Are you looking for a smarter way to shop? Sezzle is a revolutionary payment option that could help you save money, stay organized, and shop smarter. As a buy-now-pay-later option, Sezzle makes it easier than ever to shop online and in-store without having to use a traditional credit card.

Sezzle has a number of benefits for both shoppers and businesses. With Sezzle, both first-time shoppers and savvy customers get a perfect chance to manage their budget and get the items they need without having to wait. For merchants, Sezzle is likely to grow their customer base and increase customer loyalty.

Let’s take a look at how Sezzle works and whether it’s the right payment option for you.

Contents:

4. How long does it take to get approved for Sezzle merchant

5. How to use Sezzle for online shopping

6. How to use Sezzle for in-store shopping

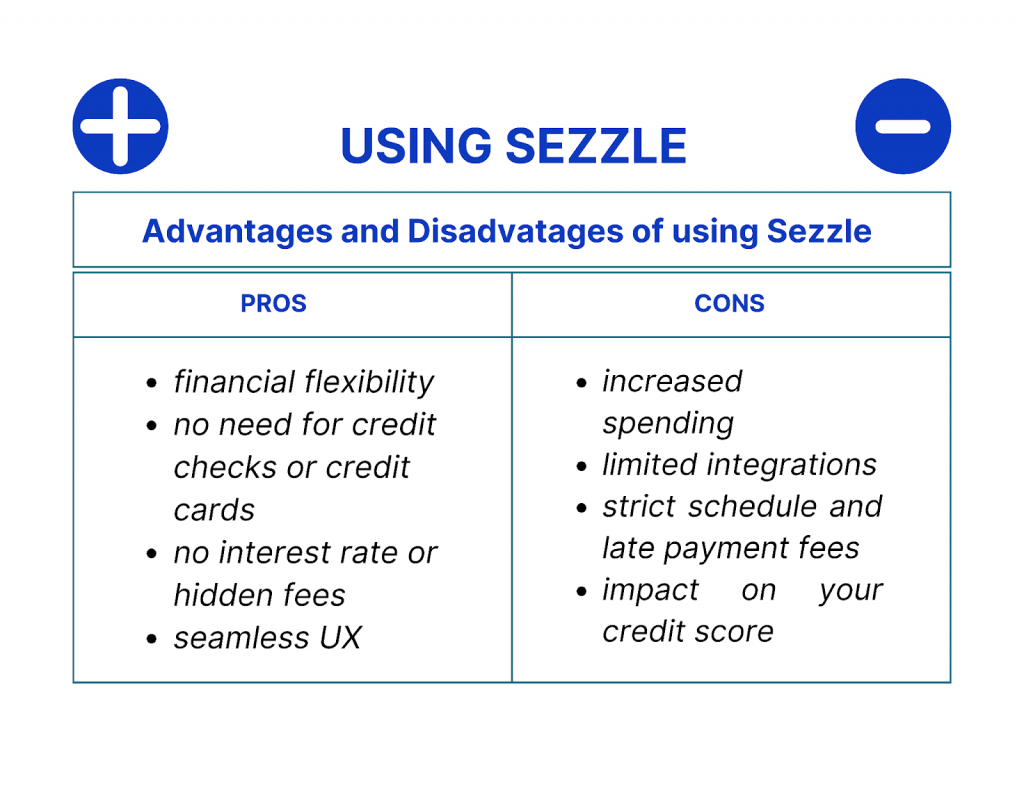

7. Pros and cons of using Sezzle

9. Potential downsides of using Sezzle

What is Sezzle?

Sezzle operates as a BNPL payment option plan that shoppers would select at checkout. It’s a digital platform with a 5-star nerdwallet rating with a pay-in-four payment plan enabling shoppers to purchase items from their favorite retailers and pay for them later. It’s the perfect solution for people who want to buy something they love but don’t want to pay for it all at once. Sezzle’s goal is to make shopping more accessible and affordable for everyone.

Sezzle makes it easy to buy what you want now, without breaking your budget. When you shop with Sezzle, you have the flexibility to spread the cost of your purchase over four equal payments, due every two weeks. You pay no interest and no hidden fees, and you can increase your buying power by up to four times with Sezzle. While Sezzle does use your debit card to process payments, the amount is not withdrawn from your bank account until the due date.

Sezzle is also a great option for merchants to accept payments if they’re looking to increase sales and order volumes. It can be easily integrated into a variety of e-commerce platforms, like Shopify, CommentSold, Wix, etc.

Want to simplify your e-commerce accounting? Check out what integrations Synder offers out of the box and let it synchronize the data in one place.

How does Sezzle work?

Sezzle is a seamless way to shop online and make in-store purchases without having to use a credit card. Instead, you can use Sezzle Virtual Card and use it as other cards for making payments when completing purchases online, or choose it as a payment method when using Apple Pay or Google pay in store.

Using Sezzle, you are actually making payments directly from your debit card. When you sign up for Sezzle, you enter a personalized spending amount and the due date for your payments. Then, whenever you make a purchase, your payment amount will be automatically deducted from your account.

The best part of Sezzle’s payment method is that you don’t have to worry about paying for your items in full. You can make payments as you go and the funds will be withdrawn from your account over the next few weeks.

Let’s look at how to sign up for Sezzle and how to use it for online and in-store shopping.

How to sign up for Sezzle

Once you’ve decided to sign up for Sezzle, you’ll need to visit the website or download the Sezzle app and enter a few details about yourself. Here are the steps:

1. Select “Debit Card” as your payment method and enter the amount you would like to spend per month.

2. Enter your debit card information, including your card number, card type, and the last four digits of your card.

3. Enter a security PIN and confirm your email address before signing up for Sezzle.

4. You’ve got your Sezzle Virtual Card!

After you’ve signed up for Sezzle, you can start shopping online or in-store virtually anywhere Google Pay or Apple Pay is accepted without having to worry about a low credit score.

How long does it take to get approved for Sezzle merchant

Getting approved as a Sezzle merchant is a straightforward process that typically doesn’t take too long.

To begin the approval process, merchants can visit Sezzle’s website and fill out the necessary application form. This form gathers essential information about the business, such as its legal name, contact details, website, and relevant financial data. Sezzle requires this information to assess the merchant’s eligibility and evaluate the potential partnership.

Once the application is submitted, Sezzle’s team begins the review process. They carefully assess various factors, including the merchant’s financial stability, customer base, industry, and adherence to Sezzle’s guidelines. The thorough evaluation ensures that Sezzle maintains a high standard of quality and minimizes any potential risks associated with partnering with a new merchant.

The duration of the approval process can vary depending on several factors, such as the completeness of the application and the volume of applications received at the time. However, on average, the approval process typically takes a few business days. Sezzle strives to provide prompt responses to merchants, understanding the importance of timely integration with their payment system.

Once a merchant is approved, they gain access to Sezzle’s merchant portal, where they can integrate the Sezzle payment option into their e-commerce platform or point-of-sale system. This integration is usually straightforward and supported by detailed documentation and technical assistance from Sezzle’s support team.

How to use Sezzle for online shopping

Once you’ve found the items you’d like to purchase, use the “Add to Cart” button to save your items to your Sezzle account. Next, you’ll need to go to the Sezzle website and sign in to your account. From there, you can select the items that you’ve already added to your cart and click “Checkout with Sezzle.” You’ll then have to enter the shipping and billing information for your Sezzle Virtual Card. You can use Sezzle Virtual Card just like any other payment card.

How to use Sezzle for in-store shopping

If you’d like to pay with Sezzle in-store, add your Sezzle virtual card to either Apple Pay or Google Pay, depending on what you use. When Sezzle’s card is added, you can use it at the checkout of your retailer just like any other virtual payment card. Simply unlock and tap your phone on the payment terminal.

Pros and cons of using Sezzle

Using Sezzle has lots of advantages and disadvantages:

Let’s dive into details.

Advantages of using Sezzle

Sezzle offers financial flexibility

By providing a “buy now, pay later” service, Sezzle enables users to make purchases and divide the total cost into manageable, interest-free installments, which promotes financial flexibility and accessibility. With traditional payment methods, many individuals may find it difficult to afford larger purchases upfront. However, Sezzle allows customers to spread out their payments over time, making it easier to budget and manage expenses. This way, Sezzle opens up opportunities for people who may not have immediate access to substantial funds, ensuring they can still enjoy the products they desire without experiencing financial strain.

Sezzle eliminates the need for credit checks or credit cards

With Sezzle, there’s no need for credit checks or the use of credit cards. This is particularly advantageous for individuals who don’t possess a credit history or have less-than-ideal credit scores. By offering a payment option that doesn’t rely on creditworthiness, Sezzle provides a fair and inclusive solution for a wider range of consumers, fostering greater financial inclusion.

Sezzle has no interest rate or hidden fees

Another significant advantage of using Sezzle is the absence of interest or hidden fees. Unlike traditional credit card purchases or loans, Sezzle doesn’t charge interest on the installment payments. This transparency in pricing allows Sezzle’s customers to make informed decisions and avoid unexpected financial burdens. By removing interest charges, Sezzle encourages responsible spending habits and promotes long-term financial wellness.

Sezzle offers seamless UX

What comes as no surprise, Sezzle offers a seamless and user-friendly experience. The Sezzle platform integrates easily with online stores, providing a hassle-free checkout process. Consumers can select Sezzle as their preferred payment method, and the total purchase amount is automatically divided into equal installments. This streamlined process enhances convenience and the overall shopping experience.

Potential downsides of using Sezzle

While Sezzle offers a number of advantages as a buy-now-pay-later payment platform, there are also some potential drawbacks to consider before using the service. It’s essential to weigh these cons against the benefits to make an informed decision about whether Sezzle is the right payment option for you.

Increased spending

One of the significant concerns with using Sezzle is the potential for increased spending and impulse purchases. The availability of splitting payments into smaller installments can give users a false sense of affordability, leading to overspending. It’s crucial to exercise discipline and ensure that you have the financial means to cover the installment payments without compromising your budget or accumulating unnecessary debt.

Limited number of integrations

Another downside is that Sezzle’s payment plan isn’t available for all retailers or online stores. While Sezzle has an extensive network of partnered merchants, there may still be limitations on where you can use the service. This can be disappointing if your preferred stores or brands don’t offer Sezzle as a payment option, potentially limiting your purchasing options.

Strict payment schedule and late payment fees

Sezzle’s payment schedule may not align with everyone’s financial situation. While the ability to pay in installments can be convenient, the timing and frequency of the payments may not suit everyone’s budgeting preferences or cash flow. Some individuals may find it challenging to keep track of multiple payment due dates or may prefer to pay for their purchases in full at the time of purchase.

It’s also worth noting here that Sezzle may charge late fees for missed or delayed payments. While they strive to provide a fair and transparent payment system, failing to make on-time payments on time can result in additional charges. It’s important to stay vigilant and ensure that you meet the payment deadlines to avoid any potential penalties.

Impact on your credit score

Lastly, using Sezzle may impact your credit score. While Sezzle doesn’t perform a credit check when you sign up for their service, they may report late or missed payments to credit bureaus, which can negatively affect your credit history. It’s essential to be responsible and make timely payments to maintain a good credit standing.

In other words, while Sezzle offers a convenient payment option with its buy-now-pay-later model, there are some cons to consider. So it’s crucial to carefully evaluate these factors and your personal financial situation before deciding to use Sezzle as a payment method.

Sezzle for business

Benefits of using Sezzle as a payment provider

Connecting Sezzle as your payment provider can offer several benefits to your business. By integrating Sezzle into your payment options, you can tap into a growing consumer trend and capitalize on the advantages it brings.

Your customer base gets bigger

First and foremost, connecting Sezzle expands your customer base. The popularity of alternative payment methods is on the rise, with more consumers seeking flexible options that suit their financial needs. By offering Sezzle as a payment choice, you can attract customers who prefer the convenience of splitting their payments over time. This broader reach can lead to increased conversion rates and customer loyalty, ultimately driving revenue growth for your business.

You can increase your AOV

Connecting Sezzle can give a boost to your average order value. With the ability to pay in installments, customers are more likely to make larger purchases, as they can spread the cost over time. This can lead to an increase in the overall value of each transaction, helping you maximize your sales potential. By empowering customers to buy more without immediate financial strain, Sezzle encourages higher spending and allows customers to enjoy the products or services they desire.

You mitigate risks

From a financial perspective, connecting Sezzle can mitigate risks and improve cash flow for your business. Sezzle assumes the risk of non-payment and pays the full purchase amount upfront, regardless of whether the customer chooses to pay in installments. This ensures that you receive your funds in a timely manner, reducing the uncertainty associated with delayed or missed payments. The reliable cash flow allows you to focus on other aspects of your business, such as inventory management and customer service.

You increase customer satisfaction and financial inclusivity

Furthermore, connecting Sezzle demonstrates your commitment to customer satisfaction and financial inclusivity. By offering a flexible payment option like Sezzle, you cater to a wider range of customers who may not have immediate access to funds or prefer alternative payment methods. This inclusivity fosters a positive brand image and builds trust with your customer base enabling you to make money.

How to connect Sezzle as your payment provider

Sezzle provides robust integration options and developer-friendly APIs, making it easy to connect with various e-commerce platforms and payment gateways. This seamless integration ensures a smooth checkout process for your customers, enhancing their shopping experience and reducing cart abandonment rates. With fewer barriers to completing a purchase, customers are more likely to follow through and convert into sales.

Integrating Sezzle into your payment system is quite straightforward. Here’s what merchants need to do to add Sezzle as a payment option on their website:

1. Find “Select Payments” in the dashboard of your website.

2. Find “More Payment Options”.

3. Click on “Connect” next to Sezzle.

This way, you can seamlessly connect Sezzle as your payment provider and start offering your customers the convenience and flexibility of using Sezzle for their purchases.

Wrapping up

Sezzle is a convenient and flexible payment solution that benefits both customers and businesses. For businesses, connecting Sezzle as a payment provider expands the customer base, boosts average order values, improves cash flow, and showcases a commitment to customer satisfaction. By integrating Sezzle as a payment option, businesses can stay ahead of evolving payment preferences and offer a more inclusive and convenient shopping experience to their customers.

For customers, it promotes financial flexibility, eliminates the need for credit checks, has no interest rates or hidden fees, and provides a seamless user experience. Sezzle allows you to easily shop online and in-store without worrying about a low credit score. This payment method uses your debit card to process payments, but the amount isn’t withdrawn from your bank account until the due date.

Sezzle’s smart payment system makes it easier than ever to shop online and in-store without having to use a traditional credit card or apply to a bank for a loan. If you’re looking for a way to shop smarter and more efficiently, Sezzle could be the perfect payment option for you!

.png)