Cryptocurrencies have been all the rage for quite some time. While not everyone understands their purpose or how they work, many are using cryptocurrencies in their business transactions, and this trend seems to be growing. Currently, many businesses are exploring this class of digital assets to meet the demand for cryptocurrency accounting.

And it’s not that simple. Due to the lack of specific accounting standards and the volatile nature of these currencies, accountants must understand the complexities of recognizing, measuring, and reporting them, often using CPA automation to improve accuracy and efficiency.

In this article, we asked Irene Wachsler, CPA and expert on cryptocurrencies and digital currencies, to help us clear out the key issues and considerations associated with accounting for and reporting cryptocurrency transactions in financial statements.

Irene Wachsler, CPA, CTRS

Irene is a CPA and Crypto/Digital Expert helping her clients organize their finances, make sense of their numbers, and handle taxes efficiently, including cryptocurrency taxation and problem-solving.

Contents:

1. What is cryptocurrency accounting?

2. Why is cryptocurrency accounting more challenging than traditional accounting?

3. What are the regulations for cryptocurrency and digital assets accounting?

5. Basics of crypto tax filing in the USA

6. Top 5 cryptocurrency accounting software

7. Conclusion

Key takeaways

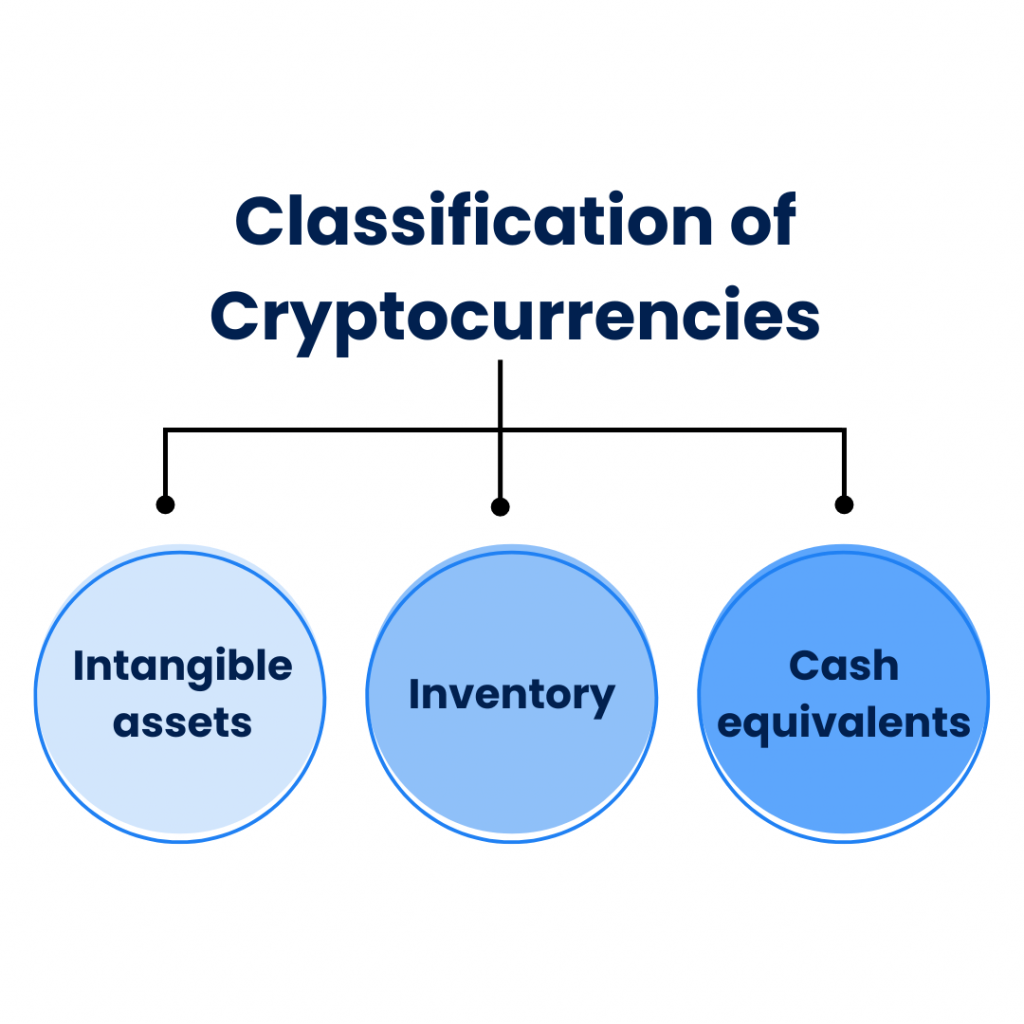

- Cryptocurrencies can be classified as intangible assets, inventory, or cash equivalents, depending on their use and acquisition purpose.

- The IRS classifies the money you make from crypto as non-taxable events, taxable as a capital gain or as an income.

- Crypto accounting challenges stem from the crypto acceptance, vague regulations, and extreme volatility.

What is cryptocurrency accounting?

To understand the nature of cryptocurrency accounting, it’s key to know exactly what cryptocurrency is. In simple words, cryptocurrency is a type of digital money that uses special codes to keep transactions secure and to create new coins. Imagine cryptocurrencies as digital versions of physical money like coins or bills, but they only exist online. These digital currencies operate on a technology known as blockchain.

What’s сryptocurrency accounting then? It’s a type of accounting, which involves the financial reporting rules and practices related to cryptocurrencies, applicable to both investors and businesses.

Let’s see what steps the cryptocurrency accounting process includes:

- Recording the cost of each asset as its book value in the intangible assets section of the balance sheet, including the date and time of the transaction.

- Calculating the difference between cost and sales price for any transactions with the FIFO (first-in-first-out) method.

- Recording any gains and losses in the journal.

While there are only three steps, the process gets more complicated and error-prone the more transactions you have.

Why is cryptocurrency accounting more challenging than traditional accounting?

Should emerging cryptocurrencies be the only hardship accountants face, we won’t be sitting here right now, as there would’ve been nothing to discuss. But in fact, there are more challenges that make crypto and traditional accounting different.

Irene Wachsler:

“Price fluctuations for cryptocurrencies make it challenging to keep the accounting records accurate in determining the Fair Market Value of these crypto assets. This, in turn, makes financial reporting challenging – especially if one has to audit or rely on these financial statements.”

| Challenge | Description |

| Volatile nature of cryptocurrency values | Cryptocurrencies have extreme price volatility, unlike traditional currencies. Their value can fluctuate rapidly, making accurate transaction recording and valuation challenging. |

| Lack of standardized accounting principles | There are no universally accepted accounting principles for cryptocurrencies, leading to inconsistent accounting practices and difficulties in comparing financial statements. |

| Transaction volume and automation | High transaction volumes on blockchain networks can overwhelm traditional accounting methods. Specialized software is needed to handle the pace and volume of transactions in real-time. |

What are the regulations for cryptocurrency and digital assets accounting?

One of the biggest challenges cryptocurrency accounting comes with is the lack of commonly approved regulations for treating digital assets – they don’t fall into traditional frameworks.

Here’s what Irene has to say:

“Most cryptocurrencies are decentralized, so no central bank or government controls the supply of coins/tokens on the market. This makes it very challenging for any government to regulate.

The Securities and Exchange Commission (SEC) has started taking steps by claiming that various cryptocurrency offerings, such as Ripple, are investment securities and, therefore, must register with the SEC and adhere to SEC regulations. Also, since cryptocurrency can be used as a medium to purchase/exchange for goods and services, the US Department of Treasury is trying to assess how to regulate some of these transactions.

And the States are getting involved because each state has its banking regulations – some stricter than others. When I evaluate banking services for a cryptocurrency (or any online bank), I make sure that the bank is registered to do business in The State of New York because New York has the most strict regulations.”

As you can see, regulations in the cryptocurrency space are still evolving, which is pretty logical considering that cryptocurrencies are a relatively new concept. This uncertainty causes a good deal of trouble for businesses and accountants. At this point, businesses that operate with cryptocurrencies need to work closely with accounting professionals who are well-versed in this area. Staying updated on regulatory changes is equally vital to ensure compliance with tax laws and financial reporting requirements.

How to account for crypto?

Since cryptocurrencies are quite controversial, including their acceptance, rather vague regulations, and high volatility, you might experience some difficulties in accounting and bookkeeping of these assets. This calls for significant effort and context knowledge since accounting practices primarily hinge on the character and use of the cryptocurrency within the organization.

Irene Wachsler:

“Accounting treats cryptocurrency as investments. That’s fine if the company or individual’s goal is to hold onto them and/or trade them, similar to what one would do with stocks or mutual funds. However, if the cryptocurrency is used to purchase goods and services, then I think this should be treated as cash, similar to how foreign currencies are treated.”

Cryptocurrencies can be classified in multiple ways, such as intangible assets, inventory, or cash equivalents.

Intangible assets

Cryptocurrencies are often classified as intangible assets, particularly when held for investment purposes. Similar to other intangibles, like patents or trademarks, their value comes from the benefits they provide. As a rule, they’re initially recorded at cost and subsequently measured at either cost or fair value, depending on the accounting standards followed.

Say a tech company called Tech Guys Inc. buys a large amount of Ethereum, hoping it’ll increase in value over time. This would result in a potential profit. In this case, the Ethereum holdings are similar to investment assets like stocks or bonds. The company records the initial purchase at its cost, and any changes in Ethereum’s value are shown on the income statement. If the value goes up, Tech Guys Inc. reports a gain; if it goes down, they report a loss.

Inventory

In some cases, cryptocurrencies might be classified as inventory, especially for businesses involved in mining or trading them. Like other inventory items, these assets are recorded at the lower of cost or net realizable value. The challenge is figuring out the right cost basis for cryptocurrencies, considering factors like mining costs and market changes.

Imagine a mining company called CryptoMine Ltd. This company mines Bitcoin using computers. The Bitcoin they mine is considered inventory because CryptoMine’s business is about producing new cryptocurrency units. It’s similar to a manufacturing company that keeps the materials and products they make in their inventory. CryptoMine tracks its Bitcoin inventory by considering the mining costs, such as electricity and computer maintenance, and the current market value of Bitcoin. If the market value drops significantly, CryptoMine might have to report a loss in the value of its Bitcoin inventory.

Cash equivalents

Cryptocurrencies can also be considered cash equivalents if they act as highly liquid investments with little risk of changes in value. This often refers to stablecoins or other cryptocurrencies with a fixed value pegged to a stable asset such as a traditional currency.

Want an example? Let’s say a global ecommerce platform called ShopGlobal Ltd. accepts stablecoins such as USDC (USD Coin) as payment. These stablecoins are pegged to the US dollar, so their value remains stable. ShopGlobal stores a large amount of USD in its wallet to quickly process returns, payouts and transactions without worrying about changes in value as is the case with other cryptocurrencies. In this case, stablecoins act as cash equivalents since they can be easily converted into traditional currency and maintain a stable value. ShopGlobal carries these stablecoins on its balance sheet at their fair value, with any changes in value reflected in the income statement.

Basics of crypto tax filing in the USA

As you already know, in the U.S., cryptocurrencies are treated as digital assets, akin to stocks and bonds. The IRS classifies the money you make from crypto as taxable income, subject to specific tax rates depending on the nature of your crypto activities and how long you’ve held your assets.

Taxable vs. non-taxable events

To determine if you owe taxes on your crypto, you should distinguish between taxable and non-taxable events. Let’s break them down.

Non-taxable events

There are certain scenarios where you won’t have to worry about tax implications. For example, if you buy cryptocurrency with cash and simply hold onto it, you’re in the clear. Taxes only come into play when you decide to sell your crypto assets.

Similarly, when you’re feeling charitable and donate cryptocurrency to qualified charities or when you receive it as a gift, you usually won’t face immediate tax obligations. However, it’s worth noting that if you eventually decide to sell the cryptocurrency you received as a gift, then you might need to consider taxes.

Another situation that doesn’t trigger tax obligations is when you transfer cryptocurrency between your wallets or accounts that you personally own. In this case, you can maintain your original cost basis without worrying about immediate tax consequences.

Taxable as capital gains

When it comes to taxes, certain cryptocurrency transactions fall under the category of capital gains. For instance, when you sell your cryptocurrencies for cash and make a profit – meaning the selling price is higher than what you initially paid – you’ll owe taxes on those gains. On the flip side, if you end up selling at a loss, you might be eligible for tax deductions.

Even exchanging one cryptocurrency for another is considered a taxable event. So, if you make a profit during the conversion, you’ll owe taxes on those gains. Remember that using your cryptocurrency to make purchases, like buying goods or services, is treated similarly to selling the asset. This means it’s subject to capital gains taxes as well.

Taxable as income

Any time you pay with cryptocurrency or receive goods/services in exchange for your work, that transaction should be considered income. This means that tax law requires you to report it as such when you file your tax return.

Mining or earning staking rewards is another source of passive income that can attract taxes; In this context, mining is the same as generating income. It is important to know that any income received from mining or staking is fully taxable, and this taxation is calculated based on the fair market value of the coins received at the time of receipt. It is necessary to keep records of this income for tax purposes.

Calculating crypto taxes

When you’re determining your cryptocurrency taxes, it can be summed up as calculating the income, gains and the losses that you incurred.

In the first place your getting paid in crypto is like any other income and attracts income tax rates. This means that once you begin earning, you will have to give back part of your earnings in taxes according to your income tax slab.

Secondly, as far as the capital gains or losses are concerned, it is strictly about the selling or disposal of the cryptocurrency by determining the difference between the cost or the basis for such cryptocurrencies and the selling price. Normally, short-term capital gains are charged at your ordinary income tax rate which is slightly higher although long-term gains are charged at lower tax rates than short-term if you held your cryptocurrency for more than a year.

Here’s a potential silver lining: if you have capital losses, then you can use those to offset some other capital gains that may have an inclination of reducing your overall taxes. So, tracking your crypto transactions and understanding their tax impact is crucial for managing your finances.

Top 5 cryptocurrency accounting software

Automated accounting software can notably improve the accounting process. When it comes to cryptocurrency accounting, it’s important to understand that this type of accounting is new, which is why such software can make an accountant’s work much easier. Here are the top 5 software options for crypto accounting:

1. Cryptio

Cryptio supports custom rules to automatically categorize transactions, such as staking rewards and payroll expenses. It allows for the import of unlimited blockchain transactions, wallets, exchanges, and custodians. The Cryptio platform includes an API for creating custom tax and accounting solutions.

Top Cryptio features:

- GAAP & IFRS-compliant valuation system

- Real-time, automated retrieval of full transaction history

- Sync with your fiat accounting & ERP system

Pricing:

Plans start at $499 per month.

2. Blockpit

Blockpit’s tax loss harvesting tools for cryptocurrencies and NFTs help maximize your tax benefit. Daily Balance Reports provide a daily view of all your wallet and exchange balances. And a market sentiment tool uses artificial intelligence to analyze trader sentiment in real-time regarding cryptocurrency markets.

Top Blockpit features:

- Crypto tax calculator

- Crypto portfolio tracker

- Automatic categorization

Pricing:

Monthly plans start at $49.

3. Bitwave

Bitwave offers enterprises a robust solution for handling digital assets, including complex tax tracking, automatic mark-to-market capabilities, crypto invoicing, and bill pay. The platform features a multi-user, multi-sig wallet, ensuring businesses can securely and compliantly hold their cryptocurrencies.

Top Bitwave features:

- Audit-ready reporting

- Simplified calculations

- Customizable data integrations

Pricing:

Pricing is available on demand after a demo.

4. Ledgible

Ledgible includes tax advisory and planning dashboards to help plan future spending and tax liabilities. While designed for individuals, it’s also tailored for CPAs, tax professionals, and accountants. The platform offers client and team management portals for tax professionals to work on behalf of clients. It tracks not only gains and losses but also fees charged during transactions.

Top Ledgible features:

- OFX reporting

- Gains & losses calculation

- Transaction downloads

Pricing:

Plans start at $49 per month.

5. SoftLedger

SoftLedger provides real-time access to critical financial data, enabling smarter decision-making. This cloud-native platform is designed to handle the complexities of distributed operations and assets. SoftLedger includes a general ledger, accounts receivable, accounts payable, inventory management, and crypto asset management.

Top SoftLedger features:

- Crypto data import from any source

- Automatic calculation of unrealized and realized gains and losses

- Crypto asset balances reconciliation as of historical dates

Pricing:

Pricing begins at $750 per month.

Conclusion

Cryptocurrency accounting is complex and requires special knowledge and tools, but it’s doable. As more businesses use digital assets, accounting is evolving accordingly. Sure, this process isn’t that easy, but if you know how to classify, value, and report cryptocurrencies, as well as understand the tax implications, you’ll handle this. And if you run into difficulties, automated accounting software for cryptocurrency can greatly simplify your workflow and save time for you or your accountant.

FAQs

Is cryptocurrency an asset or a currency?

Cryptocurrency can be considered both an asset and a currency. As an asset, it’s often held for investment purposes and its value can fluctuate over time. As a currency, it’s used as a medium of exchange for goods and services in certain markets.

Is there an accounting standard for cryptocurrency?

On December 13, 2023, the FASB released new rules (ASU 2023-08) for reporting certain crypto assets. Now, companies must measure these assets at their current market value and record any changes in value in their net income every reporting period.

For example, if a company owns Bitcoin worth $10,000 at the beginning of the month and its value increases to $12,000 by the end of the month, the company must report the $2,000 increase in their net income for that period.

Who taxes crypto?

The IRS requires you to pay taxes on crypto transactions or sales according to accepted IRS rules. This includes reporting any gains or losses on your tax return.

What is crypto accounting software?

Cryptocurrency accounting software is a tool that helps in recording and reporting of all activities in cryptocurrencies. It assists companies and traders to correctly record, categorize and and report cryptocurrency-related financial activities while ensuring tax compliance. It can include such features as valuation in real-time, statement of tax consequences, and connection to various wallets and exchanges.

Share your experience

What’s your experience with crypto and crypto accounting? How did you first get involved with cryptocurrencies? Have you invested in cryptocurrencies, and if so, which ones? Are you using any specific tools or platforms for crypto accounting and tracking?

Share your experience in the comments below!

%20(1).png)

Thank you very much for the article. I am interested lately into crypto market as CPA and looking forward to work in the industry as accountant. It was the best source so far for entry level. Thank you again.

Hi, Serkan! Thanks for stopping by. Glad you like it.

There are lots of purposes and utilization potential for the cryptocurrency projects and the overall blockchain tech from fast & secure transactions to wider use in the medical field for example or supply chain sectors, banking & fin tech, etc… The potential is enormous and we are still in the early development, testing, utilization & adoption stages. There is still lots of room to grow, progress and more innovation to happen. The crypto universe & blockchain tech will keep growing, transforming and developing rapidly over the next 7-10 years, there will be lots of new projects, utilization and faster adoption with $10+ trillion crypto market cap potential.

What the G20 economies need to do is to adopt crypto-friendly regulations and legal frameworks and facilitate its adoption into the mainstream financial sector. The crypto universe is here to stay with us and the EU with MICA Act has proven that it will create a universal EU legislation, which will in fact help facilitate faster crypto adoption rates % among citizens and growth of the crypto & blockchain start-ups across the EU territory. Other countries need to follow the suit.

Thank you so much for sharing your thoughts and opinions about the future of cryptocurrency and blockchain in the world. I am sure loads of changes are waiting for us.

Thanks for uploading this informative and helpful article! Provides a good insight into the cryptocurrency market.

Thanks David! Appreciate your comment.

Your blog post was thought-provoking and intellectually stimulating. I enjoyed the way you challenged conventional thinking and presented alternative viewpoints.

Thank you comment!

This is really a nicely written article piece. Thank you for writing this. Please keep them coming.

Thanks for your feedback! Appreciate it.