In 2020 the US government launched the Paycheck Protection Program. It included a money aid, or PPP loan, for small businesses to cover payroll expenses when no revenue hits the balance. It was deployed as a fully-forgiven financial aid to retain employment (without hourly wage reduction). And provided you applied for a PPP loan and met all the requirements, you aren’t responsible for any payments.

As of February 2021, the SBA had approved 6,913,622 PPP loans totaling $640.3 billion. Unfortunately, not all the businesses that applied for and received PPP loans managed to fulfill those conditions. Some requirement details for PPP loan forgiveness were confused or misunderstood (now, things got clarified).

As of 2022, businesses can no longer apply for the Paycheck Protection Program. However, those who got the loan back in 2020 and 2021 can still have their PPP loans forgiven.

This article will give you an overview of the PPP loan forgiveness statements and requirements. You’ll understand better what these updates can mean for your business, and, hopefully, find out the answer to the question: “Will I have to pay anything for my PPP loan?”

Here’s what you’ll learn about the paycheck protection program and the loan forgiveness in 2022:

1. Let’s recall what the PPP loan is

2. Are business expenses paid with PPP loans deductible?

3. New PPP loan requirement in 2022

4. Three main PPP loan forgiveness rules

5. Update on business costs eligible for PPP loan forgiveness

6. How to apply for PPP loan forgiveness?

Let’s recall what the PPP loan is

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) established a Paycheck Protection Program (PPP) on March 27, 2020. The program aimed to provide covered loans — 100% guaranteed — to assist businesses adversely affected by the Coronavirus Disease 2019 (COVID-19) and help keep people at work. The Small Business Administration (SBA) announced that PPP loans would have a two-year term at a 1% interest rate and that PPP loan payments would be deferred for six months. A great deal during hard times!

In 2021, the SBA approved over a million PPP loans totaling $115.3 billion. Despite the immense popularity of the Paycheck Protection Program, a lot of criticism has followed since the day of enablement. Most complaints were rooted in the lack of transparency and understanding of the protection program loan eligibility (there were some reports of fraud cases).

Another problem with the Paycheck Protection Program was unclear IRS policies on tax deductions. Many complaints were connected to allegedly prioritizing larger enterprises in funds rather than small businesses. Luckily, the government passed amendments to PPP legislation in 2021. They finally clarified the most painful points in the loan program rules.

As of February 2021, the main changes PPP loan guidelines had gone through were:

- forgiven PPP loans aimed at more funding to small businesses and sole proprietors;

- acknowledging PPP loans as income-tax-free;

- accepting tax deductions on the expenses covered with loans;

- giving Employee Retention Credit to businesses with PPP loans;

- allowing the second draw of a PPP loan.

Any small business could be eligible for obtaining resources provided within the frames of the Paycheck Protection Program. The loan-covered period comprised either 24 or 8 weeks, during which they could rely on the funds to cover their payroll costs. Moreover, SMBs that used these funds to keep their employees at work during the whole payroll-covered period were eligible for loan forgiveness (We’ll delve into loan forgiveness rules a bit further).

Probably, the most outstanding issue with the Paycheck Protection Program was the deductibility of expenses paid for with the forgivable loan. Let’s take a closer look at it in the next chapter.

Are business expenses paid with PPP loans deductible?

The short answer is YES. But the true story is a bit longer than that. Let’s dive into the details.

The PPP loan forgiveness has been a hotly discussed topic on Capitol Hill since the CARES Act came into action. Previously, businesses couldn’t deduct the expenses paid for with PPP funds. Since the loan was forgivable and thus not taxable income, it was considered a double-dipping or obtaining income from two different sources. For many SMB owners, this would lead to adverse tax consequences.

Finally, the Administration revised PPP loan forgiveness and updated some application guidelines. As a result, a great deal of ambiguity in this question disappeared. It became official that if you used your PPP to pay business expenses that used to be deductible, such as rent and utilities, you could take those deductions as usual. Thanks to the new amendments, small businesses could benefit from getting the PPP loan and not face ugly tax bills.

Where is the problem? There’s no automatic adaptation of this provision on the state level. At this point, not all states have passed the same legislation. To fully conform with the nontaxable PPP loan forgiveness, a state must adopt the most current Internal Revenue Code (IRC) and conform to the amendments.

While some states fell into a bucket of rolling conformity, meaning to adopt the most recent IRC as it became available, others – such as New Jersey, Mississippi, and Arkansas – decided to selectively pick and choose the provisions to adopt at the state level.

What does it mean for you as an SMB owner? It means that if you live in a state with selective conformity to the IRC, there remains uncertainty on whether you’ll be able to get tax deductions on those electricity bills you paid with a PPP loan. Although PPP loans are fully tax-exempt at the federal level, you might want to check your state’s local agencies on the matter.

New PPP loan requirements

At the beginning of 2021 new PPP loan requirements came into action, including:

Extension of the covered period

The period covered by a PPP loan extended from August 8, 2020, to March 31, 2022. You could also select PPP loan forgiveness covering a period of either 8 weeks after the loan’s origination date or 24 weeks after the loan’s origination date regardless of when the loan was disbursed.

Possibility of getting a PPP loan for the second time

If you had fewer than 300 employees and could document quarterly revenue losses of at least 25% in the first, second, or third quarter of 2020 relative to the same quarter of 2019, you could receive the second-draw PPP loan. The amount of the loan was up to $2 million.

A simpler application form

If your loan was $150,000 or less, you could have a simplified loan forgiveness application process. It included an application form that wasn’t more than one page in length. You were only required to provide:

- a description of the number of employees the small business owner was able to retain because of the loan,

- the estimated amount of the loan spent on payroll costs,

- and the total loan amount.

Keeping the records for compliance

The SBA holds the right to review and audit your loan for fraud even if it was already forgiven. It means you may need to attest that you complied with all PPP loan requirements at any time in the near future. To be precise, it’s necessary to retain relevant employment records for 4 years following submission of the form and other relevant records for 3 years. Reporting of demographic information is optional. Make sure you’re tracking your expenses in accounting so your accountant can easily refer to them when it’s time to file.

Three main PPP loan forgiveness rules

Before diving deeper into the details of the Paycheck Protection Program forgiveness requirements, let’s understand 3 main things about the loan forgiveness application first.

- PPP loans aren’t forgiven automatically. You should apply for loan forgiveness using appropriate application forms and within established deadlines.

- PPP loan forgiveness application forms differ depending on your business type and whether it’s your first or second application.

- Businesses have to provide documentation to support their claims on forgiveness applications. All PPP loans are undergoing an automated review, and all loans of $2 million or more undergo a manual review. Besides, any loan may be selected for a manual review at any time.

So what is loan forgiveness anyway? And what are the rules that guarantee the state will forgive it? Here’s what the SBA says:

“As long as a borrower submits its loan forgiveness application within ten months of the completion of the Covered Period (as defined below), the borrower is not required to make any payments until the forgiveness amount is remitted to the lender by SBA. If the loan is fully forgiven, the borrower is not responsible for any payments.”

Great! But what if not the whole amount of a PPP loan is forgiven?

“If only a portion of the loan is forgiven, or if the forgiveness application is denied, any remaining balance due on the loan must be repaid by the borrower on or before the maturity date of the loan.”

Is the repayment of the loan subject to interest rates?

“Interest accrues during the time between the disbursement of the loan and SBA remittance of the forgiveness amount. The borrower is responsible for paying the accrued interest on any amount of the loan that is not forgiven.”

Links to save:

Calculations and documentation for the first PPP loan

Calculations and documentation for the second PPP loan

Update on business costs eligible for PPP loan forgiveness

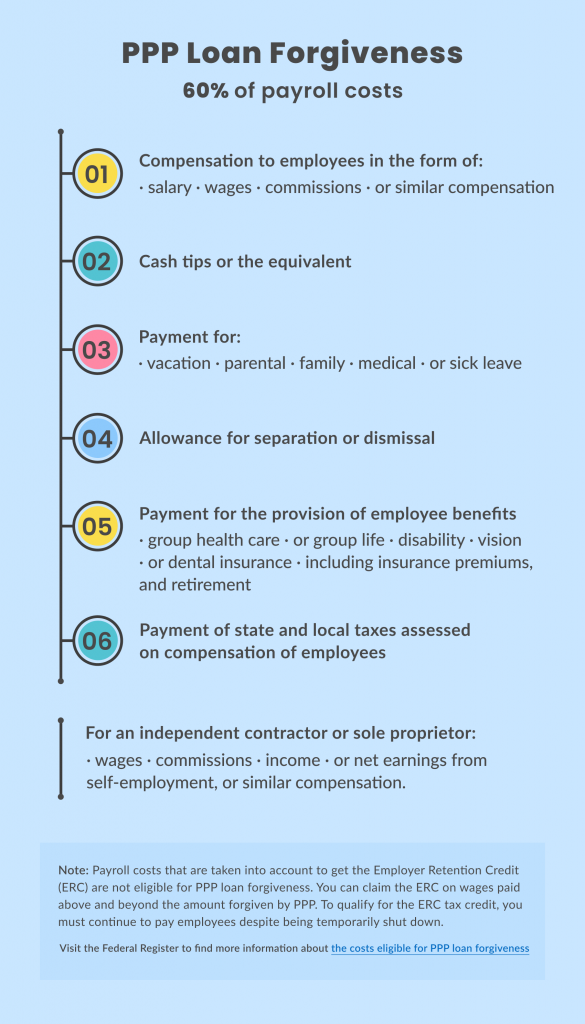

When the Paycheck Protection Program was first introduced, it obliged businesses to spend 75% of the loan amount on the payroll. The remaining 25% didn’t cover many crucial operational expenditures crucial for small businesses. Luckily, the numerous rounds of amending the Paycheck Protection Program rules introduced the desired updates.

Today, to achieve full PPP loan forgiveness, a small business owner should follow the rule of 60%.

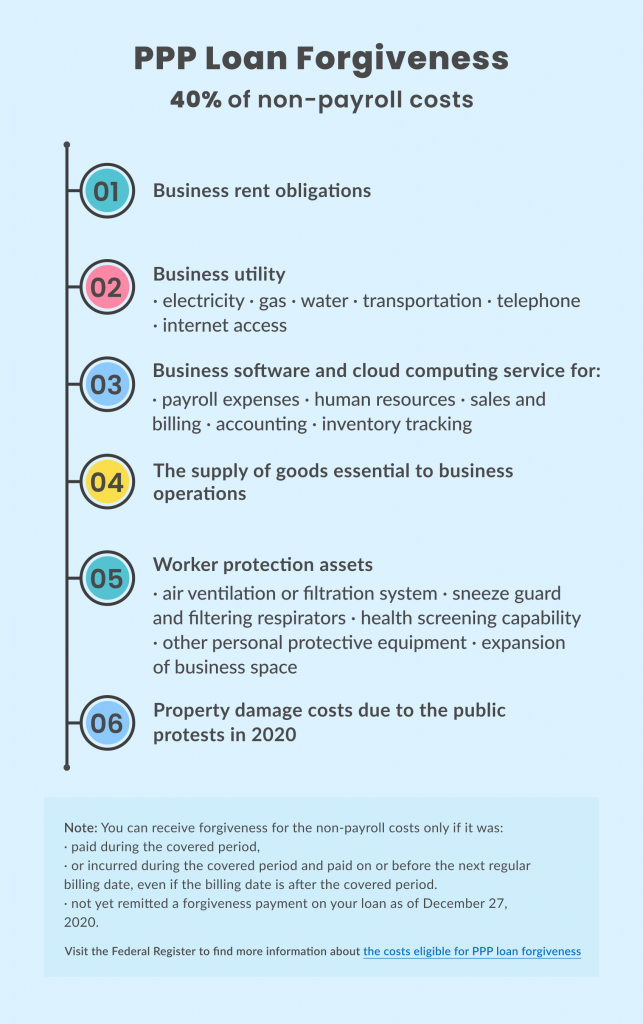

It means that 60% of the loan amounts must go to payroll payments during the period covered by the loan. But there are other costs eligible for forgiveness as well. They’re called non-payroll costs. Eligible non-payroll costs can’t exceed 40% of the PPP loan forgiveness amount. However, not all of the non-payroll costs are eligible.

Here’s a useful table we made to get a quick overview of both payroll and non-payroll costs eligible for PPP loan forgiveness. Save it on your device to take a look when needed!

Make sure you keep to the requirements strictly. Keep all the records accurate in case your forgiveness application gets audited. If you don’t provide supporting documents, you’ll have to repay the unforgiven part of the PPP loan with accrued interest.

Visit the Federal Register and find more information about the costs eligible for PPP loan forgiveness. Consult a professional accountant or your local authority to get even more detailed answers.

How to apply for PPP loan forgiveness?

As previously mentioned, small businesses that have borrowed PPP loans and complied with all the loan use requirements (like using it to keep your employees working during the covered period, etc.) may apply for loan forgiveness. The PPP loan forgiveness amount is 100%. This way, a loan forgiveness application might be worth the effort.

So, if you believe you’re eligible for forgiveness and haven’t yet exceeded the application deadlines, applying won’t be a problem. We’ll get to the forgiveness application steps right away. But first, let’s define the deadlines for the application.

According to SBA, any borrower can apply for forgiveness after all the loan funds come to an end. They can do it any time up to the loan maturity date. More precisely, within (but not exceeding) ten months after the last day of the covered period. So if you’re somewhere close to this point, you might want to hurry up. Otherwise, you’ll have to start making loan payments to your PPP lender.

Now, let’s get to the loan forgiveness application steps that are as follows:

Determine your loan forgiveness eligibility

We’ve already mentioned the forgiveness eligibility rules, so let’s recall them in short. You might want to ensure that you spent at least 60% of the loan to cover payroll costs and expenses, the rest to the operational costs, such as utility, rent, supplies, etc. Ultimately, your employees’ salaries and working hours remained at the same level as they were before the COVID.

Reach out to your PPP lender

Contacting your lender is the first thing to do, as soon as you decide to apply for loan forgiveness. Lenders can help you throughout the process, and primarily, they’ll guide you to how to apply. Since SBA introduced their direct forgiveness portal, many lenders signed up to use it, so you might be eligible to apply directly with SBA (for loans of $150,000 or less). Otherwise, you can only apply through your vendor. Anyway, contacting the lender can’t be omitted, as their assistance might be of great help.

Fill out the application form

From your lender you’ll get an application form to fill out. Depending on your business type, you’ll go with one of the following: either the SBA Form 3508, SBA Form 3508EZ, or SBA Form 3508S. The questions asked in the direct forgiveness portal usually correspond to those asked in the layer form. Let’s break them down:

SBA Form 3508 is the longest and most complicated form to scrape through. Businesses that have employees and borrowed more that $150,000 should fill out up to five pages, including calculation, signature form, Schedule A, Schedule A worksheet, and the demographic information form (the latter can be optional).

SBA Form 3508EZ targets self-employed and businesses that didn’t reduce employee salaries by more than 25% or kept their hours the same. It’s a three-page form that includes calculation, signature, and demographic information (which can be optional).

SBA Form 3508S is the simplest option. So, if your loan amount didn’t exceed $150,000, lucky you. There’s no need to provide any documentation (if it’s your first PPP loan, for the second, you might need to prove the at least 25% drop in revenue) and there are very few calculations.

Here are some useful links with more details about loan forgiveness application forms:

- SBA form 3508 PPP Loan Forgiveness Application + Instructions

- SBA form 3508EZ PPP Loan Forgiveness Application + Instructions

- SBA form 3508S PPP Loan Forgiveness Application + Instructions

Gather all the requested documents and submit your application

Your lender might request different documents that support your claim and calculations, so it’s better to have them prepared. Basically, the lender can guide you to what documentation might be necessary.

Finally, as the forms are ready and you have all the necessary documents, you can submit your application either directly with SBA or through your lender.

It’s general information about the loan forgiveness application procedures, so please consult with SBA or your lender for more details on your particular case.

PPP loan forgiveness: bottom Line

Paycheck Protection Program came as a lifesaver for many small businesses that struggled to keep afloat during the pandemic and support their employees. While the road was bumpy at the beginning, with all those eligibility details and tax deductions questions, after a couple of revisions, the program got on smooth rails.

Since the start of the program, SBA has approved over a million PPP loans, and for many businesses, the second round of PPP loans was available. Even though the program is over so far, there’s loan forgiveness that borrowers might want to consider. So as soon as you’re one of such businesses, you might want to put some effort into applying for PPP loan forgiveness and have 100% of your loan amount forgiven. Just make sure you’re eligible and haven’t missed the application deadlines.

.png)

This PPP loan forgiveness update for 2021 provides valuable information and updates on the loan forgiveness process. It covers key aspects such as eligible expenses, documentation requirements, and the application process. The article offers clarity and guidance for businesses seeking loan forgiveness and helps them stay updated on the latest developments. Thank you for sharing this informative update!