Wire transfers are a secure and efficient way to send money between individuals and businesses, providing a direct electronic transfer of funds from one bank account to another.

In this article, we’ll explore the ins and outs of wire transfers, focusing on their processing times, variations, and key considerations.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What is a wire transfer?

At its core, a wire transfer is a secure and efficient electronic means of sending money.

The process involves the sender initiating a transaction through their bank to transfer a specified amount of funds to the recipient’s bank account. This method is widely employed for diverse financial activities, from settling bills and conducting business transactions to facilitating international money transfers.

Types of wire transfers

Let’s look at the types of wire transfers one can deal with.

Domestic wire transfers

Domestic wire transfers entail the movement of funds within the borders of a single country. These transactions are known for their swiftness, often outpacing their international counterparts in processing time. It makes domestic wire transfers optimal for time-sensitive financial interaction, such as real-time business transactions or urgent bill payments.

International wire transfers

As it comes from the name, international wire transfers traverse geographical boundaries, involving money moving between banks in different countries. Such transactions might come with complications, like additional verification processes and potential intermediary banks.

Consequently, international wire transfers generally have a longer processing time than their domestic counterparts.

Related:

Handling Foreign Currency Transactions with Synder Multi-Currency

Expedited or premium options

Recognizing the urgency that sometimes accompanies financial transactions, some financial institutions offer expedited or premium wire transfer services for an additional fee. These services aim to expedite the processing time, providing a faster alternative for urgent transactions. While they offer speed, users should carefully consider the associated costs before opting for these premium options.

How do bank transfers work?

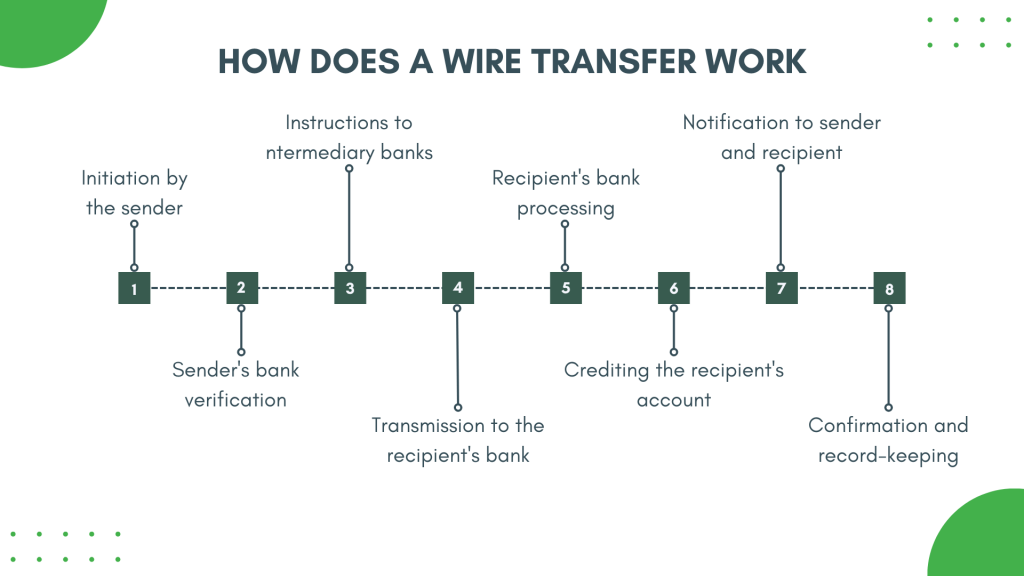

As briefly mentioned above, the transfer process involves several steps to ensure a secure and accurate money exchange between the sender and the recipient.

Here’s a breakdown of how a wire transfer works.

Step #1 – Initiation by the sender

The process begins with the sender deciding to transfer money to another party. The sender provides the bank with specific information, including the recipient’s name, account number, bank name, and the amount to transfer.

Step #2 – The sender’s bank verification

The sender’s bank verifies the request’s authenticity and the availability of funds in the sender’s account. This step is crucial to prevent fraudulent transactions and ensure the sender has sufficient funds for the transfer.

Step #3 – Instructions to intermediary or correspondent banks (for international transfers)

In the case of international wire transfers, where the sender and recipient banks are in different countries, the sender’s bank may route the transfer through intermediary or correspondent banks. These banks facilitate the transfer across borders and may be involved in currency conversion.

Step #4 – Transmission to the recipient’s bank

Once the sender’s bank completes its verification processes, it transmits the funds electronically to the recipient’s bank. The sender’s bank sends several electronic messages through a secure network, providing the necessary instructions for the transfer.

Step #5 – Recipient’s bank processing

Upon receiving the electronic instructions, the recipient’s bank processes the transaction. This process involves verifying the recipient’s account details and ensuring compliance with regulatory requirements. In the case of international transfers, the recipient’s bank may also include intermediary banks in the process.

Step #6 – Crediting the recipient’s account

After successful verification and processing, the recipient’s bank credits the specified amount to the recipient’s account. The funds are then available for the recipient to use or withdraw.

Step #7 – Notification to sender and recipient

Both the sender and recipient receive notifications confirming the completion of the wire transfer. The sender learns that the funds have been successfully transferred, and the recipient is notified of the incoming funds.

Step #8 – Confirmation and record-keeping

The banks involved in the wire transfer maintain transaction records for auditing and regulatory purposes. The sender and recipient can access statements or transaction histories to confirm the wire transfer details.

How long does a bank transfer processing take?

Now that we’ve explored the basics of wire transfers, we can look at the processing time in more detail. Understanding how long it might take for a bank to complete the transfer is crucial for businesses managing their financial transactions. At this point, they can better plan their budgets and cash flow.

What is the typical processing time for a domestic wire transfer?

Let’s start with domestic transfers.

As mentioned, such transfer processing is comparatively fast, typically within the same business day.

Most banks aim to complete domestic transfers promptly, ensuring quick and efficient transactions. However, it’s important to note that the time of day you initiate a transaction matters. Also, the specific policies of the involved banks can influence the processing time.

How long does an international wire transfer usually take?

International wire transfers usually take longer due to additional layers of verification and the potential involvement of intermediary banks.

The processing time can vary based on factors such as the countries involved, the banking systems in place, and any specific regulations governing international money transfers.

On average, international wire transfers may take anywhere from two to five business days to complete. It’s important to note that some transfers may take longer, depending on the complexity of the transaction and any unforeseen delays in the banking network.

Do different banks have varying processing times for wire transfers?

It’s also worth noting that different banks may have varying processing times for wire transfers.

Each bank has its internal processes, policies, and infrastructure, influencing how quickly they can process and complete a wire transfer. While many strive to process transfers promptly, it’s advisable to check with your specific bank for information on their wire transfer processing times.

Additionally, some banks may offer premium services with faster processing times for a higher fee (we mentioned earlier). Individuals and businesses looking for quicker transactions may explore these options if available.

Are there specific cut-off times for same-day wire transfers?

Additionally, most banks have specific cut-off times for same-day wire transfers.

As a rule, they establish those to ensure the transfer processing within the same business day. Initiating a wire transfer after the cut-off time may result in processing the transaction on the next business day.

Cut-off times can vary between banks, so it can help to know your bank’s specific deadlines. This information is typically available through the bank’s website, customer service, or in person at a branch. Being mindful of these cut-off times helps to avoid unnecessary delays in wire transfer processing.

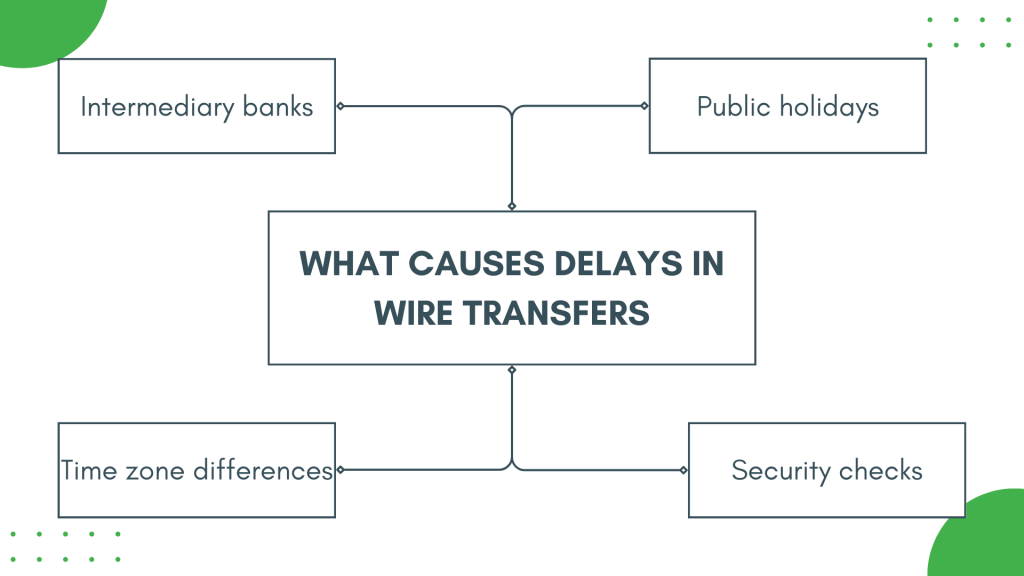

What factors can cause delays in wire transfers?

Previously, we mentioned that certain factors can affect the speed of wire transfers. Those might be public holidays or additional verifications by intermediary banks and more. Let’s look at them in more detail.

Factor #1 – Intermediary banks

In international wire transfers, funds may pass through intermediary banks, each with its processing time. These banks play a role in facilitating the transfer across borders and may be subject to their verification procedures. Delays can occur due to issues or additional verifications at these intermediary banks. It’s essential to recognize that the involvement of multiple banks in an international transfer introduces complexity, potentially extending the overall processing time.

Factor #2 – Public holidays

Public holidays in either the sending or receiving country can significantly impact the processing time of wire transfers. On these holidays, banks may be closed, disrupting the regular flow of transactions. Consequently, wire transfers initiated on or around public holidays may experience delays, with the processing only resuming when the banks reopen.

Being mindful of public holidays in both the sender’s and recipient’s locations can help plan wire transfers more effectively.

Factor #3 – Security checks

Banks prioritize security in financial transactions, including wire transfers, to prevent fraud and unauthorized activities. As a result, they may conduct thorough security checks on certain transactions. If a wire transfer raises concerns or triggers security protocols, a bank might want to verify the transfer more thoroughly. It can lead to delays in the processing time.

While these security measures are essential for protecting users, they can introduce an element of unpredictability to the duration of a wire transfer.

Factor #4 – Time zone differences

Wire transfers may involve financial institutions located in different time zones. The variance in operating hours can impact the speed at which a banks process the transaction. Initiating a wire transfer outside regular banking hours may result in the transaction being queued for processing, contributing to delays.

Considering time zone differences and aligning wire transfer requests with the operating hours of the involved banks can help minimize potential delays.

How to track the status of a wire transfer?

Tracking the status of a wire transfer is a critical aspect that businesses should not overlook. Whether sending or receiving funds, having visibility into the transfer process offers peace of mind and transparency. Let’s explore how businesses can effectively track the status of their wire transfers, utilizing online tools and leveraging customer service for timely updates.

Online banking platforms and mobile apps

Most banks provide online banking platforms or mobile apps that allow businesses to monitor the status of their wire transfers. These user-friendly interfaces offer a convenient way to access real-time updates on the transfer progress from the initiation until completion. Here’s how businesses can make the most of these digital tools.

- Initiation

Start the wire transfer through your bank’s online platform or mobile app. Provide the necessary details, including recipient information and the transfer amount. - Real-time updates

Once initiated, these platforms offer real-time updates on the status of your wire transfer. Businesses can easily track the progress and confirm when the funds have been successfully sent or received. - Transaction history

Online banking platforms maintain a transaction history section where one can review the details of their wire transfers. This archive can be a valuable reference point for past transactions and their statuses. - Alerts and notifications

Many banking platforms allow users to set up alerts and notifications for specific transactions. Businesses can receive instant updates via email or mobile notifications, keeping them informed at every stage of the wire transfer.

Contacting customer service for assistance

In addition to online tools, businesses can always turn to the bank’s customer service for assistance in tracking the status of a wire transfer. Here’s how businesses can effectively engage with customer service:

- Prepare information

Before contacting customer service, gather relevant information such as the transaction reference number, date of initiation, and recipient details. This information helps expedite the inquiry process. - Dialing customer service

Use the dedicated customer service helpline provided by the bank. Most banks offer specific numbers for wire transfer inquiries to ensure quick and focused assistance. - Inquiry and clarification

Communicate your inquiry clearly, mentioning that you are seeking information on the status of a wire transfer. Provide the gathered details for a more efficient response. - Document interaction

Take note of the information provided by customer service, including any reference numbers for the inquiry. This documentation can be valuable for future reference.

Access to timely information on the status of wire transfers is instrumental for businesses. It enables proactive decision-making, helps in addressing concerns promptly, and ensures that financial transactions align with the business’s operational needs.

Bottom line

In conclusion, understanding wire transfers, their processing times, and the available options empowers individuals and businesses to make informed decisions when conducting financial transactions. Whether it’s a domestic or international transfer, being aware of cut-off times, potential delays, and premium services contributes to a smoother and more efficient wire transfer experience.

Continue reading: What’s the receivable turnover ratio?

Share your thoughts

Do you hsve any questions of want to share your experience with wire transfers? Feel free to comment in the section below.. We’d love to hear from you!

.png)