When setting up your online store, you might be confused about what payment methods you need to accept. After all, it’s all about making things easier for your customers and increasing your conversion. Nobody likes to deal with complicated checkout procedures!

Whether you have a physical store or an ecommerce site, it’s essential to care about how customers will pay for their purchases. The payment method you choose can make a big difference in whether people buy from your store ever again. This way, it’s essential to consider the pros and cons of each payment method so that you can decide which one is best for your particular store.

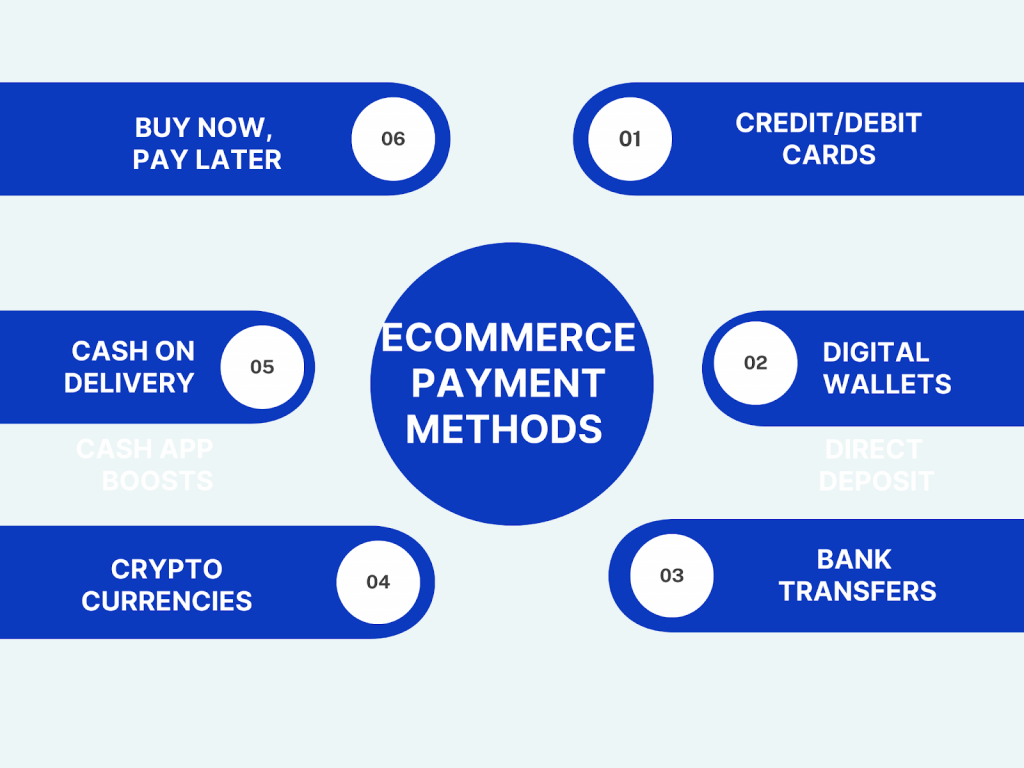

This article offers you a detailed outline of common methods of payment for ecommerce businesses.

Boost your ecommerce performance with Synder, a top-notch accounting tool for automated sync of sales data from your sales platform(s) and payment processor(s) into the books. Learn more about how Synder can streamline your business by signing up for a 15-day free trial or book a seat at our Weekly Public Demo to get a live tour of Synder.

Contents:

1. Ecommerce payment methods: Brief overview of online payment methods

Ecommerce payment methods: Brief overview of online payment methods

With the rapid growth of online stores, it becomes crucial to offer a variety of payment options to cater to diverse customer preferences.

Credit and debit cards are widely used in ecommerce, offering convenience and speed as customers securely enter their card details for electronic payment processing, popular card processors being Visa, Mastercard, American Express, and Discover. Then there are digital wallets, such as PayPal, Apple Pay, Google Pay, and Samsung Pay, which have gained popularity, allowing customers to securely store their payment information in apps or online platforms. Bank transfers is another widely used ecommerce payment method providing a direct and secure transfer of funds from customer bank accounts to the online store.

Quite a recent payment option being utilized by online store owners now is cryptocurrencies like Bitcoin, Ethereum, and Litecoin. They’re increasingly accepted, offering additional privacy and security for customers who value anonymity and decentralized payment systems. Cash on delivery (COD) is favored in certain regions, enabling customers to pay in cash upon delivery, while Buy Now Pay Later (BNPL) services like Klarna, Afterpay, and Affirm allow customers to make purchases and defer payment over time.

Here’s a more detailed description of each payment method for ecommerce.

Ecommerce payment methods: Credit and debit card

One of the most widely used payment methods, credit and debit cards offer convenience and speed. Customers can securely enter their card details during the checkout process, and the payment is processed electronically.

Advantages of credit and debit cards for receiving payments in ecommerce

Firstly, a credit or debit card provides convenience and speed, allowing customers to make purchases with just a few clicks. The ability to securely enter card details during the checkout process ensures a smooth transaction experience. Furthermore, a credit or debit card is accepted by the majority of online stores, making it highly versatile.

Another significant advantage of using credit cards to pay for online purchases is the added layer of security they offer. Card payment processors, such as Visa, Mastercard, American Express, and Discover, implement robust security measures to protect customer information in the ecommerce sphere. They use encryption technology to safeguard card details during transmission, reducing the risk of unauthorized access.

Additionally, card issuers often provide fraud protection programs that offer reimbursement for unauthorized transactions, providing customers with peace of mind. So you don’t have to worry about chargebacks, fraudulent charges, or identity theft.

Credit cards also offer additional benefits such as reward programs and cashback incentives. Many card issuers provide rewards for ecommerce transactions, including discounts, loyalty points, or cashback on purchases. This can be an attractive feature for customers who want to maximize their savings or earn rewards while shopping online.

Disadvantages of the credit and debit card for receiving payments in ecommerce

Despite the advantages, there are a few disadvantages associated with credit cards in ecommerce. One of the primary concerns is the potential for overspending. Since credit cards provide a line of credit, customers may be tempted to make impulsive purchases or get into debt beyond their means. It requires discipline and responsible financial management to avoid excessive credit card usage and the associated interest charges.

Another drawback is that there’s still some risk of credit card fraud. While a card payment processor employs strong security measures, there is a possibility of card information being compromised during online transactions. Phishing attacks, data breaches, or unauthorized access to card details can lead to fraudulent activities. However, customers are typically protected by zero-liability policies provided by card issuers, limiting their liability for fraudulent transactions.

Check out our article on ecommerce security.

Virtual credit cards

A virtual credit or debit card is a 16-digit number associated with your existing card account, randomly generated every time you want to make an online purchase. A virtual credit card, usually offered by your physical credit card provider, aims to protect users against fraud. It substitutes your real credit card so that you don’t have to share its number when you shop online. Moreover, after you make a purchase, the number is retired and never used again. It prevents fraudsters from stealing your credit card number.

Virtual credit cards are really easy to use as you can create an account with a third-party provider and start accepting credit card payments right away. Also, you don’t have to worry about the security of your online store because the risk is on the third-party provider. However, third-party providers charge high fees for virtual credit cards and some providers don’t offer the same level of security for virtual cards as regular credit cards.

Payment methods in ecommerce: Digital wallets

Digital wallets have emerged as a convenient and secure method of payment in the realm of ecommerce, bringing several advantages for both customers and businesses. But there are also some minuses to take into consideration. Take a look at a number of benefits and downsides of using digital wallets in the ecommerce business.

Advantages of digital wallets as an ecommerce payment option

There’s no denying that digital wallets offer their users convenience and speed – a seamless and efficient checkout experience. Customers can store their payment information securely in an app or online platform, eliminating the need to manually enter card details for each purchase. This streamlined process saves time and enhances the overall shopping experience.

One of the distinctive features of digital wallets is that they prioritize security by implementing robust measures to protect sensitive payment information. Additional security is provided by two-factor authentication or biometric verification (like fingerprint or facial recognition), which adds an extra layer of protection against unauthorized access and fraudulent activities. This makes digital wallets a secure option for online transactions.

Versatility and accessibility is another advantage. Popular digital wallet options like PayPal, Apple Pay, Google Pay, and Samsung Pay are widely accepted across various ecommerce platforms and mobile apps. This widespread acceptance allows customers to use their digital wallets for purchases from a range of merchants, making it a versatile payment solution.

Digital wallets also ensure simplification of making a payment during international transactions. They often support multiple currencies, facilitating seamless international transactions. Customers can make purchases from overseas merchants without the hassle of currency conversion, resulting in a more straightforward and transparent shopping experience.

One more beneficial characteristic of digital wallets which online shoppers really appreciate is loyalty programs, rewards, and exclusive offers. When customers make a payment, they can earn points, cashback, or discounts for using their digital wallets for transactions, providing additional incentives and enhancing customer loyalty.

Disadvantages of digital wallets as an ecommerce payment option

Limited acceptance of digital wallets is often named as one of the drawbacks of making a payment this way. While digital wallets are gaining popularity, they may not be universally accepted by all ecommerce platforms or physical stores. Some smaller or niche businesses may not support digital wallet payments, limiting the options for customers who solely rely on this method.

Despite enhanced security, there are sometimes privacy concerns about using digital wallets. Storing payment information in a digital wallet means entrusting sensitive data to a third-party provider. While reputable digital wallet providers prioritize security while making a payment, some customers may have concerns regarding data privacy and potential vulnerabilities that could lead to unauthorized access or data breaches.

And surely, there are transaction or payment fees users need to take into account. Associated fees usually depend on the digital wallet and the nature of the transaction. These fees could include transaction fees, currency conversion fees, or fees for certain features or services offered by the digital wallet provider. Ecommerce merchants should be aware of these costs, as they can impact their profitability.

Payment methods in ecommerce: Bank transfers

Bank transfers are a payment method in ecommerce that provides certain advantages and disadvantages for both customers and businesses. Let’s delve into the advantages and disadvantages of using bank transfers as an ecommerce payment method.

Advantages of bank transfers as a payment method for an online store

Number one advantage of bank transfers is security and trust. Bank transfers are regarded as a highly secure payment method as they involve direct transfers of funds between bank accounts. Customers can feel confident about the security of their transactions, as they are handled by established banking systems that employ robust security measures.

Using bank transfers implies cost savings as they typically involve lower transaction fees compared to credit card payments or digital wallet transactions. This can be advantageous for both customers and businesses, as they can save on processing fees, especially for larger transactions or frequent payments.

Bank transfers allow ecommerce business owners to offer more flexibility in payment options and eliminate dependency on cards or digital wallets. Bank transfers provide an alternative payment option for customers who may prefer not to use credit or debit cards or digital wallets. Some customers may not have access to these payment methods or may have concerns about sharing their card details online. Bank transfers offer them a secure and reliable alternative.

Bank transfers facilitate direct and immediate transfer of funds from the customer’s bank account to the merchant’s account. This eliminates the need for intermediaries and reduces the settlement time, ensuring quick and efficient payment processing.

Disadvantages of bank transfers as a payment method for an online store

There are still a couple of challenges bank transfers may present both to ecommerce businesses and online store customers.

With bank transfers, you get additional steps and complexity as they typically require customers to manually initiate the payment process and provide the necessary account details. This can be time-consuming and may involve additional steps compared to other payment methods, such as entering card details or authorizing a digital wallet payment.

Another concern is connected with delayed processing and delivery. While bank transfers offer security, they can be slower compared to instant payment methods. Processing times may vary depending on the banks involved, leading to potential delays in order fulfillment or delivery. This can impact the overall customer experience, especially for customers who expect faster transaction processing.

There’s also limited real-time tracking. Unlike card payments or digital wallet transactions, where real-time updates and transaction tracking are readily available, bank transfers may not provide instant visibility into the status of the payment. Customers may need to rely on bank statements or communication with the merchant to confirm successful payment completion.

Bank transfers are sometimes associated with lack of buyer protection compared to credit cards or certain digital wallets, which offer buyer protection programs. Bank transfers usually don’t provide the same level of protection in case of disputes or fraudulent transactions. Customers may face challenges in recovering funds or resolving payment-related issues, especially if unauthorized transactions occur.

Payment methods in ecommerce: Cryptocurrencies

Cryptocurrencies have gained significant attention as a payment option in ecommerce, having their unique advantages and some disadvantages. Let’s explore them.

Advantages of using cryptocurrencies as an ecommerce payment method

Security and privacy is no doubt a big plus of utilizing crypto as a payment method in the ecommerce industry. Cryptocurrency transactions provide enhanced security through cryptographic techniques. The decentralized nature of blockchain technology ensures that transactions are recorded securely, making it difficult for unauthorized access or fraud to occur. Cryptocurrencies also offer a level of privacy, as they don’t require customers to share sensitive personal information during transactions, thus reducing the risk of identity theft or data breaches.

Cryptocurrencies have global accessibility. They don’t go together with geographical boundaries or exchange rates, which makes them an attractive option for international ecommerce, as customers can make transactions without the need for currency conversion or dealing with exchange rate fluctuations. It simplifies cross-border transactions and expands the customer base for ecommerce businesses that accept cryptocurrencies.

Cryptocurrency transactions generally involve lower fees compared to traditional payment methods, such as credit card transactions or bank transfers. This can be beneficial for online store owners, especially those processing a large volume of transactions, as it reduces costs and increases profit margins.

Crypto usually comes with faster settlements as transactions are typically processed faster compared to traditional payment methods, which often require intermediary banks or payment processors. Blockchain technology enables near-instantaneous settlement, allowing merchants to receive funds quickly and expedite order processing and fulfillment.

Disadvantages of using cryptocurrencies as an ecommerce payment method

It’s common knowledge that cryptocurrencies are highly volatile, as their prices can significantly fluctuate during one day. This introduces a level of uncertainty for both customers and businesses. Customers may hesitate to use cryptocurrencies for purchases due to the potential loss of value, while businesses may need to promptly convert received cryptocurrencies into fiat currency to mitigate exposure to market volatility.

There’s a problem with limited acceptance. Although the acceptance of cryptocurrencies is growing, they are still not universally accepted by all online stores. This limits the number of merchants that customers can transact with using cryptocurrencies. Customers who prefer to use cryptocurrencies may need to search for specific merchants that support this payment option.

Using crypto implies technical complexity as cryptocurrencies require customers to have a basic understanding of how to set up and use digital wallets and manage cryptographic keys. This technical complexity can be a barrier for some customers, especially those who are less tech-savvy or unfamiliar with the concept of cryptocurrencies.

Finally, cryptocurrency transactions are typically irreversible. Once a transaction is confirmed on the blockchain, it can’t be easily reversed or disputed. This lack of chargeback options, which are available in traditional ecommerce payment methods, may pose challenges for customers in resolving disputes or receiving refunds in cases of fraud or unsatisfactory transactions.

Check out our article about cryptocurrency accounting.

Payment methods in ecommerce: Cash on delivery

Cash on delivery (COD) is a payment method in ecommerce that allows customers to pay for their purchases in cash when the goods are delivered to their doorstep. While COD has its advantages, it also comes with certain disadvantages.

Advantages of using cash on delivery as an ecommerce payment option

COD offers payment convenience to customers who may not have access to or prefer not to use electronic methods of payment. It allows them to make purchases without the need for credit or debit cards, digital wallets, or bank transfers. Customers simply need to have cash available at the time of delivery, making it a suitable payment option for those who prefer to pay in person and handle physical currency.

Cash on delivery provides a sense of security and trust for customers, as they can inspect the goods before making a payment. This reduces the risk of receiving damaged or incorrect items and ensures that customers only pay for what they have received and are satisfied with. It builds trust between the customer and the online store, enhancing customer confidence and reducing the likelihood of fraudulent transactions.

The COD method offers nowadays a unique feature – inclusion of unbanked or underbanked customers. It allows customers who don’t have access to banking services or credit cards to participate in ecommerce. It enables inclusion for individuals in areas with limited banking infrastructure or those who don’t have access to digital methods of payment. This expands the potential customer base for online stores, reaching a wider audience.

Offering cash on delivery as a payment option can potentially increase conversion rates and sales. Some customers may be more inclined to make a purchase if they have the option to pay upon delivery, as it reduces the upfront financial commitment and eliminates concerns about online payment security.

Disadvantages of using cash on delivery as an ecommerce payment option

COD introduces additional operational complexity for online stores. It requires coordination with logistics partners or in-house delivery teams to handle the cash collection and payment reconciliation process. This can add logistical challenges and costs, especially for businesses with high order volumes or in geographically dispersed regions.

When you make a payment, cash transactions carry inherent cash handling risks, such as theft or mishandling of cash during delivery or collection. Online stores must have robust security measures and protocols in place to ensure the safe handling of cash. Adequate training and supervision of delivery personnel are necessary to minimize the risks associated with cash handling.

COD can lead to a higher rate of order returns or cancellations compared to other payment methods. Customers may place orders without serious intent to purchase, resulting in wasted resources for the online store. Managing returns and cancellations in a cash-based system can be more challenging, requiring efficient processes to handle refunds or adjustments.

There’s also limited customer protection. Unlike electronic payment methods that offer buyer protection programs or chargeback options, cash on delivery does not provide the same level of protection for customers. In the event of disputes or unsatisfactory transactions, customers may face difficulties in recovering their cash or resolving issues with the online store.

Payment methods in ecommerce: Buy Now, Pay Later

Buy Now, Pay Later (BNPL) is a popular payment option in ecommerce that allows customers to make purchases and defer the payment over time. Here’s a list of its upsides and downsides of this method of payment.

Advantages of using Buy Now, Pay Later as a payment method in ecommerce

BNPL has increased purchasing power. Buy Now, Pay Later enables customers to make purchases without the immediate need for full payment. This can expand their purchasing power, allowing them to buy products or services that they may not have been able to afford upfront. It offers flexibility and convenience, particularly for customers with budget constraints or irregular income streams.

BNPL providers offer a simple and streamlined checkout experience. Customers can select the BNPL option during the payment process, often with just a few clicks. This reduces the friction of entering credit card details or setting up new payment accounts, enhancing the overall customer experience and potentially increasing conversion rates.

BNPL offers split payments and installment flexibility. Such services allow customers to split the total purchase amount into smaller, more manageable installments. This can be advantageous for customers who prefer spreading out their payments over a specific period. BNPL providers typically offer flexible repayment options, such as weekly or monthly installments, allowing customers to choose a payment schedule that aligns with their financial situation.

Some BNPL providers offer interest-free financing for a specific period or low-interest rates compared to traditional credit card options. This can be appealing to customers who want to avoid high-interest charges or prefer more affordable financing options.

Disadvantages of using Buy Now Pay Later as a payment method in ecommerce

There’s always a risk of potential debt accumulation. While BNPL can offer short-term financial relief, it can also lead to potential debt accumulation if not managed responsibly. Customers may be tempted to make impulsive purchases or underestimate their repayment abilities, resulting in financial strain or late payment fees. It requires disciplined financial planning to ensure timely and manageable repayments.

There may also be hidden fees and interest charges. While some BNPL providers offer interest-free financing, others may charge interest or additional fees. It’s important for customers to thoroughly understand the terms and conditions, including any potential late fees, penalties, or interest charges that may apply. Failure to adhere to these terms can lead to unexpected costs and impact the overall affordability of the purchase.

The BNPL payment option can potentially impact customers’ credit scores. Some BNPL providers may perform a credit check or report payment activity to credit bureaus. Late or missed payments can negatively impact a customer’s credit score, potentially affecting their ability to obtain credit in the future. Customers should be aware of the potential credit implications and ensure responsible repayment practices.

Unlike traditional credit card purchases, BNPL may offer limited or different purchase protection mechanisms. Customers may have limited recourse for disputes or issues with the products or services purchased. It is crucial for customers to understand the extent of purchase protection provided by the BNPL provider and factor this into their decision-making process.

Learn more about how BNPL options work: Klarna, Afterpay, Affirm, Sezzle.

Final thoughts on ecommerce payment methods and their impact on ecommerce business management

Choosing a suitable method of payment is crucial if you’re running an ecommerce store. You might want to consider various factors, such as security, ease of use, transaction speed, and more, to decide what method of payment might fit the bill for you. The general advice here will be to choose the method of payment that makes the most sense for your business. Keep in mind that methods of payment change as new technologies evolve. It’ll be your job to stay up-to-date and accept the best payment method for your online store.

The choice of ecommerce methods of payment has a profound impact on various aspects of business management. By offering a variety of payment options, businesses can enhance the customer experience, increase convenience, and reduce barriers to purchase, leading to higher customer satisfaction and repeat business.

Trusted and convenient payment options positively influence conversion rates and sales, as customers feel secure and are more likely to complete transactions. Efficient management of payment options ensures operational efficiency, reduces errors, and streamlines order fulfillment. Implementing robust security measures protects customer information, builds trust, and mitigates fraud risks. Evaluating the financial implications of payment methods optimizes cash flow and profitability. Staying updated on emerging payment technologies allows businesses to adapt to market trends and meet evolving customer demands. Overall, strategically managing ecommerce methods of payment contributes to business success in the dynamic digital landscape.

%20(1).png)

It’s great that you mentioned how it’s essential to care about how customers would pay for their purchases. I was watching a video about business operations last night and I learned quite a bit about the various types of payment methods that customers could use nowadays. According to what I’ve heard, it seems there are also merchant processing services nowadays too.