In today’s digital era, online businesses are constantly seeking innovative solutions to streamline their financial operations. One such solution gaining significant popularity is the Cash App business account. This article aims to explore the benefits and features of a Cash App business account, providing valuable insights for entrepreneurs looking to optimize their payment processes.

Understanding Cash App for Business

A Cash App business account is a digital payment solution provided by Cash App, a popular peer-to-peer payment platform developed by Square Inc. It enables businesses to send money and accept payments, create invoices, and manage transactions seamlessly. It serves as a dedicated account for business-related transactions, keeping them separate from personal finances.

Differentiating between personal and business accounts is crucial for maintaining financial clarity. While personal accounts are suitable for individual users, a Cash App business account offers tailored features and benefits to support online businesses. With a business account, you can enjoy specialized functionalities like invoicing, transaction tracking, and customized reports.

Benefits of using Cash App for Business

The first benefit will be streamlined payment processing and invoicing. With a Cash App business account, online businesses can seamlessly send and accept payments, simplifying the payment process for both the company and its customers. In addition, invoicing features allow for professional and customizable invoices to be generated and shared effortlessly.

Secondly, enhanced financial tracking and reporting features. Cash App business accounts provide robust cash flow tracking tools, allowing businesses to monitor their transactions, view transaction histories, and generate comprehensive reports. This facilitates better financial management, budgeting, and decision-making.

Thirdly, cost-effective transactions and reduced fees, since Cash App offers competitive transaction fees compared to traditional payment methods, making it an economical choice for businesses. Lower fees can result in significant savings, particularly for companies with a high volume of transactions.

Next, accessibility and convenience for both businesses and customers. Cash App is widely used and easily accessible, making it convenient for businesses to connect with a large customer base. Customers can make payments quickly using the app, enhancing the overall customer experience and boosting customer satisfaction.

And finally, integration with other business tools and platforms. Cash App integrates seamlessly with various accounting and bookkeeping software, facilitating efficient data synchronization and reducing manual data entry. This integration streamlines the financial processes, saving time and minimizing errors.

Setting up a business account

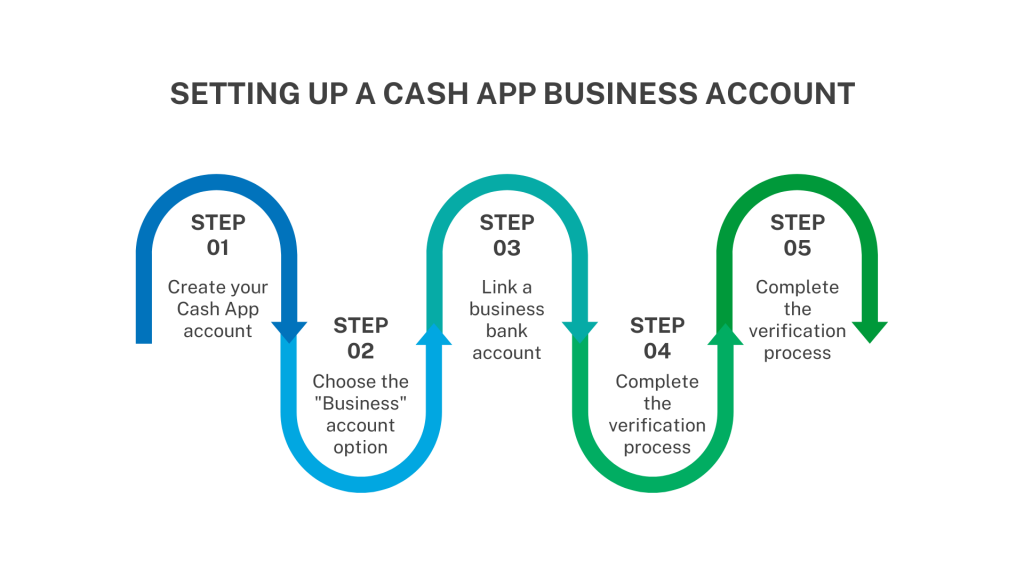

Setting up a Cash App business account is a straightforward process that allows you to start leveraging its features for your business transactions. Follow these step-by-step guidelines to create your Cash App business account:

If you’re a new Cash App user

1. Sign up for a Cash App account:

Create your Cash App account by entering your email address or mobile phone number. Follow the on-screen instructions to complete the initial setup.

2. Choose the “Business” account option:

During the business account registration process, Cash App will ask you to select the type of account you want to create. Choose the “Business” option to create a Cash App business account. Provide the necessary details about your business, such as its name, address, and contact information, to finish the creation of your Cash App account.

3. Link a business bank account:

You need to link a valid business bank account to your Cash App business account to facilitate transactions and transfers. Follow the prompts to add your business bank account information securely. Cash App will verify the account by making a small deposit or withdrawal, which you’ll need to confirm.

4. Complete the verification process:

Cash App may require additional verification for your account to ensure compliance with regulations and protect against fraud. Follow the instructions to verify your identity, which may involve providing personal identification documents (e.g., driver’s license, passport) and answering security questions. Wait for Cash App to review and approve your verification. This process usually takes a few business days.

5. Configure account settings:

Once your Cash App business account is set up and verified, navigate to the account settings within the app. Customize your business profile by adding a profile picture, business logo, and any additional information you want to display. Set up notifications and preferences for transaction alerts, balance updates, and other account-related communications.

Congratulations! You have successfully set up your Cash App business account. Now you can start utilizing its features to send and receive payments, create invoices, and manage your business transactions efficiently.

Note: Can you have multiple Cash App accounts? Yes, as long as each account is associated with a different email address and phone number.

If you already have a Cash App account and want to switch it to a business account:

Go to your Cash App personal account → Profile by clicking on the icon in the upper right corner. Tap on Edit Profile under your name. Scroll to the bottom and click on the “Switch to a business account” → “Change This Account”. Accept the confirmation message from Cash App and link your account to your business bank account. And that’ll be it!

Note: Without verification you’ll be limited to $250 in transactions per day and $1,000 in transactions per month, so make sure to not skip this step.

Best practices for using Cash App

Establish clear payment policies and guidelines

It helps to ensure a smooth payment process, both for your business and your customers. By clearly defining your accepted payment methods, due dates, and any penalties for late payments, you can minimize payment-related issues and promote transparency in your transactions.

Promote the use of Cash App among customers

Educating your customers about the benefits of using Cash App for payments can encourage them to adopt this convenient and secure payment method. You can increase customer adoption of Cash App as a preferred payment option by highlighting the advantages, such as faster transactions and enhanced security.

Utilize additional Cash App features for marketing and promotions

Cash App offers additional features, such as Boosts, which provide exclusive discounts and cashback opportunities. Leveraging these features strategically can attract customers to your business and incentivize them to choose your products or services over competitors.

Leverage invoicing and payment reminders

Cash App’s invoicing feature allows you to create professional and customized invoices. By utilizing this feature, you can streamline your invoicing process and ensure that your customers receive clear and detailed payment requests. Additionally, setting up automatic payment reminders can help reduce late payments and improve cash flow.

Communicate with Cash App customer support

If you encounter any issues or have questions related to your Cash App business account, reaching out to Cash App’s customer support can provide you with assistance and guidance. Their expertise can help resolve any account-related concerns and ensure a smooth user experience.

Stay updated with Cash App’s terms and policies

Being familiar with Cash App’s terms of service and privacy policy is crucial for compliance and understanding the platform’s rules and regulations. Regularly reviewing these terms and policies allows you to stay informed about any updates or changes that may impact your Cash App business account.

Common issues and troubleshooting

Transaction delays or failures

Transaction delays or failures may occur during payment processing. Ensure a stable internet connection and sufficient funds in your account. Contact Cash App support if the issue persists.

Disputes or unauthorized transactions

Report any unauthorized transactions or disputes to Cash App customer support. Provide transaction details and evidence for investigation and resolution.

Issues with verification

If you encounter challenges during the verification process, ensure accurate information and documentation.

Technical glitches or app errors

Resolve technical glitches or app errors by closing and reopening the app, updating to the latest version, or clearing cache. Seek technical assistance if the problem persists.

Conclusion

As businesses increasingly embrace digital payment solutions, a Cash App business account offers numerous advantages to streamline financial operations. With its user-friendly interface, cost-effective transactions, and robust features, Cash App empowers entrepreneurs to efficiently manage their payments and focus on growing their business. By utilizing a Cash App business account, businesses can enhance their financial management, provide a seamless payment experience for customers, and position themselves for success in the digital marketplace.

Whether you’re a small business owner, freelancer, or entrepreneur, considering a Cash App business account can revolutionize your payment processes, improve efficiency, and ultimately contribute to the growth and success of your business. Embrace the power of digital transactions with Cash App and unlock the full potential of your business.

Read our articles about What is a Prenote and Form 944.