Accurate and timely payroll tax reporting is essential for small businesses. It doesn’t only ensure compliance with the Internal Revenue Service (IRS) regulations but also helps them maintain financial stability. However, the complexity of payroll tax management can be overwhelming, especially for businesses with limited resources and personnel.

Fortunately, the IRS offers Form 944 as a simplified alternative to traditional payroll tax forms, easing the burden for small businesses. In this article, we’ll explore the benefits of tax return Form 944 and provide a comprehensive guide for small business owners on how to manage their payroll tax reporting effectively.

This article has been prepared for informational purposes only and gives a general overview of Form 944. We recommend consulting with a tax professional or accountant specializing in small business taxes to clarify complex tax regulations and ensure your business fully complies with the IRS requirements.

Contents:

2. When should I submit Form 944?

5. Common mistakes to avoid when you file Form 944

6. Consequences of non-compliance with Form 944

7. Simplify your tax season: Ultimate tips and tricks for completing Form 944

8. FAQ

What is IRS Form 944

IRS Form 944, also known as the Employer’s Annual Tax Return, serves as a crucial document for small employers in the United States, enabling them to report essential details with the IRS regarding their employment taxes.

One of the reasons Payroll Tax Form 944 is so popular for filing tax returns is its applicability to small business employers with an annual payroll tax liability of $1,000 or less. Small businesses are eligible to file Form 944 only once a year.

Note: If you have doubts regarding your eligibility, you may examine the guidelines issued by the IRS or reach out to them directly to seek clarification.

Form 944 allows eligible businesses to report details about:

- Total wages of the employees;

- Total income of the employees;

- Federal income tax total taken from pay;

- Both the employer’s and employee’s part of FICA tax withholdings (deductions to Social Security and Medicare);

- Credits for sick and family leave wages;

- Retention Credit for Employees.

This streamlined reporting process not only reduces administrative burden but also provides small business owners with more time to focus on their core operations which wins out over other forms.

Learn more about payroll taxes for an employer and prenote.

When should I submit Form 944?

The deadline for filing the Form 944 return is January 31 of each year. It’s crucial for employers to submit Form 944 on time to avoid any late filing penalties.

Note: Be aware that the filing deadline is generally January 31 of the following year. For example, if you’re reporting for the 2023 tax period, you need to file Form 944 by January 31, 2024. If this date is on a weekend or holiday, file by the next business day.

Benefits of Form 944

Consolidated reporting

Form 944 simplifies payroll tax reporting by consolidating various tax components into a single annual filing. With Form 944, small businesses can report federal income tax withholding, Social Security, and Medicare taxes together. This consolidation makes reconciling and verifying tax info easier. Instead of juggling multiple forms and deadlines, small business owners can focus on preparing one comprehensive form.

Note: Businesses are responsible for handling insurance matters separately from the information reported on Payroll Tax Form 944.

Reduced filing frequency

Instead of filing quarterly, eligible businesses only need to file Form 944 once a year. By reducing the frequency of tax filings, small business employers can redirect time and resources toward their core day-to-day business activities.

Moreover, if you opt to use payroll services, you can expedite the entire process even further. Payroll services automate calculations, generate necessary reports, and facilitate tax compliance.

Tax deposits flexibility

Seasonal businesses or those with fluctuating income may find Form 944 advantageous. Form 944 allows small businesses to deposit their payroll taxes throughout the year. Instead of making regular deposits, businesses can make payments when their tax liability reaches a certain level. It provides greater flexibility in managing federal tax obligations.

For example, if a business’s tax liability is relatively low in the earlier months of the year, it can defer deposits until they accumulate a sufficient amount.

Support for small business growth

By simplifying the tax filing process and reducing administrative burdens, Form 944 supports the growth of small businesses. This enables employers to focus on expanding their operations rather than getting bogged down by complex tax requirements.

Lower administrative costs

With fewer filings throughout the year, eligible employers can save on administrative costs related to preparing and submitting quarterly tax returns. This is particularly advantageous for small businesses with limited resources.

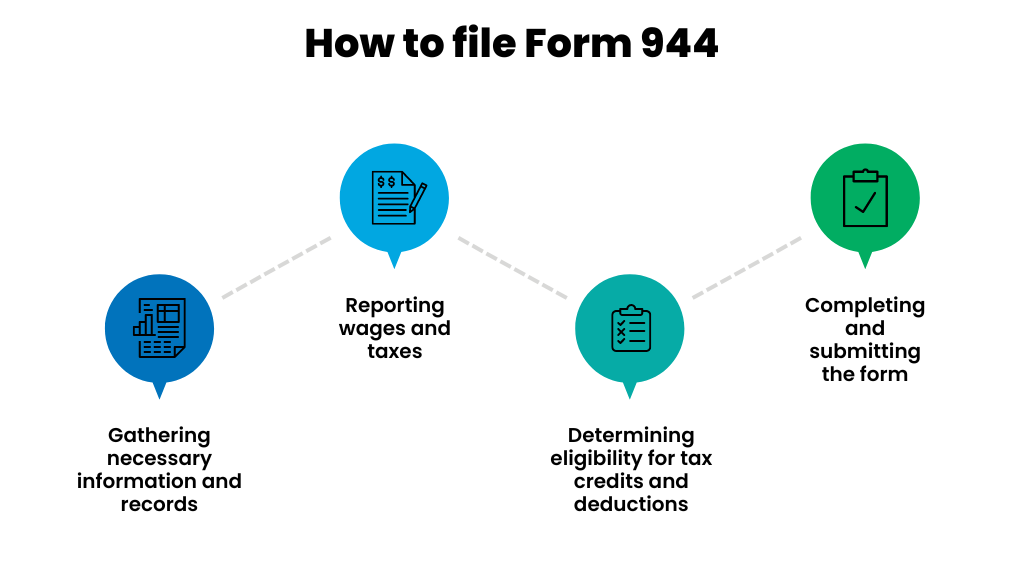

How to file Form 944

This article has been prepared for informational purposes only and gives a general overview of Form 944. We recommend consulting with a tax professional or accountant specializing in small business taxes to clarify complex tax regulations and ensure your business fully complies with the IRS requirements.

Step #1. Gathering necessary information and records

The first step in filing Form 944 is to collect all relevant payroll data and records. This includes information on employee wages, tips, and other compensation, as well as federal income tax withholding, Social Security, and Medicare taxes.

Ensure that you have accurate and up-to-date records for each employee.

Step #2. Reporting wages and taxes

Make sure to calculate and report the total wages paid and taxes withheld for each employee. The IRS has guidelines to help you figure out what wages are taxable and how to do the payroll taxes correctly.

When completing Payroll Tax Form 944, be really careful that each entry is accurately placed on the designated line for proper reporting while recording wages. Double-check your math to avoid errors or discrepancies. It’s crucial to include accurate information on both total wages paid and taxes withheld to ensure compliance.

Step #3. Determining eligibility for tax credits and deductions

When filing Form 944 lines, it’s beneficial to explore potential tax credits and deductions for your business. Examples include the Work Opportunity Tax Credit (WOTC) and the Employee Retention Credit (ERC). These incentives can reduce your total tax liability. To take advantage of these opportunities, confirm your eligibility and include the relevant info in your Form 944 submission.

Make sure to follow the IRS guidelines and meet the specific requirements for each credit or deduction to ensure accurate and compliant reporting.

Step #4. Completing and submitting the form

Once you’ve gathered all the needed info and calculated total wages and taxes, fill out each line of Form 944 carefully and clearly. Make sure to enter the correct figures in each box and double-check for any errors or omissions.

Note: Keep in mind that Form 944 is an annual filing, so pay attention to the tax year indicated on the form. Once the form is completed, sign and date it before submitting Form 944 to the IRS.

Common mistakes to avoid when you file Form 944

Misclassifying employees

It’s crucial to correctly classify employees and independent contractors to avoid penalties and ensure compliance with tax regulations. Misclassifying employees as independent contractors can lead to penalties and legal consequences.

The IRS provides guidelines to determine worker classification. Review these guidelines and consult with a tax professional if you need any guidance on how to classify your workers.

Note: Employers must keep accurate records of employee work locations, whether they are at a centralized office or working from home, for accurate reporting on Form 944.

Incorrect tax calculation

To prevent incorrect tax calculations, it’s crucial for businesses to carefully review the instructions form provided by the IRS and double-check their calculations before submitting Form 944.

By taking the time to verify their math in the IRS form, businesses can mitigate the risk of errors in tax calculations and avoid unnecessary complications with the IRS. Use reliable payroll software or consult a professional to calculate payroll taxes accurately.

Not keeping adequate records

Incomplete or inaccurate records can lead to errors in reporting income, deductions, and federal tax liability, which may result in the IRS penalties or audits coming out of the box. Adequate accounting records should include detailed information about total wages, benefits, and taxes withheld for each employee, as well as any adjustments or credits applicable to your business.

To streamline this process and avoid such mishaps, consult with a professional accountant to set up an effective payroll software for record-keeping that tracks financial transactions and payroll information throughout the year, and is tailored to your business needs. Regularly reconcile your records with bank statements to ensure accuracy and compliance with the IRS regulations.

Synder seamlessly integrates with various accounting platforms, automating tax calculations and ensuring precise reporting. Sign up now for a 15-day free trial in Synder and empower your business with a smarter and more effective approach to payroll tax compliance. Join our Weekly Public Demo to explore its benefits firsthand.

Note: If you identify errors after submitting the initial report, you can use the amendment form to correct any inaccuracies on Payroll Tax Form 944.

Ignoring changes in tax rates and regulations

Staying informed about amendments in tax laws to make timely adjustments ensures compliance with the latest requirements when filing Form 944. Ignoring these updates can lead to inadvertent non-compliance, potentially resulting in penalties.

Tax laws frequently undergo changes throughout the year. To prevent this mistake, businesses should be proactive and monitor the IRS publications, regularly check for updates on the official IRS website, subscribe to their newsletters or notifications, and consult with tax professionals to stay up to date.

Consequences of non-compliance with Form 944

To comply with tax regulations, businesses must ensure the completion and submission of tax returns on time each year. Non-compliance with Form 944 can result in various negative consequences for businesses. Failure to file the return by the specified deadline may result in penalties imposed by the IRS: fines for late filing, interest on unpaid taxes, and potential legal actions.

Additionally, non-compliance can trigger audits, investigations, and increased scrutiny from tax authorities, potentially leading to a strain on the business’s financial resources and reputation. It’s crucial for businesses to adhere to federal tax obligations, including the timely and accurate submission of Form 944, to avoid these adverse consequences.

Simplify your tax season: Ultimate tips and tricks for completing Form 944

Now that we’ve covered some of the most common mistakes to avoid, let’s shift our focus to tips & tricks. By delving into these useful recommendations, you’ll equip yourself with the knowledge needed to sidestep potential errors.

Stay updated with the IRS guidelines

Regularly review the IRS website, publications, and other resources to stay informed about tax regulations, instructions form updates, and deadline changes. The IRS provides resources and guidelines specifically tailored for small businesses to help employers navigate the requirements of Form 944.

Use reliable payroll software for the IRS 944 Form

Consider using payroll software or outsourcing payroll services to simplify the process and reduce the risk of errors. Payroll software can automate calculations, generate reports, and assist with tax compliance. Alternatively, outsourcing payroll to a trusted provider can ensure accuracy and relieve the administrative burden associated with payroll tax reporting.

Check the list of payroll apps for small businesses.

Seek professional guidance for the IRS 944 Form

To be on the safe side with your payroll tax reporting, it’s not enough to look through the IRS instructions form, you need to consult with a tax professional or accountant who specializes in small business taxes. They can check whether employers have been keeping accurate payroll records throughout the year, provide guidance, clarify complex tax regulations, and ensure compliance with the IRS requirements. Investing in professional advice can save you time, minimize errors, and potentially optimize your federal tax obligations.

Why are the IRS 944 Form copies a must?

It’s advisable for businesses to retain copies of their filed Form 944 as part of their tax return records. These records can be valuable in case of future audits or inquiries related to the annual tax return.

Conclusion

Form 944 significantly benefits small business employers by simplifying the payroll tax reporting process. Small business owners can effectively manage their payroll taxes and reduce administrative burdens by understanding the eligibility criteria, following the IRS instructions form, and avoiding common mistakes.

Staying compliant with Form 944 not only helps businesses avoid penalties but also ensures financial stability and peace of mind.

Embrace the advantages of Form 944 and streamline your payroll tax management for a successful and compliant small business. Remember, accurate and timely payroll tax reporting is essential to running a small business and maintaining a healthy relationship with the IRS.

FAQ

Who can sign Form 944?

Employers eligible for federal Form 944 must have $1,000 or less in annual payroll tax liability.

Where do you file Form 944?

Where your organization is located determines where you’ll send your completed Form 944. The amount of taxes you owe will also determine whether or not you need to send payment when you file.

To submit Form 944 send it to the appropriate address provided in the instructions form. It’s advisable to check the most recent IRS guidelines or consult a tax professional for the latest information on where to send Form 944.

How can I send Form 944?

Submitting Form 944 is a straightforward process. The IRS provides two options for employers to file Form 944.

Employers can file their Form 944 return electronically using tax preparation software, a tax professional, or e-file providers. Alternatively, for those who prefer a traditional approach, you can complete Form 944 and submit a paper return by mail. The choice of submission method depends on the preference and convenience of the business owner.

What is the difference between 941 and 944 forms?

The main difference between IRS Form 941 and 944 is the frequency of submission. Form 941 is filed quarterly. On the other hand, Form 944 is an annual form. It simplifies the reporting process by allowing eligible employers to file and pay their federal taxes once a year instead of quarterly.

Can loans simplify small business payroll tax reporting?

In the context of Payroll Tax Form 944, small businesses may find relief through various loans programs that aim to ease financial burdens associated with payroll taxes. During challenging economic times, government initiatives like the Paycheck Protection Program (PPP), may provide eligible businesses with forgivable loans to cover payroll costs, including taxes.

%20(1).png)

Excellent article! Was helpful to learn about tax forms.