Understanding tax forms can be a challenging task, particularly when dealing with detailed documents like the W-2 form. Essential for countless employees and employers during tax season, this form plays a pivotal role in the annual tax filing ritual.

It doesn’t matter if you’re well-versed in tax matters or just starting to navigate this complex territory; grasping the nuances of the W-2 tax form is essential. Our goal with this article is to simplify and clarify the W-2 form for you. We’ll explore its significance, break down its components, and guide you on how to accurately manage it, whether you’re an employee receiving it or an employer issuing it.

Want to make sure your business is tax season ready? Synder automates the recording and categorization of ecommerce transactions and SaaS subscriptions into your accounting software, ensuring accurate and up-to-date financial records for tax season. It streamlines reconciliation and provides comprehensive financial reports, making tax compliance and preparation more efficient. Additionally, its integration with popular accounting platforms like QuickBooks and Xero simplifies the overall process, reducing manual data entry and potential errors. Check out what Synder offers out of the box by signing up for our 15-day free trial, or save a spot at our Weekly Product Demo to experience the magic of smart accounting software live!

Disclaimer: This article is intended to provide a general overview and does not aim to offer specific tax advice. Tax laws and regulations can be complex and vary based on individual circumstances. If you or your business require assistance with filing the W-2 tax form or have specific tax-related queries, it is advisable to consult a qualified tax professional. Relying solely on the information provided here for tax preparation or decision-making is not recommended.

Making taxes easy:What is W-2 tax form?

The W-2 form, often called the Wage and Tax Statement, is a crucial document that all employers need to provide to their employees who earned $600 or more in a year, including any noncash payments. This requirement applies to employees from whom any income, Social Security, or Medicare tax has been deducted.

What does the W-2 form show?

It details an employee’s total yearly earnings and the various taxes taken out of their paychecks during the year. This includes federal and state taxes, and it also outlines any employer-provided benefits like health insurance contributions or funds added to health savings accounts. These could also include benefits for things like adoption or care for dependents.

Why is the W-2 form important for employees?

It’s a key document for filing tax returns. It helps employees understand how much they earned and how much tax was withheld from their income. After the end of each tax year, employers should give their employees this form, usually early in the next year, so employees have it in time for tax season.

Making taxes easy:Who needs to file tax form W-2?

Filing the tax form W-2 should be done by the employers. They should give this form to their employees by January 31st of each year. This timeline is important because it allows employees enough time to get ready for the income tax deadline, which is usually April 15th.

What’s the purpose of the W-2 for employers?

They use it to report the taxes paid under the Federal Insurance Contributions Act (FICA) for their employees for that year. By the end of January, employers also need to send a W-2 form, along with a Form W3, to the Social Security Administration (SSA). These forms, based on the previous year’s data, help the SSA figure out each worker’s Social Security benefits.

Check out our article on payroll taxes for employers.

Remember, the W-2 form you get is always about the previous year’s income. For example, a W-2 Form received in January 2024 would reflect the income earned in 2023.

Does PayPal issue W-2?

No, PayPal doesn’t issue W-2 for business owners, however, they can send you 1099-K. Starting in the 2023 tax season, there’s a significant change for business owners using third-party payment platforms like PayPal. In the past, PayPal users received a 1099-K form only if their transactions exceeded $20,000 and were over 200 in a year. However, this threshold has been drastically lowered due to the American Rescue Plan Act of 2021.

Now, beginning with the 2023 tax season, PayPal will issue a 1099-K form for transactions totaling more than $600 annually, regardless of the transaction count. This change, initially set for 2022 taxes but postponed, means that even smaller amounts of income received through PayPal for goods or services will be reported to the Internal Revenue Service.

It’s crucial to note that all business income is taxable, whether or not a 1099-K is issued. For personal transactions, like gifts or reimbursements from friends and family through a personal PayPal account, a 1099-K will not be issued, as these are not considered taxable business income. This update underscores the importance of accurately reporting all business income for tax purposes.

Don’t use your PayPal account anymore? Find out how to delete your PayPal account.

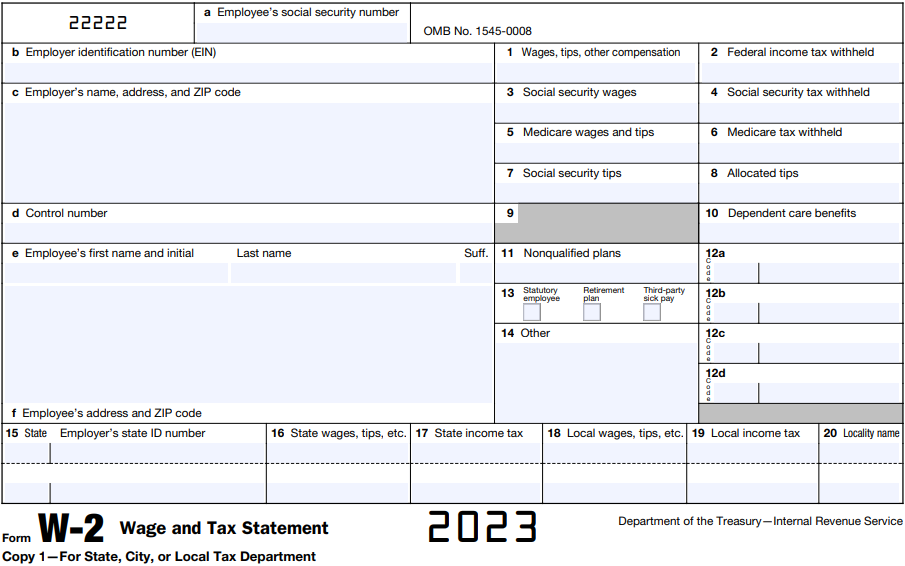

Understanding W-2 tax forms: Quick overview

W-2 tax form consists of several boxes. Each box, or block, features essential information:

Boxes A – F: Identification information

- Box A: Employee’s Social Security number.

- Box B: Employer’s identification number (EIN).

- Box C: Employer’s name, address, and ZIP code.

- Box D: A control number used by an employer.

- Boxes E, F: Employee’s name, initials, last name, suff., and employee’s address with ZIP code.

Box 1-6: Earnings and tax withholdings: Social Cecurity & Medicare

- Box 1: The total of employee’s wages, tips, and other compensation.

- Box 2: The amount of federal income tax withheld from employee’s pay.

- Box 3: The total wages subject to Social Security tax.

- Box 4: The amount of Social Security tax withheld from employee’s wages.

- Box 5: Wages and tips subject to Medicare tax.

- Box 6: The amount of Medicare tax withheld.

Boxes 7-9: Tips and tax perks

- Box 7: The amount of tips reported by the employee.

- Box 8: The amount of tips reported as paid to the employee by the employer.

- Box 9: Tax perk.

Box 10: Benefits and additional tax info

- Box 10: Total amount for dependent care benefits.

- Box 11: Distributions from nonqualified deferred compensation plans.

- Box 12: Contributions to tax-deferred annuity plans: the total cost of your employer-sponsored health plan.

- Box 13: Retirement plan.

- Box 14: Other tax information, including:

- IRC414H: Deductions under Internal Revenue Code Section 414 for pension contributions.

- IRC125: Deductions under Section 125 for pre-tax benefit programs like health insurance premiums, Dependent Care Assistance, and Health Care Flexible Spending Accounts.

- IRC132: Deductions for commuter benefits under Section 132.

- IMP: Taxable value of domestic partner’s health plan coverage.

Boxes 15-20: State and local taxes

Boxes 15-20 detail your state and local wages, tips, and respective income taxes, along with the locality name.

This overview simplifies the W-2 form’s boxes to help you understand what each section represents, from personal information and income to taxes withheld and additional benefits.

How to file tax form W-2?

Filing tax form W-2 involves both employer and employee responsibilities. Here’s a simplified guide for each:

For employers:

- Gather employee information:

- Ensure you have correct employee details, including Social Security numbers and addresses.

- Complete the W-2 form:

- Fill out the W-2 form for each employee. This includes reporting the employee’s wages, tax withholdings, and other relevant compensation information.

- Distribute W-2s to employees:

- You must provide W-2 forms to your employees by January 31st for the previous year’s earnings.

- File with the SSA:

- Send a copy of each W-2 form, along with a W3 form (which is a summary of all W-2s), to the Social Security Administration (SSA). This can be done either electronically or by mail.

- State filing:

- Depending on the state, you might also need to file the W-2 forms with the state tax department.

For employees:

- Receive your W-2:

- Your employer should provide you with the W-2 form by January 31st.

- Review your W-2:

- Check for accuracy in your personal information and the reported earnings and withholdings.

- Use the information to file your tax return:

- Use the information on your W-2 to fill out your tax return. The form reports your annual income and the taxes withheld, which are crucial for calculating your tax liability or refund.

- File your tax return:

- You can file your tax return electronically or by mail. Include the information from your W-2 in your tax return.

- Keep a copy:

- Keep a copy of your W-2 for your records, typically for at least three years.

Need more information about tax returns? Check our articles on how long the IRS can hold a refund for review & what day of the week the IRS deposits refunds to understand how tax returns work.

Can you file the W-2 tax form online at the end of tax year?

Yes, you can file W-2 tax forms online. In fact, the IRS encourages electronic filing (e-filing) for its efficiency and accuracy. Employers can file W-2 forms online through the Social Security Administration’s Business Services Online (BSO) portal. This method is often faster and more secure than mailing paper forms. Additionally, e-filing can be more convenient for handling large volumes of W-2 forms, and the SSA provides immediate confirmation once the forms are submitted.

The IRS requires employers who file 250 or more W-2 forms to file them online electronically. However, smaller businesses are also encouraged to use electronic filing.

Additionally, you need to check if your state has specific requirements or systems for electronic filing of state tax documents related to W-2 information.

Many businesses use third-party payroll services that can handle electronic filing of W-2 forms. These services ensure the forms are filled out correctly and submitted on time.

For specific instructions on how to fill out the W-2 form or detailed tax filing instructions, including filing online, refer to the Internal Revenue Service guidelines or consider consulting with a tax expert.

What are the IRS tax audit red flags?

How to get your W-2

To get your W-2 form, which is essential for filing your taxes in the United States, you can contact your employer(s) or the Internal Revenue Service, and use Form 4852.

Contacting your employer should be your first step. The W-2 form is typically sent out by employers by January 31st for the previous year’s earnings. If you haven’t received it, it’s possible they mailed it to an old address, or it’s available online through your company’s employee portal. Moreover, many employers offer electronic W-2 forms through their payroll or HR systems. Log into the employee portal to see if your W-2 is available for download. Note that if you worked for more than one employer during the tax year, ensure you receive a W-2 from each employer.

If you can’t get hold of your employer or there are some other issues, your next step is contacting the IRS. Be prepared to provide your name, address, Social Security number, and phone number, as well as your employer’s name, address, and phone number. The IRS will attempt to contact your employer on your behalf.

If you still haven’t received your W-2 by the tax filing deadline, you can use Form 4852, ‘Substitute for Form W-2, Wage and Tax Statement.’ You’ll need to estimate your wage and tax withholding as accurately as possible, which can be done using your final pay stub of the tax year.

If you file your taxes and then receive your W-2 and notice discrepancies, you may need to amend your tax return using Form 1040-X.

Remember, it’s important to keep your address updated with your employer to avoid any delays in receiving your W-2. If you’re unable to obtain your W-2 in time for tax filing, consider requesting an extension to file your tax return to avoid penalties.

W-2 vs W4: What’s the difference?

The primary distinction between W-2 and W4 Forms lies in who completes them and the timing. An employee completes the W4 when they start a new job or if they wish to update their tax status or adjust their withholdings at any later time. On the other hand, an employer is responsible for preparing the W-2 Form for each employee at the close of every tax year. This form summarizes the employee’s earnings and the total tax withheld during that year.

While the W4 captures details like the employee’s personal information, marital status, number of dependents, and the desired amount of tax to be withheld, the W-2 is a comprehensive annual statement. It reports the employee’s total earnings, including wages and tips, the taxes withheld, contributions to Social Security and Medicare, and any retirement plan contributions.

The employer files the W-2 IRS form with the Social Security Administration and provides a copy to the employee. Conversely, the W4 is retained by the employer and is not filed with any tax authorities.

W-2 vs 1099: What’s the difference?

The main difference between 1099 and W-2 forms lies in their purpose and who they’re issued to. The W-2 form is given to payroll employees, detailing their taxable compensation and tax withholdings, including federal and state income tax and FICA withholdings. It’s sent to employees and the Social Security Administration, with a filing deadline of January 31st. Employers can issue W-2s electronically if the employee agrees.

The 1099 form, on the other hand, is for independent contractors, listing gross payments made to them. This form, which also has a January 31st deadline, is sent to the contractors and the IRS. The 1099 form doesn’t report tax withholdings, as independent contractors are responsible for their own taxes.

These forms reflect different types of work relationships: W-2s for traditional employees and 1099s for independent contractors. The classification affects employer costs and tax responsibilities, with independent contractors having more control over their work and bearing their own tax liabilities. Proper classification is crucial for compliance with tax laws.

Conclusion

In conclusion, the W-2 tax form is a fundamental component of the tax system for both employees and employers. It not only serves as a record of income and taxes withheld over the year but also plays a critical role in ensuring accurate and compliant tax filing. For employees, understanding your W-2 is key to accurately filing your taxes and comprehending your earnings and deductions. Employers, on the other hand, must diligently prepare and distribute these forms, ensuring accuracy and timeliness. With this guide, navigating the specifics of the W-2 form should now be clearer, helping both employees and employers fulfill their tax responsibilities with greater confidence and ease.

Disclaimer: This article is intended to provide a general overview and does not aim to offer specific tax advice. Tax laws and regulations can be complex and vary based on individual circumstances. If you or your business require assistance with filing the W-2 tax form or have specific tax-related queries, it is advisable to consult a qualified tax professional. Relying solely on the information provided here for tax preparation or decision-making is not recommended.

.png)