For ecommerce business owners, tax filing season marks the start of a highly stressful time. Understanding how to deal with tax obligations, especially with income tax, correctly, becomes critical during this period.

To help you meet the income tax filing season fully armed and prepared, we’ve compiled a step-by-step guide. Read about what income tax filing method to choose, where to get the latest tax information, how to keep up with deadlines, and more.

Key takeaways

- The government collects income tax on individuals and businesses based on earnings.

- Taxpayers have options like e-filing through IRS-approved software, using a tax preparation service, or mailing a paper return. E-filing is recommended for its speed and convenience.

- Different states have varying tax structures, including progressive, flat, and no income taxes.

- The deadline to file a federal tax return for the tax year 2023 is April 15, 2024.

- While extensions can be granted for filing tax returns, taxes owed must still be paid by the original deadline to avoid interest and penalties.

Contents:

3. Income tax filing deadlines

4. Federal tax: Tax brackets 2023 vs 2024

5. Income tax return: Prepare in 5 steps

6. FAQs

What is income tax?

Income tax is the tax that governments collect from the businesses’ and individuals’ money earned throughout the year. The amount of tax is determined by how much money the business or individual makes.

The U.S. has a progressive tax system, which means that:

- The government decides how much tax you owe by dividing your taxable income into tax brackets, and each gets taxed at the corresponding tax rate.

- The higher your taxable income, the more income tax you’ll pay.

Who is collecting the money from tax?

Income tax is typically collected by a governmental agency or department tasked with tax administration. This entity’s specific name and structure vary by country, but it’s commonly referred to as the Tax Authority or Revenue Service.

In the U.S., the Internal Revenue Service (IRS) is responsible for collecting taxes and enforcing tax laws. The collected money is used to fund public services such as education, transportation, medical research, etc.

How does income tax work?

Your tax rate (the % of your income that you pay in taxes) is based on which income tax bracket you’re in.

📌 Note: The U.S. income tax rates are marginal, meaning each tax rate applies to only one part of your income.

Income tax calculations are reflected in the business tax return—a form filed with a tax authority that reports income, expenses, and other pertinent tax information. In the U.S., the IRS or local tax agencies play the role of such authority. Companies should usually file their tax return with income information annually.

Taxpayers file the returns by filling in special forms. Generally, there are three sections:

- general information;

- income;

- deductions/tax credits.

→ Learn more about the IRS 720 Form.

Standard deduction updates for tax year 2024

- For married couples filing jointly, the standard deduction rises to $29,200 for 2024 (an increase of $1,500 from tax year 2023).

- For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024 (an increase of $750 from 2023).

- For heads of households, the standard deduction rises to $21,900 for the tax year 2024 (an increase of $1,100 from the tax year 2023).

→ Check our deductions checklist for business owners for more details.

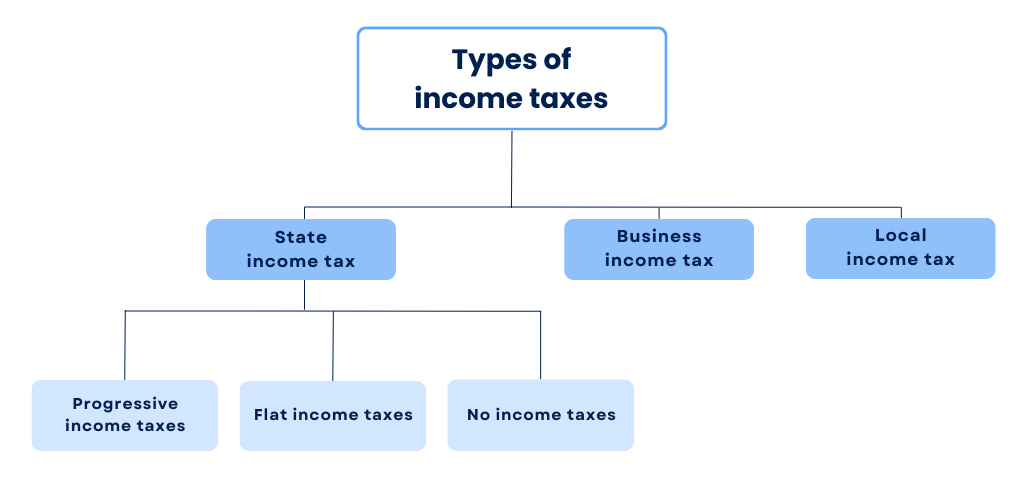

Types of income taxes

There are three primary types:

- State income tax;

- Business income tax;

- Local income tax.

Let’s take a closer look at each type of tax individually to help you understand them better in the future!

State income taxes

State income taxes are imposed by individual states on the income earned by residents and sometimes by non-residents who earn income within the state’s borders.

📌 Note: State income taxes are separate from federal income taxes.

All states fall into one of three different categories:

- States with progressive income taxes;

- States with flat income taxes;

- States with no income taxes.

1. States with progressive income taxes

Out of all the U.S. states, the vast majority share the progressive income tax structure. A progressive tax means a tax rate progresses (or increases) as taxable income increases. What is characteristic of this tax structure is that each state sets its rates and tax brackets.

2023 tax rates for states with progressive income taxes

Apply to income earned in 2023, reported on tax return filed in 2024.

| State | Tax rates | Income tax bracket |

| Alabama | 2% – 5% | $500 – $3,001 |

| Arkansas | 0% – 4.7% | $5,100 – $87,000 |

| California | 1% – 13.3% | $10,099 – $1,000,000 |

| Connecticut | 3% – 6.99% | $10,000 – $500,000 |

| Delaware | 0% – 6.6% | $2,000 – $60,001 |

| District of Columbia | 4% – 10.75% | $10,000 – $1,000,000 |

| Georgia | 1% – 5.75% | $750 – $7,001 |

| Hawaii | 1.4% – 11% | $2,400 – $200,000 |

| Iowa | 4.4% – 6% | $6,000 – $75,000 |

| Kansas | 3.1% – 5.7% | $15,000 – $30,000 |

| Louisiana | 1.85% – 4.25% | $12,500 – $50,001 |

| Maine | 5.8% – 7.15% | $24,500 – $58,050 |

| Maryland | 2% – 5.75% | $1,000 – $250,000 |

| Massachusetts | 5% – 9% | $8,000 – $1,000,000 |

| Minnesota | 5.35% – 9.85% | $30,070 – $183,341 |

| Mississippi | 0% – 5% | 5% for $10,001 and over |

| Missouri | 0% – 4.95% | $1,207 – $8,449 |

| Montana | 1% – 6.75% | $3,600 – $21,600 |

| Nebraska | 2.46% – 6.64% | $3,700 – $35,730 |

| New Jersey | 1.4% – 10.75% | $20,000 – $1,000,000 |

| New Mexico | 1.7% – 5.9% | $5,500 – $210,000 |

| New York | 4% – 10.9% | $8,500 – $25,000,000 |

| North Dakota | 0% – 2.5% | $44,775 – $225,975 |

| Ohio | 0% – 3.75% | $26,050 – $115,300 |

| Oklahoma | 0.25% – 4.75% | $1,000 – $7,200 |

| Oregon | 4.75% – 9.9% | $4,050 – $125,000 |

| Rhode Island | 3.75% – 5.99% | $73,450 – $166,950 |

| South Carolina | 0% – 6.4% | $3,200 – $16,040 |

| Vermont | 3.35% – 8.75% | $45,400 – $229,500 |

| Virginia | 2% – 5.75% | 2% – 5.75% |

| West Virginia | 2.36% – 5.12% | $10,000 – $60,000 |

| Wisconsin | 3.5% – 7.65% | $13,810 – $304,170 |

Source: Tax Foundation

2024 tax rates for states with progressive income taxes

Apply to income earned in 2024, reported on tax return filed in 2025.

| State | Tax rates | Income tax bracket |

| Alabama | 2% – 5% | $500 – $3,000 |

| Arkansas | 2% – 4.4% | $4,400 – $8,800 |

| California | 1% – 13.3% | $10,412 – $1,000,000 |

| Connecticut | 2% – 6.99% | $10,000 – $500,000 |

| Delaware | 2.2% – 6.6% | $2,000 – $60,000 |

| District of Columbia | 4% – 10.75% | $10,000 – $1,000,000 |

| Hawaii | 1.4% – 11% | $2,400 – $200,000 |

| Iowa | 4.4% – 5.7% | $6,210 – $31,050 |

| Kansas | 3.1% – 5.7% | $15,000 – $30,000 |

| Louisiana | 1.85% – 4.25% | $12,500 – $50,000 |

| Maine | 5.8% – 7.15% | $26,050 – $61,600 |

| Maryland | 2% – 5.75% | $1,000 – $250,000 |

| Massachusetts | 5% – 9% | Flat tax of 5%9% rate for over $1,000,000 |

| Minnesota | 5.35% – 9.85% | $31,690 – $193,240 |

| Missouri | 2% – 4.8% | $1,273 – $8,911 |

| Montana | 4.7% – 5.9% | 5.9% rate for over $20,500 |

| Nebraska | 2.46% – 5.84% | $3,700 – $35,730 |

| New Jersey | 1.4% – 10.75% | $20,000 – $1,000,000 |

| New Mexico | 1.7% – 5.9% | $5,500 – $210,000 |

| New York | 4% – 10.9% | $8,500 – $25,000,000 |

| North Dakota | 1.95% – 2.5% | $44,775 – $225,975 |

| Ohio | 2.75% – 3.5% | $26,050 – $92,150 |

| Oklahoma | 0.25% – 4.75% | $1,000 – $7,200 |

| Oregon | 4.75% – 9.9% | $4,300 – $125,000 |

| Rhode Island | 3.75% – 5.99% | $77,450 – $176,050 |

| South Carolina | 0% – 6.4% | $3,460 – $17,330 |

| Vermont | 3.35% – 8.75% | $45,400 – $229,550 |

| Virginia | 2% – 5.75% | $3,000 – $17,000 |

| West Virginia | 2.36% – 5.12% | $10,000 – $60,000 |

| Wisconsin | 3.5% – 7.65% | $14,320 – $315,310 |

Source: Tax Foundation

📌 Note: Georgia and Mississippi will have flat rates.

2. States with flat income taxes

Each business owner is taxed at the same rate as everyone else.

2023 tax rates for states with flat income taxes

Apply to income earned in 2023, reported on tax return filed in 2024.

| State | Tax rates |

| Arizona | 2.5% |

| Colorado | 4.4% |

| Idaho | 5.8% |

| Illinois | 4.95% |

| Indiana | 3.15% |

| Kentucky | 4.5% |

| Michigan | 4.05% |

| North Carolina | 4.75% |

| Pennsylvania | 3.07% |

| Utah | 4.65% |

Source: Tax Foundation

2024 tax rates for states with flat income taxes

Apply to income earned in 2024, reported on tax return filed in 2025.

| State | Tax rates |

| Arizona | 2.5% |

| Colorado | 4.4% |

| Georgia | 5.49% |

| Idaho | 5.8% |

| Illinois | 4.95% |

| Indiana | 3.05% |

| Kentucky | 4% |

| Michigan | 4.25% |

| Mississippi | 4.7% |

| North Carolina | 4.5% |

| Pennsylvania | 3.07% |

| Utah | 4.65% |

Source: Tax Foundation

3. States that don’t have income tax

There’s no income tax in the following states:

| States with no income tax, 2023 | States with no income tax, 2024 |

| Alaska | Alaska |

| Florida | Florida |

| Nevada | Nevada |

| New Hampshire | New Hampshire* |

| South Dakota | South Dakota |

| Tennessee | Tennessee |

| Texas | Texas |

| Washington | Washington** |

| Wyoming | Wyoming |

Source: Tax Foundation

* – doesn’t tax regular income, but does tax the money you make from investments’ interest and dividends (3%)

** – doesn’t tax regular income. 7% long-term capital gains tax on profits of $250,000 or more.

📌 Note: Even though these states have no income tax, keep in mind that property, sales, or other taxes and fees in these states could be higher. For example, Tennessee and Washington are among the five states with the highest average combined state and local sales tax rates: Tennessee – 9.55%, Washington – 9.38%.

Quick question: What if I moved from one state to another?

If you live and work in the same state, typically, you’re required to file just one state tax return annually, if necessary. However, suppose you relocated to a different state within the year, living in one state while working in another, or owning income-generating rental properties across various states. In that case, you might need to file multiple state returns.

Business or individual income tax

Depending on how your business is set up, you might need to pay a separate business tax, or your business earnings might be included in your individual income tax.

For example, a C corporation is usually seen as an entity separate from its owner. As a business owner, you’ll pay your business income tax, which is a flat 21%, separate from your personal income tax.

Sole proprietorship/LLC/partnership businesses aren’t subject to corporate income tax; you’d fill out your personal tax return and pay the taxes on those profits at your individual income tax rate.

→ Learn about 14 tax tips for business owners.

Local income taxes

Local income taxes are taxes levied by local government entities such as cities, counties, or municipalities on the income of individuals or businesses within their jurisdictions. They make up an additional layer of income taxes across 16 states (particularly in the Midwest and Northwest).

Income tax filing deadlines

Usually, tax season in the U.S. starts at the end of January. However, the exact date can change due to tax legislation changes or external factors. This year, for example, the IRS opened for business on January 29, 2024.

In the framework of this season, there’s a list of important dates, which are fundamental for income tax filing season:

- The first week of March – the beginning of tax refunds of Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). NOTE: tax refunds can be made only for taxpayers who filed their tax reports electronically with direct deposit and have no issues with them.

- April 15 (can be changed) – the last day for filing tax returns.

Find out the deadlines for your particular state with the IRS official website.

Tax deadlines and dates for the tax year 2023

In case a taxpayer needs more time to prepare the tax return, the IRS provides an opportunity to extend the deadlines. So, the standard deadline to file federal tax return for the tax year 2023 is April 15, 2024.

To extend income tax deadlines, taxpayers should file a request no later than the last day of tax season. Businesses and corporations should fill out IRS Form 7004 or Form 1138 and send it to the IRS in the form of an electronic request (e-file) or indicate an extension in income tax payments. In this case, your tax return due date is pushed to October 15, 2024

📌 Note: Income tax extension of the time to file a tax return doesn’t apply to the deadline for paying taxes. It concerns only the documental part of the tax process. So, taxpayers must pay all necessary taxes due April 15, 2024, even with a tax extension.

Federal tax: Tax brackets 2023 vs 2024 from IRS.gov

Since IRS.gov has already presented the income tax brackets for 2023 and 2024, we suggest you compare the two years to see what’s changed and what to expect during the following year.

The IRS provides seven rates when filing federal income tax: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

📌 Note: Due to the Tax Cuts and Jobs Act of 2017, the brackets will remain the same until 2025. However, the IRS can adjust the income thresholds for each federal tax bracket each year to reflect inflation.

2023 tax brackets and rates

These federal tax brackets apply to income earned in 2023, reported on tax returns filed in 2024.

| Tax rate | Single | Married filing jointly | Married filing separately | Head of household |

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $11,000 | $0 to $15,700 |

| 12% | $11,001 to $44,725 | $22,001 to $89,450 | $11,001 to $44,725 | $15,701 to $59,850 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 | $44,726 to $95,375 | $59,851 to $95,350 |

| 24% | $95,376 to $182,100 | $190,751 to $364,200 | $95,376 to $182,100 | $95,351 to $182,100 |

| 32% | $182,101 to $231,250 | $364,201 to $462,500 | $182,101 to $231,250 | $182,101 to $231,250 |

| 35% | $231,251 to $578,125 | $462,501 to $693,750 | $231,251 to $346,875 | $231,251 to $578,100 |

| 37% | $578,126 or more | $693,751 or more | $346,876 or more | $578,101 or more |

Source: IRS

2024 tax brackets and rates

These federal tax brackets apply to income earned in 2024, reported on tax returns filed in 2025.

| Tax rate | Single | Married filing jointly | Married filing separately | Head of household |

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $11,600 | $0 to $16,550 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 | $100,501 to $191,950 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,725 | $191,951 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 | $243,701 to $609,350 |

| 37% | $609,351 or more | $731,201 or more | $365,601 or more | $609,350 or more |

Source: IRS

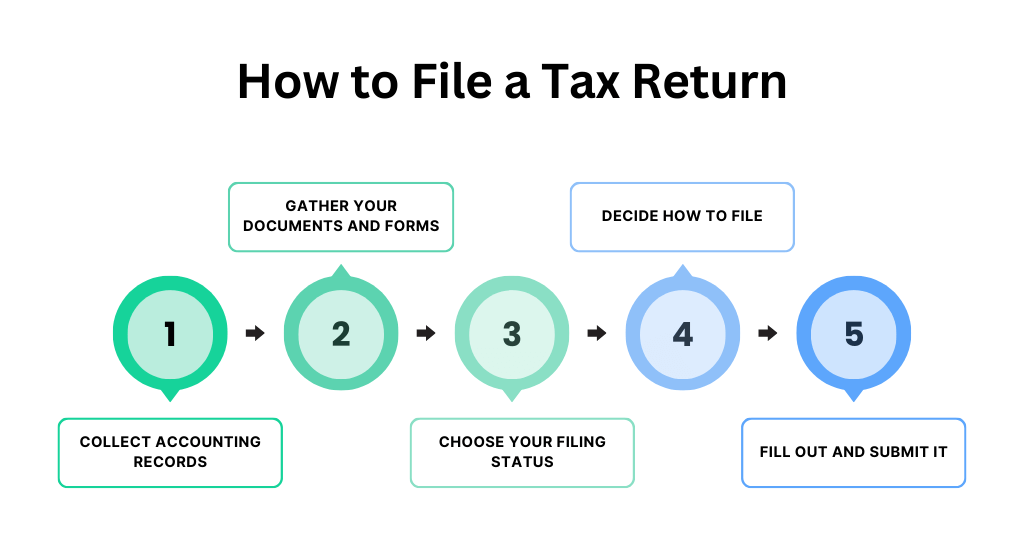

Income tax return: Prepare in 5 steps

Filing your tax return involves several key steps, designed to ensure you accurately report your income. Let’s go through the detailed breakdown of the main steps involved.

Step 1: Collect accounting records

Correct and precise data is the basis of an income tax. To track the cash flow, ecommerce business owners need to collect payment information in their books. The biggest challenge here is to reconcile this data with statements from your checking bank account. This is when online accounting tools can really help.

For example, Synder is an accounting software that provides its users with the feature of fast and accurate import of current and historical data from payment processors/ecommerce channels to an accounting system, and flawless reconciliation.

Such software is extremely useful during tax season as it makes detailed reports for each transaction, recording the tax info into the corresponding fields in your accounting company. Synder undertakes all mechanical accounting work, and helps prepare a list of essential reports, so that you can concentrate only on tax optimization and your company development strategy.

If you want to know more about how Synder can help you prepare for tax season or improve your business accounting, don’t hesitate to visit our Weekly Product Demo session or sign up for a free trial.

Step 2: Gather your documents and forms

Ensure you have:

- Social Security numbers for yourself, your spouse, and any dependents.

- W-2 IRS forms for each job held during the tax year, detailing your earnings and federal, state, and other taxes withheld.

- 1099 forms for other income, including 1099-NEC for self-employment income, 1099-INT for interest earned, and 1099-DIV for dividends.

- Receipts and records for deductible expenses. This could include medical expenses exceeding 7.5% of your adjusted gross income, state and local taxes paid, mortgage interest, student loan interest, and charitable contributions.

- Documentation for educational expenses, including tuition and fees, which may qualify for education tax credits.

- Last year’s federal and state tax returns.

→ Learn the difference between 1099 and W-2.

Step 3: Choose your filing status

Your tax obligations depend a lot on your tax filing status. It affects your standard deduction amount, eligibility for certain credits, and the tax rate applied to your income. The income tax rate can vary depending on whether you’re married or not. When filling out this information, pay attention to this detail.

The main statuses are:

- Single;

- Married filing jointly;

- Married filing separately;

- Head of household;

- Qualifying widow(er) with dependent child.

Choose the one that best reflects your situation as of December 31 of the tax year you’re filing for.

Step 4: Decide how to submit

Your choice of how to file your tax return can affect how quickly you complete the process and receive any refund due. The IRS suggests two tax filing options:

- E-file with IRS-approved software. This option can lead to faster processing times, quicker refunds, and provides built-in calculators to help with deductions and credits. Many taxpayers are eligible for free filing options based on their income.

- Mail a paper return (not recommended). While this method is declining in popularity due to longer processing times, some people prefer it for its tangible record-keeping or because they’re filing a type of return that can’t be e-filed.

The third option is to consult with a professional tax preparer or accountant. This is especially useful if you have a complex tax situation, such as owning a business, having multiple income sources, or needing to file back taxes. They can provide tailored advice and optimize your tax outcome.

Check Synder’s accountants’ directory to find a perfect match for your business needs!

How to file a tax return online

The IRS recommends e-filing and suggests 4 options for how you can file your income taxes:

- Use IRS Free File or Fillable Forms.

- Use a Free Tax Return Preparation Site.

- Use Commercial Software.

- Find an Authorized e-file Provider.

Step 5: Fill out and submit it

This step is where you officially report your financial information to the tax authorities, applying the data you’ve gathered and decisions you’ve made in the previous steps. It involves a series of forms and schedules where you’ll detail your income, deductions, and credits. Here’s what you need to know:

a. Understand the forms

- Form 1040. The cornerstone of your tax return. U.S. taxpayers use this form to file their annual income tax return. You’ll report your income, subtract deductions to calculate your taxable income, and determine how much tax you owe or are refunded.

- Schedules. Additional forms for specific situations. For example, Schedule A is for itemized deductions, Schedule B is for interest and dividend income, and Schedule C is used by self-employed individuals to report business income and expenses.

b. Report all income

- Wages and salaries. Reported on Form W-2.

- Self-employment income. Reported on Schedule C, with expenses related to your business also detailed here.

- Investment income. Including interest (Form 1099-INT), dividends (Form 1099-DIV), and capital gains (Form 1099-B), reported on Schedule D.

- Other income. This could include rental income, alimony received, unemployment compensation, and any other income not reported elsewhere.

c. Claim deductions

- Standard deduction. A fixed amount that reduces your taxable income, varying by filing status. Most taxpayers opt for this because it’s simpler and higher due to recent changes in tax laws.

- Itemized deductions. If your total itemizable deductions (like mortgage interest, state and local taxes, charitable contributions, and medical expenses exceeding a certain threshold) are greater than your standard deduction, itemizing can save you more on taxes. These are reported on Schedule A.

d. Claim tax credits

- Nonrefundable credits. Can reduce your tax bill to zero but not result in a refund. Examples include the Child Tax Credit and Education Credits.

- Refundable credits. Can reduce your tax bill to below zero and result in a refund. The Earned Income Tax Credit is a key example.

e. Calculate your tax liability

After reporting income and subtracting deductions, you’ll determine your taxable income. Then, apply the appropriate tax rates to calculate your tax liability. Subtract the credits for which you’re eligible to find out if you owe additional taxes or are due for a refund.

A point to remember

Once your return form is completed, review it for accuracy, then submit it by the tax filing deadline.

- If you owe taxes, ensure you pay by the deadline to avoid penalties and interest.

- If you’re due a refund, the IRS will process it after they receive your return. E-filing and choosing direct deposit is the quickest way to get your refund.

Conclusion

Though it may seem complicated, income tax filing shouldn’t bring you tension or stress. Thorough and well-planned preparation will help you complete tax processes without issues. Hopefully, this step-by-step guide hsa given you a clearer picture of the income tax filing season. And geared with some smart online accounting software solutions, you’ll get through it more smoothly with the knowledge of how to file your tax return.

FAQs

Can I submit everything by myself?

Yes. Many individuals choose to file taxes using software solutions, which guides users through the process with straightforward questions about their income, deductions, and credits. For those with simpler tax situations (such as having only W-2 income and taking the standard deduction), self-filing is a straightforward process.

How to file taxes with W2?

- Collect your W-2 forms from all employers you worked for during the tax year.

- Choose your filing method: online software, tax preparer, or paper filing.

- Enter the information from your W-2 into your chosen filing method (this includes your income, tax withheld, and other relevant details provided on the form).

- Add any additional income and deductions to complete your tax return.

- Submit your tax return by the filing deadline to avoid penalties.

What are 3 basic ways to file your taxes?

1. Online/e-file. The most popular and convenient method, using IRS-approved tax software to guide you through the filing process. Ideal for a range of tax situations, from simple to complex.

2. Tax professional. Hiring a certified tax preparer or accountant to handle your tax return. Best for those with complicated tax situations, such as owning a business or having multiple income sources.

3. (Not recommended) Paper filing. Completing your tax return manually and mailing it to the IRS. This method is less common due to the convenience and speed of electronic filing, but is still an option for those who prefer it.

What is a tax refund?

Receiving a tax refund is a key aspect of the income tax return process that many look forward to. This portion of your return comes into play if the taxes you’ve paid throughout the year exceed what you owe to the government. A tax refund means the government is returning the excess amount you’ve overpaid.

Why is it important to consider possible tax deductions and credits?

In a nutshell, a business owner can deduct some business expenses from income, and as a result, the tax amount will decrease.

Let’s say you’ve made some payments to retirement savings plans or had rent and insurance expenses. According to the U.S. income tax legislation, such spending is deductible, which means that as a business owner, you can use these expenses to lower taxes. The same scheme applies to tax credits.

The list of expenses that can be used for tax deduction differs depending on the jurisdiction, so you need to check it out in your state income tax requirements.

This article has been prepared for informational purposes only and gives a general overview of income tax. It’s not intended to provide any tax advice. Keep in mind that it’s better to consult with a tax professional to ensure that taxes are properly calculated and reported.

Share your experience

Have you gone through the twists and turns of tax filing season successfully? We’d love to hear about your experience and any tips you might have to offer! Share your story in the comments to help others approach tax season with confidence and ease.

%20(1).png)

It helped when you mentioned that the income tax rate can vary depending on your status. My friend is having a hard time filing for their business tax. I should advise him to hire an expert in business tax filing for a smooth process.

It helped when you mentioned that income tax filing shouldn’t bring you issues. My friend is having a hard time preparing their taxes. I should advise him to hire an expert in tax preparation to ensure quality work.

We’re happy that you found helpful information in our blog. Best of luck to your friend in their tax preparation process!

Recently, one of my friends from college mentioned he’d like to start a business in two months. I think your guide will be helpful for my friend’s next year’s tax preparation process, so I’ll email it now. Thanks for explaining that some business owners need to pay separate business taxes from their individual ones.

Hi Eli, thanks for finding it helpful!

This guide simplifies the often complex process of filing income tax. The step-by-step approach is incredibly helpful. I appreciate the clarity on deductions and the emphasis on accuracy. A must-read for anyone navigating tax season!

Thanks for helping me understand that income tax is what the government collects throughout the year from business owners and individuals. I guess tax return filing would be a different matter, since you mentioned that there are certain eligibilities that you need to meet to see if you can file for that. In my opinion, having a professional to assist or guide you regarding these things would be vital for your own peace of mind and to prevent any violations as well.

Thanks for commenting, Mia! Absolutely agree about having professional help. An advisor might know many nuances a less tax-savvy person might simply miss out.

Appreciate your clarification on income tax, which is the amount collected by the government from businesses and individuals annually. It seems filing a tax return is a distinct process, as there are specific eligibility criteria to meet before proceeding. In my view, having a professional guide or assist you in these matters is crucial for peace of mind and to avoid any potential violations.

Thanks, Travis. You can’t overesimate professional help, especially when it comes to taxes.

It’s interesting when you said that tax deadlines should be planned for the best accounting solutions. The other night, my brother informed me he was looking for a reliable tax service that could provide efficient help and proper planning for the tax preparation of his clothing business taxation. He asked if I had ideas on the best legal approach. I’m grateful for this helpful tax guide article for efficient planning. I’ll tell him it will be much better if he consults a trusted tax preparation service as they can provide more insights about the proper approach.

Thanks for your thoughts, Steve! I believe consulting with a tax service might be a wise move.

Excellent article! This article will prove helpful to many.