Accounting is an intricate world, where numbers drive decisions and accuracy is paramount. Here, balance sheet account reconciliation is a critical practice. It’s the process that ensures the harmony between a company’s financial records and its actual financial position.

In this article, we will delve deep into the realm of balance sheet account reconciliation, exploring its significance, key components, challenges, benefits, and the evolving role of technology, all in an effort to demystify the art of achieving financial clarity.

The role of a balance sheet in accounting

A balance sheet serves as a cornerstone of financial reporting and provides a clear snapshot of a company’s financial condition. It is a fundamental tool that aids in assessing a company’s financial health, evaluating its ability to meet short-term obligations, and understanding the sources of its funding and equity. Through its structured presentation of assets, liabilities, and equity, the balance sheet is a crucial resource for informed decision-making by stakeholders in the financial world.

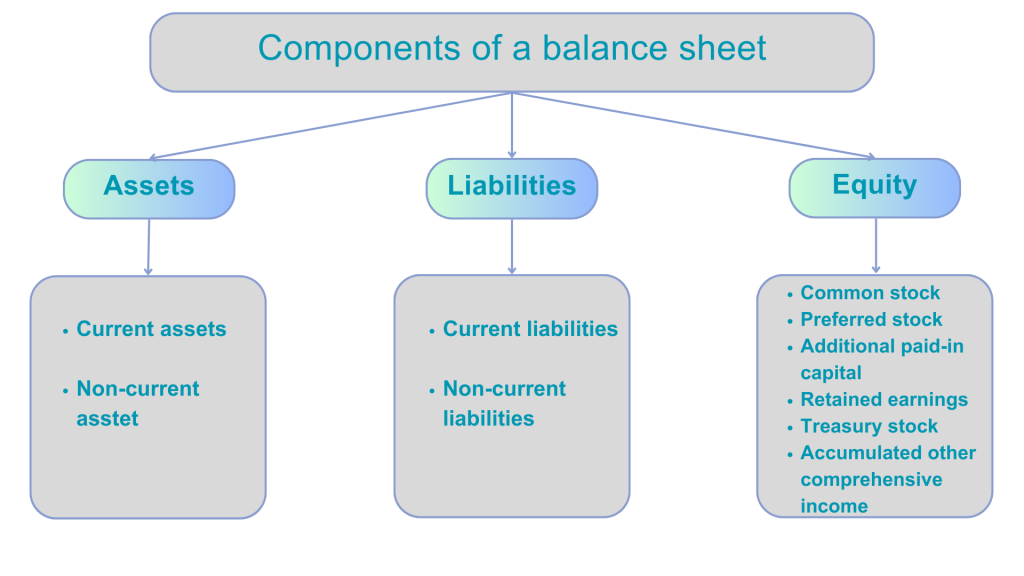

So, as mentioned above, a balance sheet presents a summary of a company’s assets, liabilities, and shareholders’ equity. Let’s break it down.

Assets

Assets represent what a company owns or controls, which have economic value and can be used to generate future benefits. Assets typically fall into one of the two catigories, sich as current and non-current (or long-term) assets.

- Current Assets are assets that you expect to be converted into cash or used up within a year or the normal operating cycle of a business. Examples include cash, accounts receivable (money owed to the company by customers), inventory (goods for sale), and short-term investments.

- Non-Current Assets, also known as long-term assets, are items that you don’t plan to convert into cash or use up shortly. They include property, plant, and equipment (physical assets used in the business), long-term investments, and intangible assets (such as patents, copyrights, and trademarks).

Liabilities

Liabilities are the obligations or debts a company owes to external parties. Similar to assets, liabilities are categorized into current and non-current (long-term) liabilities.

- Current Liabilities are obligations that are expected to be settled within a year or the normal operating cycle. Examples include accounts payable (amounts owed to suppliers), short-term loans, and accrued expenses.

- Non-Current Liabilities, also called long-term liabilities, these are obligations that are not due for settlement soon. They can include long-term loans, bonds payable, and deferred tax liabilities.

Shareholders’ Equity

Also known as owner’s or stockholders’ equity, this represents the residual interest in the company’s assets after deducting liabilities. It reflects the net investment by the company’s owners or shareholders.

- Common Stock are the par value of shares issued to shareholders.

- Preferred Stock represents a separate class of ownership with certain privileges.

- Additional Paid-In Capital stands for the amount shareholders have paid above the par value of the shares.

- Retained Earnings are accumulated profits retained within the company rather than distributed as dividends.

- Treasury Stock are shares of the company’s stock that it has repurchased.

- Accumulated Other Comprehensive Income represents gains and losses that bypass the income statement (e.g., unrealized gains on available-for-sale securities).

The balance sheet follows the fundamental accounting equation:

Assets = Liabilities + Shareholders’ Equity.

This equation ensures that the company’s resources are financed by its obligations and the investments made by its owners.

The accuracy of accounting records is paramount for a dependable balance sheet, as it reflects a company’s financial status. Inaccuracies can distort asset, liability, and equity values, potentially misleading stakeholders.

Synder, accounting software for online businesses, boosts accuracy via automated entry, seamless bank integration, precise transaction categorization, reconciliation, audit trails, real-time monitoring, and data validation. This ensures financial data aligns with standards for an accurate view of a company’s financial health.

Should you believe Synder can be the solution you’re looking for, don’t hesitate to book a seat at our webinar or sign up for a free trial to learn more about how it can help your particular business.

Understanding balance sheet account reconciliation

Balance sheet reconciliation, in its essence, is the meticulous process of aligning a company’s financial records with its actual financial position. The balance sheet, as the core financial statement that portrays a company’s assets, liabilities, and equity, requires meticulous care to maintain its accuracy. This is where balance sheet reconciliations come into play. By systematically comparing and matching various accounts within the balance sheet, companies ensure that the reported figures reflect the true financial state.

At its core, balance sheet reconciliation involves reconciling the accounts listed on the balance sheet with their corresponding entries in the general ledger. The general ledger serves as the master record of all financial transactions, making it the foundational source for balance sheet data. Reconciliation aims to bridge any discrepancies between the general ledger and the financial statement, ensuring that each account’s balance is accurate and consistent.

Key components of balance sheet reconciliations

The balance sheet is a compilation of various accounts that collectively depict a company’s financial health. Reconciling these accounts is essential for accurate financial reporting and decision-making. Here are some key components of balance sheet reconciliations:

Bank reconciliation

Among the most critical aspects of balance sheet reconciliation is bank reconciliation. This involves matching the transactions recorded in the company’s bank statements with those in the general ledger. Discrepancies can arise due to timing differences or errors, making bank reconciliation a crucial process for ensuring that cash accounts on the balance sheet are precise.

Accounts receivable and accounts payable

Reconciling accounts receivable and accounts payable ensures that the amounts owed to and by the company are accurately reflected. This process involves cross-referencing invoices, purchase orders, and payment records to ensure that outstanding balances are correctly recorded.

Inventory reconciliation

For businesses that deal with physical goods, reconciling inventory accounts is crucial. It ensures that the value of goods on hand is accurately reported, helping prevent overvaluation or undervaluation of assets.

Navigating the reconciliation process

Conducting effective balance sheet reconciliations requires a systematic approach to ensure accuracy and completeness. Here’s a step-by-step guide to navigating the reconciliation process:

- Collect all necessary documentation, including bank statements, invoices, purchase orders, and supporting records for the accounts you’ll be reconciling.

- Compare the transactions recorded in the general ledger with the supporting documentation. Ensure that the amounts, dates, and descriptions match.

- If discrepancies are identified, investigate the root cause. Discrepancies could be due to errors in recording, timing differences, or other issues.

- Take corrective action to rectify any discrepancies. This might involve adjusting entries in the general ledger, communicating with vendors or customers, or resolving banking issues.

- Maintain clear and detailed records of the reconciliation process. Document the steps taken, the discrepancies found, and the actions taken to rectify them.

- Have the reconciliations reviewed and approved by relevant stakeholders, such as supervisors or auditors. This adds an additional layer of accountability and quality control.

Challenges and pitfalls of balance sheet reconciliation

While balance sheet reconciliations are crucial for financial accuracy, they aren’t without challenges. Some common challenges include:

- Data volume and complexity

Large companies with numerous transactions can face a high volume of data to reconcile. Complexity arises when dealing with different currencies, locations, and business units. - Human error

Manual reconciliation processes are susceptible to human errors. A simple typo or miscalculation can lead to inaccurate financial reporting. - Timing differences

Transactions might appear differently on bank statements and in the general ledger due to timing differences. This can lead to temporary discrepancies. - Incomplete documentation

Missing or incomplete documentation can hinder the reconciliation process, making it difficult to match transactions accurately. - System integration

Ensuring that various accounting systems and software tools communicate seamlessly is a challenge, especially for organizations using different platforms.

To address these challenges, companies are increasingly turning to technology and automation solutions to streamline and enhance the reconciliation process.

Bank reconciliation: a closer look

Bank reconciliation is a linchpin in the balance sheet reconciliation process. It’s the process of comparing a company’s bank statements with its own records to ensure that all transactions have been accurately recorded. Let’s take a closer look at this crucial aspect of reconciliation:

Banks often process transactions with a delay, leading to timing differences between the bank statement and the company’s records. For example, a company might issue a check at the end of a month, but the bank might process it a few days later, causing a temporary discrepancy. Bank reconciliation aims to identify and resolve such timing differences.

Bank reconciliation also serves as a potent tool for fraud detection and financial control. By meticulously comparing bank statements with recorded transactions, companies can spot unauthorized transactions or discrepancies that might indicate fraudulent activity. This vigilance contributes to maintaining the integrity of financial data.

Benefits of efficient balance sheet reconciliation

Efficient balance sheet reconciliations offer a multitude of benefits for businesses, ranging from accurate financial reporting to improved decision-making:

Accurate financial reporting

Accurate reconciliations ensure that financial statements, including the balance sheet, accurately represent the company’s financial position. This transparency is essential for investors, stakeholders, and regulatory compliance.

Enhanced transparency

Proper reconciliation practices increase the transparency of financial data. This transparency is vital for establishing trust with investors, lenders, and other stakeholders.

Reduced financial risks

Accurate reconciliation reduces the risk of financial errors, such as overstatements or understatements of assets, liabilities, and equity. This mitigates potential legal and financial consequences.

Regulatory compliance

Many industries are subject to strict regulatory standards that mandate accurate and transparent financial reporting. Proper balance sheet reconciliations help businesses meet these compliance requirements.

Informed decision-making

Reliable financial data empowers businesses to make informed decisions. Whether it’s evaluating investments, setting budgets, or planning expansions, accurate financial information is crucial.

Workload automation in reconciliation

As businesses evolve and embrace digital transformation, technology is reshaping the way balance sheet reconciliations are performed. Workload automation, powered by sophisticated software solutions, is revolutionizing the reconciliation process. Here’s how:

- Efficiency

Automation tools can handle large volumes of data more efficiently than manual processes. They can quickly compare and match transactions, reducing the time spent on repetitive tasks. - Accuracy

Automation minimizes the risk of human errors that can occur during manual reconciliation. This is particularly crucial for ensuring the precision of financial data. - Consistency

Automated processes follow predefined rules consistently, reducing the variability that can arise when different individuals perform manual reconciliations. - Scalability

Businesses experiencing growth can seamlessly scale their reconciliation processes with automation. Handling a larger volume of transactions becomes more manageable with automation tools. - Data analytics

Automation tools often come with built-in analytics capabilities. These tools can identify trends, patterns, and anomalies in financial data, providing valuable insights for decision-making.

However, it’s important to note that while automation streamlines and enhances the reconciliation process, human oversight remains essential. Human expertise is still required to interpret results, investigate discrepancies, and make strategic decisions based on the reconciled data.

Conclusion

Balance sheet account reconciliation is far more than a routine accounting task; it’s the cornerstone of financial accuracy and transparency. Accurate balance sheet reconciliations uphold the integrity of financial statements, empower businesses to make informed decisions, and ensure compliance with regulatory standards. Through meticulous comparison, investigation, and resolution, businesses align their financial records with the reality of their financial position.

As technology continues to advance, the role of automation in balance sheet reconciliation is becoming increasingly significant. Automation not only enhances efficiency and accuracy but also frees up valuable human resources to focus on strategic analysis and decision-making. In this era of data-driven decision-making, the art of balance sheet account reconciliation remains pivotal in providing the reliable financial foundation upon which successful businesses are built.

Learn more about Xero alternatives and What time of day does IRS deposit refunds.

Share your thoughts

Share your thoughts and experience in the comments section below. We’re fond of good stories!

.png)