Navigating the complexities of the Canadian tax system, particularly for foreigners, can be a daunting and overwhelming task. However, understanding and complying with the requirements of Goods and Services Tax (GST) and Harmonized Sales Tax (HST) is essential for enterprises operating in Canada.

Hence, in this article, we’ll dive into the essentials of GST/HST compliance in Canada. From registration, filing, and record-keeping to understanding the specific obligations and exemptions that apply to different business entities, this guide offers expert tax knowledge for foreign businesses entering the Canadian market.

Contents:

1. Understanding GST and HST: How does the tax function in Canada?

2. Who is required to pay GST and HST in Canada?

- GST and HST registration: Taxable sales threshold

- Case study: Ecommerce client and GST/HST compliance

3. How can foreigners claim GST and HST refunds?

4. What are the requirements for foreigners doing business in Canada?

5. What are the record-keeping and filing requirements for GST/HST?

- How often do you have to file GST/HST returns?

- How to file a GST and HST return

- Common filing errors and CRA inspections

Understanding GST and HST: How does the tax function in Canada?

The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) are crucial components of the Canadian tax system. Simply put, GST is a federal tax that is levied on most goods and services sold or provided in Canada.

In some provinces, GST combines with provincial sales taxes to form Harmonized Sales Tax (HST), ensuring a streamlined and straightforward approach to taxation in which the Canada Revenue Agency (CRA) collects the tax and refunds input tax credits (ITCs). In other provinces (British Columbia, Saskatchewan, Manitoba), provincial sales tax (PST) is administered directly by the province (as well as QST in Quebec). Registration for PST and QST is separate from GST/HST and needs to be completed directly with the Province where business is conducted.

GST and HST: Rates and variations across provinces

The primary goal of GST/HST, also referred to as a value-added tax (VAT), is to create a fair and efficient tax system that generates revenue without excessively burdening consumers or businesses. By applying these taxes, Canada funds essential services and initiatives that benefit all citizens.

Understanding these rates and how they apply can often be a bit of a puzzle for many businesses. The current HST rate varies by province – for example, it’s 15% in Nova Scotia but 13% in Ontario. There’s variation because provinces have the flexibility to merge their provincial taxes with the federal GST, leading to different HST rates across the country.

GST, usually at 5%, applies to most transactions, but there are exceptions. Some goods and services are zero-rated (like basic groceries and certain medical devices), while others are exempt (like certain types of education and health services).

For specific rules on which rate to apply, and GST/HST rates per province, please follow this link.

GST and HST: Personalized guidance for tax compliance

At Strata-G, we understand that managing GST/HST can be complex, especially for businesses expanding into Canada or foreign enterprises exploring the Canadian market. Our role is to take the mystery out of this issue and help simplify it. We do this by offering personalized guidance tailored to your business’s unique needs and leveraging cutting-edge technology to ensure efficient and accurate tax handling.

Our expertise isn’t just about compliance; it’s about understanding the intricacies of GST/HST and how they impact your business operations. We stay abreast of the latest changes in tax laws to offer you the most current advice, helping you to not only stay compliant but also optimize your tax position. Whether you’re struggling with rate differences across provinces or determining the tax status of your goods and services, Strata-G provides the guidance businesses need every step of the way.

Who is required to pay GST and HST in Canada?

Understanding who needs to pay the GST and HST taxes is crucial for any business operating within or dealing with Canada.

Primarily, GST/HST is paid by consumers at the point of sale, but the responsibility for collecting and remitting it falls on businesses. This includes not only Canadian businesses but also foreign entities providing goods or services in Canada. Whether you’re a start-up in Vancouver or a foreign software company with Canadian clients, understanding your GST/HST obligations is essential.

However, not everyone is required to collect GST/HST. For example, small suppliers whose taxable revenues don’t exceed a specific threshold are exempt from it. Certain other goods and services are either zero-rated or exempt from GST/HST. Zero-rated items are taxed at 0%, meaning businesses can claim credits for the GST/HST paid on purchases related to these sales. Exempt goods and services, on the other hand, aren’t subject to GST/HST, and therefore, no credits can be claimed on them.

GST and HST registration: Taxable sales threshold

For most businesses, the following CRA Table breaks down the requirement for registering for GST/HST:

- If you don’t exceed the $30,000 taxable sales threshold over four consecutive calendar quarters:

- Then you are a small supplier

- You do not have to register.

- You may choose to register voluntarily if you make taxable sales, leases, or other supplies in Canada. This is beneficial if you incur GST/HST charges on expenses and want to receive a refund of the input tax credits you have paid.

- Your effective date of voluntary registration is the day you request your GST/HST account or up to 30 days prior.

- You exceed the $30,000 threshold in a single calendar quarter:

- Then you are no longer a small supplier and must charge GST/HST on the supply that made you exceed $30,000 within the calendar quarter

- You must register for GST/HST (and QST)

- Your effective date of registration is no later than the day of the supply that made you exceed $30,000.

- You exceed the $30,000 threshold over the previous four (or fewer) consecutive calendar quarters (but not a single quarter):

- Then you are no longer a small supplier at the end of the month following the quarter in which you exceed $30,000

- You must register for GST/HST (and QST)

- Your effective date of registration is no later than the beginning of the month after you are no longer a small supplier and must start collecting GST/HST on taxable sales from the registration date.

Case study: Ecommerce client and GST/HST compliance

At Strata-G, we have numerous success stories of guiding businesses through the maze of GST/HST. Take, for instance, a recent Canadian ecommerce client that was expanding its operations across the country. Confused with the GST/HST regulations across the different provinces, they came to us for help. We thoroughly analyzed their business model to identify GST/HST implications, guiding them through the registration process tailored to different provincial requirements. Our team implemented a streamlined system for efficient tax collection and remittance and gave them the advice they needed on compliant invoicing practices.

How can foreigners claim GST and HST refunds?

For foreign entities, understanding the ins and outs of GST/HST is crucial, especially when it comes to claiming refunds.

There are two different kinds of foreign claims for GST/HST refunds:

1) Foreign travelers (business/personal) who are only in Canada for a temporary period of time. 2) Foreign corporations conducting business in Canada.

Temporary foreign visitors

Foreigners may be eligible for a GST/HST refund under specific circumstances. This usually applies to non-resident businesses that have incurred GST/HST on expenses related to their commercial activities in Canada where no permanent establishment exists. To claim a refund, these businesses mustn’t be registered for GST/HST and shouldn’t have a permanent establishment in the country. The process starts by accurately determining the amount of GST/HST paid and then filing a refund application that includes all of the necessary documentation and receipts.

However, this process can often come with a great deal of different challenges. One common issue is attempting to understand what qualifies for a refund and the stringent documentation required to do so. Plus, navigating the Canadian tax system from abroad can be difficult and overwhelming due to the differing tax laws and regulations.

For example, a foreign tech company that participated in a trade show in Toronto that is unfamiliar with the Canadian tax system, may not be aware that they could claim back the GST/HST paid on their exhibition expenses. The tech team would need to gather all the required documents and file the refund application (GST386) with the CRA no later than one year after the last day of the convention.

Foreign corporations conducting business in Canada

You may be carrying on business in Canada even if you don’t have a permanent establishment in Canada. Through this business you may be incurring expenses with GST/HST charged and by registering for GST/HST you may recover the GST/HST paid on expenses, known as input tax credits.

Non-residents wanting to register for the GST/HST can fill out Form RC1, Request for a Business Number and Certain Program Accounts, and fax or mail it to your designated non-resident tax services office. Once registered, a non-resident can file a GST/HST tax return with the CRA and receive refunds on GST/HST paid over and above GST/HST collected on sales in Canada.

What are the requirements for foreigners doing business in Canada?

Entering into the Canadian market as a foreign business has a unique set of legal and tax requirements, making it necessary to have a comprehensive understanding of the Canadian tax system. If you’re a foreign entity providing goods or services in Canada, registering for GST/HST becomes essential, especially when your business crosses a certain revenue threshold.

As a general rule of thumb, you can’t register for GST/HST if you only provide exempt supplies. While registration is a requirement (even with no permanent establishment), if you make taxable sales, leases, or other supplies in Canada and you are no longer considered a small supplier.

Specific cases for GST and HST registration

There are specific examples where a non-resident may be required to register for GST/HST. Strata-G provide the following examples:

- You make taxable sales related to:

- Cross-border digital products and services (ecommerce sales),

- Sales of Goods located in Canada,

- Platform-Based Short-Term Accommodation (AirBnb).

- You arrange the sale of books, newspapers, magazines, periodicals, or similar printed publications in Canada directly or through an employee or agent. You must register once you are no longer a small supplier.

- You sponsor or host a convention in Canada and more than 25% of the attendees are residents of Canada. In this case, you must register even if you are a small supplier.

- You make taxable supplies (including zero-rated – e.g. certain sales of food) of admissions in Canada for a place of amusement, a seminar, an activity, or an event held in Canada. In this case, you must register even if you are a small supplier.

Non-tax requirements

Beyond just the tax obligations, there are other legal issues that need to be taken into consideration, such as corporate structuring, employment laws, and adhering to specific industry regulations. While it may seem overwhelming, it’s easy to navigate with the right guidance.

This is where Strata-G can help. Our experience with international clients gives us the knowledge to provide specialized assistance to foreign businesses in Canada. We don’t just help with GST/HST registration; we offer a comprehensive understanding of what it means to comply with Canadian tax laws. Our team walks you through each step, ensuring clarity and smooth business operations.

Plus, at Strata-G, we embrace the power of technology to help ease the compliance burden. Our digital tools are designed to automate and streamline tax calculations, track sales and expenses, and ensure accurate and timely tax filings. This tech-driven approach not only simplifies the compliance process but also offers a transparent and efficient way to manage your financial obligations in Canada.

What are the record-keeping and filing requirements for GST/HST?

Navigating the record-keeping and filing requirements for GST/HST in Canada is a critical part of running a business and getting it right the first time is key to staying compliant and avoiding penalties.

Every business registered for GST/HST must maintain detailed records of all taxable goods and services sold, along with the GST/HST collected or paid. This includes sales invoices, purchase receipts, and accounting records. These records must be kept for at least six years from the end of the last tax year they relate to.

How often do you have to file GST/HST returns?

When it comes to filing, businesses typically file GST/HST returns on a monthly, quarterly, or annual basis, depending on their sales volume. Filing on time is crucial; late filings can result in penalties and interest charges. Each return must accurately report the total sales, the amount of GST/HST collected, and the Input Tax Credits – the GST/HST paid on business purchases that can be reclaimed.

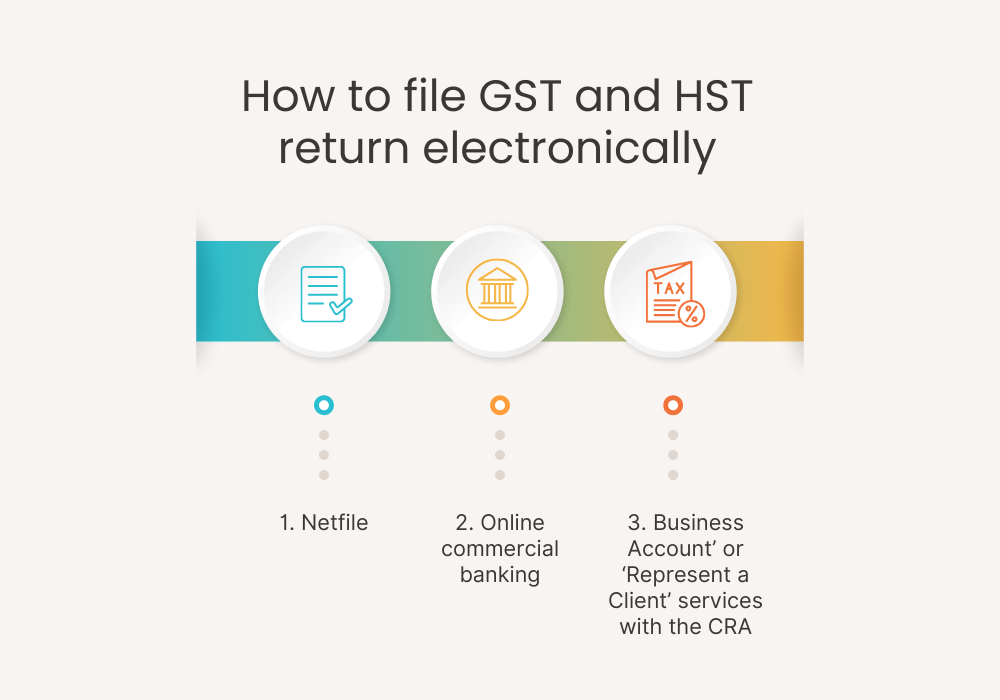

How to file a GST and HST return

You can file a GST/HST return electronically (Netfile, through online commercial banking, ‘My Business Account’ or ‘Represent a Client’ services with the CRA), by TELEFILE, or on paper. There is a requirement to file electronically if you are not a charity and your annual taxable supplies/sales are greater than $1.5 million.

Common filing errors and CRA inspections: Importance of accuracy in GST/HST returns

One common mistake that Strata-G has assisted clients with, is navigating the revenue line (line 101) on the GST/HST return. Line 101 should include all taxable supplies of goods and services, including zero-rates supplies (this is line 90 on an electronic return), and exempt supplies, zero-rated exports, and other sales and revenue (line 91 on electronic returns).

The CRA regularly compares revenue reported on a corporate tax return, with the revenue reported on the GST/HST return, and mismatches may result in unnecessary inspection. Finally, the CRA will complete a reasonableness check on the amount of GST/HST collected (line 105), compared to revenue in line 101.

A manufacturer of goods in Ontario should have a rate close to 13% when dividing line 105 by line 101 (unless there are zero-rated goods present), as the HST rate applying to sales in Ontario is 13%. Meanwhile, a retailer in Alberta should have a result closer to 5% when dividing line 105 by 101.

Variances from these probabilities will result in a call from the CRA, so it’s vital to ensure the amounts reported on your GST/HST return are accurate and included in the appropriate lines.

Conclusion

Successfully managing GST/HST obligations in Canada requires a thorough understanding of the tax system and meticulous attention to detail in compliance and record-keeping. The varying rates, different filing requirements, and specific scenarios for foreign businesses demand a strategic approach to tax management.

At Strata-G, we know the ins and outs of the intricacies of these requirements. We help businesses maintain impeccable records, ensuring they’re always audit-ready. Our team works closely with clients to establish efficient record-keeping practices and to navigate the complexities of filing returns accurately and on time.

By leveraging our expertise and cutting-edge technology, we ensure that our clients not only comply with GST/HST regulations but also optimize their financial strategies.

.png)

Can you tell me if a non-resident can get a refund of the GSH/HST paid on the purchase of a bicycle or a meal at a restaurant? Thank you!

Hello Nancy, thanks for reaching out with your question. In Canada, there isn’t a broad-based program for GST/HST refunds for tourists or non-residents on purchases like restaurant meals or bicycles. However, it’s advisable to consult the Canada Revenue Agency (CRA) or seek guidance from a qualified tax expert tailored to your particular circumstances.