Completing required tax documents successfully is important for staying compliant with applicable tax laws and regulations. When you work as an independent contractor, you’ll need different tax forms to be filled out properly.

W9 and 1099 forms are both considered important tax documents for establishing a working relationship between independent contractors and a business.

If you are a small business employer looking to hire contractors, you may be wondering what the differences are between 1099 vs W9. Both W9s and 1099s are tax forms that are required when employers work with an independent contractor. These forms are often seen as the same thing, but they have differences that are important to understand.

This article will explain the distinctions between W9 and 1099 forms; when to use them, and how they work together.

Disclaimer: This guide is provided for informational purposes only and should not be used as a substitute for consulting with a professional accountant for advice on accounting, tax, or financial issues.

Contents:

1. What are W9 and 1099 tax Forms?

2. What is the difference between a contractor and an employee?

- Who is required to fill out a W9?

- What are the tax deadlines for Form W9?

- Advantages of W9 Form for employers

- Disadvantages of W9 Form for employers

- When to issue a 1099

- 1099-NEC vs. 1099-MISC

- Advantages of a 1099 Form for employers

- Disadvantages of a 1099 Form for employers

5. 1099 vs. W9: Key differences

6. How to fill out a W9 and a 1099

7. How to use W9 and 1099 Forms together

9. FAQs

What are W9 and 1099 tax Forms?

W9 and 1099 are both tax forms considered essential documents in the United States to manage tax reporting and compliance for both individuals and businesses.

The distinction between the 1099 and W9 is clear-cut: the contractor completes the W9 form to furnish information to their employing business, which subsequently reports the contractor’s annual earnings on the 1099 form.

What is the difference between a contractor and an employee?

The classification of a worker as either a contractor or an employee is a crucial distinction with significant implications for both the employer and the worker. The primary differences between a contractor and an employee lie in the nature of their relationship with the employer, as well as the level of independence each has over their work.

Contractor

A contractor, often referred to as an independent contractor or freelancer, is typically hired for a specific project or task. The independent contractor is considered a self-employed individual who operates their own business. They maintain a higher degree of control over how they perform their work, including setting their own hours and having the flexibility to take on multiple clients simultaneously. Contractors are responsible for their own taxes, insurance, and benefits.

Employee

On the other hand, an employee works under the direct control and supervision of an employer. Employees are typically subject to a set work schedule and use company-provided tools and equipment. Employers have the authority to dictate how, when, and where employees perform their duties. Employees often receive benefits such as health insurance, retirement plans, and paid time off. Employers are responsible for withholding taxes, providing workers’ compensation, and contributing to Social Security and Medicare on behalf of their employees.

Note: Employers must verify the accuracy of the information of the payee on the W9 form before processing payments, minimizing the risk of errors in tax reporting.

Misclassifying workers can lead to legal and financial consequences, so it’s crucial for employers to accurately determine the status of their workers based on these criteria and adhere to applicable labor laws and tax regulations.

What role does the term ‘independent’ play in the W9 and 1099 process?

The term ‘independent’ is fundamental in the W9 and 1099 process as it signifies the nature of the working relationship. An ‘independent’ contractor is not an employee, and this distinction is vital for tax purposes.

The W9 is the initial step, collecting essential information to confirm this independent status. Subsequently, the 1099 form is utilized to report the income paid to independent contractors, reflecting the unique tax treatment associated with this classification.

What is a W9 Form?

The W9 form, officially titled ‘Request for Taxpayer Identification Number and Certification,’ is a document used in the United States for tax purposes. It is not submitted to the Internal Revenue Service (IRS) but is instead provided by individuals or entities (such as independent contractors, freelancers, or vendors) to businesses or clients.

The primary purpose of the W9 form is to collect the recipient’s taxpayer information, including their name, address, and Social Security Number (SSN) or Employer Identification Number (EIN). The information gathered on the W9 is used by the business to accurately report payments made to the contractors, especially if those payments meet or exceed $600 in a tax year.

Who is required to fill out a W9?

Individuals or entities that receive income from a business or client are generally required to fill out a W9. This includes

- independent contractors,

- freelancers,

- consultants,

- vendors who provide goods or services to a business.

Essentially, anyone who may receive reportable income and is not classified as an employee should complete a W9 when requested by a payer.

What are the tax deadlines for Form W9?

Unlike many other tax forms, there is no specific deadline for submitting a W9 form to the payer. Instead, individuals or entities are typically asked to provide a W9 at the time of entering into a business relationship or before receiving payments. However, it is essential to submit the W9 promptly to ensure accurate and timely reporting of income to the IRS.

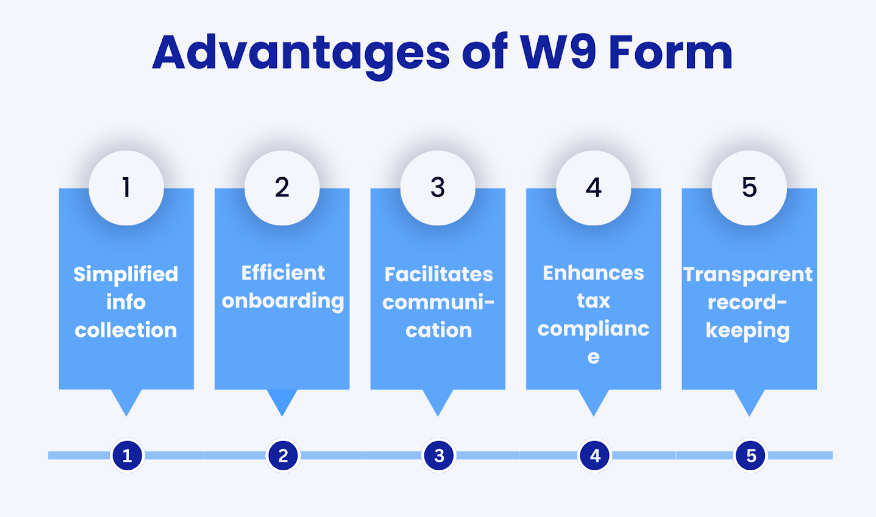

Advantages of W9 Form for employers

The W9 form serves as a valuable tool for employers seeking to streamline their onboarding processes and maintain accurate records of their workforce. Similar to how a car requires routine check-ups, the W9 form ensures the health of the employer’s financial vehicle.

1. Simplified information collection

The W9 form streamlines the process of gathering essential information from independent contractors and freelancers, including their legal name, address, and taxpayer identification number (TIN).

2. Efficient onboarding

Employers benefit from the efficiency of the W9 form in onboarding new contractors. Its straightforward nature expedites the collection of crucial data, allowing for quicker integration into the workforce.

3. Facilitates communication

With accurate information obtained through the W9 form, employers can maintain effective communication with contractors, ensuring that correspondence and documentation align with the contractor’s legal and tax details.

4. Enhances tax compliance

The W9 form plays a pivotal role in ensuring employers comply with IRS regulations. It provides the necessary information to accurately report payments made to contractors, aiding in the issuance of 1099-MISC forms at the end of the tax year.

5. Transparent record-keeping

Accurate bookkeeping practices are essential when preparing W9 and 1099 forms, ensuring that all income and expenses are meticulously recorded for tax reporting purposes.

Having W9 forms on file enables employers to keep transparent and organized records of their independent contractors. This proves invaluable for financial and tax reporting, contributing to overall compliance and accountability.

Disadvantages of the W9 form for employers

While the W9 form is a standard and necessary tool for businesses to collect essential taxpayer information from their non-employee service providers, there are some potential disadvantages for employers. It can be either the risk of legal issues or additional paperwork burdens for small businesses managing their account. Here’s the full list:

1. Risk of legal issues

Relying solely on the W9 form without a comprehensive contract may expose employers to legal issues. Ambiguities in the terms of engagement may result in disputes over payment, deliverables, or other aspects of the working relationship.

2. Additional paperwork may be required

The W9 form requires employers to complete additional documentation, which can be burdensome for small businesses and organizations with limited administrative resources.

One more notable challenge is the administrative burden of collecting and managing W9 forms from a large number of contractors or vendors.

3. Limited information

The W9 form primarily collects basic information such as the recipient’s name, address, and TIN. Employers may find this limited compared to the comprehensive details provided through other employment-related forms like the W4 for traditional employees.

4. No withholding of taxes

Similar to the 1099 arrangement, employers do not withhold income taxes, Social Security, or Medicare from payments made to individuals who submit a W9. This lack of withholding may pose challenges for workers who may not adequately plan for their tax obligations, potentially leading to underpayment during tax filing.

5. Potential for misclassification

Relying solely on the information provided in the W9 form may result in misclassification of workers. Employers need to carefully evaluate the worker’s status to ensure proper classification as an independent contractor rather than an employee, as misclassification can lead to legal and financial consequences.

6. Limited control over work

Independent contractors, as indicated by the submission of a W9, typically have more autonomy in determining their work schedules and methods. This limited control over the details of the work may present challenges for employers who are used to directing employees more closely.

7. Dependency on individual contractors

Engaging workers exclusively through the W9 process may lead to a high dependence on individual contractors. This dependency can be risky if a key contractor becomes unavailable or decides to terminate the relationship, impacting project timelines and overall business operations.

Employers should establish efficient processes for obtaining and organizing W9 forms to mitigate these risks and ensure compliance with tax regulations.

What is a 1099 Form?

The 1099 form is a series of documents used in the United States to report various types of income other than wages, salaries, and tips.

The IRS considers the 1099 form a type of ‘information return’. It’s crucial for documenting income earned by individuals or entities who are not classified as employees. You’ll be issued a 1099 form at the end of the year with the information that was provided on your W9 form. The 1099 form tells the IRS the total income you have earned from the individual or company that hired and paid you. You should receive a 1099 form for anything over $600 in income.

Common 1099 forms include 1099-NEC for non-employee compensation and 1099-MISC for various types of miscellaneous income. These forms are provided by businesses to non-employees and are also reported to the IRS.

When to issue a 1099

A 1099 form should be issued by businesses or individuals who make payments totaling $600 or more in a tax year for services provided by a non-employee, such as independent contractors, freelancers, or vendors. It is essential to issue the 1099 forms to recipients and submit copies to the IRS by the specified deadlines to ensure accurate income reporting.

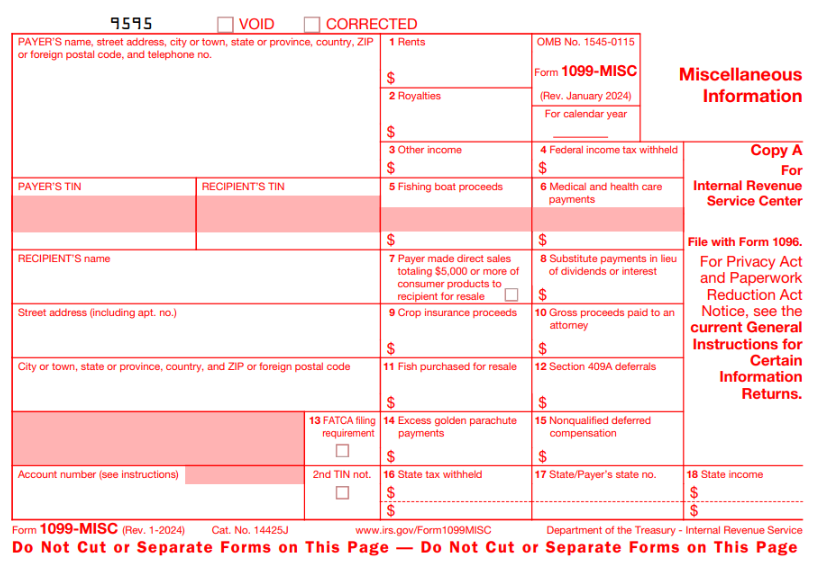

1099-NEC vs. 1099-MISC

The distinction between 1099-NEC and 1099-MISC forms is crucial for businesses when reporting payments made to non-employees, such as independent contractors and freelancers. Both forms serve distinct purposes, and understanding their differences is essential for accurate tax compliance.

1099-NEC (non-employee compensation)

Focus: 1099-NEC is specifically designed for reporting payments made to independent contractors or freelancers for their services. It is the go-to form for businesses to report non-employee compensation.

Amount: Payments totalling $600 or more for services rendered during the tax year are reported on the 1099-NEC. This includes fees, commissions, and any other compensation for services provided by non-employees.

Deadline: The deadline for filing 1099-NEC forms to the IRS and providing copies to recipients is typically January 31st.

1099-MISC (miscellaneous income)

Focus: 1099-MISC, on the other hand, has a broader scope and is used for various types of miscellaneous income.

Amount: 1099-MISC is now primarily used for reporting other types of income, including rents, royalties, prizes, awards, and certain other payments.

Deadline: The deadline for filing 1099-MISC forms to the IRS and providing copies to recipients is also typically January 31st.

In summary, 1099-NEC is dedicated to reporting non-employee compensation, streamlining the process for businesses and ensuring clear documentation of payments made to independent contractors. Meanwhile, 1099-MISC retains its role in reporting various miscellaneous income other than non-employee compensation.

It is crucial for businesses to correctly use each form to comply with IRS regulations and accurately report the different types of payments made to non-employees during the tax year.

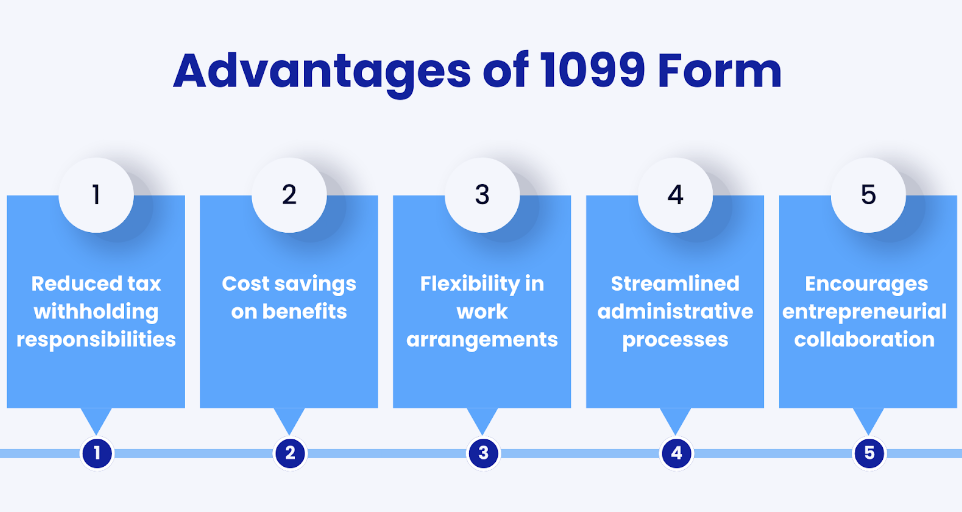

Advantages of a 1099 form for employers

While the W9 form streamlines information collection for onboarding independent contractors, the 1099 form offers employers distinct advantages in terms of classification, cost savings, and flexible workforce management.

Let’s delve into the specific advantages that the 1099 form brings to employers.

1. Reduced tax withholding responsibilities

Employers issuing 1099 forms are not responsible for withholding taxes, allowing for a more straightforward payment process. This can result in cost savings and a simplified payroll system compared to employees subject to tax withholding.

2. Cost savings on benefits

Independent contractors typically do not receive employee benefits such as health insurance, retirement contributions, or paid time off. Employers utilizing 1099 forms can realize significant cost savings by avoiding these additional financial commitments.

3. Flexibility in work arrangements

Engaging independent contractors through 1099 forms provides employers with greater flexibility in hiring temporary or project-specific workers.

This adaptability allows companies to scale their workforce according to project needs without the long-term commitments associated with traditional employment.

4. Streamlined administrative processes

Employers benefit from streamlined administrative processes when using 1099 forms, as they are not required to manage payroll taxes, unemployment insurance, or other compliance-related tasks typically associated with traditional employees. This can lead to increased efficiency in administrative functions.

5. Encourages entrepreneurial collaboration

By utilizing the 1099 form, employers foster a sense of entrepreneurial collaboration with independent contractors.

This arrangement often attracts skilled professionals seeking autonomy and entrepreneurial opportunities, contributing to a dynamic and diverse workforce.

Disadvantages of a 1099 form for employers

While there are benefits to using the 1099 form for certain types of employment arrangements, there are also potential disadvantages for employers. Here are some considerations:

1. Limited control

Employers have less control over independent contractors compared to traditional employees. Independent contractors operate independently, determining their own schedules and methods of completing tasks. This lack of control may lead to challenges in managing and directing the work.

2. No withholding of taxes

Unlike traditional employees, employers are not required to withhold income taxes, Social Security, or Medicare from payments made to independent contractors. This can lead to potential issues for contractors who may not set aside sufficient funds for taxes, and it may result in underpayment when taxes are due.

3. Possibility of misclassification

Incorrectly classifying workers as independent contractors when they should be considered employees can lead to legal and financial consequences. If the IRS or state labour agencies determine that workers were misclassified, employers may face fines and penalties and may be held liable by the IRS to employment taxes for the worker.

4. No access to employee benefits

Independent contractors are not entitled to employee benefits such as health insurance, retirement plans, and paid time off. This can make it challenging for employers to attract and retain top talent, especially in industries where such benefits are highly valued.

5. Potential for turnover

Independent contractors are free to take on projects from multiple clients simultaneously. This lack of exclusivity can result in higher turnover rates, as contractors may be less committed to a single client.

While the use of the 1099 form offers flexibility and cost advantages for employers engaging independent contractors, it is not without its drawbacks.

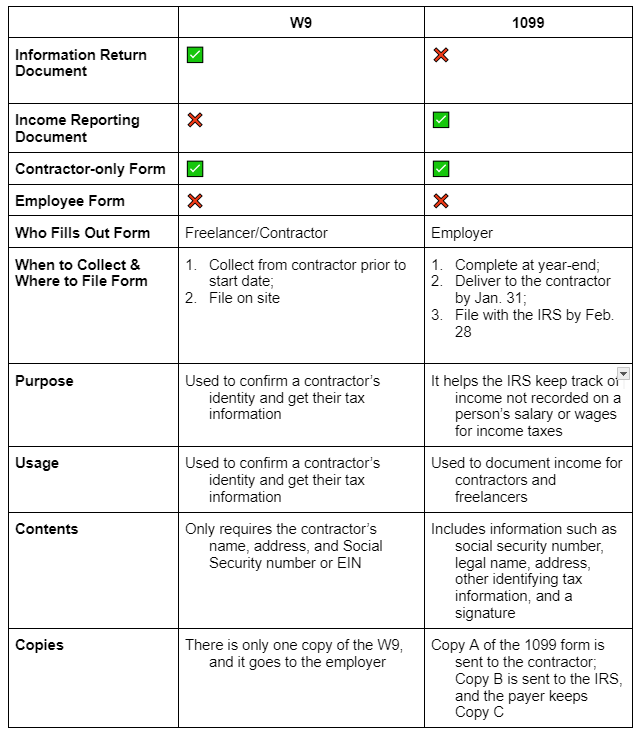

1099 vs. W9: Key differences

As Americans invest approximately 2 billion hours in tax preparation and incur billions in tax-preparation expenses, it becomes advantageous for taxpayers to grasp not only the forms they are completing but also the reasons behind them.

The difference between IRS Forms W9 and 1099 boils down to their roles in tax-related paperwork. W9 is given to contractors for the purpose of collecting personal information, while the 1099 is for reporting wages to the IRS.

W9

The W9 is like a request for the contractors’ ID and tax info, mainly used by businesses or employers, so the contractors’ earnings can be reported at year-end. It’s the starting point for collecting essential details.

1099

1099, on the other hand, is the official income-reporting document that shows how much income contractors got from different sources. It is sent to contractors at year-end (no later than the following Jan. 31), if they earned $600 or more, so they can report and pay taxes on the earnings you paid them. A copy must also be sent to the IRS.

So, the W9 gets your info, and the 1099 keeps track of the money you make, making sure everyone follows IRS rules and reports taxes accurately. It’s crucial for both businesses and individuals to know when and how to use these forms in financial transactions.

How to fill out a W9 and a 1099

Understanding how to navigate IRS Forms W9 and 1099 is crucial for both businesses and individuals involved in financial transactions.

Note: When submitting a W9 or 1099 form, it’s important to ensure that the information provided is in proper order, facilitating efficient processing by the IRS.

How to fill out a W9

- Start by providing your name, business name (if applicable), and tax classification.

- Furnish your TIN or Social Security Number (SSN).

- Indicate whether you are exempt from backup withholding.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed W9 to the requester, such as your employer or the business engaging in transactions with you.

How to fill out a 1099

- Include your information as the payer, providing your name, address, and TIN or SSN.

- Specify the recipient’s details, including their name, address, and TIN or SSN.

- Indicate the type of income being reported (e.g., non-employee compensation, rent, miscellaneous income).

- Enter the total amount paid to the recipient.

- Ensure all information is accurate and up-to-date.

- Submit the 1099 to the IRS by the designated deadline (usually by the end of January).

- Provide a copy of the completed 1099 to the recipient.

- By following these steps, you can navigate the W9 and 1099 forms effectively, ensuring compliance and accurate reporting of income for tax purposes.

How to use W9 and 1099 forms together

The W9 and 1099 forms are interconnected in the process of documenting and reporting income for tax purposes. The W9 is a precursor, providing the payer with the necessary taxpayer information, while the 1099 is the formal record of income paid to the recipient, submitted to both the recipient and the IRS. This process is particularly important for individuals who are not employees but still receive income that needs to be reported for tax purposes.

Learn more about Form W9 from our article: When Is a W9 Not Required? Form W9: What It Is and Why You Need It.

Tips and tricks

Navigating the intricacies of W9 and 1099 forms is crucial for smooth tax compliance. Here are some helpful tips and tricks to streamline the process and ensure accurate reporting:

1. Early communication

Open communication between employers and contractors is key. Encourage the early exchange of W9 forms to avoid delays in processing payments and ensure all necessary information is readily available.

2. Organized record-keeping

Maintain a well-organized system for collecting and storing W9 forms. This can simplify the year-end reporting process and help businesses stay on top of their tax obligations.

3. Utilize accounting software

Use accounting solutions to efficiently manage W9 and 1099 processes. Many tools offer features specifically designed for tax compliance, making it easier to track payments and generate accurate reports.

How can Synder be beneficial to you on a tax matter?

For businesses seeking seamless financial management and effortless synchronization of data, Synder is the solution you’ve been waiting for.

It effortlessly syncs data, making it the ideal companion for small business owners. Whether a business owner is dealing with income reporting, expense tracking, or managing diverse financial aspects, Synder ensures accuracy and efficiency, and provides top-level support.

Don’t miss out on the opportunity to enhance your financial operations. Sign up now for a free trial and gain access to features designed to simplify your financial workflow. Take the next step in optimizing your business processes, and don’t forget to explore the informative Weekly Public Demo for additional insights. Synder – where financial management meets simplicity.

4. Training for HR and accounting teams

Provide training for HR and accounting teams on the proper handling of W9 and 1099 forms. This can reduce the risk of errors and improve overall efficiency in the tax reporting process.

5. Stay informed about deadlines

Be aware of tax deadlines for submitting W9 forms and issuing 1099 forms. Timely submission is crucial for avoiding penalties and ensuring compliance with IRS regulations.

6. Regularly update information

Encourage contractors to update their information promptly if there are any changes. This includes address updates, name changes, or modifications to TIN.

7. Consult with tax professionals

When in doubt, seek advice from tax professionals. Consulting with experts can help businesses navigate complex tax regulations and ensure adherence to the latest updates.

Browse our CPA directory to find accounting experts with ease.

8. Stay informed on tax law changes

Tax laws can change, affecting what you can deduct. Stay informed about any updates that may impact your business by regularly checking IRS articles and publications. This will help ensure that you are aware of the latest regulations and can make informed decisions regarding your tax deductions and obligations.

Feel free to discover more in A Comprehensive Guide on Accounting for Taxes. We hope you find it as informative as this one!

FAQs

1. Who uses a W9 Form?

Businesses, including clients and employers, typically request W9 forms from independent contractors, freelancers, and service providers.

2. Who receives a 1099 Form?

Individuals or entities that receive income outside of traditional employment, such as freelancers, contractors, and investors, may receive a 1099 form.

Read our guide about 1099 form vs W-2 form.

3. Do I need to submit a W9 Form every year?

Generally, you need to submit a W9 each time you start working with a new client or business. It is not required annually unless your information changes.

4. Can an independent contractor refuse to fill out a W9 Form?

While technically possible, refusing to provide a W9 may lead to backup withholding or other complications. It’s in the best interest of the independent contractor to comply with the request to ensure accurate tax reporting.

5. How can homeowners benefit from tax credit on mortgage interest?

To benefit from tax credit on mortgage interest, homeowners should ensure accurate information on their W9 or 1099 forms. This precision is key for eligibility and maximizing available deductions during tax filing.

Continue reading IRS Schedule C: What Schedule C Is and Why You Need This IRS Tax Form.

.png)