The Unified Chart of Accounts (UCOA) is a revolutionary accounting tool designed to bring uniformity and clarity to financial transactions across a diverse range of organizations. By providing a standardized framework for recording financial activities, UCOA enables entities to report their finances accurately, facilitating easier comparison, analysis, and understanding. This guide delves into the essence of UCOA, exploring its significance, benefits, and application across different sectors.

What is UCOA?

The Unified Chart of Accounts (UCOA) is a standardized accounting framework designed to help organizations—especially nonprofits, but also applicable to small businesses, local government entities, and other organizations—consistently categorize financial transactions. This standardization aims to streamline financial reporting, budgeting, and analysis processes, making it easier for organizations to prepare their financial statements, ensure compliance with accounting standards, and conduct comparisons or benchmarking analyses.

The UCOA framework is comprehensive, covering all aspects of an organization’s financial activities. It provides a detailed listing of accounts that can be used in the general ledger, facilitating accurate and uniform recording of financial data. The accounts are organized into categories such as assets, liabilities, net assets, revenues, expenses, and others, each with further subdivisions to cover the full spectrum of financial transactions an organization might encounter.

In simple words, the Unified Chart of Accounts (UCOA) is like a universal language for organizing and reporting an organization’s money matters. It’s a standardized way to categorize all the financial transactions a company or nonprofit makes. Think of it as a big, organized list that helps everyone understand where money comes from and where it goes, using the same set of rules. This makes it easier to keep track of finances, compare financial information with other organizations, and make sure everything adds up correctly for reports or audits.

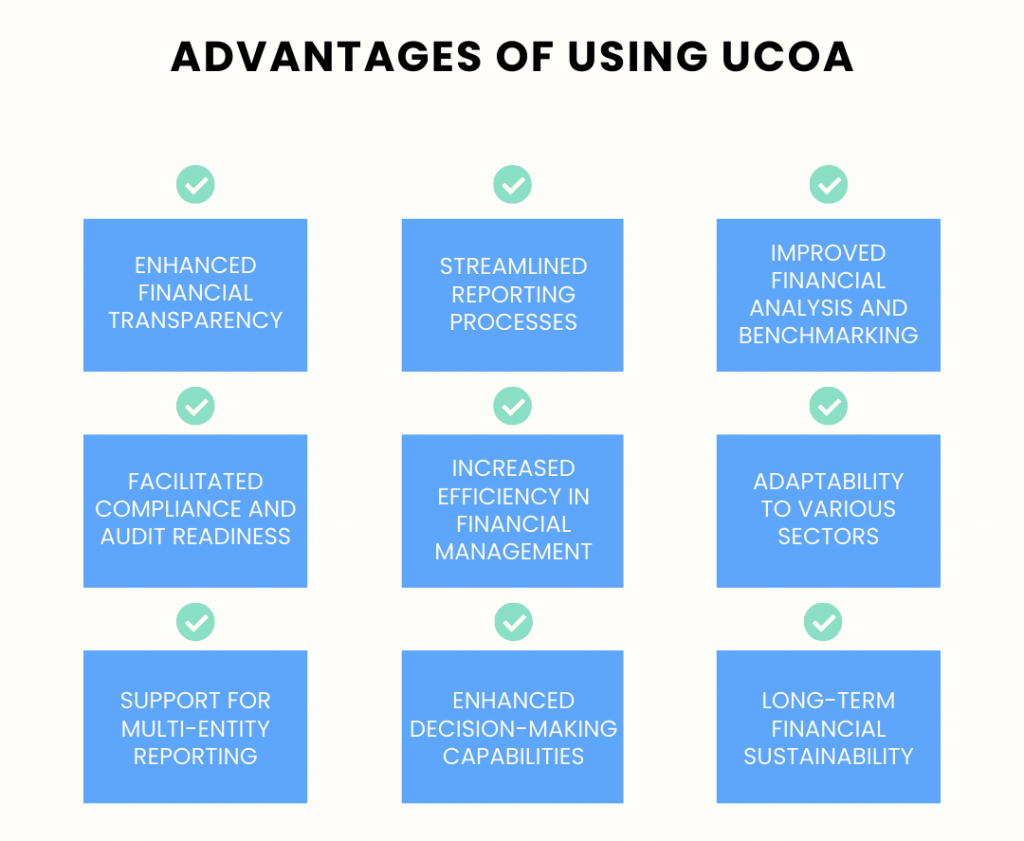

Advantages of using UCOA

Adopting UCOA offers numerous advantages that can significantly enhance financial management and reporting. Here are the key benefits of using UCOA:

1. Enhanced financial transparency

UCOA promotes clarity and transparency in financial reporting by providing a consistent framework for categorizing transactions. This uniformity allows stakeholders, including donors, investors, and regulatory bodies, to easily understand and compare financial statements, fostering greater trust and accountability.

Automate transaction categorization within your accounting system by integrating Synder. With Synder, manual entry errors are significantly reduced, ensuring that every transaction is accurately categorized according to your predefined rules. This simplifies bookkeeping processes and provides clearer insights into your financial performance.

2. Streamlined reporting processes

With a standardized chart of accounts, organizations can streamline their financial reporting processes, reducing the time and effort required to prepare financial statements. This efficiency minimizes administrative overhead and allows for quicker decision-making based on financial data.

3. Improved financial analysis and benchmarking

The consistent categorization of financial data facilitated by UCOA enables more accurate and meaningful financial analysis. Organizations can benchmark their financial performance against peers or industry standards more effectively, identifying areas of strength and opportunities for improvement.

4. Facilitated compliance and audit readiness

UCOA is designed to align with generally accepted accounting principles (GAAP) and other regulatory standards, simplifying compliance with financial reporting requirements. This alignment makes it easier for organizations to prepare for audits, reducing the risk of compliance issues and enhancing the integrity of financial statements.

5. Increased efficiency in financial management

By adopting UCOA, organizations can achieve greater efficiency in managing their finances. The standardized account codes and classifications reduce the likelihood of errors and inconsistencies in financial data, streamlining internal financial management practices and simplifying the reconciliation process.

6. Adaptability to various sectors

UCOA’s flexible structure can be adapted to meet the specific needs of different sectors, including nonprofits, for-profit entities, and local government organizations. This adaptability ensures that organizations of all types can benefit from the improved financial reporting and analysis capabilities offered by UCOA.

7. Support for multi-entity reporting

For organizations that operate multiple entities or programs, UCOA facilitates consolidated financial reporting by ensuring that all entities use a common accounting language. This simplifies the process of aggregating financial data across the organization, providing a comprehensive view of its financial health.

8. Enhanced decision-making capabilities

The clarity and consistency in financial reporting provided by UCOA empower organizational leaders to make more informed decisions. With reliable and comparable financial data, managers can better assess financial performance, plan future activities, and allocate resources effectively.

9. Long-term financial sustainability

By improving financial management practices, UCOA contributes to the long-term sustainability of organizations. Enhanced transparency, efficiency, and compliance support better financial planning and management, laying the foundation for sustainable growth and development.

Challenges in adopting UCOA

Adopting the Unified Chart of Accounts (UCOA) can offer significant benefits for financial management and reporting, but the transition comes with its own set of challenges. These hurdles can vary in complexity depending on the size of the organization, its existing financial systems, and the specific sector it operates in.

Here are some common challenges organizations might face when adopting UCOA:

1. Training and education

Implementing UCOA requires thorough training for the accounting and finance staff to understand the new system. This involves learning the new account structure and understanding the rationale behind the categorizations and how they align with the organization’s reporting and compliance requirements.

2. System integration and data migration

Integrating UCOA with existing accounting software and systems can be complex, especially if those systems are customized or proprietary. Data migration from the old chart of accounts to UCOA needs to be carefully planned and executed to ensure accuracy and completeness, avoiding data loss or misclassification.

3. Customization requirements

While UCOA is designed to be comprehensive and adaptable across various sectors, some organizations may find that it doesn’t perfectly fit their unique financial reporting needs. Customizing UCOA to accommodate specific requirements can be a challenge, requiring expert knowledge to ensure that the integrity and benefits of the standardized system are maintained.

4. Maintaining consistency across departments

For larger organizations or those with multiple departments and programs, ensuring consistent adoption and use of UCOA across all areas can be challenging. This consistency is crucial for accurate consolidated reporting and analysis.

5. Cost implications

The transition to UCOA can involve upfront costs, including software updates or changes, training programs for staff, and potential consulting fees for expert advice during the transition. Organizations must budget for these expenses and weigh them against the long-term benefits of adopting UCOA.

Strategies for overcoming these challenges

Overcoming the challenges of adopting UCOA involves several strategic approaches:

- Effective change management: Implementing clear communication strategies, involving stakeholders in the transition process, and addressing concerns proactively can help mitigate resistance to change.

- Comprehensive training programs: Developing tailored training sessions that address the specific needs and levels of expertise within the organization can ensure a smoother transition.

- Expert consultation: Seeking advice from accounting professionals or consultants who specialize in UCOA implementations can provide valuable insights and assistance, particularly for system integration and customization.

- Phased implementation: Gradually introducing UCOA, starting with pilot departments or projects, can help organizations manage the transition more effectively and allow for adjustments before full-scale implementation.

- Monitoring and feedback: Establishing mechanisms for ongoing monitoring and feedback collection post-implementation can help identify issues early and facilitate continuous improvement.

Nonprofit chart of accounts and its importance

A nonprofit chart of accounts is a critical organizational tool that categorizes every financial transaction of a nonprofit organization into a structured and understandable format. This chart serves as the backbone of the organization’s accounting system, enabling it to record, report, and analyze financial information accurately and efficiently. Its importance in the nonprofit sector cannot be overstated, as it directly impacts financial management, reporting, compliance, and strategic decision-making.

So why is it important?

1. Facilitates financial reporting and transparency

A well-organized chart of accounts allows nonprofits to generate clear and detailed financial statements, including the balance sheet, income statement, and statement of cash flows. This transparency is crucial for building trust with donors, grantmakers, members, and regulatory bodies.

2. Enables effective budgeting and financial management

By categorizing financial transactions systematically, nonprofits can track their income and expenditures against their budgets more accurately. This aids in effective financial management, helping organizations allocate resources efficiently and identify areas where cost savings can be made.

3. Supports fund accounting and donor restrictions

Nonprofits often receive funds that are restricted for specific purposes. A chart of accounts that includes categories for these restrictions simplifies fund accounting, ensuring that funds are used in accordance with donor intentions and legal requirements.

4. Streamlines grant reporting and compliance

Many nonprofits rely on grants that come with reporting requirements. A chart of accounts tailored to track grant-related transactions simplifies the preparation of reports for grantors and ensures compliance with the terms of the grant.

5. Improves donor and stakeholder confidence

A transparent and accountable financial reporting system, underpinned by a well-structured chart of accounts, increases confidence among donors and stakeholders. It demonstrates that the nonprofit manages its resources responsibly and effectively pursues its mission.

FASB and AICPA for a nonprofit chart of accounts

The Financial Accounting Standards Board (FASB) and the American Institute of Certified Public Accountants (AICPA) provide standards and guidelines that significantly influence the structure and content of the chart of accounts for nonprofit organizations. These standards ensure consistency, transparency, and comparability in nonprofit financial reporting, facilitating stakeholders’ understanding and analysis of an organization’s financial health and operations.

FASB standards for nonprofits

FASB is the primary body responsible for setting accounting standards in the United States. Key aspects include:

- Net asset classification: FASB standards require nonprofits to classify net assets into two categories: net assets with donor restrictions and net assets without donor restrictions. This classification reflects the existence and nature of donor-imposed restrictions on the use of the funds.

- Reporting of expenses: Nonprofits must report expenses by both their natural and functional classifications. This means organizations must show expenses such as salaries, rent, and supplies (natural classification), as well as how those expenses are allocated across program services, management and general activities, and fundraising (functional classification).

- Liquidity and availability of resources: Nonprofits are required to provide qualitative and quantitative information about the liquidity and availability of their financial assets to meet cash needs for general expenditures within one year of the balance sheet date.

AICPA standards and guidance for nonprofits

The AICPA provides additional guidance and standards that complement FASB rules, particularly through its Audit and Accounting Guide for Not-for-Profit Entities. Key areas of focus include:

- Financial statement presentation: The guide provides detailed instructions on how to present financial statements, including the statement of financial position, statement of activities, and statement of cash flows, in a way that aligns with FASB standards.

- Notes to financial statements: It includes guidance on preparing notes that accompany financial statements, offering clarity on accounting policies, commitments, and contingencies, and detailed breakdowns of financial statement line items.

- Revenue recognition: The AICPA guide addresses how nonprofits should recognize and report different types of revenue, including contributions, grants, membership dues, and program service revenues, ensuring compliance with FASB ASC Topic 606, Revenue from Contracts with Customers, and Topic 958 for contributions.

Definition of Standard Chart of Accounts

A Standard Chart of Accounts (SCOA) is a structured list of accounts designed to provide a consistent way of categorizing all the financial transactions of an organization. This standardization ensures that financial statements are comparable and understandable across different entities and sectors. The SCOA plays a crucial role in accounting and financial reporting, serving as the foundation for recording, analyzing, and communicating financial information.

Key features of a Standard Chart of Accounts

Uniform structure

A SCOA provides a systematic approach to organizing financial data, typically structured around major categories such as assets, liabilities, equity, revenues, and expenses.

Categorization

Each major category is further divided into subcategories and individual accounts that provide detailed financial transactions and balance tracking.

Flexibility

While standardized, a SCOA can often be customized to some extent to meet the specific needs of an organization, allowing for the addition of accounts necessary for unique financial activities or reporting requirements.

Compatibility

Designed to be compatible with generally accepted accounting principles (GAAP), a SCOA facilitates compliance with financial reporting standards and regulations.

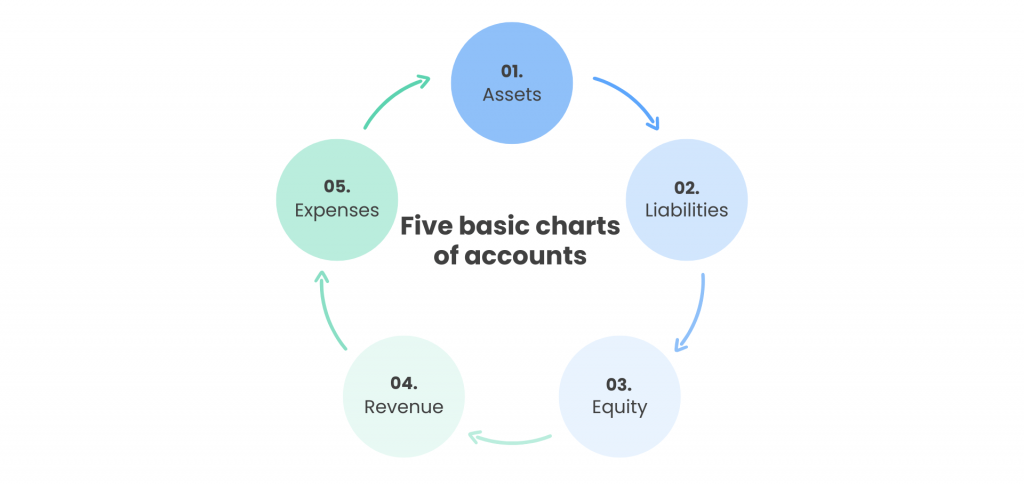

Five basic charts of accounts

The five basic categories or charts of accounts in accounting are essential for organizing an organization’s financial transactions systematically. These categories form the backbone of the accounting system, allowing for the effective recording, reporting, and analysis of financial data.

1. Assets

Assets are economic resources owned or controlled by the organization that are expected to bring future benefits. This category is typically divided into current assets (such as cash, accounts receivable, inventory, which are expected to be converted into cash or used within a year) and non-current assets (such as property, plant, and equipment, also known as fixed assets, and intangible assets like patents and trademarks, which are utilized over a longer period).

2. Liabilities

Liabilities represent the organization’s obligations—amounts it owes to others. Liabilities are also categorized into current liabilities (obligations expected to be settled within a year, such as accounts payable, accrued expenses, and short-term loans) and non-current liabilities (long-term obligations, including long-term loans, bonds payable, and lease obligations, which are due beyond one year).

3. Equity

Equity, often referred to as owner’s equity (in a sole proprietorship or partnership) or stockholders’ equity (in a corporation), represents the residual interest in the organization’s assets after deducting liabilities. For corporations, this includes common stock, preferred stock, retained earnings, and additional paid-in capital. For smaller businesses, it may simply consist of the owner’s capital accounts or drawings.

4. Revenue

Revenue accounts track the inflows of economic benefits during a period, typically from the sale of goods and services to customers but also from interest, dividends, and other increases in equity that are not from contributions by equity participants. Revenues are earned through the primary activities of the business, such as sales revenue, service revenue, and royalties.

5. Expenses

Expenses represent outflows, depletions of assets, or incurrences of liabilities during a period as a result of delivering or producing goods, rendering services, or carrying out other activities that constitute the entity’s ongoing major operations. Common examples include cost of goods sold (COGS), salaries and wages, rent, utilities, and depreciation.

These five categories are universally recognized in both accrual and cash accounting systems, forming the structure through which financial transactions are recorded, summarized, and presented in financial statements. Each category can be further detailed into sub-accounts to provide more specific information about the organization’s financial activities, enhancing the accuracy and utility of financial reporting for decision-making and compliance purposes.

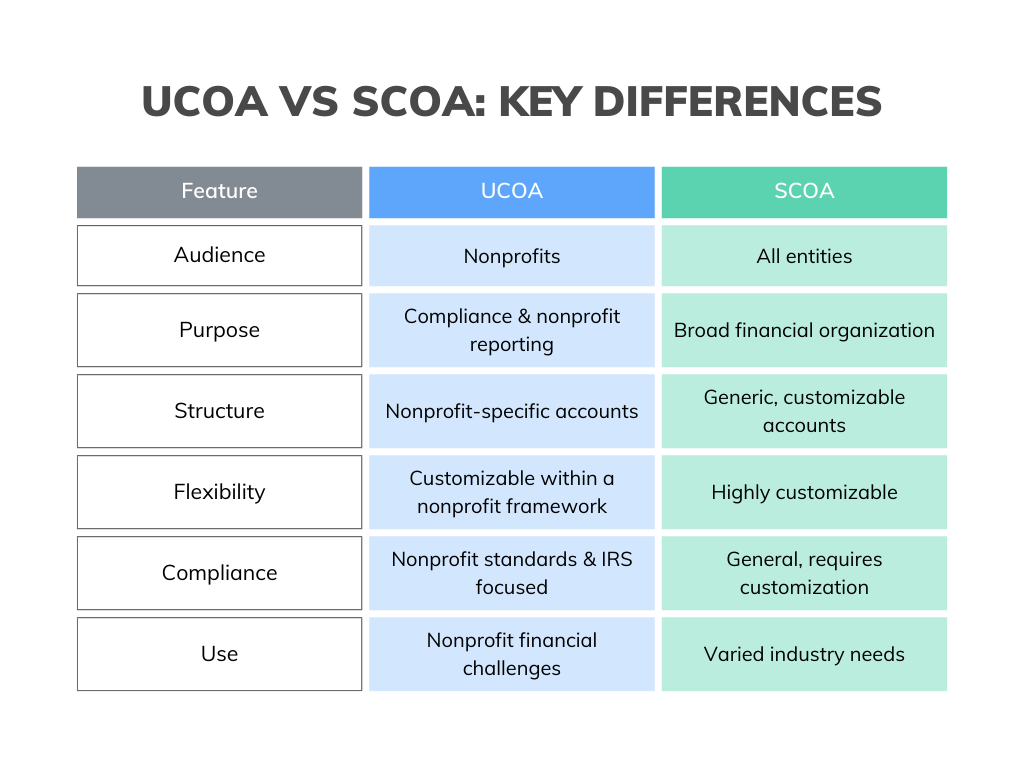

Differences between UCOA and Standard Chart of Accounts

The Unified Chart of Accounts (UCOA) and a Standard Chart of Accounts (SCOA) both serve the essential function of organizing financial transactions into a structured format for reporting and analysis. However, they cater to different needs and are designed with specific audiences in mind. Understanding their differences is key to selecting the right system for an organization’s accounting and financial reporting requirements.

Target audience and purpose

UCOA: Specifically designed for nonprofits, the UCOA aims to streamline financial reporting and ensure compliance with accounting standards relevant to nonprofit organizations. It facilitates comparability and consistency in financial statements across the nonprofit sector and aids in meeting the requirements of donors, grantmakers, and regulatory bodies.

SCOA: A SCOA is more generic and can be used by various types of entities, including for-profit businesses, government agencies, and nonprofits. It’s designed to be adaptable to the specific financial recording and reporting needs of any organization without the specialized focus on nonprofit requirements.

Structure and detail

UCOA: Offers a detailed structure that includes accounts specifically relevant to nonprofit operations, such as fund accounting, contributions received, grants, and donor restrictions. The UCOA also aligns with financial reporting standards like FASB and IRS requirements, making it easier for nonprofits to prepare compliant financial statements and tax returns.

SCOA: While it can be detailed, a SCOA’s structure is determined by the business’s or organization’s specific needs. It includes broad categories like assets, liabilities, equity, revenue, and expenses, with the flexibility to add or remove accounts as needed. The level of detail and complexity varies widely depending on the size and complexity of the organization.

Customization and flexibility

UCOA: While it provides a comprehensive framework tailored to nonprofits, the UCOA also allows for customization to address the unique financial aspects of individual organizations. However, the core structure is designed to maintain consistency across the nonprofit sector.

SCOA: Highly customizable to fit the precise needs of any organization, a SCOA can be as simple or complex as required. It allows businesses to structure their financial accounts in a way that best supports their operational and reporting processes.

Reporting and compliance

UCOA: The UCOA is particularly focused on ensuring that nonprofits can meet specific reporting requirements and standards, making it easier to report to stakeholders, comply with grant reporting, and prepare for audits.

SCOA: A SCOA supports general financial reporting and compliance but must be tailored by the organization to meet specific regulatory and reporting requirements. The responsibility for ensuring compliance with accounting standards and tax laws rests with the organization to incorporate into its COA design.

Implementation and use

UCOA: Primarily used by nonprofits, its implementation addresses the sector’s unique financial management challenges and compliance needs.

SCOA: Can be implemented across a wide range of industries and sectors. Its design and use are more varied, depending on the specific requirements and goals of the organization.

UCOA and nonprofit organizations

The Unified Chart of Accounts (UCOA) is significant for nonprofit organizations, providing a structured and standardized framework that caters to their unique financial reporting, accounting, and compliance needs. Nonprofits face specific challenges in financial management, including fund accounting, restrictions on donations, grant reporting, and the necessity for transparent financial statements for stakeholders. UCOA addresses these challenges by offering a comprehensive system that simplifies financial processes and enhances financial transparency and accountability.

How to implement UCOA for nonprofit organizations

Implementing the Unified Chart of Accounts (UCOA) for nonprofit organizations involves a structured process to ensure the transition is smooth and the system is effectively integrated into the organization’s financial management practices. Here’s a step-by-step guide to help nonprofits adopt UCOA:

1. Assess the current financial system

Review the current financial reporting system and chart of accounts to identify gaps, inefficiencies, or areas for improvement. Consider the unique aspects of the nonprofit, such as fund accounting, grant reporting, and donor restrictions, to ensure the new system addresses these areas.

2. Gain buy-in from stakeholders

Include staff from finance, fundraising, and program management to ensure the system meets cross-departmental needs. Highlight the advantages of UCOA, such as improved financial transparency, efficiency, and compliance, to secure support from management and board members.

3. Plan the implementation

Create a detailed plan outlining timelines, responsibilities, training schedules, and milestones. Assign a dedicated team to manage the transition, ensuring they have a clear understanding of UCOA and its benefits.

4. Customize UCOA to fit the organization

While UCOA provides a comprehensive framework, customization may be necessary to accommodate specific needs, such as unique fund categories or specialized program areas. Adapt UCOA to align with legal and regulatory requirements specific to the nonprofit sector and the organization’s operational jurisdictions.

5. Train staff

Offer comprehensive training for finance and accounting staff on the new chart of accounts and any updated financial processes. Ensure staff from other departments understand how the new system impacts their work, focusing on reporting and budgeting procedures.

6. Integrate UCOA with accounting software

Check that the organization’s accounting software can accommodate the UCOA structure and make any necessary updates or changes. Carefully plan the migration of financial data to the new chart of accounts, ensuring accuracy and completeness.

7. Run a local test, go live, review

Implement UCOA in a controlled environment or select a portion of the organization’s operations to run a local test of the new system. Use feedback from the pilot phase to make adjustments and resolve any issues before full-scale implementation.

Roll out the new UCOA-based system across the entire organization, monitoring any issues or challenges closely. Offer ongoing support and resources to staff to address any questions or challenges as they adapt to the new system.

Regularly review the system’s performance, seeking feedback from users to identify areas for improvement. Be prepared to make adjustments to the UCOA and related processes based on operational changes, new compliance requirements, or feedback from stakeholders.

8. Document policies and procedures

Document all changes in financial management policies and procedures to reflect the adoption of UCOA. Make sure the updated policies and procedures are easily accessible to all relevant staff and stakeholders.

Unified Chart of Accounts in Excel

Creating a Unified Chart of Accounts (UCOA) in Excel can streamline financial reporting and analysis for organizations, especially those needing a flexible, accessible way to manage their accounting needs. While a UCOA is particularly beneficial for non-profits, it can be adapted for use by businesses of various sizes and sectors. Here’s a simplified approach to setting up a UCOA in Excel:

Step 1: Planning your chart of accounts

Based on the standard five categories (Assets, Liabilities, Equity, Revenue, and Expenses), plan additional categories or subcategories specific to your organization’s needs.

Decide on a numbering system for your accounts. A common approach is to start assets with 1 (e.g., 1010 for Cash), liabilities with 2, equity with 3, revenues with 4, and expenses with 5. Adjust according to your needs. Leave gaps in numbering for each category to add accounts in the future without disrupting the structure.

Step 2: Setting up Excel

Start with a fresh Excel workbook to dedicate to your chart of accounts. Create columns for Account Number, Account Name, Category (Assets, Liabilities, etc.), and any other relevant details like Description, Notes, or Subcategories.

Example table structure

| Account number | Account name | Category | Description |

| 1010 | Cash | Assets | Cash in bank and on hand |

| 2010 | Accounts Payable | Liabilities | Money owed to suppliers |

| 3010 | Retained Earnings | Equity | Profits reinvested in the business |

| 4010 | Service Revenue | Revenue | Income from services provided |

| 5010 | Salaries Expense | Expenses | Salaries and wages for employees |

Step 3: Populating the chart

Start entering your account details into the Excel sheet based on the planning you’ve done. Include all relevant details that will make the chart useful for your accounting processes.

Use Excel’s formatting tools to make the chart easy to read. You might use bold for category headers, colors for distinguishing between major categories, or freeze panes to keep the header visible.

Step 4: Implementation and maintenance

Once the initial setup is complete, review the chart of accounts to ensure it meets your organization’s needs. Make adjustments as necessary.

Ensure that anyone involved in financial management is familiar with how to use and interpret the chart of accounts. As your organization grows and changes, your chart of accounts will need to be updated. Plan regular reviews to add new accounts or adjust existing ones.

Additional tips

- Drop-down lists: For ease of use, consider setting up drop-down lists in Excel for categories or subcategories using the Data Validation tool.

- Linking sheets: If you use multiple sheets for different purposes (e.g., budgeting, financial reporting), you can link account numbers or names to your chart of accounts to maintain consistency.

- Security: Protect your workbook or specific cells to prevent unauthorized changes to your chart of accounts.

→ Learn how to set up and use the chart of accounts in QuickBooks.

Conclusion

The Unified Chart of Accounts (UCOA) represents a paradigm shift in financial management, offering organizations a standardized, efficient, and transparent approach to financial reporting. By embracing UCOA, entities across various sectors can achieve improved financial clarity, compliance, and operational efficiency. As we look to the future, the continued evolution and adoption of UCOA, supported by technological advancements, promises to further enhance its value as an indispensable tool for effective financial management.

Unified Chart of Accounts (UCOA) FAQs

What distinguishes UCOA from traditional chart of accounts systems?

UCOA’s standardized structure facilitates uniform financial reporting and analysis across different sectors, enhancing transparency and comparability.

How does UCOA benefit organizations with multiple funding sources?

UCOA simplifies the management of diverse revenue streams, enabling accurate tracking, reporting, and analysis of funds.

Can UCOA be integrated with any accounting software?

Yes, UCOA’s flexible design allows it to be integrated with a wide range of accounting software solutions, enhancing automation and efficiency.

What steps should be taken to transition to UCOA?

Transitioning to UCOA involves assessing current financial processes, developing a tailored implementation plan, engaging stakeholders, and providing comprehensive training.

Share your experience

How has the UCOA benefited your organization? What challenges did you face during its implementation, and how did you overcome them? Do you have any tips or best practices to share with others considering the transition to UCOA?

If you’ve implemented the Unified Chart of Accounts in your organization, or if you have insights and experiences related to nonprofit financial management, please share them with us. We’d love to hear from you!

.png)

Thanks for the article! Was informative to learn about unified credit.