In business, money moves around a lot, making it like a big puzzle. Now, think of Remittance Advice as the helpful guide that makes sure the puzzle pieces fit together correctly.

In this article, we’re going to look at Remittance Advice, what it does, and why it’s so important for businesses.

Key takeaways

- Remittance Advice provides key payment details, helping businesses keep accurate and transparent records.

- It helps match payments to invoices, reducing errors and improving financial management.

- Modern electronic formats make Remittance Advice faster and more efficient, crucial for smooth international transactions.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What is Remittance Advice, and how does it function in financial transactions?

Remittance Advice is essentially an informational document that accompanies a payment. Its primary function is to provide detailed insights into the transaction, acting as a bridge between the payer and payee.

When a business makes a payment, the Remittance Advice is sent along with it, offering a comprehensive breakdown of crucial details, ensuring that the payee has all the necessary information at their fingertips to update their records accurately.

This not only enhances transparency but also contributes significantly to the efficiency of financial processes within a business.

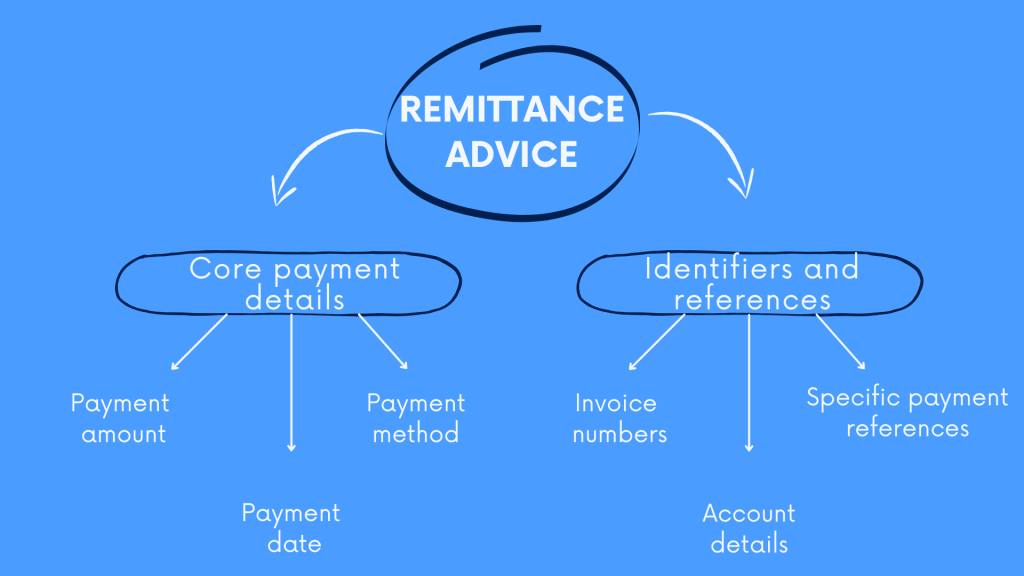

What information is typically included in a Remittance Advice document?

A Remittance Advice document is a treasure trove of information crucial for both the payer and the payee. It serves as a detailed guide, ensuring all parties involved in a transaction have a clear understanding of the financial exchange.

Core payment details

At its core, a Remittance Advice document includes essential details about the payment. This includes the payment amount, the date the payment was made, and the method of payment (such as bank transfer, check, or online payment). These fundamental elements provide the necessary context for the payee, allowing them to understand the basic aspects of the financial transaction.

Identifiers and references

In addition to core payment details, a Remittance Advice often contains important identifiers. These can include invoice numbers, account details, or specific payment references. Such information links the payment to specific invoices or financial obligations, making it easier for the payee to track and verify the transaction.

This additional information serves as a roadmap, guiding the payee through the often complex maze of financial records. For businesses, receiving a Remittance Advice means more than just getting a sum of money. It provides a comprehensive understanding of what the payment pertains to, which invoices it covers, and any other relevant details.

And that come with some benefits.

- Enhancing record-keeping

The level of detail included in a Remittance Advice is instrumental in efficient record-keeping. By clearly linking payments to invoices and providing all necessary transaction details, businesses can reduce errors in their financial records. This accuracy is crucial for maintaining a transparent and organized financial environment. - Fostering transparency

A detailed Remittance Advice fosters a transparent financial environment. With clear and comprehensive documentation, both payers and payees can easily verify the details of each transaction. This transparency not only helps in maintaining accurate records but also builds trust between business partners, reducing the likelihood of disputes and misunderstandings.

How does Remittance Advice streamline reconciliation processes for businesses?

One of the standout features of Remittance Advice is its ability to streamline the reconciliation processes for businesses. Reconciliation, in the financial context, involves matching payments with the corresponding invoices. Here, Remittance Advice acts as a beacon, guiding businesses through this often intricate process. By providing a detailed breakdown of each payment, including associated invoices and references, the payee can swiftly and accurately reconcile incoming payments with their records.

This efficiency is not merely a convenience but a crucial element in maintaining accurate financial records. Businesses, especially those dealing with a high volume of transactions, benefit significantly from the systematic approach that Remittance Advice introduces to the reconciliation process. It minimizes the likelihood of errors, ensures that payments are allocated to the correct invoices, and overall contributes to a more robust financial management system.

What are the different formats of Remittance Advice, and how have they evolved with technology?

Traditionally, Remittance Advice existed in a paper-based format. Physical documents were sent along with payments, providing the necessary details for the payee to reconcile the transaction.

With advancements in technology, the format of Remittance Advice has evolved. Electronic Data Interchange (EDI), email attachments, and other digital methods have become the new norm. This shift from paper to digital has brought several significant advantages.

Speed and real-time transmission

Electronic formats are much faster than their paper counterparts. Businesses can transmit payment information in real-time, ensuring that payees receive the necessary details almost instantly. This speed enhances the efficiency of financial transactions and helps in quicker reconciliation.

Easier storage and management

Digital Remittance Advice is easier to store and manage compared to physical documents. It reduces the clutter associated with paper and allows for better organization of financial records. Electronic storage also facilitates easy retrieval and long-term preservation of documents.

Automation and integration

Modern technology has further automated the generation and processing of Remittance Advice. This automation makes Remittance Advice a seamless part of the overall financial ecosystem. By integrating with accounting and financial management systems, businesses can streamline their processes and improve accuracy.

Flexibility for businesses

The evolution to digital formats provides businesses with the flexibility to choose the format that best suits their operational needs. Whether it’s EDI, email attachments, or other digital methods, companies can adopt the approach that aligns with their workflow, marking a significant shift from the traditional paper-based approach.

How does Remittance Advice contribute to transparency and dispute resolution in transactions?

Transparency in financial transactions is a cornerstone for building trust between parties. Remittance Advice plays a pivotal role in fostering this transparency. By providing detailed information about each payment, including the associated invoices and references, it allows the payee to easily verify the accuracy of the transaction. This transparency not only builds trust but also acts as a preventive measure against disputes.

In cases where discrepancies do arise, Remittance Advice becomes a valuable tool for resolving disputes. The detailed information contained in the document serves as a reference point, allowing both parties to trace the origin of the error and rectify it efficiently. Businesses, armed with comprehensive Remittance Advice, can address disputes with clarity, minimizing the impact on relationships and ensuring the smooth flow of financial transactions.

What are the global implications of Remittance Advice in the context of international transactions and cross-border payments?

The significance of Remittance Advice extends beyond domestic transactions, making it a crucial player in the realm of international business. In the context of cross-border payments, where different languages, currencies, and regulatory frameworks come into play, Remittance Advice becomes a unifying factor. Its detailed nature allows businesses to communicate payment information effectively, overcoming potential language barriers.

Moreover, in an era where compliance and regulatory considerations weigh heavily on international transactions, Remittance Advice acts as a compliant and transparent tool. It ensures that both the payer and payee are equipped with the necessary information to adhere to diverse regulatory requirements. As businesses continue to expand globally, the role of Remittance Advice in facilitating smooth and compliant cross-border transactions becomes increasingly indispensable.

Key takeaways

In wrapping up, think of Remittance Advice as a reliable companion in the world of finances. It brings clarity, efficiency, and transparency to the table.

From its basic role in detailing payments to its tech upgrades and global impact, Remittance Advice is like a linchpin in how businesses handle money matters. Remembering these six key things about it is crucial as we deal with the complexities of today’s business world. It’s not just a document – it’s what makes transactions smooth, keeps records accurate, and strengthens business relationships.

Continue reading: What you ned to know about the 1042-S form?

Share your thoughts

Do have any questions? Feel free to ask them or share your opinion in the comments section below!

.png)