If you want to start a business or compile a business plan for your current company selling online on Amazon, you probably cannot help but think of ways to create and improve your strategy. Doing sales business on Amazon requires all of your dedication, time, and effort, and of course, money.

But what does it take to launch a profitable online sales business? What significant parts of your business plan might be missing to start a successful business? What are the ways to automate your business on Amazon to help you clear your headspace and turn your workflow into a smooth and easy process? We’re willing to share the answers to all of these questions and more in this article!

Contents:

1. Amazon + Amazon FBA: yay or nay?

2. How does Amazon FBA business work?

- Fulfillment fee for an FBA business

- Inventory storage fee

- Unplanned services fee

- Removal order fee

- Returns processing fee

3. A guide on what to include in your Amazon FBA Business Plan

4. Amazon FBA businesses: Pros and cons

6. Amazon SKU

8. Simple steps to start your business automation

Amazon + Amazon FBA: yay or nay?

Amazon business in general

Amazon is the largest e-commerce platform at the moment with a net sales revenue of a whopping $514B in 2022. On Amazon, you can find literally any product or item. One of the main reasons to start your sales business on Amazon is the unlimited profit potential: you can grow as much as you wish.

On the other hand, breaking Amazon’s selling policies may lead to serious consequences, such as shutting your account down or Amazon’s withdrawal of your money, so you should always stay honest. You might also have to deal with unscrupulous sellers, who might steal your listings or do something else in order to spoil your selling process.

Business owners have to take risks. However, it’s up to you to decide whether the risk is worth it.

Amazon FBA in general

Amazon FBA business, or “Fulfilled by Amazon”, is a popular Amazon program that lets sellers send their stock to Amazon warehouses so they can fulfill orders faster and more cost-effectively. Sellers ship their products to an Amazon fulfillment center and mark them as eligible for FBA. Then, when an order comes in from an Amazon customer, the seller simply packs the product into a prepackaged shipping box and sends it off to the customer.

When the product arrives at Amazon’s fulfillment center, warehouse workers scan the package and add it to their inventory database. Once they receive it, they place the product on a shelf and send it out to the customer.

By using the FBA business program, Amazon sellers can focus on profit and marketing their products online rather than worry about storage, shipping logistics and other operational details.

How does Amazon FBA business work?

Suppose you were wondering what Amazon’s FBA business is for FBA sellers, how to start an Amazon FBA business and become FBA sellers, and how to make money on FBA for FBA sellers. Amazon FBA may help you bring your business to a higher level. Allowing Amazon to manage your logistics makes operations easier. Knowing how many customers shop on Amazon is also tempting for retailers when deciding where to search out new customers.

As a result, your business gets a popular product that becomes visible to millions of Amazon customers while providing world-class fast shipping and acclaimed customer service.

We’ve compiled a list of actionable steps explaining how to launch an FBA business on Amazon and take advantage of it!

Step 1: Set up Amazon FBA

The process of sending your inventory to Amazon is called ‘FBA setup’. The first step in order to launch an FBA business is to create an Amazon selling account and log in to Seller Central to set up FBA.

Step 2: Create product listing for your FBA business

To create a product listing on Amazon, you need to take several simple steps. After adding the products to the Amazon catalog, all you need to do to complete a listing is to specify FBA inventory. You can do it by going to Seller Account → Inventory → Manage Inventory. At this step of creating an Amazon listing, you can change the Fulfilled by… option from Merchant to Amazon. There you go – you’ve successfully created the listing for your Amazon product.

What are the Amazon FBA product title requirements?

1. Titles for Amazon FBA products must not exceed 200 characters, including spaces.

2. Titles must not contain promotional phrases, such as “free shipping”, “100% quality guaranteed”.

3. Titles must not contain characters for decoration, such as ~ ! * $ ? _ ~ { } # < > | * ; ^ ¬ ¦

4. Titles must contain product-identifying information, such as “hiking boots” or “umbrella”.

We’ve prepared an Amazon product research guide, so don’t forget to check out the article about top-selling products on Amazon to choose the most profitable option for your e-commerce business!

Step 3: Prepare products for shipment with FBA

At this step, you have two options: either you take care of preparation or let Amazon do it. Preparation requirements may include:

- Poly bagging;

- Bubble wrap;

- Overboxing;

- Hanger removal;

- Taping.

Products need to be prepared for safe and secure transportation according to Amazon packing guidelines and shipping and routing requirements.

“Failure to comply with FBA product preparation requirements, safety requirements, and product restrictions may result in the refusal of inventory at the Amazon fulfillment center, disposal or return of inventory, blocking of future shipments to the fulfillment center, or charging for preparation or for noncompliance at the fulfillment center. Please share these requirements with your carrier or vendor to ensure that they fully understand these requirements.”

If you’re doing the preparation on your own, it’s recommended to use the Shipment checklist provided by Amazon so that you won’t miss any important step. Here are some recommendations from Amazon on how to pack your products before the shipment:

1. Use a rigid box with flaps intact. For best results, use a new, single-wall, corrugated shipping container with a high-burst or crush-strength stamp. Acceptable standard boxes include:

- Regular slotted carton (RSC);

- B-flute;

- ECT-32 (edge crush test);

- 200 lb./sq. inch (burst strength).

2. Pick the box of the right size for what you’re shipping. If the container is too large, you’ll need to fill it up with enough packaging material so that the box won’t collapse if heavier boxes are stacked on top during shipping.

3. Remove or cover all old shipping labels, markings, and scannable barcodes if you’re reusing boxes, or when reusing a retail box to ship different products (for example, a large printer box to ship smaller media products).

4. Wrap all items separately.

5. Use adequate packaging material. A minimum of 2 inches of appropriate packing material around each item and the same amount in between your products and the walls of the box should be used. After you pack your box, shake it gently. The contents shouldn’t move when shaken.

6. Use strong tape designed for shipping.

If you want Amazon to prepare your products for you, in the column Who preps? select Amazon.

📌 Note: FBA can only prep products that have a single UPC or EAN that corresponds to an ASIN in Amazon’s product catalog.

Step 4: Ship the goods to Amazon fulfillment center

You need to create a shipping plan, print an Amazon shipment label, and send shipment to Amazon FBA fulfillment center.

Here’s what to do next according to Amazon FBA Guide:

1. Once your carrier has picked up your shipment or you’ve dropped it off at a shipping center, mark your shipment as Shipped in the Shipment Summary page of the shipment creation workflow.

2. Track your shipment in your Shipping Queue. For shipments with status Shipped or In Transit:

- Small Parcel: Check your tracking numbers for shipment updates.

- Less than Truckload (LTL) or Full Truckload (FTL): Contact your carrier.

3. For shipments with a Delivered status, allow 24 hours for the status to be updated before contacting your carrier to confirm the delivery location and receipt of signature.

4. When a shipment’s status changes to Checked-in, it means at least a portion of the shipment arrived at the fulfillment center, but no units from the shipment have been received. Once the fulfillment center begins scanning barcodes and receiving the inventory, the status will change to receiving.

5. Allow 3-6 days from when your shipment is delivered to the fulfillment center for your properly packed and prepped inventory to be received. Once your inventory has been fully received, it will be available for sale on Amazon.com.

Amazon FBA fees

Selling on Amazon with FBA also comes with a list of Amazon FBA fees. If you’re selling through the FBA business program, be aware that you’ll be charged a variety of fees by Amazon to do so. However, knowing about all potential Amazon fees upfront will help you manage your expenses more effectively.

Here’s the list of the Amazon seller fees you might face:

- Amazon fulfillment fee;

- Amazon inventory fee;

- Amazon unplanned services fee;

- Amazon removal order fee;

- Amazon returns processing fee.

Fulfillment fee for an FBA business

It’s an Amazon per-unit fee charged to fulfill items to customers for purchases in the Amazon store. It applies to order handling, pick and pack charges, weight handling, etc.

Here’s the full list of fees divided by product type, size, and weight.

On April 28, 2022, Amazon started to apply a 5% fuel and inflation surcharge to FBA fulfillment fees. As well, on October 14, 2022 Amazon first introduced peak fulfillment fees of $0.35 per item for the holiday season, which lasted till January 14, 2023.

Inventory storage fee

This fee is charged by Amazon monthly, typically between the 7th and 15th day of the month, and is based on the size of the product and the time of the year. It’s calculated on your daily average volume in cubic feet.Here are the rates per cubic feet in accordance with Amazon policy:

📌 Note: If the product has been in the fulfillment center for more than 365 days, it’s subject to Amazon long-term storage fees.

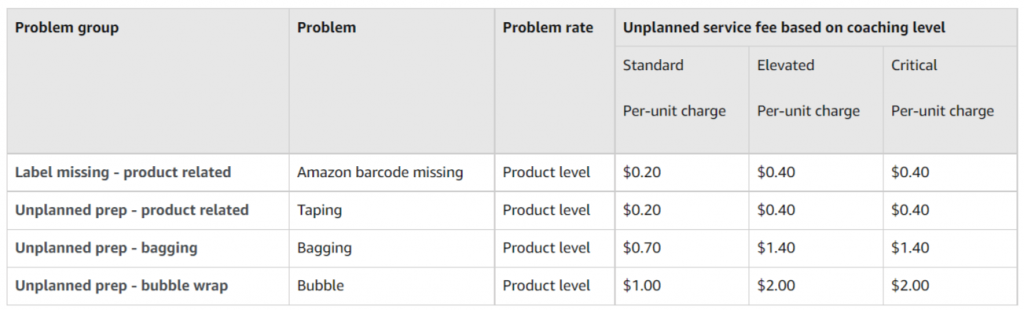

Unplanned services fee

These Amazon fees are charged when the inventory arrives at a fulfillment center without proper preparation or labeling. Unplanned service fees are charged per unit.

Here are the rates from Amazon Seller Central:

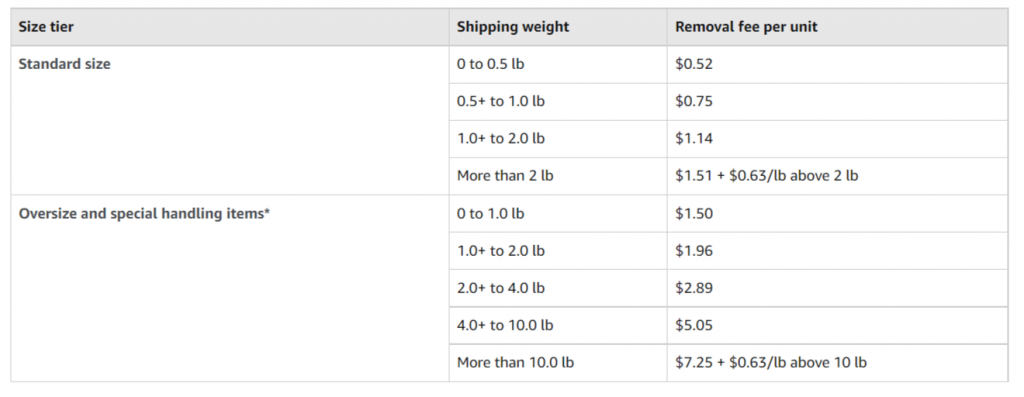

Removal order fee

It’s an Amazon per-item fee which is charged when you request Amazon to return or dispose of your inventory in a fulfillment center. The fee is charged when the removal order is complete.

Here are the rates from Amazon Seller Central:

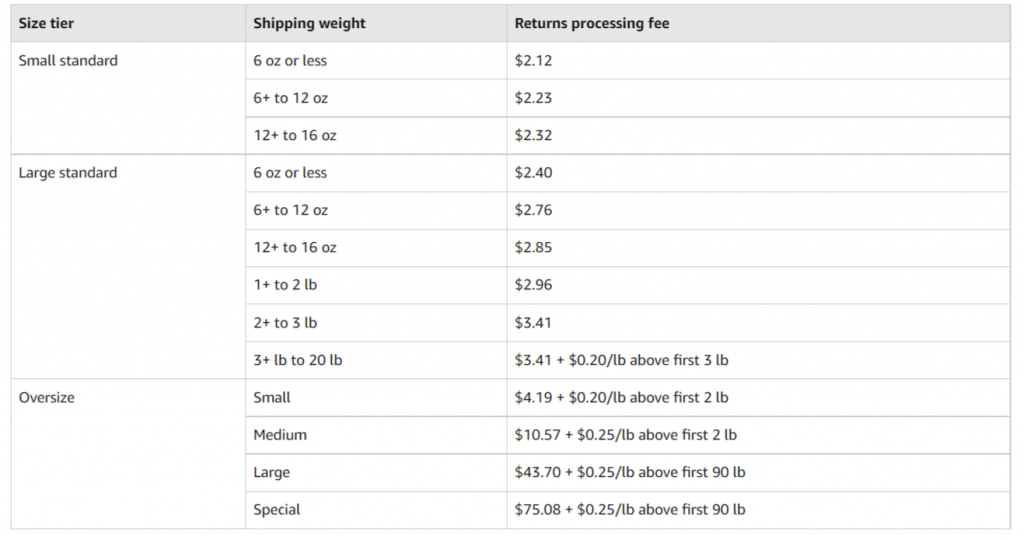

Returns processing fee

This Amazon fee is charged on orders when Amazon provides a customer with free return shipping.

📌 Note: Amazon doesn’t charge returns processing fees for items returned in such categories as Watches, Jewelry, Luggage, Handbags & Sunglasses.

Here are the prices from Amazon Seller Central:

To learn more about the cost of selling on Amazon in general, check our article with all the important information on Amazon seller fees.

A guide on what to include in your Amazon FBA Business Plan

An Amazon FBA business plan template assists in establishing a good start for your business and its further growth. It’s an essential amount of work needed to set up your business positioning, analyze the way to achieve your goals, and make sure that your business is capable of succeeding in e-commerce.

Here are the basic parts of the detailed Amazon FBA Business Plan Template:

1. Executive summary

This is the most critical part of FBA business planning. It’s an essential tool to structure your business plan. Ideally, this step has to be completed last in order to summarize each section of your plan. To capture your FBA business plan’s key points, write an executive summary that succinctly outlines your strategy, based on the detailed sections of your plan.

2. Company description

An Overview of your FBA business. You may include your mission and vision, company formation information, founders, location, your competitive advantage, and notable achievements, if applicable. It features three important subsections:

- Main objectives: This subsection outlines the goals and purposes of starting this FBA business.

- Products or services: This is where you identify your products. It involves the development stages of your FBA business, product images, pricing, past test results, and anticipated future products.

- Value proposition: This part defines your competitive edge that differentiates you from the rest of the competition. Your value proposition answers the questions ‘What do you offer?’, ‘What makes you different from the competitors?’, and ‘Why do you do what you do?’. Essentially, it gives a good gauge of how clear your business trajectory is.

Overall, it’s advisable here for an FBA business to place special emphasis on a combination of unique product features, exceptional service, and competitive pricing. By doing so, you can set yourself apart from the competition and position your FBA business for success in the highly competitive Amazon marketplace.

3. Marketing plan, analysis and product research

This step is an absolute must to launch a profitable business on Amazon that sells any type of product. It serves as a vital guide for the merchant according to which a business selling on Amazon might plan and execute marketing activities, and identify where the future goals of the business will tie into your Amazon FBA Business Plan.

It holds the key information that all your partners and potential investors will want to find out. You may include the following, depending on your needs:

- SWOT analysis: Strengths, weaknesses, opportunities, and threats. This analysis focuses on determining the best opportunities for an FBA business to pursue in order to achieve growth goals.

- Financial projections: Based on the expected sales figures, how much does an FBA business envisage your business turning over?

- Target market research: Find out about the target market size, total addressable market (TAM), market research/trends, and what you do. Note: to learn more about trends for any particular niche, try the Google Trends tool, and Jungle Scout web app.

- Customer segments/target customer profiles & personas: This is where an FBA business can find mass and niche markets. Here, you can also find the groups of people who are most likely to buy your products and the qualitative factors that matter most to them.

- Customer relationships: These are strategies for an FBA business to build a lasting relationship with your target market like communication with your customers, analyzing your product reviews and addressing customer feedback.

- Brand and product positioning: it’s about doing brand and product research. You might want to find out the following information: Where in the market does your brand sit? Are you offering a premium range of items? Does your brand convey cheap and cheerful? Is design a major selling factor?

- Elevator pitches and taglines: These are quick and creative ways to describe your brand. You might carry out some product research of brands dealing with similar products and find the most effective ways of brand presentation.

- Marketing plans/channels to be used: Include details of whether you plan to reach customers via paid ad placement or organic search engine ranking, affiliate outreach, or a combination of all three.

- Marketing ideas and strategies: Planning advertising ahead of time will ensure that you’ve given some thought to what kind of ads to utilize, where to place your ads, how much you can allocate to advertising, and how you can track advertising progress.

- Marketing budget: Based on your company’s finances, find out how much you can afford to spend on marketing.

- Estimates of ‘cost per action’ of any testing conducted: This part can include cost per click, cost per conversion, sampling costs, and more. While it can be easy to get bogged down in detail, it’s important to only focus on metrics that actually matter to your business.

4. Operational plan for working with FBA

This part is intended to organize the moving parts of your business and allow for a practical understanding of the industry and your products.

If you’re starting out on a shoestring budget, much of the operational plan will be irrelevant. However, we’ve included a detailed checklist of components to consider for businesses with access to larger amounts of capital and bigger plans. Here are the most important things to keep in mind:

- Facilities and space needed: In case you’re using FBA warehouses or you’re handling warehousing yourself, you need to account for these needs. In the latter case they would include the space needed in your own house/distribution center/other facilities.

- Technology needs: There is a range of software and cloud-based technologies that can be useful for simplifying the operations of an Amazon seller business. For example, Synder simplifies Amazon accounting by automating the flow of financial data in your cloud accounting system.

- Logistics and distribution plans: Consider including details about your prep warehouses and freight forwarding partners.

5. Management & organization of a business with FBA

In a nutshell, this section of your FBA business plan discusses the management and industry experience of your team and provides a rundown on the people assigned to each task.

You may include some or all of the following, depending on your needs:

- Founders and executive team.

- Owners and shareholders.

- Board of directors.

- Consultants and special advisors.

- Key team members and department heads.

6. Financial plan for an BFA business

It’s a critical step in your Amazon Seller business plan because this is where you show the exact figures and a run-through of your current financial state, startup costs, forecasts, and goals.

This is geared towards providing secure funding of what you need and a product/business development budget. For those who loaned the funds to launch your business on Amazon, it’s here that you want to include a repayment schedule, rundown of the exact use of funds, steps you plan to reach your goals, payment schedule in detail, petty cash funds, and contingency funds.

Here are some prompts for what to include:

- Revenue streams: Look at what you’re charging and if you could be charging more. How are you receiving your payments, and does it contribute enough to overall revenue?

- Cost structure: Pin down fixed and variable expenses to give you an opportunity to see what you can improve on.

- Current balance sheet: This is applicable for existing FBA businesses.

- Past two years’ financial list, if applicable.

- Projections for 12 months and annually through year 5.

- Break-even analysis.

- Cash flow projections.

- Income and expenses.

- Expense projection.

7. Appendices

This includes the finer details that are referenced throughout the business plan.

You may want to include the following:

- Articles of incorporation and company status.

- Shareholders agreement and company constitution.

- Resumes of founders and key team members.

- Copies of insurance contracts.

- Licenses.

- Trademarks and patent registrations.

- Employment and supply contracts.

- Appraisals.

- Deeper research data or links to references.

Amazon FBA businesses: Pros and cons

Pros of FBA for an Amazon seller

Special services

With Amazon FBA, FBA sellers can take advantage of special services that the platform provides you with. Among them are:

- Free shipping;

- Two-day shipping for Prime Members;

- Powerful inventory management tool;

- Handling customer service;

- Access to a worldwide audience;

- Omnichannel access.

Shipping cost

As a seller on Amazon, you want to offer your customers the best service possible and that includes shipping. You also want to be cost-effective in order to remain profitable and keep them coming back for more. And that’s when Amazon FBA steps in.

Amazon FBA takes care of a huge part of your business management and appears to be cheaper than providing shipping with the help of third-party services, even with the added fees.

Returns management

Refunds are a common part of e-commerce operations on Amazon, and managing them can be an administrative headache for FBA sellers. Effective refund management processes should be clear, concise and simple to follow. With so many different policies, rules, and prices involved in accepting returns, the complexity can become overwhelming.

With Amazon FBA, businesses don’t need to worry about returns and refunds for the products they sell, since the FBA program takes care of everything on its own, communicating with the customers and providing the best options.

Storage space

If you sell physical products on Amazon, you’ll need some type of storage to keep your inventory. Even if you sell digital products and don’t have a warehouse, you’ll probably still need some type of storage space. If you sell on different marketplaces or have an in-house ecommerce site, you’ll need multiple storage spaces to keep everything organized.

Amazon FBA provides its users with not only the technical service, but also the physical storage. You can find Fulfillment Centers across the world which makes things convenient when you’re planning to go global.

Cons of Amazon FBA

Long-term storage fees

Amazon FBA doesn’t actually like when your products are placed in its Fulfillment Centers for too long.

When you store your items you sell in an Amazon warehouse, you’re renting space by the unit. But how long will your items be stored? If you plan to sell everything within a few months – that’s great. But what if it takes longer? Before starting to work with Amazon FBA, make sure that your products will be sold within 1 year.

Amazon product preparation requirements

In order to sell your products on Amazon, FBA sellers need to follow the product setup guidelines. You can only sell your products on Amazon if they meet these requirements. Failure to follow these setup guidelines may result in suspension of your selling privileges.

There are a lot of points and requirements that the seller on Amazon needs to follow before actually shipping the product to the warehouse and sometimes it just adds more headache.

May be too costly for beginners

If you’ve just launched a business selling online on Amazon, it’s natural to be cautious. With so many things to consider, it’s always tricky moving from one business venture to another and Amazon FBA seems like a risky proposition for those who are just starting out to sell online. Newcomers to this business need to do their due diligence and weigh their options before deciding on which avenue is best suited for them.

No direct customer interaction

For any business on Amazon, just like for most businesses in the world, customer service is the first line of defense. It also happens to be the most visible part of an organization. If a customer has a negative experience with your business on Amazon, they’re much more likely to post about it than share something positive.

This is why it’s so important for a business selling on Amazon to focus on creating great experiences for their customers and potential customers. However, it’s really hard to create a customer oriented strategy, when you don’t have direct customer interactions and the customers see not you, the owner of the store they bought something from, but the employees of Amazon FBA, who have nothing to do with your e-commerce business.

What does DBA stand for?

DBA stands for doing business as. If you want to register the name of your small business on Amazon, there are two things you need to know. First of all, you don’t have to reveal your personal name or your formal business entity name, as you may create a different name under which you can manage your small business. Secondly, opening a business bank account becomes possible with a DBA and Federal Tax ID Number (EIN).

Let’s say you’d like to launch a shop selling glasses and lenses on Amazon, but you don’t want to operate under your own name. What you could do is file a DBA for Perfect Vision and start doing business under a new name.

You might decide to turn Perfect Vision into an LLC, and if it’s doing well, you might want to expand into sunglasses and accessories. Should you wish to stay under Perfect Vision LLC but also sell under Sunny Accessories on Amazon, a DBA helps differentiate the businesses without creating various corporate structures.

But make sure not to confuse an LLC and DBA. An LLC is a formal business structure, whereas a DBA is another name for your company to operate under.

Amazon SKU

An Amazon SKU is a unique code used by a business selling online to track a product for inventory and sales purposes. Typically, it includes product attribution details such as size, color, and any other pertinent information that you can glean at a glance.

One of the most confusing things for Amazon sellers is understanding the difference between an SKU and Amazon’s ASIN. An ASIN is Amazon’s SKU to identify a product universally and should NEVER be used as your SKU. An ASIN simply means a product exists on Amazon for sale, but it’s not your SKU. When listing products, configure your own SKUs and don’t let Amazon configure them for you or rely on ASINs.

Amazon SKUs in your inventory management system will make it possible for you to:

- Record loss;

- Make strategic inventory forecasting decisions;

- Track item location within your warehouse;

- Improve inventory accuracy—no overselling;

- Identify shrinkage;

- Reconcile inventory in your inventory management system with items actually in stock;

- Make it easy for employees to look up inventory for customers;

- Perform profit analysis by SKU to determine best/worst sellers via attributes;

- Use the same SKUs on all your marketplaces;

- Have better communication with vendors;

- Pick, pack, and ship orders faster;

- Understand how long the product has been in inventory.

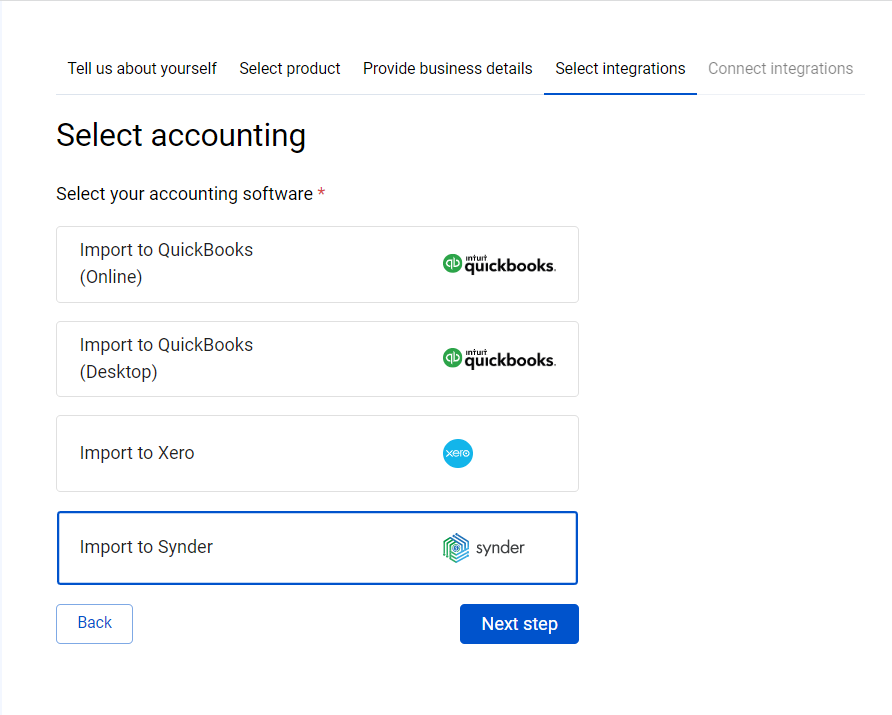

Each Amazon SKU needs to be entered into your tracking system (not a spreadsheet!) in QuickBooks, Xero, or another accounting software. Your accounting system needs to be able to integrate with your inventory management system. If you plan on selling on multiple marketplaces, it will act as a hub for your SKUs. It’s important to use the same SKU on all marketplaces.

Amazon sellers taxes

The amount of tax depends on:

- The identity of the seller;

- The type of item or service purchased;

- The time and location of fulfillment;

- The shipment or delivery address of your order;

Amazon sellers taxes for certain products or services also depend on city, county, or state laws. So you’ll need to either consult your accountant or have neat accounting books to file tax reports on your own.

Simple steps to start your business automation

What’s the process of automation for businesses selling on Amazon? It’s the ability of your business to work and be profitable even if you’re not working on it. It may be easily achieved with e-commerce accounting software.

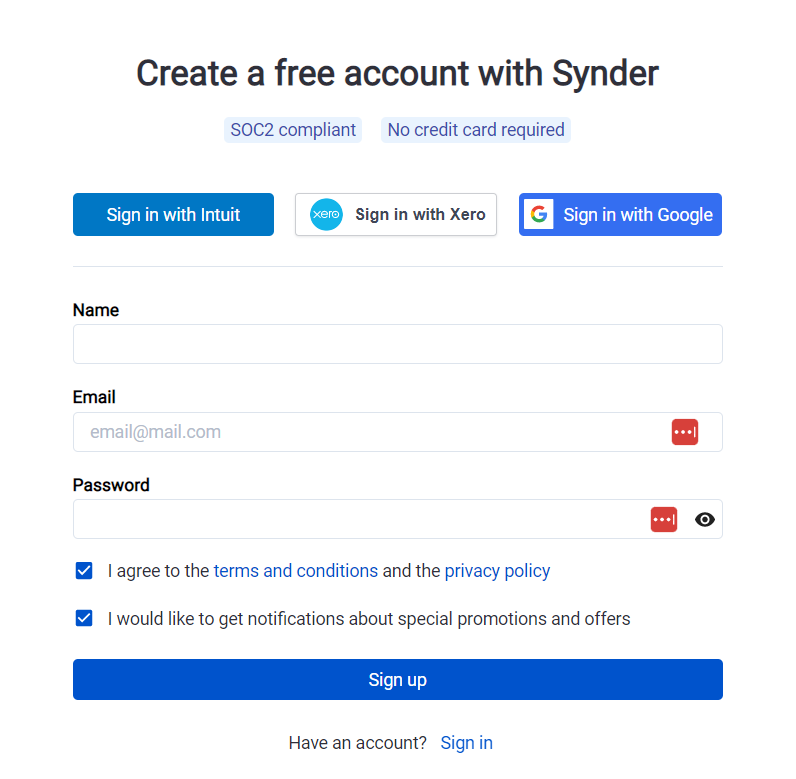

You’ll save money and be ready for tax time without much preparation done if you connect your Amazon account to your accounting platform and automate your Amazon transactions. Synder e-commerce business accounting software gives you the opportunity to examine all the wonderful product features it has to offer.

Every Amazon sales transaction made in your payment gateways connected to Synder will be automatically recorded in your books. Track 100% precise and detailed sales transaction data of your receipts. Synder will take care of every sale transaction from Amazon and keep it organized so that you’re ready for tax season.

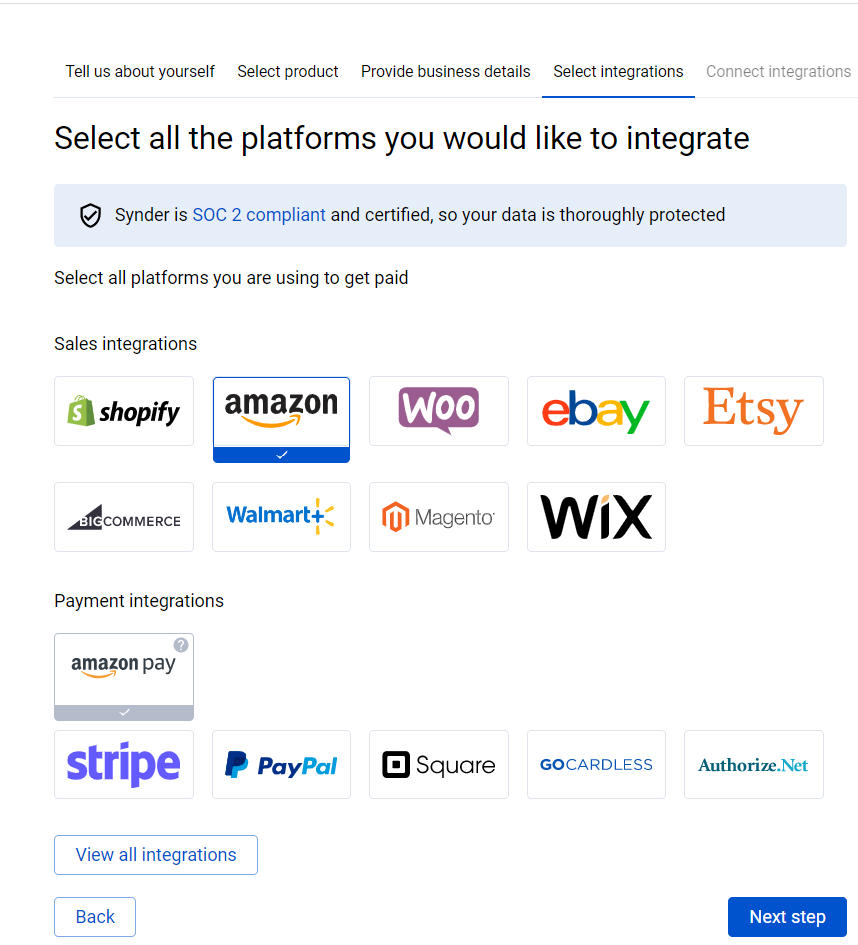

Are you ready to integrate your Amazon account with accounting and payment platforms to understand what a real automated Amazon business is like? Here are three simple steps you should start with:

1. Create your Synder account.

2. Connect your Amazon account to Synder.

3. Connect your accounting platform (QuickBooks, Xero or Synder Books) and/or payment gateways.

Final thoughts

All in all, is having an Amazon business connected with sales worth it? Amazon is one of the best platforms for selling online. However, it has its own quirks, so consider all the advantages and disadvantages before you start a business on Amazon.

What we know for sure is that the more profitable your FBA business becomes, the more complicated it is to keep track of your sales transactions and other financial activities, and it’s definitely not a fascinating part of business in general. If you choose Amazon for your retail store, it’d be wise to automate all the possible processes to the fullest. After that, you may get more time to work on building strategies, planning, and growing your business.

Synder accounting software has numerous advantages over manual work for the life of an entrepreneur selling on Amazon as it can reconcile books accurately and seamlessly in less than 60 seconds. Automating your Amazon business will make your Amazon accounting so much easier. You’ll be able to track your expenses, synchronize all of your sales transactions, create reports, all while selling on Amazon. Get ready to use small business accounting services with a powerful QuickBooks Amazon integration, Xero Amazon integration or Synder Books Amazon integration.

Register for Synder’s 15-day free trial or book office hours.

%20(1).png)

Very well explained! I have learned many great things from your articles. I have been checking out all of your blogs as well, thanks for sharing this.

Thank you so much for your continuous support!