain that’s similar to PayPal’s.

Fake websites and login pages

Once sellers are directed to the fake website, they’re presented with a login page that appears identical to the PayPal official login page. The fraudsters aim to trick sellers into entering their PayPal login credentials, including their email address and password. Unbeknownst to the sellers, these fake login pages capture and transmit their entered information directly to the offenders. With the obtained credentials, the scammers gain unauthorized access to the seller’s PayPal account, potentially causing significant harm.

Mobile-based phishing

In addition to email-based phishing, scammers also employ mobile-based phishing techniques. For example, they may send you an unsolicited text message while impersonating PayPal’s support team. These messages contain similar tactics, such as urgent requests for account verification or notifications of suspicious activity. These fraudulent messages often include links that, when clicked, direct sellers to fake websites or prompt them to download malicious applications. These applications may contain malware or keyloggers that compromise the security of the seller’s mobile device and capture sensitive information.

Fake purchase PayPal scams

In fake buyer or fake purchase scams, scammers make fraudulent purchases from sellers and then claim they never received the item or received an item significantly different from what was described. They often exploit the PayPal buyer protection policies to obtain refunds or free merchandise, resulting in financial loss and potential damage to the seller’s reputation.

False claims of non-delivery

One common tactic scammers use in fake buyer scams is falsely claiming non-delivery of the purchased item. After the transaction is completed, the scammer insists that the item never arrived or provides false tracking information to support their claim. They leverage the buyer protection policies, which prioritize the interests of buyers, to initiate a dispute and demand a refund.

Misrepresentation of items

In some instances, scammers receive the purchased item but then falsely claim that it significantly differs from the item described by the seller. They may exaggerate minor flaws, fabricate defects, or even swap the original item with a different or damaged one. By alleging a substantial discrepancy, scammers aim to secure a refund or return the item for a full refund while keeping the original product.

Exploiting PayPal’s buyer protection policies

Scammers often try to exploit PayPal’s buyer protection policies, which were originally designed to provide a secure and reliable purchasing experience for buyers. These policies can inadvertently create an imbalance, favoring buyers over sellers. Scammers take advantage of this bias to manipulate the system and secure refunds or chargebacks without legitimate grounds, leaving sellers at a disadvantage.

Unauthorized transaction scams pose a significant threat to sellers, as scammers gain illicit access to their PayPal accounts, conducting fraudulent transactions without the seller’s knowledge or consent. These scams can result in severe money losses and disruptive consequences for the seller’s business operations.

Illicit account access

Scammers employ various techniques to gain unauthorized access to a seller’s PayPal account. This can include exploiting weak passwords, obtaining login credentials through phishing scams, or leveraging malware and keyloggers to capture sensitive information.

Sometimes, a hacked account gives scammers unrestricted access to the seller’s funds and they can initiate transactions without raising suspicion. Sometimes, a scammer will simply keep the account until a seller pays some ransom to get it back (ransomware scam).

Fraudulent transactions

Once inside the compromised PayPal account, scammers engage in a series of fraudulent transactions. They may make unauthorized purchases from other sellers, transfer funds to different accounts, or even withdraw funds directly. These transactions are often conducted swiftly and in large amounts, maximizing the financial impact on the seller.

The consequences of unauthorized transaction scams can be devastating for sellers. They may experience substantial financial losses as scammers deplete their PayPal balance or make purchases using their account funds. Additionally, sellers may face chargebacks and disputes from affected buyers, leading to further financial strain and potential damage to their reputation.

Detecting scammers: What can you do to avoid a scammer taking your money?

To help you protect your money, your account, and your personal information, it’s better to be safe than sorry.

Recognizing warning signs can help sellers identify a potential scam and take appropriate precautions. Though you can’t foresee it, certain things should warn you about potential fraudulent activities against you. So here are some red flags you might want to set up your inner scam alarm to watch out for.

Red flag #1 – Unusual buyer behavior

Pay attention to buyers who exhibit suspicious behavior. For example, if a buyer frequently changes their order, shipping details, or seems indecisive and inconsistent, this could be a tactic to confuse and scam sellers.

Another unusual behavior that can be a sign of fraudulent activity is a request to ship items to unverified or multiple addresses, especially if it deviates from the verified address on PayPal.

Be cautious of buyers who have overly complex orders or requests that significantly differ from your usual business practices. These can sometimes be setups for scams.

All in all, genuine buyers typically respect the PayPal platform’s rules and guidelines, valuing transparency and adhering to the usual flow of buying and selling.

Red flag #2 – Requests for off-platform transactions

Scammers often attempt to lure sellers into completing transactions outside of PayPal, for example, to pay for an item via services like Western Union or MoneyGram, or using a gift card. They may claim it’s more convenient or offer false incentives, promises of faster payment, etc. However, engaging in off-platform money transactions exposes sellers to significant risks, as it bypasses the protections and safeguards provided by PayPal.

So if someone offers you to fulfill a transaction outside PayPal, it’s definitely a red flag, huge and scarlet. Being Captain Obvious at this point, sellers should always conduct their transactions within PayPal’s secure environment.

Poor grammar and broken English can sometimes be a sign of a scam, particularly when combined with other suspicious factors. It’s important to note, however, that not all buyers with imperfect English are scammers, as they might be non-native English speakers. The key here is to look for communication that seems overly formal or awkwardly phrased in a way that feels unnatural, as well as inquiries that aren’t directly related to the transaction or the item being sold.

If you notice these signs, it’s wise to proceed with caution. Ask more detailed questions about their inquiries, and if the responses continue to be vague or unrelated, it could be a sign of a scam.

Red flag #4 – Emotional manipulation and urgency

As mentioned above, scammers don’t hesitate to employ a sense of urgency, sympathy, or intimidation. They may try to manipulate you by playing on your emotions, such as expressing a personal crisis, to gain your trust, and scam you.

If something feels off, you might want to switch on the wait-a-minute mode and investigate before proceeding with the transaction.

Red flag #5 – It feels too good to be true

The saying “If it feels too good to be true, it probably is” holds significant weight in identifying potential scams. If a buyer is overly accommodating or agrees to all terms without negotiation or typical due diligence, it might mean you can lose your money. Also, if a new buyer suddenly places a large order without prior history or inquiries, it could be a setup for a scam, especially if it’s accompanied by some of the other red flags mentioned.

What’s more, be cautious if a buyer sends you more money than the asking price (aka PayPal overpayment scam). They might then ask for the difference to be refunded. This is a common scam where the initial payment is made with fraudulent funds or a stolen credit card, and you might lose the refunded amount when the fraud is discovered.

Red flag #6 – Your gut feeling tells you that something is wrong

This red flag is about the subconscious signals or discomfort you might feel during a transaction. Your intuition is shaped by your past experiences and knowledge, even if you’re not consciously aware of it. It manifests as a feeling that something is off, despite not having explicit evidence. For example:

- Feeling uneasy about how the transaction is proceeding, even if everything seems fine on the surface.

- Feeling skeptical about the buyer’s or seller’s authenticity, their communication style, or their responses.

- Noticing subtle inconsistencies or discrepancies that don’t quite add up, but can’t be pinpointed easily.

Your intuition often picks up on these subtle cues and patterns that your conscious mind may not immediately recognize. Ignoring these feelings can sometimes lead to overlooking critical warning signs of a scam.

So if your instincts continue to signal a warning, it’s often safer to err on the side of caution. It’s better to miss out on a potential opportunity than to fall victim to a scam.

Key takeaways

It’s important to note that while these red flags can indicate potential scams, they aren’t definitive proof. Some buyers may have legitimate reasons for their behavior or inquiries. However, when dealing with buyers who exhibit multiple warning signs, sellers might need to employ additional security measures.

How to avoid PayPal scams and protect your business

Prevention is paramount when protecting yourself as a seller and avoiding PayPal scams. Safeguarding your PayPal transactions requires awareness, knowledge, and diligence. At this point, you might want to be proactive and implement several measures and best practices to fortify your defenses and mitigate the risk of falling victim to fraudulent activities.

Secure your PayPal account

Ensuring the security of your PayPal account is vital to protect your financial assets, personal information, reputation, and business operations. By using robust security measures, you significantly reduce the chances of unauthorized access, fraudulent activities, and disruptions. This way, you contribute to a safe and trustworthy environment for you and your customers, enhancing the overall PayPal experience. The most basic protection measures that you might want to consider might look ridiculously obvious but they have the power to stop the vast majority of scams.

- Create strong passwords for your PayPal account, combining upper and lowercase letters, numbers, and special characters. Avoid using easily guessable information such as your name or birthdate.

- Activate the two-factor authentication feature to add an extra layer of security. This ensures that even if scammers obtain your password, they’ll still require a unique verification code to access your account.

- Frequently monitor your PayPal account for any suspicious or unauthorized activity. Report any discrepancies to PayPal immediately to initiate an investigation.

Safeguard your sales

Another way to prevent fraud and protect your sales is to do basic research about the buyer, like looking through buyers’ profiles and paying attention to feedback and reviews. You might also consider verifying shipping addresses or insuring high-value items for added security. Let’s break it down a bit:

- Before engaging in transactions, research buyers’ profiles, ratings, and reviews. Be wary of new accounts, low feedback scores, or negative reviews, as they may indicate potential scammers.

- Always ship to the verified addresses provided by PayPal. Scammers often request alternative addresses or international shipping, which can increase the risk of fraudulent activities. You might want to use the shipping options PayPal offers.

- Consider insuring high-value items to protect yourself from potential financial losses. Insuring your shipments provides an additional layer of security in case of delivery disputes or theft.

Learn how to cancel a PayPal transaction.

Recognizing phishing attempts

Phishing attempts are rampant in the realm of PayPal scams, making it imperative for users to remain highly vigilant and adopt precautionary measures to safeguard their accounts. One crucial step to enhance your defense against phishing attacks is to secure your browsing using a Virtual Private Network (VPN), which can establish an encrypted connection between your device and the internet. Consider adhering to the following precautions, along with employing a VPN, to fortify your protection:

- Whatever action you want to take concerning your PayPal account, ensure that you are accessing PayPal through the official website by verifying the URL. Look for the padlock symbol and “https” in the website’s address bar, indicating a secure connection.

- Be cautious of emails requesting personal information or redirecting you to unfamiliar websites. Don’t click on the links, don’t download any attachments, or call a phone number provided by the potential PayPal scammer, simply send the fake email over to [email protected] and then promptly delete it.

- Before shipping any merchandise in response to an email claiming you’ve received a PayPal payment, first verify by logging into your PayPal account directly. Ensure the payment is legitimate and not a scam. Always access your account by typing PayPal.com into your browser, not by clicking email links.

- PayPal will never ask for your password, full Social Security number, or financial details. Don’t share such information through email, phone, or on suspicious websites.

Here’s a list of PayPal scams that are common if you use a personal account of PayPal.

PayPal’s safety measures and protections

As you can see, taking even the most basic and obvious security measures can help you avoid losing your revenue to scammers. But it’s worth saying that you’re not left alone in fighting scammers. PayPal has strong safety measures and protections in place to combat scams and protect sellers.

Buyer and Seller Protection

One of PayPal’s key offerings is its Buyer and Seller Protection programs. Provided that both buyers and sellers can get scammed on PayPal, these programs aim to resolve disputes and provide financial recourse to eligible sellers who have fallen victim to scams. In the event of a fraudulent transaction, sellers can rely on PayPal’s support to investigate the incident and potentially recover their lost revenue.

Dedicated investigation team

To effectively tackle scams and fraudulent activities, PayPal maintains a dedicated team of experts responsible for investigating such cases. These professionals analyze transaction details, review communications between buyers and sellers, and assess supporting evidence to ascertain the legitimacy of claims. By conducting thorough investigations, PayPal strives to identify and take action against scammers, providing sellers with a higher level of security and peace of mind.

PayPal’s Resolution Center

The PayPal Resolution Center plays a crucial role in facilitating communication and conflict resolution between buyers and sellers. This platform serves as a centralized hub where both parties can openly discuss their concerns, initiate disputes, and work towards resolving conflicts. The Resolution Center provides a structured process that allows for effective mediation, helping sellers navigate through difficult situations and find a fair resolution.

With PayPal’s Buyer and Seller Protection programs, scam investigation teams, and the Resolution Center at your disposal, you can rest assured that there’s a support system in place to assist you in the event of a scam. These measures aim to minimize the impact of fraudulent activities on sellers and maintain the trust and integrity of the PayPal platform.

I think it might be a scam: Responding to suspicious transactions

If you suspect a PayPal scam or come across a suspicious transaction, it’s crucial to take immediate action to protect yourself and minimize potential risks. By following these steps, you can respond effectively to suspicious transactions:

Step 1. Examine transaction details

Carefully examine the transaction details, including the buyer’s information, payment amount, and any accompanying messages or instructions. Look for any inconsistencies or red flags that may indicate fraudulent activity.

Step 2. Communicate with the buyer

Reach out to the buyer through the PayPal messaging system or other communication channels to seek clarification or additional information. Politely inquire about the transaction and express any concerns you may have. Keep records of all communication for future reference.

Step 3. Verify buyer’s identity

If the transaction appears suspicious, consider verifying the buyer’s identity. Request identification documents or additional information to ensure the legitimacy of the buyer. Exercise caution when sharing sensitive information and be mindful of privacy and data protection.

Want to learn how to verify your PayPal account? Read our guide.

Step 4. Contact PayPal support

If you’re still unsure about the transaction and the buyer contact PayPal customer support directly through their official channels. Report to them any potential scams or fraudulent activities. They can provide guidance, verify the legitimacy of a transaction, and assist with dispute resolution.

Step 5. File a dispute with PayPal

If you believe you’ve fallen victim to a PayPal scam, file a dispute or claim through PayPal’s Resolution Center promptly. Provide all necessary information and evidence to support your case and maximize your chances of receiving a refund. Maintain detailed records of all communications, transactions, and evidence related to the suspected scam. This documentation will support your case during any dispute resolution process.

Now let’s look further into taking action when you got scammed.

What to do if you get scammed on PayPal?

All the precautions and red flags sometimes are clear only after we’ve been scammed. So if you suspect you’ve been scammed on PayPal, taking immediate and appropriate actions to mitigate the damage and potentially recover your funds is crucial.

Contact PayPal immediately

Log into your PayPal account and navigate to the Resolution Center. Report the unauthorized transaction or scam there. PayPal’s team will investigate the issue and guide you through the process of filing a claim.

Save all correspondence related to the scam, including emails, messages, transaction details, etc. This information can be crucial for investigations.

Report the scam to authorities

If you’ve lost money or believe you’ve been part of a fraudulent scheme, report it to local law enforcement or cybercrime units. Reporting helps in the fight against scammers and may assist in the broader effort to prevent such scams.

Safeguard your PayPal account

Change your PayPal password immediately. Make sure it’s strong, unique, and not used for any other accounts. Consider using a password manager to create and store complex passwords. Also, enable Two-Factor Authentication (2FA) on your PayPal account. This adds an extra layer of security, ensuring that only you can access your account.

Securing your financial assets

Once you’ve changed all your passwords, do monitor your PayPal account for any unusual activity. Also, check the bank accounts and credit cards linked to your PayPal account for unauthorized transactions.

If you find unauthorized transactions on your linked bank accounts or credit cards, contact your financial institutions immediately. They can help secure your accounts and may assist in recovering lost funds.

Key Takeaway

Remember, the sooner you act, the better your chances of resolving the issue and protecting your money. PayPal has systems in place to support victims of scams, but it’s also important for users to be proactive in securing their accounts and responding swiftly to any suspicious activity.

Getting your money back: PayPal refund for scams

Did you get scammed on PayPal? Don’t worry, PayPal can help you get your money back. They know it’s important to keep things safe for everyone who uses their service, so they’re ready to help out if you’ve been tricked.

Report the scam

As soon as you realize you’ve been scammed, go to the PayPal Resolution Center on their website. Tell them all about what happened, including the details of the transaction and any proof you have that it was a scam. The more details you give, the better your chances are of getting your money back.

Wait for the review

PayPal has a team that looks into these kinds of problems. They’ll go over everything you sent them to figure out if you were scammed and what should be done next.

Be patient

Once you’ve reported the scam, it might take some time for PayPal to finish their investigation. They want to make sure they get everything right. So, it’s a good idea to be patient and wait for their decision.

Getting your refund

If PayPal decides you were scammed, they’ll put the money back in your PayPal account. This helps take care of any money you lost because of the scam and helps your business keep going.

Remember, if you have any questions or need help while they’re sorting things out, you can always talk to PayPal’s customer service. They’re there to help you through this.

Bottom line: Making transactions safe for you as a PayPal seller

Online transactions can be tricky, especially with the rise of sophisticated PayPal scams. But remember, knowledge is power. By staying informed and alert, you can significantly reduce the risk of falling victim to these fraudulent schemes.

As we’ve explored in this comprehensive guide, recognizing the red flags, fortifying your account security, and responding promptly to any suspicious activity are key steps in safeguarding your PayPal experience. It’s about striking a balance between taking advantage of PayPal’s convenience and staying vigilant against potential threats.

But this journey towards a scam-free online transaction experience isn’t a solo mission. We’re in this together! Your insights and experiences are invaluable in enriching our collective understanding and developing stronger defenses against these scams.

We want to hear from you!

Have you ever encountered a PayPal scam or have tips on how to avoid them? Your experiences could be invaluable to our community. Share your stories and insights in the comments section below.

FAQ Section

Q1: What are PayPal scams?

PayPal scams are fraudulent activities where scammers use deceptive practices to defraud people using PayPal. These can include phishing attacks, invoice scams, unauthorized transactions, and more.

Q2: Can you get scammed on PayPal?

Unfortunately yes, both buyers and sellers using PayPal can potentially fall victim to scams. Scammers often target users by exploiting the platform’s features and user trust.

Q3: How do PayPal phishing scams work?

In phishing scams, scammers send fake emails or text messages that appear to be from PayPal, asking for sensitive information like login credentials. They may direct users to a counterfeit website to steal personal and financial information.

Q4: What is a fake invoice scam on PayPal?

A fake invoice scam involves scammers sending fraudulent invoices to sellers, pretending to be legitimate buyers. The invoices may look authentic but are used to deceive sellers into providing goods or services without actual payment.

Q5: Can fraudsters make unauthorized transactions on my PayPal account?

Yes, if scammers gain access to your PayPal account, they can make unauthorized transactions. This can happen if you unknowingly share your login details or if your account security is compromised, even leading to identity theft.

Q6: What should I do if I suspect a PayPal scam?

If you suspect an online scam, do not respond to any suspicious email or message. Verify any communication by logging into your PayPal account directly through the official website or app. Report any suspicious activities to PayPal immediately.

Q7: How can I protect myself from PayPal scams?

Protect yourself by using strong, unique passwords for your PayPal account, enabling two-factor authentication, being cautious of unsolicited communications, and never sharing your personal information via email or unverified websites.

Q8: Does PayPal offer protection against scams?

PayPal offers Buyer and Seller Protection programs that may help in cases of fraud. However, these protections have certain conditions and limitations, so it’s essential to understand them and practice safe online transaction habits.

Q9: How to spot a potential PayPal scam?

Red flags include urgent requests for personal information, offers that seem too good to be true, requests for transactions outside of PayPal, and emails with poor grammar or that come from suspicious email addresses.

Q10: Can I get a refund from PayPal if I am scammed?

If you have been scammed, report scams to PayPal immediately. They will investigate the case. If the transaction qualifies under PayPal’s protection policies, you may receive a refund. However, each case is reviewed individually, and outcomes can vary.

%20(1).png)

Hi, thanks for stopping by. You might want to consider visiting the dedicated fraud reporting page on the PayPal website: https://www.paypal.com/lc/webapps/mpp/security/report-problem

Hi Volha, I need to get in touch with PayPal re a recent phishing scam – but this link doesn’t work.

Hey Naobie,

Thanks for stopping by. Not sure which link you’re talking about, but you might want to contact PayPal to report phishing or scam following this link: https://www.paypal.com/lc/webapps/mpp/security/report-problem