All things taxes and employment can be complex, especially when the nuances of forms like the 1099 and W-2 come to the surface. These two forms, though often considered interchangeable, serve distinct purposes and are vital in determining the employment status of individuals. Accounting software usually helps with tax filing, but as a business owner, you need to know all the espects of employment, including the 1099 and W-2.

In this article, we’ll take a quick look at the definitions of 1099 and W-2, their purposes, and the crucial differences between these forms, shedding light on the implications for both businesses and individuals.

What’s 1099 form?

The 1099 form is a document provided by businesses to individuals who are not employees but have provided services on a contractual basis. It’s commonly used for freelancers, consultants, and other independent contractors. Unlike W-2 employees, those receiving a 1099 are considered independent businesses or sole proprietors. The purpose of the 1099 is to report income earned by these independent contractors, providing them with the information needed to file their taxes accurately.

Independent contractors enjoy greater flexibility in their work arrangements, often setting their own schedules and working for multiple clients simultaneously. However, it’s crucial for individuals in this category to be aware of their tax responsibilities, as they are typically considered self-employed.

What’s W-2 form?

The W-2 form is the employee’s counterpart, representing a traditional employer-employee relationship. If you receive a W-2, you’re considered an official employee of the company. This form reports your annual earnings, tax withholdings, and other relevant financial information.

Employers are responsible for issuing W forms to employees by the end of January each year, and individuals use this document to file their income tax returns. The W-2 provides a clear snapshot of an individual’s financial activity within the context of their employment.

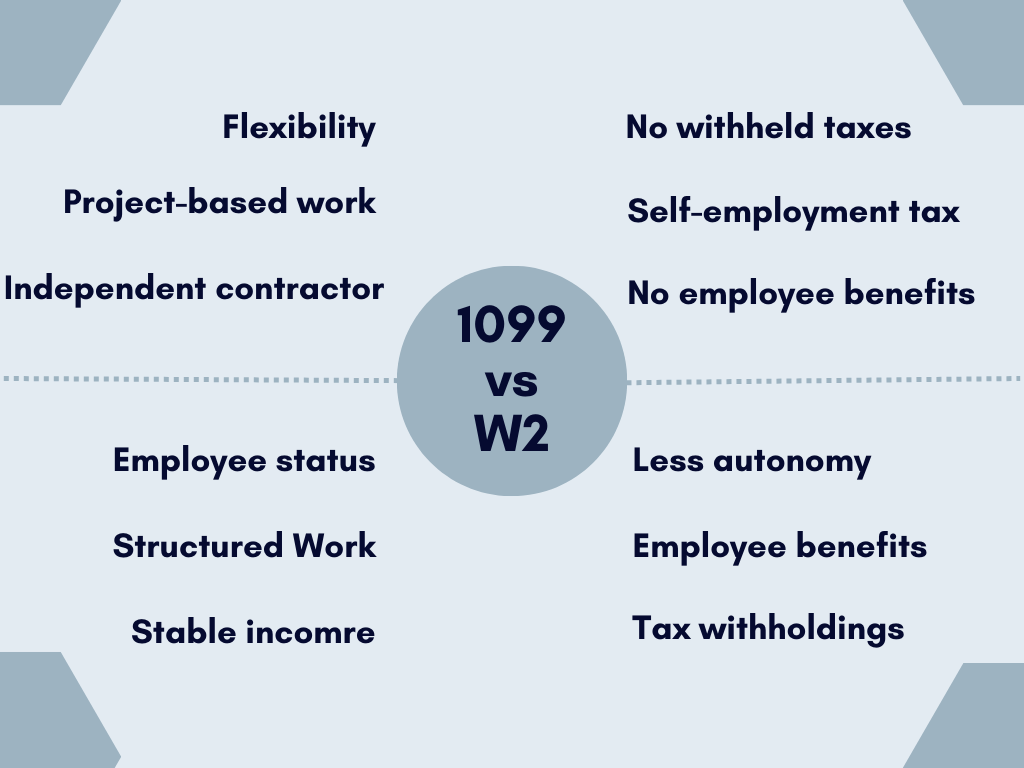

The differences between 1099 & W2 forms

The distinction between the 1099 and W-2 forms becomes even more pronounced when viewed from the perspectives of both the employer and the employee.

From the business’s (employer’s) angle

- 1099 (Independent Contractor)

Employers engaging independent contractors benefit from flexibility in their workforce. They can tap into specialized skills on a project basis without the long-term commitments associated with hiring employees. Additionally, businesses issuing 1099 forms are not responsible for withholding income taxes or paying Social Security and Medicare taxes. This flexibility allows employers to streamline their operations and manage costs effectively. - W-2 (Employee)

Employers providing W-2 forms signify a more traditional employer-employee relationship. In this scenario, businesses have greater control over the work schedules and methods of their employees. While this may reduce the flexibility of the workforce, it allows for more direct oversight and management. Employers are responsible for withholding income taxes and contributing to Social Security and Medicare on behalf of their employees. This approach provides a structured system that ensures tax compliance throughout the year.

From the perspective of an employee

- 1099 (Independent Contractor)

Individuals receiving a 1099 operate as independent business entities. This status offers increased autonomy and flexibility in choosing projects, setting work hours, and determining work methods. However, the trade-off is that contractors are responsible for managing their own taxes, including self-employment tax. They also lack access to traditional employee benefits like health insurance, retirement plans, and paid time off. - W-2 (Employee)

Receiving a W-2 indicates an employee-employer relationship, where individuals work under the direction and control of their employer. While employees enjoy the security of a stable income and access to benefits such as health insurance and retirement plans, they have less control over their work schedules and methods. Taxes, including income tax and Social Security/Medicare taxes, are automatically withheld from their paychecks, simplifying the tax process but reducing immediate take-home pay.

Considerations for employers / employees

For employers, the choice between engaging independent contractors or hiring employees depends on the nature of the work, the need for specialized skills, and the level of control required. Employees may provide stability, but independent contractors offer flexibility.

Employees, on the other hand, must consider their preferences for work autonomy, benefits, and tax responsibilities. Independent contractors may enjoy more freedom but should be prepared for the complexities of managing their own taxes and lack of traditional employment benefits. In contrast, employees benefit from a structured work environment but have less control over their work arrangements.

Understanding these differences is crucial for both employers and employees to make informed decisions that align with their business goals or personal preferences.

Explore the difference between W-9 and 1099 Forms.

How to distinguish between 1099 & W2

Distinguishing between these two forms is critical for both individuals and businesses. Here are key characteristics to help you identify whether you’re working as an independent contractor (1099) or an employee (W-2):

- Control and independence

Contractors have more control over how and when they perform their work. - Training and equipment

Employees often receive training and use company-provided equipment, while contractors use their tools. - Expense responsibility

Contractors generally handle their own business expenses, while employers cover expenses for employees.

Understanding these distinctions is vital to prevent misclassification and ensure compliance with tax laws. Misclassifying workers can lead to legal repercussions for businesses and financial challenges for workers. Always be aware of the terms and conditions of your working relationship.

The role of payroll tax in 1099 & W2 scenarios

Business payroll tax is a critical aspect of both the 1099 and W-2 scenarios, influencing businesses and individuals alike.

- For businesses issuing 1099 forms, they’re not required to withhold income taxes or pay Social Security and Medicare taxes. Instead, contractors are responsible for paying their own employee federal taxes, often through quarterly estimated tax payments. This can be an adjustment for those used to the convenience of automatic withholdings.

- In contrast, businesses issuing W-2 forms must withhold federal and state income taxes, along with Social Security and Medicare taxes, from employees’ paychecks. Employers also contribute a matching amount for Social Security and Medicare taxes. This automatic withholding system simplifies the tax process for employees, ensuring that their tax obligations are met throughout the year. It’s a structured approach that aids in avoiding end-of-year surprises.

Understanding the implications of payroll taxes is crucial for both businesses and individuals. For businesses, it’s about compliance with tax regulations and fulfilling their obligations as employers. For individuals, it’s understanding the impact on their take-home pay and ensuring they have adequate funds set aside for tax liabilities.

Tax returns for a 1099 / W2 employee

Regardless of employment status, proper tax planning is essential. At this point, understanding the nuances of tax returns is critical for individuals operating under both 1099 and W-2 scenarios. The differences in tax obligations stem from the nature of the employment relationship, and each form comes with its own set of considerations. Let’s have a quick overview of those.

Tax return considerations for an employee operating under the 1099 form include:

- Responsibility for self-employment tax

- Independent contractors are responsible for paying their self-employment tax, which covers Social Security and Medicare contributions. This tax is in addition to income taxes. You calculate it on the net earnings from self-employment.

- Quarterly estimated tax payments

- Unlike W-2 employees who have taxes automatically withheld from their paychecks, 1099 contractors make quarterly estimated tax payments to the IRS. Failure to do so can result in penalties and interest.

- Deductions for business expenses

- One advantage for an independent worker is the ability to deduct legitimate business expenses. These include costs related to equipment, travel, home office, and other necessary expenses incurred in the course of doing business.

- Tax forms

- Form 1040: Independent contractors report their income and deductions on the standard Form 1040.

- Schedule C: Contractors must complete Schedule C to detail their business income and expenses.

- Schedule SE: To calculate self-employment tax, contractors use Schedule SE.

Now, let’s look at what a W2 employee should consider about their tax returns:

- Automatic tax withholdings

- W-2 employees benefit from automatic tax withholdings by their employers. Income taxes, Social Security, and Medicare taxes are deducted from each paycheck, simplifying the tax process.

- Access to employee benefits

- W-2 employees may enjoy various employee benefits such as health insurance, retirement plans, and other perks. These benefits can impact the overall taxable income and tax liabilities.

- Limited deductions

- Unlike independent contractors, employees have limited opportunities for tax deductions. However, they may still be eligible for some, such as those related to student loan interest or certain work-related expenses.

- Tax Forms:

- Form 1040: W-2 employees report their income and applicable deductions on Form 1040.

- W-2 Form: Employers provide employees with a W-2 summarizing their annual earnings and tax withholdings.

- Additional schedules: Depending on individual circumstances, employees may need to complete those, such as Schedule A for itemized deductions, for example.

In both cases, understanding the tax implications of 1099 and W-2 forms is critical for handling finances healthily. Seeking the guidance of tax professionals can provide tailored advice based on individual circumstances, ensuring compliance with tax laws and optimizing the overall tax position.

Pros and cons of independent contractor status (1099)

Becoming an independent contractor comes with its set of advantages and challenges. Let’s explore the pros and cons:

Advantages

- Flexibility

Contractors have the flexibility to choose their projects and working hours. - Tax deductions

They can deduct business expenses, potentially reducing their taxable income. - Diverse income sources

Contractors can work with multiple clients simultaneously, diversifying their income streams.

Disadvantages

- Inconsistent income

Income may fluctuate, with periods of feast and famine. - No benefits

- Contractors don’t typically receive employee benefits like health insurance or retirement plans.

- Tax complexity

Managing self-employment taxes can be more complex and requires discipline.

Understanding these aspects is crucial for individuals considering independent contractor status. While the freedom and flexibility can be appealing, it’s essential to weigh these against the potential challenges.

Pros and cons of employee status (W-2)

Being an employee also has its share of advantages and disadvantages.

Advantages

- Stable income

Employees enjoy a more stable and predictable income - Benefits

Health insurance, retirement plans, and other benefits are often provided by employers. - Less tax complexity

Taxes are automatically withheld, simplifying the process.

Disadvantages

- Less flexibility

Employees have less control over their schedules and work assignments. - Limited tax deductions

Deductions available to employees are often more limited. - Dependence on a single employer

Job security is tied to the employer’s decisions.

Choosing employee status offers stability and benefits but may limit some aspects of professional freedom. Individuals should carefully consider their priorities and preferences when making this decision.

How to avoid misclassification

Misclassifying workers as independent contractors or employees can have serious legal and financial consequences for businesses. To avoid misclassification, businesses should:

- Understand the criteria

Be aware of the factors that distinguish independent contractors from employees. - Use clear contracts

Clearly outline the terms of the working relationship in contracts. - Seek professional guidance

Consult legal and tax professionals to ensure compliance with regulations.

For individuals, it’s essential to understand their rights and responsibilities based on their employment status. If uncertain, seeking professional advice can provide clarity and prevent potential issues down the line.

Conclusion

In conclusion, comprehending the distinctions between the 1099 and W2 forms is pivotal for businesses and individuals. The crux lies in the employment relationship and the subsequent ramifications for tax returns, financial statements, and overall financial well-being.

The independent contractor, as reflected in the 1099 form, epitomizes flexibility and autonomy, offering businesses a dynamic pool of specialized skills without the long-term commitments of traditional employees. What businesses might appreciate is the amount of control you have over them (independent contractors), which might differ from that over a worker with a W-2. Strategic decisions about workforce composition impact tax liabilities, compliance, and financial health.

Conversely, for individuals, the employment status – whether as an independent contractor or an employee with a W-2 – profoundly influences tax returns. Independent contractors navigate the complexities of self-employment tax and should track income and expenses diligently, leveraging a tax calculator app and seeking professional guidance. On the other side, employees benefit from automatic tax withholdings, access to traditional benefits, and a more structured work environment. In both scenarios, informed decisions during tax planning, understanding the implications for financial statements, and seeking guidance from tax professionals serve as indispensable cornerstones for navigating the intricate landscape of 1099s and W-2s.

Ultimately, the pathway chosen, whether as an independent contractor or an employee, shapes the financial trajectory for both businesses and individuals, highlighting the significance of mastering the nuances within these critical tax forms.

%20(1).png)