In recent times, the IRS has issued a notable piece of advice that has left many taxpayers wondering: “Wait to file your taxes.” This seemingly unconventional guidance has raised eyebrows and sparked curiosity among individuals and businesses alike.

This recommendation comes on the heels of several significant developments and challenges that have shaped the tax landscape. From sweeping tax law changes to the ongoing impact of the COVID-19 pandemic, there are various circumstances that have prompted the IRS to suggest a bit of patience when it comes to filing taxes.

The purpose of this article is to delve into the rationale behind the IRS’s unconventional advice and provide valuable insights to taxpayers. We’ll speak about the key reasons behind the IRS’s recommendation and offer guidance on how to navigate this tax season effectively. Understanding why the IRS is advising delay can help you make informed decisions and optimize your financial situation.

Dreading tax season? Ease up your accounting practice – use Synder, a cutting-edge accounting software tailored to transfer your transaction data from the sales and payment channels into the books. It’ll save you tons of time, nerves, and errors. Don’t wait, create a free account now to try Synder out firsthand or secure a spot at the Weekly Public Demo to learn more about the power of Synder’s automation.

Contents:

1. Reasons why the IRS recommends you to wait to file taxes

- Tax law changes

- Missing or late documents

- Tax credits and deductions

- Errors and corrections

- Tax planning opportunities

- State tax changes

- IRS processing delays

- Refund timing

2. Benefits of waiting to file taxes

3. When should you consider filing taxes early?

4. Tips for taxpayers waiting to file

5. Recap of why the IRS is saying to wait to file taxes

Reasons why the IRS recommends you to wait to file taxes

The IRS may recommend that taxpayers wait to file their taxes for various reasons, depending on the individual circumstances and tax law changes. Here are some key reasons why the IRS might advise taxpayers to wait:

1.Tax law changes

The IRS may recommend waiting if there have been significant changes to tax laws or regulations that could affect your tax return. It’s essential to ensure that you have the most up-to-date information to accurately complete your tax return and maximize your tax benefits.

2. Missing or late documents

If you are waiting for essential tax documents, such as W-2s, 1099s, or other income statements, the IRS may suggest holding off on filing until you have all the necessary information. Filing with incomplete or incorrect information can lead to errors and delays in processing your return.

3. Tax credits and deductions

Tax laws can change, and some tax credits or deductions may not be available or may have different eligibility criteria from year to year. Waiting until you have a clear understanding of the current tax rules can help you take advantage of all available credits and deductions.

4. Errors and corrections

Rushing to file your taxes can lead to errors on your return. Waiting allows you to review your return carefully, double-check calculations, and make any necessary corrections to avoid potential audits or penalties.

5. Tax planning opportunities

By waiting until closer to the tax deadline, you have more time to engage in tax planning strategies. This might include making contributions to retirement accounts, maximizing deductions, or exploring other options to reduce your tax liability.

6. State tax changes

In addition to federal tax changes, state tax laws can also change from year to year. If you are required to file state taxes, waiting can give you time to understand any state-specific changes that may affect your return.

7. IRS processing delays

The IRS may experience processing delays, especially during peak tax filing season. Waiting until closer to the tax deadline can help you avoid potential bottlenecks in the IRS’s system and ensure a smoother processing experience.

8. Refund timing

If you anticipate receiving a tax refund, waiting to file could affect when you receive your refund. Filing early may result in a quicker refund, while filing later may lead to a delay in receiving your refund.

It’s essential to consult with a tax professional or use tax preparation software to determine the best timing for filing your taxes based on your individual circumstances and any IRS recommendations or guidance provided for the tax year in question. Taxpayers should stay informed about tax law changes and deadlines to ensure they file their returns accurately and on time.

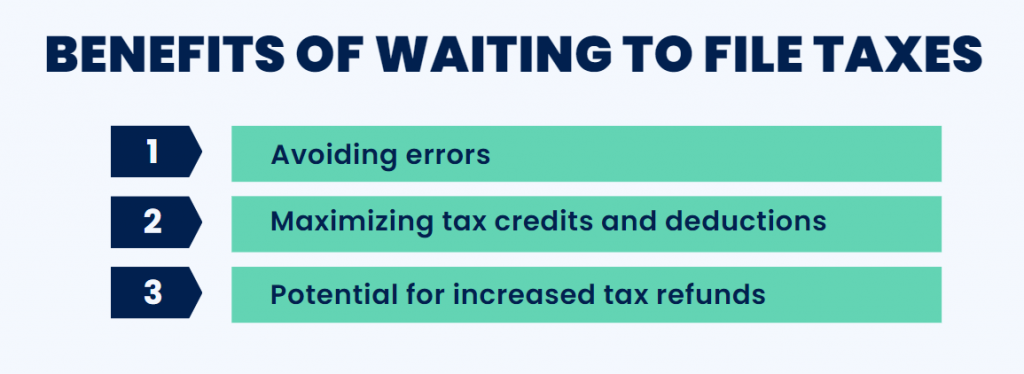

Benefits of waiting to file taxes

While it may seem counterintuitive, there are several advantages to exercising patience and waiting before you file your taxes for the year.

Let’s explore these benefits in detail:

Avoiding errors

a) How waiting can reduce the chances of making errors on your tax return

Rushing to file your taxes, especially when tax law changes are still being implemented, can increase the likelihood of making costly mistakes. Waiting allows you to take your time, double-check your documents, and ensure that you’ve included all relevant information accurately.

b) Why is it important to make sure your returns are accurate and complete?

Accuracy is paramount when it comes to your tax return. Errors can lead to audits, delays in processing, and potential penalties. By waiting, you can be more confident in the completeness and correctness of your tax filing, reducing the risk of IRS inquiries later on.

Maximizing tax credits and deductions

a) How waiting can help taxpayers take advantage of available credits and deductions

Tax laws change, and new credits and deductions may become available throughout the year. Waiting allows you to stay informed and claim all the tax breaks you’re eligible for, potentially lowering your tax liability.

b) Examples of tax incentives that may change over time

Tax incentives, such as energy-efficient home improvements or educational expenses, often have expiration dates or annual updates. By waiting, you can strategize your tax filing to make the most of these incentives, ensuring you receive the maximum tax benefit.

Potential for increased tax refunds

a) How waiting may result in larger refunds due to updated calculations

The IRS typically needs time to adjust its systems to accurately calculate refunds based on the latest tax laws. Waiting to file can lead to more precise calculations, potentially resulting in a larger tax refund.

b) The benefits of patience in maximizing your tax refund

A larger tax refund can provide financial relief or be put to good use in savings or investments. By being patient and allowing the IRS to update its systems, you increase the likelihood of receiving the full refund you deserve.

You might also be interested in learning more about how to file income tax return.

In a nutshell, while the IRS’s recommendation to wait to file taxes may seem unusual, it offers numerous benefits that can positively impact your tax return. Waiting to file your taxes can be a wise financial decision that pays off in the long run.

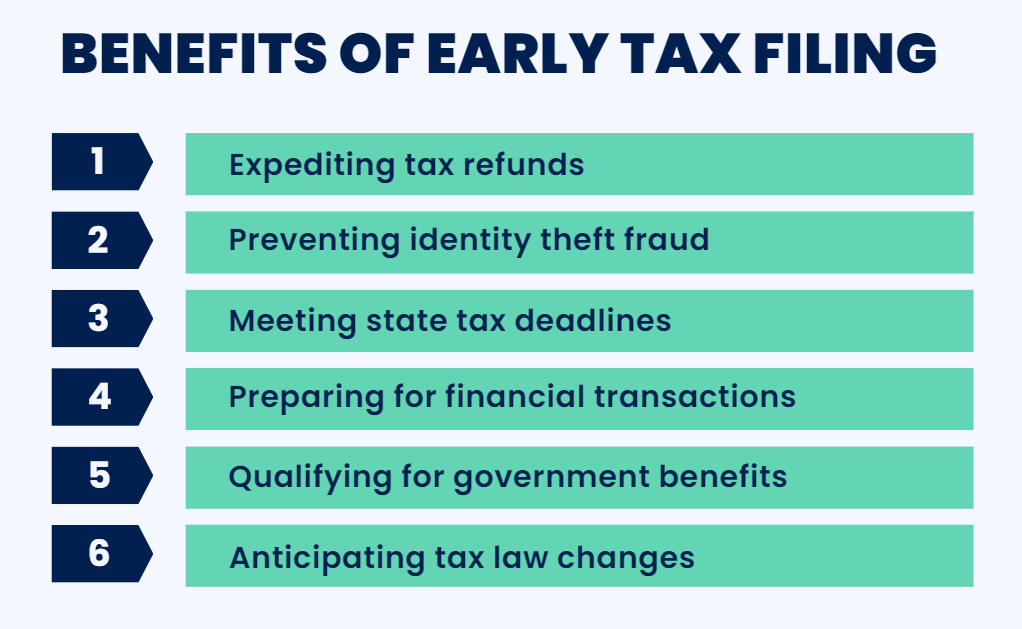

When should you consider filing taxes early?

While waiting to file your taxes has its advantages and is generally recommended, there are situations where filing early may still be advisable.

Let’s explore these special circumstances and provide examples of when early filing might be the right choice:

- Immediate refunds: If you urgently need your tax refund for essential expenses, such as bills, medical costs, or debt repayment, filing early can expedite the refund process.

- Identity theft concerns: If you suspect or have experienced identity theft that could impact your tax return, filing early can help prevent fraudulent claims.

- State tax deadlines: State tax deadlines may differ from federal deadlines. If your state requires an early filing, you should adhere to these deadlines.

- Upcoming financial transactions: If you plan to buy a house, apply for a loan, or engage in significant financial transactions in the near future, filing early may be beneficial. Lenders often require recent tax returns as part of their application process.

- Qualifying for government benefits: Some government benefits or assistance programs may require current tax return information for eligibility determination. Filing early ensures that your financial data is up-to-date for such applications.

- Anticipated tax changes: If you’re aware of impending tax law changes that could negatively impact your financial situation, filing before these changes take effect may be advantageous.

In these special circumstances, early filing can be a practical choice to address immediate financial needs, protect against identity theft, meet state tax deadlines, or secure your eligibility for certain benefits or transactions. However, for most taxpayers, waiting to file allows for a more comprehensive and potentially more beneficial tax return.

Tips for taxpayers waiting to file

For those heeding the IRS’s recommendation to wait before filing taxes, here are some essential tips to make the most of your time and ensure a smooth tax-filing process when the moment arrives:

1. Stay informed

a). Keep up with IRS updates and changes

- Regularly visit the official IRS website (irs.gov) for the latest updates, tax law changes, and guidance specific to the current tax season.

- Subscribe to IRS newsletters or mailing lists to receive important announcements and updates directly to your inbox.

- Follow the IRS on social media platforms for real-time updates and tax-related news.

b). Use reliable sources for tax information

- Seek out reputable tax professionals, financial advisors, or tax software providers who stay informed about tax law changes and can provide expert guidance.

- Consider consulting IRS-certified Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs for free tax help if you meet their eligibility criteria.

Read more about what day of the week the IRS deposits refunds.

2. Organize financial records

a) Have all necessary documents ready

- Create a checklist of required tax documents, including W-2s, 1099s, investment statements, and receipts for deductions.

- Organize and label your documents by category to streamline the tax preparation process.

b) Gather financial records

- Invest in tax preparation software or apps that can help you track and categorize expenses throughout the year.

- Consider using a dedicated filing system or digital storage solutions to keep your financial records easily accessible and well-organized.

3. Plan a smooth filing process

a) Prepare for filing once the IRS provides the green light

- Review your financial situation and assess any changes that may affect your tax return, such as new dependents, income sources, or deductions.

- Double-check your personal information, including Social Security numbers, to ensure accuracy.

- Calculate any estimated tax payments you may need to make if you have self-employment income or other taxable earnings not subject to withholding.

b) Avoid last-minute filing stress

- Don’t procrastinate. Set a tentative filing date once you have all the necessary information, and aim to file your return well before the deadline.

- Consider using tax preparation software or enlisting the help of a tax professional to simplify the filing process and minimize the risk of errors.

- Keep digital and physical copies of your filed tax return, supporting documents, and any correspondence with the IRS for future reference.

In other words, by staying informed, maintaining organized financial records, and planning ahead, you can make the waiting period before filing your taxes productive and reduce stress when it’s time to submit your return. Preparedness and knowledge are your allies in navigating the tax season effectively.

Recap of why the IRS is saying to wait to file taxes

Largely, the IRS’s guidance to delay filing your taxes is rooted in the need to align tax systems with recent legislative changes, ensuring accuracy and fairness in tax processing. Waiting also allows taxpayers to leverage updated calculations, maximize credits and deductions, and avoid potential errors associated with rushed filings.

Patience is a virtue during the tax season. Waiting to file allows for comprehensive tax planning and the incorporation of last-minute changes. But be prepared by organizing your financial records, assessing your tax situation, and planning ahead to minimize last-minute filing stress. By practicing patience and careful preparation, taxpayers can navigate the complexities of the tax season more effectively, ensuring they make the most of their financial situation.

Still got questions? Learn about who to contact and how to speak to someone at the IRS.

Share your experience

Have you ever been in a situation when the IRS was saying to wait to file taxes? Share your experience in the comments below. We’d love to hear from you!

.png)

Wow, this blog is fantastic. I love reading your articles. Keep up the good work! You realize that many individuals are searching around for this info, and you could aid them greatly.

Thank you so much for your kind words and encouragement! We’re delighted to know you find our articles valuable. We’ll definitely keep striving to provide helpful and informative content. Your support means a lot to us!