Once the tax filing season is over, we’re eagerly awaiting the due return of overpaid taxes. However, we may occasionally find ourselves embroiled in the complexity of IRS refund reviews.

Herein lies the pressing question: “How long can the IRS hold your refund for review?” The specter of unexpected delays, rigorous reviews, and adjusted refund amounts can be daunting. Yet, by understanding the process, we can alleviate some of the stress.

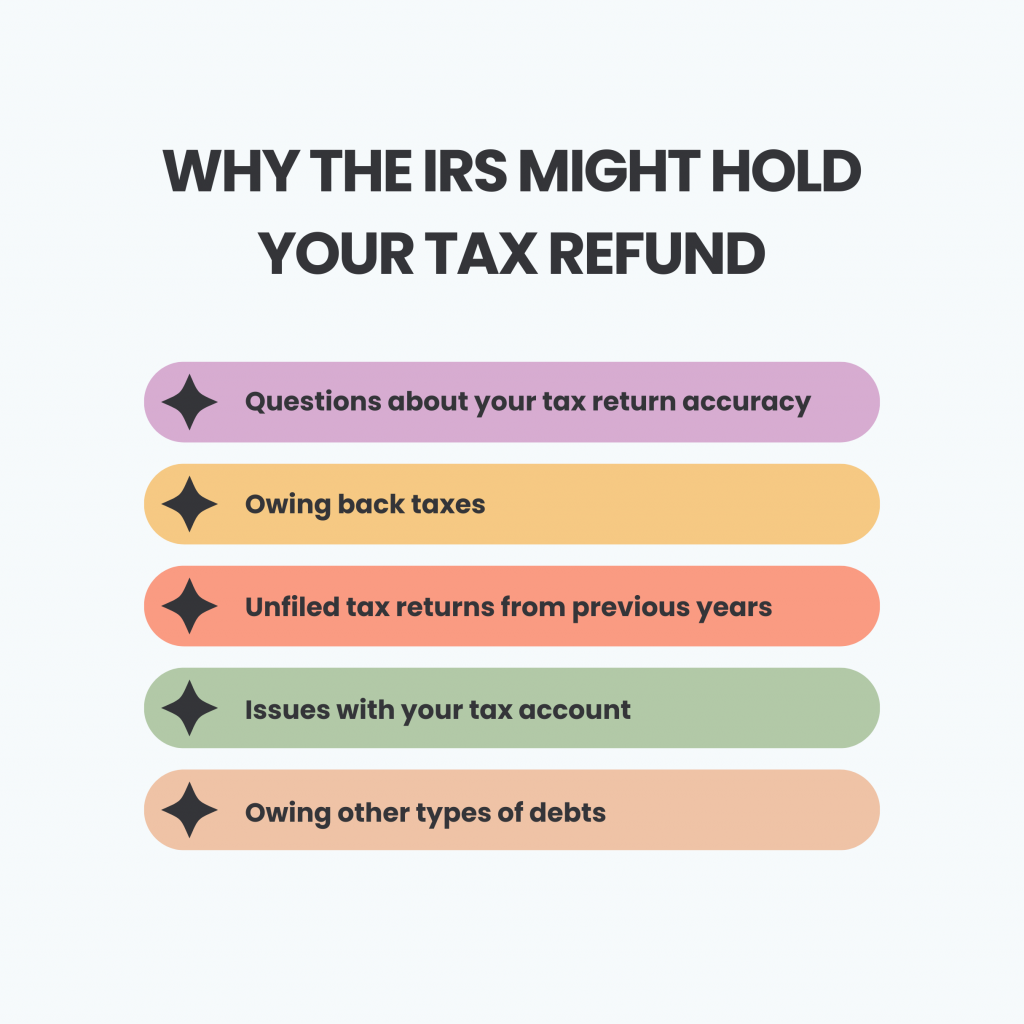

The underlying causes of refund delays

When the IRS withholds or takes your refund, it’s more than a mere financial inconvenience or issues of the amount of tax you owe. It’s an indication of potential discrepancies in your tax profile in general. Here are the common reasons why the IRS might be holding your refund:

1. Questions about your tax return accuracy

One common reason is when the IRS has questions about the accuracy of your previous year’s return. This might happen if they suspect errors in tax filing or are conducting an audit. In such cases, if the IRS changes your refund and you disagree, you generally have 60 days to dispute their decision.

Got it! But what should I do if I notice a mistake myself?

If you’ve discovered an error on your tax return or realized that you overlooked a beneficial deduction or credit, don’t fret. There’s a solution in the form of an amended return. The IRS provides a straightforward process for such corrections, allowing taxpayers to file an amended return using Form 1040-X.

2. Owing back taxes

If you owe back taxes, the IRS will typically apply your refund to this debt. This will happen even if you are under an existing payment plan. If you’re unable to clear your tax debt immediately or within the filing deadline, enter into a payment agreement, or an installment agreement, with the IRS. This will help minimize the imposition of penalties and interest, and help you avoid enforcement actions related to collection.

If you want to learn more, read our article about backup withholding.

3. Unfiled tax returns from previous years

If you have unfiled tax returns from previous years, the IRS can initiate a “delinquent return inquiry”. They will freeze your refund until you file all outstanding returns and pay any related tax bills.

Learn how to file your income tax return.

4. Issues with your tax account

Issues with your tax account, such as identity theft or discrepancies related to your dependents, also stand as reasons for refund withholding. Provide proof of your identity or resolve the dependent-related discrepancy, and the IRS will release your refund within a few weeks.

5. Owing other types of debts

Your refund can also be used to offset other types of debts:

- unpaid student loans,

- back child support,

- outstanding unemployment compensation repayments,

- state taxes.

In such scenarios, you need to engage with the entity to which you owe money, not the IRS.

Find out how to prepare your business for tax season.

Timelines at a glance: How long can the IRS hold your refund for review?

If everything is okay with your tax return, the IRS usually sends back refunds pretty fast. For most people, it takes less than 3 weeks. That’s because the IRS can quickly check most of returns and agree with the refund amount you asked for.

But, in case the IRS needs to take a closer look at your return, the review process can take longer. If they ask you for more information and you give it to them, they try to do everything within 60 days. So, if you have to wait a bit, it doesn’t mean something is wrong. They might just be making extra sure everything checks out.

And if you were a little late sending in your return or had to fix something, the IRS will get you your refund within 90 days.

Your refund, not as expected?

If the IRS finally issued a refund and it isn’t what you expected, a few different things might have happened. The IRS might have fixed something in your Recovery Rebate Credit or Child Tax Credit. Or, they might have used your refund to pay off old debts you owe. Usually, the IRS will tell you about these changes, and you can check to make sure they’re right.

Can I lower my taxes and get a bigger refund?

Yes, you can lower your taxes and potentially get a bigger refund. You can do so if you utilize tax credits like the Earned Income Tax Credit (EITC).

The EITC provides financial relief for individuals earning income from a job. It’s applicable whether you’re single, married, with or without children. This credit can reduce the federal taxes you owe. But if the EITC amount surpasses your owed taxes, the excess is returned to you as part of your refund.

Furthermore, even if you do not owe income tax, qualifying for the EITC means you can still receive a refund.

What to do if you’re still waiting for your refund

As you already know, most refunds land within 21 days of electronically filing. But delays might happen.

Checking on your refund, simplified

Navigating through the refund tracking process is straightforward with the IRS’s “Where’s My Refund?” tool:

- access the tool via the IRS website or the IRS2Go app,

- inputting your Social Security number, filing status, and the exact refund amount,

- view your refund’s status.

When is the right time to call the IRS?

Calling the IRS at 800-829-1040 is an option under certain circumstances:

- if it’s been more than 21 days since e-filing,

- if it’s been over six weeks since mailing your return,

- if the aforementioned tool directs you to do so.

Otherwise, you might be better off avoiding a potentially lengthy hold, as calling outside these conditions generally doesn’t yield additional information.

However, if the issues persist, you can contact the IRS Taxpayer Advocate Service. This is the independent organization within the IRS system that helps taxpayers solve problems with the IRS.

Getting your refund quicker next time

For a swifter refund in the future, consider e-filing. E-filing lets you bypass the slower manual data input that comes with paper returns. If you opt for direct deposit, your refund will land directly in your bank account or on a prepaid card.

Ensuring tax compliance for your business

Looking for tools that can help you and your accountant to go through the tax season smoothly? Time to try smart accounting automation!

Synder Sync helps ensure tax compliance for your business by accurately capturing and recording sales, taxes, and fees. It automatically categorizes transactions for correct tax reporting and integrates seamlessly with accounting platforms like QuickBooks for consistent financial updates. Synder can also import missed historical data, and manage multiple currencies with real-time conversion rates. Additionally, its detailed financial reports provide key insights during the tax season.

Check out what Synder offers out of the box – register for a 15-day free trial, or book a seat at our Weekly Product Demo to discover how the tool works with a specialist. Make your tax season less taxing!

Wrapping up

Understanding why the IRS refunds can be delayed is key to managing your taxes effectively. Delays can be due to issues like return errors, unpaid taxes, or old debts. Typically, simple returns take under 3 weeks, while complex ones might take 60-90 days.

To make the process smoother, ensure accurate filing, settle any debts, and use IRS tools. If things get tricky, consider professional advice.

Ever wondered what happens when you report someone to the IRS? Check out our article to find out how the process works.

.png)

I went to a meeting to verify my identity for the Texas and it has still been 6 months since I got it they told me it was for sure I was going to get it still have not received it yet why is that it’s been under review for 6 months

Hi Christopher, to find out about the progress of your specific situation, please contact the IRS. Best of luck!

I have not yet received my 2022 taxes. I had to go down to the office of the IRS to verify my Identity. Did that they told me it would take up to 127 days for me to receive a letter From the IRS, letting me know how much I will be receiving If any.Well, it’s been almost 200 days. Still I have not received a letter. I go on to check this transgrip, and it’s still saying under review When I check where is my refund status.

I haven’t got my taxes yet for e2022 every time I call, nobody can figure it out and they keep saying give us up to 60 days.. it’s been 360 days and still nothing. no answers nobody knows anything.

Hi Fernando, I’m sorry to hear about the delay and confusion regarding your 2022 tax return. It must be frustrating to experience such a lengthy wait without clear answers. Th IRS offers various ways to check the status of your tax return, including the “Where’s My Refund?” tool on the IRS website, or the IRS2Go mobile app. For more detailed inquiries, you can call the IRS, but be prepared for potential wait times. If you’re facing significant delays and challenges with the IRS, the Taxpayer Advocate Service (TAS) may be able to assist. TAS is an independent organization within the IRS that helps taxpayers resolve problems. Best of luck!

I verified my identity 6 months ago with representative in March 2023. And I still haven’t received my 2022 refund yet.

Hi Vivian, we understand your frustration, and we’re sorry to hear about your situation. However, it’s important to note that we cannot provide tax advice. We strongly recommend reaching out to the IRS directly for clarification and consider seeking assistance from a qualified tax professional who can provide guidance tailored to your specific circumstances. Your peace of mind is our priority, and we hope you find a resolution soon.

I still haven’t received my 2019 tax refund and all I do is get a run around but I was approved I can’t use the where’s my refund app because I don’t know exactly the right amount I was approved for

Hi Cristina, not receiving your 2019 tax refund and facing difficulties with the IRS can be very frustrating, especially when you’re unable to use the “Where’s My Refund?” tool due to uncertainty about the exact refund amount. Here are steps you can take to address this situation:

Review your tax return: Start by reviewing your copy of the 2019 tax return to find the refund amount you reported. This can help you use the “Where’s My Refund?” tool more effectively.

Request a tax transcript: If you don’t have your tax return copy, request a tax transcript from the IRS. This can be done online through the IRS website or by calling the IRS. The transcript will show your refund amount, among other details.

Contact the IRS: Given the delay and the difficulties you’ve experienced, contacting the IRS directly might provide more specific information about your refund status. Due to high call volumes, it might take several attempts to get through. When you do, be prepared with your Social Security number, filing status, and the exact whole dollar amount of your expected refund as best as you can estimate.

Taxpayer Advocate Service (TAS): If you continue to face challenges and are getting a runaround, the Taxpayer Advocate Service may help. TAS is an independent organization within the IRS designed to help taxpayers resolve problems. You can contact them by visiting the IRS website and looking for the Taxpayer Advocate Service.

Update your address: Make sure the IRS has your current address. If you’ve moved since filing your return, a missing refund check could be a simple address issue.

Check for offsets: Your refund might have been used to offset debts such as past due federal taxes, state income tax, child support, or student loans. The Bureau of the Fiscal Service’s Treasury Offset Program can provide information if this is the case.

Given the age of your refund claim, it’s crucial to act promptly to resolve any issues, as there may be deadlines that affect your ability to receive your refund. Keep records of all communications with the IRS or any other entities for your reference. Best of luck!

My CPA who is among the most highly regarded in my large city and formerly w IRS helped me timely file to claim refund for 2018 -all paperwork timely. IRS on phone admitted mistake and said I had to use tax advocate who agreed w CPA said my paperwork was 100% compliant. He has been working it for months then told me today the 3-year stature of limitations will bar refund as of Dec 31 2023 according to another IRS agent. How can this be since my CPA and I have been working with IRS who admitted mistakes since last April or May and provided 40 + pages documenting how I filed everything correctly/timely and even showing a copy of my original return/extension stamped “received” by IRS as they accidentally I believe sent me their own file copy at one point.

Hi Sarah, your situation sounds incredibly frustrating and complex, and involving a lengthy resolution process. The three-year statute of limitations for tax refunds generally means that taxpayers have three years from the due date of the original tax return to claim a refund. However, there are important exceptions. The complexity of tax law and the nuances of dealing with IRS procedural errors mean that every detail can be crucial. Working closely with your CPA or even getting a tax attorney involved will hopefully help you navigate this challenging situation effectively. Best of luck and thank you for sharing with our community!

As a person who is still waiting on my 2022 return, I’d say 90 days is a reach.

On the bright side the interest your return builds while still being held by the irs, Could land you a way bigger check.

Also anyone who has not received a refund should get in contact with your State Rep & get connect with a tax advocate to help your case along.

Thank you for sharing Anastacia!

The irs held my return for a year and a half I had the next year’s refund before they disbursed the prior years

Hi Karie, that sounds incredibly frustrating! Hopefully, your future tax processes will be smoother. Thank you for sharing your experience.

I was told 60 days on 2/25/24… on 7/11/24 I was told 21 days. If I hear anything or receive my return by 8/2/24 I’ll let yall know what happens.