Your business finances hold the answer to your business’s performance. The documents, known as your financial statements, give you a clear picture of how well your business is doing. But for it to work, all the pieces must fit perfectly. At this point, account reconciliation is the glue that holds this puzzle together, ensuring all the numbers in your financial records match those in your bank statements.

However, reconciliation can be tricky — even a tiny mistake or a missing piece can mess up the whole picture. Fixing these mistakes can be a real headache, taking time and effort. No wonder many businesses decide to use automated reconciliation solutions.

In this article, we’ll discover why reconciliation is a big deal and speak about popular account reconciliation software. We’ll also review the challenges businesses face when reconciling accounts and answer common questions surrounding reconciliation software.

TL;DR

- Account reconciliation software automates matching financial transactions across various accounts, significantly reducing manual work and improving accuracy.

- It integrates with existing financial systems, supports multicurrency transactions, and enhances audit readiness with detailed audit trails.

- Choosing the right software involves considering your business size, transaction complexity, and desired features like automation and real-time reporting.

- This technology is essential for maintaining accurate financial records, ensuring compliance, and enabling strategic decision-making.

Contents:

1. What does account reconciliation mean?

2. Why do we need regular account reconciliations?

3. How to reconcile accounts: Manual reconciliation vs reconciliation software

4. Top 7 account reconciliation software

5. When things might go wrong: What makes reconciliation a challenging task?

6. FAQ: Reconciliation Software

What does account reconciliation mean?

Account reconciliation is all about carefully checking and confirming that the numbers in two different financial records match up. Usually, this means looking at a company’s own books, like the general ledger, and comparing them with outside records, such as bank statements or credit card statements.

The main goal here is to verify that every transaction is recorded correctly in the company’s books and that these records accurately show how the business is doing financially. If any differences or discrepancies between these records are found, they need to be fixed accordingly.

It’s worth noting that reconciliation is an ongoing process.

Why do we need regular account reconciliations?

Let’s be honest, reconciliation does seem like A LOT of work. What’s more, most businesses reconcile their bank accounts at least monthly, which adds up to days, not hours, if done manually. So why do we need to reconcile accounts, in the first place?

Compliance and reporting

For businesses, staying compliant with financial regulations is non-negotiable, it’s a legal requirement. Accurate financial records are essential for compliance, and reconciliation ensures that your financial reporting is spot-on.

Detecting errors

Humans make mistakes. Whether it’s a misplaced decimal point or a double-entry oversight, errors can and do happen. Regular reconciliation helps catch these mistakes early, ensuring they don’t snowball into bigger problems down the line.

Preventing fraud

It’s an unfortunate reality that businesses must guard against fraud. Regular checks of your accounts can reveal unauthorized transactions or alterations, allowing you to act swiftly to mitigate any damage.

Ensuring financial health

With account reconciliations, you’re essentially giving your business regular financial health checks. This confirms that what’s recorded in your books matches up with reality (like your actual bank balances), which is key for informed decision-making.

Cash flow management

Knowing exactly where your business stands financially helps with effective cash flow management. Reconciliation provides a clear picture of your financial position, enabling better planning and budgeting.

Find out more by reading our guide on balance sheet account reconciliation.

How to reconcile accounts: Manual reconciliation vs reconciliation software

The choice between manual reconciliation and using reconciliation software comes down to efficiency, accuracy, and scale. Both methods are designed to verify that financial records are accurate and reflect true transaction activity, but they differ significantly in their approach and capabilities.

So, the choice between manual reconciliation and using software depends on the specific needs, size, and resources of a business. Small operations with a manageable volume of transactions might get by with manual reconciliation, at least initially. However, as a business grows, the efficiency, accuracy, and scalability offered by reconciliation software make it a worthwhile investment, not just for the finance team but for the overall health and compliance of the business.

Top 7 account reconciliation software

We’ll now review 7 popular software that can assist you in reconciling your bank accounts with your internal records. All these software can do much more for you than just reconcile. But for the purpose of this article, we’ll zoom in on the reconciliation features of these solutions.

1. Synder

Synder is a comprehensive cloud accounting software specializing in automating data synchronization into your books for various ecommerce platforms (Amazon, Shopify, eBay, and many more) and payment gateways (PayPal, Stripe, Square, etc). It integrates seamlessly with accounting software, such as QuickBooks and Xero. Here’s how it helps in reconciliation:

- Automating transaction matching: Synder automatically syncs and matches records across different platforms with your bank account feeds. This means you get your bank accounts and books reconciled per each platform giving you a proper view of your ecommerce or SaaS operations.

- Catching discrepancies: By syncing transactions in real-time, Synder quickly identifies any discrepancies between what’s recorded in your accounting software and what actually happened in your bank or on platforms like Shopify or PayPal.

- Simplifying multicurrency transactions: If you’re dealing with sales and expenses in different currencies, Synder handles the currency conversion and validates that these transactions are accurately reflected in your accounting records.

- Streamlining financial reports: With all transactions accurately recorded and reconciled, generating financial reports becomes much simpler. Synder validates that the data in your reports is up-to-date and accurate, aiding in better financial decision-making.

To learn more about how Synder helps with reconciliation and other financial operations, feel free to book a seat at our Weekly Public Demo or sign up for a free trial to learn more about how it can address your particular business needs.

2. FloQast

FloQast’s platform allows teams to attach supporting documentation, communicate within the system, and track the status of reconciliations. By automating manual processes, FloQast reduces the risk of errors and accelerates the financial close. Here’s how it steps in to help:

- Streamlining the process: FloQast makes reconciliation faster and less painful by automating much of the grunt work. This means your team can say goodbye to the endless manual data entry and the headaches that come with it.

- Enhancing accuracy: By automating data matching and providing clear oversight, FloQast helps reduce errors. You’re less likely to miss a discrepancy or make a mistake, which means your financial statements are more accurate and reliable.

- Saving time: With FloQast handling the heavy lifting, your team gets back precious hours. Instead of slogging through reconciliation, you can focus on analysis, strategy, and other high-value activities that drive the business forward.

- Improving collaboration: FloQast is designed to facilitate teamwork. It doesn’t matter if your team members are in the office or working remotely; they can collaborate effectively, ensuring that the reconciliation process isn’t just faster but also more cohesive.

3. Cube

Cube is designed for finance professionals who prefer working in spreadsheets like Excel and Google Sheets but need the advanced capabilities of FP&A (Financial Planning and Analysis) software. It streamlines the reconciliation and close processes with powerful reporting and collaboration tools. Here’s how Cube aids in reconciliation:

- Offering comprehensive spreadsheet integration: Finance teams can enjoy the full benefits of an advanced FP&A platform without leaving the comfort of their preferred spreadsheet environment. This integration means quicker adoption and less time spent learning new software.

- Providing audit tools: Cube’s dynamic audit solution lets you zoom in on every transaction and piece of data right down to the individual cell, helping in thorough and efficient reconciliations.

- Allowing for 360-degree data management: Cube pulls data from various sources and neatly lines it up for you. This means you get a full picture of your finances without the headache of juggling data from different places.

- Creating reports: Cube makes it easy to create financial reports, get them approved, and send them out to everyone who needs to see them. It gets the right info to the right people.

4. SolveXia

SolveXia is a software tool that helps businesses automate their financial tasks, like checking if their account records match up correctly, finding mistakes in data, and creating reports. It allows companies to set up automated systems tailored to their specific needs, making their work more efficient, accurate, and compliant with financial rules. Here’s how it makes a difference:

- Handling data seamlessly: Whether your data comes in a straightforward spreadsheet or a complex format, SolveXia can handle it. It’s adept at pulling information from various sources like your general ledger, banks, and suppliers to get your accounts reconciled quickly.

- Smart data matching: The platform is designed to intelligently match data, reducing the need for manual checks. It also highlights variances and exceptions, alerting your team to areas that need attention.

- Improving workflow: SolveXia not only flags issues but also streamlines the workflow for addressing them. This includes sending out alerts and creating a process for staff to make necessary corrections.

- Providing advanced analytics: SolveXia can integrate and analyze data across different areas, so apart from reconciliation it also offers analytics tools.

5. NanoNets

NanoNets is an AI tool that takes the heavy lifting out of organizing and checking all kinds of financial documents like bank statements and invoices. Here’s how it helps:

- Automated document handling: It sorts out documents from different places, like bank statements, invoices, and receipts, making the first step of handling data a lot smoother.

- Smart data extraction: Thanks to OCR technology (optical character recognition), NanoNets quickly pulls out the important bits from documents. This means faster and more accurate data collection.

- Clever matching: It lines up transactions from various sources and matches them based on set rules to make the reconciliation process easy.

6. BlackLine

BlackLine is a solution that helps manage the financial closing process, with a big focus on making account reconciliation easier. Thanks to BlackLine’s automatic features, companies can cut down on mistakes, make things clearer, and get their financial close process done more efficiently. Here’s how BlackLine makes a difference:

- Ensuring accuracy and consistency: With its sophisticated algorithms and rules-based processes, BlackLine minimizes the risk of errors. It validates that every transaction is accounted for correctly, leading to more accurate financial statements.

- Facilitating real-time oversight: One of BlackLine’s strengths is providing finance teams with a real-time view of the reconciliation status across all accounts. This visibility means you can quickly identify and address any issues as they arise, rather than waiting until the end of the month or quarter.

- Improving compliance and control: BlackLine not only helps in keeping your financial records in tip-top shape but also in complying with relevant accounting standards and regulations. Its detailed audit trails and documentation support make it easier to demonstrate compliance during audits.

7. Adra

Adra by Trintech makes the reconciliation process smoother and more dependable for finance teams. It automates key tasks, provides visibility into the reconciliation status, and ensures accuracy and compliance. Here’s how Adra assists in reconciliation:

- Providing real-time visibility: With Adra, finance teams get a clear, real-time view of the reconciliation status across all accounts. This immediate insight helps in quickly spotting and resolving issues, ensuring that reconciliations are up-to-date.

- Enhancing accuracy: Adra uses sophisticated matching algorithms to ensure that transactions across different systems are accurately reconciled.

- Streamlining workflow: Adra organizes the reconciliation process into a structured workflow. This organization helps teams manage tasks more effectively, from identifying discrepancies to resolving exceptions and finalizing reports.

- Improving compliance: Adra helps ensure compliance with accounting standards and regulations by providing a detailed audit trail for every action taken during the reconciliation process. This documentation is invaluable during audits and for internal reviews.

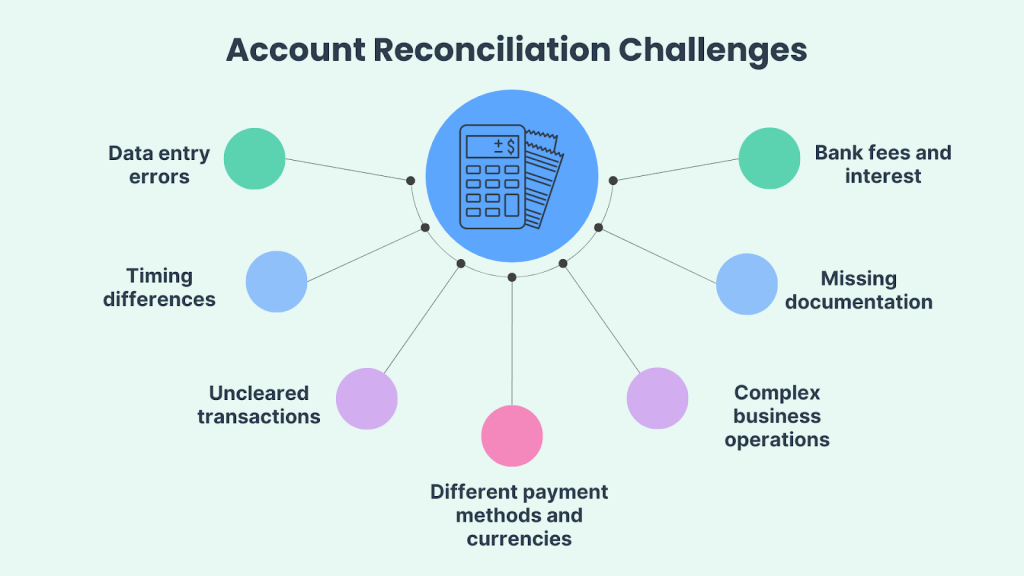

When things might go wrong: What makes reconciliation a challenging task?

When trying to improve your reconciliation process you not only need to know what to strive for but also what to avoid. Let’s look at the main challenges that make reconciliation tough, along with tips for choosing the right reconciliation software.

Different payment methods and currencies

Dealing with various payment methods and currencies adds complexity. Choose software that supports multiple payment methods and currency conversions if you use them in your business.

Data entry errors

Mistakes in typing numbers or forgetting to record transactions are common and can mess up your records. Software with error detection and correction features will help you stay on top of these problems.

Timing differences

Sometimes there’s a delay between when a transaction happens and when it shows up in your bank account. Software that can track and adjust for these timing differences will help keep your records accurate.

Uncleared transactions

Checks that haven’t been cashed or deposits not yet processed can make reconciliation tricky. Opt for software that allows you to easily account for pending transactions.

Bank fees and interest

Forgetting to include bank fees or interest in your records can cause discrepancies. Software that automatically updates this data ensures nothing is overlooked.

Missing documentation

Lost receipts or invoices make it hard to verify transactions. Software that includes document management and storage will keep everything organized and accessible.

Complex business operations

Businesses with complicated operations, like inventory management or dealing with prepaid expenses, need more detailed reconciliation. Also, adding or closing accounts requires adjustments to keep records straight. Look for software that can handle complex accounting tasks if your business operations call for it.

Bottom line

Summing up all the above, account reconciliation is an indispensable process for businesses, ensuring financial accuracy, fraud detection, and regulatory compliance.

Such software automates the reconciliation process, minimizing human errors, enhancing transparency, and promoting accountability. Embracing reconciliation software empowers businesses to maintain precise financial records, make informed decisions, and navigate the complexities of modern finance with greater confidence.

Read more about desktop accounting software and accounts payable automation software.

Share your reconciliation software journey!

Have you had successes, faced challenges, or learned valuable lessons from using reconciliation software? We invite you to share your stories and feedback in the comments section below. Your experiences can help others navigate their own reconciliation processes more effectively!

FAQ: Reconciliation Software

1. What is reconciliation software?

Reconciliation software is a tool designed to automate the process of matching financial records and transactions across different accounts and systems. It helps verify the accuracy of financial statements by identifying discrepancies and facilitating their resolution.

2. Why is reconciliation software important?

Reconciliation software streamlines the reconciliation process, significantly reducing the time and effort required to match transactions manually. It enhances accuracy, improves compliance with financial regulations, and allows finance teams to focus on more strategic tasks.

3. Can reconciliation software integrate with existing financial systems?

Yes, most reconciliation software can integrate with a wide range of financial systems, including general ledgers, banking platforms, ERP systems, and other accounting software. This integration facilitates seamless data flow and automates the reconciliation process.

4. Does reconciliation software support multicurrency transactions?

Many reconciliation software solutions are designed to handle multicurrency transactions, accommodating businesses that operate across different countries. They can automatically convert currencies and reconcile transactions in various currencies.

5. How does reconciliation software improve audit readiness?

Reconciliation software provides detailed audit trails, documenting every action taken during the reconciliation process. This transparency and accountability make it easier to demonstrate compliance during audits and ensure financial records are accurate and up-to-date.

6. Can small businesses benefit from reconciliation software?

Absolutely. Small businesses can significantly benefit from reconciliation software by automating manual processes, reducing errors, and saving time. There are various scalable options available that can grow with the business.

7. What features should I look for in reconciliation software?

Key features to look for include automation capabilities, integration with existing financial systems, support for multicurrency transactions, real-time reporting and visibility, audit trails, and user-friendly interfaces.

8. How does reconciliation software handle discrepancies?

Reconciliation software automatically identifies discrepancies between matched records and provides tools for investigating and resolving these issues. It alerts users to variances and facilitates the adjustment process.

9. Is reconciliation software secure?

Security is a top priority for reconciliation software providers. They typically offer robust security measures, including encryption, secure data storage, and controlled access permissions to protect sensitive financial data.

10. How do I choose the right reconciliation software for my business?

Consider your specific reconciliation needs, the size of your business, the complexity of your financial transactions, and your budget. Look for software that integrates well with your existing systems, offers the features you need, and comes with positive reviews and reliable customer support.

11. Can accounting software be used for bank reconciliation?

Yes, accounting software can definitely be used for bank reconciliations. Most modern accounting software comes with built-in features that allow you to match transactions recorded in your accounting system with those listed on your bank statement. While dedicated reconciliation software may offer more specialized tools for complex reconciliation tasks, many businesses find that their accounting software sufficiently meets their needs for bank reconciliation in Excel.

Read our quick comparison of NetSuite and QuickBooks Enterprise and what services they can offer businesses.

%20(1).png)