Being integrated into one of the world’s most popular social media networks, TikTok Shop offers unique opportunities for businesses to sell their products directly to consumers. However, the financial aspect of the platform can be complex to navigate, especially when it comes to comprehending the different types of fees involved.

This article explains the most important seller fees associated with TikTok Shop. So, let’s start!

Learn how to manage your ecommerce accounting with ease using Synder.

Contents:

1. Does TikTok charge you to sell products?

- How to calculate referral fee

- Example of calculating the referral fee

- New seller referral fee promotion

- How to keep track of your TikTok fees

3. Marketplace commission fee (Southeast Asia)

4. Does TikTok Shop collect sales tax?

Key takeaways:

- TikTok Shop imposes fees on sellers, including commission fees, which vary by product category, and a consolidated referral fee, which includes marketplace commission and transaction fees.

- Sellers need to consider shipping costs, which can be managed independently or through TikTok’s logistics services.

- New seller promotions offer reduced referral fees, helping lower the barriers to entry on TikTok Shop.

- TikTok Shop automatically calculates and remits sales tax, adhering to local tax laws based on the buyer’s location.

Does TikTok charge you to sell products?

Yes. Like most ecommerce platforms, TikTok Shop has its own seller fees. Primarily, these are commission fees. The specific amount of these fees can vary depending on the product category and other factors.

- Commission fees (Southeast Asia). TikTok Shop charges a commission on each sale made through the platform. This commission is a percentage of the sale price and varies by product category.

- Referral fees (US only). A consolidated charge that combines both the marketplace commission and any transaction fees into one single fee. The referral fee rate varies depending on the specific product category.

- Shipping costs. If using the platform’s logistics services, there might be additional shipping costs. Sellers need to factor this into their pricing or decide to handle shipping independently.

→ Learn how to set up a TikTok Shop.

The upcoming changes in fees

TikTok Shop in the United States has recently implemented a significant change to its fee structure. As of April 1, 2024, TikTok transitioned from a flat commission fee structure to a product-dependent marketplace commission fee structure. This adjustment means that commission fees now vary depending on the product category, allowing for more tailored pricing strategies for sellers.

Furthermore, TikTok Shop has also eliminated the $0.30 transaction fee as of April 1, 2024. This move is likely aimed at simplifying the cost structure for sellers and making the platform more attractive by reducing the per-transaction cost burden.

Starting July 1, 2024, the commission fees are set to increase up to 8%.

Now that you know the basics, let’s get into more details to learn the peculiarities of each fee.

Referral fee (US only)

The referral fee is a consolidated fee structure introduced in the United States. It combines elements of the marketplace commission and transaction fees.

This approach simplifies the seller’s experience by integrating all the costs associated with selling a product through TikTok Shop into one fee.

- From April 1, 2024: 6%;

- From July 1, 2024: 8%.

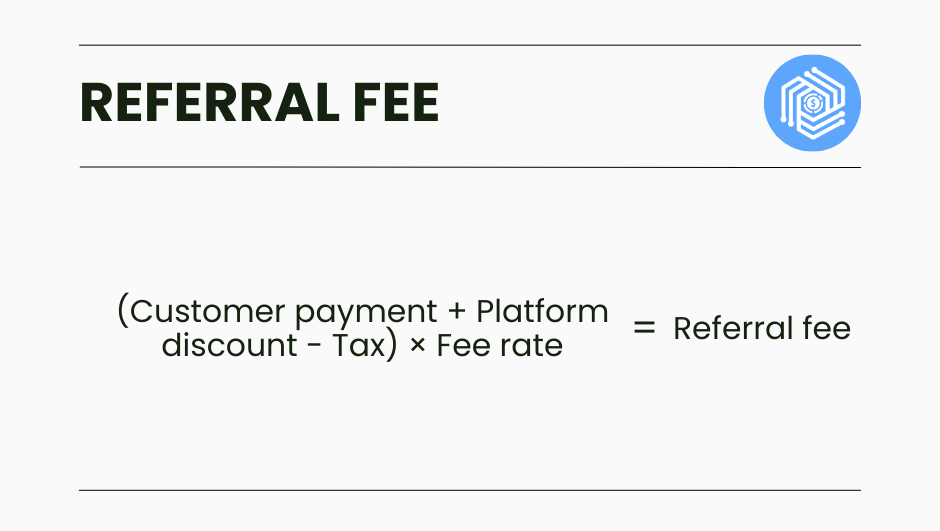

How to calculate referral fee

- Customer payment is the amount the customer pays for the product.

- Platform discount is any discount provided by TikTok that reduces the product’s price to the customer.

- Tax is the sales tax applied to the transaction.

- The fee rate is the percentage charged based on the product category.

Example of calculating the referral fee

You’re a business owner selling a gadget on TikTok Shop for $100. The platform offers a $10 discount on the product, and the applicable sales tax is $8 (not included in the fee calculation).

Let’s assume the referral fee rate for gadgets is 6%.

Here’s how the referral fee would be calculated:

Referral fee = ($100 + $10 – $0) × 6% = $110 × 6% = $6.60

So, the referral fee you would pay TikTok for this sale is $6.60.

New seller referral fee promotion

The TikTok Shop has introduced a new seller referral fee promotion as part of its updates to the fee structure in the United States. This promotion is particularly aimed at new sellers on the platform.

As part of the new promotion specifically for new sellers, TikTok Shop is offering an incentive where these sellers can enjoy reduced referral fees under certain conditions. This can significantly lower the entry barriers for new merchants looking to establish themselves on TikTok Shop.

Starting February 1, 2024 new merchants who achieve “Active” status in Seller Center—indicating the completion of their onboarding process—can benefit from a special referral rate of 2% + $0.30 per order. This discounted rate applies for the first 60 days after they reach this status.

However, for these sellers who become “Active” from April 1, 2024, through October 31, 2024, the discount applies only to the initial $500,000 of sales.

How to keep track of your TikTok fees

Want to streamline your financial operations and save time? Synder’s here!

Synder Sync is engineered to seamlessly integrate your TikTok Shop transaction details into your accounting system, making it easier than ever to monitor and manage your fees and overall financials.

Why choose Synder for TikTok Shop?

- Set up once and forget! Synder automatically synchronizes your sales and fee data from TikTok Shop directly into leading accounting software like QuickBooks (Online and Desktop), Xero, and Sage Intacct.

- Keep a close eye on your TikTok fees, sales data, and payouts. Synder’s integration provides detailed insights into various financial metrics, including platform fees.

- Pre-match and reconcile. Synder simplifies your reconciliation process by pre-matching your transaction data with bank records. This automation ensures accuracy and saves significant time in your financial reporting.

Optimize your financial workflows and stay ahead of your competition with real-time, accurate financial reporting and analytics.

Create a free account to manage your TikTok Shop finances with Synder today. To learn more benefits, book a seat on our Weekly Product Demo with Synder’s specialists, who will cover the hottest features!

Marketplace commission fee (Southeast Asia)

Applicable for Southeast Asia: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

Commission fees on TikTok Shop are a percentage of the total sale amount that TikTok charges sellers when a product is sold through the platform. These fees are typically set based on the category of the product being sold, and each category might have different commission rates.

The cost varies from 5% to 20%.

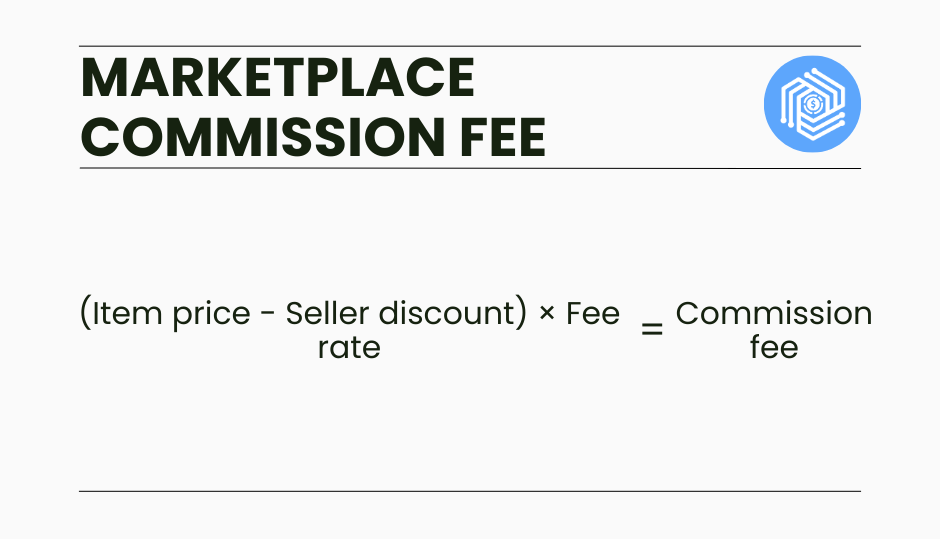

How is TikTok Shop commission fee calculated?

The commission fee is calculated as a percentage of the selling price of the product. If there are additional costs included on the checkout page.

Typically, the commission is applied just to the item’s sale price. Shipping fees and TikTok Shop platform discounts are not included as part of the commission fee calculation.

Note: If you offer a discount on your product, the commission is typically calculated on the discounted price. For instance, if the $100 shirt is on sale for $80, the commission fee of 15% would be $12.

1. If you want to check the details of the commission amount for orders that have yet to be settled:

Go to TikTok Shop Seller Center → Finance → Transactions → To settle → View Details → Estimated Settlement Details.

2. If you want to check the details of the commission amount for orders that have been settled:

Go to TikTok Shop Seller Center → Finance → Transactions → Settled → View Details → Earning Details.

Example of calculating commission fee

Let’s say you’re selling a piece of apparel on TikTok Shop, and the commission rate for apparel is 15%. If you sell a shirt for $100, the commission fee calculation would be as follows:

Commission fee = Selling price × Fee rate

Commission fee = $100 × 15% = $15

So, for a shirt sold at $100, you would pay TikTok $15 as a commission fee, and you would receive the remaining $85, minus any other applicable fees like payment processing or shipping fees, if they apply.

Does TikTok Shop collect sales tax?

Yes. The collection of sales tax on ecommerce platforms like TikTok Shop is determined by the local tax laws in the jurisdictions where the buyers are located. Here’s how it generally works:

- Tax laws compliance. Ecommerce platforms are required to comply with tax laws, which can vary widely depending on the country, state, or even city. This includes calculating, collecting, and remitting sales tax based on the rates applicable to the location where the goods are delivered.

- Sellers responsibility. Sellers are responsible for setting up their accounts to include tax collection where applicable (specifying which products are taxable and entering the business’s tax registration numbers if required).

- Calculation. Platforms like TikTok Shop generally have systems in place to automatically calculate the appropriate sales tax based on the buyer’s delivery address and the type of product being sold.

- Remittance. After collecting sales tax, the platform would then be responsible for remitting the taxes collected to the appropriate tax authorities. This simplifies the process for sellers, who otherwise would need to handle these remittances themselves.

Example of sales tax collection

Imagine you sell a piece of clothing to a customer in New York City.

- Product price: $50;

- New York state sales tax rate: 4%;

- New York City sales tax rate: 4.5%;

- Additional local taxes (e.g., Metropolitan Commuter Transportation District surcharge): 0.375%.

The total sales tax rate would be 8.875% in this scenario. Therefore, the sales tax collected on a $50 item would be:

Sales tax = $50 × 8.875% = $4.44

So, the total amount charged to the customer would be:

Total = $50 + $4.44 = $54.44

This amount includes the base price of the item plus the sales tax. The platform would then be responsible for collecting this tax from the customer at the time of purchase and remitting it to the appropriate tax authority.

Bottom line

The fee structure of the TikTok Shop matters a lot for sellers who want to benefit from the diversity of the platform’s coverage. By understanding these fees, business owners can make well-informed decisions, strategically manage their costs, and fully leverage every opportunity that arises.

Since the platform is growing every day and attracts many sellers and buyers with differing interests, mastering the financial nuances of the TikTok Shop will be an important factor in determining successful online sales on the platform.