Have you ever been puzzled by the phrase “IRS Treas 310” on your bank statement wondering what on Earth it might mean? No worries, you’re not alone. It might sound confusing, but it’s just a fancy way of saying that you’ve received a tax refund from the IRS.

The goal of this article is to make IRS Treas 310 and tax refunds easy to understand. We want to explain why you might get a tax refund and what it means for your money. By the end of the article, you’ll have a clear picture of IRS Treas 310 and what to do when you see it in your bank statement. We want to make sure you know what’s going on with your money and that you’re not missing out on any cash that’s rightfully yours from the IRS.

Want to make sure your business taxes are as accurate as possible? Take advantage of Synder, a state-of-the-art accounting software syncing details of your incoming payments like taxes, refunds, platform fees, etc., and the books. Make sure your tax season is seamless and worry-free by signing up for a 15-day free trial or spare a spot at the coming Weekly Public Demo.

Contents:

1. Why do you get tax refunds?

3. What does IRS Treas 310 stand for on your bank statement?

4. What is the issue and confusion about Treas 310 from the IRS?

5. The reasons why you received the IRS Treas 310 tax refund

6. What are different scenarios of receiving IRS Treas 310 tax refunds?

7. What to do when you receive an IRS Treas 310 tax refund: A guide to handling your windfall

- Step 1. Verifying the legitimacy of the refund

- Step 2. Handling a potential mistake

- Step 3. Managing your refund

8. Conclusion

Why do you get tax refunds?

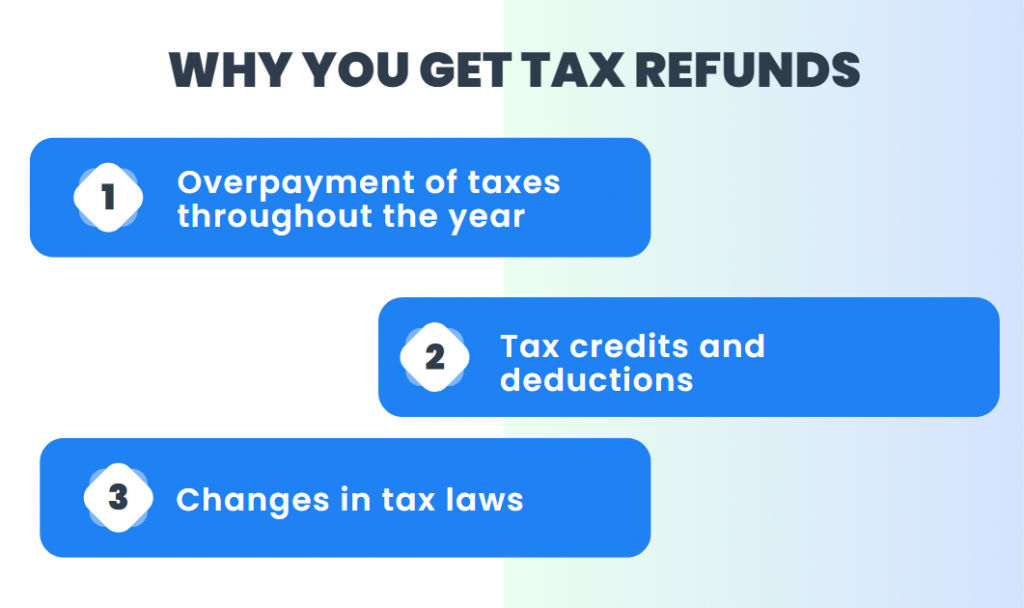

Tax refunds are like unexpected cash gifts from the government, and they happen for a few common reasons. One big reason is that you might have paid more in taxes throughout the year than you actually owed. So, the IRS owes you some money back. Other times, it’s because of tax credits, deductions, or changes in tax laws that affect how much you get back.

Check out our articles about the day of the week the IRS deposits refunds and the time of day the IRS deposits refunds.

What is IRS Treas 310?

Let’s start by breaking down the mysterious term “IRS Treas 310.” In plain terms, it stands for “Internal Revenue Service Treasury 310.” While it might appear as a cryptic code, it’s simply the way the government communicates that you’ve received a tax refund from the IRS. This is significant because it identifies a financial transaction that can directly impact your financial well-being. Whether it’s a small or substantial amount, understanding IRS Treas 310 is crucial to making the most of your refund.

What does IRS Treas 310 stand for on your bank statement?

Now, you might be wondering how to spot this on your bank statement. Usually, it’ll show up as “IRS Treas 310” followed by some additional codes or numbers. This is the IRS’s way of letting you know that they’ve deposited money into your bank account. It’s vital to keep an eye out for this label, as it can help you distinguish your tax refund from other transactions, ensuring you don’t overlook the funds that belong to you.

What is the issue and confusion about Treas 310 from the IRS?

It’s not uncommon for people to feel a bit puzzled when they first see IRS Treas 310 on their bank statement. The confusion can stem from the unfamiliar terminology and the sudden appearance of funds. Some individuals may even worry if it’s a mistake or a scam. However, understanding the meaning behind IRS Treas 310 will ease these concerns. It’s a legitimate refund from the IRS, and you have every right to claim it.

In the next section, we’ll explore why you might receive this refund, addressing common questions and concerns to ensure you’re well-prepared to manage your IRS Treas 310 deposit confidently and efficiently. Keep reading!

The reasons why you received the IRS Treas 310 tax refund

Receiving an IRS Treas 310 tax refund can be a welcome surprise, but understanding why you’re getting it is crucial to managing your finances effectively. In this section, we’ll explore the various reasons behind these refunds and what you should know about each of them.

1. Overpayment of taxes

How overpayments occur

Overpayments might seem like an unusual occurrence, but they happen more frequently than you might imagine. Here’s how it typically unfolds:

- Withholding excess: When you fill out your W-4 form with your employer, you determine how much income tax should be withheld from your paychecks. If you choose a conservative approach and withhold more than necessary, you’ll overpay your taxes.

- Estimated tax payments: Self-employed individuals or those with variable incomes often make estimated tax payments. If these payments exceed the actual tax liability, an overpayment occurs.

- Changing financial circumstances: Life is unpredictable, and changes in your financial situation, such as a drop in income or an increase in deductions (like buying a home), may result in overpayments if not considered during tax filing.

The process of refunding overpaid taxes

The IRS doesn’t keep your overpaid taxes. Instead, they have a process for refunding the surplus back to you:

- Tax return: You file your annual tax return, where you indicate the amount you believe you’ve overpaid.

- IRS review: The IRS reviews your tax return to validate the overpayment.

- Refund initiation: Once the overpayment is verified, the IRS starts the process of issuing a refund.

- Direct deposit: In most cases, the refund is directly deposited into your bank account. This transaction is labeled as IRS Treas 310 on your bank statement.

The process is similar to how you might reconcile accounts to ensure accuracy in your financial records, a practice often supported by account reconciliation software.

2. Tax credits and deductions

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a lifeline for individuals and families with modest incomes. If you meet the eligibility criteria, the EITC can significantly reduce your tax liability or even lead to a tax refund, even if you didn’t owe any taxes initially. The amount of the credit varies based on your income and the number of qualifying dependents you have. If the EITC surpasses your tax liability, the excess is sent to you as a refund, often showing up as IRS Treas 310.

Child Tax Credit

The Child Tax Credit is basically a type of financial support to families when they have dependent children. It offers a tax credit for each qualifying child, and if the credit amount exceeds your tax liability, you may receive it as a refund. This is reflected in your bank account as an IRS Treas 310 deposit. This process can be thought of as categorizing financial transactions to better understand where funds are allocated, much like organizing a chart of accounts example in business accounting.

Education credits

Education credits, such as the American Opportunity Credit and the Lifetime Learning Credit, aim to alleviate the financial burden of higher education expenses. If you qualify for these credits and they surpass your tax owed, you may receive the excess as a refund, typically denoted as an IRS Treas 310 deposit. These credits help offset costs related to tuition, textbooks, and other qualified educational expenses.

3. Changes in tax laws or regulations

Explanation of tax law changes

Tax laws and regulations aren’t static; they can change annually, affecting your tax liability and potential refunds. These changes encompass alterations to tax rates, deduction limits, and the availability of various tax credits. Staying informed about these changes is crucial because they can significantly impact the amount you receive as a refund.

Impact on tax refunds

When tax laws or regulations change, they can either increase or decrease the amount of your tax refund. For example, the introduction of a new tax credit due to a change in the law might boost your refund, while a reduction in allowable deductions could have the opposite effect. Understanding how these changes affect your tax situation is pivotal for both anticipating and managing your IRS Treas 310 tax refund. Staying informed and adjusting your financial planning accordingly can make a significant difference in your financial well-being.

What are different scenarios of receiving IRS Treas 310 tax refunds?

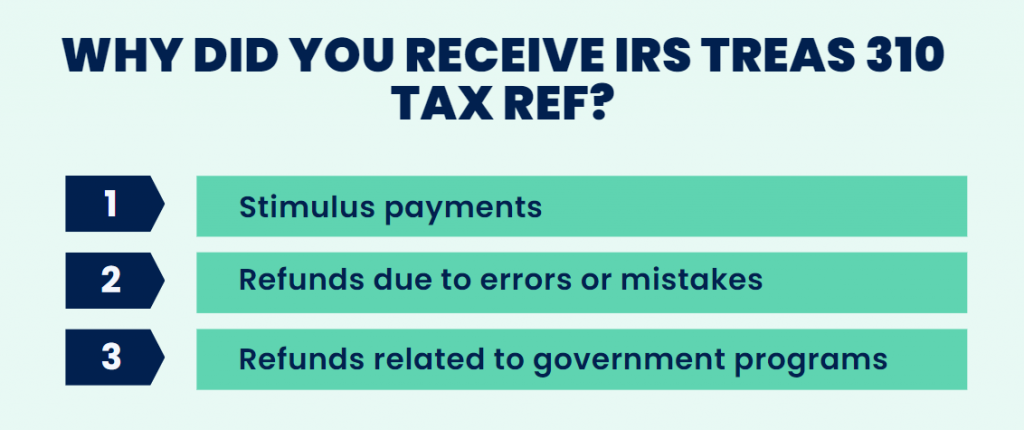

When you spot an IRS Treas 310 deposit in your bank account, it may not always be solely tied to your annual tax return. There are various special situations and circumstances that can lead to this type of refund.

In this section, we’ll delve into these scenarios to help you comprehend the reasons behind your IRS Treas 310 tax refund.

Stimulus payments

- Economic Impact Payments (EIP)

Economic Impact Payments, often referred to as stimulus checks, gained significant attention during times of economic hardship, such as the COVID-19 pandemic. These payments were issued to provide financial relief to eligible individuals and families. If you received these payments, they might be listed as IRS Treas 310 deposits on your bank statement. It’s crucial to differentiate these from regular tax refunds, as they were separate payments made by the government to help during exceptional circumstances. - Recovery Rebate Credit

The Recovery Rebate Credit is another element of the economic relief efforts during the pandemic. If you didn’t receive the full amount of your eligible stimulus payments, you might be entitled to claim the remaining portion as a credit on your tax return. This credit could result in an IRS Treas 310 deposit if it exceeds your tax liability.

Refunds due to errors or mistakes

- Incorrect tax filing

Sometimes, tax returns contain errors or mistakes that lead to an incorrect tax liability calculation. If you later discover that you’ve paid more taxes than you should have due to a filing mistake, the IRS may issue a refund to rectify the error. These refunds are typically labeled as IRS Treas 310.

You might want to learn more about how to file an income tax return.

- IRS audit results

If you’ve been subject to an IRS audit, and it’s determined that you paid more in taxes than necessary, the IRS will return the excess amount as a refund. This refund is essentially a correction resulting from the audit findings and is often marked as IRS Treas 310.

Read more about IRS audit red flags.

- Social Security benefits

If you’re receiving Social Security benefits, your tax situation can be unique. Sometimes, due to changes in your income or tax laws, you may have overpaid your taxes on these benefits. In such cases, the IRS will issue a refund for the excess tax withheld, which will be noted as IRS Treas 310 on your bank statement. - Veterans’ benefits

Similar to Social Security benefits, veterans receiving certain types of benefits may find themselves in a situation where they’ve overpaid taxes. In these instances, the IRS will refund the excess amount, and you’ll see it reflected as an IRS Treas 310 deposit. - Other government payments

Besides Social Security and veterans’ benefits, there are various other government programs and payments where overpayment of taxes can occur. These may include unemployment benefits or government assistance programs. If you’ve paid more in taxes on these payments than required, you’ll receive a refund marked as IRS Treas 310.

Understanding these special situations behind IRS Treas 310 tax refunds is essential for managing your finances accurately. While tax refunds are generally a welcome financial boost, being aware of the specific circumstances that lead to them will help you make informed decisions about your money and ensure you’re not overlooking any funds owed to you by the government, a principle that underscores the importance of maintaining a clear and detailed PayPal transactions history.

What to do when you receive an IRS Treas 310 tax refund: A guide to handling your windfall

Receiving an unexpected IRS Treas 310 tax refund can be a financial boon, but it’s crucial to navigate it wisely to maximize its benefits. Let’s explore the steps you should take when you find an IRS Treas 310 deposit in your bank account and how to make the most of this windfall.

Step 1. Verifying the legitimacy of the refund

Before you celebrate your IRS Treas 310 refund, it’s essential to verify its legitimacy to ensure you’re not falling victim to a scam or misunderstanding the source of the funds.

- Check your records: Review your tax records and recent financial transactions to confirm that the refund corresponds to a legitimate tax overpayment, government program benefit, or an economic relief payment you’re entitled to.

- Contact the IRS: If you have any doubts about the source of the refund or its authenticity, it’s advisable to contact the IRS directly. They can provide information about the refund and verify its validity.

Step 2. Handling a potential mistake

Mistakes can happen, and in some cases, you might receive an IRS Treas 310 refund that you’re not entitled to. Here’s what to do if you suspect an error:

- Don’t spend it: If you believe the refund is incorrect, it’s best to refrain from spending the money right away. Keep it in a separate account to avoid complications if you need to return it.

- Contact the IRS: Reach out to the IRS to discuss the situation and inquire about the nature of the refund. They can guide you on the appropriate steps to rectify any errors.

- Seek professional advice: If the situation is complex or if you’re unsure about the appropriate actions to take, consider consulting a tax professional or financial advisor for guidance.

Step 3. Managing your refund

Once you’ve confirmed the legitimacy of your IRS Treas 310 refund, it’s time to manage it wisely to meet your financial goals.

- Budgeting: Assess your financial needs and goals. Consider using a portion of the refund to build an emergency fund, or invest in long-term savings.

- Debt reduction: If you have high-interest debts, such as credit card balances or loans, consider using a portion of the refund to pay them down. Debt reduction can boost your financial stability.

- Save and invest: Consider putting some of the refund into a savings account or investment vehicle that aligns with your financial objectives. This can help you improve your financial standing and ensure you have a promising financial future.

- Charitable contributions: If you’re in a comfortable financial position, you might choose to donate a portion of the refund to a charitable cause that’s meaningful to you.

- Emergency fund: Ensure that you have an emergency fund to cover unexpected expenses. If you don’t have one, consider using a portion of the refund to establish or bolster it.

- Consult a financial advisor: If you’re unsure about the best way to manage your refund, consider consulting a financial advisor. They can give you the necessary guidance taking into account your financial goals and situation.

On the whole, receiving an IRS Treas 310 tax refund can be a pleasant surprise, but it’s essential to handle it thoughtfully. Verify its legitimacy, address potential mistakes, and use the funds wisely to improve your financial well-being. Whether you choose to pay down debt, save, invest, or support a charitable cause, your IRS Treas 310 refund can be a valuable tool for achieving your financial goals.

Conclusion

IRS Treas 310 may seem like an obscure code, but it represents a critical aspect of your financial life. Recognizing it on your bank statement signifies that you’ve received a tax refund or a government payment. Understanding the source of these funds is essential for managing your finances effectively and ensuring that you’re not missing out on money that rightfully belongs to you.

Taxes can be complex, and the rules governing them are subject to change. We encourage you to stay informed about tax matters by keeping up with the latest developments in tax laws and regulations. Moreover, when you encounter tax situations that are particularly intricate or unclear, seeking professional advice from a tax expert or financial advisor can be a wise choice. Their expertise can help you navigate complex tax scenarios, optimize your financial decisions, and ensure compliance with tax laws. Remember, taxes are an integral part of your financial journey, and staying informed is your best tool for making wise financial choices.

Curious to learn why the IRS can recommend you to wait to file taxes? Check out our recent article about it.

Share your experience

Have you ever received IRS Treas 310? Whether it was a tax refund, a stimulus payment, or another type of government disbursement, we’d love to hear about your experience. Share your story, questions, or any insights you may have in the comments section below! Your input can help others better understand these payments and their purposes.

%20(1).png)

What does COM2 TREAS 310 mean?

Thank you.

Hi Rosalind, to understand the specific nature of a “COM2 TREAS 310” transaction, it would be best to contact your bank or the IRS directly for more detailed information regarding the source and purpose of the deposit. This can help clarify exactly what the payment is for and ensure there are no discrepancies with your expected transactions.